MSCI AC Europe and Middle East Index (USD) (NET)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

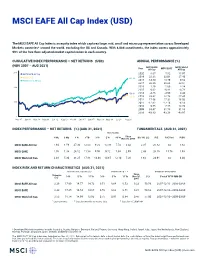

MSCI EAFE All Cap Index (USD)

MSCI EAFE All Cap Index (USD) The MSCI EAFE All Cap Index is an equity index which captures large, mid, small and micro cap representation across Developed Markets countries* around the world, excluding the US and Canada. With 8,088 constituents, the index covers approximately 99% of the free float-adjusted market capitalization in each country. CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (NOV 2007 – AUG 2021) MSCI EAFE MSCI World Year All Cap MSCI EAFE All Cap 300 MSCI EAFE All Cap 2020 8.67 7.82 15.97 2019 22.38 22.01 27.40 MSCI EAFE 262.28 MSCI World All Cap 2018 -14.50 -13.79 -9.52 2017 26.35 25.03 22.51 200 2016 1.29 1.00 8.24 2015 0.62 -0.81 -0.78 158.80 2014 -4.86 -4.90 4.44 149.91 2013 23.62 22.78 27.45 2012 17.56 17.32 16.03 100 2011 -12.62 -12.14 -6.13 2010 9.55 7.75 13.74 2009 33.47 31.78 31.83 2008 -43.83 -43.38 -40.97 0 Nov 07 Jan 09 Mar 10 May 11 Jun 12 Aug 13 Oct 14 Dec 15 Jan 17 Mar 18 May 19 Jul 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Nov 30, 2007 Div Yld (%) P/E P/E Fwd P/BV MSCI EAFE All Cap 1.94 1.59 27.30 12.03 9.20 10.09 7.74 3.42 2.35 20.82 na 1.82 MSCI EAFE 1.76 1.38 26.12 11.58 9.00 9.72 7.34 2.99 2.43 20.10 15.76 1.93 MSCI World All Cap 2.48 5.30 31.25 17.81 14.48 14.65 12.10 7.26 1.64 24.91 na 3.04 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Nov 30, (%) Period YYYY-MM-DD -

Client Demand for Sustainable Investing Is Growing

Client demand for sustainable investing is growing Assets in US sustainable funds reached $231 billion by the end of 2020, up from $139 billion at the end of 2019 — a roughly 66% increase.1 In fact, 85% of all individual investors, including 95% of millennials, have expressed an interest in sustainable investing.2 When your clients and prospects ask you about sustainable investing, will you be prepared to have the conversation? INVESTING IN A MORE SUSTAINABLE ECONOMY We believe that capital markets will be shaped We seek to invest in companies that are profoundly by global sustainability challenges well-positioned to benefit from this transition including climate change, environmental to a more sustainable global economy, which pollution, natural resource constraints and is why we integrate environmental, social human capital issues such as diversity, inclusion ESG and governance (ESG) factors across all and gender equity. We expect these trends will drive growth our strategies. In-depth ESG analysis helps for well-positioned companies and create risks for those unable us understand a company’s quality and character, which we or unwilling to adapt. believe enhances our investment decisions. INTEGRATING ESG CRITERIA INTO FINANCIAL ANALYSIS CAN HELP ENHANCE RETURNS US INTERNATIONAL DEVELOPED EMERGING MARKETS 15.00 8.00 12.00 7.02 7.00 9.52 6.29 10.00 12.00 11.37 10.85 6.00 8.00 7.07 9.00 5.00 4.00 6.00 6.00 3.00 4.00 2.00 Annualized Return (%) Return Annualized 3.00 (%) Return Annualized (%) Return Annualized 2.00 1.00 0.00 0.00 0.00 (Annualized return: 5/1/90 to 6/30/21) (Annualized return: 10/1/07 to 6/30/21) (Annualized return: 6/6/13 to 6/30/21) MSCI KLD 400 Social Index MSCI EAFE ESG Leaders Index MSCI Emerging Markets ESG Leaders Index S&P 500 Index MSCI EAFE Index MSCI Emerging Markets Index Data as of 6/30/2021 Investing involves risk, including the loss of principal. -

The New Neutral: the Long-Term Case for Currency Hedging

Robert Bush Thought Leadership Xpert Insights 12/17 The New Neutral—The long-term case for currency hedging It’s fair to say that currency-hedged approaches to The Long Term Case for Currency Hedging) and international investing have really come to the fore consider the more strategic reasons for hedging, and, over the last few years, with $14.8 billion of AUM in in particular, the potential risk reduction it offers. hedged ETFs at the beginning of 2014, compared with “$41bn of AUM as of the end of November Take a look at Figure 1, which reflects the difference 2017” (Source: Morningstar). Without asking every in volatility for the MSCI EAFE, a key benchmark single investor’s motivation, it’s impossible to say for international developed equity markets, on a exactly what the driving force behind this interest hedged (without currency) and an un-hedged (with has been, but we suspect the strong performance currency) basis. A positive number represents more of the dollar, particularly against the euro and the risk in the basket that includes currency. What was yen, where quantitative easing has weakened those surprising, to us at least, was that over this time currencies, has really shone a spotlight on the role period leaving currency in resulted in volatility on currencies can play in an international investment. average 2.7 percentage points higher 90% of the time. It really begs the question—why? What is it Instead of focusing on the tactical, return-oriented about currency—and, by the way, it’s not, in our aspects of the hedging decision, let’s focus on some view, additional return—that meant investors lost key findings from research we’ve recently undertaken out by retaining their exposure? (see our latest White Paper The New Neutral: Figure 1: The difference in volatility between MSCI EAFE hedged and un-hedged (2/1978–2/2017) 8.00 6.00 4.00 2.00 0.00 –2.00 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2017 Source: Morningstar Direct, 3/31/1973–11/30/17. -

Notice of Filing of Proposed Rule Change to List and Trade Options on the MSCI EAFE Index and on the MSCI Emerging Markets Index

SECURITIES AND EXCHANGE COMMISSION (Release No. 34-74430; File No. SR-CBOE-2015-023) March 4, 2015 Self-Regulatory Organizations; Chicago Board Options Exchange, Incorporated; Notice of Filing of Proposed Rule Change to List and Trade Options on the MSCI EAFE Index and on the MSCI Emerging Markets Index Pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (the “Act” or “Exchange Act”),1 and Rule 19b-4 thereunder,2 notice is hereby given that on February 26, 2015, the Chicago Board Options Exchange, Incorporated (the “Exchange” or “CBOE”) filed with the Securities and Exchange Commission (the “Commission”) the proposed rule change as described in Items I, II, and III below, which Items have been prepared by the Exchange. The Commission is publishing this notice to solicit comments on the proposed rule change from interested persons. I. Self-Regulatory Organization’s Statement of the Terms of Substance of the Proposed Rule Change CBOE proposes to list and trade options that overlie the MSCI EAFE Index and the MSCI Emerging Markets Index (“EAFE options” and “EM options”). EAFE and EM options would be P.M., cash-settled contracts with European-style exercise. The text of the proposed rule change is available on the Exchange’s Web site (http://www.cboe.com/AboutCBOE/CBOELegal RegulatoryHome.aspx), at the Exchange’s Office of the Secretary, and at the Commission. II. Self-Regulatory Organization’s Statement of the Purpose of, and Statutory Basis for, the Proposed Rule Change In its filing with the Commission, the self-regulatory organization included statements concerning the purpose of and basis for the proposed rule change and discussed any comments it 1 15 U.S.C. -

Product Commentary CLEARBRIDGE INTERNATIONAL GROWTH FUND

2Q 2021 Product Commentary CLEARBRIDGE INTERNATIONAL GROWTH FUND Elisa Mazen, Michael Testorf, CFA, Pawel Wroblewski, CFA and Thor Olsson Portfolio Managers Average annual total returns and fund expenses (%) Key takeaways as of June 30, 2021 • Recent Fund outperformance has been broad- based, led by more defensive, secular growth Since Incept. Expenses companies, with structural and emerging growth Class A 3-mo 1-yr 5-yr 10-yr (02/03/09) Gross Net holdings also contributing. Excluding sales 6.77 29.06 16.17 11.55 14.43 1.10 1.06 charges • Banks and energy are two areas we have mostly Including effects avoided, but our valuation approach to growth of maximum 0.62 21.64 14.80 10.89 13.88 1.10 1.06 helped identify two European banks and a global sales charges oil services provider in the quarter whose MSCI EAFE (Net) 5.17 32.35 10.28 5.89 N/A - - risk/reward were too attractive to overlook. (USD) Performance shown represents past performance and is no guarantee of future • International equity markets have seen rotating results. Current performance may be higher or lower than the performance shown. leadership due to various factors, such as the Investment return and principal value will fluctuate so shares, when redeemed, may be likelihood of interest rate increases and differing worth more or less than the original cost. Class A shares have a maximum front-end sales charge of 5.75%. Total returns assume the reinvestment of all distributions at net asset monetary policies, moves creating short-term value and the deduction of all Fund expenses. -

MSCI EAFE ESG Screened Index (USD)

MSCI EAFE ESG Screened Index (USD) The MSCI EAFE ESG Screened Index is based on the MSCI EAFE Index, its parent index, and includes large and mid-cap securities across 21 Developed Markets (DM)* countries excluding the U.S and Canada. The index excludes companies from the parent index that are associated with controversial, civilian and nuclear weapons and tobacco, that derive revenues from thermal coal and oil sands extraction and that are not compliant with the United Nations Global Compact principles. CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (MAY 2012 – AUG 2021) MSCI EAFE Year ESG Screened MSCI EAFE MSCI EAFE ESG Screened 2020 9.27 7.82 MSCI EAFE 2019 22.43 22.01 231.82 2018 -14.27 -13.79 225.67 2017 25.13 25.03 200 2016 0.09 1.00 2015 -0.04 -0.81 2014 -4.61 -4.90 2013 23.88 22.78 100 50 May 12 Mar 13 Dec 13 Sep 14 Jun 15 Apr 16 Jan 17 Oct 17 Jul 18 May 19 Feb 20 Nov 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr May 31, 2012 Div Yld (%) P/E P/E Fwd P/BV MSCI EAFE ESG Screened 2.06 1.57 25.94 11.49 9.44 9.86 na 9.51 2.30 20.23 16.30 1.95 MSCI EAFE 1.76 1.38 26.12 11.58 9.00 9.72 na 9.19 2.43 20.10 15.76 1.93 INDEX RISK AND RETURN CHARACTERISTICS (MAY 31, 2012 – AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN TrackingTurnover Since Beta 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr May 31, (%) Period YYYY-MM-DD Error (%) (%) 2012 MSCI EAFE ESG Screened 0.99 0.66 4.50 17.51 14.42 na 0.53 0.64 na 0.68 33.72 2018-01-25—2020-03-23 MSCI EAFE 1.00 0.00 2.32 17.65 14.54 na 0.50 0.62 na 0.66 34.12 2018-01-25—2020-03-23 1 Last 12 months 2 Based on monthly net returns data 3 Based on ICE LIBOR 1M *DM countries include: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the UK. -

MSCI EAFE Index.Indd

���������������� The MSCI EAFE Index® is recognized as the pre-eminent benchmark in the United States to measure international equity performance. It comprises 21 MSCI country indices, representing the devel- oped markes outside of North America: Europe, Australasia and the Far East. Since inception in, the MSCI EAFE Index has had an average gross annual return of 11.2%. MSCI aims to include in its international indices 85% of the free fl oat-adjusted market capitaliza- tion in each industry group, within each country. As of Dec 30, 2005 the MSCI EAFE Index contained 1,137 securities with a total market capitalization of over USD 10.2 trillion. The MSCI EAFE Index is published daily by MSCI and through multiple vendors and in real time every 60 seconds through Reuters and Bloomberg. ����������������������������������������� COUNTRY NO OF SECURITIES WEIGHT COUNTRY NO OF SECURITIES WEIGHT Japan 369 25.6% Finland 21 1.4% United Kingdom 155 24.0% Belgium 20 1.1% France 62 9.3% Singapore 41 0.8% Switzerland 38 6.9% Denmark 19 0.8% Germany 50 6.8% Ireland 17 0.8% Australia 83 5.2% Norway 18 0.7% Italy 39 3.8% Greece 21 0.6% Spain 33 3.7% Austria 13 0.4% Netherlands 26 3.4% Portugal 11 0.3% Sweden 47 2.4% New Zealand 13 0.2% Hong Kong 41 1.6% EAFE Total 1137 100.0% ��������������� ������������������������������������������������������������������� ������ ����� ��� ��������������������������� �� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� Gross Index Level CONTACT US Amsterdam + 31.20.462.1382 Atlanta + 1.404.949.4529 ���������������������������������������� ������������������������������������������ Boston + 1.617.856.8716 SECTOR NO OF SECURITIES WEIGHT INDEX CAPITALIZATION AND CONCENTRATION 226 Cape Town Financials 28.5% Total Market Capitalization (USD, MM) 10,218,281 + 27.21.683.3245 209 Consumer Discretionary 12.3% Number of Securities 1,137 China Netcom 233 Industrials 10.7% Dollar Wt. -

MSCI EAFE INDEX STRATEGY 1St Quarter 2021

MSCI EAFE INDEX STRATEGY 1st Quarter 2021 STRATEGY DESCRIPTION: BENCHMARK DESCRIPTION: The objective of the MSCI EAFE (Europe, Australasia The MSCI EAFE Index represents the performance of and Far East1) Index Strategy is to track the return of large- and mid-cap equities across 21 developed the MSCI EAFE Index. Inception date: May 31, 2014. markets in Europe, Australasia and the Far East, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country1. INVESTMENT TECHNIQUE: SAMPLE PORTFOLIO STATISTICS2: This portfolio is optimized, considering client • Turnover: Approximately 1.5% - 3.5% annually requirements. It is available as a separate account • Weighted Avg. Market Cap: $70 Billion (with or without customization) or a commingled • Constituents: 883 vehicle. • Countries: 22 • Beta (relative to S&P 500): 0.81 COMPOSITE RETURNS* as of 3/31/21 GROSS OF FEES (%) NET OF FEES (%) BENCHMARK (%) QTR1 2021 3.55 3.52 3.48 TRAILING 1 YEAR 44.74 44.64 44.57 TRAILING 3 YEAR (annualized) 6.26 6.16 6.02 TRAILING 5 YEAR (annualized) 9.07 8.97 8.85 Since Inception (annualized) 4.68% 4.58% 4.46% *Please scroll to the end of this document for performance and other disclosures. TOP 10 HOLDINGS3 as of 3/31/21 (%) COUNTRY WEIGHTS3 as of 3/31/21 (%) Nestle SA 1.97 Australia 7.00 Japan 24.63 ASML Holdings 1.58 Austria 0.18 Netherlands 4.29 Roche Holdings AG 1.39 Belgium 0.92 New Zealand 0.26 Novartis AG 1.16 Denmark 2.34 Norway 0.64 LVMH 1.13 Finland 0.98 Portugal 0.16 Toyota Motor Corp 1.00 France 11.05 Singapore 1.09 Unilever Plc 0.90 Germany 9.44 Spain 2.40 AIA Group Limited 0.89 Hong Kong 3.36 Sweden 3.58 Softbank Group Corp 0.80 Ireland 0.70 Switzerland 9.13 Sony Corp Corporation 0.80 Israel 0.58 UK 14.17 Italy 2.37 USA (ETF) 0.72 Total: 11.64% Total: 100.00% 1. -

Blackrock Index Funds, Inc. Blackrock Advisors

STATEMENT OF ADDITIONAL INFORMATION BlackRock Index Funds, Inc. iShares Russell 2000 Small-Cap Index Fund iShares MSCI EAFE International Index Fund 100 Bellevue Parkway, Wilmington, Delaware • Phone No. (800) 441-7762 BlackRock Index Funds, Inc. (the “Corporation”) currently consists of two operating portfolios or series, iShares Russell 2000 Small-Cap Index Fund (“Russell 2000 Small-Cap Index Fund”) and iShares MSCI EAFE International Index Fund (“MSCI EAFE International Index Fund” and together with Russell 2000 Small-Cap Index Fund, the “Funds”). Russell 2000 Small-Cap Index Fund invests all of its assets in Master Small Cap Index Series of Quantitative Master Series LLC (the “Master LLC”) that has the same investment objective as Russell 2000 Small-Cap Index Fund. This Statement of Additional Information of the Funds is not a prospectus and should be read in conjunction with the prospectuses of the Funds, each dated April 30, 2021, as they may be amended or supplemented from time to time, (the “Prospectuses”), which have been filed with the Securities and Exchange Commission (the “Commission”) and can be obtained, without charge, by calling (800) 441-7762 or by writing to the Funds at the above address. The Prospectuses are incorporated by reference into this Statement of Additional Information, and Part I of this Statement of Additional Information and the portions of Part II of this Statement of Additional Information that relate to a Fund have been incorporated by reference into the Fund’s Prospectuses. The portions of Part II of this Statement of Additional Information that do not relate to a Fund do not form a part of that Fund’s Statement of Additional Information, have not been incorporated by reference into that Fund’s Prospectuses and should not be relied upon by investors in that Fund. -

EAFE the MODERN INDEX STRATEGY Msci.Com Modern Index Strategy

EAFE THE MODERN INDEX STRATEGY msci.com Modern index strategy MSCI indexing offers a modern, seamless and fully integrated approach to measuring the full equity opportunity set, with no gaps or overlaps. Modern Seamless Integrated 4 21 >900 Evolves to measure and Covers the full opportunity set Consistent methodology for regions countries constituents capture equity markets as they and all its segments, including every market exist today GICS® sectors EMEA Our indexes are built using All of MSCI’s indexes are created Where other providers use either an innovative maintenance using the Global Industry a long- or short-term liquidity methodology that provides Classification Standard (GICS®), measure to assess the eligibility superior balance between the an industry classification system of stocks for their indexes, APAC need for a stable index that developed by MSCI and S&P MSCI uses both, recognizing the is flexible enough to adjust Global, which provides a common differences in liquidity between quickly to a constantly changing framework to classify stocks. developed and emerging markets opportunity set. We provide timely They offer exhaustive coverage of and enhancing the investability and consistent treatment of the investable opportunity set with and replicability of our indexes. corporate events and synchronized non-overlapping size and MSCI puts strong emphasis on rebalancings, globally. style segmentation. investability and replicability of its indexes through the use of size and liquidity screens. 2 msci.com msci.com 3 MSCI delivers MSCI EAFE Index country allocation3 8.65% Switzerland the modern 8.82% Germany 11.10% France 16.94% United Kingdom 24.61% Japan index strategy 29.88% Other The MSCI EAFE Index is designed to represent the performance of large- and mid-cap securities across 21 developed markets in Europe, Australasia and the Far East,1 excluding the U.S. -

The Aletheia Group

Research Bites: U.S. and International – Indices First Quarter 2021 Know Your Benchmark A look at the most common global indices and their performance Knowing how to properly benchmark an investment manager and its strategies is crucial to understanding their performance—both on an absolute and relative basis. Indices can have significantly different weightings to countries and regions depending on the investment objective. That will ultimately have an impact on their returns and exposure. MSCI ACWI Index Developed Markets Emerging Markets MSCI World Index MSCI Emerging Markets Index Americas MSCI EAFE Europe & Europe & Americas Pacific Americas Pacific Middle East Middle East Canada Austria Australia Argentina Czech Republic China United States Belgium Hong Kong Brazil Egypt India Denmark Japan Chile Greece Indonesia Finland New Zealand Colombia Hungary Korea France Singapore Mexico Germany Peru Poland Malaysia Ireland Qatar Pakistan Israel Russia Philippines Italy Saudi Arabia Taiwan Netherlands South Africa Thailand Norway Turkey Portugal Spain UAE Sweden Switzerland United Kingdom Research Bites: U.S. and International ‒ Indices The global markets are broken up between developed markets and emerging markets, with the MSCI ACWI Index including both. A common mistake investors make is thinking that the MSCI World or MSCI EAFE indices include emerging markets. Another oversight is not knowing which countries are defined as developing or emerging. Benchmarking an active manager to the correct index is an important element of evaluating -

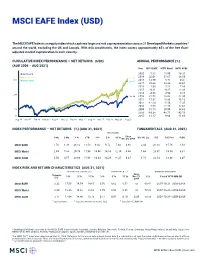

MSCI EAFE Index (USD) (NET)

MSCI EAFE Index (USD) The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float- adjusted market capitalization in each country. CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) Year MSCI EAFE MSCI World MSCI ACWI MSCI EAFE 2020 7.82 15.90 16.25 2019 22.01 27.67 26.60 MSCI World 311.27 300 2018 -13.79 -8.71 -9.41 MSCI ACWI 299.95 2017 25.03 22.40 23.97 2016 1.00 7.51 7.86 2015 -0.81 -0.87 -2.36 2014 -4.90 4.94 4.16 200 188.44 2013 22.78 26.68 22.80 2012 17.32 15.83 16.13 2011 -12.14 -5.54 -7.35 2010 7.75 11.76 12.67 100 2009 31.78 29.99 34.63 2008 -43.38 -40.71 -42.19 50 2007 11.17 9.04 11.66 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI EAFE 1.76 1.38 26.12 11.58 9.00 9.72 7.34 4.90 2.43 20.10 15.76 1.93 MSCI World 2.49 5.88 29.76 17.94 14.96 14.83 12.14 6.66 1.66 23.87 19.54 3.31 MSCI ACWI 2.50 4.57 28.64 15.91 14.34 14.29 11.27 6.67 1.71 22.54 18.46 3.07 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD (%) 2000 MSCI EAFE 2.32 17.65 14.54 14.67