2019 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Financial Statements

Annual Report and Financial Statements for the year ended 31 December 2018 Dimensional Funds ICVC Authorised by the Financial Conduct Authority No marketing notification has been submitted in Germany for the following Funds of Dimensional Funds ICVC: Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund Accordingly, these Funds must not be publicly marketed in Germany. Table of Contents Dimensional Funds ICVC General Information* 2 Investment Objectives and Policies* 3 Authorised Corporate Directors’ Investment Report* 6 Incorporation and Share Capital* 10 The Funds 10 Fund Cross-Holdings 10 Authorised Status* 10 Regulatory Disclosure* 10 Potential Implications of Brexit* 10 Responsibilities of the Authorised Corporate Director 11 Responsibilities of the Depositary 11 Report of the Depositary to the Shareholders 11 Directors' Statement 11 Independent Auditors’ Report to the Shareholders of Dimensional Funds ICVC 12 The Annual Report and Financial Statements for each of the below sub-funds (the “Funds”); Emerging Markets Core Equity Fund Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund are set out in the following order: Fund Information 14 Portfolio Statement* 31 Statement of Total Return 149 Statement of Change in Net Assets Attributable to Shareholders 149 Balance Sheet 150 Notes to the Financial Statements 151 Distribution Tables 168 Remuneration Disclosures (unaudited)* 177 Supplemental Information (unaudited) 178 * These collectively comprise the Authorised Corporate Directors’ (“ACD”) Report. Dimensional Fund Advisors Ltd. Annual Report and Financial Statements, 31 December 2018 1 Dimensional Funds ICVC General Information Authorised Corporate Director (the “ACD”): Dimensional Fund Advisors Ltd. -

Corporate Strategy

Corporate Strategy May 2012 Contents 1. Corporate Mission 9. Strengthening Management Foundation 2. Corporate Governance 10. Improve Financial Standing 3. Management Policy: Balanced Corporate Management 11. Strengthen Environmental Management/Environment- 4. Management Framework Oriented Businesses 5. Essential Growth Strategies 12. Forecast for FY2012 6. Direction of Growth Strategies 13. Management Targets 7. Strengthening the Global Strategy Notes: 8. Technological Development: FY2007: April 1, 2007 – March 31, 2008 Strong Businesses Stronger FY2008: April 1, 2008 – March 31, 2009 FY2009: April 1, 2009 – March 31, 2010 FY2010: April 1, 2010 – March 31, 2011 FY2011: April 1, 2011-March 31, 2012 FY2012: April 1, 2012 – March 31, 2013 11 1. Corporate Mission Encourage Fulfillment of Social Responsibility through Our Business Activities QualityQuality TrustTrust TechnologyTechnology Seven Guiding Principles Corporate Mission GrowthGrowth The Mitsubishi Electric Group will continually improve its technologies CitizenshipCitizenship and services by applying creativity to all aspects of its business. By doing so, we enhance the quality of life in our society. EnvironmentEnvironment EthicsEthics 22 2. Corporate Governance Increased Flexibility and Transparency of the Management, Reinforced Supervisory Function over the Management General Shareholders’ Meeting Actual practices at Mitsubishi Electric Reporting to Reporting to Appointment • Thorough separation of execution and supervision Execution Supervision Appointment / • Majority of board -

Power Transformer

www.seec.com.tw Power Transformer INTEGRATION OF POWER SYSTEM We Light Up the Taipei 101, Once the highest building in the world 22.8KV Substation in every 10 oor. CRTR :3P 22.8KV 2~4MVA * 70 PCS PANEL :3P HV&/LV* l780 SETS 161KV Substation in B4 Belong to TPC TR :3P 161/22.8KV 60MVA * 4 PCS GIS:3P 161/22.8KV 60MVA * 4 PCS We Light Up the Taipei 101, Contents Once the highest building in the world The Course of Change and Development 2 Main Products 3 Manufacture Capability & Scope 4 Manufacture Technology 5 Technology R&D 6 22.8KV Substation in every 10 oor. Quality Assurance 7 CRTR :3P 22.8KV 2~4MVA * 70 PCS PANEL :3P HV&/LV* l780 SETS Products Characteristics Cores 8 Windings 9 Tanks 10 Manufacture Process of Oil Immersed Transformer 11 Main Domestic Customers 12 Main Export Customers 12 161KV Substation in B4 Belong to TPC TR :3P 161/22.8KV 60MVA * 4 PCS GIS:3P 161/22.8KV 60MVA * 4 PCS 1 Power transformer Power The Course of Change and Development In 1955, Shinlin Electric Joint Stock Company made its first step to manufacture heavy-duty electrical equipments in collaboration with Mitsubishi Electric Corporation, and developed 69kV, 161kV, 345kV power transformers. In 2003, successfully developed 345kV 650MVA transformer, the maximum capacity in Taiwan, for Taichung Thermal power Plant. And 161kV 60MVA SF6 Gas Insulated. Transformer for underground transformer station in Taipei World Trade Center. The 50-year-long relentless improvement, reliable expertise and superb quality enable Shihlin Electric to deliver customized products and services. -

Annual Report 2007 Mitsubishi Electric Corporation Annual Report 2007 1 to Our Shareholders Corporate Strategy: Implementing Balanced Management

X-X01-7-C7792-A HQ0707〈MDOC〉 Printed in Japan AT A GLANCE CORPORATE DATA FINANCIAL HIGHLIGHTS Energy and Electric Systems Industrial Automation Systems Information and Communication As of March 31, 2007 Years ended March 31 Yen U.S. dollars Systems (millions) (thousands) MITSUBISHI ELECTRIC CORPORATION 2007 2006 2005 2007 868,789 860,111 644,111 Tokyo Building, 06 06 06 2-7-3, Marunouchi, 25,296 95,967 20,677 Net sales ¥3,855,745 ¥3,604,185 ¥3,410,685 $32,675,805 Chiyoda-ku, Tokyo 100-8310, Operating income 233,002 157,718 120,642 1,974,593 951,065 956,930 688,004 Japan 07 07 07 49,310 126,227 20,803 Phone: +81 (3) 3218-2111 Net income 123,080 95,692 71,175 1,043,051 ESTABLISHED: Total assets 3,452,231 3,313,742 3,162,472 29,256,195 January 15, 1921 Shareholders’ equity 1,059,209 942,202 720,637 8,976,347 MAIN PRODUCTS AND BUSINESS LINES MAIN PRODUCTS AND BUSINESS LINES MAIN PRODUCTS AND BUSINESS LINES Capital expenditure 140,557 134,413 125,657 1,191,161 PAID-IN CAPITAL: Turbine generators, hydraulic turbine Programmable logic controllers, inverters, Wireless communications equipment, ¥175,820 million R&D expenditure 132,722 130,639 130,541 1,124,763 generators, nuclear power plant equipment, servomotors, human-machine interface, mobile handsets, cable communications SHARES ISSUED: motors, transformers, power electronics motors, hoists, magnetic switches, no-fuse systems, satellite communications equipment, circuit breakers, gas insulated circuit breakers, short-circuit breakers, equipment, artificial satellites, radar 2,147,201,551 shares Yen U.S. -

Government Pension Fund Global Holding of Equities at 31 December

Government Pension Fund Global Holding of equities at 31 December 2011 et value K) K) arket value arket ark wnership wnership ector ector oting oting NO NO S M ( V O S M ( V O AUSTRALIA David Jones Ltd Consumer Services 51 018 951 0.67% 0.67% Abacus Property Group Financials 22 995 524 0.51% 0.51% Deep Yellow Ltd Basic Materials 2 644 029 0.29% 0.29% ABC Learning Centres Ltd Consumer Services 1 672 0.50% 0.50% Dexus Property Group Financials 158 816 463 0.65% 0.65% Acrux Ltd Health Care 16 824 771 0.58% 0.58% Discovery Metals Ltd Basic Materials 25 004 853 0.71% 0.71% Adelaide Brighton Ltd Industrials 54 271 215 0.48% 0.48% Downer EDI Ltd Industrials 55 616 672 0.66% 0.66% AED Oil Ltd Oil & Gas 642 658 0.30% 0.30% DuluxGroup Ltd Industrials 104 835 466 1.61% 1.61% AGL Energy Ltd Utilities 259 696 118 0.64% 0.64% Echo Entertainment Group Ltd Consumer Services 97 268 039 0.64% 0.64% AJ Lucas Group Ltd Industrials 1 743 778 0.24% 0.24% Elders Ltd Consumer Goods 3 899 317 0.55% 0.55% Alesco Corp Ltd Industrials 3 440 168 0.52% 0.52% Emeco Holdings Ltd Industrials 24 130 089 0.65% 0.65% Alliance Resources Ltd Basic Materials 762 474 0.17% 0.17% Energy Resources of Australia Ltd Basic Materials 10 573 558 0.27% 0.27% Alumina Ltd Basic Materials 110 036 341 0.66% 0.66% Energy World Corp Ltd Utilities 35 210 692 0.48% 0.48% Amcor Ltd/Australia Industrials 474 366 213 0.89% 0.89% Envestra Ltd Utilities 31 301 292 0.46% 0.46% AMP Ltd Financials 444 770 671 0.63% 0.63% Equatorial Resources Ltd Basic Materials 6 626 114 0.57% 0.57% Ampella Mining -

ANNUAL REPORT 2021 01 to Our Shareholders and Investors Financial Highlights

2021 2021 ANNUAL REPORT For the year ended March 31, 2021 目次Contents 02 株主・投資家の皆さまへTo Our Shareholders and Investors 21 研究開発Research and Development 03 財Financial 務 ハ イライト Highlights 22 知的財産Intellectual Property 非Non-nancial 財 務 ハ イライト Highlights 三Sustainability 菱 電 機 グ ル at ープ の 04 23 サステナビリティMitsubishi Electric Group イニシアティブと外部Initiatives / External Evaluation 評 価 05 2423 サステナビリティマネジメントSustainability Management 06 価値創造活動Initiatives to Create Value 26 GG: ガバナンスGovernance 33 EE: 環境Environment 経営戦略Corporate Strategy 08 37 SS: 社会Social At a Glance At a Glance ̶ 2020 年度のトピックス 45 ESG Information Disclosure List 14 Fiscal 2021 Topics 45 ESG 情報開示一覧 16 セグメント別営Review of Operations 業 概 況 Directors and Executive Ofcers 46 役員 16 重電システムEnergy and Electric Systems Organization 47 組織図 17 産Industrial 業 メカトロニクス Automation Systems 47 Major Subsidiaries and Afliates Information and 18 情 報 通信システム 48 セグメント別 主 要 関 係 会 社 Communication Systems 48 19 電子デバイス Financial Section 19 Electronic Devices 49 財務セクション 20 家庭電器 49 20 Home Appliances Corporate Data / 67 企 業データ/株 式 情 報 XX Shareholder Information OurWe, Groupthe Mitsubishi will strive Electric to further Group will increasecontribute its to corporate realizing valuesustainability through through bothall of wheelsour activities, of economic and further and social enhance value bycorporate contributing value tothat the emphasizes achievement the of creation sustainabilityof both economic through and socialall of our value. activities On February 1, 2021, thewe celebratedMitsubishi theElectric 100th Group anniversary celebrated of ourthe founding.100th anniversary We have includedof its establishment. our commitment We have to addedrealize tosustainability the management through policy all of of our maintaining activities, Balancedin our corporate Corporate management Management, policy which that consistsbalances of growth “Growth,” and “Protabilityprotability/efciency, & Efciency,” and andsoundness, “Soundness” we have and started have started taking onsteps the toward path to the the next next 100 100 years. -

Annual Report 2012(英語)

Contents 02 To Our Shareholders 03 Financial Highlights 04 Corporate Strategy 08 At a Glance Fiscal 2012 Overview 10 Review of Operations 10 Energy and Electric Systems 11 Industrial Automation Systems 12 Information and Communication Systems 13 Electronic Devices 14 Home Appliances 15 Research and Development/Intellectual Property 18 Corporate Social Responsibility 21 Corporate Governance 22 Directors and Executive Officers 23 Organization 24 Major Subsidiaries and Affiliates 25 Financial Section 73 Corporate Data/Shareholder Information Aiming to become a global, leading green company, enriching society with technology. Looking ahead to our 100th anniversary in 2021, our continued aim is to help enrich society. By enriching society, we mean creating a “people-friendly” society that ensures safety, peace of mind, health and comfort for all, as well as a more “earth-friendly” society that recycles and uses resources efficiently. We at the Mitsubishi Electric Group provide a wide spectrum of products and services, ranging from semiconductors to large-scale systems, with applications for homes, offices, factories, social infrastructure and even space systems. As we strive to become a global, leading green company that enriches society with technology, we will increase cross-cooperation within the Group while providing advanced technologies and engaging in a wide array of business pursuits. For the earth and for the future—the Mitsubishi Electric Group will continue to make steady steps toward achieving this goal. MITSUBISHI ELECTRIC CORPORATION ANNUAL REPORT 2012 01 To Our Shareholders Amid downturns in the European and East Asian economies, supply chain pressures caused by flooding in Thailand and a slowdown in Japanese production and exports, the business environment in the latter half of the fiscal year ended March 31, 2012 (hereinafter, fiscal 2012) worsened. -

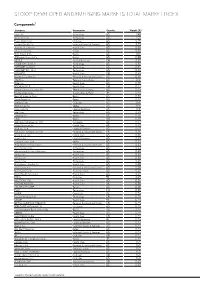

Stoxx® Developed and Emerging Markets Total Market Index

STOXX® DEVELOPED AND EMERGING MARKETS TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) Apple Inc. Technology US 1.48 Microsoft Corp. Technology US 1.07 Exxon Mobil Corp. Oil & Gas US 0.79 General Electric Co. Industrial Goods & Services US 0.75 Johnson & Johnson Health Care US 0.69 Amazon.com Inc. Retail US 0.63 Wells Fargo & Co. Banks US 0.61 JPMorgan Chase & Co. Banks US 0.58 NESTLE Food & Beverage CH 0.57 FACEBOOK CLASS A Technology US 0.57 ALPHABET CLASS C Technology US 0.54 ALPHABET INC. CL A Technology US 0.53 NOVARTIS Health Care CH 0.53 Procter & Gamble Co. Personal & Household Goods US 0.52 AT&T Inc. Telecommunications US 0.51 Pfizer Inc. Health Care US 0.48 ROCHE HLDG P Health Care CH 0.47 Verizon Communications Inc. Telecommunications US 0.45 Toyota Motor Corp. Automobiles & Parts JP 0.45 Bank of America Corp. Banks US 0.43 Home Depot Inc. Retail US 0.42 Chevron Corp. Oil & Gas US 0.41 Walt Disney Co. Media US 0.41 Coca-Cola Co. Food & Beverage US 0.41 Intel Corp. Technology US 0.39 Citigroup Inc. Banks US 0.38 HSBC Banks GB 0.38 Berkshire Hathaway Inc. Cl B Insurance US 0.37 Gilead Sciences Inc. Health Care US 0.37 VISA Inc. Cl A Financial Services US 0.37 Samsung Electronics Co Ltd Personal & Household Goods KR 0.36 Merck & Co. Inc. Health Care US 0.36 PepsiCo Inc. Food & Beverage US 0.35 Comcast Corp. Cl A Media US 0.35 Philip Morris International In Personal & Household Goods US 0.33 Cisco Systems Inc. -

Government Pension Fund Global Holding of Equities at 31 December 2013 Sector Value Market (NOK) Voting Ownership Sector Value Market (NOK) Voting Ownership

GOVERNMENT PENSION FUND GLOBAL HOLDING OF EQUITIES AT 31 DECEMBER 2013 Sector value Market (NOK) Voting Ownership Sector value Market (NOK) Voting Ownership ARGENTINA Drillsearch Energy Ltd Oil & Gas 18 144 955,40 0,58% 0,58% Telecom Argentina SA Telecommunications 17 006 739,52 0,08% 0,08% DUET Group Utilities 101 256 692,21 0,75% 0,75% AUSTRALIA DuluxGroup Ltd Industrials 78 155 606,37 0,70% 0,70% Abacus Property Group Financials 33 610 624,02 0,54% 0,54% Echo Entertainment Group Ltd Consumer Services 74 460 069,86 0,68% 0,68% Acrux Ltd Health Care 89 250 225,35 3,86% 3,86% Elders Ltd Consumer Goods 1 530 014,93 0,54% 0,54% Adelaide Brighton Ltd Industrials 279 408 953,36 2,20% 2,20% Emeco Holdings Ltd Industrials 7 384 644,17 1,01% 1,01% AGL Energy Ltd Utilities 441 414 094,41 0,97% 0,97% Energy Resources of Australia Ltd Basic Materials 118 412 500,06 3,34% 3,34% Ainsworth Game Technology Ltd Consumer Services 26 677 182,18 0,35% 0,35% Energy World Corp Ltd Utilities 21 468 629,15 0,60% 0,60% AJ Lucas Group Ltd Industrials 1 652 073,08 0,10% 0,10% Envestra Ltd Utilities 69 789 644,49 0,63% 0,63% Alliance Resources Ltd Basic Materials 418 727,49 0,17% 0,17% Equatorial Resources Ltd Basic Materials 2 323 105,86 0,53% 0,53% ALS Ltd/Queensland Consumer Goods 172 035 041,30 0,91% 0,91% ERM Power Ltd Utilities 24 750 345,53 0,80% 0,80% Altium Ltd Technology 49 313 790,34 3,47% 3,47% Fairfax Media Ltd Consumer Services 26 156 623,69 0,32% 0,32% Alumina Ltd Basic Materials 335 531 607,99 1,98% 1,98% Federation Centres Ltd Financials 147 823 -

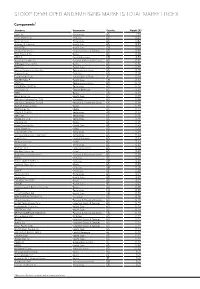

Stoxx® Developed and Emerging Markets Total Market Index

STOXX® DEVELOPED AND EMERGING MARKETS TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) Apple Inc. Technology US 1.70 Exxon Mobil Corp. Oil & Gas US 0.85 Microsoft Corp. Technology US 0.82 Johnson & Johnson Health Care US 0.65 NOVARTIS Health Care CH 0.60 General Electric Co. Industrial Goods & Services US 0.59 Wells Fargo & Co. Banks US 0.58 NESTLE Food & Beverage CH 0.57 Procter & Gamble Co. Personal & Household Goods US 0.52 JPMorgan Chase & Co. Banks US 0.52 Pfizer Inc. Health Care US 0.49 Verizon Communications Inc. Telecommunications US 0.46 Chevron Corp. Oil & Gas US 0.46 Toyota Motor Corp. Automobiles & Parts JP 0.45 ROCHE HLDG P Health Care CH 0.43 AT&T Inc. Telecommunications US 0.40 FACEBOOK CLASS A Technology US 0.40 Coca-Cola Co. Food & Beverage US 0.39 HSBC Banks GB 0.39 Merck & Co. Inc. Health Care US 0.38 Berkshire Hathaway Inc. Cl B Insurance US 0.38 Samsung Electronics Co Ltd Personal & Household Goods KR 0.38 Bank of America Corp. Banks US 0.38 Walt Disney Co. Media US 0.37 GOOGLE CLASS C Technology US 0.37 Intel Corp. Technology US 0.36 Google Inc. Cl A Technology US 0.36 Citigroup Inc. Banks US 0.36 Gilead Sciences Inc. Health Care US 0.35 Home Depot Inc. Retail US 0.35 Cisco Systems Inc. Technology US 0.34 International Business Machine Technology US 0.34 PepsiCo Inc. Food & Beverage US 0.33 Amazon.com Inc. Retail US 0.33 Oracle Corp. -

Mitsubishi Electric ADVANCE Vol.84

VOL. 84/SEP. 1998 Mobile Communications Edition MITSUBISHI ELECTRIC A Quarterly Survey of New Products, Systems, and Technology ●Vol. 84/Sep. 1998 Mitsubishi Electric ADVANCE Our cover photographs show the GSM-type MT-30 digital mobile telephone. This light- weight (170g) and compact (135 x 48 x 26mm) unit provides up to two hours of continuous conversation and 120 hours in standby mode using standard batteries, performance that Mobile Communications Edition puts it in the top class worldwide. CONTENTS Editor-in-Chief Shin Suzuki TECHNICAL REPORTS Editorial Advisors Jozo Nagata OVERVIEW Toshimasa Uji The Present and Future Trends of Mobile Communications ................... 1 Keisuke Ueki by Michio Nakanishi Masakazu Okuyama Yasuo Kobayashi The Development of Digital Mova D203 Hyper ......................................... 2 Masao Hataya by Tetsuaki Oga and Shin?ichi Fukui Toshiharu Nozawa Seiya Inoue GSM and PCS1900 Digital Cellular Phones............................................... 4 Takashi Nagamine by Takayuki Nonami Hiroaki Kawachi Development of Model MT151 Mobile AccessTM Phone ........................... 7 Akihiko Naito by Kiyoshi Takahashi and Akira Matsumoto Kouji Ishikawa Shingo Maeda A W-CDMA Modem for Mobile Toshikazu Saita Next-Generation Communication Systems............................................... 9 Akira Inokuma by Takahisa Aoyagi and Hideshi Murai Vol. 84 Feature Articles Editor Viterbi Equalization Technologies for Mobile Broadband Systems ............................................................... 12 -

Dissertation Mathias Knappe

Quellenverzeichnis ABDOLVAND/LIESENER 2009 Abdolvand, B./Liesener, M. (2009): Was treibt den Ölpreis? – oder: Der Versuch die Pyramide auf die Beine zu stellen, Schriftenreihe Horizonte 21: Umwelt, Energie, Sicherheit, Band 1, Universitätsverlag Potsdam, Potsdam ABERNATHY/CLARK 1985 Abernathy, W. J./Clark, K. B. (1985): Innovation – Mapping the winds of creative destruction, in: Research Policy, Vol. 14, No. 1, Seiten 3-22 ABERNATHY/ Abernathy, W. J./Utterback, J. M. (1978): Patterns of Industrial UTTERBACK 1978 Innovation, in: Technology Review, Vol. 80, No. 7, Seiten 40- 47 ABRAHAM 2012 Abraham, D. (2012): The Battle for New Resources: Minor minerals in green technologies, in: RIETI Policy Discussion Paper Series 12-P-005 AGOSTO 2002 Agosto, D. E. (2002): Bounded rationality and satisficing in young people's web-based decision making, in: Journal of the American Society for Information Science and Technology, Vol. 53, No. 1, Seiten 16-27 AHA/RADEMACHER 2011 Aha, C./Rademacher, S. (2011): Rechtliche Rahmenbedingun- gen der Elektromobilität in Deutschland und der Volksrepublik China, in: Korthauer, R. (Hrsg.): Handbuch Elektromobilität, 2. Auflage, EW Medien und Kongresse, Frankfurt, Seiten 177-192 ALCHIAN 1950 Alchian, A. (1950): Uncertainty, Evolution and Economic The- ory, in: Journal of Political Economy 58, Seiten 211-221 ALCHIAN/DEMSETZ 1972 Alchian, A. A./Demsetz, H. (1972): Production, information costs, and economic organization, in: The American Economic Review, Vol. 62, No. 5, Seiten 777-795 AMBRIZ 2010 Ambriz, A. M. (2010): Produktinnovationen durch Kompetenz- clusterbildung in kompetenzzellenbasierten Netzen, Chemnitz ANDERSON et al. 2002 Anderson, F./McNiven, C./Rose, A. (2002): An analysis of pat- terns of collaboration in Canadian manufacturing and biotech- nology firms, in: De la Mothe, J.