NA Power Electronics Supply Chain Assessment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Financial Statements

Annual Report and Financial Statements for the year ended 31 December 2018 Dimensional Funds ICVC Authorised by the Financial Conduct Authority No marketing notification has been submitted in Germany for the following Funds of Dimensional Funds ICVC: Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund Accordingly, these Funds must not be publicly marketed in Germany. Table of Contents Dimensional Funds ICVC General Information* 2 Investment Objectives and Policies* 3 Authorised Corporate Directors’ Investment Report* 6 Incorporation and Share Capital* 10 The Funds 10 Fund Cross-Holdings 10 Authorised Status* 10 Regulatory Disclosure* 10 Potential Implications of Brexit* 10 Responsibilities of the Authorised Corporate Director 11 Responsibilities of the Depositary 11 Report of the Depositary to the Shareholders 11 Directors' Statement 11 Independent Auditors’ Report to the Shareholders of Dimensional Funds ICVC 12 The Annual Report and Financial Statements for each of the below sub-funds (the “Funds”); Emerging Markets Core Equity Fund Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund are set out in the following order: Fund Information 14 Portfolio Statement* 31 Statement of Total Return 149 Statement of Change in Net Assets Attributable to Shareholders 149 Balance Sheet 150 Notes to the Financial Statements 151 Distribution Tables 168 Remuneration Disclosures (unaudited)* 177 Supplemental Information (unaudited) 178 * These collectively comprise the Authorised Corporate Directors’ (“ACD”) Report. Dimensional Fund Advisors Ltd. Annual Report and Financial Statements, 31 December 2018 1 Dimensional Funds ICVC General Information Authorised Corporate Director (the “ACD”): Dimensional Fund Advisors Ltd. -

Automotive – Winter 2019 Industry Insights: Automotive – Winter 2019

INDUSTRY INSIGHTS Automotive – Winter 2019 Industry Insights: Automotive – Winter 2019 2 0 1 8 B Y Highlights THE NUMBERS The automotive industry slowed in the second half of 2018 as global sales, earnings and stock prices stalled due primarily to economic uncertainty and declining consumer confidence globally after a strong opening half to the year. The automotive industry continues to evolve as Global light vehicle sales decreased by 0.5% 1 electrification gains a stronger foothold globally and autonomous vehicle in 2018 compared to 2017. development remains a focus. Late in the year, North American automakers implemented drastic restructuring plans to eliminate less profitable sedans from their lineups and focus on larger vehicles. For the year, China’s auto sales fell 1.7% with Global light vehicle sales declined 0.5% in 2018 relative to 2017 driven 1,4 by the unexpected decline in China. In the U.S., light vehicle sales grew 27.7 million units sold. 0.6% in 2018 to 17.3 million units.1 In December 2018, U.S. light vehicle sales reached 17.51 million units at a seasonally adjusted annual rate (SAAR), in line with recent historical periods.2 In 2018, U.S. light vehicle SAAR was 17.29 Interest rates on consumer installment loans for new automobiles million units, up from the 17.19 million mark in reached 5.30% in November 2018 in the U.S., up from 4.81% in 2017.2 November 2017 and the 5.05% mark in August 2018, creating further headwinds for the industry.3 In 2018, auto production and sales in China declined 4.29% and 2.8%, New passenger registrations increased by respectively, compared to 2017. -

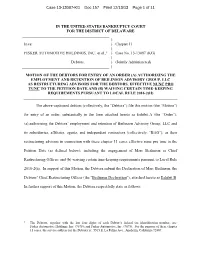

Chapter 11 ) FISKER AUTOMOTIVE HOLDINGS, INC., Et Al.,1 ) Case No

Case 13-13087-KG Doc 157 Filed 12/13/13 Page 1 of 11 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re: ) Chapter 11 ) FISKER AUTOMOTIVE HOLDINGS, INC., et al.,1 ) Case No. 13-13087 (KG) ) Debtors. ) (Jointly Administered) ) MOTION OF THE DEBTORS FOR ENTRY OF AN ORDER (A) AUTHORIZING THE EMPLOYMENT AND RETENTION OF BEILINSON ADVISORY GROUP, LLC AS RESTRUCTURING ADVISORS FOR THE DEBTORS, EFFECTIVE NUNC PRO TUNC TO THE PETITION DATE AND (B) WAIVING CERTAIN TIME-KEEPING REQUIREMENTS PURSUANT TO LOCAL RULE 2016-2(H) The above-captioned debtors (collectively, the “Debtors”) file this motion (the “Motion”) for entry of an order, substantially in the form attached hereto as Exhibit A (the “Order”): (a) authorizing the Debtors’ employment and retention of Beilinson Advisory Group, LLC and its subsidiaries, affiliates, agents, and independent contractors (collectively, “BAG”), as their restructuring advisors in connection with these chapter 11 cases effective nunc pro tunc to the Petition Date (as defined below), including the engagement of Marc Beilinson as Chief Restructuring Officer; and (b) waiving certain time-keeping requirements pursuant to Local Rule 2016-2(h). In support of this Motion, the Debtors submit the Declaration of Marc Beilinson, the Debtors’ Chief Restructuring Officer (the “Beilinson Declaration”), attached hereto as Exhibit B. In further support of this Motion, the Debtors respectfully state as follows: 1 The Debtors, together with the last four digits of each Debtor’s federal tax identification number, are: Fisker Automotive Holdings, Inc. (9678); and Fisker Automotive, Inc. (9075). For the purpose of these chapter 11 cases, the service address for the Debtors is: 5515 E. -

Corporate Strategy

Corporate Strategy May 2012 Contents 1. Corporate Mission 9. Strengthening Management Foundation 2. Corporate Governance 10. Improve Financial Standing 3. Management Policy: Balanced Corporate Management 11. Strengthen Environmental Management/Environment- 4. Management Framework Oriented Businesses 5. Essential Growth Strategies 12. Forecast for FY2012 6. Direction of Growth Strategies 13. Management Targets 7. Strengthening the Global Strategy Notes: 8. Technological Development: FY2007: April 1, 2007 – March 31, 2008 Strong Businesses Stronger FY2008: April 1, 2008 – March 31, 2009 FY2009: April 1, 2009 – March 31, 2010 FY2010: April 1, 2010 – March 31, 2011 FY2011: April 1, 2011-March 31, 2012 FY2012: April 1, 2012 – March 31, 2013 11 1. Corporate Mission Encourage Fulfillment of Social Responsibility through Our Business Activities QualityQuality TrustTrust TechnologyTechnology Seven Guiding Principles Corporate Mission GrowthGrowth The Mitsubishi Electric Group will continually improve its technologies CitizenshipCitizenship and services by applying creativity to all aspects of its business. By doing so, we enhance the quality of life in our society. EnvironmentEnvironment EthicsEthics 22 2. Corporate Governance Increased Flexibility and Transparency of the Management, Reinforced Supervisory Function over the Management General Shareholders’ Meeting Actual practices at Mitsubishi Electric Reporting to Reporting to Appointment • Thorough separation of execution and supervision Execution Supervision Appointment / • Majority of board -

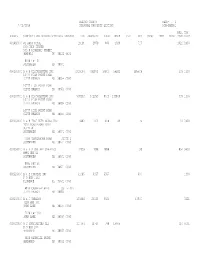

1 7/01/2014 Personal Property Listing Pgm-Paedrl Bus

DESOTO COUNTY PAGE- 1 7/01/2014 PERSONAL PROPERTY LISTING PGM-PAEDRL BUS. TAX ______PARCEL _____________________________________NAME/MAILING ADDRESS/PHYSICAL ADDRESS ____TRUE ________ASSESSED ____FURN ____MECH ____LESD ____INVT ____BANK ____DEBT ____MISC ____TYPE ____DIST 001692000 #1 AUTO STORE 19191 2879 833 1329 717 1022 2400 C/O JOHN TURNER 503 N HIGHLAND STREET MEMPHIS TN 38122 4521 8108 HWY 51 SOUTHAVEN MS 38671 000103000 A & B DISTRIBUTING INC 3219144 482872 37843 59521 385508 339 1300 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 000103001 A & B DISTRIBUTING INC 948352 142253 8445 133808 339 1306 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 002663000 A & B FAST AUTO GLASS INC 6682 1002 878 49 75 31 2400 7020 TCHULAHOMA ROAD SUITE #1 SOUTHAVEN MS 38671 0000 7020 TCHULAHOMA ROAD SUITE 1 SOUTHAVEN MS 38671 0000 003356000 A & B SIGNS AND GRAPHICS 12639 1896 1858 38 854 3400 8985 HWY 51 SOUTHAVEN MS 38671 0000 8985 HWY 51 SOUTHAVEN MS 38671 0000 002526000 A & E HOSPICE INC 41045 6157 5557 600 1300 P O BOX 1332 FLORENCE AL 35631 0000 6810 CRUMPLER BLVD SUITE 101 OLIVE BRANCH MS 38654 002132000 A & J TOBACCO 133464 20020 6520 13500 3221 7128 HWY 301 HORN LAKE MS 38637 0000 7128 HWY 301 HORN LAKE MS 38637 0000 002722000 A C SPECIALTIES LLC 111754 16763 798 15965 314 5101 P O BOX 277 HERNANDO MS 38632 0000 3425 MAGNOLIA DRIVE HERNANDO MS 38632 0000 DESOTO COUNTY PAGE- 2 7/01/2014 PERSONAL PROPERTY LISTING PGM-PAEDRL BUS. -

Richmond Electric Vehicle Initiative Electric Vehicle Readiness Plan

Project Funded By: US Department of Energy Funding Awarded To: Virginia Department of Mines, Minerals and Energy Al Christopher, Energy Division Director Document Prepared and Virginia Clean Cities Project Managed By: Alleyn Harned, Executive Director 540-568-8896 [email protected] Michael Phillips, REVi Project Manager 804-482-1790 [email protected] Document Contributors: Dominion Virginia Power Andrew Flavin, Alternative Energy Policy Research Analyst 804-819-2826 [email protected] Richmond Regional Planning District Commission Robert Crum, Executive Director 804-323-2033 John Fogg, Senior Planner J. Sargeant Reynolds Community College Charles Swaim, School of Business Assistant Dean 804-523-5023 Melissa Gay, Automotive Technology Group Project Manager Sustainable Transportation Strategies David Mayfield, Principal [email protected] This material is based upon work supported by the Department of Energy under Award Number DE-EE0005550, awarded to the Virginia Department of Mines, Minerals and Energy (DMME). This report was prepared as an account of work sponsored by an agency of the United States Government. Neither the contributors to this program, the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States Government or any agency thereof. -

AWAR Volume 24.Indb

THE AWA REVIEW Volume 24 2011 Published by THE ANTIQUE WIRELESS ASSOCIATION PO Box 421, Bloomfi eld, NY 14469-0421 http://www.antiquewireless.org i Devoted to research and documentation of the history of wireless communications. Antique Wireless Association P.O. Box 421 Bloomfi eld, New York 14469-0421 Founded 1952, Chartered as a non-profi t corporation by the State of New York. http://www.antiquewireless.org THE A.W.A. REVIEW EDITOR Robert P. Murray, Ph.D. Vancouver, BC, Canada ASSOCIATE EDITORS Erich Brueschke, BSEE, MD, KC9ACE David Bart, BA, MBA, KB9YPD FORMER EDITORS Robert M. Morris W2LV, (silent key) William B. Fizette, Ph.D., W2GDB Ludwell A. Sibley, KB2EVN Thomas B. Perera, Ph.D., W1TP Brian C. Belanger, Ph.D. OFFICERS OF THE ANTIQUE WIRELESS ASSOCIATION DIRECTOR: Tom Peterson, Jr. DEPUTY DIRECTOR: Robert Hobday, N2EVG SECRETARY: Dr. William Hopkins, AA2YV TREASURER: Stan Avery, WM3D AWA MUSEUM CURATOR: Bruce Roloson W2BDR 2011 by the Antique Wireless Association ISBN 0-9741994-8-6 Cover image is of Ms. Kathleen Parkin of San Rafael, California, shown as the cover-girl of the Electrical Experimenter, October 1916. She held both a commercial and an amateur license at 16 years of age. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the copyright owner. Printed in Canada by Friesens Corporation Altona, MB ii Table of Contents Volume 24, 2011 Foreword ....................................................................... iv The History of Japanese Radio (1925 - 1945) Tadanobu Okabe .................................................................1 Henry Clifford - Telegraph Engineer and Artist Bill Burns ...................................................................... -

Power Transformer

www.seec.com.tw Power Transformer INTEGRATION OF POWER SYSTEM We Light Up the Taipei 101, Once the highest building in the world 22.8KV Substation in every 10 oor. CRTR :3P 22.8KV 2~4MVA * 70 PCS PANEL :3P HV&/LV* l780 SETS 161KV Substation in B4 Belong to TPC TR :3P 161/22.8KV 60MVA * 4 PCS GIS:3P 161/22.8KV 60MVA * 4 PCS We Light Up the Taipei 101, Contents Once the highest building in the world The Course of Change and Development 2 Main Products 3 Manufacture Capability & Scope 4 Manufacture Technology 5 Technology R&D 6 22.8KV Substation in every 10 oor. Quality Assurance 7 CRTR :3P 22.8KV 2~4MVA * 70 PCS PANEL :3P HV&/LV* l780 SETS Products Characteristics Cores 8 Windings 9 Tanks 10 Manufacture Process of Oil Immersed Transformer 11 Main Domestic Customers 12 Main Export Customers 12 161KV Substation in B4 Belong to TPC TR :3P 161/22.8KV 60MVA * 4 PCS GIS:3P 161/22.8KV 60MVA * 4 PCS 1 Power transformer Power The Course of Change and Development In 1955, Shinlin Electric Joint Stock Company made its first step to manufacture heavy-duty electrical equipments in collaboration with Mitsubishi Electric Corporation, and developed 69kV, 161kV, 345kV power transformers. In 2003, successfully developed 345kV 650MVA transformer, the maximum capacity in Taiwan, for Taichung Thermal power Plant. And 161kV 60MVA SF6 Gas Insulated. Transformer for underground transformer station in Taipei World Trade Center. The 50-year-long relentless improvement, reliable expertise and superb quality enable Shihlin Electric to deliver customized products and services. -

Philanthropic Activities

2011/10/21 2011/10/21 Contents Philanthropic Activities 1 Social Welfare 2 Environmental Preservation 7 Science & Technology 13 Philanthropic Foundations 16 Culture & Sports 19 Disaster Relief 22 Milestones 24 Archives 26 Social Welfare 27 Environmental Preservation 35 Science & Technology 41 Other 44 Supporting social welfare Activities, technologies and A major driving force in the programs in Japan and products that make development and application overseas designed to help Mitsubishi Electric a Socially of technologies that turn bold people live fuller lives. Responsible Investment. new ideas into the things that make the modern world work. More More More Philanthropic Foundations Milestones Culture & Sports Archives Disaster Relief Philanthropy Promotion Organization *http://www.meaf.org/ Aiming for CO2 reduction of 1kg per person per day 1 Helping People Live Fuller Lives Mitsubishi Electric funds and supports social welfare programs in Japan and overseas designed to help people live fuller lives, and help them make meaningful contributions to their local communities. SOCIO-ROOTS Fund The Mitsubishi Electric SOCIO-ROOTS Fund was established in 1992 as a gift program in which the Company matches any donation made by an employee, thus doubling the goodwill of the gift. More than 1,000 employees participate in the Fund each year. As of March 2011, the Fund had provided a total of approximately ¥585 million to some 1,400 various social welfare facilities and programs. In recent years, we have extended the scope of our donations to include social welfare activities related to environmental preservation and disaster relief. In fiscal 2008, we made contributions to the Children's Forest Program in Malaysia organized by OISCA (an international NGO engaged in agricultural development and environmental protection activities, mainly in Asia and the Pacific region) and participated in local tree-planting activities under a framework that brings together the Fund and our corporate achievement award system. -

Annual Report 2007 Mitsubishi Electric Corporation Annual Report 2007 1 to Our Shareholders Corporate Strategy: Implementing Balanced Management

X-X01-7-C7792-A HQ0707〈MDOC〉 Printed in Japan AT A GLANCE CORPORATE DATA FINANCIAL HIGHLIGHTS Energy and Electric Systems Industrial Automation Systems Information and Communication As of March 31, 2007 Years ended March 31 Yen U.S. dollars Systems (millions) (thousands) MITSUBISHI ELECTRIC CORPORATION 2007 2006 2005 2007 868,789 860,111 644,111 Tokyo Building, 06 06 06 2-7-3, Marunouchi, 25,296 95,967 20,677 Net sales ¥3,855,745 ¥3,604,185 ¥3,410,685 $32,675,805 Chiyoda-ku, Tokyo 100-8310, Operating income 233,002 157,718 120,642 1,974,593 951,065 956,930 688,004 Japan 07 07 07 49,310 126,227 20,803 Phone: +81 (3) 3218-2111 Net income 123,080 95,692 71,175 1,043,051 ESTABLISHED: Total assets 3,452,231 3,313,742 3,162,472 29,256,195 January 15, 1921 Shareholders’ equity 1,059,209 942,202 720,637 8,976,347 MAIN PRODUCTS AND BUSINESS LINES MAIN PRODUCTS AND BUSINESS LINES MAIN PRODUCTS AND BUSINESS LINES Capital expenditure 140,557 134,413 125,657 1,191,161 PAID-IN CAPITAL: Turbine generators, hydraulic turbine Programmable logic controllers, inverters, Wireless communications equipment, ¥175,820 million R&D expenditure 132,722 130,639 130,541 1,124,763 generators, nuclear power plant equipment, servomotors, human-machine interface, mobile handsets, cable communications SHARES ISSUED: motors, transformers, power electronics motors, hoists, magnetic switches, no-fuse systems, satellite communications equipment, circuit breakers, gas insulated circuit breakers, short-circuit breakers, equipment, artificial satellites, radar 2,147,201,551 shares Yen U.S. -

Government Pension Fund Global Holding of Equities at 31 December

Government Pension Fund Global Holding of equities at 31 December 2011 et value K) K) arket value arket ark wnership wnership ector ector oting oting NO NO S M ( V O S M ( V O AUSTRALIA David Jones Ltd Consumer Services 51 018 951 0.67% 0.67% Abacus Property Group Financials 22 995 524 0.51% 0.51% Deep Yellow Ltd Basic Materials 2 644 029 0.29% 0.29% ABC Learning Centres Ltd Consumer Services 1 672 0.50% 0.50% Dexus Property Group Financials 158 816 463 0.65% 0.65% Acrux Ltd Health Care 16 824 771 0.58% 0.58% Discovery Metals Ltd Basic Materials 25 004 853 0.71% 0.71% Adelaide Brighton Ltd Industrials 54 271 215 0.48% 0.48% Downer EDI Ltd Industrials 55 616 672 0.66% 0.66% AED Oil Ltd Oil & Gas 642 658 0.30% 0.30% DuluxGroup Ltd Industrials 104 835 466 1.61% 1.61% AGL Energy Ltd Utilities 259 696 118 0.64% 0.64% Echo Entertainment Group Ltd Consumer Services 97 268 039 0.64% 0.64% AJ Lucas Group Ltd Industrials 1 743 778 0.24% 0.24% Elders Ltd Consumer Goods 3 899 317 0.55% 0.55% Alesco Corp Ltd Industrials 3 440 168 0.52% 0.52% Emeco Holdings Ltd Industrials 24 130 089 0.65% 0.65% Alliance Resources Ltd Basic Materials 762 474 0.17% 0.17% Energy Resources of Australia Ltd Basic Materials 10 573 558 0.27% 0.27% Alumina Ltd Basic Materials 110 036 341 0.66% 0.66% Energy World Corp Ltd Utilities 35 210 692 0.48% 0.48% Amcor Ltd/Australia Industrials 474 366 213 0.89% 0.89% Envestra Ltd Utilities 31 301 292 0.46% 0.46% AMP Ltd Financials 444 770 671 0.63% 0.63% Equatorial Resources Ltd Basic Materials 6 626 114 0.57% 0.57% Ampella Mining -

Effect of Consonance Between Features and Voice Impression On

Interdisciplinary Information Sciences Vol. 18, No. 2 (2012) 83–85 #Graduate School of Information Sciences, Tohoku University ISSN 1340-9050 print/1347-6157 online DOI 10.4036/iis.2012.83 Effect of Consonance between Features and Voice Impression on the McGurk Effect Shuichi SAKAMOTOÃ, Hiroshi MISHIMA, and Yoˆiti SUZUKI Research Institute of Electrical Communication and Graduate School of Information Sciences, Tohoku University, Sendai 980-8577, Japan Received June 13, 2012; final version accepted August 31, 2012 The McGurk effect is one of the typical phenomena caused by human multi-modal information processing between auditory and visual speech perception. In this paper, we investigated the relation between the degree of the McGurk effect and the perceived impression by speech sounds and moving images of the talker’s face. As stimuli, uttered speech sounds were combined with moving images of a different talker’s face. These stimuli were presented to observers, who were asked to respond to what the talker was saying. At the same time, they were asked to report their subjective impressions of these stimuli. Matching between the voice and moving image was used as the index of the judgment. Results showed that matching between a voice and a talker’s facial movements affected the degree of the McGurk effect, suggesting that audio–visual kansei information affects phoneme perception. KEYWORDS: McGurk effect, audio–visual speech perception, multi-modal processing, lip-reading 1. Introduction Many researchers have pointed out that visual information strongly affects speech understanding [1, 2]. Using recent broadband networks, not only auditory information (speech signal) but also visual information (moving image of talker’s face) can be transferred easily.