Aa3 BOOK-ENTRY ONLY Fitch: AA- See “RATINGS” Herein

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Spring 2017 in This Issue

Spring 2017 SMU Announces 2017 Athletics Hall of In this issue Fame Class 2017 Hall of Fame Class SMU and SMU Athletics, in conjunction with the Announced SMU Lettermen’s Association, have announced the newest class of the SMU Athletics Hall of Fame. Men’s Basketball Makes The 2017 inductees include: Krista Wilson Klein, History Rod Jones, Ricardo Prado, George Hardie, Oscar Roan and Richard Quick. Football Announces 2017 Recruiting Class These athletes will be recognized at the annual Hall of Fame banquet and induction ceremony on Friday, May 5 at Moody Coliseum. Jerry LeVias Mustang Football Golf Classic - Hardie was a member of the men's tennis team from 1972-75 and was part of two Southwest Conference championship Register Today! teams in 1973 and 1975. Individually, Hardie was a four-time All-American in singles play and an All-American doubles play- er in 1974. During his senior season, he reached the NCAA singles championship match and finished as runner-up. Hardie Ponies in the Press also claimed two SWC singles titles, in 1973 and 1974. Post SMU, Hardie competed professionally making it to the round of 16 twice at the Australian Open In Memoriam Jones, a decorated multi-sport athlete at SMU, competed on the men's track and field and football teams 1982-1986. He was Upcoming Dates and a member of the 1983 NCAA Indoor and Outdoor Trach & Field Championship teams, as well as the 1986 NCAA Outdoor Championship team. A four-time All-American, he earned honors in the mile relay (1984), 1,600m relay (1983 & 1986) and Events the 400m (1986). -

SMU Parking and ID Card Services E 521 72 75 76

Parking Map 2019–20 SMU Parking and ID Card Services E 521 72 75 76 AV 74 73 77 78 31 32 71 N 3 Construction Area THENS AIRLINE RD 521 A T DANIEL AVENUE DANIEL AVENUE T P 79 80 COUR 4 Q 34 AIRLINE 33 S 521 5 6 81 82 35 37 DUBLIN STREET DURHAM STREET 7 UNIVERSITY BOULEVARD 521 R UNIVERSITY BLVD 1 521 41 8 DALLAS HALL 38 U FONDREN DRIVE FONDREN DR M LANE 42 39 40 39 T S. HYER LANE BOAZ 9 Construction AIRLINE ROAD Area 43 11 McFARLIN BLVD ROBER McFARLIN BOULEVARD 521 45 46 10 W3 L 12 44 83 84 CENTENNIAL HALL DYER COURT V DYER STREET DYER STREET DYER STREET Visitor Center 521 87 521 52 85 86 W2 116 13 51 50 113 47 53 GEORGE W. BUSH W1 PRESIDENTIAL CENTER 114 88 89 90 91 92 93 PARKING 14 15 49 115 SMU BOULEVARD 54 55 56 SMU BOULEVARD 48 16 17 B J 117 94 INTRAMURAL VENUE 118 57 FIELDS 18 58 59 BINKLEY AVENUE BUSH A 112 W4 20 95 Y ) 19 60 96 C SSWA 98 SSWAY 521 ARD 21 H 97 E 65 R 23 62 521 22 A L E X P 24 63 66 100 99 GE W. BUSH EXPRE BISHOP BOULEV D 25 26 R 521 T W I N S I X T 64 O GE 102 (NORTH CENTRA 27 28 103 I E S D R I V E 101 Construction Area 29 69 E 104 106 105 521 30 F 119 MOCKINGBIRD 521 STATION/ G OWNBY DRIVE 107 108 DART RAIL SCHLEGEL ST 70 521 521 ARD 521 75 VENUE 120 WORCOLA STREET 109 521 VE. -

Combined Guide for Web.Pdf

2015-16 American Preseason Player of the Year Nic Moore, SMU 2015-16 Preseason Coaches Poll Preseason All-Conference First Team (First-place votes in parenthesis) Octavius Ellis, Sr., F, Cincinnati Daniel Hamilton, So., G/F, UConn 1. SMU (8) 98 *Markus Kennedy, R-Sr., F, SMU 2. UConn (2) 87 *Nic Moore, R-Sr., G, SMU 3. Cincinnati (1) 84 James Woodard, Sr., G, Tulsa 4. Tulsa 76 5. Memphis 59 Preseason All-Conference Second Team 6. Temple 54 7. Houston 48 Troy Caupain, Jr., G, Cincinnati Amida Brimah, Jr., C, UConn 8. East Carolina 31 Sterling Gibbs, GS, G, UConn 9. UCF 30 Shaq Goodwin, Sr., F, Memphis 10. USF 20 Shaquille Harrison, Sr., G, Tulsa 11. Tulane 11 [*] denotes unanimous selection Preseason Player of the Year: Nic Moore, SMU Preseason Rookie of the Year: Jalen Adams, UConn THE AMERICAN ATHLETIC CONFERENCE Table Of Contents American Athletic Conference ...............................................2-3 Commissioner Mike Aresco ....................................................4-5 Conference Staff .......................................................................6-9 15 Park Row West • Providence, Rhode Island 02903 Conference Headquarters ........................................................10 Switchboard - 401.244-3278 • Communications - 401.453.0660 www.TheAmerican.org American Digital Network ........................................................11 Officiating ....................................................................................12 American Athletic Conference Staff American Athletic Conference Notebook -

Peruna Named Official SMU Mascot

Health and Fitness Sports How to be healthy on Halloween Sailing team still looking for support from student body Page 2 Page 3 VOLUME 95, ISSUE 34 WEDNESDAY, OCTOBER 28, 2009 SMUDAILYCAMPUS.COM FIRST COPY FREE, ADDITIONAL COPIES 50 CENTS DALLAS, TEXAS SENATE Peruna named official SMU mascot BY BROOKS POWELL a Peruna handler, said they were class of 1944 alumna Francis Ware. taken for granted. Staff Writer [email protected] concerned a potential change in Ware’s family has had a “Peruna is really more than a the mascot was not brought before tremendous impact on SMU, mascot — he’s an icon,” Ware said. The SMU student senate passed a the students and the greater SMU including facilitating its founding. “An icon is not a real thing, you resolution Tuesday naming Peruna, community. Her grandfather Stephen J. Hay II, know, but it represents the real thing the black Shetland pony, SMU’s To encourage passage of the mayor of Dallas from 1907-1911, perfectly. And that’s our spirit.” official mascot, ostensibly ending resolution, the Department of lobbied Dallas citizens to buy the Judith Banes, executive director the controversy over the two new Recreational Sports brought the live bonds necessary to build the first of Recreational Sports, also shared horses given to the university by mascot, Peruna VIII, and his stuffed building on campus, Dallas Hall, as a variety of anecdotes about Peruna BROOKS POWELL/ The Daily Campus philanthropist Madeleine Pickens. analog to the floor of the Senate. a tribute to their generosity. from her years as an SMU student. -

Southern Methodist University OFFICIAL

OFFICIAL STATEMENT DATED OCTOBER 7, 2010 RATINGS: NEW ISSUE Moody’s: “Aa3” BOOK-ENTRY ONLY Standard & Poor’s: “AA-” See “RATINGS” herein. The delivery of the Series 2010 Bonds (as described below) is subject to the opinion of Vinson & Elkins L.L.P., Bond Counsel, to the effect that interest on the Series 2010 Bonds is excludable from gross income for federal income tax purposes under existing law, subject to the matters described under “TAX MATTERS” herein, and is not a specific preference item or included in a corporation’s adjusted current earnings for purposes of the federal alternative minimum tax. See “TAX MATTERS—TAX EXEMPTION” herein for a discussion of Bond Counsel’s opinion. $116,330,000 Southern SOUTHWEST HIGHER EDUCATION AUTHORITY, INC. Methodist Higher Education Revenue Bonds University (Southern Methodist University Project) Series 2010 Dated: Date of Delivery Due: October 1, as shown below The Southwest Higher Education Authority, Inc. (the “Issuer”) is offering $116,330,000 of its Higher Education Revenue Bonds (Southern Methodist University Project) Series 2010 (the “Series 2010 Bonds”). Interest on the Series 2010 Bonds accrues from the date of delivery and is payable on April 1, 2011, and semiannually on each October 1 and April 1 thereafter. The Series 2010 Bonds will be issued as fully registered bonds in denominations of $5,000 or integral multiples thereof and, when issued, will be registered in the name of Cede & Co., as nominee for The Depository Trust Company (“DTC”), New York, New York. DTC will act as securities depository for the Series 2010 Bonds. So long as the book-entry system is in effect, purchases of beneficial ownership interests in the Series 2010 Bonds will be made in book-entry form only and purchasers will not receive certificates representing their interests in the Series 2010 Bonds purchased. -

UAB SAM HOUSTON STATE Saturday, August 19 • 7 P.M

2006 OPPONENTS UAB SAM HOUSTON STATE Saturday, August 19 • 7 p.m. CST (Exhibition) Friday, August 25 • 7 p.m. CST Starkville, Miss. • MSU Soccer Field (500) Huntsville, Texas • Holleman Field (600) Paul Harbin F Sally Palmer Marcia Oliveira GK Melissa Sauceda GENERAL INFORMATION MEDIA RELATIONS GENERAL INFORMATION MEDIA RELATIONS Location . .Birmingham, Alabama Soccer Contact . .Michelle Cunningham Location . .Huntsville, Texas Soccer Contact . .Paul Ridings Founded . .1969 Office Phone . .(205) 934-0725 Founded . .1879 Office Phone . .(936) 294-1764 Enrollment . .16,357 Cell Phone . .(205) 417-8145 Enrollment . .15,322 Cell Phone . .TBA Nickname . .Blazers E-Mail . [email protected] Nickname . .Bearkats E-Mail . [email protected] Colors . .Forest Green & Old Gold SID Fax . .(205) 934-7505 Colors . .Orange & White SID Fax . .(936) 294-3538 Conference . .Conference USA Press Box . .n/a Conference . .Southland Press Box . .None President . .Dr. Carol Garrison Web Page . .www.uabsports.com President . .Dr. James F. Gaertner Web Page . .www.GoBearkats.com Athletic Director . .Richard Margison Athletic Director . .Bobby Williams SWA . .Rosalind Ervin SERIES INFORMATION SWA . .n/a SERIES INFORMATION Stadium . .West Campus Field Overall . .UAB leads 3-2-0 Stadium . .Holleman Field Overall . .First meeting Capacity . .2,500 [MSU @ Home: 1-1-0; Away: 1-2-0] Capacity . .600 [MSU @ Home: 0-0-0; Away: 0-0-0] Dept. Phone . .(205) 934-7252 Last MSU win: . .9/30/01 (1-0) Dept. Phone . .(936) 294-1729 Last MSU win: . .n/a Ticket Office . .(205) 934-8001 Last MSU home win: . .9/6/96 (2-0) Ticket Office . .(936) 294-1729 Last MSU home win: . .n/a Last MSU road win: . -

14Msocguide Complete.Pdf

GO TigersGO . COM The University of Memphis Table of Contents/Media Information MEDIA ATHLETICS COMMUNICATIONS The 2014 edition of theTigers Soccer Media Guide is a comprehensive source of informa- tion with statistics and historical references for use by media covering Tigers soccer. For additional information about Tigers soccer, please call the University of Memphis Athlet- A look at media policies and guidelines, as Julie ics Communications Office at 901-678-2337. well as information about the Mike Rose Nelson Soccer Stadium, the University of Memphis, the American Athletic Conference and 2014 SOCCER CONTACT Photographers will be granted credentials QUICK FACTS opponents. O: 901-678-5223 through the University of Memphis Athletics C: 281-961-3569 Communications Office and not the Mike General Information Rose Soccer Complex. Media Quick Facts .................................................1 E-MAIL: School: ......... The University of Memphis Media Information .....................................1 [email protected] Location: ........................Memphis, Tenn. Mike Rose Soccer Complex .........................2 STATISTICS Founded: .........................................1912 University President ...................................3 Athletics Communications Enrollment: ...................................21,480 Athletics Director ........................................4 203 Athletic Office Bldg./570 Normal St. Affiliation: .......................NCAA Division I The U of M Athletics Communications Office University of Memphis -

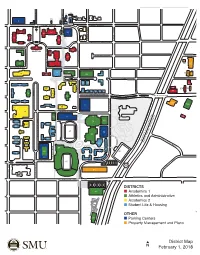

District Map February 1, 2018

32 34 35 30 31 2 3 33 4 8 39 36 37 5 6 38 7 1 42 9 DALLAS HALL 40 43 41 10 11894 11995 45 46 11 12096 44 66 67 12197 70 51 68 69 110125 12 50 98 47 52 122 100124 110226 71 72 73 74 75 76 19923 13 14 49 53 48 15 16 103 127 104 54 77 128 17 55 19 18 56 57 78 105129 20 79 80 22 58 21 23 59 61 84 81 24 26 60 82 25 27 83 28 64 85 87 62 86 11790 29 63 88 89 65 130 91 DISTRICTS 92 Academics 1 Athletics and Administrative Academics 2 Student Life & Housing OTHER 93 Parking Centers Property Management and Plano District Map February 1, 2018 ALPHABETICAL ORDER 9 Perkins Administration Building 35 Daniel House 39 Airline Parking Center 23 Perkins Chapel 36 Heroy Science Hall 73 Alpha Epsilon Pi 21 Perkins Hall 37 Fondren Science Building 33 Alpha Psi Lambda 15 Peyton Hall 38 Dedman Life Sciences Building 42 Annette Caldwell Simmons Hall 71 Phi Delta Theta 39 Airline Parking Center 85 Armstrong Commons 72 Phi Gamma Delta 40 Hyer Hall 83 Arnold Dining Commons 69 Pi Kappa Alpha 41 Fondren Library Center 67 Beta Theta Pi 28 Prothro Hall 42 Annette Caldwell Simmons Hall 57 Binkley Parking Center 104 Robson & Lindley Aquatics Center 43 Harold Clark Simmons Hall 8 Blanton Observatory 27 Selecman Hall 44 Clements Hall 53 Blanton Student Services Building 13 Shuttles Hall 45 Hughes-Trigg Student Center 54 Boaz Commons 70 Sigma Alpha Epsilon 46 Patterson Hall 22 Bridwell Library 74 Sigma Phi Epsilon 47 Maguire Building 94 Café Brazil 20 Smith Hall 48 Crow Building 6 Carr Collins Hall 14 Smith Health Center 49 Fincher Building 50 Caruth Hall 30 SMU Apartments -

2013 Msoc Mediaguide.Pdf

Table of Contents/Media Information MEDIA ATHLETICS COMMUNICATIONS The 2013 edition of the Tigers Soccer Media Guide is a comprehensive source of infor- mation with statistics and historical references for use by media covering Tigers soccer. For additional information about Tigers soccer, please call the University of Memphis A look at media policies and guidelines, as Alex Athletics Communications Office at 901-678-2337. well as information about the Mike Rose Hubbard Soccer Stadium, the University of Memphis, the American Athletic Conference and 2013 SOCCER CONTACT PHOTOGRAPHERS QUICK FACTS opponents. O: 901-678-3291 C: 720-934-7083 General Information Press and television photographers are Media Quick Facts .................................................1 E-MAIL: School: ......... The University of Memphis Media Information .....................................1 [email protected] requested to stay at least 10 feet from the Location: ........................Memphis, Tenn. Mike Rose Soccer Complex .........................2 playing surface. Photographers must have Founded: .........................................1912 Interim University President .......................3 Blake working credentials for access to the field. Enrollment: ...................................22,139 Photographers will be granted credentials Athletics Director ........................................4 Barington Affiliation: .......................NCAA Division I University of Memphis ...............................5 through the University of Memphis -

Tornado Strikes Near Carrollton Public School

\K( \hi \( ,1 1 FRIDAY Sbptembbi 7,2001 Vol. 87 No. 13 Todayi IS B ® Htfi91Low75 SEP 1 2 2 / f Htfi 87 Low 76 An independent newspaper serving Southern Methodist University • Dallas, Texas smudailycampus.com Tornado strikes near Carrollton public school By De'Borah Bankston SENIOR STAFF WRITER • BANKSTONI0UREACH.COM TcfffifXiSft* MYTHS ; Just 17 miles northwest of the SMU cam pus lies McCoy Elementary School in There are many misconceptions iCarrollton. that swirl around tales of torna ' Wednesday, this school was witness to •the first recorded tornado strike in the city's dos. Knowing the truth about • history. this phenomenon can pro tea you ; School was in session and the day was in the event of a storm. •coming to an end as winds blasted through ;the neighborhood. The storm snapped power and telephone • Tornadoes are not always clearly ilines, damaged homes, and ripped apart :trees across the Dallas suburb. visible, they are often hidden by At Polk Middle School, children fol heavy rainfall. lowed standard tornado safety procedures and no one was injured. • Damage caused by tornados ; "We didn't try to downplay the serious doesn't stem from changes in air • ness of this with the children, but we were pressure, but from the dangerous ;calm. This carried over to everyone," said ;Mark Hyatt, Assistant Superintendent of ly fast winds of the storm. Thus, Support Services for the Carrollton-Farmers opening windows will not protect Branch Independent School District. "Everyone went into the halls, just like we your house - in fact, it could do for the drills and there were no prob make it more vulnerable. -

SMU-Parking-Map.Pdf

Visitor Parking Map 2008-09 SMU Park ’N Pony Parking and ID Card Services Hughes-Trigg Student Center, First floor 214-768-7275 (PARK) Visit smu.edu/parknpony for vehicle regulations and general parking information. ALPHABETICAL 85 Material Accumulation Center 84 Pi Kappa Alpha 34 Hyer Hall 79 Alpha Kappa Alpha 3027 Dyer Court 3035 Dyer Street 6424 Hilltop Lane 3105 Fondren Drive ORDER 56 McElvaney Hall 86 Sigma Alpha Epsilon 35 Science Information Center 80 Patterson Hall/SMU Police 6000 Bishop Boulevard 3005 Dyer Court 6425 Airline Road 3128 Dyer Street 73 Airline Parking Garage 9 McFarlin Auditorium 50 Sigma Chi 36 Fondren Library Center 81 Dawson Service Center 6506 Airline Road 6405 Boaz Lane 3100 Binkley Avenue 6414 Hilltop Lane 3050 Dyer Street 77 Annette Caldwell Simmons 59 Meadows Museum 90 Sigma Phi Epsilon 37 Fondren Library West 82 Lambda Chi Alpha Building (future site) 5900 Bishop Boulevard 3050 SMU Boulevard (DeGolyer Library) 3004 Dyer Court 53 Binkley Parking Garage 60 Meadows Museum Parking SORORITIES 6404 Hilltop Lane 83 SMU Service House 3101 Binkley Avenue Garage 38 Fondren Library East 3041 Dyer Street 47 Blanton Student Services 5900 Bishop Boulevard 71 Alpha Chi Omega (Fondren Library) 84 Pi Kappa Alpha Building 13 Memorial Health Center 3020 Daniel Avenue 6414 Hilltop Lane 3035 Dyer Street 6185 Airline Road 6211 Bishop Boulevard 79 Alpha Kappa Alpha 39 Clements Hall 85 Material Accumulation Center 48 Boaz Hall 94 Moody Coliseum 3105 Fondren Drive 3200 Dyer Street 3027 Dyer Court 3200 Binkley Avenue 6024 Airline -

Full Page Photo

Welcome to the 2017 American Athletic Conference Men’s Soccer Championship Westcott Field (Dallas) on the campus of Southern Methodist University (SMU) will host the 2017 American Athletic Conference Men’s Soccer Championship. SMU earned the 2017 American Athletic Conference men’s soccer regular-season title and clinched the No. 1 seed in the Conference Championship. UCF will be seeded No. 2 while UConn and Temple claimed the third and fourth seeds, respectively. All four teams will compete for the championship title and the conference’s automatic bid to the NCAA Tournament. The Knights and the Huskies kick off Championship semifinals action at 5:30 p.m. ET/4:30 p.m. CT in the first match of the day on Friday, Nov. 10, while the host Mustangs face the Owls in the night cap at 8 p.m. ET/7 p.m. CT. Both semifinal matchups will air live on The American Digital Network (www.YouTube.com/AmericanAthleticConf. The semifinal winners will square off in the title game on Sunday, Nov. 12 (2 p.m. ET/1 p.m. CT, ESPNU) for the conference’s automatic bid to the NCAA Tournament. No. 3 UConn Nov. 10, 4:30 p.m. CT Dallas, Texas No. 2 UCF Nov. 12, 1 p.m. CT Dallas, Texas 2017 American Men’s Soccer Champion No. 4 Temple Nov. 10, 7 p.m. CT Dallas, Texas No. 1 SMU @American_MSoc Facebook.com/AmericanConf 2017 NCAA Championship – Men’s College Cup The winner of the the American Athletic Conference Championship receives the league’s automatic bid to the 48-team NCAA Division I Men’s Soccer Championship.