Greater Norwich Infrastructure Needs & Funding Study October 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A R Y 2 0 0 8 E D I T I O N

F E B R U A R Y 2 0 0 8 E D I T I O N UK Commercial Property Investment Transactions 1 Jan 2008 - 31 Jan 2008 Value of Sales Number £1,481m 73 CONTENTS Total Value of UK Investment Transactions (Year to Date January 2008) SECTOR LISTING........................................ 2 GEOGRAPHICAL LISTING...........................5 4,000 3,633 BUYERS & SELLERS LISTING....................9 3,500 3,161 THREE MONTH YIELD INDEX...................12 3,000 2,829 2,655 ACTIVE PROPERTY INVESTORS.............14 2,500 INVESTMENT STATISTICS.......................18 The monthly bulletin is available in hardcopy and 2,000 PDF formats for £395.00 pa (12 issues). 1,481 1,500 The next edition of the bulletin will be published on Monday 3rd March 2008. m £ Volume Transaction 1,000 This report is intended for general information and is based upon material in our possession or 500 supplied to us, which we believe to be reliable. Whilst every effort has been made to ensure its 0 accuracy and completeness we cannot offer any warranty that factual errors may not have 2004 2005 2006 2007 2008 occurred. Year to Date (Jan - Jan) For further information please visit our website: www.propertydata.com or call 01785 859300 Office Retail Industrial Leisure Other Total Copyright (c) 2008. Property Data Ltd. Year-to-Date Investor Breakdown 1 Jan 2008 - 31 Jan 2008 Institutions Property Co's Private Investor Overseas Other Purchases £m 41 376 218 725 120 Sales £m 660 182 30 205 404 Net Investment £m -619 194 188 520 -284 Year-to-Date Sector Breakdown 1 Jan 2008 - 31 Jan 2008 -

(Council) Councillors Cllr Fairclough Astley Bridge Ward

TYPE Title LastName Organisation/CompanyName (Council) Councillors Cllr Fairclough Astley Bridge Ward (Council) Councillors Cllr Walsh OBE Astley Bridge Ward (Council) Councillors Cllr Wild Astley Bridge Ward (Council) Councillors Cllr Dean Bradshaw Ward (Council) Councillors Cllr Haslam Bradshaw Ward (Council) Councillors Cllr Hall Bradshaw Ward (Council) Councillors Cllr Byrne Breightmet Ward (Council) Councillors Cllr Byrne Breightmet Ward (Council) Councillors Cllr Challender Breightmet Ward (Council) Councillors Cllr Critchley Bromley Cross Ward (Council) Councillors Cllr Wells Greenhalgh Bromley Cross Ward (Council) Councillors Cllr Wilkinson Bromley Cross Ward (Council) Councillors Cllr Bashir-Ismail Crompton Ward (Council) Councillors Cllr Darvesh Crompton Ward (Council) Councillors Cllr Harkin Crompton Ward (Council) Councillors Cllr Gillies Farnworth Ward (Council) Councillors Cllr Ibrahim Farnworth Ward (Council) Councillors Cllr Spencer Farnworth Ward (Council) Councillors Cllr Ayub Great Lever ward (Council) Councillors Cllr Iqbal Great Lever ward (Council) Councillors Cllr Murray Great Lever ward (Council) Councillors Cllr Morris Halliwell ward (Council) Councillors Cllr Thomas Halliwell ward (Council) Councillors Cllr Zaman Halliwell ward (Council) Councillors Cllr Clare Harper Green ward (Council) Councillors Cllr Francis Harper Green ward (Council) Councillors Cllr Mistry Harper Green ward (Council) Councillors Cllr Allen Heaton and Lostock ward (Council) Councillors Cllr Rushton Heaton and Lostock ward (Council) Councillors -

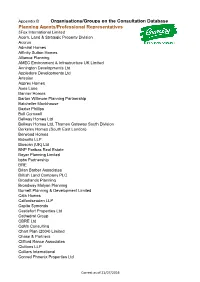

Organisations/Groups on the Consultation Database Planning

Appendix B Organisations/Groups on the Consultation Database Planning Agents/Professional Representatives 3Fox International Limited Acorn, Land & Strategic Property Division Acorus Admiral Homes Affinity Sutton Homes Alliance Planning AMEC Environment & Infrastructure UK Limited Annington Developments Ltd Appledore Developments Ltd Artesian Asprey Homes Axes Lane Banner Homes Barton Willmore Planning Partnership Batcheller Monkhouse Baxter Phillips Bell Cornwell Bellway Homes Ltd Bellway Homes Ltd, Thames Gateway South Division Berkeley Homes (South East London) Berwood Homes Bidwells LLP Bioscan (UK) Ltd BNP Paribas Real Estate Boyer Planning Limited bptw Partnership BRE Brian Barber Associates British Land Company PLC Broadlands Planning Broadway Malyan Planning Burnett Planning & Development Limited Cala Homes Calfordseaden LLP Capita Symonds Castlefort Properties Ltd Cathedral Group CBRE Ltd CgMs Consulting Chart Plan (2004) Limited Chase & Partners Clifford Rance Associates Cluttons LLP Colliers International Conrad Phoenix Properties Ltd Correct as of 21/07/2016 Conrad Ritblat Erdman Co-Operative Group Ltd., Countryside Strategic Projects plc Cranbrook Home Extensions Crest Nicholson Eastern Crest Strategic Projectsl Ltd Croudace D & M Planning Daniel Watney LLP Deloitte Real Estate DHA Planning Direct Build Services Limited DLA Town Planning Ltd dp9 DPDS Consulting Group Drivers Jonas Deloitte Dron & Wright DTZ Edwards Covell Architecture & Planning Fairclough Homes Fairview Estates (Housing) Ltd Firstplan FirstPlus Planning Limited -

49 P51 AO1 Hot Noms.Qxp 04/12/2007 17:23 Page 51

49 p51 AO1 Hot noms.qxp 04/12/2007 17:23 Page 51 www.propertyweek.com Analysis + opinion – Hot 100 51 07.12.07 ROLL OF HONOUR The following 527 rising stars were all nominated by readers, but did not receive enough votes to make it on to the Hot 100 list. However, we have decided to publish all of their names to recognise and reward their individual achievements Ab Shome, RBS Caroline McDade, Drivers Jonas Douglas Higgins Ian Webster, Colliers CRE Adam Buchler, Buchler Barnett Celine Donnet, Cohen & Steers Duncan Walker, Helical Bar Ian Webster, Savills Adam Oliver, Coleman Bennett Charles Archer, Colliers CRE Edward Offenbach, DTZ James Abrahms, Allsop Adam Poyner, Colliers CRE Charles Bull, DTZ Corporate Finance Edward Siddall-Jones, Nattrass Giles James Ackroyd, Colliers CRE Adam Robson, Drivers Jonas Charles Ferguson Davie, Moorfield Group Edward Towers James Bain, Mollison Adam Varley, Lambert Smith Hampton Charles Kearney, Gerry O’Connor Elizabeth Higgins, Drivers Jonas James Baker, Nice Investments Adam Winton, Kaupthing Estate Agents Elliot Robertson, Manorlane James Cobbold, Colliers CRE Agnes Peters, Drivers Jonas Charlie Archer, Colliers CRE Emilia Keladitis, DTZ Corporate Finance James Ebel, Harper Dennis Hobbs Akhtar Alibhai, Colliers CRE Charlie Barke, Cushman & Wakefield Emma Crowley, Jones Lang LaSalle James Feilden, GVA Grimley Alan Gardener, Jones Lang LaSalle Charlie Bezzant, Reed Smith Richards Butler Emma Wilson, Urban Splash James Goymour, Edward Symmons Alan Hegarty, Bennett Property Charlote Fourmont, Drivers Jonas -

Cgms Consulting on Behalf of Twyford Abbey Properties

LONDON BOROUGH OF EALING DEVELOPMENT (OR CORE) STRATEGY SUBMISSION DEVELOPMENT PLAN DOCUMENT – INDEPENDENT EXAMINATION HEARING SESSION TUESDAY 15 NOVEMBER 2011, 10.30 AM MATTER 9 – PROTECTING AND ENHANCING EALING’S GREEN AND OPEN SPACES Representations on behalf of Twyford Abbey Properties Ltd Personal Identification (Representor Number): 5 Representation Numbers: 22, 23, 24, 25, 26 and 28 October 2011 Planning G Heritage Specialist & Independent Advisors to the Property Industry Author: Valerie Scott Director Approved by: Richard Tilley Director Report Status: Final Issue Date: 10 October 2011 CgMs Ref: VJS/13250 © CgMs Limited No part of this report is to be copied in any way without prior written consent. Every effort is made to provide detailed and accurate information, however, CgMs Limited cannot be held responsible for errors or inaccuracies within this report. © Ordnance Survey maps reproduced with the sanction of the controller of HM Stationery Office. Licence No: AL 100014723 LB Ealing, Development (or Core) Strategy Submission Development Plan Document – Independent Examination – Matter 9 – Protecting Representation on behalf of and Enhancing Ealing’s Green and Open Spaces Twyford Abbey Properties Ltd CONTENTS PAGE(S) Introduction 4 Inspector’s Issues and Questions 4 Recommended Change to Policy and Text 7 APPENDICES 1. Site Plan 2. Display Boards 3. Draft Layout 4. Feasibility Appraisal 5. Marketing Report 6. Review of the Feasibility Appraisal and Marketing Report carried out by GL Hearn on behalf of the Council 7. Hotel Appraisal Report by GVA Grimley CgMs Ltd © 3/7 VJS/AW/7706 LB Ealing, Development (or Core) Strategy Submission Development Plan Document – Independent Examination – Matter 9 – Protecting Representation on behalf of and Enhancing Ealing’s Green and Open Spaces Twyford Abbey Properties Ltd Introduction 1. -

Affordable Housing Regulation 12 Consultation Statement

Affordable housing supplementary planning document Town and Country Planning (Local Development) Regulations 2012 Consultation Statement in accordance with regulation 12(a). The Town and Country Planning (Local Development) regulations of 2012 stipulate in regulation 12(a) that before adoption of a supplementary planning document, the local planning authority must prepare a statement setting out: i) the persons the local planning authority consulted when preparing the supplementary planning document; ii) a summary of the main issues raised by those persons, and; iii) how those issues have been addressed in the supplementary planning document. In accordance with that regulation 12(a) the persons and organisations listed in appendix A were consulted in preparing the Affordable housing SPD. Public consultation on the draft version of the document took place between 1st October to 31st October 2014. Details of the consultation can be found here: http://www.norwich.gov.uk/YourCouncil/Consultations/ClosedConsultations/2014/Pages/N orwichLocalPlanAffordableHousingSPD.aspx Appendix B to this document sets out the responses received to the consultation and how the issues raised have been addressed in the SPD. In addition, in accordance with that regulation 12(a) the persons and organisations listed in appendix A were consulted again between 19th January to 30th January 2015 on the implications of national planning policy changes for JCS policy 4 and the introduction of the ‘vacant building credit’. Details of the consultation can be found here: http://www.norwich.gov.uk/YourCouncil/Consultations/Pages/AffordableHousingSPDRecon sultation.aspx Appendix C to this document sets out the responses received to the consultation and how the issues raised have been addressed in the SPD. -

Top 100 Surveyors

41top100surveyorsdr&!!!.qxd 05/10/2007 16:37 Page 69 Top 250 consultants 69 TOP 100 SURVEYORS Rank Practice Surveying staff Total UK Total UK Offices chartered staff staff 2007 2006 Total Quantity Building 2006 Other 2007 2007 2006 UK Worldwide 11 Atkins 1,628 556 274 798 6,340 5,807 12,066 11,372 175 255 22 EC Harris 1,255 950 300 5 1,722 1,459 2,312 2,054 21 42 36 King Sturge 786 0 128 658 842 678 1,638 1,387 27 50 47 Gardiner & Theobald 689 634 15 40 700 626 1,000 900 21 49 55 Davis Langdon 681 611 12 58 950 859 1,593 1,356 19 95 64 Faithful + Gould (Part of Atkins) 641 514 75 52 826 849 1,180 1,155 26 53 7= – Mott MacDonald 544 536 8 0 2,584 1,667 5,554 4,007 52 122 7= 8 Franklin + Andrews 544 536 8 0 609 558 780 715 18 28 911 Turner & Townsend 482 434 36 12 1,084 918 1,342 1,121 13 53 10 10 Knight Frank 478 0 78 400 478 454 1,416 1,262 58 157 11 12 Drivers Jonas 458 2 100 356 460 425 650 580 8 11 12 9 Gleeds 457 375 35 47 592 592 1,049 997 18 40 13 13 Capita Symonds 318 154 74 90 1,493 1,373 3,783 3,568 40 40 14 17 Mouchel Parkman 257 26 128 103 1,849 1,293 7,458 5,507 12 18 15 – Erinaceous 219 84 43 92 364 0 749 0 112 120 16 14 Systech Group 204 204 0 0 211 202 319 286 6 16 17 16 Cyril Sweett 178 134 19 25 237 213 669 568 15 78 18 15 Corderoy 165 155 5 5 173 168 258 254 9 10 19 19 UK Building Surveyors 164 34 94 36 225 179 537 411 31 31 20 18 Jacobs 161 99 13 49 1,338 1,190 6,013 3,870 42 52 21 – Rider Levett Bucknall 139 97 36 6 230 147 412 292 8 69 22= 21 Mace 131 131 0 0 788 686 2,002 1,374 10 22 22= – Currie & Brown 131 113 6 -

TR Property Investment Trust Plc – Report & Accounts for the Year Ended 31 March 2009 Report Investment Trusttr Property Plc –

TR Property Investment Trust plc –TR Property Investment Trust Report March 2009 & Accounts for the year ended 31 TR Property Investment Trust plc Report & Accounts for the year ended 31 March 2009 TR Property Investment Trust plc is managed by This document is printed on Revive Silk of which 75% of the furnish is made from 100% de-inked post consumer waste. The remaining 25% being mill broke and virgin fibres. This paper is bleached using a combination of Totally Chlorine Free (TCF) and Elemental Chlorine Free (ECF). The manufacturing mill is accredited with the ISO 14001 standard for environmental management. TR Property Investment Trust plc Directors’ Review Accounts 1 Overview 63 Independent Auditors’ Report 2 Statement of Investment Objective and Policy 64 Group Income Statement 4 Financial Highlights and Performance 65 Group and Company Statement of Changes in Equity 5 Historical Performance 66 Group and Company Balance Sheets 6 Chairman’s Statement 67 Group and Company Cash Flow Statements 11 Managers’ Report – Market Background and Outlook 68 Notes to the Financial Statements 16 Ordinary Shares – Financial Highlights and Performance Shareholder Information 17 Ordinary Shares – Manager’s Report 86 Notice of Annual General Meeting 22 Ordinary Shares – Portfolio Details 89 Explanation of Notice of Annual General Meeting 28 Ordinary Shares – Income Statement 90 Glossary of Terms 29 Ordinary Shares – Balance Sheet 91 Directors and Other Information 30 Sigma Shares – Financial Highlights and Performance 92 General Shareholder Information -

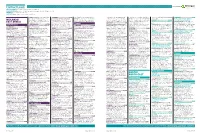

Contract Leads Powered by EARLY PLANNING Projects in Planning up to Detailed Plans Submitted

Contract Leads Powered by EARLY PLANNING Projects in planning up to detailed plans submitted. PLANS APPROVED Projects where the detailed plans have been approved but are still at pre-tender stage. TENDERS Projects that are at the tender stage CONTRACTS Approved projects at main contract awarded stage. Planning authority: Sandwell Job: Detailed COVENTRY £0.6M depot Client: Carvers (Wolverhampton) Ltd Northampton, NN6 8NN Contractor: Orbit Plans Granted for power distribution depot Rawcliffe, Goole, Humberside, DN14 8RW Tel: SHEFFIELD £10M Plans Submitted for 156 flats & 30 houses Grove Street Car Park, Grove Street Developer: P J Barnett Associates, Waterloo Housing Association, Garden Court, Binley Client: Western Power Distribution Agent: B3 01405 839779 Former Staybrite Works, Weedon MIDLANDS/ Client: Nighthawk Ltd Agent: PJ Planning, Planning authority: Coventry Job: Detail House, 92 - 94 Chapel Ash, Wolverhampton, Business Park, Harry Weston Road, Coventry, Architects, Loughborough Technology Centre, HALIFAX £0.58M Street Meadowhall Way/Drive 125 Heath Lane, Stourbridge, West Midlands, Plans Granted for pumping station Client: West Midlands, WV3 0TY Tel: 01902 427297 West Midlands, CV3 2SU Tel: 024 7643 8000 Epinal Way, Loughborough, Leicestershire, Land Adjacent To High Ridge, Denfield Planning authority: Sheffield Job: Plans EAST ANGLIA DY8 1BB Tel: 0121 2120706 Cofely District Energy Developer: Cofely LEICESTER £1M LE11 3GE Contractor: Speller Metcalfe Lane Appr On Appeal for retail/car showrooms/ PETERBOROUGH £0.74M District Energy, 4 Heatline Project Office, Tenders 22 High Street Kibworth Beauchamp (Malvern) Ltd, Maple Road, Enigma Business Planning authority: Calderdale Job: Outline takeaway Client: British Land Ltd Developer: Early Planning Glebe Farm House, Peterborough Road Much Park Street, Civic Centre 4, Coventry, CAMBRIDGE £0.95M Planning authority: Harborough Job: Detail Park, Malvern, Hereford & Worcester, WR14 Plans Submitted for 8 houses Client: Mr. -

Contract Leads Powered by EARLY PLANNING Projects in Planning up to Detailed Plans Submitted

Contract Leads Powered by EARLY PLANNINGProjects in planning up to detailed plans submitted. PLANS APPROVEDProjects where the detailed plans have been approved but are still at pre-tender stage. TENDERSProjects that are at the tender stage CONTRACTSApproved projects at main contract awarded stage. Client: De Montfort University Agent: RPS, Plans Granted for 14 flats Client: The Planning authority: Sandwell Job: Detail Lockington, Derby, DE74 2RH Tender return Planning authority: Broadland Job: Detail Planning authority: Hartlepool Job: Detailed Planning authority: Kirklees Job: Detail Highfield House, 5 Ridgeway, Quinton Federation of Groundwork Trusts Developer: Plans Granted for office & temporary stands date: is 31st August 2012. Tel: 01509 672772 Plans Granted for 8 houses/6 flats & 1 luxury Plans Submitted for retail unit (alterations) Plans Granted for club (extension) Client: Mr. MIDLANDS/ Business Park, Quinton, Birmingham, West C T Planning Ltd, Trafalgar House, 20A Market Client: West Bromwich Albion FC Developer: house Client: Youngs Homes Agent: Richard Client: Highpoint Estates Limited Agent: A Hussain Developer: PH Planning And Midlands, B32 1AF Tel: 0121 213 5500 Street, Lichfield, Staffordshire, WS13 6LH Tel: Glancy Nicholls Architects, 3 Greenfield Contracts Pike Associates, Netherconesford, 93 - 95 Harris Partnership Ltd, 2 St. Johns North, Design, Brooksfield, South Kirkby, Pontefract, EAST ANGLIA NORTHAMPTON £1.8M 01543 418779 Crescent, Edgbaston, Birmingham, West BIRMINGHAM £5M King Street, Norwich, Norfolk, NR1 1PW -

2012 Annual Report & Accounts

ANNUAL REPORT 2 012 & ACCOUNTS The Directors present the Annual Report for the year ended 31 December 2012 which includes the business review, governance report and audited financial statements for the year. References to ‘SEGRO’, the ‘Group’, the ‘Company’, ‘we’, or ‘our’ are to SEGRO plc and/or its subsidiaries, or any of them as the context may require. Pages 1 to 67, inclusive, of this Annual Report comprise a Directors’ Report that has been drawn up and presented in accordance with English company law and the liabilities of the Directors in connection with that Report shall be subject to the limitations and restrictions provided by such law. The Annual Report contains forward looking statements. For further information see the inside back cover. OVERVIEW SEGRO is a leading owner, asset CONTENTS manager and developer of modern OVERVIEW warehousing, light industrial and 02 Highlights 03 Chairman’s Statement data centre properties, with £4.7 PERFORMANCE REVIEWPERFORMANCE 04 SEGRO Today 08 Strong Demand Drivers for billion of assets (including our share Modern Warehouse Space of joint venture assets) principally PERFORMANCE REVIEW 10 Chief Executive’s Review concentrated in London’s Western 11 Progress Against our Strategic Priorities Corridor (including the Thames 18 Key Performance Indicators Valley) and in key conurbations in 20 A Strong Year for New GOVERNANCE CORPORATE Development Projects France, Germany and Poland, as well 22 Building Critical Mass in the Logistics Market as suburban office buildings in the 24 Corporate Responsibility Review 32 Financial Review Thames Valley, Brussels and Milan. 40 Principal Risks and Uncertainties GOVERNANCE The Group serves over 1,300 44 Board of Directors 46 Governance Report customers spread across a diverse 52 Nomination Committee Report FINANCIAL STATEMENTS 54 Audit Committee Report range of industry sectors. -

21212A Rt EPRA Report Rt

Going for gold EPRA Annual Report Survey 2011/12 Contents Foreword 1 Highlights 2 1. Introducing the survey 3 2. Award winners 6 3. Survey results 8 4. EPRA reporting measures 10 5. Award process 13 Participant list 14 Foreword I am delighted to announce the results of our EPRA We have observed that interpretation of the BPR and its Annual Report Survey 2011/12. The survey comprised definitions can vary across EPRA constituents. Now that a review of 85 annual reports from leading listed real the EPRA Performance Measures have become more estate companies across Europe to assess compliance firmly established, the next step for companies will be with EPRA’s Best Practice Recommendations (BPR). to work together with EPRA to determine the most appropriate treatment for these items in the EPRA We have seen significant improvements in BPR Performance Measures disclosures. compliance, as reflected in the overall survey results and in the increase in the number of companies with gold Finally I would like to thank Catherine Rolph and the awards. Gold, silver and bronze awards have been team of reviewers at Deloitte, from across our European Claire Faulkner given to those companies we judged to have best real estate practice. Head of Real Estate, complied with the BPR. 33 awards were made in total, Deloitte UK 15 of them gold, compared to 9 last year. A further Please contact myself, or alternatively Gareth Lewis at +44 (0) 20 7007 0116 9 silver and 9 bronze awards were issued. EPRA, if you would like any further information about [email protected] this survey.