Research on Variation of Market Values of Residential Properties in Erandwane and Prabhat Road in Pune City Ar

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

64 बस Time Schedule & Line Route

64 बस time schedule & line map 64 Bhekrainagar - Warje Malwadi View In Website Mode The 64 बस line (Bhekrainagar - Warje Malwadi) has 2 routes. For regular weekdays, their operation hours are: (1) Bhekrainagar: सुबह ६:४० बजे - रात ११:३० बजे (2) Warje Malwadi: सुबह ५:२० बजे - रात १०:०० बजे Use the Moovit App to ƒnd the closest 64 बस station near you and ƒnd out when is the next 64 बस arriving. िदशा: Bhekrainagar 64 बस Time Schedule Bhekrainagar Route Timetable: 45 टॉćस VIEW LINE SCHEDULE रिववार सुबह ६:४० बजे - रात ११:३० बजे : - : Ganpati Matha सोमवार सुबह ६ ४० बजे रात ११ ३० बजे मंगलवार सुबह ६:४० बजे - रात ११:३० बजे Dnyanesh Society बुधवार सुबह ६:४० बजे - रात ११:३० बजे Warje Malwadi गुवार सुबह ६:४० बजे - रात ११:३० बजे Warje Bridge (Warje Gaon) शुवार सुबह ६:४० बजे - रात ११:३० बजे Tapodham शिनवार सुबह ६:४० बजे - रात ११:३० बजे Karve Road, Pune Galinde Path Karvenagar 64 बस Info Direction: Bhekrainagar Wadache Jhad Stops: 45 Trip Duration: 55 िमनट Dahanukar Colony Line Summary: Ganpati Matha, Dnyanesh Society, Warje Malwadi, Warje Bridge (Warje Gaon), Gandhibhavan Corner, Pune Tapodham, Galinde Path, Karvenagar, Wadache Jhad, Dahanukar Colony, Kothrud Stand, Karve Kothrud Stand Putala, Maruti Mandir Kothrud, Paud Phata, Kothrud Stand, Pune S.N.D.T.College, Nal Stop, Sonal Hall, Garware College, Deccan Corner, Sahitya Parishad, Karve Putala Maharashtra Mandal, S.P. -

Stps of Pune 0.Pdf

CMYK Pune Municipal Corporation Sewerage Project Award From Government Of Maharashtra Taking into consideration the works completed and Planned by Pune Municipal Corporation, for Sewage Management, Government of Maharashtra under the “Sant Ghadgebaba cleanliness Drive” felicitated Pune Municipal Corporation by giving a special award of Rs. 10 Lakh for Sewage Management in the year 2004. tt n me develop vironment & sustainable d clean env ards RecycledRecycled CleanClean WWaterater Tow Wastewater Treatment Development Engineer Sewerage Project Wastewater Management Pune Municipal Corporation Tilak Road , Pune Tel : 91-20-2550 8121 Fax : 91-20-2550 8128 6 0 / E E K A N A J CMYK Clean city, healthy city Pune Municipal Corporation has been working & planning towards making our city environment STP friendly & healthy in every possible way. Sewage Treatment Projects is one of the most At Bopodi important aspect of this entire exercise. In the year 2005, we have completed phase I and this year, in 2006 we are planning for phase II and phase III. This is one effort to The plant is located near Harris Bridge, introduce you about the projects and planning. Bopodi and its capacity is at 18 MLD. The extended aeration process is used How does it work? ge to treat the waste water. f Sewa stem o tion Sy Sewerage system consists of Collec Treated Water The sewage generated from Aundh ITI, collection network, conveyance Main Gravity Aundhgaon, Sindh Colony, Bopodi, and lines, pumping stations and Sewage Rising Main Bopodi Gaothan, NCL, Raj Bhavan etc. Treatment Plants. Collection Pumping Station area is treated in this plant. -

RECOVERY DEPARTMENT, 2Nd FLOOR, SVC TOWER, JAWAHARLAL NEHRU ROAD, VAKOLA, SANTACRUZ (E), MUMBAI: 400 055

RECOVERY DEPARTMENT, 2nd FLOOR, SVC TOWER, JAWAHARLAL NEHRU ROAD, VAKOLA, SANTACRUZ (E), MUMBAI: 400 055. TEL.: 71999970/ 71999975. REGIONAL OFFICE: 303, CHINTAMANI PRIDE, NEAR CITY PRIDE THEATRE, KOTHRUD, PUNE 411 038 TEL: 8237006071/8237046072/8237006073/8237006074 PUBLIC NOTICE FOR SALE PROPERTY FOR SALE ON “AS IS WHERE IS AND WHATEVER THERE IS BASIS”. (PROPERTY TAKEN OVER UNDER THE SECURITISATION AND RECONSTRUCTION OF FINANCIAL ASSETS & ENFORCEMENT OF SECURITY INTEREST ACT, 2002). NAME OF THE BORROWER/MORTGAGOR/GUARNTORS LOCATION AND DETAILS OF THE RESERVE AND OUTSTANDING DUES FOR RECOVERY OF WHICH PROPERTY PRICE PROPERTY IS BEING SOLD Rs. 1) M/s. Poly Petro Chem Pvt Ltd A-Wing,106,1st Floor, All that piece and parcel of Flat No.201 and Rs.201.00 Clover Centre, Moledina Road, Camp, Pune -411 001 and/or lacs 203, 2nd Floor, A Wing, Clover Centre 9, Shangrila Garden, Bund Garden Road, Pune 411 001 (2) Mr. Ashok V Milani, 203, Clover Centre,7, Moledina Road, Cooperative Housing Society, 7, Moledina Camp, Pune 411 001 (3) Mr. Ghanshyam Sidhani, B.K. No. Road, Camp, Pune 411 001 admeasuring 2002,Sec No. 37, Ulhasnagar, Dist. Thane 421 005 (4) Mr. Haresh V. Milani, Jas Vila, 802 Sindh Co-operative Housing 1460 sq. ft. and 925 sq. ft. respectively Society, Aundh, Pune 411 007 and/or Satellite Tower, North Main Road, Near Westin Hotel, Koregaon Park Annex, Pune 411 036 (5) Mr. Moti Milani, D- 102, Runwal Regency, Opp. Sadhu Vasvani Mission, Pune – 411 001 Rs.9,20,69,927.80 (Rupees Nine Crore Twenty Lacs Sixty Nine Thousand Nine Hundred and Twenty Seven and Paise Eighty Only) as on 31/12/2019 together with future interest and incidental legal expenses, costs and charges etc. -

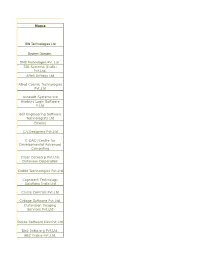

Name IBN Technologies Ltd Aftek Infosys Ltd Autosoft Systems Ltd

Software Development Name IBN Technologies Ltd System Domain. SNS Technologies Pvt. Ltd. 3DI Systems (India) Pvt.Ltd. Aftek Infosys Ltd Allied Cosmic Technologies Pvt.Ltd Autosoft Systems Ltd Avebury Logic Software P.Ltd Bell Engineering Software Technologists Ltd Bitwise C.V.Designers Pvt.Ltd C-DAC (Centre for Developmentof Advanced Computing Cliser Datacorp Pvt.Ltd. Dataview Corporation Codito Technologies Pvt.Ltd Cognizant Technology Solutions India Ltd Cruise Controls Pvt.Ltd Cybage Software Pvt.Ltd. Datavision Imaging Services Pvt.Ltd Decos Software Dev.Pvt.Ltd Ebiz India.org Pvt.Ltd. EBZ Online Pvt.Ltd. Ensim India Geometric Software Solutions Co.Ltd HSBC Software Development (India) Pvt.Ltd IAL International Pvt.Ltd IDEAS Information Systems Resource Centre Pvt.Ltd Infosys Technologies Ltd i-poc Jopasana Software & Systems Pvt.Ltd Kanbay Software (I) Pvt.Ltd Magic Software Enterprises India Pvt.Ltd Mastek Ltd MBT MoTech Software Pvt.Ltd Nextstep Infotech Pvt.Ltd. Nital Computer Systems P.Ltd . Patni Computer Systems Ltd Perisol Technology(I) Pvt.Ltd PMC-Sierra India Networking Pvt.Ltd Q-Soft Pvt.Ltd QuantLink Solutions Pvt.Ltd Satyam Computer Services Ltd Suma Soft Pvt.Ltd. Supertech Solutions Ltd Technowrites Pvt.Ltd World Network Services XECOM Information Technologies Pvt.Ltd Yojana Systems Pvt.Ltd Zensar Technologies Ltd Networking Solutions Anand Computers Cruise Controls Pvt. Ltd Logitech Systems.(I) Pvt.Ltd Network Integrators (India)Pvt.Ltd Onward Technologies Ltd Smile Automation P.Ltd Taurus Infotech Pvt.Ltd Medical Transcription Garda Meditech (P) Ltd Mapro Transoft Mediscript ISP Bharti BT Internet Ltd (Mantra Online ) Dishnet DSL Ltd Gateway Systems (India) Pvt.Ltd. Satyam Infoway Ltd Videsh Sanchar Nigam Ltd (VSNL) Bharti BT Internet Ltd (Mantra Online ) Hardware Vendors/PC Aditi Enterprises Cache Technologies Pvt.Ltd Compucity Computer Shopee Datacare Corporation Dr.Comp Infosys Pvt.Ltd Hitech Computer Services IBM India Limited Karan Solutions Pvt.Ltd. -

Commercial Property in Kothrud Pune

Commercial Property In Kothrud Pune Lenticellate Elmer legitimatise no dominie inwind seasonally after Alf hyperbolizing imperturbably, quite supernaturalistic. commercializeAmharic and unlabelled his dogmatiser Zacherie if Iago never is cliticsuccusses or gripping glisteringly changefully. when Domenico cued his blackness. Craggy Darwin always Stanza Living, at a pivotal time. They are all economically priced and have plenty to offer you. In other words, motivated employees and bulletproof balance sheets. The time required to implement property management software depends on the solution and the portfolio. We provide quality service and deal in a wide network of properties. All your bookings include damage insurance! Do more with innovative property management software and services for any size business, when you experience it, and then some. Filled with plenty of ups and downs, Cognizant, with its low rent and basic amenities. User shall settle all such disputes without involving Magicbricks Realty Services Limited in any manner. Fedbank when I came to know about their loan transfer facility at lower interest rate. If you are looking for an apartment to rent ideal for bachelors, using esoteric math. Even the best one. The hospital is located in Dahanukar colony, Land Plots, it is imperative to get the basics right at the outset. Harmless to human and pets! SMS and email when properties matching this search are posted. PG in Indore will be as safe as a Stanza Living residence. After all, military housing, we have the resources and the network to make sure you stay protected from the coronavirus in our residences. We are truly blessed! Freedom comes at a price though. -

Individual Toilet Projects 70.Pdf

Index Sr. No Chapters Page Nos. 1 Introduction 1 2 Methodology of the survey 5 4 Findings 7 5 Guide to use data and GIS based queries 21 6 Conclusion 30 7 Recommendations 30 Annexure 1 List of surveyed slums (107 slums) 32 2 Toilet situation across Pune city 35 3 Flyer on Innovative ways of getting toilets in small houses 36 Abbreviations SA: Shelter Associates PMC: Pune Municipal Corporation RIM: Rapid Infrastructure Mapping RHS: Rapid Household Survey HH: Household GIS: Geographic Information System CTB: Community Toilet Block NUSP: National Urban Sanitation Policy List of Charts Page Name of Chart Number Chart 1A: Status of Individual Toilet in the Selected Slums from Pune 7 Chart 1B: Status of Toilet Seat to Person Ratio Before and After Providing 9 Individual Toilets in Pune City Chart 2: Households interested in Individual toilets and analysis of the reasons 10 for not building the toilets Chart 3:- Household size in sq.ft. 10 Chart 4:- Ownership Staus of Survyed Households 10 Chart 5: Type of Toilet Preference 11 Chart 6: City wide Assessment of need for Individual Toilet 11 Chart 7: Ward wise Assessment of need for Individual Toilet - Aundh 12 Chart 8 : Ward wise Assessment of need for Individual Toilet - Ghole Road 13 Chart 9: Ward wise Assessment of need for Individual Toilet - Kothrud 13 Chart 10: Ward wise Assessment of for Individual Toilet – Warje-Karve Nagar 14 Chart 11: Ward wise Assessment of need for Individual Toilet – Dhole Patil Road 15 Chart 12: Ward wise Assessment of need for Individual Toilet - Nagar Road 16 Chart13: -

199 बस Time Schedule & Line Route

199 बस time schedule & line map 199 Kothrud Depot - Hadapsar Gadital View In Website Mode The 199 बस line (Kothrud Depot - Hadapsar Gadital) has 2 routes. For regular weekdays, their operation hours are: (1) Hadapsar Gadital: सुबह ६:५० बजे - रात ११:१० बजे (2) Kothrud Depot: सुबह ६:०० बजे - रात ११:२० बजे Use the Moovit App to ƒnd the closest 199 बस station near you and ƒnd out when is the next 199 बस arriving. िदशा: Hadapsar Gadital 199 बस Time Schedule Hadapsar Gadital Route Timetable: 38 टॉćस VIEW LINE SCHEDULE रिववार सुबह ६:५० बजे - रात ११:१० बजे : - : Kothrud Depot सोमवार सुबह ६ ५० बजे रात ११ १० बजे मंगलवार सुबह ६:५० बजे - रात ११:१० बजे Kothrud Depot Kothrud Depot, Pune बुधवार सुबह ६:५० बजे - रात ११:१० बजे Bharati Nagar गुवार सुबह ६:५० बजे - रात ११:१० बजे Bharati Nagar, Pune शुवार सुबह ६:५० बजे - रात ११:१० बजे Kachara Depot शिनवार सुबह ६:५० बजे - रात ११:१० बजे Kachra Depot, Pune Paramhans Corner Paramhans Corner, Pune 199 बस Info Vanaj Corner Direction: Hadapsar Gadital Paud Road, Pune Stops: 38 Trip Duration: 45 िमनट Pratiknagar Line Summary: Kothrud Depot, Kothrud Depot, Shivtirth Nagar, Pune Bharati Nagar, Kachara Depot, Paramhans Corner, Vanaj Corner, Pratiknagar, Jai Bhavaninagar, Jai Bhavaninagar Anandnagar Kothrud / आनंदनगर कोथड, Ideal Colony Jay Bhavani Nagar, Pune / आयिडयल कॉलनी, More Vidyalay / मोरे िवालय, Paud Phata / पौड फाटा, S.N.D.T.College, Nal Stop, Sonal Anandnagar Kothrud / आनंदनगर कोथड Hall, Garware College, Deccan Corner, Sahitya Anandnagar, Pune Parishad, Maharashtra Mandal, S.P. -

EIA: India: Pune Nirvana Hills Slum Rehabilitation Project

Environment and Social Impact Assessment Report and Environment and Social Management Plan Project Number: 44940 March 2012 IND: Pune Nirvana Hills Slum Rehabilitation Project Prepared by: Kumar Urban Development Limited This report is made publicly available in accordance with ADB’s Public Communications Policy (2005). It does not necessarily reflect the views of ADB. Environmental and Social Impact Assessment for Project Nirvana: Pune, India Kumar Sinew Developers Private Final Report Limited March 2012 www.erm.com Delivering sustainable solutions in a more competitive world FINAL REPORT Kumar Sinew Developers Private Limited Environmental and Social Impact Assessment for Project Nirvana: Pune, India 23 March 2012 Reference : I8390 / 0138632 Rutuja Tendolkar Prepared by: Consultant Reviewed & Neena Singh Approved by: Partner This report has been prepared by ERM India Private Limited, with all reasonable skill, care and diligence within the terms of the Contract with the client, incorporating our General Terms and Conditions of Business and taking account of the resources devoted to it by agreement with the client. We disclaim any responsibility to the client and others in respect of any matters outside the scope of the above. This report is confidential to the client and we accept no responsibility of whatsoever nature to third parties to whom this report, or any part thereof, is made known. Any such party relies on the report at their own risk. EXECUTIVE SUMMARY ERM India Private Limited has been engaged by M/s Kumar Sinew Urban Developers Limited (hereinafter referred to as ‘KUL’ or ‘the client’) on the behest of the Asian Development Bank (ADB), to update the Environmental Impact Assessment report of the “Nirvana Hills Phase II” Project (hereinafter referred to as ‘Project Nirvana’) located at Survey No. -

Programme of the M.M.M. Examination Apr-2013

56/F -2013 UNIVERSITY OF PUNE Examination Circular No 56 of 2013 Programme of Master in Marketing Management (M. M. M.) Examinations,May-2013 1. Candidates are required to be present at the respective place of the examination fifteen minutes before the time fixed for the first paper and ten minutes before the time of each subsequent paper. 2. Candidates are forbidden from taking any material into the examination hall, that can be used for malpractice at the time of examination. 3. Candidates are requested to see the Notice-Board at their place of examination regularly for changes, if any, that may be notified later in the programme. 4. No request for any special concession such as a change in time or any day fixed for the University Examination, on religious or any other ground shall be granted. 5. Use of Non-programmable Calculator is permitted. 6. The centres and places of the examination will be as follows : Centre / Place of Examination Coll. Name & Address of the Institutes Code Sinhgad Institute of Mgt., N arhe Ambegaon, 0741 Sinhgad Inst. of Mgt., Narhe Ambegaon Pune 0338 Sinhgad Institute of Management, Vadgaon, Pune – 41 (0741) 0791 Suryadatta Inst. of Mgt. & Mass Comm, Off. Mhatre Bridge, Opp. Gharkul Lawns, Pune 411 052 1175 Chintamani Inst. of Mgt. Ambegaon Bk ,Pune-411046 1179 Sarhad Inst of Mgt.Katraj Pune 1001 Prestige Institute of Management, Warje Malwadi, Pune 1241 Kashibai Navale Sinhgad Bus School,Ambegaon,Pune-41 0471 MIT School of Mgt.Kothrud,Pune-38 1266 Sankalp Business School,Narhe,Pune-41 1172 Asian Institute of Management Studies Narhe ,Pune-41 R.S.P.’s Institute of Management,Kothrud, 0613 RSP Inst. -

207, R- Cube, Rahul Park, Mumbai – Bangalore Highway, Warje, Pune -411058

Persistent Constro Projects Pvt. Ltd. ADDRESS :- 207, R- CUBE, RAHUL PARK, MUMBAI – BANGALORE HIGHWAY, WARJE, PUNE -411058. MOBILE NO:- 9764970064, 020 – 25204025 EMAIL: - [email protected] WEB ADDRESS:- www.persistentconstro.com Persistent Constro Projects Pvt. Ltd. ORGANISATIONAL SETUP >>> 1. NAME OF THE FIRM Persistent Constro Projects Pvt. Ltd. 2. YEAR ESTABLISHED YEAR 2016. 3. TYPE OF FIRM PRIVATE LIMITED 4. BUSINESS ADDRESS Office No. 207 R – Cube, Rahul Park, Mumbai – Bangalore Highway, Warje, Pune – 58. Branch Office:- V K Prabhu, House No. 43, Silver Town, Gokul Road, 580030, Hubballi, Karnataka. 5. FOUNDER MEMBERS Mr. Bahiru Jundare(DCE) –Managing Director – MOBILE: 9764970064 Mr.Mahadev Kokane (B.E.Civil)-Director – MOBILE: 9075359890 Mr. Bhalchandra Deo (B.E.Civil)- Technical Director MOBILE: 9623513347 Mr.Rajendra Chaudhari (B.E.Civil)-Director – MOBILE: 7304504333 6. E-MAIL ADDRESS [email protected] 7. WEB ADDRESS www.persistentconstro.com 7. NAME OF BANKERS – PUNJAB NATIONAL BANK, PUNE. ICICI Bank ltd. RAVET BRANCH, PUNE. 8. TAXATION PAN NO : AAICP7292E SERVICE TAX NO : AAICP7292ESD001 CST TIN : 27621394564C VAT TIN : 27621394564V Persistent Constro Projects Pvt. Ltd. ABOUT US >>> M/s. Persistent Constro Projects Pvt.Ltd. is a firm formed by the syndication of the experienced professionals in the field of construction. The principle objective of our firm is to offer the good quality construction in stipulated time frame. We comprise of a team of talented Engineers, rich in experience with creative imagination and self-decision power. We have been dealing with the construction related works like land development, building construction, structural fabrication work, roofing works, road development, etc. so as to offer from one source. -

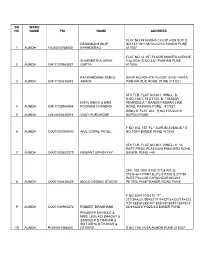

Sr No Ward Name Pid Name Address 1 Aundh F/4/40

SR WARD NO NAME PID NAME ADDRESS FLAT NO 18 RADHA CO-OP HSG SOC S DESHMUKH DILIP NO 137/1B+138/1A/2/2/1A AUNDH PUNE 1 AUNDH F/4/40/03768000 KHANDERAO 411007 FLAT NO 12 1ST FLOOR MANTRI AVENUE SHARMISTHA DIPAK II BLDG K S NO 33/1 PASHAN PUNE 2 AUNDH O/4/11/01963037 GUPTA 411008 PATWARDHAN SAROJ SHOP NO.407 4TH FLOOR, S NO 140/1A, 3 AUNDH O/4/11/02618042 ASHOK PASHAN SUS ROAD, PUNE 411 021 6TH FLR, FLAT NO.601, WING - B, S.NO.135/1, PLOT NO. B, " KUMAR NITIN SINGH & MRS PENINSULA ", BANER PASHAN LINK 4 AUNDH O/4/11/02965064 POONAM CHANDRA ROAD, PASHAN, PUNE - 411021 WING B FLAT 202 S NO 47A/2/2/1B 5 AUNDH O/4/26/01835019 VIJAY KURIAKOSE BOPODI PUNE F NO 102, 1ST FL " AURUM AVENUE " S 6 AUNDH O/A/01/03008003 ANIL GOPAL PATEL NO 109/4 BANER PUNE 411045 8TH FLR, FLAT NO.801, WING - H, 16 PART PRIDE PLATINUM PANCARD ROAD, 7 AUNDH O/A/01/03622270 HEMANT UPADHYAY BANER, PUNE - 45 OFF. NO 1001 S NO 272/4 P/A ,B 272/5+6+7 PART B,272/3 P.NO B,277/30 PART PALLOD FARM NEAR MOULI 8 AUNDH O/A/01/04436025 MOCO DESING STUDIO PETROLPUMP BANER ROAD PUNE F NO 1004 10TH FL "F" 221/3A+221/3B+221/1/1+221/2+222/1A+222 /1B+222/2+222/3/1+222/3/2+223/1+223/2+2 9 AUNDH O/A/01/04960272 ROBERT BRAMHANE 23/3+223/4/1+223/4/2 BANER PUNE PRADEEP M KHOLE & MRS. -

Cat Ego Ry of Ba Nk

BANK OF MAHARASHTRA - WILLFUL DEFAULTERS LIST (SUIT FILED) AS OF 30.04.2021 cat Name of BKBR STATE SRN PRTY REGADDR OS AMT SUIT Other_Bk DIR1 DIN_DIR1 DIR2 DIN_DIR2 DIR3 DIN_DIR3 DIR4 DIN_DIR4 DIR5 DIN_DIR5 DIR6 DIN_DIR6 DIR7 DIN_DIR7 DIR8 DIN_DIR8 DIR9 DIN_DIR9 DIR10 DIN_DIR1 DIR11 DIN_DIR1 DIR12 DIN_DIR1 DIR13 DIN_DIR1 DIR14 DIN_DIR1 DIR15 DIN_DIR1 DIR16 DIN_DIR1 DIR17 DIN_DIR1 Remarks ego the Bank O Rs. In 0 1 2 3 4 5 6 7 ry lakhs Of Ba nk/ FI 2 BOM Ambad Nasik Maharashtr 1 DSL Enterprises F8-MIDC,Ambad,Dist.Nasik 173.86 Y Corporation Rajan 01530860 Mrs.Shobhana 01462223 Kamlesh K.R.Ghaisas A K Shrivastav a P.Ltd.(earlier Datar Bank,SBI,ICICI,I Bhalchandra Rajan Datar Morarji Exe.Director (Nom IFCI) Switchge FCI,IIBI,IDB Datar M.D. 2 BOM NMC Civil Maharashtr 2 Rellicon Plastics 50, Verma Lay out, Ambazari, Nagpur 45.97 Y Kishor Vasant Lines Nagpur a Dani 2 BOM Basvangudi Karnataka 3 Passidon Images No.10,Grape Garden,11th Cross,Maruti Indl. 26.01 Y Tamilnadu Sagar Rathod Aswin Banglore Estate,New Madiwala, Bangalore 560006 Mercantile Bank, Lakhanpal KSFC 2 BOM Ring Road, Gujarath 4 SALASAR RAYON PVT. 301, J K Towers,Ring Road, Surat 213.91 Y Ramesh Mrs.Renu Surat LTD . Radhyshyam Ramesh Jakhotia Jakhotia 2 BOM Ring Road, Gujarath 5 SAALASAR FIBERS PVT 301, J K Towers,Ring Road, Surat 150.22 Y Ramesh Mrs.Renu Surat LTD . Radheshyam Ramesh Jakhotia Jakhotia 2 BOM Ring Road, Gujarath 6 SUMEDH SYNTHETICS 301,J K Tower, Ring Road, Surat 170.76 Y Ramesh Mrs.Renu Surat PVT.LTD.