Central Otago Lakes / [email protected] / P

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NEW ZEALAND PRIMITIVE METHODIST MINISTERS By

This research is dedicated to Mr. Alan Charlesworth Armitage (1915- 2002) of Christchurch, who encouraged this research. His family roots NEW ZEALAND in England were in the West Riding. Originally Independents living at Hightown in the Spen Valley, here they joined the Primitive Methodists and then moved to Leeds. Subsequently some of the family moved to New Zealand where they became Wesleyan Methodists. PRIMITIVE METHODIST MINISTERS by CIRCUITS [2015] In 1988 the late William Leary published his Ministers & Circuits in the Primitive ABBREVIATIONS Methodist Church, a Directory which records the ministerial stationing. Ths accuracy of Leary’s listing in part is complicated by an inconsistency of B - born presenting material for the oversea stations – Australia/Australasia, Canada and CH - children New Zealand. His source for this research was the annual Primitive Methodist Ct. - circuit Conference. D - died - EM - entered ministry When conference met in late spring in the United Kingdom to decide the Kendall - H.B. Kendall, The Origin and History of the Primitive Methodist Church ministerial stationing, it was mid-winter in New Zealand. Given also the time 2 vols (London, Joseph Johnson, nd [c1905]) taken to get there from the United Kingdom, especially prior to the opening of HLP - hired local preacher the Suez Canal in 1869, the newly arrived minister might be go to another circuit LP - local preacher other than that in the Conference Minutes. The New Zealand Conference also M - married met in the spring, mid-winter in the United Kingdom MinTr - ministerial training MT - New Zealand Methodist Times One further complication is not so much that ministers served both in the NZ Meth Ch – New Zealand Methodist Church [post 1913] United Kingdom and New Zealand, but some served both in Australia and New NZ Mins – New Zealand Methodist Minutes of Conference Zealand (Australasia), and a few also in Canada. -

5 Day Otago Rail Trail Daily Trip Notes

5 Day Otago Rail Trail Daily trip notes A 5 Day – 4 Night cycle from Clyde to Middlemarch along the original Otago Central Rail Trail. Steeped in history and with a constant easy gradient, it is a great way to view scenery not seen from the highway. Trip highlights Cycle the historic Rail Trail. Spectacular views of Mt Cook and the Southern Alps. Explore the old gold mining town of Clyde. Cycle through tunnels and over rail bridges. Try your hand at ‘curling’ ‑ bowls on ice! Take a journey on the famous Taieri Gorge Train. This tour is a combined tour with Natural High and Adventure South. DAY 1 – Christchurch to Clyde DAY 2 – Clyde to Lauder DAY 3 – Lauder to Ranfurly DAY 4 – Ranfurly to Dunedin DAY 5 – Dunedin to Christchurch The trip Voted #2 ‘Must Do Adventure’ in the most recent edition of Lonely Planet’s New Zealand guide book, this adventure will have you cycling back in time to New Zealand’s rural past along a trail that has been specially converted for walkers, mountain bikers and horse riders - with no motor vehicles allowed! The Trail follows the old Central Otago branch railway line from Clyde to Middlemarch, passing through many towns along the way. This trip is not just about the cycling but rather exploring the many small towns and abandoned gold diggings as well as meeting the locals. Along the way you can even try your hand Natural High Tel 0800 444 144 - email: [email protected] - www.naturalhigh.co.nz at the ancient art of curling (bowls on ice). -

Zonta Club of Auckland West Inc. a Brief History How Did the Club Begin

Zonta Club of Auckland West Inc. A Brief History How did the club begin? Joan-Mary Longcroft was responsible for Charter of club, Charter dinner held at Ellerslie Racecourse on 6 November 1976 with 26 members. Margaret Dahm was charter president, Jill Dainow and Berti Carnachan Vice presidents, Merle Redfern secretary. Gavel presented May 1977. “Service to others is the rent you pay for your room here on earth” First activities and projects Funding of a stud guide dog and 6 guide dogs - money raised by barbecues, fashion parades, Garden Party. Took part inTelethon 1981 First Invitation dinner held 1980, at Toby Jug Restaurant in Titirangi. Roaring twenties evening Trees donated to Waitemata Council,1983 Eileen Gash, member in 1980s made a bequest to Zonta, interest of which is still being used for projects today Matua Valley BBQ – “come and get it” changeover celebration 1982 - met in Tui Glen - contributed to Columbia relief project, 2 x water wells in Sri Lanka as part of Zonta international Projects, Amelia Earhart awards. 1984 -Club planted/ donated fruit and nut trees in local schools as part of community projects 1984 - Resuscitators donated to Local St John, funds donated to Southland Flood relief, language nest at Hoani Waititi Marae and to IHC 1984 annual dinner raised funds for a pain machine for Waitakere Hospital 1985 – Zonta Scholarship to local student, interclub cricket match between Auckland Clubs Stress seminar for woman from the community – highly successful. Notable projects over the years Art in the Garden – held over a weekend for a seat and room at West Auckland Hospice Senior citizens annual Christmas afternoon tea for people from rest homes, private hospitals etc, from West Auckland Invitation Dinner through which funds were raised for the Hippy programmes in South Auckland. -

Natural Hazards on the Taieri Plains, Otago

Natural Hazards on the Taieri Plains, Otago Otago Regional Council Private Bag 1954, 70 Stafford St, Dunedin 9054 Phone 03 474 0827 Fax 03 479 0015 Freephone 0800 474 082 www.orc.govt.nz © Copyright for this publication is held by the Otago Regional Council. This publication may be reproduced in whole or in part provided the source is fully and clearly acknowledged. ISBN: 978-0-478-37658-6 Published March 2013 Prepared by: Kirsty O’Sullivan, natural hazards analyst Michael Goldsmith, manager natural hazards Gavin Palmer, director environmental engineering and natural hazards Cover images Both cover photos are from the June 1980 floods. The first image is the Taieri River at Outram Bridge, and the second is the Taieri Plain, with the Dunedin Airport in the foreground. Executive summary The Taieri Plains is a low-lying alluvium-filled basin, approximately 210km2 in size. Bound to the north and south by an extensive fault system, it is characterised by gentle sloping topography, which grades from an elevation of about 40m in the east, to below mean sea level in the west. At its lowest point (excluding drains and ditches), it lies about 1.5m below mean sea level, and has three significant watercourses crossing it: the Taieri River, Silver Stream and the Waipori River. Lakes Waipori and Waihola mark the plain’s western boundary and have a regulating effect on drainage for the western part of the plains. The Taieri Plains has a complex natural-hazard setting, influenced by the combination of the natural processes that have helped shape the basin in which the plain rests, and the land uses that have developed since the mid-19th century. -

Download Our Interplanetary Cycle Brochure

Otago Museum Shop. Museum Otago and a 10% discount at the the at discount 10% a and Perpetual Guardian Planetarium Guardian Perpetual Otago Museum Shop. Museum Otago $2 off Adult admission to the the to admission Adult off $2 Otago Museum Shop. Museum Otago and a 10% discount at the the at discount 10% a and Present this flyer to receive to flyer this Present and a 10% discount at the the at discount 10% a and Perpetual Guardian Planetarium Guardian Perpetual Perpetual Guardian Planetarium Guardian Perpetual $2 off Adult admission to the the to admission Adult off $2 exploring our amazing universe. amazing our exploring $2 off Adult admission to the the to admission Adult off $2 Present this flyer to receive to flyer this Present Guardian Planetarium to continue continue to Planetarium Guardian Present this flyer to receive to flyer this Present and Otago Museum’s Perpetual Perpetual Museum’s Otago and exploring our amazing universe. amazing our exploring cycle journey, visit the observatory the visit journey, cycle exploring our amazing universe. amazing our exploring Guardian Planetarium to continue continue to Planetarium Guardian When you have completed your your completed have you When Guardian Planetarium to continue continue to Planetarium Guardian and Otago Museum’s Perpetual Perpetual Museum’s Otago and and Otago Museum’s Perpetual Perpetual Museum’s Otago and of our Solar System Solar our of cycle journey, visit the observatory observatory the visit journey, cycle cycle journey, visit the observatory observatory the visit journey, cycle When you have completed your your completed have you When University of Otago, School of Surveying. -

Download an Otago Brochure

Otago Main Centres The DUNEDIN Tohu Whenua Story Nau mai, haere mai ki te kaupapa o Tohu Whenua. Tohu Whenua are places that have shaped Aotearoa DunedinNZ New Zealand. Located in stunning landscapes and rich with stories, they offer some of our best heritage experiences. QUEENSTOWN Walk in the footsteps of extraordinary and ordinary New Zealanders and hear about the deeds, struggles, triumphs and innovations that make us who we are. With Tohu Whenua as your guide, embark on a journey to some of our most important landmarks and immerse Destination Queenstown yourself in our diverse and unique history. Visit Tohu Whenua in Northland, Otago and West Coast. ŌAMARU Local Information In the event of an emergency, dial 111 To report or check current road conditions Weather in Otago can change unexpectedly. on the state highway call 0800 4 HIGHWAYS Make sure you take appropriate warm clothing, (0800 44 44 49) or check online at a waterproof jacket, food and water when www.journeys.nzta.govt.nz/otago/ embarking on walks in the area. Claudia Babirat Cover image credits. Top: Oamaru, Waitaki NZ. Bottom left: Arrowtown, Claudia Babirat. Bottom right: Otago Central Rail Trail, James Jubb. Larnach Castle TWBR02 www.tohuwhenua.nz/otago The Otago 1 Tss Earnslaw 5 Otago Central Rail Trail 9 DUNEDIN RAILWAY STATION Lady of the Lake Pedalling Otago’s rural heart A first-class destination Story The TSS Earnslaw is one of the world’s oldest and New Zealand’s original Great Ride, this popular Ornate and flamboyant, Dunedin’s railway station largest remaining steamships and has graced Lake cycle journey offers a taste of genuine Southern is today considered one of the world’s best. -

Methodist Church of New Zealand Archives Auckland District Baptism Registers

Methodist Church of New Zealand Archives Auckland District Baptism Registers Holdings at October 2013 For more information, please contact: The Archivist Methodist Church of New Zealand Archives PO Box 931 Christchurch New Zealand 8140 Phone 03 366 6049 Email: [email protected] Website: www.methodist.org.nz The Methodist Church of New Zealand Archives in Christchurch is the approved repository for Methodist baptism registers once completed by parishes. They are part of parish and church records held in the Methodist Archives. Registers can date from the first Wesleyan missionaries’ time in New Zealand during the 1830s, through to the present day. They include all branches of Methodism in New Zealand: Primitive Methodist, Wesleyan, United Free Methodist, and Bible Christian. Some registers, particularly those still in use, are held by parishes. Details of how to contact parishes are on the Methodist Church website www.methodist.org.nz In the case of union or combined parishes, registers containing Methodist baptisms may be held by other repositories such as the Presbyterian Archives and Anglican Archives. The format of baptism registers varied over the years. Early registers often only contained the name of the person being baptised, the date of baptism, the district they lived in and the name of the minister performing the baptism. Later on, when standard baptism registers were printed and distributed by the Methodist Church, more information was added, such as birth date, names of parents, their address and the parish or circuit in which the baptism was taking place. This information varies from register to register – the most basic register is a notebook ruled with lines and often these registers carried on being used until they were full. -

Otago Rail Trail Ladies E-Bike Tour a Journey Into the Past Through Spectacular Central Otago!

Otago Rail Trail Ladies E-Bike Tour A Journey Into The Past Through Spectacular Central Otago! tour highlights • Historical gold works • Vast wide open expanses • Rich in history • Easy trail riding • Great company • Experienced attentive guide official partner Tuatara Tours is proud to be in an official partnership with The New Zealand Cycle Trail. The objective of the partnership is to create a nationwide network of cycle trails that connect the Great Rides with the rest of New Zealand. the tour The Otago Central Rail Trail is ideal for cyclists who wish to see some spectacular Central Otago scenery, at an easy pace, on flat gravelled terrain. Trains typically travel through hills, around hills but (if it can be avoided) not uphill (the maximum gradient is 2%). tours run The Rail Trail runs for 150kms between Clyde and Middlemarch (close to Dunedin), passing through the towns of Clyde, Alexandra, Chatto Creek, Tours run: November - April Omakau, Lauder, Oturehua, Wedderburn, Ranfurly, Waipiata and Hyde. tour cost • The tours are designed to be 5 days of fun cycling with no 2019/ 2020 pressure and no competition, ride at your own pace. • You get detailed practical hands on lessons on how to ride and NZD$2200 Starting in Christchurch: operate your E-Bike. Includes the cost of an E Bike for the duration of the tour • You will be amazed at how easy E-Bikes are to ride and operate options & supplements and how easy the whole idea of biking a trail has become. Single Supplement: NZD$475 about your guide fast facts Join Helen our experienced bike tour guide on this tour. -

24 and 25 Victoriae 1861 No 29 Auckland Representation

NEW Z E A LAN D. ANNO VICESIMO QUARTO ET vtcESIMO QUINTO VICTORI£ REGIN£. ~o. 29. ANALYSIS. Title. 3. Electoral Districts established. Preamble. 4. Names of Districts and number of Members. 1. Short Title. 5. A.ct not to repeal existing Law. t. Council to consist of 35 Members. I6. Duration of A.ct. AN ACT to divide the Province of Auck Title. land into New Electoral Districts for the Election of Members of the Pro vincial Council. [6th Septernber, 1861.J WHEREAS an Act was made and passed by the Provincial P 1 Council of the Province of Auckland intitl11ed "An Act to reamhe. divide the Province of Auckland into new Electoral Districts for the election of Members of the Provincial Council" And Whereas the said Act was reservtd by the Superintendent of the said Province of Auckland for the signification of the Governor's pleasure thereon And Whereas His Excellency the Governor was pleased to withhold his assent to the said Act upon the grounds that "the fourth section of that Act purporting to provide for the formation of the Electoral Rolls for the election of Members of the Provincial Council was in contravention of the third and fourth section of the Act of the General Assembly intituled 'The Provincial Elections Act 1858' making other provision for that purpose and was therefore illegal" And Whereas it is expedient to give effect to the intention of the said Provincial Council as expressed in the said Act BE IT THEREFORE ENACTED by the General Assembly of New Zealand in Parliament assembled and by the authority of the same as follows I. -

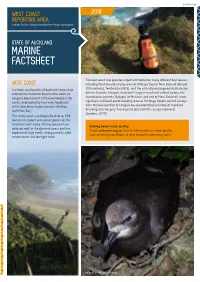

WEST COAST 2018 REPORTING AREA Includes Franklin, Rodney and Waitākere Ranges Local Boards

20-PRO-0199 WEST COAST 2018 REPORTING AREA Includes Franklin, Rodney and Waitākere Ranges local boards STATE OF AUCKLAND MARINE FACTSHEET The west coast also provides important habitat for many different bird species; WEST COAST including the dune and swamp areas of Whātipu Bay for New Zealand dotterel The black sand beaches of Auckland’s west coast (tūturiwhatu), fernbird (mātātā), and the critically endangered Australasian extend from Karioitahi Beach in the south, to bittern (matuku hūrepo), Auckland’s largest mainland seabird colony, the Rangitira Beach (north of Muriwai Beach) in the Australasian gannets (tākapu) at Muriwai, and one of New Zealand’s most north, interrupted by the rocky headlands significant mainland petrel breeding areas at Te Henga. Recent council surveys of the Waitākere Ranges between Whātipu from Muriwai south to Te Henga have also identified a number of mainland and Māori Bay. breeding sites for grey-faced petrel (ōi) and little penguin (korora) (Landers, 2017). The rocky coast is ecologically diverse, 598 documented plant and animal species on the intertidal reefs alone. Marine species have Bathing beach water quality: adapted well to the dynamic coast and the Check safeswim.org.nz for live information on water quality exposure of large swells, strong currents, cold and swimming conditions at your favourite swimming spots. temperatures and low light levels. Grey faced petrel, James Russell. WEST COAST BEACH PROFILING Beach profile (cross-shore change) monitoring is At southern Muriwai, following dune reshaping works undertaken at Piha and Muriwai beaches. Surveying in 2009 and 2016/2017, sand levels have remained high at northern Piha where the Wekatahi and Marawhara and have maintained a healthy shape despite significant streams run into the ocean has been carried out winter storms. -

Bannockburn Heritage Landscape Study

Bannockburn Map produced for sale in 1890 by Andrew Farquarson Ridland of Bannockburn, a goldminer who worked on the Carrick Range, quartz goldmining. At least fifteen copies were hand-drawn and coloured, framed in gilt, and sold for 30 shillings. R. Murray, Cromwell, P. Crump Collection. Bannockburn Heritage Landscape Study SCIENCE FOR CONSERVATION 244 Janet Stephenson, Heather Bauchop, and Peter Petchey Published by Department of Conservation PO Box 10-420 Wellington, New Zealand Science for Conservation is a scientific monograph series presenting research funded by New Zealand Department of Conservation (DOC). Manuscripts are internally and externally peer-reviewed; resulting publications are considered part of the formal international scientific literature. Individual copies are printed, and are also available from the departmental website in pdf form. Titles are listed in the DOC Science Publishing catalogue on the website, refer http://www.doc.govt.nz under Publications, then Science and Research. This report was prepared for publication by DOC Science Publishing, Science & Research Unit; editing and layout by Geoff Gregory. Publication was approved by the Manager, Science & Research Unit, Science Technology and Information Services, Department of Conservation, Wellington. © Copyright September 2004, New Zealand Department of Conservation COVER: Tussock covered landscape, Central Otago. Crown Copyright: Department of Conservation Te Papa Atawhai. Photographer: Bill Hyslop. ISSN 1173–2946 ISBN 0–478–22603–9 In the interest of forest conservation, DOC Science Publishing supports paperless electronic publishing. When printing, recycled paper is used wherever possible. CONTENTS Abstract 9 1. Introduction 10 1.1 Testing the methodology 10 1.2 Bannockburn Heritage Landscape Study 11 1.3 Information sources and techniques 11 1.4 Concepts used in this study 13 2. -

Māori Election Petitions of the 1870S: Microcosms of Dynamic Māori and Pākehā Political Forces

Māori Election Petitions of the 1870s: Microcosms of Dynamic Māori and Pākehā Political Forces PAERAU WARBRICK Abstract Māori election petitions to the 1876 Eastern Māori and the 1879 Northern Māori elections were high-stakes political manoeuvres. The outcomes of such challenges were significant in the weighting of political power in Wellington. This was a time in New Zealand politics well before the formation of political parties. Political alignments were defined by a mixture of individual charismatic men with a smattering of provincial sympathies and individual and group economic interests. Larger-than-life Māori and Pākehā political characters were involved in the election petitions, providing a window not only into the complex Māori political relationships involved, but also into the stormy Pākehā political world of the 1870s. And this is the great lesson about election petitions. They involve raw politics, with all the political theatre and power play, which have as much significance in today’s politics as they did in the past. Election petitions are much more than legal challenges to electoral races. There are personalities involved, and ideological stances between the contesting individuals and groups that back those individuals. Māori had to navigate both the Pākehā realm of central and provincial politics as well as the realm of Māori kin-group politics at the whānau, hapū and iwi levels of Māoridom. The political complexities of these 1870s Māori election petitions were but a microcosm of dynamic Māori and Pākehā political forces in New Zealand society at the time. At Waitetuna, not far from modern day Raglan in the Waikato area, the Māori meeting house was chosen as one of the many polling booths for the Western Māori electorate in the 1908 general election.1 At 10.30 a.m.