Morningstar Fund Flows and Investment Trends

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vanguard Total Bond Market Index Fund Annual Report December 31

Annual Report]%FDFNCFS 7BOHVBSE5PUBM#POE.BSLFU*OEFY'VOE Contents Your Fund’s Performance at a Glance. 1 About Your Fund’s Expenses. 2 Performance Summary. .4 Financial Statements. 8 Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus. :PVS'VOET1FSGPSNBODFBUB(MBODF t 'PSUIFNPOUITFOEFE%FDFNCFS SFUVSOTGPS7BOHVBSE5PUBM#POE .BSLFU*OEFY'VOESBOHFEGSPNGPS*OWFTUPS4IBSFTUPGPS*OTUJUVUJPOBM 4FMFDU4IBSFT5IJTQFSGPSNBODFXBTJOMJOFXJUIUIFSFUVSOPGUIFCFODINBSL JOEFYBGUFSUBLJOHUIFDPTUTPGSVOOJOHUIFGVOEJOUPBDDPVOU t 5IFFNFSHFODFPG$07*%JOFBSMZUVSOFEJOUPBHMPCBMIFBMUIDSJTJT BOE BHHSFTTJWFBUUFNQUTUPDPOUBJOJUSFTVMUFEJOBTIBSQEPXOUVSOJOFDPOPNJDBDUJWJUZ 6OFNQMPZNFOUTQJLFE BOETFDUPSTXIFSFTPDJBMEJTUBODJOHJTOUQPTTJCMFXFSFIJUIBSE 1PMJDZNBLFSTXFSFRVJDLUPQSPWJEFSPCVTUGJTDBMBOENPOFUBSZTUJNVMVTUPCMVOUUIF QBOEFNJDTFDPOPNJDJNQBDU.BOZDFOUSBMCBOLTTMBTIFETIPSUUFSNJOUFSFTUSBUFT BOEFYQBOEFEPSFYUFOEFEBTTFUQVSDIBTFQSPHSBNT t 8JUIZJFMETGBMMJOHBOEQSJDFTSJTJOH 645SFBTVSJFTQPTUFEBSFUVSOPG .PSUHBHFCBDLFETFDVSJUJFTSFUVSOFEMFTTUIBOUIBU BTMPXNPSUHBHFSBUFTMFEUPQMFOUZ PGTVQQMZCVUDPSQPSBUFCPOETGBSFEFWFOCFUUFSUIBO5SFBTVSJFT SFUVSOJOH t #ZDSFEJURVBMJUZ MPXFSSBUFEJOWFTUNFOUHSBEFCPOETHFOFSBMMZEJECFUUFSUIBO IJHIFSSBUFEPOFTCZNBUVSJUZ CPOETXJUINBUVSJUJFTPGZFBSTPSNPSFTJHOJGJDBOUMZ PVUQFSGPSNFE .BSLFU#BSPNFUFS "WFSBHF"OOVBM5PUBM3FUVSOT -

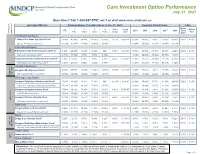

Core Investment Option Performance July 31, 2021

Core Investment Option Performance July 31, 2021 Questions? Call 1-800-657-5757, ext 3 or visit www.msrs.state.mn.us 2 INVESTMENT OPTIONS AVERAGE ANNUAL TOTAL RETURNS AS OF JULY 31, 20211 CALENDAR YEAR RETURNS FEES Gross 1 3 5 10 Since Incept Admin YTD 2020 2019 2018 2017 2016 Fund Year Years Years Years Incept Date Fee4 VOLATILITY 3 RISK LEVEL Exp US Small Cap Equity T. Rowe Price Small Cap Stock Fund5 13.46% 45.98% 18.44% 18.28% 15.29% 11.57% 03-31-00 25.00% 33.96% -3.07% 15.45% 19.00% 0.66% 0.10% Russell 2000 Benchmark Index6 13.29% 51.97% 11.49% 14.28% 12.34% 19.96% 25.52% -11.01% 14.65% 21.31% International Equity 5 7 HIGH Fidelity Diversified International Com Pool 8.85% 26.43% 12.99% 12.16% NA 7.85% 12-13-13 19.79% 29.75% -15.18% 26.72% -2.92% 0.58% 0.10% MSCI EAFE Benchmark Index6 9.81% 30.55% 7.88% 9.58% 6.32% 8.02% 22.29% -15.24% 26.65% 1.21% Vanguard Total International Stock Index Fund5 8.30% 29.52% 8.28% 9.90% 5.79% 6.42% 11-30-10 11.30% 21.56% -14.38% 27.57% 4.73% 0.07% 0.10% International Spliced Benchmark Index6 8.27% 29.60% 8.35% 9.90% 5.78% 11.24% 21.80% -14.61% 27.41% 4.72% US Mid Cap Equity Vanguard Mid Cap Index Fund5 16.80% 39.77% 16.02% 15.02% 13.70% 13.53% 12-15-10 18.27% 31.06% -9.21% 19.28% 11.24% 0.03% 0.10% TO HIGHTO Mid Cap Spliced Benchmark Index6 16.80% 39.78% 16.02% 15.02% 13.71% 18.24% 31.09% -9.22% 19.30% 11.25% MODERATE US Large Cap Equity Vanguard Total Stock Market Index Fund5 17.23% 38.98% 18.14% 17.41% NA7 14.44% 4-28-15 21.02% 30.82% -5.15% 21.19% 12.69% 0.02% 0.10% CRSP U.S. -

September 30, 2015)

Optional Retirement Program Performance Report State Retirement and Pension System of Maryland (As of September 30, 2015) Investment Options Expense Ratio Average Annual Rates of Return Active/ Gross Expense Ticker Money Market Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio FDRXX Fidelity Cash Reserves 0.37% 0.37% 0.01% 0.01% 0.01% 0.01% 0.01% N/A TIAA-CREF Money Market Account (R3) 0.32% 0.32% 0.00% 0.00% 0.00% 0.00% 0.00% Citigroup 3-month Treasury Bill Index 0.02% 0.03% 0.04% 0.04% 0.06% Active/ Gross Expense Stable Value Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio N/A TIAA-CREF Traditional Retirement Annuity N/A N/A 3.96% 4.02% 4.04% 4.06% 4.07% Citigroup 3-month Treasury Bill Index + 1.25% 1.27% 1.28% 1.29% 1.29% 1.31% Active/ Gross Expense Core Fixed Income/ Intermediate-Term Bond Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio FXSTX Fidelity Spartan U.S Bond Index (I) Passive 0.06% 0.07% 2.95% 3.38% 1.63% 2.51% 3.04% VBTIX TIAA-CREF Vanguard Total Bond Market Index Fund Passive 0.06% 0.06% 2.76% 3.33% 1.59% 2.44% 3.00% WATFX Western Asset Core Bond Fund (I ) Active 0.45% 0.49% 3.07% 4.49% 2.43% 3.70% 4.17% N/A TIAA-CREF Bond Market Account Active 0.37% 0.37% 2.53% 3.39% 1.60% 2.78% 3.06% BC Aggregate Bond Index 2.94% 3.45% 1.71% 2.56% 3.10% Active/ Gross Expense Inflation-Linked Bond Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio BPLBX Fidelity BlackRock Inflation Protected Bond Active 0.32% 0.42% -2.11% -0.36% -2.02% 0.59% 2.07% BPLBX TIAA-CREF BlackRock Inflation Protected Bond Active 0.32% 0.42% -2.11% -0.36% -2.02% 0.59% 2.07% Barclays US TIPS Index -0.83% 0.37% -1.83% 0.79% 2.55% Active/ Gross Expense Balanced Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio FBAKX Fidelity Balanced Fund (K) Active 0.46% 0.46% -0.65% 6.86% 8.77% 11.45% 9.59% N/A TIAA-CREF Social Choice Account (R3) Active 0.33% 0.33% -1.82% 3.89% 6.89% 9.14% 7.42% . -

Bond Market's Scariest Gauge Is Worse Than Ever

December 17, 2020 | bloomberg.com Markets Bond Market’s Scariest Gauge Is Worse Than Ever Corporate credit markets are more exposed to duration risk than at any other time in history. By Brian Chappatta January 14, 2021 Around this time a year ago, I ruffled in every sense of the word. While one-way moves of that kind of a few feathers among bond traders with As was the case last time around, this is magnitude are rare, benchmark 10-year the headline “This Is the Scariest Gauge happening because the numerator (yield) Treasury yields did increase by 20 basis for the Bond Market.” The upshot was has continued to tumble while the denomi- points in the first five trading days of the that when looking at the ratio of yields nator (duration) increases. The average new year. So with the duration of the on corporate debt relative to its duration, investment-grade corporate bond yield was corporate-bond index at almost nine years investors were more susceptible to losses a record-low 1.74% as of Dec. 31, compared heading into 2021, it’s basic math (roughly from a move higher in interest rates than with 2.84% a year earlier, while the modi- 8.84 times 0.2%, with a slight adjustment at any time in history. fied duration on the index increased to for spread tightening) that investment- Well, if that gauge was scary in January 8.84 years at the end of 2020, just about a grade bonds lost 1.52% last week. It really 2020, it’s downright terrifying now. -

Fixed-Income Insights

Fixed-Income Insights Staying Active in Fixed Income An unbiased side-by-side performance comparison of active and passive bond strategies may be an eye-opener for those considering index products. by Stephen Hillebrecht, CFA, Fixed-Income Product Strategist IN BRIEF n Rather than debating “active versus passive,” we should be asking, “Which strategy can deliver more attractive risk-adjusted returns, after expenses, to investors?” n In certain categories, the largest passive strategies have underperformed the category averages, and done so with additional risk. n Passive approaches may bring unintended exposures, such as increased rate sensitivity or exposure to the most indebted companies. n Certain fixed-income indexes are not easily replicated, potentially leading to missed opportunities for passive products. n Fixed-income markets have inefficiencies that create opportunity for active management. The “active versus passive” debate has been well covered in the financial media and popular press. The market has weighed in on this debate, as reflected in the fund flows into passive index funds and exchange-traded funds (ETFs) versus outflows from actively managed equity mutual funds. Much of this has been driven by the recent uneven performance of active equity managers, which, we believe, is largely cyclical in nature. We also believe that active and passive strategies can play complementary roles in equity portfolios. In some asset classes, however, passive management is not optimal—and that is the case, particularly, in certain segments of the fixed-income market. DELIVERING THE BEST FIXED-INCOME SOLUTION? categorized by Morningstar, more than $1 trillion is If someone were to offer a mutual fund with a per- invested in passive mutual funds ($559 billion) and formance record that ranked in the bottom third of ETFs ($515 billion) as of year-end 2017. -

Fundflash US

FundFlash US July 2020 FundFlash US July 2020 JULY OVERVIEW FundFlash provides a summary of the regional trends and developments in the funds market over the previous month. ACTIVE VS PASSIVE FLOW, $B FLOW SENTIMENT, % The report is built using the Global Market Intelligence (GMI) funds ▲47 B 47% module which tracks $50trn in global funds assets with unique views of distributor and internationally sold business. ▲4 B GMI Funds sits alongside our Institutional module and together is relied ▼-4 B 53% on by over 100 asset managers as their source for global asset management market intelligence. Active mutual funds Passive mutual funds % of # funds with negative flows All ETFs % of # funds with positive flows 3 YR FUND INDUSTRY ASSET & FLOW MOMENTUM, $B 25,000 AUM Cumulative net flow 1,000 THE MONTH IN REVIEW 900 • In July, US stocks recorded their fourth positive month in a row. The 20,000 800 S&P 500 gained 5.5% and the tech sector drove the Nasdaq up 6.8% 700 15,000 600 for the month. US unemployment driven by Covid-19 remained in 500 double digit territory ending July at 10.2% as the nation’s GDP 10,000 400 300 contracted 33% on an annualized basis in 2Q marking a US recession. 5,000 200 100 PRODUCTS 0 • Fixed- income products stayed in favor as investors continued to seek Aug 2017 Jan 2018 Jun 2018 Nov 2018 Apr 2019 Sep 2019 Feb 2020 Jul 2020 safe havens. For the year, cumulative flows in active funds remained 300 FLOWS BY INVESTMENT STYLE AND YEAR - CUMULATIVE in negative territory, while ETF product flows trended positive. -

SVO-Identified Bond ETF List

SVO-Identified Bond ETF List ETFs Eligible to be Reported as Bonds February 28, 2021 The NAIC is the authoritative source for insurance industry information. Our expert solutions support the efforts of regulators, insurers and researchers by providing detailed and comprehensive insurance information. The NAIC offers a wide range of publications in the following categories: Accounting & Reporting Special Studies Information about statutory accounting principles and Studies, reports, handbooks and regulatory the procedures necessary for fi ling financial annual research conducted by NAIC members on a statements and conducting risk-based capital variety of insurance related topics. calculations. Consumer Information Statistical Reports Important answers to common questions about auto, Valuable and in-demand insurance industry- home, health and life insurance — as well as buyer’s wide statistical data for various lines of guides on annuities, long-term care insurance and business, including auto, home, health and life Medicare supplement plans. insurance. Financial Regulation Supplementary Products Useful handbooks, compliance guides and reports on Guidance manuals, handbooks, surveys and financial analysis, company licensing, state audit research on a wide variety of issues. requirements and receiverships. Legal Capital Markets & Investment Analysis Comprehensive collection of NAIC model laws, Information regarding portfolio values and regulations and guidelines; state laws on insurance procedures for complying with NAIC reporting topics; -

Vanguard Total Bond Market Index Fund Annual Report December 31

Annual Report]%FDFNCFS 7BOHVBSE5PUBM#POE.BSLFU*OEFY'VOE Contents Your Fund’s Performance at a Glance. 1 About Your Fund’s Expenses. 2 Performance Summary. .4 Financial Statements. 8 Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus. :PVS'VOET1FSGPSNBODFBUB(MBODF t 'PSUIFNPOUITFOEFE%FDFNCFS SFUVSOTGPS7BOHVBSE5PUBM#POE .BSLFU*OEFY'VOESBOHFEGSPNGPS*OWFTUPS4IBSFTUPGPS*OTUJUVUJPOBM 4FMFDU4IBSFT5IJTQFSGPSNBODFXBTJOMJOFXJUIUIFSFUVSOPGUIFCFODINBSL JOEFYBGUFSUBLJOHUIFDPTUTPGSVOOJOHUIFGVOEJOUPBDDPVOU t 5IFFNFSHFODFPG$07*%JOFBSMZUVSOFEJOUPBHMPCBMIFBMUIDSJTJT BOE BHHSFTTJWFBUUFNQUTUPDPOUBJOJUSFTVMUFEJOBTIBSQEPXOUVSOJOFDPOPNJDBDUJWJUZ 6OFNQMPZNFOUTQJLFE BOETFDUPSTXIFSFTPDJBMEJTUBODJOHJTOUQPTTJCMFXFSFIJUIBSE 1PMJDZNBLFSTXFSFRVJDLUPQSPWJEFSPCVTUGJTDBMBOENPOFUBSZTUJNVMVTUPCMVOUUIF QBOEFNJDTFDPOPNJDJNQBDU.BOZDFOUSBMCBOLTTMBTIFETIPSUUFSNJOUFSFTUSBUFT BOEFYQBOEFEPSFYUFOEFEBTTFUQVSDIBTFQSPHSBNT t 8JUIZJFMETGBMMJOHBOEQSJDFTSJTJOH 645SFBTVSJFTQPTUFEBSFUVSOPG .PSUHBHFCBDLFETFDVSJUJFTSFUVSOFEMFTTUIBOUIBU BTMPXNPSUHBHFSBUFTMFEUPQMFOUZ PGTVQQMZCVUDPSQPSBUFCPOETGBSFEFWFOCFUUFSUIBO5SFBTVSJFT SFUVSOJOH t #ZDSFEJURVBMJUZ MPXFSSBUFEJOWFTUNFOUHSBEFCPOETHFOFSBMMZEJECFUUFSUIBO IJHIFSSBUFEPOFTCZNBUVSJUZ CPOETXJUINBUVSJUJFTPGZFBSTPSNPSFTJHOJGJDBOUMZ PVUQFSGPSNFE .BSLFU#BSPNFUFS "WFSBHF"OOVBM5PUBM3FUVSOT -

Stock Index Investments

Stock Index Investments Index US ID EM Mutual Name expense Fund or ETF ratio* S&P500 Mutual Fidelity ZERO Large Cap Index (FNILX) -0- fund Fidelity 500 Index (FXAIX) 0.015% Schwab S&P500 Index (SWPPX) 0.02% Vanguard 500 Index, Admiral shares (VFIAX) 0.04% ETF iShares Core S&P500 (IVV) 0.04% Vanguard S&P500 (VOO) 0.03% Total market Mutual Fidelity ZERO Total Market Index (FZROX) -0- fund Fidelity Total Market Index (FSKAX) 0.015% Schwab Total Stock Market Index (SWTSX) 0.03% Vanguard Total Stock Market Index, Admiral 0.04% shares (VTSAX) ETF iShares Core S&P Total US Stock Market (ITOT) 0.03% Schwab Multi-cap Core (SCHB) 0.03% Vanguard Total Stock Market (VTI) 0.03% Extended market Mutual Fidelity ZERO Extended Market Index (FZIPX) -0- (small- and mid- fund Fidelity Extended Market Index (FSMAX) 0.045% cap) Vanguard Extended Market Index, Admiral 0.07% shares (VEXAX) ETF Vanguard Extended Market (VXF) 0.07% International Mutual Fidelity International Index (FSPSX) 0.035% (no US) fund Schwab International Index (SWISX) 0.06% —Developed Vanguard Developed Markets Index, Admiral 0.07% countries only shares (VTMGX) ETF iShares Core MSCI International Developed 0.05% Markets (IDEV) SPDR Portfolio Developed World Ex US (SPDW) 0.04% Vanguard FTSE Developed Markets (VEA) 0.05% International Mutual Fidelity ZERO International Index (FZILX) -0- (no US) fund Fidelity Total International Index (FTIHX) 0.06% — Developed + Emerging ETF Vanguard Total International Stock (VXUS) 0.09% Global (+US) Mutual Vanguard Total World Stock Index, Admiral 0.10% fund shares (VTWAX) ETF Vanguard Total World Stock (VT) 0.09% Emerging markets Mutual Fidelity Emerging Markets Index (FPADX) 0.075% fund ETF Schwab Emerging Markets (SCHE) 0.13% Vanguard FTSE Emerging Markets (VWO) 0.12% This information is for educational purposes only and is not intended to be investment advice. -

SVO-Identified Bond ETF List

SVO-Identified Bond ETF List ETFs Eligible to be Reported as Bonds December 31, 2020 The NAIC is the authoritative source for insurance industry information. Our expert solutions support the efforts of regulators, insurers and researchers by providing detailed and comprehensive insurance information. The NAIC offers a wide range of publications in the following categories: Accounting & Reporting Special Studies Information about statutory accounting principles and Studies, reports, handbooks and regulatory the procedures necessary for fi ling financial annual research conducted by NAIC members on a statements and conducting risk-based capital variety of insurance related topics. calculations. Consumer Information Statistical Reports Important answers to common questions about auto, Valuable and in-demand insurance industry- home, health and life insurance — as well as buyer’s wide statistical data for various lines of guides on annuities, long-term care insurance and business, including auto, home, health and life Medicare supplement plans. insurance. Financial Regulation Supplementary Products Useful handbooks, compliance guides and reports on Guidance manuals, handbooks, surveys and financial analysis, company licensing, state audit research on a wide variety of issues. requirements and receiverships. Legal Capital Markets & Investment Analysis Comprehensive collection of NAIC model laws, Information regarding portfolio values and regulations and guidelines; state laws on insurance procedures for complying with NAIC reporting topics; -

Vanguard Total Bond Market Index Fund Summary Prospectus

Vanguard Total Bond Market Index Fund Summary Prospectus April 29, 2021 Investor Shares Vanguard Total Bond Market Index Fund Investor Shares (VBMFX) The Fund’s statutory Prospectus and Statement of Additional Information dated April 29, 2021, as may be amended or supplemented, are incorporated into and made part of this Summary Prospectus by reference. Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund online at www.vanguard.com/prospectus and https://personal.vanguard.com/ us/literature/reports/MFs. You can also obtain this information at no cost by calling 800-662-7447 or by sending an email request to [email protected]. The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is acriminaloffense. Investment Objective The Fund seeks to track the performance of a broad, market-weighted bond index. Fees and Expenses The following table describes the fees and expenses you may pay if you buy, hold, and sell Investor Shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and example below. Shareholder Fees (Fees paid directly from your investment) Sales Charge (Load) Imposed on Purchases None Purchase Fee None Sales Charge (Load) Imposed on Reinvested Dividends None Redemption Fee None Account Service Fee Per Year (for certain fund account balances below $10,000) $20 Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment) Management Fees 0.14% 12b-1 Distribution Fee None Other Expenses 0.01% Total Annual Fund Operating Expenses 0.15% 1 Example The following example is intended to help you compare the cost of investing in the Fund’s Investor Shares with the cost of investing in other mutual funds. -

Are VIX Futures Etps Effective Hedges? Geng Deng, Phd, FRM, Craig Mccann, Phd, CFA, and Olivia Wang, Phd 1

Are VIX Futures ETPs Effective Hedges? Geng Deng, PhD, FRM, Craig McCann, PhD, CFA, and Olivia Wang, PhD 1 Exchange-traded products (ETPs) linked to futures contracts on the CBOE S&P 500 Volatility Index (VIX) have grown in volume and assets under management in recent years, in part because of their perceived potential to hedge against stock market losses. In this paper we study whether VIX-related ETPs can effectively hedge a portfolio of stocks. We find that while the VIX increases when large stock market losses occur, ETPs which track short term VIX futures indices are not effective hedges for stock portfolios because of the negative roll yield accumulated by such futures-based ETPs. ETPs which track medium term VIX futures indices suffer less from negative roll yield and thus appear somewhat better hedges for stock portfolios. Our findings cast doubt on the potential diversification benefit from holding ETPs linked to VIX futures contracts. We also study the effectiveness of VIX ETPs in hedging Leveraged ETFs (LETFs) in which rebalancing effects lead to significant losses for buy-and-hold investors during periods of high volatility. We find that VIX futures ETPs are usually not effective hedges for LETFs. I. Introduction Exchange-traded products (ETPs) linked to futures contracts on the CBOE S&P 500 Volatility Index (VIX) first launched 2009 have become one of the most heavily traded ETP types. The VIX is an estimate of the future stock market volatility calculated by the Chicago Board Options Exchange (CBOE) based on prices of put and call options on the S&P 500 Index.