Vanguard Total Bond Market Index Fund Annual Report December 31

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vanguard Total Bond Market Index Fund Annual Report December 31

Annual Report]%FDFNCFS 7BOHVBSE5PUBM#POE.BSLFU*OEFY'VOE Contents Your Fund’s Performance at a Glance. 1 About Your Fund’s Expenses. 2 Performance Summary. .4 Financial Statements. 8 Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus. :PVS'VOET1FSGPSNBODFBUB(MBODF t 'PSUIFNPOUITFOEFE%FDFNCFS SFUVSOTGPS7BOHVBSE5PUBM#POE .BSLFU*OEFY'VOESBOHFEGSPNGPS*OWFTUPS4IBSFTUPGPS*OTUJUVUJPOBM 4FMFDU4IBSFT5IJTQFSGPSNBODFXBTJOMJOFXJUIUIFSFUVSOPGUIFCFODINBSL JOEFYBGUFSUBLJOHUIFDPTUTPGSVOOJOHUIFGVOEJOUPBDDPVOU t 5IFFNFSHFODFPG$07*%JOFBSMZUVSOFEJOUPBHMPCBMIFBMUIDSJTJT BOE BHHSFTTJWFBUUFNQUTUPDPOUBJOJUSFTVMUFEJOBTIBSQEPXOUVSOJOFDPOPNJDBDUJWJUZ 6OFNQMPZNFOUTQJLFE BOETFDUPSTXIFSFTPDJBMEJTUBODJOHJTOUQPTTJCMFXFSFIJUIBSE 1PMJDZNBLFSTXFSFRVJDLUPQSPWJEFSPCVTUGJTDBMBOENPOFUBSZTUJNVMVTUPCMVOUUIF QBOEFNJDTFDPOPNJDJNQBDU.BOZDFOUSBMCBOLTTMBTIFETIPSUUFSNJOUFSFTUSBUFT BOEFYQBOEFEPSFYUFOEFEBTTFUQVSDIBTFQSPHSBNT t 8JUIZJFMETGBMMJOHBOEQSJDFTSJTJOH 645SFBTVSJFTQPTUFEBSFUVSOPG .PSUHBHFCBDLFETFDVSJUJFTSFUVSOFEMFTTUIBOUIBU BTMPXNPSUHBHFSBUFTMFEUPQMFOUZ PGTVQQMZCVUDPSQPSBUFCPOETGBSFEFWFOCFUUFSUIBO5SFBTVSJFT SFUVSOJOH t #ZDSFEJURVBMJUZ MPXFSSBUFEJOWFTUNFOUHSBEFCPOETHFOFSBMMZEJECFUUFSUIBO IJHIFSSBUFEPOFTCZNBUVSJUZ CPOETXJUINBUVSJUJFTPGZFBSTPSNPSFTJHOJGJDBOUMZ PVUQFSGPSNFE .BSLFU#BSPNFUFS "WFSBHF"OOVBM5PUBM3FUVSOT -

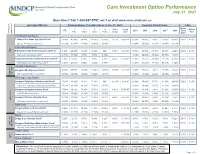

Core Investment Option Performance July 31, 2021

Core Investment Option Performance July 31, 2021 Questions? Call 1-800-657-5757, ext 3 or visit www.msrs.state.mn.us 2 INVESTMENT OPTIONS AVERAGE ANNUAL TOTAL RETURNS AS OF JULY 31, 20211 CALENDAR YEAR RETURNS FEES Gross 1 3 5 10 Since Incept Admin YTD 2020 2019 2018 2017 2016 Fund Year Years Years Years Incept Date Fee4 VOLATILITY 3 RISK LEVEL Exp US Small Cap Equity T. Rowe Price Small Cap Stock Fund5 13.46% 45.98% 18.44% 18.28% 15.29% 11.57% 03-31-00 25.00% 33.96% -3.07% 15.45% 19.00% 0.66% 0.10% Russell 2000 Benchmark Index6 13.29% 51.97% 11.49% 14.28% 12.34% 19.96% 25.52% -11.01% 14.65% 21.31% International Equity 5 7 HIGH Fidelity Diversified International Com Pool 8.85% 26.43% 12.99% 12.16% NA 7.85% 12-13-13 19.79% 29.75% -15.18% 26.72% -2.92% 0.58% 0.10% MSCI EAFE Benchmark Index6 9.81% 30.55% 7.88% 9.58% 6.32% 8.02% 22.29% -15.24% 26.65% 1.21% Vanguard Total International Stock Index Fund5 8.30% 29.52% 8.28% 9.90% 5.79% 6.42% 11-30-10 11.30% 21.56% -14.38% 27.57% 4.73% 0.07% 0.10% International Spliced Benchmark Index6 8.27% 29.60% 8.35% 9.90% 5.78% 11.24% 21.80% -14.61% 27.41% 4.72% US Mid Cap Equity Vanguard Mid Cap Index Fund5 16.80% 39.77% 16.02% 15.02% 13.70% 13.53% 12-15-10 18.27% 31.06% -9.21% 19.28% 11.24% 0.03% 0.10% TO HIGHTO Mid Cap Spliced Benchmark Index6 16.80% 39.78% 16.02% 15.02% 13.71% 18.24% 31.09% -9.22% 19.30% 11.25% MODERATE US Large Cap Equity Vanguard Total Stock Market Index Fund5 17.23% 38.98% 18.14% 17.41% NA7 14.44% 4-28-15 21.02% 30.82% -5.15% 21.19% 12.69% 0.02% 0.10% CRSP U.S. -

September 30, 2015)

Optional Retirement Program Performance Report State Retirement and Pension System of Maryland (As of September 30, 2015) Investment Options Expense Ratio Average Annual Rates of Return Active/ Gross Expense Ticker Money Market Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio FDRXX Fidelity Cash Reserves 0.37% 0.37% 0.01% 0.01% 0.01% 0.01% 0.01% N/A TIAA-CREF Money Market Account (R3) 0.32% 0.32% 0.00% 0.00% 0.00% 0.00% 0.00% Citigroup 3-month Treasury Bill Index 0.02% 0.03% 0.04% 0.04% 0.06% Active/ Gross Expense Stable Value Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio N/A TIAA-CREF Traditional Retirement Annuity N/A N/A 3.96% 4.02% 4.04% 4.06% 4.07% Citigroup 3-month Treasury Bill Index + 1.25% 1.27% 1.28% 1.29% 1.29% 1.31% Active/ Gross Expense Core Fixed Income/ Intermediate-Term Bond Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio FXSTX Fidelity Spartan U.S Bond Index (I) Passive 0.06% 0.07% 2.95% 3.38% 1.63% 2.51% 3.04% VBTIX TIAA-CREF Vanguard Total Bond Market Index Fund Passive 0.06% 0.06% 2.76% 3.33% 1.59% 2.44% 3.00% WATFX Western Asset Core Bond Fund (I ) Active 0.45% 0.49% 3.07% 4.49% 2.43% 3.70% 4.17% N/A TIAA-CREF Bond Market Account Active 0.37% 0.37% 2.53% 3.39% 1.60% 2.78% 3.06% BC Aggregate Bond Index 2.94% 3.45% 1.71% 2.56% 3.10% Active/ Gross Expense Inflation-Linked Bond Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio BPLBX Fidelity BlackRock Inflation Protected Bond Active 0.32% 0.42% -2.11% -0.36% -2.02% 0.59% 2.07% BPLBX TIAA-CREF BlackRock Inflation Protected Bond Active 0.32% 0.42% -2.11% -0.36% -2.02% 0.59% 2.07% Barclays US TIPS Index -0.83% 0.37% -1.83% 0.79% 2.55% Active/ Gross Expense Balanced Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio FBAKX Fidelity Balanced Fund (K) Active 0.46% 0.46% -0.65% 6.86% 8.77% 11.45% 9.59% N/A TIAA-CREF Social Choice Account (R3) Active 0.33% 0.33% -1.82% 3.89% 6.89% 9.14% 7.42% . -

Vanguard 2019 Investment Stewardship Semiannual

Vanguard 2019 Investment Stewardship Semiannual Engagement Update Semiannual Engagement Update Introduction 1 Board composition 2 Oversight of strategy and risk 6 Executive compensation 8 Governance structures 10 Company engagements 12 b Good governance can enhance and protect shareholder value over time. Boards that are well-composed for today and tomorrow have independent, experienced, and diverse members capable of overseeing strategy, governing risk, setting appropriate compensation, and embracing policies that give voice to shareholders. One of the hallmarks of good governance is engagement with shareholders. Each year, on behalf of Vanguard funds, our Investment Stewardship team meets with hundreds of portfolio companies. In these interactions, we have open, constructive dialogues about corporate governance. This semiannual engagement update provides snapshots of some of the discussions we held in the six months ended December 31, 2018. The substance of those discussions was framed by Vanguard’s four principles of corporate governance: Board Oversight of Executive Governance composition strategy & risk compensation structures These pillars cover topics such as board independence, alignment of strategy to long-term value creation, and linkage of pay to performance. Although these discussions can vary widely by company, sector, and region, our engagements tend to fall into three broad categories. Strategic engagements are meetings in which we learn about—but don’t seek to direct—a company’s long- term strategy. These enable us to understand the board’s approach to overseeing and aligning governance practices with the company’s long-term goals. Event-driven engagements focus on specific ballot items—often contentious—or a leadership change or company crisis. -

THE VOICE of CHESTER COUNTY Voice MARCH 2015

the THE VOICE OF CHESTER COUNTY Voice MARCH 2015 The Chester County Chamber Foundation Gala A night of fun for a great cause! Last Saturday the Chester County Chamber Foundation hosted the 2015 Auction Gala and what a night it was! Gala attendees put on their most fashionable 1960’s outfits and made their way to White Manor Country Club. Upon arrival, guests were greeted with champagne and appetizers. Between networking and catching up with friends, ordering a signature drink and checking out the Silent Auction-- the buzz coming from cocktail hour was remarkable. As the ballroom doors opened, guests were led to the Wine Wall, photo booth, and delicious food stations. It wasn’t long before the Smooth Sounds of Steve Silicato had everyone on the dance floor. Amongst all the good times, it was important to remember why we were there. All the proceeds from the raffles, games, and Live & Silent auctions will fund our Youth Leadership Program. Thank you to all who came to support this event and our mission at the Chamber Foundation. 1 Join the Chamber at our Annual State of the County Luncheon Featuring Chester County Commissioners Terence Farrell, Michelle Kichline, and Kathi Cozzone, CCCBI hosts the Chester County Commissioners for our State of the County Luncheon on Wednesday, April 8th. This event provides an update on Chester County and draws hundreds of business and community leaders. We’ll be honoring the recipient of the Boling Award, presented to a person who exemplifies the meaning of a dedicated public servant who excelled in his accomplishments on behalf of the public. -

Bond Market's Scariest Gauge Is Worse Than Ever

December 17, 2020 | bloomberg.com Markets Bond Market’s Scariest Gauge Is Worse Than Ever Corporate credit markets are more exposed to duration risk than at any other time in history. By Brian Chappatta January 14, 2021 Around this time a year ago, I ruffled in every sense of the word. While one-way moves of that kind of a few feathers among bond traders with As was the case last time around, this is magnitude are rare, benchmark 10-year the headline “This Is the Scariest Gauge happening because the numerator (yield) Treasury yields did increase by 20 basis for the Bond Market.” The upshot was has continued to tumble while the denomi- points in the first five trading days of the that when looking at the ratio of yields nator (duration) increases. The average new year. So with the duration of the on corporate debt relative to its duration, investment-grade corporate bond yield was corporate-bond index at almost nine years investors were more susceptible to losses a record-low 1.74% as of Dec. 31, compared heading into 2021, it’s basic math (roughly from a move higher in interest rates than with 2.84% a year earlier, while the modi- 8.84 times 0.2%, with a slight adjustment at any time in history. fied duration on the index increased to for spread tightening) that investment- Well, if that gauge was scary in January 8.84 years at the end of 2020, just about a grade bonds lost 1.52% last week. It really 2020, it’s downright terrifying now. -

Fixed-Income Insights

Fixed-Income Insights Staying Active in Fixed Income An unbiased side-by-side performance comparison of active and passive bond strategies may be an eye-opener for those considering index products. by Stephen Hillebrecht, CFA, Fixed-Income Product Strategist IN BRIEF n Rather than debating “active versus passive,” we should be asking, “Which strategy can deliver more attractive risk-adjusted returns, after expenses, to investors?” n In certain categories, the largest passive strategies have underperformed the category averages, and done so with additional risk. n Passive approaches may bring unintended exposures, such as increased rate sensitivity or exposure to the most indebted companies. n Certain fixed-income indexes are not easily replicated, potentially leading to missed opportunities for passive products. n Fixed-income markets have inefficiencies that create opportunity for active management. The “active versus passive” debate has been well covered in the financial media and popular press. The market has weighed in on this debate, as reflected in the fund flows into passive index funds and exchange-traded funds (ETFs) versus outflows from actively managed equity mutual funds. Much of this has been driven by the recent uneven performance of active equity managers, which, we believe, is largely cyclical in nature. We also believe that active and passive strategies can play complementary roles in equity portfolios. In some asset classes, however, passive management is not optimal—and that is the case, particularly, in certain segments of the fixed-income market. DELIVERING THE BEST FIXED-INCOME SOLUTION? categorized by Morningstar, more than $1 trillion is If someone were to offer a mutual fund with a per- invested in passive mutual funds ($559 billion) and formance record that ranked in the bottom third of ETFs ($515 billion) as of year-end 2017. -

Vanguard Money Market Funds Annual Report August 31, 2018

Annual Report | August 31, 2018 Vanguard Money Market Funds Vanguard Prime Money Market Fund Vanguard Federal Money Market Fund Vanguard Treasury Money Market Fund Vanguard’s Principles for Investing Success We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path. Goals. Create clear, appropriate investment goals. Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost. Discipline. Maintain perspective and long-term discipline. A single theme unites these principles: Focus on the things you can control. We believe there is no wiser course for any investor. Contents Your Fund’s Performance at a Glance. 1 CEO’s Perspective. 3 Advisor’s Report. 5 Prime Money Market Fund. .7 Federal Money Market Fund. 26 Treasury Money Market Fund. 42 About Your Fund’s Expenses. 55 Trustees Approve Advisory Arrangements. .57 Glossary. 59 Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus. See the Glossary for definitions of investment terms used in this report. Your Fund’s Performance at a Glance • For the 12 months ended August 31, 2018, Vanguard Prime Money Market Fund returned 1.59% for Investor Shares and 1.66% for Admiral Shares. Vanguard Federal Money Market Fund returned 1.42% and Vanguard Treasury Money Market Fund 1.43%. -

Fundflash US

FundFlash US July 2020 FundFlash US July 2020 JULY OVERVIEW FundFlash provides a summary of the regional trends and developments in the funds market over the previous month. ACTIVE VS PASSIVE FLOW, $B FLOW SENTIMENT, % The report is built using the Global Market Intelligence (GMI) funds ▲47 B 47% module which tracks $50trn in global funds assets with unique views of distributor and internationally sold business. ▲4 B GMI Funds sits alongside our Institutional module and together is relied ▼-4 B 53% on by over 100 asset managers as their source for global asset management market intelligence. Active mutual funds Passive mutual funds % of # funds with negative flows All ETFs % of # funds with positive flows 3 YR FUND INDUSTRY ASSET & FLOW MOMENTUM, $B 25,000 AUM Cumulative net flow 1,000 THE MONTH IN REVIEW 900 • In July, US stocks recorded their fourth positive month in a row. The 20,000 800 S&P 500 gained 5.5% and the tech sector drove the Nasdaq up 6.8% 700 15,000 600 for the month. US unemployment driven by Covid-19 remained in 500 double digit territory ending July at 10.2% as the nation’s GDP 10,000 400 300 contracted 33% on an annualized basis in 2Q marking a US recession. 5,000 200 100 PRODUCTS 0 • Fixed- income products stayed in favor as investors continued to seek Aug 2017 Jan 2018 Jun 2018 Nov 2018 Apr 2019 Sep 2019 Feb 2020 Jul 2020 safe havens. For the year, cumulative flows in active funds remained 300 FLOWS BY INVESTMENT STYLE AND YEAR - CUMULATIVE in negative territory, while ETF product flows trended positive. -

Vanguard® Value Index Fund

Vanguard® Vanguard® Value Index Fund Product Summary Vanguard Style View : Large Value Seeks to track the performance of the CRSP US Large Cap Value Index portfolio of large-capitalization value stocks. Index. Investment style Value Blend Growth Large-cap value equity. Passively managed, full-replication approach. Large Fund remains fully invested. Mid Low expenses minimize net tracking error. Small Note: The Investor Shares are closed to new investors. Market capitalization Central tendency Expected range of fund holdings Quarterly Commentary People and Process The human toll of COVID-19 further mounted during the second Vanguard Value Index Fund seeks to track the investment quarter of 2021 amid fresh outbreaks of the virus and new performance of the CRSP US Large Cap Value Index, an variants. The global economy nevertheless continued to rebound unmanaged benchmark representing U.S. large-capitalization value sharply if unevenly. Countries that have better succeeded in stocks. The fund attempts to replicate the target index by containing the virus—whether through vaccinations, lockdowns, or investing all, or substantially all, of its assets in the stocks that both—tended to fare the best. With the reopening of economies make up the index, holding each stock in approximately the same and pent-up demand boosting corporate profits, global stocks proportion as its weighting in the index. The experience and finished the quarter significantly higher. U.S. stocks outperformed stability of Vanguard’s Equity Index Group have permitted other developed markets as a whole as well as emerging markets. continuous refinement of techniques for reducing tracking error. The group uses proprietary software to implement trading The combination of faster economic growth, a recovery in decisions that accommodate cash flow and maintain close commodity prices, ongoing fiscal and monetary stimulus, and a correlation with index characteristics. -

SVO-Identified Bond ETF List

SVO-Identified Bond ETF List ETFs Eligible to be Reported as Bonds February 28, 2021 The NAIC is the authoritative source for insurance industry information. Our expert solutions support the efforts of regulators, insurers and researchers by providing detailed and comprehensive insurance information. The NAIC offers a wide range of publications in the following categories: Accounting & Reporting Special Studies Information about statutory accounting principles and Studies, reports, handbooks and regulatory the procedures necessary for fi ling financial annual research conducted by NAIC members on a statements and conducting risk-based capital variety of insurance related topics. calculations. Consumer Information Statistical Reports Important answers to common questions about auto, Valuable and in-demand insurance industry- home, health and life insurance — as well as buyer’s wide statistical data for various lines of guides on annuities, long-term care insurance and business, including auto, home, health and life Medicare supplement plans. insurance. Financial Regulation Supplementary Products Useful handbooks, compliance guides and reports on Guidance manuals, handbooks, surveys and financial analysis, company licensing, state audit research on a wide variety of issues. requirements and receiverships. Legal Capital Markets & Investment Analysis Comprehensive collection of NAIC model laws, Information regarding portfolio values and regulations and guidelines; state laws on insurance procedures for complying with NAIC reporting topics; -

Vanguard Balanced Portfolio Semiannual Report

Semiannual Report | June 30, 2021 Vanguard Variable Insurance Funds Balanced Portfolio Contents About Your Portfolio’s Expenses ..................... 1 Financial Statements ................................ 3 Trustees Approve Advisory Arrangement ............31 Liquidity Risk Management..........................32 About Your Portfolio’s Expenses As a shareholder of the portfolio, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a portfolio's gross income, directly reduce the investment return of the portfolio. A portfolio's expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your portfolio and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period. The accompanying table illustrates your portfolio's costs in two ways: • Based on actual portfolio return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the portfolio's actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the portfolio. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your portfolio under the heading ”Expenses Paid During Period.“ • Based on hypothetical 5% yearly return.