Diversification Benefits of Cat Bonds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vanguard Total Bond Market Index Fund Annual Report December 31

Annual Report]%FDFNCFS 7BOHVBSE5PUBM#POE.BSLFU*OEFY'VOE Contents Your Fund’s Performance at a Glance. 1 About Your Fund’s Expenses. 2 Performance Summary. .4 Financial Statements. 8 Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus. :PVS'VOET1FSGPSNBODFBUB(MBODF t 'PSUIFNPOUITFOEFE%FDFNCFS SFUVSOTGPS7BOHVBSE5PUBM#POE .BSLFU*OEFY'VOESBOHFEGSPNGPS*OWFTUPS4IBSFTUPGPS*OTUJUVUJPOBM 4FMFDU4IBSFT5IJTQFSGPSNBODFXBTJOMJOFXJUIUIFSFUVSOPGUIFCFODINBSL JOEFYBGUFSUBLJOHUIFDPTUTPGSVOOJOHUIFGVOEJOUPBDDPVOU t 5IFFNFSHFODFPG$07*%JOFBSMZUVSOFEJOUPBHMPCBMIFBMUIDSJTJT BOE BHHSFTTJWFBUUFNQUTUPDPOUBJOJUSFTVMUFEJOBTIBSQEPXOUVSOJOFDPOPNJDBDUJWJUZ 6OFNQMPZNFOUTQJLFE BOETFDUPSTXIFSFTPDJBMEJTUBODJOHJTOUQPTTJCMFXFSFIJUIBSE 1PMJDZNBLFSTXFSFRVJDLUPQSPWJEFSPCVTUGJTDBMBOENPOFUBSZTUJNVMVTUPCMVOUUIF QBOEFNJDTFDPOPNJDJNQBDU.BOZDFOUSBMCBOLTTMBTIFETIPSUUFSNJOUFSFTUSBUFT BOEFYQBOEFEPSFYUFOEFEBTTFUQVSDIBTFQSPHSBNT t 8JUIZJFMETGBMMJOHBOEQSJDFTSJTJOH 645SFBTVSJFTQPTUFEBSFUVSOPG .PSUHBHFCBDLFETFDVSJUJFTSFUVSOFEMFTTUIBOUIBU BTMPXNPSUHBHFSBUFTMFEUPQMFOUZ PGTVQQMZCVUDPSQPSBUFCPOETGBSFEFWFOCFUUFSUIBO5SFBTVSJFT SFUVSOJOH t #ZDSFEJURVBMJUZ MPXFSSBUFEJOWFTUNFOUHSBEFCPOETHFOFSBMMZEJECFUUFSUIBO IJHIFSSBUFEPOFTCZNBUVSJUZ CPOETXJUINBUVSJUJFTPGZFBSTPSNPSFTJHOJGJDBOUMZ PVUQFSGPSNFE .BSLFU#BSPNFUFS "WFSBHF"OOVBM5PUBM3FUVSOT -

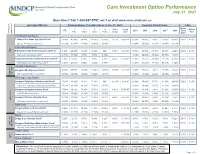

Core Investment Option Performance July 31, 2021

Core Investment Option Performance July 31, 2021 Questions? Call 1-800-657-5757, ext 3 or visit www.msrs.state.mn.us 2 INVESTMENT OPTIONS AVERAGE ANNUAL TOTAL RETURNS AS OF JULY 31, 20211 CALENDAR YEAR RETURNS FEES Gross 1 3 5 10 Since Incept Admin YTD 2020 2019 2018 2017 2016 Fund Year Years Years Years Incept Date Fee4 VOLATILITY 3 RISK LEVEL Exp US Small Cap Equity T. Rowe Price Small Cap Stock Fund5 13.46% 45.98% 18.44% 18.28% 15.29% 11.57% 03-31-00 25.00% 33.96% -3.07% 15.45% 19.00% 0.66% 0.10% Russell 2000 Benchmark Index6 13.29% 51.97% 11.49% 14.28% 12.34% 19.96% 25.52% -11.01% 14.65% 21.31% International Equity 5 7 HIGH Fidelity Diversified International Com Pool 8.85% 26.43% 12.99% 12.16% NA 7.85% 12-13-13 19.79% 29.75% -15.18% 26.72% -2.92% 0.58% 0.10% MSCI EAFE Benchmark Index6 9.81% 30.55% 7.88% 9.58% 6.32% 8.02% 22.29% -15.24% 26.65% 1.21% Vanguard Total International Stock Index Fund5 8.30% 29.52% 8.28% 9.90% 5.79% 6.42% 11-30-10 11.30% 21.56% -14.38% 27.57% 4.73% 0.07% 0.10% International Spliced Benchmark Index6 8.27% 29.60% 8.35% 9.90% 5.78% 11.24% 21.80% -14.61% 27.41% 4.72% US Mid Cap Equity Vanguard Mid Cap Index Fund5 16.80% 39.77% 16.02% 15.02% 13.70% 13.53% 12-15-10 18.27% 31.06% -9.21% 19.28% 11.24% 0.03% 0.10% TO HIGHTO Mid Cap Spliced Benchmark Index6 16.80% 39.78% 16.02% 15.02% 13.71% 18.24% 31.09% -9.22% 19.30% 11.25% MODERATE US Large Cap Equity Vanguard Total Stock Market Index Fund5 17.23% 38.98% 18.14% 17.41% NA7 14.44% 4-28-15 21.02% 30.82% -5.15% 21.19% 12.69% 0.02% 0.10% CRSP U.S. -

The Value-Added of Investable Hedge Fund Indices

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Heidorn, Thomas; Kaiser, Dieter G.; Voinea, Andre Working Paper The value-added of investable hedge fund indices Frankfurt School - Working Paper Series, No. 141 Provided in Cooperation with: Frankfurt School of Finance and Management Suggested Citation: Heidorn, Thomas; Kaiser, Dieter G.; Voinea, Andre (2010) : The value- added of investable hedge fund indices, Frankfurt School - Working Paper Series, No. 141, Frankfurt School of Finance & Management, Frankfurt a. M. This Version is available at: http://hdl.handle.net/10419/36695 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Frankfurt School – Working Paper Series No. 141 The Value-Added of Investable Hedge Fund Indices by Thomas Heidorn, Dieter G. -

September 30, 2015)

Optional Retirement Program Performance Report State Retirement and Pension System of Maryland (As of September 30, 2015) Investment Options Expense Ratio Average Annual Rates of Return Active/ Gross Expense Ticker Money Market Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio FDRXX Fidelity Cash Reserves 0.37% 0.37% 0.01% 0.01% 0.01% 0.01% 0.01% N/A TIAA-CREF Money Market Account (R3) 0.32% 0.32% 0.00% 0.00% 0.00% 0.00% 0.00% Citigroup 3-month Treasury Bill Index 0.02% 0.03% 0.04% 0.04% 0.06% Active/ Gross Expense Stable Value Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio N/A TIAA-CREF Traditional Retirement Annuity N/A N/A 3.96% 4.02% 4.04% 4.06% 4.07% Citigroup 3-month Treasury Bill Index + 1.25% 1.27% 1.28% 1.29% 1.29% 1.31% Active/ Gross Expense Core Fixed Income/ Intermediate-Term Bond Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio FXSTX Fidelity Spartan U.S Bond Index (I) Passive 0.06% 0.07% 2.95% 3.38% 1.63% 2.51% 3.04% VBTIX TIAA-CREF Vanguard Total Bond Market Index Fund Passive 0.06% 0.06% 2.76% 3.33% 1.59% 2.44% 3.00% WATFX Western Asset Core Bond Fund (I ) Active 0.45% 0.49% 3.07% 4.49% 2.43% 3.70% 4.17% N/A TIAA-CREF Bond Market Account Active 0.37% 0.37% 2.53% 3.39% 1.60% 2.78% 3.06% BC Aggregate Bond Index 2.94% 3.45% 1.71% 2.56% 3.10% Active/ Gross Expense Inflation-Linked Bond Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio BPLBX Fidelity BlackRock Inflation Protected Bond Active 0.32% 0.42% -2.11% -0.36% -2.02% 0.59% 2.07% BPLBX TIAA-CREF BlackRock Inflation Protected Bond Active 0.32% 0.42% -2.11% -0.36% -2.02% 0.59% 2.07% Barclays US TIPS Index -0.83% 0.37% -1.83% 0.79% 2.55% Active/ Gross Expense Balanced Net Expense Ratio 1 Year 2 Year 3 Year 4 Year 5 Year Passive Ratio FBAKX Fidelity Balanced Fund (K) Active 0.46% 0.46% -0.65% 6.86% 8.77% 11.45% 9.59% N/A TIAA-CREF Social Choice Account (R3) Active 0.33% 0.33% -1.82% 3.89% 6.89% 9.14% 7.42% . -

Università Degli Studi Di Padova Padua Research Archive

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Archivio istituzionale della ricerca - Università di Padova Università degli Studi di Padova Padua Research Archive - Institutional Repository On the (Ab)use of Omega? Original Citation: Availability: This version is available at: 11577/3255567 since: 2020-01-04T17:03:43Z Publisher: Elsevier B.V. Published version: DOI: 10.1016/j.jempfin.2017.11.007 Terms of use: Open Access This article is made available under terms and conditions applicable to Open Access Guidelines, as described at http://www.unipd.it/download/file/fid/55401 (Italian only) (Article begins on next page) \On the (Ab)Use of Omega?" Massimiliano Caporina,∗, Michele Costolab, Gregory Janninc, Bertrand Mailletd aUniversity of Padova, Department of Statistical Sciences bSAFE, Goethe University Frankfurt cJMC Asset Management LLC dEMLyon Business School and Variances Abstract Several recent finance articles use the Omega measure (Keating and Shadwick, 2002), defined as a ratio of potential gains out of possible losses, for gauging the performance of funds or active strategies, in substitution of the traditional Sharpe ratio, with the arguments that return distributions are not Gaussian and volatility is not always the rel- evant risk metric. Other authors also use Omega for optimizing (non-linear) portfolios with important downside risk. However, we question in this article the relevance of such approaches. First, we show through a basic illustration that the Omega ratio is incon- sistent with the Second-order Stochastic Dominance criterion. Furthermore, we observe that the trade-off between return and risk corresponding to the Omega measure, may be essentially influenced by the mean return. -

On the Ω‐Ratio

On the Ω‐Ratio Robert J. Frey Applied Mathematics and Statistics Stony Brook University 29 January 2009 15 April 2009 (Rev. 05) Applied Mathematics & Statistics [email protected] On the Ω‐Ratio Robert J. Frey Applied Mathematics and Statistics Stony Brook University 29 January 2009 15 April 2009 (Rev. 05) ABSTRACT Despite the fact that the Ωratio captures the complete shape of the underlying return distribution, selecting a portfolio by maximizing the value of the Ωratio at a given return threshold does not necessarily produce a portfolio that can be considered optimal over a reasonable range of investor preferences. Specifically, this selection criterion tends to select a feasible portfolio that maximizes available leverage (whether explicitly applied by the investor or realized internally by the capital structure of the investment itself) and, therefore, does not trade off risk and reward in a manner that most investors would find acceptable. 2 Table of Contents 1. The ΩRatio.................................................................................................................................... 4 1.1 Background ............................................................................................................................................5 1.2 The Ω Leverage Bias............................................................................................................................7 1.3. A Simple Example of the ΩLB ..........................................................................................................8 -

Monte Carlo As a Hedge Fund Risk Forecasting Tool

F eat UR E Monte Carlo as a Hedge Fund Risk Forecasting Tool By Kenneth S. Phillips edge funds have gained The notion of uncorrelated, absolute popularity over the past “retur ns encompassing a broad range of asset Hseveral years, especially among institutional investors. Assets allocated classes and distinct strategies has enjoyed to alternative investment strategies, distinct from private equity or venture great acceptance among conservative inves- capital, have grown by several hundred tors seeking more predictable and consistent percent since the dot-com bubble burst in 2000 and now top US$2.5 trillion. retur ns with less volatility. The notion of uncorrelated, absolute returns encompassing a broad range ” of asset classes and distinct strategies has enjoyed great acceptance among conservative investors seeking more level of qualitative due diligence, may management objectives resulted in the predictable and consistent returns with or may not have provided warnings evaporation of nearly US$6.5 billion of less volatility. As a result, the industry and/or given investors adequate time to investor equity, virtually overnight. has begun to mature and investors now redeem their capital. Although the ar- Global Equity Market Neutral range from risk-averse fiduciaries to ag- ticle implicitly considers different forms (GEMN). Since 2003, GEMN had gressive high-net-worth individuals. of investment risk such as leverage managed a globally diversified, equity As the number of hedge funds and and derivatives, it focuses primarily on market neutral hedge fund. Employ- complex strategies has grown, so too quantitative return-based data that was ing various amounts of leverage while have the frequency and severity of publicly available rather than strategy- attracting several billion dollars of negative events—what statisticians refer or security-specific risk. -

Fund of Hedge Funds Portfolio Optimization Using the Omega Ratio

risk management / compliance LE Fund of Hedge Funds Portfolio IC T R Optimization Using the Omega Ratio A D E ® BY STEVE TOGHER, CAIA , clearly demonstrate how Omega quantitative measure should be an UR AND TambE BARsbaY captures these higher moments. It is end-all solution. an equation that adds to mean and Our objective here is to present a EAT variance, captures all of the higher method of “optimizing” a portfolio F t is interesting to ponder moment information in the return of hedge funds using the Omega how new and radical distribution, incorporates sensitivity ratio. For the purposes of our discus- theories and equations to return levels, and is intuitive and sion we will focus on a portfolio of Iin financial analysis become widely relatively easy to calculate. alternative investment managers accepted. It most likely is a function The body of literature about con- with nonnormal returns but, of of simplicity, elegance of design, structing and optimizing portfolios course, the underlying investments and ease of application. But it is of hedge funds continues to grow can be anything. We put optimizing even more interesting to observe and the alternatives are varied. In in quotes because our analysis is not how, once widely accepted, such most cases a comparison is made the sole input in determining the concepts can be misapplied. Perhaps to MVO, which suffers from similar optimized portfolio. two of the most common examples drawbacks as Sharpe when applied are the application of the Sharpe to hedge fund returns. DeSouza and Understanding the Omega Ratio ratio and mean variance optimiza- Gokcan (2004) defined an approach We believe that using the Omega tion (MVO) to hedge fund portfolio that is modeled on asset allocation ratio for this purpose is a rather intu- analysis. -

Bond Market's Scariest Gauge Is Worse Than Ever

December 17, 2020 | bloomberg.com Markets Bond Market’s Scariest Gauge Is Worse Than Ever Corporate credit markets are more exposed to duration risk than at any other time in history. By Brian Chappatta January 14, 2021 Around this time a year ago, I ruffled in every sense of the word. While one-way moves of that kind of a few feathers among bond traders with As was the case last time around, this is magnitude are rare, benchmark 10-year the headline “This Is the Scariest Gauge happening because the numerator (yield) Treasury yields did increase by 20 basis for the Bond Market.” The upshot was has continued to tumble while the denomi- points in the first five trading days of the that when looking at the ratio of yields nator (duration) increases. The average new year. So with the duration of the on corporate debt relative to its duration, investment-grade corporate bond yield was corporate-bond index at almost nine years investors were more susceptible to losses a record-low 1.74% as of Dec. 31, compared heading into 2021, it’s basic math (roughly from a move higher in interest rates than with 2.84% a year earlier, while the modi- 8.84 times 0.2%, with a slight adjustment at any time in history. fied duration on the index increased to for spread tightening) that investment- Well, if that gauge was scary in January 8.84 years at the end of 2020, just about a grade bonds lost 1.52% last week. It really 2020, it’s downright terrifying now. -

Fixed-Income Insights

Fixed-Income Insights Staying Active in Fixed Income An unbiased side-by-side performance comparison of active and passive bond strategies may be an eye-opener for those considering index products. by Stephen Hillebrecht, CFA, Fixed-Income Product Strategist IN BRIEF n Rather than debating “active versus passive,” we should be asking, “Which strategy can deliver more attractive risk-adjusted returns, after expenses, to investors?” n In certain categories, the largest passive strategies have underperformed the category averages, and done so with additional risk. n Passive approaches may bring unintended exposures, such as increased rate sensitivity or exposure to the most indebted companies. n Certain fixed-income indexes are not easily replicated, potentially leading to missed opportunities for passive products. n Fixed-income markets have inefficiencies that create opportunity for active management. The “active versus passive” debate has been well covered in the financial media and popular press. The market has weighed in on this debate, as reflected in the fund flows into passive index funds and exchange-traded funds (ETFs) versus outflows from actively managed equity mutual funds. Much of this has been driven by the recent uneven performance of active equity managers, which, we believe, is largely cyclical in nature. We also believe that active and passive strategies can play complementary roles in equity portfolios. In some asset classes, however, passive management is not optimal—and that is the case, particularly, in certain segments of the fixed-income market. DELIVERING THE BEST FIXED-INCOME SOLUTION? categorized by Morningstar, more than $1 trillion is If someone were to offer a mutual fund with a per- invested in passive mutual funds ($559 billion) and formance record that ranked in the bottom third of ETFs ($515 billion) as of year-end 2017. -

Hedge Fund Performance Evaluation

International Business & Economics Research Journal – May/June 2014 Volume 13, Number 3 Hedge Fund Performance Evaluation Using The Sharpe And Omega Ratios Francois van Dyk, UNISA, South Africa Gary van Vuuren, North-West University, Potchefstroom Campus, South Africa André Heymans, North-West University, Potchefstroom Campus, South Africa ABSTRACT The Sharpe ratio is widely used as a performance evaluation measure for traditional (i.e., long only) investment funds as well as less-conventional funds such as hedge funds. Based on mean- variance theory, the Sharpe ratio only considers the first two moments of return distributions, so hedge funds – characterised by asymmetric, highly-skewed returns with non-negligible higher moments – may be misdiagnosed in terms of performance. The Sharpe ratio is also susceptible to manipulation and estimation error. These drawbacks have demonstrated the need for augmented measures, or, in some cases, replacement fund performance metrics. Over the period January 2000 to December 2011 the monthly returns of 184 international long/short (equity) hedge funds with geographical investment mandates spanning North America, Europe, and Asia were examined. This study compares results obtained using the Sharpe ratio (in which returns are assumed to be serially uncorrelated) with those obtained using a technique which does account for serial return correlation. Standard techniques for annualising Sharpe ratios, based on monthly estimators, do not account for this effect. In addition, this study assesses whether the Omega ratio supplements the Sharpe Ratio in the evaluation of hedge fund risk and thus in the investment decision-making process. The Omega and Sharpe ratios were estimated on a rolling basis to ascertain whether the Omega ratio does indeed provide useful additional information to investors to that provided by the Sharpe ratio alone. -

Fundflash US

FundFlash US July 2020 FundFlash US July 2020 JULY OVERVIEW FundFlash provides a summary of the regional trends and developments in the funds market over the previous month. ACTIVE VS PASSIVE FLOW, $B FLOW SENTIMENT, % The report is built using the Global Market Intelligence (GMI) funds ▲47 B 47% module which tracks $50trn in global funds assets with unique views of distributor and internationally sold business. ▲4 B GMI Funds sits alongside our Institutional module and together is relied ▼-4 B 53% on by over 100 asset managers as their source for global asset management market intelligence. Active mutual funds Passive mutual funds % of # funds with negative flows All ETFs % of # funds with positive flows 3 YR FUND INDUSTRY ASSET & FLOW MOMENTUM, $B 25,000 AUM Cumulative net flow 1,000 THE MONTH IN REVIEW 900 • In July, US stocks recorded their fourth positive month in a row. The 20,000 800 S&P 500 gained 5.5% and the tech sector drove the Nasdaq up 6.8% 700 15,000 600 for the month. US unemployment driven by Covid-19 remained in 500 double digit territory ending July at 10.2% as the nation’s GDP 10,000 400 300 contracted 33% on an annualized basis in 2Q marking a US recession. 5,000 200 100 PRODUCTS 0 • Fixed- income products stayed in favor as investors continued to seek Aug 2017 Jan 2018 Jun 2018 Nov 2018 Apr 2019 Sep 2019 Feb 2020 Jul 2020 safe havens. For the year, cumulative flows in active funds remained 300 FLOWS BY INVESTMENT STYLE AND YEAR - CUMULATIVE in negative territory, while ETF product flows trended positive.