Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2014 Corporate Social Responsabilitity Report

2014 Corporate Social Responsabilitity Report Chairman’s Message 3 Social Report The Group key figures 5 • Carige’s Corporate Social Responsibility 35 Identity of the Group • The Banca Carige Group’s profile 6 • Mission, Vision and Core Values 9 38 CUSTOMERS • Strategies 10 • Organisational Structure and Distribution Network 15 Governance 49 EMPLOYEES • Corporate governance 18 • The internal control and risk management 28 system 63 Economic Report COMMUNITY • Financial highlights 29 • Value added 32 71 SHAREHOLDERS Methodological note 83 76 SUPPLIERS Annexes • Tables 85 • GRI-G3.1 indicators 109 78 ENVIRONMENT Any information included in this document is referred to the 2014 financial year, unless - where specified - an update was planned prior to the approval of the 2014 Corporate Social Responsibility Report by the Board of Directors on 12th May 2015. For any following updatings, reference should be made to the website www.gruppocarige.it, particularly to the sections Governance and Investor Relations. Chairman’s Message that, with a view to recovering profitability On top of this, we should not forget to safeguard the corporate assets over time. the additional effort arising from the partially unfavourable outcome of the This was a sterling work, pursued with Comprehensive Assessment carried out by determination, and which led to a profound the ECB and disclosed at the end of October and substantial renewal of the Banca Carige 2014. While acknowledging the presence of Group over a period of just twelve months. It adequate risk protections -

Banca Carige and Nexi Sign Agreement for the Creation of a Payment Systems Partnership

PRESS RELEASE PRESS RELEASE BANCA CARIGE AND NEXI SIGN AGREEMENT FOR THE CREATION OF A PAYMENT SYSTEMS PARTNERSHIP BANCA CARIGE WILL TRANSFER THE MERCHANT ACQUIRING ASSETS TO ITS PARTNER Genoa, 3 April 2018 – Banca Carige S.p.A. (“Banca Carige”) and Nexi S.p.A (“Nexi”), a leading player in the management of payment services, announce they have today entered into a ten-year partnership for the distribution of new, innovative payment products and services through the Carige Group’s distribution network. Under the agreement, the Merchant Acquiring business will be sold by Banca Carige to Nexi Payments S.p.A. (“Nexi Payments”), a company controlled by Nexi, for a consideration of EUR 25 million. Banca Carige currently runs the Merchant Acquiring business by distributing products and services to approximately 20,000 customers through its branch network in Italy. The transactional volume in the Merchant Acquiring business totalled EUR 1.8 bn in 2017. Thanks to the partnership, Banca Carige will have the opportunity to leverage the specialised expertise and investment capacity of Nexi, a leader in digital payments, and will be able to distribute new, innovative payment systems for faster and safer transactional processing to its customers. Taking advantage of new solutions designed and developed by Nexi, Banca Carige will boost the use of cards -including for small everyday payments- and will be able to offer the new suite of international credit and debit cards featuring digital payment options to its customers. The ten-year partnership is expected to generate up to EUR 15 mln in fee and commission income linked to the achievement of pre-set sales targets for the distribution of Merchant Acquiring services, in addition to revenues generated by the placement of services connected with other agreements. -

UBS Investment Bank

PROSPECTUS DATED 20 July 2017 BANCA CARIGE S.P.A. — CASSA DI RISPARMIO DI GENOVA E IMPERIA €5,000,000,000 Euro Medium Term Note Programme Arranger and Dealer UBS Investment Bank IMPORTANT INFORMATION This Prospectus comprises a base prospectus in respect of all Notes other than Exempt Notes (as defined below) issued under the Programme (as defined below) for the purposes of Article 5.4 of Directive 2003/71/EC as amended (the "Prospectus Directive ") and for the purpose of giving information with regard to the Issuer (as defined below), the Issuer and its subsidiaries and affiliates taken as a whole ("Banca Carige Group " or the "Group ") which, according to the particular nature of the Issuer and the Notes, is necessary to enable investors to make an informed assessment of the assets and liabilities, financial position, profit and losses and prospects of the Issuer. The Issuer accepts responsibility for the information contained in this Prospectus and the Final Terms for each Tranche of Notes issued under the Programme. To the best of the knowledge of the Issuer (having taken all reasonable care to ensure that such is the case) the information contained in this Prospectus is in accordance with the facts and does not omit anything likely to affect the import of such information. This Prospectus must be read and construed together with any supplements hereto and with any information incorporated by reference herein and, in relation to any Tranche of Notes which is the subject of Final Terms (as defined below), must be read and construed together with the relevant Final Terms. -

European Npls - FY18 an Overview of the Non-Performing Loan Market

An Acuris Company Year-End 2018 European NPLs - FY18 An overview of the non-performing loan market Alessia Pirolo Head of NPL Coverage, Debtwire +44 (0) 20 3741 1399 [email protected] Amy Finch Data Journalist, Debtwire +44 (0) 20 3741 1187 [email protected] European NPLs – FY18 An Acuris Company Overview: A Record Year for NPL sales 3-7 Trends by Country Italy 8-13 Spain 14-17 New Entries: Portugal, Greece and Cyprus 18-24 UK and Ireland 25-28 Germany 29-30 Index List of closed deals 31-40 Criteria 41 Authors and contact details 42 2 European NPLs – FY18 An Acuris Company A Record Year for NPL sales The European non-performing loan (NPL) market reached its peak in 2018 with disposal totalling EUR 205.1bn in gross book value (GBV). Debtwire NPL Database tracked 142 transactions. The year just closed has been by far a record, compared with EUR 144bn in 2017 and EUR 107bn in 2016, according to data from Deloitte. The last quarter of 2018 saw a particularly intense pace of activity, given that at the end of the third quarter closed deals totalled EUR 125bn. The most active country was Italy, which totalled half of the total volume of NPL sales. In 2018, 64 NPL sales with a gross book value (GBV) of EUR 103.6bn were tracked in the country, almost half of which were via securitisations within the government’s Garanzia sulla Cartolarizzazione delle Sofferenze (GACS) scheme, which now has only until 6 March 2019 to run. Spain has started to see a slowdown of sales, but still completed a massive EUR 43.2bn in 27 deals. -

Accordo Carige

VERBALE DI ACCORDO In data 17 novembre 2008 tra UniCredit, nelle persone dei Sigg. Angelo Carletta, Gianluigi Robaldo, Fabrizio Ferretti, Fabrizio Rinella, Giancarla Zemiti, Paolo Giannoccoli, Silvio Lops, Valeria Ruggiero, Massimo Giovannelli, Miriam Travaglia, Francesco Trapanese, Anna Lisa Rizza UniCredit Banca, nelle persone dei Sigg. Enrico Pozzi, Massimiliano Fara, Lucia Landi UniCredit Banca di Roma, nelle persone dei Sigg. Cinzia Fichera, Sergio D’Ercole Banco di Sicilia, nelle persone dei Sigg. Paolo Ruggi, Giuseppe Giordano, Antonio Saetta e Banca Carige, nelle persone dei Sigg. Giacomo Ottonello, Sergio Donegà, Luciano Salvati e le OO.SS. DIRCREDITO-FD, Giancarlo Mirandola, Giuliano Arosio, Donato Forte, Pietro Santagata, FABI, Angelo Di Cristo, Franco Ottobre, Carmelo Raffa, Cetty Di Benedetto, Stefano Cefaloni, Giovanni Galli, Carola Tessadri, Maria Furfaro, Stefano Seghezza, Massimo Giavarini, FIBA/Cisl, Ezio Massoglio, Ester Balconi, Gabriele Urzì, Daniele Bedogni, Giuseppe Matta, Monica Sebastiani, Costanzo Cavalli FISAC/Cgil, Andrea Bonansea, Fausto Ricci, Marco Salvi, Francesco Re, Franco Ospazi, Vito La Francesca, Sergio Bui, Sergio Lorenzo Bonanini, Maria Elena Di Betta, Maria Pazzini SINFUB, Antonio Raccuglia, Antonio Barbato, Francesco Cuccovillo, Filippo Pretolani, Eraldo Montali SILCEA, Vincenzo Fusciardi, Nicola Cavadi, Luigi Canadelli, Corrado Medetti, Maurizio Licandro, Sergio Russo, Alberto Di Gennaro UGL Credito Pietro Agrillo, Davide Zecca, Andrea Cavagna, Sergio Isella, Flavio Varesano, Angelo Garaventa, -

Insurance Agents % • Re-Engineering of Business Processes ROE Adj

BANCABANCA CARIGECARIGE Cassa di Risparmio di Genova e Imperia UniCredit European Regional Investors Conference Munich, 24 May 2007 -1- BANCA CARIGE Agenda Carige Group Overview Strategic Plan 2006-2008 2006 & 1Q07 Results Carige on Capital Markets Investors Conference Investors Annexes UniCredit Regional European -2- BANCA CARIGE A strategic location The new Trans-European Corridors: an opportunity for Carige • From a geografic point of view Genoa and Liguria Region are in a Banca Carige strategic position headquarters (Genoa, Liguria) •The market share of Carige in Liguria is about 30% -3- BANCA CARIGE Banca Carige Group today ~52.000 small shareholders Fondazione CR Assicurazioni Genova e CNCE WestLB Generali Market Imperia 41.15% 14.56% 5.05% 2.10% 37.14% Banca Carige SpA Cassa di Risparmio di Genova e Imperia Banking Insurance Finance Trustee Real Estate • Banca Carige • Carige Vita Nuova (life) • Carige AM SGR •Cr Savona • Carige Ass.ni (non life) • Creditis (consumer credit) • Cr Carrara • BM Lucca •B. CesarePonti Main Companies only -4- BANCA CARIGE A medium-sized Group MARKET CAP €b, data at 17.05.07 CARIGE MARKET CAP RATING • Ordinary shares 4.6 €b • Fitch A 99,4 • Saving shares 0.7 €b • Moody’s A2 • S&P’s A- 77,3 17,5 14,3 12,7 10,2 5,3 3,4 1,4 e m MPS Banca Carige Creval Crede aolo+CrFi it+Capitalia Ubi P BPM+BPER Banco Popolar Unicred IntesaSan Banco Popolare= BPVN+BPI ; UBI Banca: BPU+B.Lombarda -5- BANCA CARIGE A long term steady growth... Annual average yield per ordinary share since IPO 2003 Capital increase 2006 Capital increase (€ 215M) Capital gain (a) 12.4% and acq.of CR Carrara Dividend Yield (b) 3.6% 2004 Carige AM SGR and acq.of Banca Ponti Total Return (a+b) 16.0% Price at 15.05.07 (3.81 €) Price Vol. -

Presentazione Di Powerpoint

BANCABANCA CARIGECARIGE Cassa di Risparmio di Genova e Imperia September 2005 -1- BANCA CARIGE GROUP Agenda Carige’s project: history and results The 2005-2007 Business Plan The adoption of IAS and 1H 2005 results Carige share performance -2- BANCA CARIGE GROUP Carige’sCarige’s project:project: historyhistory andand resultsresults The 2005-2007 Business Plan The adoption of IAS and 1H 2005 results Carige share performance -3- BANCA CARIGE GROUP Historical evolution Independence through growth 1483 - 1989 1990 - 1998 1999 - 2003 A long history Capital base Expansion and as one of the strengthening and diversification: oldest banks in opening to new from a regional to the world shareholders: a multilocal from savings bank network and from to stock company a bank to a financial conglomerate -4- BANCA CARIGE GROUP Timeline of events Establishment of Change of name Creation of a IPO: first savings Capital increase Acquisition of 124 Establishment of Cassa di to Cassa di Multifunctional bank to be floated reserved to branches from Carige AM SGR Risparmio di Risparmio di group on the Italian institutional BdS, Intesa and SpA - acquisition Genova Genova e Imperia Stock Exchange investors Capitalia of Banca C. Ponti 14831483 18461846 19291929 19671967 19911991 19921992 19941994 19951995 19971997 19981998 19991999 2000–20022000–2002 22003003 20020044 Foundation of Merger of Monte di Banca Carige Commitment of Acquisition of the Italian International Sharecapital Monte di Pietà di Pietà into Cassa di becomes the the Foundation to insurance activities of partnership increase; Genova Risparmio di banking subsidiary privatise Banca Baloise Group; the non agreements acquisition of Genova of Foundation Carige. -

Circular 11492: Circularlist

RELATIONSHI RELATIONSHI RELATIONS RELATIONSHIP INSTITUTION RSDD # P SPECIALIST P SPECIALIST HIP MANAGER MANAGER PHONE 1ST CONSTITUTION BANCORP 2784920 YOGESH DALAL 212-720-2253 JOHN ANELLO 212-720-2878 473 BROADWAY HOLDING CORPORATION 1035157 ROLAND GERRARD 212-720-2450 JOHN ANELLO 212-720-2878 AAREAL BANK AG 3123432 STEPHANIE MARTIN 212-720-1418 BERNARD JACOBS 212-720-5890 ABBEY NATIONAL TREASURY SERVICES PLC 3041385 LARRY ROSTOKER 212-720-2513 RALPH SANTASIERO 212-720-2557 ABN AMRO BANK N.V. 25012 LARRY ROSTOKER 212-720-2513 RALPH SANTASIERO 212-720-2557 ABN AMRO BANK N.V. - JERSEY CITY REP OFFICE 3158603 LARRY ROSTOKER 212-720-2513 RALPH SANTASIERO 212-720-2557 ABSA BANK LTD. 2291996 COSMO DEBARI 212-720-2405 JANET DUNLOP 212-720-2227 ADIRONDACK BANCORP, INC. 2467474 YOGESH DALAL 212-720-2253 JOHN ANELLO 212-720-2878 ADIRONDACK TRUST COMPANY 645317 ROLAND GERRARD 212-720-2450 JOHN ANELLO 212-720-2878 AGRICULTURAL BANK OF CHINA 2625126 FRANK PAINE 212-720-2650 DENNIS HERBST 212-720-2258 ALDEN STATE BANK 414102 FRED FINKELBERG 212-720-2157 JOHN ANELLO 212-720-2878 ALLGEMEINE HYPOTHEKENBANK RHEINBODEN AG 3128624 RAY CASTRO 212-720-2301 BERNARD JACOBS 212-720-5890 ALLIANCE FINANCIAL CORPORATION 1140510 YOGESH DALAL 212-720-2253 JOHN ANELLO 212-720-2878 ALLIED IRISH BANKS, LTD. 3403 PETER SCHNEIDER 212-720-2215 RALPH SANTASIERO 212-720-2557 AMBOY BANCORPORATION 2611718 JEROME KOTCH 212-720-2236 JOHN ANELLO 212-720-2878 AMERICAN EXPRESS BANK INTERNATIONAL 727576 SCHUYLER MACGUIRE 212-720-2544 WILLIAM BRODOWS 212-720-2508 AMERICAN EXPRESS -

Banca Carige Banca Carige Italia Banca Caripe Banca

BANCA CARIGE BANCA CARIGE ITALIA BANCA CARIPE BANCA CESARE PONTI BANCA DEL FUCINO BANCA DEL MONTE DI LUCCA BANCA DEL SUD BANCA DELL'ADRIATICO BANCA DI VITERBO CREDITO COOPERATIVO BANCA DI CREDITO COOP. DI CAMBIANO BANCA DI CREDITO COOP. CASTAGNETO CARDUCCI BANCA DI CREDITO POPOLARE BANCA DI IMOLA BANCA DI PIACENZA BANCA DI PISA E FORNACETTE CREDITO COOPERATIVO BANCA DI SASSARI BANCA EUROMOBILIARE BANCA FIDEURAM BANCA FININT BANCA GENERALI BANCA IFIGEST BANCA IFIS BANCA MEDIOLANUM BANCA PASSADORE BANCA POPOLARE DI LANCIANO E SULMONA BANCA POPOLARE DEL CASSINATE BANCA POPOLARE DEL FRUSINATE BANCA POPOLARE DEL LAZIO BANCA POPOLARE DELL'ALTO ADIGE - VOLKSBANK BANCA POPOLARE DELL'EMILIA ROMAGNA BANCA POPOLARE DI APRILIA BANCA POPOLARE DI BARI BANCA POPOLARE DI MANTOVA BANCA POPOLARE DI MILANO BANCA POPOLARE DI PUGLIA E BASILICATA BANCA POPOLARE DI SPOLETO BANCA POPOLARE PUGLIESE BANCA POPOLARE SANT'ANGELO BANCA POPOLARE VALCONCA BANCA PROSSIMA BANCA SISTEMA BANCA TERCAS BANCA VALSABBINA BANCO DI DESIO E DELLA BRIANZA BANCO DI LUCCA BANCO DI NAPOLI BANCO DI SARDEGNA BANCO POPOLARE CABEL CASSA DEI RISPARMI DI FORLI' E DELLA ROMAGNA CASSA CENTRALE BANCA - CREDITO COOP. DEL NORD EST CASSA CENTRALE RAIFFEISEN DELL'ALTO ADIGE CASSA DI RISPARMIO DELLA PROV. DELL'AQUILA CASSA DI RISPARMIO DEL FRIULI V. GIULIA CASSA DI RISPARMIO DEL VENETO CASSA DI RISPARMIO DI ASTI CASSA DI RISPARMIO DI BIELLA E VERCELLI CASSA DI RISPARMIO DI BOLOGNA CASSA DI RISPARMIO DI BOLZANO - SPARKASSE CASSA DI RISPARMIO DI CARRARA CASSA DI RISPARMIO DI CESENA CASSA DI RISPARMIO DI FIRENZE CASSA DI RISPARMIO DI ORVIETO CASSA DI RISPARMIO DI PISTOIA E LUCCHESIA CASSA DI RISPARMIO DI RAVENNA CASSA DI RISPARMIO DI S. -

Intesa Sanpaolo E Banca Carige, Credito Valtellinese, Veneto Banca

Intesa Sanpaolo and Banca Carige, Credito Valtellinese, Veneto Banca and Banca Popolare di Bari sign contracts of sale for 198 branch offices of the Intesa Sanpaolo Group Joint press release pursuant to Article 114 of Legislative Decree No. 58/98 Turin,Milan/Genoa/Sondrio/Montebelluna/Bari, October 5 2007 – Today, Intesa Sanpaolo signed contracts of sale (the “Transaction”) with Banca Carige, Credito Valtellinese, Veneto Banca and Banca Popolare di Bari (jointly referred to as the “Buyers”) related to the 198 branch offices (the “Network”) being sold by Intesa Sanpaolo, as established by the Antitrust Authority (“AGCM”) in Measure No. 16249 issued on December 20 2006 in relation to the merger between Banca Intesa and Sanpaolo IMI. The Network includes 198 branch offices throughout Italy (0.6% of the market), located in 11 regions and 16 provinces. The branch offices will be split as follows: 78 branch offices to Banca Carige in the provinces of Turin (14), Aosta (1), Como (19), Pavia (6), Venice (18), Padua (15), Rovigo (1), and Sassari (4); 35 branch offices to Credito Valtellinese, in the provinces of Turin (19), Alessandria (4), and Pavia (12); 42 branch offices to Veneto Banca in the provinces of Imperia (5), Venice (18), Padua (7), Udine (9), and Rovigo (3); 43 branch offices to Banca Popolare di Bari in the provinces of Pesaro (2), Terni (11), Naples (15), Caserta (10), and Brindisi (5). The payment for sale of the 198 branch offices amounts to € 1,900 million, split as follows: Banca Carige: € 996 million Credito Valtellinese: € 395 million Veneto Banca: € 328 million Banca Popolare di Bari: € 181 million Said amount is subject to a possible mechanism to adjust the price in relation to the total amount of deposits and savings (direct and indirect) at the date of sale of the branch offices. -

GRUPPO CARIGECARIGE Programme and Covered Bond Issue

GRUPPOGRUPPO CARIGECARIGE Programme and Covered Bond Issue Investor Presentation Obbligazioni Bancarie Garantite August 2010 GRUPPO CARIGE 1 Executive Summary Ratings: A2/P1 Moody’s, A/F1 Fitch, A-/A2 S&P Among the top 10 Italian banking Groups Banca Carige Adequate capital ratios Excellent / long standing mortgage origination and servicing history No direct exposure to subprime market and monoline Low level of indebtedness by households Italian Mortgage High home ownership of the Italian households Market Property values’ volatility much lower than in other European countries Low delinquencies compared to other European countries Italian legislative covered bond: Obbligazioni Bancarie Garantite (“OBG”) OBG Triple A expected rating (Moody’s, Fitch Ratings) Programme Benefits from 26% currently committed over-collateralisation 95.07% Italian prime residential mortgages, 4.93% Italian commercial mortgages all originated by Gruppo Carige Eligible mortgage loans, as per Italian OBG law Collateral All loans are performing Characteristics High concentration in the north of Italy (80%) Highly seasoned portfolio (38 Months Weighted average seasoning) WA LTV: 50.88% (Residential) and 24.64% (Commercial) GRUPPO CARIGE 2 Solid ratings Short term credit rating: P-1 Short term credit rating: F1 Short term credit rating: A2 Long term credit rating: A2 Long term credit rating: A Long term credit rating: A- Outlook: Stable Outlook: Stable Outlook: Negative Credit opinion 23 November 2009 Report 24 May 2010 Report 4 May 2010 Ratings of Banca Carige SpA reflect the The ratings of Banca Carige are based on The ratings on Banca Carige SpA reflect bank's strong franchise in the north- its expansion through organic growth the bank's strong franchise in its home western Italian region of Liguria, its and the acquisition of branches, which Region of Liguria in northwestern Italy, satisfactory financial fundamentals as has helped to underpin operating good liquidity, and good efficiency, well as ongoing integration challenges. -

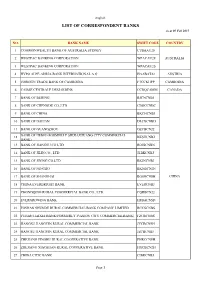

LIST of CORRESPONDENT BANKS As at 05 Feb 2015

english LIST OF CORRESPONDENT BANKS As at 05 Feb 2015 NO. BANK NAME SWIFT CODE COUNTRY 1 COMMONWEALTH BANK OF AUSTRALIA SYDNEY CTBAAU2S 2 WESTPAC BANKING CORPORATION WPACAU2F AUSTRALIA 3 WESTPAC BANKING CORPORATION WPACAU2S 4 HYPO ALPE-ADRIA-BANK INTERNATIONAL A.G HAABAT22 AUSTRIA 5 FOREIGN TRADE BANK OF CAMBODIA FTCCKHPP CAMBODIA 6 CAISSE CENTRALE DESJARDINS CCDQCAMM CANADA 7 BANK OF BEIJING BJCNCNBJ 8 BANK OF CHENGDU CO.,LTD CBOCCNBC 9 BANK OF CHINA BKCHCNBJ 10 BANK OF DALIAN DLCBCNBD 11 BANK OF GUANGZHOU GZCBCN22 BANK OF HEBEI (FORMERLY SHIJIAZHUANG CITY COMMERCIAL 12 BKSHCNBJ BANK) 13 BANK OF JIANGSU CO LTD BOJSCNBN 14 BANK OF JILIN CO., LTD JLBKCNBJ 15 BANK OF JINING CO.LTD BKJNCNBJ 16 BANK OF NINGBO BKNBCN2N 17 BANK OF SHANGHAI BOSHCNSH CHINA 18 CHINA EVERBRIGHT BANK EVERCNBJ 19 CHONGQING RURAL COMMERCIAL BANK CO., LTD. CQRBCN22 20 EVERGROWING BANK HFBACNSD 21 FOSHAN SHUNDE RURAL COMMERCIAL BANK COMPANY LIMITED RCCSCNBS 22 FUJIAN HAIXIA BANK(FORMERLY FUZHOU CITY COMMERCIALBANK) FZCBCNBS 23 JIANGSU JIANGYIN RURAL COMMERCIAL BANK JYCBCNSH 24 JIANGSU JIANGYIN RURAL COMMERCIAL BANK JZCBCNBJ 25 ZHEJIANG PINGHU RURAL COOPERATIVE BANK PHRCCNSH 26 ZHEJIANG XIAOSHAN RURAL COOPERATIVE BANK HXCBCN2H 27 CHINA CITIC BANK CIBKCNBJ Page 1 english NO. BANK NAME SWIFT CODE COUNTRY 28 PPF BANKA A.S. PMBPCZPP 29 RAIFFEISENBANK A.S. RZBCCZPP CZECH REPUBLIC 30 UNICREDIT BANK CZECH REPUBLIC,A.S. BACXCZPP 31 DEUTSCHE BANK AG DEUTDESM DENMARK 32 BANK OF CHINA BKCHFRPP FRANCE 33 MEGA INTERNATIONAL COMMERCIAL BANK CO. LTD. ICBCFRPP 34 BHF- BANK AKTIENGESELLSCHAFT BHFBDEFF 35 DEUTSCHE BANK AG DEUTDEFF GERMANY 36 DEUTSCHE POSTBANK AG PBNKDEFF 37 CHINATRUST COMMERCIAL BANK, HONG KONG CTCBHKHH 38 COMMONWEALTH BANK OF AUSTRALIA HONG KONG BRANCH CTBAHKHK HONGKONG 39 DEUTSCHE BANK AG DEUTHKHH 40 AB BANK LIMITED ABBLINBB 41 BANK OF TOKYO-MITSUBISHI UFJ, LTD., THE BOTKINBB INDIA 42 PUNJAB AND MAHARASHTRA CO-OPERATIVE BANK LIMITED PMCBINBB 43 BANK CENTRAL ASIA CENAIDJA 44 BANK MANDIRI (PERSERO), PT BMRIIDJA 45 BANK MEGA PT MEGAIDJA 46 BANK MIZUHO INDONESIA, PT.