Frost Brown Todd Tax

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Case Study

INTERACTION® CASE STUDY FROST BROWN TODD LLC InterAction improves firm’s data quality, reduces bounce rate from 40% to 7% in just four months CLEAN DATA - THE KEY TO MARKETING SUCCESS Managing contact information and corresponding data accurately is a must when it comes to supporting successful marketing operations. That imperative was reinforced recently at the Midwestern law firm, Frost Brown Todd LLC. With more than 500 attorneys in 12 offices located in Indiana, Kentucky, Ohio, Pennsylvania, Tennessee, Texas, Virginia, and West Virginia, Frost Brown Todd serves some of America’s top corporations and emerging companies. Maintaining strong relationships with its extensive list of clients and prospective clients has been a hallmark of the firm’s success for more than a century. In addition to providing clients with the unparalleled services that have earned Frost Brown Todd national ranking in nearly two dozen practice areas, a similarly important key to nurturing client relationships is effective communications. To that end, the firm places considerable emphasis on marketing efforts directed to its extensive contact lists. DIRTY DATA – THE KEY TO INEFFICIENT MARKETING Much of Frost Brown Todd’s legacy contact data became duplicated, outdated, and inaccurate over a long period of time. This led to a host of issues, including a 40% email bounce rate, and a significant time drain on attorneys and staff as they had to repeatedly manually recreate marketing lists for firm- sponsored events. This only added to the duplication in the underlying data. NEW LIFE FOR CRM The firm decided to revive InterAction by investing in experienced consultants, by hiring a full-time customer relationship management (CRM) administrator, and by deploying full-time data stewards. -

Private Equity March 2020 Update

Private Equity March 2020 Update frostbrowntodd.com ©2020 Frost Brown Todd LLC. All rights reserved. ADVERTISING MATERIAL Table of Contents Private Equity Investment in Oil and Gas through DrillCo Transactions By Michael Brewster Navigating Blockchain and Data Privacy By Daniel Murray and Courtney Rogers Perrin Data Privacy Concerns in Private Equity By Craig Cox and Daniel Murray Private Equity Fund Investment in Qualified Small Business Stock – An Introduction to Section 1202’s Benefits By Scott Dolson SURPRISE! You may be liable for union pension plan withdrawal liability. By Michael Bindner Credit Financing: Adjusted EBITDA Cheat Sheet By Aaron Turner Introduction to Private Equity’s Acquisition of Medical Groups By Brian Higgins and Tom Anthony Private Equity Investment in Oil and Gas through DrillCo Transactions By Michael Brewster As a result of tighter capital markets, Operators like the use of DrillCo interest in the assets through the traditional financing for upstream oil arrangements because, if structured assignment that it receives. and gas operations, such as drilling, properly, DrillCos preserve cash flow A DrillCo is typically used in areas where is increasingly difficult to obtain. and avoid balance sheet liabilities. For the geological formations have proven Borrowers face increasingly stringent an operator with limited access to capital to be productive and where the geology lending standards, and lenders are ever that is holding acreage with development has been developed. Because of the prior cognizant of the inherent risk of upstream potential, a DrillCo transaction presents production and the tested geology, there oil and gas development, especially in an attractive mechanism by which the is a reduced risk profile associated with a low-price environment. -

Frost Brown Todd (FBT) Is Well Positioned to Counsel Businesses on SALT Matters and Incentives Based Projects

STATE AND LOCAL TAX (SALT) There are very few areas in the law that can affect the bottom-line like state and local taxes. Frost Brown Todd (FBT) is well positioned to counsel businesses on SALT matters and incentives based projects. We have a team of tax professionals with the experience and relationships necessary to look beyond a simple problem analysis—offering our clients creative and innovative solutions to match specific Inside Experience business situations. Our team knows how tax and revenue departments work from the inside, with some of our team members coming from SALT Practice Highlights governmental positions before entering private practice. » Represented hundreds of business taxpayers in countless forums in SALT controversies. Strong Advocacy » Advised clients on wide range of tax credits for various types of taxes. Our team partners with CivicPoint, a subsidiary of FBT. CivicPoint is a full-service public affairs » Established foreign trade zone for manufacturing facilities and warehouse/distribution centers firm that allows businesses, trade associations, to lower property tax liability. and non-governmental organizations to work » Obtained rulings from State and Local Governments on multiple areas of law, including to allow successfully in conjunction with state and local taxpayers use of alternative apportionment formula for corporation income tax purposes. governments in Tennessee, Kentucky, Ohio, Indiana, and West Virginia. CivicPoint provides » Structured and obtained recycling income tax credits for OEMs and Tier suppliers. clients with the services and confidence to support all aspects of government » Represented a national food products company in structuring and documenting local tax relations, from launching major initiatives to benefits for a major expansion of its West Coast operation. -

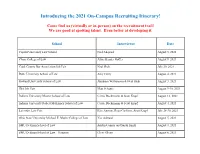

Introducing the 2021 On-Campus Recruiting Itinerary!

Introducing the 2021 On-Campus Recruiting Itinerary! Come find us (virtually or in-person) on the recruitment trail! We are good at spotting talent. Even better at developing it. School Interviewer Date Capital University Law School Noel Shepard August 3, 2021 Chase College of Law Alyse Bender Hoffer August 9, 2021 Cook County Bar Association Job Fair Neal Shah July 20, 2021 Duke University School of Law Amy Curry August 4, 2021 Howard University School of Law Abraham Williamson & Neal Shah August 3, 2021 IBA Job Fair Matt Schantz August 9-10, 2021 Indiana University Maurer School of Law Carrie Doehrmann & Scott Krapf August 12, 2021 Indiana University Robert McKinney School of Law Carrie Doehrmann & Scott Krapf August 4, 2021 Lavender Law Fair Kim Amrine, Ryan Goellner, Scott Krapf July 28-30, 2021 Ohio State University Michael E. Moritz College of Law Yaz Ashrawi August 5, 2021 SMU Dedman School of Law Austin Connor and Sarah Smith August 3, 2021 SMU Dedman School of Law – Houston Cleve Glenn August 6, 2021 School Interviewer Date South Texas College of Law – Houston Avery Addison July 16, 2021 Southeastern Minority Job Fair Abraham Williamson & Peter Cummins July 16, 2021 Texas Southern University Thurgood Marshall School of Law Ken Bullock and Hannah Johannes August 3, 2021 University of Alabama School of Law Tonya Austin and America Tabor August 5, 2021 University of Cincinnati College of Law Brice Smallwood and Ryan Goellner August 3, 2021 University of Houston Law Center Brian Cooper and Lindsay Contreras August 2, 2021 University -

1-Bios.Min.Law.2014-Order of Speaking

Energy & Mineral Law Foundation Kentucky Mineral Law Conference October 22-23, 2014 PROGRAM CHAIRS Timothy J. Hagerty, Program Chair Frost Brown Todd LLC Tim Hagerty is a Member of Frost Brown Todd LLC, in Louisville, Kentucky, where he concentrates his practice in environmental and natural resources law, with an emphasis on the energy and natural resources industries. Over his twenty-year legal career, Mr. Hagerty has assisted clients in obtaining and defending permits under the Clean Water Act, the Surface Mining Control and Reclamation Act, and related federal and state environmental and resource protection laws for projects ranging from large surface coal mines to coal-fired electric generating plants to oil and gas operations. Mr. Hagerty has also provided counsel on the development, construction, and operation of large-scale commercial developments, master planned communities, major highway and transit projects, and even riverboat casinos. His professional experiences include providing both compliance counseling and representation in litigation at the administrative, trial, and appellate court levels. Mr. Hagerty also has extensive experience assisting public and private clients in complying with the National Environmental Policy Act (NEPA), the Endangered Species Act, the Clean Air Act, the National Historic Preservation Act, and related resource review requirements. Mr. Hagerty is a frequent speaker at regional and national conferences and seminars regarding the Clean Water Act, SMCRA, NEPA, and related environmental laws. Before joining Frost Brown Todd, Mr. Hagerty practiced environmental law with Beveridge & Diamond, P.C., in Washington, D.C. He is a graduate of the Yale Law School and the University of Louisville. Timothy J. -

REPORT on Behalf of Our Firm And, in Particular, Our Women’S Initiative Committee, I Would Like to Welcome You to Our Diversity and Inclusion Report

Winter/Spring 2017 REPORT On behalf of our firm and, in particular, our Women’s Initiative committee, I would like to welcome you to our Diversity and Inclusion Report. We intend for this report to highlight a number of great things that are happening throughout our firm, spotlight some of our people who help to create this great place to work, and, also to mention some of the recognitions that we have received from others. Frost Brown Todd was an “early adopter” in seeking to encourage women to come here and advance. Our formal Women’s Initiative was created in 2001. Since that time, we have continued to grow and evolve both the committee and our efforts. We think that as a firm we have addressed a number of the more obvious concerns, but we continue to press forward to determine what other changes may be needed in order to permit all of our people to feel valued for who they are and what they bring to us as a culture. That is our ultimate goal. We know that becoming a fully diverse and inclusive firm is a journey, but we are committed to that journey because we truly believe that we will be a better firm. In addition, we know that we will provide better client service by doing so. We hope that you will enjoy learning more about some of our team members who are on this journey with us. Welcome! Kimberly K. Mauer Chair, Women’s Initiative Frost Brown Todd Diversity & Inclusion Report Winter/Spring DIVERSITY & INCLUSION 2017 REPORT Our Vision Statement Frost Brown Todd is committed to building and maintaining, as a central and permanent -

APPELLATE ADVOCATES Frost Brown Todd

Frost Brown Todd APPELLATE ADVOCATES Appellate advocacy demands a specialized approach, which can be quite different from the approach taken before a lower court. The most successful trial attorney oftentimes is unfamiliar with the intricacies demanded for appellate practice and procedure. Frost Brown Todd’s (FBT) appellate attorneys are uniquely skilled and experienced to handle the many issues faced on appeal before the appellate courts. Our practitioners also possess a comprehensive understanding of the complex legal framework of administrative rules, regulations and statutes. Review of adverse administrative decisions differs markedly from conventional appellate practice—timing and procedural challenges are unique and errors are often fatal. Our attorneys have broad expertise in appealing administrative decisions, many having begun their careers as lawyers in administrative regulatory agencies. FBT attorneys excel not only in arguing appeals of right, but in formulating the best possible argument to increase the likelihood of discretionary review. frostbrowntodd.com Indiana | Kentucky | Ohio | Pennsylvania | Tennessee | Texas | Virginia | West Virginia THIS IS AN ADVERTISEMENT. ©2018 Frost Brown Todd LLC All rights reserved. REDUCE RISK Preparation for an appeal begins before trial. FBT’s appellate advocates collaborate with trial and administrative lawyers to reduce risk by: » Identifying issues to present in pretrial motions. » Crafting jury instructions. » Ensuring evidentiary rulings are preserved for appeal. » Drafting post-trial motions. Preparation is also the key to a successful appeal. Our appellate advocate group knows the trial record and how to strategically integrate the record into legal arguments. STRATEGIC THINKING The decisions of appellate courts have important consequences for businesses as those decisions guide trial courts in future cases. -

Ohio, Kentucky, Indiana, Michigan and Pennsylvania Retail Development & Law Symposium

Directory Ohio, Kentucky, Indiana, Michigan and Pennsylvania Retail Development & Law Symposium Hilton Columbus/Polaris Columbus, OH | February 27 – 28, 2020 #ICSC www.icsc.com/2020S01 Ohio, Kentucky, Indiana, Michigan and Pennsylvania Retail Development & Law Symposium THURSDAY FEBRUARY 27 F. Lease Provisions – What Really Matters to the Client Thomas FitzSimmons Registration Of Counsel 5:30 – 8:00 pm ▶ Hilton Columbus/Polaris Singerman Mills Desberg & Kauntz Co. LPA Cleveland, OH Member-Hosted Reception G. Litigating the Deal – Practical Considerations for Real 7:00 – 8:00 pm ▶ Hilton Columbus/Polaris Estate Witnesses Leigha Hanby Corporate Counsel Dick’s Sporting Goods FRIDAY FEBRUARY 28 Pittsburgh, PA Registration H. Navigating Deals in Ground-Up Development 6:45 am – 4:45 pm ▶ Polaris Foyer T.J. Hess Associate Breakfast Kayne Law Group Columbus, OH 7:15 – 8:00 am ▶ Polaris Ballroom A-B-D-E I. Closing the LLC Loophole in Ohio Roundtable Discussions Kendall P. Kadish 8:00 – 9:00 am ▶ Polaris Ballroom A-B-D-E Associate Join expert-led discussions to find out more about the topics that Keating Muething & Klekamp PLL interest you. All roundtable topics will be held twice, so partic- Cincinnati, OH ipants may rotate to a different roundtable following the first 30-minute session. J. Autopilot Leases – Negotiating Single Tenant Leases Ready A. Your Retailer Tenant Has Declared Bankruptcy – Now for Your Savvy 1031 Buyer What? Eric E. Landen David M. Blau Member Senior Counsel Frost Brown Todd LLC Clark Hill PLC Cincinnati, OH Birmingham, MI K. Going Dark – The Rise of Dark Kitchens and Other Co-Op B. -

Report Fall/Winter DIVERSITY & INCLUSION 2016 REPORT

Fall/Winter 2016 REPORT On behalf of our firm and, in particular, our diversity and inclusion committee, I would like to welcome you to our first diversity and inclusion report. While our firm has been a leader in our communities for many years in advocating for diversity and in supporting inclusiveness, this is the first of what we expect to be ongoing periodic reviews of some of our diversity and inclusion activities. In this report, we spotlight some of our diverse lawyers, report on events to support the growth of diversity in the profession, and note some of the recognition that we have earned, individually and as a firm, for our efforts in this area. Frost Brown Todd has long recognized the importance of diversity both to our firm and to our communities. We were one of the first law firms in our region to appoint a dedicated director of diversity, and we have also helped lead the way locally in the adoption of female and family friendly policies in the legal profession, as well as the introduction of policies to make our firm openly supportive of the LGBTQ community. Our efforts to recruit and retain lawyers from diverse backgrounds and to help them succeed began decades ago and continue. We also have recognized that diversity alone is not the answer to being a place where our team members feel free to be the same person at work as at home. That is why, over five years ago, we broadened our focus to encompass inclusion as well as diversity. As a firm, we value diverse points of view and truly believe that we serve our clients best when we can bring to them teams that provide such perspectives. -

The Unitary Filing Method in Kentucky — the Lazarus Effect by Mark F

Volume 89, Number 3 July 16, 2018 The Unitary Filing Method in Kentucky — The Lazarus Effect by Mark F. Sommer and Ryan M. Gallagher Reprinted from State Tax Notes, July 16, 2018, p. 223 © 2018 Tax Analysts. All rights reserved. Analysts does not claim copyright in any public domain or third party content. SPECIAL REPORT state tax notes® The Unitary Filing Method in Kentucky — The Lazarus Effect by Mark F. Sommer and Ryan M. Gallagher through various tax cuts and increases,3 including significant raises to the cigarette tax,4 changes to the income tax rate structure,5 and new sales taxes on various services.6 One independent tax policy nonprofit estimates that H.B. 487 would raise up to an additional $487 million for the commonwealth.7 The most significant change in H.B. 487 is the commonwealth’s return to the unitary filing method (commonly referred to as mandatory combined reporting) for corporations.8 This change will affect many taxpayers, as it “will significantly broaden the corporate tax base in” and capture otherwise lost taxes from “many Mark F. Sommer is a member and Tax, businesses that were able to ‘structure’ their Employee Benefits and Estates Practice Group way out of Kentucky’s corporate income tax leader, and Ryan M. Gallagher is a summer 9 grasp.” associate with Frost Brown Todd LLC in Louisville, Kentucky. For tax years on or after January 1, 2019, multi-entity corporate families must change In this viewpoint, the authors discuss the their filing method to one of two combined unitary filing method in Kentucky, including its methods from the 2005 enacted nexus-only- statutory origins and how things stand following the unitary doctrine’s resurrection. -

Speaker Bios

Speaker Bios David V. Allen is now counsel for the Mixed-Use Group of Brookfield Properties Development LLC, which acquired Forest City Realty Trust, Inc. in December of 2018. His responsibilities include construction, development, acquisitions, sustainability initiatives, and leasing. Prior to Forest City, David was a partner with Taft, Stettinius & Hollister, LLP, handling privately and publicly financed projects, condominiums, low income housing tax credit transactions and many other types of development. Mr. Allen taught business law and ethics at Walsh University and served four years on Strongsville City Council. David is also a past a presenter and moderator in ICSC law seminars as well as past presenter, moderator and Chair of the Real Estate Law Institute for the Cleveland Metropolitan Bar Association. David is a graduate of The University of Akron School of Law and Baldwin-Wallace College. Mr. Allen belongs to the American Institute of Architects, the Gorilla Group, the British-American Chamber of Commerce and has published various articles on real estate development, ethics and entrepreneurship. Kim Amrine is a Member and the Director of Diversity and Inclusion at Frost Brown Todd. This past year, Kim celebrated her 13-year anniversary in her role as the firm’s Director of Diversity and Inclusion at FBT and her 20-year anniversary with the firm. Her billable hour requirement is zero, meaning, Kim’s primary responsibility is to ensure that FBT’s commitment to diversity and inclusion are not just words in a glossy brochure or a mission on the website. She uses her passion, great resources and leadership support to ensure that the firm is constantly pushing the needle to improve in the areas of diversity, equity and inclusion, and ultimately to promote a more inclusive work environment at Frost Brown Todd. -

IN the UNITED STATES BANKRUPTCY COURT for the WESTERN DISTRICT of KENTUCKY (Owensboro Division)

Case 20-40133-acs Doc 629 Filed 09/25/20 Entered 09/25/20 14:31:22 Page 1 of 5 IN THE UNITED STATES BANKRUPTCY COURT FOR THE WESTERN DISTRICT OF KENTUCKY (Owensboro Division) In re: ) Chapter 11 ) Hartshorne Holdings, LLC, et al., ) Case No. 20-40133 ) 1 Debtors. ) (Jointly Administered) NOTICE OF SECOND SUPPLEMENTAL DECLARATION OF EDWARD M. KING IN SUPPORT OF DEBTORS’ RETENTION AND EMPLOYMENT OF FROST BROWN TODD LLC The above-captioned debtors and debtors-in-possession (collectively, the “Debtors”), by and through their undersigned local counsel, hereby provide notice of the attached Second Supplemental Declaration of Edward M. King in Support of Debtors’ Retention and Employment of Frost Brown Todd LLC (the “Second Supplemental Declaration,” and Frost Brown Todd LLC is “FBT”) as local counsel. On March 26, 2020, this Court entered the Amended Order Authorizing the Debtors to Retain and Employ Frost Brown Todd LLC as Local Counsel Nunc Pro Tunc to the Petition Date (Doc. No. 212), subject to ongoing disclosure if “…FBT discovers any connection with any interested party or enters into any new relationship with any interested party…” FBT represented a party that was interested in purchasing the collateral of one of the Debtors’ secured lenders directly from that secured party. As negotiations developed, the parties decided that an entity controlled by FBT’s client would seek to purchase such assets from the Debtors and upon such determination, FBT disengaged from representing that party. In light of FBT’s ongoing duty to disclose, the Supplemental Declaration is attached. [Signature page follows.] 1 The Debtors in these chapter 11 cases and the last four digits of each Debtors’ taxpayer identification number are as follows: Hartshorne Holdings, LLC (3948); Hartshorne Mining Group, LLC (0063); Hartshorne Mining, LLC (1941) and Hartshorne Land, LLC (5582).