“Sleep Through the Static” Good Morning, I Trust Everyone Had A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Places to Go, People to See Thursday, Feb

Versu Entertainment & Culture at Vanderbilt FEBRUARY 28—MARCH 12,2, 2008 NO. 7 RITES OF SPRING PLACES TO GO, PEOPLE TO SEE THURSDAY, FEB. 28 FRIDAY, FEB. 29 SATURDAY 3/1 Silverstein with The Devil Wears Prada — Rocketown John Davey, Rebekah McLeod and Kat Jones — Rocketown Sister Hazel — Wildhorse Saloon The Regulars Warped Tour alums and hardcore luminaries Silverstein bring their popular Indiana native John Davey just might be the solution to February blues — his unique pop/ Yes, they’re still playing together and touring. Yes, they can still rock sound to Nashville. The band teamed up with the Christian group The Devil folk sound is immediately soothing and appealing and is sure to put you in a good mood. with the best of ’em. Yes, you should go. Save all your money this THE RUTLEDGE Wears Prada for a long-winded U.S. tour. ($5, 7 p.m.) 401 Sixth Avenue South, 843-4000 week for that incredibly sweet sing-along to “All For You” (you know 410 Fourth Ave. S. 37201 ($15, 6 p.m.) 401 6th Avenue S., 843-4000 you love it). ($20-$45, 6 p.m.) 120 Second Ave. North, 902-8200 782-6858 Music in the Grand Lobby: Paula Chavis — The Frist Center for the Steep Canyon Rangers — Station Inn Red White Blue EP Release Show — The 5 Spot Visual Arts MERCY LOUNGE/CANNERY This bluegrass/honky-tonk band from North Carolina has enjoyed a rapid Soft rock has a new champion in Red White Blue. Check out their EP Nashville’s best-kept secret? The Frist hosts free live music in its lobby every Friday night. -

Top 40 Singles Top 40 Albums

12 May 2008 CHART #1616 Top 40 Singles Top 40 Albums Forever Don't Hold Back Unbreakable: 2008 NZ Tour Edition 50th Anniversary 1 Chris Brown 21 The Potbelleez 1 Westlife 21 Gray Bartlett Last week 5 / 3 weeks SBME Last week 22 / 12 weeks MOS/Universal Last week 10 / 22 weeks Platinum x1 / SBME Last week 17 / 3 weeks EMI Take A Bow Stop And Stare Rockferry Past, Present, Future 2 Rihanna 22 OneRepublic 2 Duffy 22 Tiki Taane Last week 4 / 2 weeks Universal Last week 18 / 17 weeks Universal Last week 3 / 5 weeks Gold x1 / Universal Last week 22 / 25 weeks Gold x1 / DirtyDub/Rhythm/DRM... Love In This Club Tattoo Flight Of The Conchords Rejoice 3 Usher feat. Young Jeezy 23 Jordin Sparks 3 Flight Of The Conchords 23 Katherine Jenkins Last week 1 / 10 weeks Gold x1 / SBME Last week 36 / 2 weeks SBME Last week 1 / 3 weeks Gold x1 / SubPop/Rhythmethod Last week 32 / 3 weeks Universal No Air Sorry Believe Legend: The Very Best Of 4 Jordin Sparks feat. Chris Brown 24 Buckcherry 4 Geoff Sewell 24 Willie Nelson Last week 2 / 10 weeks Platinum x1 / SBME Last week 26 / 6 weeks Universal Last week 2 / 4 weeks Gold x1 / SewellMusic/Ode Last week 18 / 6 weeks Gold x1 / SBME Lollipop What Is It? Back To Black: Deluxe Edition E=MC2 5 Lil Wayne 25 Baby Bash feat. Sean Kingston 5 Amy Winehouse 25 Mariah Carey Last week 6 / 3 weeks Universal Last week 33 / 6 weeks SBME Last week 6 / 49 weeks Platinum x2 / Universal Last week 20 / 3 weeks Universal 4 Minutes Party People The Swing Sessions Watershed 6 Madonna feat. -

Tolono Library CD List

Tolono Library CD List CD# Title of CD Artist Category 1 MUCH AFRAID JARS OF CLAY CG CHRISTIAN/GOSPEL 2 FRESH HORSES GARTH BROOOKS CO COUNTRY 3 MI REFLEJO CHRISTINA AGUILERA PO POP 4 CONGRATULATIONS I'M SORRY GIN BLOSSOMS RO ROCK 5 PRIMARY COLORS SOUNDTRACK SO SOUNDTRACK 6 CHILDREN'S FAVORITES 3 DISNEY RECORDS CH CHILDREN 7 AUTOMATIC FOR THE PEOPLE R.E.M. AL ALTERNATIVE 8 LIVE AT THE ACROPOLIS YANNI IN INSTRUMENTAL 9 ROOTS AND WINGS JAMES BONAMY CO 10 NOTORIOUS CONFEDERATE RAILROAD CO 11 IV DIAMOND RIO CO 12 ALONE IN HIS PRESENCE CECE WINANS CG 13 BROWN SUGAR D'ANGELO RA RAP 14 WILD ANGELS MARTINA MCBRIDE CO 15 CMT PRESENTS MOST WANTED VOLUME 1 VARIOUS CO 16 LOUIS ARMSTRONG LOUIS ARMSTRONG JB JAZZ/BIG BAND 17 LOUIS ARMSTRONG & HIS HOT 5 & HOT 7 LOUIS ARMSTRONG JB 18 MARTINA MARTINA MCBRIDE CO 19 FREE AT LAST DC TALK CG 20 PLACIDO DOMINGO PLACIDO DOMINGO CL CLASSICAL 21 1979 SMASHING PUMPKINS RO ROCK 22 STEADY ON POINT OF GRACE CG 23 NEON BALLROOM SILVERCHAIR RO 24 LOVE LESSONS TRACY BYRD CO 26 YOU GOTTA LOVE THAT NEAL MCCOY CO 27 SHELTER GARY CHAPMAN CG 28 HAVE YOU FORGOTTEN WORLEY, DARRYL CO 29 A THOUSAND MEMORIES RHETT AKINS CO 30 HUNTER JENNIFER WARNES PO 31 UPFRONT DAVID SANBORN IN 32 TWO ROOMS ELTON JOHN & BERNIE TAUPIN RO 33 SEAL SEAL PO 34 FULL MOON FEVER TOM PETTY RO 35 JARS OF CLAY JARS OF CLAY CG 36 FAIRWEATHER JOHNSON HOOTIE AND THE BLOWFISH RO 37 A DAY IN THE LIFE ERIC BENET PO 38 IN THE MOOD FOR X-MAS MULTIPLE MUSICIANS HO HOLIDAY 39 GRUMPIER OLD MEN SOUNDTRACK SO 40 TO THE FAITHFUL DEPARTED CRANBERRIES PO 41 OLIVER AND COMPANY SOUNDTRACK SO 42 DOWN ON THE UPSIDE SOUND GARDEN RO 43 SONGS FOR THE ARISTOCATS DISNEY RECORDS CH 44 WHATCHA LOOKIN 4 KIRK FRANKLIN & THE FAMILY CG 45 PURE ATTRACTION KATHY TROCCOLI CG 46 Tolono Library CD List 47 BOBBY BOBBY BROWN RO 48 UNFORGETTABLE NATALIE COLE PO 49 HOMEBASE D.J. -

Virtual Care Package 3

Cleveland State University EngagedScholarship@CSU Textual Materials Administrative Communications 9-8-2020 Virtual Care Package 3 Cleveland-Marshall College of Law Follow this and additional works at: https://engagedscholarship.csuohio.edu/covidadmintextual How does access to this work benefit ou?y Let us know! Recommended Citation Cleveland-Marshall College of Law, "Virtual Care Package 3" (2020). Textual Materials. 3. https://engagedscholarship.csuohio.edu/covidadmintextual/3 This Book is brought to you for free and open access by the Administrative Communications at EngagedScholarship@CSU. It has been accepted for inclusion in Textual Materials by an authorized administrator of EngagedScholarship@CSU. For more information, please contact [email protected]. CSU Cleveland-Marshall College of Law Virtual Care Package For You! Welcome to CSU Cleveland-Marshall! In choosing law, you have chosen a noble profession dedicated to serving those in need. But as you embark on your journey forward, we know that you, like all members of the C|M|LAW community, face unprecedented challenges during these difficult times. Throughout the semester, you will receive virtual care packages like this. Please know that C|M|LAW faculty and staff want you to thrive during your law school years and beyond. We truly are your law school for life. We are lucky to have many amazing local coffee shops near the law school, so you can fuel up for a study session while supporting small business owners. These shops also offer home delivery of their great coffee! Rising Star Coffee Roasters, located in the Old Arcade and in several other locations around NE Ohio, has delicious and unique matcha and cold brew drinks. -

Una Menor De Tui Denuncia Una Agresión Por Su Estética

Larevista Páginas 18 a 23 OBRAS DE ARTE Carmen Eva Rufo Alcayde «En el teatro CON ASCENSOR Ya tiene otro hay que Son edificios singulares y artísticos que adornan las ciudades,como la programa empezar por Delegación de la Xunta, enVigo. en Tele 5 los clásicos» Una menor de Tui denuncia una agresión El primer diario que no se vende por su estética ‘punky’ Jueves 21 FEBRERO DE 2008. AÑO IX. NÚMERO 1874 La reyerta se produjo el fin de semana en la zona de copas. La joven asegura que ella y sus amigas son acosadas por su aspecto desde hace año y medio. El padre de la El Concello de Vigo confirma que A Laxe abrió sin licencia de primera ocupación denunciante afirma que a una de ellas le arrancaron mechones de pelo y ‘piercings’. 5 Zona Franca entregó ayer parte de la documenta- ción. Faltan informes técnicos, según Urbanismo. 2 Los comerciantes exigen medidas ante Deportes Reino Unido pondrá la oleada de robos de los últimos días Esta semana han sido detenidas siete personas por un impuesto sólo hurtos, casi todos realizados en tiendas de ropa. 3 para los inmigrantes Para financiar la sanidad y la educación.Tendrán que abonar 26,4 €al lograr el visado, según anunció el Gobier- no laborista, con el fin de que paguen lo que utilizan. 8 JOSÉ ÁNGEL / EFE Vuelca con 35 chicos dentro Un autobús escolar que llevaba a 35 alum- nos de Secundaria volcó ayer en Toledo. El conductor y uno de los chicos están graves. 8 ! O La Guardia Civil distribuye las fotos L de tres pederastas a los que busca 26 personas han sido detenidas por descargarse un ví- 25 ciudades AVE, y Vigo.. -

Its Worst Christmas in Years 5 Holiday Sales Strategie

JIMMY IVINE ON U2, YOUTUBE AND WHEN TO EXPECT DRE DAY >P.16 BRANDY'S BIG COMEBACK >P.37 DR PEPPER'S GUNS N' ROSES PROMOTION GOES FLAT >P.6 COMMON'S `MIND' GAMES >P.38 WHAT THE MUSIC BIZ CAN LEARN FROM OBAMA >P.8 EXPERIENCE THE BUZZ BLACKEST FR Why Physical Retail Expects Its Worst Christmas In Years DECEMBER 6, 2008 www.billboard.com PLUS. www.billboard.biz US $6.99 CAN $8.99 UK £5.50 Fore SCII 3 -DIGIT 907 The Season's Digital i EENCTCC 000/004 120193NBB /CB /9AMAR10 001 A04 Look Next Year's Hit II1I11II111I11I1II111_111_111_1111111111111111111111 A At 0012 MONTY GRBBNLY i A 3740 ELM AVE 000880 5 Holiday Sales Strategie LONG BEACH CA 90807 -3402 www.americanradiohistory.com LOEB& LOEB LLP PPESENTS B J music& money S Y M P O S I U M March 5, 2009 St. Regis, New York City CONNECT WITH THE DEALMAKERS DRIVING THE MUSIC BUSINESS Now in its 8th year, this one -day event brings TOPICS INCLUDE: together the best minds from the music, legal, Investing in Online Music Start -Ups financial and Wall Street communities for an in -depth Working with Consumer Brands examination of the financial realities with which the Trends in Venture Capital and Private Equity music industry is contending. Mobile Music Applications Music Publishing M &A Join Billboard and today's most important entertainment Behind the Scenes: Case Studies executives for compelling keynote interviews, informative panel sessions, networking receptions and more. CONFIRMED SPEAKERS: Roger Faxon, Chairman /CEO, EMI Music Publishing Scott Sperling, Co- President, Thomas H. -

All Audio Songs by Artist

ALL AUDIO SONGS BY ARTIST ARTIST TRACK NAME 1814 INSOMNIA 1814 MORNING STAR 1814 MY DEAR FRIEND 1814 LET JAH FIRE BURN 1814 4 UNUNINI 1814 JAH RYDEM 1814 GET UP 1814 LET MY PEOPLE GO 1814 JAH RASTAFARI 1814 WHAKAHONOHONO 1814 SHACKLED 2 PAC CALIFORNIA LOVE 20 FINGERS SHORT SHORT MAN 28 DAYS RIP IT UP 3 DOORS DOWN KRYPTONITE 3 DOORS DOWN HERE WITHOUT YOU 3 JAYS IN MY EYES 3 JAYS FEELING IT TOO 3 THE HARDWAY ITS ON 360 FT GOSSLING BOYS LIKE YOU 360 FT JOSH PYKE THROW IT AWAY 3OH!3 STARSTRUKK ALBUM VERSION 3OH!3 DOUBLE VISION 3OH!3 DONT TRUST ME 3OH!3 AND KESHA MY FIRST KISS 4 NON BLONDES OLD MR HEFFER 4 NON BLONDES TRAIN 4 NON BLONDES PLEASANTLY BLUE 4 NON BLONDES NO PLACE LIKE HOME 4 NON BLONDES DRIFTING 4 NON BLONDES CALLING ALL THE PEOPLE 4 NON BLONDES WHATS UP 4 NON BLONDES SUPERFLY 4 NON BLONDES SPACEMAN 4 NON BLONDES MORPHINE AND CHOCOLATE 4 NON BLONDES DEAR MR PRESIDENT 48 MAY NERVOUS WRECK 48 MAY LEATHER AND TATTOOS 48 MAY INTO THE SUN 48 MAY BIGSHOCK 48 MAY HOME BY 2 5 SECONDS OF SUMMER GOOD GIRLS 5 SECONDS OF SUMMER EVERYTHING I DIDNT SAY 5 SECONDS OF SUMMER DONT STOP 5 SECONDS OF SUMMER AMNESIA 5 SECONDS OF SUMMER SHE LOOKS SO PERFECT 5 SECONDS OF SUMMER KISS ME KISS ME 50 CENT CANDY SHOP 50 CENT WINDOW SHOPPER 50 CENT IN DA CLUB 50 CENT JUST A LIL BIT 50 CENT 21 QUESTIONS 50 CENT AND JUSTIN TIMBERLAKE AYO TECHNOLOGY 6400 CREW HUSTLERS REVENGE 98 DEGREES GIVE ME JUST ONE NIGHT A GREAT BIG WORLD FT CHRISTINA AGUILERA SAY SOMETHING A HA THE ALWAYS SHINES ON TV A HA THE LIVING DAYLIGHTS A LIGHTER SHADE OF BROWN ON A SUNDAY AFTERNOON -

Patagonia Music Collective

patagonia music collective VOLUME ONE buy a song, benefit the environment Patagonia has teamed up with a diverse group of world-class musicians to help protect and restore our natural environment. The musicians donate an exclusive song, you buy some great music and non-profit environmental groups receive much-needed funds. & | Earthjustice is a non-profit public interest law firm dedicated to protecting the magnificent places, natural resources, and wildlife of this earth, and to defending the right of all people to a healthy environment. | Urban Farming’s mission is to create an abundance of food for people in need by planting, supporting and encouraging the establishment of gardens on unused land and space while increasing diversity, raising awareness for health and wellness, inspiring and educating youth, adults and seniors to create an economically sustainable system to uplift communities around the globe. | SOLV is a non-profit that brings together volunteers, conservation groups, businesses and government agencies to help restore natural spaces and encourage environmental stewardship. | Freedom to Roam is a coalition of business, government and conservation groups working together to enhance awareness and conservation of wildlife corridors across North America. Its goal is to ensure that lands and waters are connected so that animals have the freedom to roam and can move to survive a warming and more crowded world. | The Kokua Hawai‘i Foundation supports environmental education in the schools and communities of Hawai‘i. Its mission is to provide students with experiences that will enhance their appreciation for and understanding of their environment so they will be lifelong stewards of the earth. -

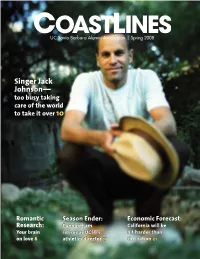

Singer Jack Johnson— Too Busy Taking Care of the World to Take It Over 10

UC Santa Barbara Alumni Association | Spring 2008 Singer Jack Johnson— too busy taking care of the world to take it over 10 Romantic Season Ender: Economic Forecast: Research: Cunningham California will be Your brain retires as UCSB’s hit harder than on love 6 athletics director 15 the nation 21 2 Coastlines JOB #: Canary 975 NAME: Nicole AD SIZE: 8.375 x 10.875 BLEED: 0.125” PUB: UCSB Coastline INS. DATE: April ‘08 MATERIALS: x1a Spring 2008 Vol. 38, No. 4 Contents 6 FEATURES 6 UC Santa Barbara Researcher Stephanie Ortigue Studies Your Brain on Love By Elizabeth Werhane ‘00 10 Alumnus Jack Johnson ‘97 Maintains His 10 Subdued Style Amidst Stardom By Matt Kettmann ‘99 15 The Final Winning Score for Gary Cunningham as He Heads Into Retirement By John Zant 21 UCSB Economic Forecast Says California 15 Economy to Fare Worse Than Nation’s DEPARTMENTS 4 Editor’s Column: Looking to the Future 17 Sports Roundup: Coach Mark French to Retire 22 Around Storke Tower: News & Notes From the Campus 28 Research Roundup: Human Impact on Oceans 31 Alumni Authors: From the Kitchen to the Corporation 32 Milestones: ’50s to the Present COVER: Surfing Singer Jack Johnson ‘97 Remains Down-to-Earth While Finding Major Success in the Music World. Cover photo by Thomas Campbell Coastlines is published four times a year - Winter, Spring, Summer, and Fall - by the UCSB Alumni Association, University of California, Santa Barbara, Santa Barbara, CA 93106-1120. Inclusion of adver- tising in Coastlines is not meant to imply endorsement by the UCSB Alumni Association of any company, product, or service being advertised. -

Ifpi.Org Recording Industry in Numbers 2009 the Definitive Source of Global Music Market Information

Recording Industry In Numbers 2009 The Definitive Source Of Global Music Market Information www.ifpi.org Recording Industry In Numbers 2009 The Definitive Source Of Global Music Market Information www.ifpi.org It all started in a café in Bristol, England in 1934, when dance musicians were replaced by vinyl records played on a phonograph. Back then, PPL had just two FOR 75 YEARS, members – EMI and Decca. Now we have over 3,400 record companies and, following a merger with the principal performer societies, 39,500 performers. In addition, our reach has extended to include international repertoire and overseas PPL HAS BEEN royalties through 42 bilateral agreements with similar organisations around the world. PPL licenses businesses playing music, from broadcasters to nightclubs, from GROWING INTO A streaming services to sports studios, from internet radio to community radio. Licensees are able to obtain a single licence for the entire PPL repertoire, a service which is seen as increasingly valuable for both rightholders and users alike as MODERN SERVICE consumption of music continues to grow. Broadcasters such as the BBC have commented that they simply would not be able to use music at such a scale, across nine TV channels, sixty radio stations, the iPlayer and numerous online services ORGANISATION without a licence from PPL. The PPL licence is equally valuable to other users, such as commercial radio stations, BT Vision, Virgin Media, Last.fm and even the fourteen oil rigs that want to keep their oil workers entertained on their tours of duty. FOR THE MUSIC For the performers and record companies who entrust their rights to PPL, the income from these new distribution outlets is becoming increasingly valuable. -

5 Art Exhibit to Include

Tuesday March 4, U-HIGH IDWAYzoos Volume 83, Number 6 University High School 1362 East 59th Street, Chic ago, Illinois 60637 J.OOml& m1m1 ASSEMBLY SALUTES LATE 5 ALUMNUS AND BLUES LEGEND PAUL BUTTERFIELD Photo by Sydney Marcus Photo by Adam Gelman THE MISSISSIPPI LOADED WITH ACTIVITIES ranging from modern dance to baking to the HEAT lit up the crowd, history of wrestling, Artsfest, February 21, offered 74 workshops organized by February 13 in Max students, faculty members and visiting artists. To kick off the day, members Palevsky Theater. of the martial arts company Enso performed a dynamic demonstration of Shodokan Aikido in Upper Kovler. The day closed with a selection of show SIZZLING tunes from Broadway musicals performed by the Musical Theatre Skit Club , and Bel Canto in Max Palevsky Theater. SATURDAY AT SCIENCE EXPO Art exhibit to include work by LI-Highers Photo by Adam Gelman BylsabeldelCanto show. Seventy percent of the proceeds from the U-High art will go to the Lab Midway reporter Schools Scholarship Fund. xhibited at Stuart Rodgers Prizes will also be awarded. (S.R.) gallery alongside art by A phone call from Vice President of E students from four other Chi Sales and Marketing of Stuart Rodgers cago high schools, CT-Highers' work Photography Holly Rodgers sparked will include photographs, sculptures, U-High's involvement in the exhibit, paintings and drawings. according to Fine Arts Department The exhibit opens Friday, April 18 Chairperson John Biser. Photo by George Yates III and continues until Friday, May 2, 9 "She wanted to know if students CREATING golden a.m.-5 p.m. -

Ban on Text Messaging While Driving? Campusbeat by Michelle White Legislature Pending Ka Leo Staff Writer Bill That Would Cost TUESDAY, FEB

VOLUME 102 ISSUE 67 T H E V O I C E Jack Johnson New album review ‘Sleeping rough Static’ A Weekend Venue | Page 8 WWW.KALEO.ORG EO KServing the students of the UniversityL of Hawai‘i at Mānoa since 1922 ISOLATED SHOWERS The race for humanity Pro Bowl Week We have a Web site Candidates profi t off Darfur tragedy NFC and AFC back for bowl game Tell us what you think THURSDAY H:80° L:69° Commentary | Page 4 Sports | Page 12 Web | Kaleo.org FEB. 7, 2008 Ban on text messaging while driving? CampusBeat By Michelle White Legislature pending Ka Leo Staff Writer bill that would cost TUESDAY, FEB. 19 students hundreds • Campus Security found an intoxi- cated individual in Campus Center at midnight. The visitor was not By Chad Fujihara 21. Security allowed a friend to Ka Leo Contributing Writer pick him up. If Hawai‘i lawmakers get • A hookah device was confiscated their way, sending a text mes- from a student at Hale Mokihana. sage might cost cell phone users A hookah is prohibited on campus. close to $500. Security may return the contra- The Hawai’i state senate, in band if the student does not bring the current legislature session, it back on campus. Disciplinary is reading a bill that hopes to action will be sought by the Vice ban text messaging while driv- Chancellor. ing. If it goes through, the new law would prohibit text messag- ing while driving and fine those violating it. The exact amount of the fine has yet to be decided, though other states with similar KUMARI SHERREITT• KA LEO O HAWAI‘I Text messaging is a dangerous addiction to have while driving.