Representation Letter from Nasdaq Stockholm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Execution Venues List

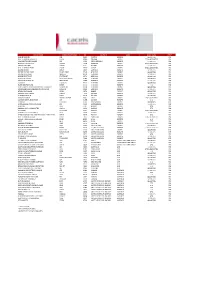

Execution Venues List This list should be read in conjunction with the Best Execution policy for Credit Suisse AG (excluding branches and subsidiaries), Credit Suisse (Switzerland) Ltd, Credit Suisse (Luxembourg) S.A, Credit Suisse (Luxembourg) S.A. Zweigniederlassung Österreichand, Neue Aargauer Bank AG published at www.credit-suisse.com/MiFID and https://www.credit-suisse.com/lu/en/private-banking/best-execution.html The Execution Venues1) shown enable the in scope legal entities to obtain on a consistent basis the best possible result for the execution of client orders. Accordingly, where the in scope legal entities may place significant reliance on these Execution Venues. Equity Cash & Exchange Traded Funds Country/Liquidity Pool Execution Venue1) Name MIC Code2) Regulated Markets & 3rd party exchanges Europe Austria Wiener Börse – Official Market WBAH Austria Wiener Börse – Securities Exchange XVIE Austria Wiener Börse XWBO Austria Wiener Börse Dritter Markt WBDM Belgium Euronext Brussels XBRU Belgium Euronext Growth Brussels ALXB Czech Republic Prague Stock Exchange XPRA Cyprus Cyprus Stock Exchange XCYS Denmark NASDAQ Copenhagen XCSE Estonia NASDAQ Tallinn XTAL Finland NASDAQ Helsinki XHEL France EURONEXT Paris XPAR France EURONEXT Growth Paris ALXP Germany Börse Berlin XBER Germany Börse Berlin – Equiduct Trading XEQT Germany Deutsche Börse XFRA Germany Börse Frankfurt Warrants XSCO Germany Börse Hamburg XHAM Germany Börse Düsseldorf XDUS Germany Börse München XMUN Germany Börse Stuttgart XSTU Germany Hannover Stock Exchange XHAN -

BIOTIE THERAPIES CORP. STOCK EXCHANGE RELEASE 30 September 2016, at 2.15 A.M

BIOTIE THERAPIES CORP. STOCK EXCHANGE RELEASE 30 September 2016, at 2.15 a.m. (EET) ACORDA THERAPEUTICS, INC. GAINS TITLE TO ALL SHARES IN BIOTIE THERAPIES CORP. AND THE SHARES WILL DELIST FROM NASDAQ HELSINKI Acorda Therapeutics, Inc. (Nasdaq: ACOR) (”Acorda”) has today lodged security approved by the Arbitral Tribunal and thus gained title to all the shares in Biotie Therapies Corp. (Nasdaq Helsinki: BTH1V) (“Biotie”) in accordance with Chapter 18, Section 6 of the Finnish Companies Act. After the security has been lodged, the minority shareholders of Biotie being parties to the redemption proceedings are only entitled to receive the redemption price and the interest payable thereon. Upon application by Biotie, Nasdaq Helsinki Ltd (“Nasdaq Helsinki”) has on 25 August 2016 decided that the Biotie shares will be delisted from the Official List of Nasdaq Helsinki upon title to all shares in Biotie having been transferred to Acorda. The quoting of the Biotie shares on Nasdaq Helsinki will thus cease in accordance with a separate release to be published by Nasdaq Helsinki. Turku, 30 September 2016 Biotie Therapies Corp. Antero Kallio CEO For further information, please contact: Virve Nurmi, Biotie Therapies Corp. tel. +358 2 274 8900, e-mail: [email protected] DISTRIBUTION: www.biotie.com Nasdaq Helsinki Ltd Main Media INFORMATION REGARDING BIOTIE Biotie is a biopharmaceutical company focused on products for neurodegenerative and psychiatric disorders. Biotie's development has delivered Selincro (nalmefene) for alcohol dependence, which received European marketing authorization in 2013 and is currently being rolled out across Europe by partner H. Lundbeck A/S. -

Surveillance Stockholm

Surveillance Stockholm Exchange Notice Stockholm 2020-05-18 News for listed companies 8/20 Information from the Surveillance function at Nasdaq Stockholm with regards to amendments to the Act on Temporary Exemptions Following up on the Surveillance update on March 31, 2020, regarding Corona related topics relevant for issuers on Nasdaq Stockholm and Nasdaq First North Growth Market Stockholm, Nasdaq now informs about amendments to the Act (2020:198) on temporary exemptions to facilitate the implementation of corporate and association meetings (the Act on Temporary Exemptions) that came into force today, May 18, 2020. Summary As of today, Swedish companies are temporarily allowed to hold general meetings without any physical participation. According to amendments to the Act on Temporary Exemptions general meetings can be held either by electronic connection in combination with postal voting, or by the shareholders only participating by postal vote. If the general meeting is held by postal vote only, shareholders must also be able to exercise their other rights by post. To apply these temporary exemptions, it must be stated in the notice to the general meeting, entailing that the option to hold the meeting completely without physical participation can be applied by companies that have not yet convene the general meeting, or companies that decide to postpone the general meeting within the time limits set out in applicable law. You can find the Act on Temporary Exemptions (available in Swedish only) – https://www.riksdagen.se/sv/dokument-lagar/dokument/svensk-forfattningssamling/lag-2020198- om-tillfalliga-undantag-for-att_sfs-2020-198 Please be advised that we are available for discussions regarding regulatory and disclosure-related matters. -

Tallink Grupp 2021 Q2 Presentation

29 JULY 2021 Q2 2021 TALLINK GRUPP AS RESULTS WEBINAR PRESENTERS PAAVO NÕGENE HARRI HANSCHMIDT JOONAS JOOST CHAIRMAN OF THE MANAGEMENT BOARD MEMBER OF THE MANAGEMENT BOARD FINANCIAL DIRECTOR TALLINK GRUPP 2 TALLINK GRUPP The leading European provider of leisure and business travel and sea transportation services in the Baltic Sea region. OPERATIONS • Fleet of 15 vessels • Seven ferry routes (3 suspended) • Operating four hotels (1 closed) KEY FACTS STRONG BRANDS • Revenue of EUR 443 million in 2020 • Served 3.7 million passengers in 2020 • Transported 360 thousand cargo units • Operating EUR 1.5 billion asset base • 4 352 employees (end of Q2 2021) • 2.8 million loyalty program members TALLINK LISTED ON NASDAQ TALLINN (TAL1T) AND NASDAQ HELSINKI (TALLINK) GRUPP 3 STATUS OF EMPLOYMENT OF VESSELS IN 2021 YTD Continuous employment in 2021 Status of vessels not employed in the first months of the year Megastar Tallinn-Helsinki Silja Europa Short-term charter in June; Tallinn-Helsinki from 23 June Star Tallinn-Helsinki Silja Serenade Tallinn-Helsinki in June; Helsinki-Mariehamn from 24 June Galaxy Turku-Stockholm Silja Symphony Sweden domestic cruises in July and August Baltic Princess Turku-Stockholm Baltic Queen Tallinn-Stockholm from 7 July SeaWind Muuga-Vuosaari Victoria I Short-term charter in July-September Regal Star Paldiski-Kapellskär Romantika Short-term charter in July-September Sailor Paldiski-Kapellskär Atlantic Vision Long-term charter Isabelle Inactive TALLINK GRUPP 4 2021 Q2 DEVELOPMENTS AND KEY FACTS OPERATING ENVIRONMENT -

Initial Public Offerings Law Review

Law Review Law the Initial Public Offerings Offerings Public Initial Initial Public Offerings Law Review Second Edition Editor David J Goldschmidt Second Edition Second lawreviews © 2018 Law Business Research Ltd Initial Public Offerings Law Review Second Edition Reproduced with permission from Law Business Research Ltd This article was first published in April 2018 For further information please contact [email protected] Editor David J Goldschmidt lawreviews © 2018 Law Business Research Ltd PUBLISHER Tom Barnes SENIOR BUSINESS DEVELOPMENT MANAGER Nick Barette BUSINESS DEVELOPMENT MANAGERS Thomas Lee, Joel Woods ACCOUNT MANAGERS Pere Aspinall, Sophie Emberson, Laura Lynas, Jack Bagnall PRODUCT MARKETING EXECUTIVE Rebecca Mogridge RESEARCHER Arthur Hunter EDITORIAL COORDINATOR Gavin Jordan HEAD OF PRODUCTION Adam Myers PRODUCTION EDITOR Simon Tyrie SUBEDITOR Caroline Fewkes CHIEF EXECUTIVE OFFICER Paul Howarth Published in the United Kingdom by Law Business Research Ltd, London 87 Lancaster Road, London, W11 1QQ, UK © 2018 Law Business Research Ltd www.TheLawReviews.co.uk No photocopying: copyright licences do not apply. The information provided in this publication is general and may not apply in a specific situation, nor does it necessarily represent the views of authors’ firms or their clients. Legal advice should always be sought before taking any legal action based on the information provided. The publishers accept no responsibility for any acts or omissions contained herein. Although the information provided is accurate -

Zealand Pharma Increases Its Share Capital As a Consequence of Exercise of Employee Warrants

Company announcement – No. 26 / 2019 Zealand Pharma increases its share capital as a consequence of exercise of employee warrants Copenhagen, August 23, 2019 – Zealand Pharma A/S (“Zealand”) (NASDAQ: ZEAL) (CVR-no. 20 04 50 78), a Copenhagen-based biotechnology company focused on the discovery and development of innovative peptide-based medicines, has increased its share capital by a nominal amount of DKK 16,500 divided into 16,500 new shares with a nominal value of DKK 1 each. The increase is a consequence of the exercise of warrants granted under one of Zealand's employee warrant programs. Employee warrant programs are part of Zealand’s incentive scheme, and each warrant gives the owner the right to subscribe for one new Zealand share at a pre specified price, the exercise price, in specific predefined time periods before expiration. For a more detailed description of Zealand’s warrant programs, see the company’s Articles of Association, which are available on the website: www.zealandpharma.com. The exercise price was DKK 101.20 per share and the total proceeds to Zealand from the capital increase amount to DKK 1,669,800.00. The new shares give rights to dividend and other rights from the time of the warrant holder's exercise notice. Each new share carries one vote at Zealand’s general meetings. Zealand has only one class of shares. The new shares will be listed on Nasdaq Copenhagen after registration of the capital increase with the Danish Business Authority. Following registration of the new shares, the share capital of Zealand will be nominal DKK 31,831,290 divided into 31,831,290 shares with a nominal value of DKK 1 each. -

Nasdaq Stockholm Welcomes Logistea to First North

Nasdaq Stockholm Welcomes Logistea to First North Stockholm, May 8, 2017 — Nasdaq (Nasdaq: NDAQ) announces that the trading in Logistea AB’s shares (short name: LOG) commenced today on Nasdaq First North in Stockholm. Logistea belongs to the financial sector (sub sector: real estate) and is the 35th company to be admitted to trading on Nasdaq’s Nordic markets* in 2017. Logistea is a real estate company that owns and manages the property Örja 1:20, located along the E6 highway in Landskrona, Sweden. The property consists of a logistics terminal and an office building, with a total, rentable area of 42 000 square meters. Its largest tenant is DSV. For more information, please visit www.logistea.se. “We welcome Logistea to Nasdaq First North,” said Adam Kostyál, SVP and Head of European listings at Nasdaq. “We congratulate the company on its listing, and look forward to supporting them with the investor exposure that comes with a Nasdaq First North listing.” Logistea AB has appointed FNCA Sweden AB as the Certified Adviser. *Main markets and Nasdaq First North at Nasdaq Copenhagen, Nasdaq Helsinki, Nasdaq Iceland and Nasdaq Stockholm. About Nasdaq First North Nasdaq First North is regulated as a multilateral trading facility, operated by the different exchanges within Nasdaq Nordic (Nasdaq First North Denmark is regulated as an alternative marketplace). It does not have the legal status as an EU-regulated market. Companies at Nasdaq First North are subject to the rules of Nasdaq First North and not the legal requirements for admission to trading on a regulated market. The risk in such an investment may be higher than on the main market. -

Final Report Amending ITS on Main Indices and Recognised Exchanges

Final Report Amendment to Commission Implementing Regulation (EU) 2016/1646 11 December 2019 | ESMA70-156-1535 Table of Contents 1 Executive Summary ....................................................................................................... 4 2 Introduction .................................................................................................................... 5 3 Main indices ................................................................................................................... 6 3.1 General approach ................................................................................................... 6 3.2 Analysis ................................................................................................................... 7 3.3 Conclusions............................................................................................................. 8 4 Recognised exchanges .................................................................................................. 9 4.1 General approach ................................................................................................... 9 4.2 Conclusions............................................................................................................. 9 4.2.1 Treatment of third-country exchanges .............................................................. 9 4.2.2 Impact of Brexit ...............................................................................................10 5 Annexes ........................................................................................................................12 -

Trifork Holding AG Listing on SIX Swiss Exchange Postponed

Company announcement no. 23 / 2021 Schindellegi, Switzerland – 23 June 2021 Trifork Holding AG Listing on SIX Swiss Exchange postponed On June 15, 2021, SIX Swiss Exchange granted Trifork approval to list the Trifork shares in accordance with the International Reporting Standard of SIX Swiss Exchange. As a consequence, Trifork after consulting our advisors and approval of our board on June 17 decided and announced the decision to list its shares on SIX Swiss Exchange as a dual listing following the successful IPO and listing on Nasdaq Copenhagen. The intention was to start trading as of 28 June 2021. Trifork has been informed by SIX Swiss Exchange that FINMA (Swiss Financial Market Supervisory Authority) considers applying the Ordinance on Trading of Swiss Equity Securities on Foreign Exchanges (Verordnung über die Anerkennung ausländischer Handelsplätze für den Handel mit Beteiligungspapieren von Gesellschaften mit Sitz in der Schweiz) issued in November 2018 which creates legal uncertainty. Trifork will seek to clarify the situation with the Swiss authorities before proceeding with a potential Swiss listing as Trifork remains fully committed to the existing listing and trading of its shares on Nasdaq Copenhagen. There will be no impact on the listing and trading of Trifork’s shares on Nasdaq Copenhagen. The Board of Directors will provide an update on the potential listing on SIX Swiss Exchange in due course. For further information, please contact: Investors Dan Dysli, Head of Investor Relations [email protected], +41 79 421 6299 Swiss Media Dynamics Group AG Philippe Blangey, Partner [email protected], +41 79 785 46 32 Danish Media Peter Rørsgaard, Trifork CMO [email protected], +45 2042 2494 About Trifork Trifork Group, headquartered in Schindellegi, Switzerland, with offices in 11 countries in Europe and North America, is an international IT group focusing on the development of innovative software solutions. -

Lieux Exécution 201904

VENUE NAME VENUE SHORTNAME MIC COUNTRY ZONE ASSET CLASS TYPE * WIENER BOERSE WB XWBO AUSTRIA EUROPE SECURITIES RM NYSE EURONEXT BRUSSELS ENXBE XBRU BELGIUM EUROPE ETD & SECURITIES RM PRAGUE STOCK EXCHANGE PSE XPRA CZECH REPUBLIC EUROPE SECURITIES RM NASDAQ COPENHAGEN OMX DK XCSE DENMARK EUROPE ETD & SECURITIES RM NASDAQ HELSINKI OMX FI XHEL FINLAND EUROPE SECURITIES RM NYSE EURONEXT PARIS ENXFR XPAR FRANCE EUROPE ETD & SECURITIES RM BOERSE BERLIN BERLIN XBER GERMANY EUROPE SECURITIES RM BOERSE DUESSELDORF DUSSELDORF XDUS GERMANY EUROPE SECURITIES RM BOERSE MUENCHEN MUNICH XMUN GERMANY EUROPE SECURITIES RM BOERSE STUTTGART STUTTGART XSTU GERMANY EUROPE SECURITIES RM DEUTSCHE BOERSE DEUTSCHE BOERSE XFRA GERMANY EUROPE SECURITIES RM DEUTSCHE BOERSE AG FRANCFORT XFRA GERMANY EUROPE SECURITIES RM EQUIDUCT EQUIDUCT XBER GERMANY EUROPE SECURITIES RM EUREX DEUTSCHLAND EUREX XEUR GERMANY EUROPE ETD RM HANSEATISCHE WERTPAPIERBOERSE HAMBURG HAMBOURG XHAM GERMANY EUROPE SECURITIES RM NIEDERSAECHSISCHE BOERSE ZU HANNOVER HANOVRE XHAN GERMANY EUROPE SECURITIES RM ATHENS EXCHANGE ATHEX XATH GREECE EUROPE SECURITIES RM NASDAQ OMX ICELAND OMX IC XICE ICELAND EUROPE SECURITIES RM EURONEXT DUBLIN ENXIE XDUB IRELAND EUROPE SECURITIES RM BORSA ITALIANA BORSA ITALIANA XMIL ITALY EUROPE ETD & SECURITIES RM LONDON METAL EXCHANGE LME XLME LONDON EUROPE ETD RM EURO MTF EURO MTF XLUX LUXEMBOURG EUROPE SECURITIES MTF LUXEMBOURG STOCK EXCHANGE BDL XLUX LUXEMBOURG EUROPE SECURITIES RM FISH POOL FISH FISH NORWAY EUROPE ETD RM NASDAQ OMX COMMODITIES OMX CO NORX NORWAY -

COVID-19 Could Push Another 100 Million People Into Extreme

WORLD MSCI WORLD INDEX MARKET S 0.33% ▲ Vikram Limaye CEO at Radical Uncertainty: Decision Black Sea & Eurasia Coun - India’s NSE Making Beyond the Numbers tries in the Spotlight “The markets don’t seem to be con - An informative, profound yet practical Politics, Economy, Capital Markets, nected with the ground reality and the book by leading economists John Central Bank Interest Rates, News uncertainty” (p.3) Kay and Marvyn King (p.5) & Data (p. 10-11) USA : The US election news cycle kicked into full gear MALI: The Malian president resigned on with the Democratic National Convention. Next week, Wednesday following a military coup. This is the Republican National Convention will take center stage. the country's second coup in less than 10 years. BELARUS: President Alexan - Oxfam report Dignity Not Destitution der Lukashenko won Belarus' presidential election two weeks ago as protests continue to E.Asia & Pacific 239.8m sweep the country. South Asia 128.8m M Latin America Carib. 54. 3m A F .6m X 47 O 5 : Meadle East & N.Africa 44.9m e c r u o Sub Saharan Africa 44.6m S Europe & C.Asia 30. 5m LYBIA: GNA Chief Fayez al-Sar - Other High Income 4. 7m raj ordered on Friday a ceasefire in Libya.The Eastern-based par - liament also called for an imme - “Economic stimulus packages must support ordinary workers and small businesses, and bail outs OXFAM: diate ceasefire. for big corporations must be conditional on action to build fairer, more sustainable economies” Jose Maria Vera, Oxfam International Interim Executive Director COVID-19 could push another 100 Million People into Extreme POVERTY p to 100 million people will be pushed into "ex - poverty, but the new estimate puts the deterioration at 70 treme poverty" by the coronavirus crisis, World to 100 million. -

May 2010 Statistics Report from the NASDAQ OMX Nordic Exchanges

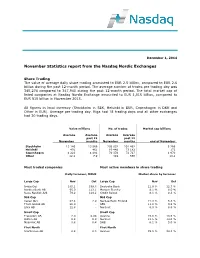

December 1, 2014 November Statistics report from the Nasdaq Nordic Exchanges Share Trading The value of average daily share trading amounted to EUR 2.5 billion, compared to EUR 2.6 billion during the past 12-month period. The average number of trades per trading day was 345,274 compared to 347,940 during the past 12-month period. The total market cap of listed companies at Nasdaq Nordic Exchange amounted to EUR 1,015 billion, compared to EUR 915 billion in November 2013. All figures in local currency (Stockholm in SEK, Helsinki in EUR, Copenhagen in DKK and Other in EUR). Average per trading day. Riga had 18 trading days and all other exchanges had 20 trading days. Value millions No. of trades Market cap billions Average Average Average Average past 12 past 12 November months November months end of November Stockholm 13 140 13 566 205 032 201 462 5 266 Helsinki 491 461 69 448 73 182 172 Copenhagen 4 223 4 481 70 376 72 727 1 970 Other 12.1 7.9 419 568 10.1 Most traded companies Most active members in share trading Daily turnover, MEUR Market share by turnover Large Cap Nov Oct Large Cap Nov Oct Nokia Oyj 145.1 189.4 Deutsche Bank 12.9 % 12.7 % Nordea Bank AB 95.0 113.1 Morgan Stanley 8.1 % 8.0 % Novo Nordisk A/S 79.2 129.2 Credit Suisse 8.1 % 8.3 % Mid Cap Mid Cap Vacon Oyj 47.4 2.9 Nordea Bank Finland 21.3 % 5.3 % Thule Group AB 20.0 - SEB 11.8 % 9.8 % Lifco AB 12.8 - Nordnet 6.0 % 8.6 % Small Cap Small Cap Transcom AB 2.0 0.08 Avanza 15.8 % 13.5 % Bulten AB 0.8 0.9 Nordnet 13.5 % 13.0 % Mycronic AB 0.8 0.4 SHB 6.1 % 5.0 % First North