View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Important Notice

IMPORTANT NOTICE NOT FOR DISTRIBUTION TO ANY U.S. PERSON OR TO ANY PERSON OR ADDRESS IN THE U.S. Important: You must read the following before continuing. The following applies to the Offering Circular following this page, and you are therefore advised to read this carefully before reading, accessing or making any other use of the Offering Circular. In accessing the Offering Circular, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from us as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES OR ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE NOTES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE U.S. OR OTHER JURISDICTION AND THE NOTES MAY NOT BE OFFERED OR SOLD WITHIN THE UNITED STATES OR TO, OR FOR THE ACCOUNT OR BENEFIT OF U.S. PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT), EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. THE FOLLOWING OFFERING CIRCULAR MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER, AND IN PARTICULAR, MAY NOT BE FORWARDED TO ANY U.S. PERSON OR TO ANY U.S. ADDRESS. -

Virgin Atlantic

Virgin Atlantic Cryptocurrencies: Provisional Lottie Pyper considers the 2020 and beyond Liquidation and guidance given on the first Robert Amey, with Restructuring: Jonathon Milne of The Cayman Islands restructuring plan under Conyers, Cayman, and Hong Kong Part 26A of the Companies on recent case law Michael Popkin of and developments Campbells, takes a Act 2006 in relation to cross-border view cryptocurrencies A regular review of news, cases and www.southsquare.com articles from South Square barristers ‘The set is highly regarded internationally, with barristers regularly appearing in courts Company/ Insolvency Set around the world.’ of the Year 2017, 2018, 2019 & 2020 CHAMBERS UK CHAMBERS BAR AWARDS +44 (0)20 7696 9900 | [email protected] | www.southsquare.com Contents 3 06 14 20 Virgin Atlantic Cryptocurrencies: 2020 and beyond Provisional Liquidation and Lottie Pyper considers the guidance Robert Amey, with Jonathon Milne of Restructuring: The Cayman Islands given on the first restructuring plan Conyers, Cayman, on recent case law and Hong Kong under Part 26A of the Companies and developments arising from this Michael Popkin of Campbells, Act 2006 asset class Hong Kong, takes a cross-border view in these two off-shore jurisdictions ARTICLES REGULARS The Case for Further Reform 28 Euroland 78 From the Editors 04 to Strengthen Business Rescue A regular view from the News in Brief 96 in the UK and Australia: continent provided by Associate South Square Challenge 102 A comparative approach Member Professor Christoph Felicity -

Report for 2Degrees and TVNZ on Vodafone/Sky Merger

Assessing the proposed merger between Sky and Vodafone NZ A report for 2degrees and TVNZ Grant Forsyth, David Lewin, Sam Wood August 2016 PUBLIC VERSION Plum Consulting, London T: +44(20) 7047 1919, www.plumconsulting.co.uk PUBLIC VERSION Table of Contents Executive Summary .................................................................................................................................. 4 1 Introduction ..................................................................................................................................... 6 1.1 The applicants’ argument for allowing the merger .................................................................... 6 1.2 The structure of our report ........................................................................................................ 6 2 The state of competition in New Zealand ....................................................................................... 8 2.1 The retail pay TV market ........................................................................................................... 8 2.2 The retail fixed broadband market ..........................................................................................10 2.3 The retail mobile market..........................................................................................................12 2.4 The wholesale pay TV market ................................................................................................13 2.5 New Zealand’s legal and regulatory regimes ..........................................................................14 -

Thailand's Pay TV Sector

Thailand in View: Thai Pay-TV 2011 Executive Summary A CASBAA market report January 2011 Thailand in View 2011 provides an in-depth review of the cable and satellite TV market, now connecting to more than 50% of homes in Thailand. An essential resource for anyone seeking concise and current analysis of the industry today and the outlook moving forward. Don’t miss the full report for CASBAA members at www.casbaa.com/publications. Executive Summary Growth of free-to-air satellite TV From only a few channels in 2008, Thailand now has Expanding reach of cable and satellite TV in Thailand more than 100 FTA channels broadcast on satellite platforms, and the number keeps on growing. Thailand’s cable and satellite TV sector experienced Leading operators and content providers plan to tremendous growth as viewing households more launch a total number of 40-50 new channels with than tripled from 2.67 million in 2007 to 9.33 million a wide variety of programming content including in mid 2010, as measured by Nielsen. By the end edutainment, local documentaries, musical of 2010, the number is estimated to have risen varieties, public relations channels (sponsored by further to over 10 million households, for nearly 50% government agencies), lifestyle, home & food, and penetration. other entertainment channels – with each channel targeting a specific audience segment. Indeed, between 2007 and 2010, cable and satellite The decision by premium player TrueVisions to TV viewership grew on average 52 percent each year join this arena further underscores the intensity of with rural areas showing the most rapid expansion competition on this TV platform. -

Thailand in View a CASBAA Market Research Report

Thailand in View A CASBAA Market Research Report Executive Summary 1 Executive Summary 1.1 Pay-TV environment market competition from satellite TV, and perceived unfair treatment by the National Broadcasting and The subscription TV market experienced a downturn Telecommunications Commission, whose very broad in 2014 as a result of twin events happening almost “must carry” rule created a large cost burden on simultaneously: the launch of DTT broadcasting in operators (particularly those that still broadcast on an April 2014 increased the number of free terrestrial TV analogue platform). stations from six to 24 commercial and four public TV broadcasters, leading to more intense competition; and Based on interviews with industry leaders, we estimate the military takeover in May 2014 both created economic that in 2015 the overall pay-TV market contracted by uncertainty and meant government control and three percent with an estimated value of around US$465 censorship of the media, prohibiting all media platforms million compared to US$480 million the previous from publishing or broadcasting information critical of year. Despite the difficult environment, TrueVisions, the military’s actions. the market leader, posted a six percent increase in revenue year-on-year. The company maintained its The ripple effects of 2014’s events continue to be felt by leading position by offering a wide variety of local and the industry two years after. By 2015/2016, the number of international quality content as well as strengthening licensed cable TV operators had decreased from about its mass-market strategy to introduce competitive 350 to 250 because of the sluggish economy, which convergence campaigns, bundling TV with other suppressed consumer demand and purchasing power, products and services within True Group. -

As Filed with the Securities and Exchange Commission on October 11, 1996

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON OCTOBER 11, 1996 REGISTRATION NO. 333-10875 - ------------------------------------------------------------------------------- - ------------------------------------------------------------------------------- SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ------------------ AMENDMENT NO. 1 TO FORM S-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 ------------------ PRIMUS TELECOMMUNICATIONS GROUP, INCORPORATED (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) DELAWARE 4813 54-1708481 (STATE OR OTHER (PRIMARY STANDARD (I.R.S. EMPLOYER JURISDICTION OF INDUSTRIAL IDENTIFICATION NO.) INCORPORATION OR CLASSIFICATION CODE ORGANIZATION) NUMBER) 8180 GREENSBORO DRIVE SUITE 1100 MCLEAN, VIRGINIA 22102 (703) 848-4625 (ADDRESS, INCLUDING ZIP CODE, AND TELEPHONE NUMBER, INCLUDING AREA CODE, OF REGISTRANT'S PRINCIPAL EXECUTIVE OFFICES) ------------------ K. PAUL SINGH CHAIRMAN AND CHIEF EXECUTIVE OFFICER 8180 GREENSBORO DRIVE SUITE 1100 MCLEAN, VIRGINIA 22102 (703) 848-4625 (NAME, ADDRESS, INCLUDING ZIP CODE, AND TELEPHONE NUMBER, INCLUDING AREA CODE, OF AGENT FOR SERVICE) ------------------ COPIES TO: JAMES D. EPSTEIN, ESQ. DAVID J. BEVERIDGE, ESQ. PEPPER, HAMILTON & SCHEETZ SHEARMAN & STERLING 3000 TWO LOGAN SQUARE 599 LEXINGTON AVENUE PHILADELPHIA, PA 19103-2799 NEW YORK, NY 10022 (215) 981-4000 (212) 848-4000 ------------------ APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after this Registration Statement becomes effective. ------------------ If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [_] If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. -

Vod/ Ott Industry in Apac

MARKET STUDY REPORT ON IPTV/ VOD/ OTT INDUSTRY IN APAC September 2017 1 Research by IBC Consultants (www.consult-ibc.com) Contents Executive Summary....................................................................................................................................... 3 Introduction .................................................................................................................................................... 4 Description – What is IPTV, VOD and OTT? .......................................................................... 4 IPTV ........................................................................................................................................ 4 VOD ......................................................................................................................................... 5 OTT .......................................................................................................................................... 6 Value Chain .......................................................................................................................... 7 Market Overview: Global ............................................................................................................................ 8 Market Overview: Asian Countries ....................................................................................................... 11 Market Segmentation ................................................................................................................................ -

Business Overview Company Background

Ticker: TRUE TB (SET), TRUE.BK (Reuters) TRUE TB (Bloomberg) Hi Lo 12-m share price (Bt/sh) (as of August 31, 2012) 4.32 2.70 Business Overview True Corporation Plc, one of Thailand’s strongest and most recognizable brands, is the only fully-integrated, nationwide telecom operator providing services to almost 25 million subscribers. True Group’s strength is its ability to offer the convergence benefits of its networks, products and services. Our three core business segments are: True Mobile Group, which includes TrueMove, Thailand’s third-largest mobile operator, TrueMove H, our 3G brand which in conjunction with CAT Telecom Public Company Limited (CAT) provides nationwide commercial 3G+ services via HSPA technology on the 850 MHz spectrum, and Hutch, which provides CDMA services; TrueOnline, the largest fixed-line phone provider in the Bangkok Metropolitan Area (BMA) and the Broadband and WiFi operator with the most comprehensive nationwide network using ADSL, DOCSIS 3.0 cable modem and FTTH (fiber to the home) technologies; and TrueVisions, the only nationwide pay TV and high-definition TV (HDTV) operator. The results of our digital convergence and other businesses, which include digital commerce under TrueMoney, convergence packages and digital content and media which are grouped under the TrueLife brand, and the lifestyle venture TrueCoffee, are reported under TrueOnline. Public CP Group - Foreign 12.1% shareholders - Local 23.6% 64.3% 35.7% Reported under TrueOnline 99.41/% 100.0%2/ 100.0% 100.0% Mobile Group Pay TV Wireline/OnlineWireline/online Convergence & others Remark: 1/ Indirectly holds 99.3% in TrueMove and 99.4% in Real Move (TrueMove H brand) 2/ Indirectly holds 100.0% in TrueVisions Group (which holds 99.3% in TrueVisions PLC and 99.0% in TrueVisions Cable PLC) True Group seeks to promote the development of the country through innovation and technology. -

List of Participating Merchants Mastercard Automatic Billing Updater

List of Participating Merchants MasterCard Automatic Billing Updater 3801 Agoura Fitness 1835-180 MAIN STREET SUIT 247 Sports 5378 FAMILY FITNESS FREE 1870 AF Gilroy 2570 AF MAPLEWOOD SIMARD LIMITED 1881 AF Morgan Hill 2576 FITNESS PREMIER Mant (BISL) AUTO & GEN REC 190-Sovereign Society 2596 Fitness Premier Beec 794 FAMILY FITNESS N M 1931 AF Little Canada 2597 FITNESS PREMIER BOUR 5623 AF Purcellville 1935 POWERHOUSE FITNESS 2621 AF INDIANAPOLIS 1 BLOC LLC 195-Boom & Bust 2635 FAST FITNESS BOOTCAM 1&1 INTERNET INC 197-Strategic Investment 2697 Family Fitness Holla 1&1 Internet limited 1981 AF Stillwater 2700 Phoenix Performance 100K Portfolio 2 Buck TV 2706 AF POOLER GEORGIA 1106 NSFit Chico 2 Buck TV Internet 2707 AF WHITEMARSH ISLAND 121 LIMITED 2 Min Miracle 2709 AF 50 BERWICK BLVD 123 MONEY LIMITED 2009 Family Fitness Spart 2711 FAST FIT BOOTCAMP ED 123HJEMMESIDE APS 2010 Family Fitness Plain 2834 FITNESS PREMIER LOWE 125-Bonner & Partners Fam 2-10 HBW WARRANTY OF CALI 2864 ECLIPSE FITNESS 1288 SlimSpa Diet 2-10 HOLDCO, INC. 2865 Family Fitness Stand 141 The Open Gym 2-10 HOME BUYERS WARRRANT 2CHECKOUT.COM 142B kit merchant 21ST CENTURY INS&FINANCE 300-Oxford Club 147 AF Mendota 2348 AF Alexandria 3012 AF NICHOLASVILLE 1486 Push 2 Crossfit 2369 Olympus 365 3026 Family Fitness Alpin 1496 CKO KICKBOXING 2382 Sequence Fitness PCB 303-Wall Street Daily 1535 KFIT BOOTCAMP 2389730 ONTARIO INC 3045 AF GALLATIN 1539 Family Fitness Norto 2390 Family Fitness Apple 304-Money Map Press 1540 Family Fitness Plain 24 Assistance CAN/US 3171 AF -

Presentation Title

ITC-WCO-WTO Rules of Origin Facilitator http://findrulesoforigin.org/ Stylized facts and trends Mr. Dzmitry Kniahin Market Analyst, International Trade Centre Informal Session on 25th Anniversary of the WTO Agreement on Rules of Origin 3 March 2020 2 3 4 Motivation • Multitude of preferential trade agreements (450+) with many duty-free opportunities, but companies find them difficult to use • Rules of origin (ROO) are legally technical and complex • ROO differ across products and trade agreements, but no single global searchable online database to navigate this maze • ITC business surveys in 38 developing nations found ROO to be one of the most problematic non-tariff measures experienced by manufacturing exporters Simplify information about rules of origin and facilitate their use 5 Last updated: March 2020 6 7 A joint initiative of ITC, WCO and WTO June 28, 2018 – WCO General Council October 17, 2019 – WTO Committee on ROO PRESS RELEASE PRESS RELEASE 8 State of play Preferential rules of origin coverage • in 350 trade agreements • of which 328 are in force (or 73% of the total in force) • including almost all preferential schemes for LDCs, based on member notifications to the WTO User access • Access to the tool is free to all users in the world • No login, no password 9 Capacity building activities in developing countries 10 A building block of Global Trade Helpdesk 11 Preferential origin qualifying process In order for a product to be traded under preferential origin (low tariff), the exporter needs to answer ‘YES’ to each of the five questions. IF the answer to any of the questions is ‘NO’, the product must be traded under the MFN rate • Is there a trade agreement between 1. -

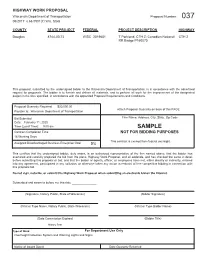

SAMPLE Contract Completion Time NOT for BIDDING PURPOSES 16 Working Days This Contract Is Exempt from Federal Oversight

HIGHWAY WORK PROPOSAL Wisconsin Department of Transportation Proposal Number: 037 06/2017 s.66.0901(7) Wis. Stats COUNTY STATE PROJECT FEDERAL PROJECT DESCRIPTION HIGHWAY Douglas 8744-00-72 WISC 2019601 T Parkland, CTH Z; Canadian National CTH Z RR Bridge P160070 This proposal, submitted by the undersigned bidder to the Wisconsin Department of Transportation, is in accordance with the advertised request for proposals. The bidder is to furnish and deliver all materials, and to perform all work for the improvement of the designated project in the time specified, in accordance with the appended Proposal Requirements and Conditions. Proposal Guaranty Required: $20,000.00 Attach Proposal Guaranty on back of this PAGE. Payable to: Wisconsin Department of Transportation Bid Submittal Firm Name, Address, City, State, Zip Code Date: February 11, 2020 Time (Local Time): 9:00 am SAMPLE Contract Completion Time NOT FOR BIDDING PURPOSES 16 Working Days This contract is exempt from federal oversight. Assigned Disadvantaged Business Enterprise Goal 5% This certifies that the undersigned bidder, duly sworn, is an authorized representative of the firm named above; that the bidder has examined and carefully prepared the bid from the plans, Highway Work Proposal, and all addenda, and has checked the same in detail before submitting this proposal or bid; and that the bidder or agents, officer, or employees have not, either directly or indirectly, entered into any agreement, participated in any collusion, or otherwise taken any action in restraint of free competitive bidding in connection with this proposal bid. Do not sign, notarize, or submit this Highway Work Proposal when submitting an electronic bid on the Internet. -

C Ntentasia 2014

10-23 February C NTENTASIA 2014 www.contentasia.tv l facebook.com/contentasia l @contentasia l www.asiacontentwatch.com Thai platforms draw battle lines Channel grab speeds up in Year of the Horse from the horse's mouth The Year of the Horse kicked off with a coup for Turner (Shitiz Jain joins Ricky Ow’s team as finance SVP), a loss for Discovery (Shitiz Jain exits after 15 years), extremes for RTL CBS (new channel, RTL CBS Extreme, launches in March), more fighting in Hong Kong (RTHK knocked back on new HQ but vows to go down fighting)... clearly a mixed bag of fortunes so far for Asia’s content industry. What are the soothsayers forecast- ing for this year of the green wood horse? Most are using words like “fast”, some mention conflict and hard line Major League Soccer: Thierry Henry from New York Red Bulls, beIN Sports stands on principles that in other years Content battle lines continue to be drawn Scottish League Cup, and a schedule of would probably be negotiable. in Thailand, with sports at the centre of a factual and magazine programming. This year’s horse is also full of pow- high-stakes TV play that started last year. TrueVisions also added sports channel erful fire energy. Warnings abound Al Jazeera-backed sports channel, beIN ASN2 to its expanded sports offering this about explosions, gun-fire and con- Sports, is the latest beneficiary of intensified month. The platform said the new deal flict. The common theme is that this is rivalry between pay-TV incumbent TrueVi- gives viewers more NFL, NCAA, basketball unlikely to be a peaceful year.