2017 Half-Year Financial Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

World of Wheels Country Entry

ITALY Background: Italy became a nation-state in 1861 when the regional states of the peninsula, along with Sardinia and Sicily, were united under King Victor Emmanuel II. An era of parliamentary gov- ernment came to a close in the early 1920s when Benito Mussolini established a Fascist dictatorship. His disastrous alliance with Nazi Germany led to Italy's defeat in World War II. A democratic re- public replaced the monarchy in 1946 and eco- nomic revival followed. Italy was a charter mem- ber of NATO and the European Economic Com- munity (EEC). It has been at the forefront of Euro- pean economic and political unification, joining the Economic and Monetary Union in 1999. Per- sistent problems include illegal immigration, or- ganized crime, corruption, high unemployment, sluggish economic growth, and the low incomes and technical standards of southern Italy compared with the prosperous north. Geography Italy: Location: Southern Europe, a peninsula extending into the central Mediterranean Sea, northeast of Tunisia. Area: total: 301,230 sq km. note: includes Sardinia and Sicily. Area - comparative: slightly larger than Arizona. Land boundaries: total: 1,932.2 km. Border countries: Austria 430 km, France 488 km, Holy See (Vatican City) 3.2 km, San Marino 39 km, Slovenia 232 km, Switzerland 740 km. Coastline: 7,600 km. Climate: predominantly Medi- terranean; Alpine in far north; hot, dry in south. Terrain: mostly rugged and mountainous; some plains, coastal lowlands. Natural resources: coal, mercury, zinc, potash, marble, barite, asbestos, pumice, fluoro- spar, feldspar, pyrite (sulfur), natural gas and crude oil reserves, fish, arable land. Natural hazards: regional risks include landslides, mudflows, avalanches, earthquakes, volcanic eruptions, flooding; land subsidence in Venice. -

Cnhind.Com (Name, Telephone, E-Mail And/Or Facsimile Number and Address of Company Contact Person) Securities Registered Pursuant to Section 12(B) of the Act

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ____________________________________ FORM 20-F ____________________________________ ☐ REGISTRATION STATEMENT PURSUANT TO SECTIONS 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 001-36085 ____________________________________ CNH INDUSTRIAL N.V. (Exact name of registrant as specified in its charter) ____________________________________ The Netherlands (Jurisdiction of incorporation or organization) 25 St. James’s Street London SW1A 1HA United Kingdom (Address of principal executive offices) Michael P. Going Secretary c/o CNH Industrial America LLC 6900 Veterans Blvd. Burr Ridge, IL 60527 Telephone: +1 630-887-3766 FAX: +1 630-887-2344 Email: [email protected] (Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol (s) Name of Each Exchange on which Registered Common Shares, par value €0.01 CNHI New York Stock Exchange 4.50% Notes due 2023 CNHI23 New York Stock Exchange 3.850% Notes due 2027 CNHI27 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None _______________________________________ Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 1,350,132,117 common shares, par value €0.01 per share, and 387,951,116 loyalty program special voting shares, par value €0.01 per share. -

CONTENTS Sommario

CONTENTS Sommario Foreword Presentazione pag. 3 Introduction Introduzione pag. 5 Subject scope and technical notes Definizione dell'oggetto e note tecniche pag. 11 Part One - Parte I The pioneer period and the Great War IIperiodopionieristico e la Grande Guerra pag. 15 The Aftermath of the Great War: Fiume, Albania, and Libya Gli anni successivi alia Grande Guerra. Fiume, Albania e Libia pag. 33 The Ethiopian Campaign La Guerra etiopica pag. 41 The Spanish Civil War La Guerra di Spagna pag. 49 The Second World War La Seconda Guerra Mondiale pag. 53 From the Post-war years and tRe Cold War to the present Iblindati dal secondo dopoguerra alia "GuerraJredda" e ai giorni nostri pag. 72 Part Two-Parte II A.Mi.Co. (armored machine gun car) FIAT 1912 A.Mi.Co. FIAT 1912 pag. 89 Isotta Fraschini Type RM armored car IsottaFraschinitipoRM pag. 93 Bianchi armored cars Automitragliatrici Bianchi pag. 98 Lancia lzM armored car Automitragliatrici Lancia lzM (ANSALDO) pag. 105 FIAT-Terni (Tripoli) light armored car Automitragliatrice leggera FIAT-Terni (Tripoli) pag. 124 75 CK AA gun motor carriage Autocannone da 75 CK pag. 138 75/27 AV mobile gun Autocannone da 75/27AV pag. 148 76/30 R.M. mobile gun (1915-17) Autocannone da 76/30 R.M. pag. 152 102mm mobile gun on SPA 9000C chassis Autocannone da!02/35 su SPA 9000C pag. 155 Corni-Scognamiglio light armored car Autoblindo leggera Corni-Scognamiglio pag. 164 Pavesi and Ansaldo wheeled tanks Carri armati Ansaldo e Pavesi a ruote pag. 167 FIAT-Ansaldo 611C armored car Autoblindo FIAT 611C pag. -

Elenco Dei Datori Di Lavoro Ammessi Alle Agevolazioni Contributive

Disciplina transitoria dei contratti di formazione e lavoro (art. 14 del D. Lgs. 6 ottobre 2004, n. 251) - Elenco dei datori di lavoro ammessi alle agevolazioni contributive Numero di lavoratori Denominazione Azienda Sede di competenza ammessi ai benefici 2 EMME CAR MATERA 3 3 M SOFTWARE CHIETI 1 3 PIU' 2 INTERNATIONAL BARI 2 3F FILIPPI BOLOGNA 6 3I INGEGNERIA IMPIANTI INDUSTRIALI TERNI 1 4 P PADOVA 1 A & C ADIVAR COMIFAR ROMA 1 A DOLCE RICHIESTA TERNI 1 A P I ANONIMA PETROLI ITALIANA ROMA CENTRO 1 A P PRODUZIONE AMBIENTE PERUGIA 1 A. MENARINI FIRENZE 31 A.C. NIELSEN ITALIA MILANO 4 A.C.E.M. FOGGIA 7 A.C.T.V. S.P.A. VENEZIA 67 A.G.V. ALESSANDRIA 1 A.I.E.S. DISTRETTO AUTONOMO ROGGIA MOLINARA NOVARA 1 A.L.G.E. PINEROLO 2 A.M.A. ENGINEERING TERAMO 1 A.M.P. COSTRUZIONI NAPOLI 1 A.MENARINI MANUFACTURING LOGISTICS AND SERVICES FIRENZE 1 A.R.E.S CATANIA 2 A.S.M.VENDITA E SERVIZI - VOGHERA PAVIA 1 A.S.O. SIDERURGICA BRESCIA 1 A.T.A.P. DELLE PROVINCE DI BIELLA E VERCELLI BIELLA 2 A.T.C. LA SPEZIA 8 A.T.C. AZIENDA TRASPORTI CONSORZIALI BOLOGNA 2 Page 1 Disciplina transitoria dei contratti di formazione e lavoro (art. 14 del D. Lgs. 6 ottobre 2004, n. 251) - Elenco dei datori di lavoro ammessi alle agevolazioni contributive Numero di lavoratori Denominazione Azienda Sede di competenza ammessi ai benefici A.T.C.M. POS.CONTRATTI FORMAZ. MODENA 17 A.T.M. AZIENDA TRASPORTI E MOBILITA' RAVENNA 2 A.T.R. -

Half-Year Financial Report at 30 June 2018

HALF-YEAR FINANCIAL REPORT AT 30 JUNE 2018 Disclaimer This Half-Year Financial Report for 2018 has been translated into English solely for the convenience of the international reader. In the event of conflict or inconsistency between the terms used in the Italian version of the report and the English version, the Italian version shall prevail, as the Italian version constitutes the sole official document WorldReginfo - 87529b96-28ff-41bc-a02a-3f645e347404 Half -year financial report at 30 June 2018 TABLE OF CONTENTS BOARDS AND COMMITTEES...................................................................................................... 4 REPORT ON OPERATIONS AT 30 JUNE 2018 .......................................................................... 5 Group results and financial position ........................................................................................................ 5 Outlook .................................................................................................................................................. 14 Industrial and financial transactions ...................................................................................................... 15 Related party transactions ..................................................................................................................... 17 "Non-GAAP" performance indicators ................................................................................................... 18 CONDENSED CONSOLIDATED HALF-YEAR FINANCIAL STATEMENTS AT 30 JUNE -

2018 Half-Year Financial Report

2018 Half-year Financial Report 2018 HALF-YEAR FINANCIAL REPORT Interim Report on Operations 1 Board of Directors, Committees and Independent Auditors 2 Key Data 3 Risk factors 3 EXOR Group profile 5 Significant events in the First Half of 2018 6 Review of the Consolidated Results of the EXOR Group 8 Alternative performance measures 12 Review of the Consolidated Results of the EXOR Group – Shortened 20 Review of performance of the Operating Subsidiaries 36 Risk factors from subsidiaries 36 Subsequent events and 2018 outlook 37 EXOR Group - Half-year Condensed Consolidated Financial Statements at 30 June 2018 66 Responsibility statement This Report, and in particular the section “Review of Performance of the Operating Subsidiaries”, contains forward-looking statements. These statements are not guarantees of future performance. Rather, they are based on the Group’s Subsidiaries current state of knowledge, future expectations and projections about future events and are, by their nature, subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them. Actual results may differ materially from those expressed in such statements as a result of a variety of factors, including: change in the global financial market, general economic environment, changes in local economic and political conditions, changes in trade policy the enactment of tax reforms or other changes in tax laws and regulations, volatility and deterioration of capital and financial market including possible effect of Brexit, terror attacks in Europe, weather, floods, earthquakes or other natural disasters, changes in government regulation, production difficulties, including capacity and supply constraints and many other risks and uncertainties, most of which are outside of the Group’s subsidiaries control. -

Assembly of Western European Union

ilg- Assembly of Western European Union DOCUMENT 1569 l2May 1991 FORTY-THIRD SESSION European cooperation on armoured vehicles ? REPORT submitted on behalf of the Technological and Aerospace Commrttee by Mr Diaz de Mera, Rapporteur -.\ D,o .J ASSEMBLY OF WESTERN ETIROPEAN LTNION -13. avenue du Prcsrdent-Wilson. '157'75Paris Cedex 16 - Tel. 01.53.67.22.00 Document 1569 12 May 1997 European cooperation on armoured vehicles REPORT' submitted on behalf of the Technological and Aerospace Committeez by Mr Diaz de Mera, Rapporteur TABLE OF CONTENTS DRAFT RECOMMENDATION on European cooperatron on armoured vehrcles EXPLANATORY MEMORANDUM submitted by Mr Diaz de Mera, Rapporteur I Introduction II. Armoured vehicle production in WEU member countries (t) Germany (tt) Sparn (nr) France (w) Italy' (v) United Krngdom III. The state of play m European cooperatlon rn this area IV. Conclusions I Adopted unanrmoush'by the Committce. 2 L[embers of the Committee Mr ]vlarshall (Chatman); MM Lenzer, Athnson (Vice-Chairmer),MrsAgutar, Mr Arnau, Mrs Blunck, Mrs Bribosia-Prcard, Mr Cherrrbi, Sir John Cope (Alternate: Sir Dudley Smith), Mr Cunliffe (Alternate: Alexander), Mr Drana, Mrs Durrreu, Mr Feldmann. Mrs Gelderblom-Lankhout, MM Jeambrun, Le Grand. Litherland, L6pez Henares (Alternate'. Diaz de )ulera),Ivfrll Lorenzr, Luis, Martelli, Olivo (Alternate. Lauricella),Nnvl Polydoras. Probst, Ramirez Pery, S/aes, Theis,Yallerx, Mrs Zrssr. Associate members: lvovf Ktratltoglu, Dmqer, Yurur. N B. The names of those taking part m the vote are printed m ttaltcs. DOCL]MENT -

Jean-Pierre MAULNY, IRIS

Institut de Relations Internationales et Strategiques Jean-Pierre MAULNY, IRIS Trevor TAYLOR, University ofCransfield Burkard SCHMITT, West European Union Institute Franck-Emmanuel CAILLAUD, IRIS > Adresse >Telephone > Telecopie >Internet IRIS 01 53 27 60 60 2 bis, rue Mercoeur 01 53 27 60 70 www.iris-france.org 75011 PARIS. FRANCE 1 1/ "-! ) . ~ CONTENTS Chapter 1 : Germany P. 4 I) The economic and industrial model of the German defence industry P: 4 II) The German model of the State-Industry relationship P. 9 III) Analysis of the strategies and spreadsheets of these companies : The example of DaimlerChrysler Aerospace (DASA) P. 18 IV) Study of an Economic and Industrial Co-operation Model where a German Company is Involved P. 35 Chapter 2: Spain P. 47 I) The Economic and Industrial Model of the Spanish Public Sector P. 47 II) The Spanish Model of State-Industry Relations P. 53 III) Analysis of CASA'S Strategy and Balance sheets P. 57 IV) Study of models of economic and industrial co-operation with Spain P. 62 Chapter 3: France P. 71 I) The French economic and industrial model P. 71 II) The French model of the relationship between State and Industry P. 82 III) Analysis of French companies' strategy and balance sheets P. 94 IV) Study of economic and industrial co-operation models involving a French company P. 109 Chapter 4: Italy P.133 I) The Defence Industry in Italy P. 133 II) Finmeccanica- a group in the midst of transformation P. 136 III) The role of the State P. 145 2 Chapter 5 :United Kingdom P.lSO I) Corporate governance in the UK defence sector P. -

Half-Year Financial Report 2016

Half-year Financial Report 2016 WorldReginfo - 425eb84f-1ef0-4b24-8089-358b7ebd941a WorldReginfo - 425eb84f-1ef0-4b24-8089-358b7ebd941a Società per Azioni Share Capital Euro 246,229,850, fully paid-in Registered Office in Turin, Italy – Via Nizza 250 – Turin Company Register No. 00470400011 The Half-year Financial Report 2016 is prepared pursuant to Legislative Decree 58/1998 (Consolidated Finance Act) and subsequent revisions, as well as the Issuers’ Regulation issued by Consob. This Half-year Financial Report has been drawn up in accordance with International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and adopted by the European Union and has been prepared in accordance with IAS 34 – Interim Financial Reporting. The accounting principles applied are consistent with those used for the preparation of the annual consolidated financial statements at December 31, 2015, except as stated otherwise in the Notes under Standards and amendments effective January 1, 2016. The Report includes the Interim Report on Operations, the half-year condensed consolidated financial statements at June 30, 2016, the list of EXOR Group companies at June 30, 2016 and the attestation pursuant to art. 154-bis, paragraph 5 of Legislative Decree 58/1998. The Half-year Financial Report 2016 is also published with the independent Auditors’ Review Report on the half-year condensed consolidated financial statements. HALF-YEAR FINANCIAL REPORT 2016 Interim Report on Operations 1 Board of Directors, Committees, -

02/09/2019 Curriculum Vitae Pierre La Tour

Pierre La Tour Date and Place of Birth: 18 December 1967, Geneva (Switzerland) Nationality: Italian WORK EXPERIENCE The experiences highlighted below only focus on extraordinary, one-off activities. Besides these, day-to-day/standard tasks involving Controlling, Accounting, Treasury and Taxation are deliberately not mentioned in this document. March 2019 – August 2019: CNH Industrial – Ankara (Turkey) Finance Director – Turktraktor (JV between CNH Industrial and the Koc Group) Responsible for Commercial, Manufacturing and Product Development Control, Accounting, Treasury and Taxation Net Revenues: ̴ US$ 1.0 bn Reports to: JV CEO and CNHI APAC CFO (based in Europe) Finance Headcount: 52 (headcount in Ankara, Istanbul, Erenler, Izmir) November 2015 – February 2019: CNH Industrial – Shanghai (China) Chief Financial Officer – China Responsible for Commercial, Manufacturing and Product Development Control, Accounting, Treasury and Taxation Net Revenues: ̴ US$ 1.4 bn Reports to: APAC CFO (based in Europe) Finance Headcount: 58 excluding JVs (headcount in Shanghai, Harbin, Chongqing, Urumqi, Foshan) Main Achievements: - Legal Entities rationalization project (ongoing): consolidation of operations to achieve higher efficiency and cost effectiveness, reducing intercompany transactions and streamlining the Group’s structure. Project approved by Group CFO in Jan. 2017. Project go-live (first phase) 1 st Jan 2018. - US$ 90m capital injection in CNH Harbin, completed in Nov. 2018 - US$ 100m capital injection in CNH China, completed in Nov. 2017 - Commercial Vehicles Joint Ventures restructuring . Naveco: carve-out of the Yuejin business (NS ̴ US$ 350 m) and sale to SAIC Motor Corporation (signing date 31 st May 2016, closing date 31 st Dec. 2016) . SIH (NS ̴ US$ 2 bn): equity transfer followed by capital injections (Nov 2016: US$ 140m, 2018 ongoing: US$ 45m), resulting in dilution of the equity holding . -

FCA Consent Decree January 10, 2019

Case 3:17-md-02777-EMC Document 484-1 Filed 01/10/19 Page 1 of 224 1 LEIGH P. RENDÉ (PA Bar No. 203452) JOSEPH W.C. WARREN (DC Bar No. 452913) 2 Environment and Natural Resources Division Environmental Enforcement Section P.O. Box 7611, Ben Franklin Station 3 Washington, DC 20044-7611 Telephone: (202) 514-1461 4 Email: [email protected] Email: [email protected] 5 Counsel for the United States 6 XAVIER BECERRA Attorney General of California 7 NICKLAS A. AKERS Senior Assistant Attorney General 8 JUDITH A. FIORENTINI (CA Bar No. 201747) Supervising Deputy Attorney General 9 JON F. WORM (CA Bar No. 248260) LAUREL M. CARNES (CA Bar No. 285690) Deputy Attorneys General 10 600 West Broadway, Suite 1800 San Diego, CA 92101 11 Telephone: (619) 738-9325 Email: [email protected] 12 Email: [email protected] Email: [email protected] 13 Counsel for the People of the State of California 14 UNITED STATES DISTRICT COURT 15 NORTHERN DISTRICT OF CALIFORNIA 16 SAN FRANCISCO DIVISION 17 IN RE: CHRYSLER-DODGE-JEEP No. 3:17-md-02777-EMC 18 ECODIESEL MARKETING, SALES PRACTICES, AND PRODUCTS CONSENT DECREE 19 LIABILITY LITIGATION Hon. Edward M. Chen 20 21 22 23 24 25 CONSENT DECREE 3:17-md-2777-EMC Case 3:17-md-02777-EMC Document 484-1 Filed 01/10/19 Page 2 of 224 1 UNITED STATES, 2 Plaintiff, 3 v. 4 FCA US LLC, 3:17-cv-3446-EMC 5 FIAT CHRYSLER AUTOMOBILES N.V., V.M. -

Locally-Stored Version

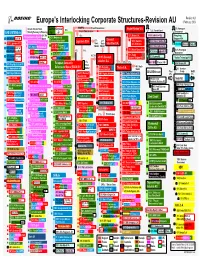

Revision AU Europe's Interlocking Corporate Structures-Revision AU 3 February 2003 32.32% / Golden Share DaimlerChrysler SOGEPA French Government Alcatel-Alstom S.A. 51% Norwegian 30% Pacte D'Actionnaires 73.2% Finnish Govt BAE SYSTEMS plc Ministry Economy & Financing 54% 46% Government 66% Stk 15% 50% Alstom S.A. Patria Industries Oyj Kongsberg 50% Sika Intl (w/ LM) Finmeccanica S.p.A Market 100% Motoren und Gruppen ASA Turbinen-Union GmbH 17% 4.3% Dassault 100% Patria Finavitec Oy 100% WASS (Whitehead) SpA Lagardere SCA 100% Chantiers 2.5% Lagardere SCA Stock Stock Industries S.A. de L'Atlantique 33% Viking Submarine Corp. AB 33% MTU Turbomeca Market Market 100% Patria Vehicles Oy 50% Team Lancer (w/ 50% Agusta Westland, Ltd. Rolls-Royce (MTR) GmbH 51% Alcatel Space S.A. 50.3% Norwegian Alvis; Raytheon;UDLP) 15% 11% 50% Patria–Hagglunds Oy 32% NH Industries Government 33% Eurojet Turbo GmbH 51% Thales 40% Tanker Transport 45.76% 27% Nammo AS 45% Bell Agusta A/C Ltd. 12% Intl Aero Engines AG 49.9% Dassault Systems Belgium NV Raufoss Technology A/S Support Co. Ltd. 35% Aviation S.A. 50% ATIL (w/ Boeing) European Aeronautic 6% 34% 9.7% 40% NEXPLO Indust. AB 45% Nammo A/S 50% Flagship, Ltd. (w/ VT) Stock 100% Alenia Aeronautica S.p.A Defence and Space (EADS) BV 50% European 46% Stock 50% Aerosystems Intl Market Aerosystems Ltd Thales S.A. Market 36% Investor 20% Eurofighter GmbH 42.5% Eurofighter GmbH AB LM Ericsson Float Group BAES 100% Royal Ordnance 45.76% Dassault 100% Sogitec Industrie 99% Thales Nederland BV 29% 35% Aviation S.A.