Notice of Asset Acquisition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Translated for the OECD by Coudert Brothers LLP, Global Legal Advisors, Beijing, Shanghai and Hong Kong, China

Translated for the OECD by Coudert Brothers LLP, Global Legal Advisors, Beijing, Shanghai and Hong Kong, China _______________________________________________________ 2003 6 10 2003 7 15 2003 9 30 2003 12 4 1960 12 14 1961 9 30 1964 4 28 1969 1 28 1971 6 7 1973 5 29 1994 5 18 1995 12 21 1996 5 7 1996 11 22 1996 12 12 2000 12 14 13 70 OECD 2003 2003 Centre français d'exploitation du droit de copie CFC 20 rue des Grands-Augustins 75006 Paris France 33-1 44 07 47 70 33-1 46 34 67 19 Copyright Clearance Center CCC Customer Service 508 750-8400 222 Rosewood Drive Danvers MA 01923 USA CCC CCC Online www.copyright.com OECD Publications 2, rue André-Pascal, 75775 Paris Cedex 16, France 1997 üü Donald J. Johnston ............................................................................................................................... 6 ............................................................................................................................... 9 ......................................................... 12 ............................................................................. 17 / ............................................................. 17 ................................................. 31 ......................................................................... 35 ................................................................................. 46 ............................................................ 60 ........................................................ 84 5 1. 2. 1999 2003 3. 1 4. 1997 5. 2 6. 7. 3 8. 6 9. IAS 1 / 10. 4 11. 12. 13. 5 14. 1 / 2 3 4 5 15. 6 16. 1 2001 IASB IFRS 7 / 8 17. 18. 1999 3 2003 3 2 2000 5 19. 3 20. 2 Corporate Governance in Asia: A Comparative Perspective Role of Disclosure in Strengthening Corporate Governance and Accountability Role of Boards and Stakeholders in Corporate Governance Shareholder Rights and the Equitable Treatment of Shareholders 3 9 21. 1 2 3 4 5 22. 4 23. 24. 25. 12 IOSCO 26. 1999 5 27. 4 10 APEC 11 28. 5 29. 6 30. -

Japan's Powder Paradise

tokyo FEBRUARY 2012 weekenderJapan’s premier English language magazine Since 1970 HOKKAIDO JAPAN’S POWDER PARADISE LOVE IS IN THE AIR TWELVE DATE TIPS FOR 2012 VALENTINE’S RESTAURANT GUIDE EDUCATION SPECIAL CAN JAPAN EMBRACE THE 4 F’S? A PIONEERING INTERNATIONAL SCHOOL AGENDA INTERVIEW PLUS! All The Biggest Live Weekender Q&A with WIN Great Prizes with Shows this Month German Ambassador our Readers Survey IN THIS ISSUE: The Latest APAC news from the Asia Daily Wire, People Parties & Places, Hit the Ice in Tokyo and much more... FEBRUARY, 2012 CONTENTS ON PISTE IN HOKKAIDO Weekender heads north to Hokkaido’s winter wonderland. VALENTINE’S DAY PEOPLE, PARTIES, PLACES AGENDA Twelve date ideas for 2012 and Tokyo’s longest running society columnist The best live shows coming up a gorgeous Grand Marnier recipe. hangs out with the Jacksons. in Tokyo this month. 11 Asia Daily Wire 22 Hoshino Resort Tomamu 36 American Apparel A roundup of all the top APAC news of the Exploring one of Hokkaido’s most After a great 2011, the LA based fashion past month. luxurious ski resorts. basics brand is expanding in Japan. 12 German Ambassador Interview 31 Education Special 38 Bill Hersey Q&A with Volker Stanzel, Ambassador of Weekender asks, can Japan embrace the Tokyo’s Longest Running Society Column the Federal Republic of Germany. 4 F’s instead of the 3 R’s? Printed in Weekender For 42 Years! 16 Tokyo Restaurant Guide 32 ISAK 43 Win a Skincare Set Worth ¥30,000 Special guide to Tokyo’s top restaurants An international school with a difference. -

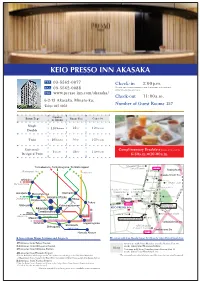

Iikura Iikura Katamachi Roppongi 2-Chome Tameike Zaimusho-Ue Akasaka-Mitsuke Tanimachi Junction Kasumigaseki

to Yotsuya Imperial Palace Palace Plaza Park Sakuradamon-Gate cho Sta. National Diet Library Akasaka-mitsuke Nagata n Sta. Sakuradamo Hi Metropolitan t Akasaka-mitsuke Police Board Akasaka Imperial Palace otsugi St. Sta. Prudential Tower National Diet Bldg. CITI T Misuji Satm. BANK oyama St. Hibiya Park . A a a Zaimusho-ue t a. chi St. S St Hie Shrine me Kasumigaseki a ho y aitc Canadian Embassy i am b Aoy ido-mae Sta. Kasumigaseki Sta. i Kokkaigij H . Sanno Park Tower Prime Minister's ta Ministry of S Official Residence Akasaka Park Bldg. a t TBS k Finance o a Tameike-sanno Sta. Hibiya Library as Y k Police Box Ministry of Economy u A r Tameike a k . a u Akasaka Tameike Tower Kinko’s t c S h Tasaki Pearl o o Medical Square Akasaka GS h ic Seven Gallery JT Bldg. To a r w Akasaka St. ATT Bldg. an i Eleven Akasaka Intercity om a Mail Box Etc. Toranomon on is Nogi Shrine Akasaka Church S h U.S.Embassy Hospital ta c Underpass #13 Exit . U Hikawa Shrine So tob Akasaka Ark Hills mae ori Ark Mori Bldg. St. Roppongi 2-chome S Ark Hills h a. Tokyo Midtown t i S Reinanzaka . m Tanimachi Junction . t Suntory t a . k S b a Church S t a z Roppongi T-Cube Hall S i a o g #3 Exit s Fransiscan Chapel g o d a h a N GS GS Spanish Embassy a IBM t y i The National . Roppongi- r i t A b Art Center, Tokyo Japan Shiroyama- u i Mikawadai Park itchome Sta. -

Reference Data

TRANSLATION FOR YOUR CONVENIENCE ONLY Reference Data November 18, 2005 Investors Meeting Tokyu Corporation (9005) http://www.tokyu.co.jp/ Contents ◆ Tokyu Area ◇ Regional Map of Tokyu Area ・・・・・・・・・・・・・・・・・・・・・・ 1 ◇ Summary of Tokyu Area ・・・・・・・・・・・・・・・・・・・・・・・・ 2 ◆ Transportation ◇ History of Revenues from Fares and Passenger Volume ・・・ ・・・・・・・・ 3 Large-scale improvement project of railway; change to the quadruplle tracking ◇ ・・4 and the raised line crossings ◇ Mutual Direct Train Service between Toyoko Line and Minatomirai Line ・・・・・ 5 ◇ Improvement construction in Toyoko Line from Shibuya to Yokohama ・・・・・ 6 ◇ New Lines Planned to Connect with Tokyu Lines ・・・・・・・・・・・・・・ 7 ◆ Real Estate ◇ Major Leased Buildings of Tokyu Group ・・・・・・・・・・・・・・・・・・8 ◇ Major Facilities Relating to Tokyu Group at Shibuya ・・・・・・・・・・・・ 9 ◇ Grandberry Mall ・・・・・・・・・・・・・・・・・・・・・・・・・・・ 10 ◇ Type-1 Urban Area Redevelopment Project of Futako-Tamagawa East District ・・・・・・・11 ◇ Area Redevelopment Around Tama-Plaza sta. ・・・・・・・・・・・・・・・ 12 ◇ Nagata-cho 2chome Project ・・・・・・・・・・・・・・・・・・・・・・・13 ◆ Retail ◇ Commercial Facilities of Tokyu Group ・・・・・・・・・・・・・・・・・・・ 14 ◇ Major Commercial Facilities along Tokyu Railways ・・・・・・・・・・・・・15 ◆ Leisure-Service ◇ Leisure Facilities of Tokyu Group ・・・・・・・・・・・・・・・・・・・・・16 ◇ its communications Inc. ・・・・・・・・・・・・・・・・・・・・・・・ 17 ◆ Hotels ◇ Hotels of Tokyu Group ・・・・・・・・・・・・・・・・・・・・・・・ 18 ◆ Other ◇ Outline of Employees ・・・・・・・・・・・・・・・・・・・・・・・ 19 ◇ Competitive Comparison of Shareholder's Structure (Tokyu Corporation) ・・・20 ◇ Complimentary Ticket -

Consumer Commission Leaflet

Consumer Commission - Investigation and deliberation toward the creation of a consumer-oriented society - What is the Consumer Commission? Structure of the Consumer Commission The Consumer Commission was established in the Cabinet The Consumer Commission consists of commissioners (no more than 10) Office on September 1, 2009 with the aim of performing the who are assigned by the Prime Minister. The Commission may set up following activities as an independent third party organization. temporary commissioners and expert commissioners as needed. Members of the Consumer Commission As it is necessary to deliberate a number of issues from a wide range of fields (As of September 2013) (Tertiary) The Consumer Commission investigates and discusses concerning consumer issues, the Commission conducts investigations and various consumer issues and submits opinions (proposals, deliberations by setting up subsidiary committees (Committee on Food Chairperson etc.) to relevant government ministries and agencies Labelling, Examination Committee for Newly Developed Food and Shoji KAWAKAMI including the Consumer Affairs Agency. Expert Examination Committee on Public Utility Rate, etc.) in addition to Professor at the Graduate Schools for Law and Politics, University of Tokyo The Consumer Commission conducts investigations and the plenary meetings. Acting chairperson deliberations in response to inquiries of the Prime Minister, Activities of the Consumer Commission relevant Ministers or the Commissioner for Consumer Yutaka ISHITOYA Affairs Agency. The Consumer Commission plenary meetings are open to the public. See the Lawyer website of the Consumer Commission for the application form, references and reports of the meetings. Ryozo AKUZAWA Dean of the Faculty of Applied Life Science, Nippon Veterinary and Life Science University Prime Minister Kimie IWATA President of Japan Institute of Workers’ Evolution Proposals, recommendations, Cabinet Office etc. -

ANA Intercontinental Tokyo

to Yotsuya Imperial Palace Palace Plaza Park Sakuradamon-Gate a. National Diet Library Nagatacho St Akasaka-mitsuke a. Sakuradamon St Akasaka Kinko’s Hitotsugi St. Metropolitan Toyokawa Inari Akasaka Imperial Palace Akasaka-mitsuke Police Board bic Sta. Ministrv of Ministry of Justice Camera Prudential Tower National Diet Bldg. SMBC Tam Communications Misuji St. BANK Kasumigaseki Hibiya Park a. achi St Hie Shrine Zaimusho-ue Ministry of For Aoyama St. akasaka Sacas . Kokkaigijido-mae Sta. Kasumigaseki Sta. Hibiya St Sanno Park Tower Prime Miniter’s Ministry of esidence Ministry of Environment Aoyama 1-chome Sta. Akasaka Park Bldg. Finance to TBS Hibiya Library o Tameike-sanno Sta. Police Box Ministry of Economy Y u Akasaka Sta. r Tameike Kasumigaseki a Japan Post Holdings k Akasaka Tameike Tower Bldg. a. u Resona c Kinko’s BANK Toranomon St h Medical Square Akasaka GS ho St Seven JT Bldg. AkasakaAkasaka St. Church Eleven Akasaka Intercity a. Mail Box Etc. Toranomon Nogi Shrine U.S.Embassy Toranomon Hikawa Shrine Underpass #13 Exit Hospital Kotohira Tower Toranomon Hills Uchisaiwaic ARK Hills Front Tower RoP Shintora St. Sotobori St. Akasaka Ark Hills mae Hinokimachi Ark Mori Bldg. Tokyo Mid town Park Roppongi 2-chome Ark Hills Shimbashi Tanimachi Junction Suntory Reinanzaka Church t. Roppongi T-Cube #3 Exit Hall S GS Fransiscan Chapel GS Spanish Embassy Nogizaka Sta. Roppongi- Ark Hills Swedish ago St. to Omotesando Mikawadai Park 1-chome Sta. South Tower Embassy Maruetsu At pongiRoppong St. Shiroyama-hills Hibiya St. Sakurada Atago Shrine Grand Tower Bldg. Roppongi Police Box Rop Izumi Garden Jikei Medical Unv.Hospital Union Tower Super Market TV Tokyo 5 a. -

JOINT FAO/WHO FOOD STANDARDS PROGRAMME CODEX ALIMENTARIUS COMMISSION Twenty-Ninth Session Geneva, Switzerland, 3- 8 July 2006

ALINORM 06/29/34 JOINT FAO/WHO FOOD STANDARDS PROGRAMME CODEX ALIMENTARIUS COMMISSION Twenty-ninth Session Geneva, Switzerland, 3- 8 July 2006 REPORT OF THE FIFTH SESSION OF THE CODEX AD HOC INTERGOVERNMENTAL TASK FORCE ON FOODS DERIVED FROM BIOTECHNOLOGY Chiba, Japan, 19-23 September 2005 Note: This document incorporates Codex Circular Letter CL 2005/46-FBT - iii - 4/80.2 CL 2005/46- FBT October 2005 To: Codex Contact Points Interested International Organizations From: Secretary, Codex Alimentarius Commission, Joint FAO/WHO Food Standards Programme, Viale delle Terme di Caracalla, 00100 Rome, Italy Subject: Distribution of the Report of the Fifth Session of the Codex Ad Hoc Intergovernmental Task Force on Foods Derived from Biotechnology (ALINORM 06/29/34) and Request for comments on Food Safety Assessment of Food Derived from Recombinant-DNA Plants Modified for Nutritional or Health Benefits The Report of the Fifth Session of the Codex Ad Hoc Intergovernmental Task Force on Foods derived from Biotechnology is attached. It will be considered by the Twenty-ninth Session of the Codex Alimentarius Commission (Geneva, Switzerland, 3-8 July 2006). REQUESTS FOR COMMENTS The Task Force agreed to initiate new work on development of an annex to the Guideline for the Conduct of Food Safety Assessment of Foods Derived from Recombinant-DNA Plants: Food Safety Assessment of Food Derived from Recombinant-DNA Plants Modified for Nutritional or Health Benefits. An electronic Working group, led by Canada, was established to develop a proposed draft annex (scoping document) to be considered in the next Task Force. It was agreed that a Circular Letter be sent to request further comments on this work, on the basis of which the electronic working group should initiate its work. -

Life Insurance Business in Japan 2014-2015

LIFE INSURANCE BUSINESS IN JAPAN 2014-2015 The Life Insurance Association of Japan Contents 1. Summary of the Life Insurance Market in Fiscal 2014 ....................................................................... 2 a ) Insurance Business Results ............................................................................................................... 2 b ) Revenues and Expenditures .............................................................................................................. 7 c ) Assets ................................................................................................................................................... 9 d ) Liabilities and Net Assets ................................................................................................................... 10 e ) Member Companies and Sales Force............................................................................................. 10 2. Topics in the Life Insurance Industry ................................................................................................. 11 a) Revisions to the Insurance Business Act ......................................................................................... 11 b) Japan's Corporate Governance Code ............................................................................................. 13 c) Principles for Responsible Institutional Investors (Japan's Stewardship Code) ........................... 14 d) Follow-up Activities on Postal Privatization ..................................................................................... -

Mori Hills Reit Investment Corporation (Code:3234)

MORI HILLS REIT INVESTMENT CORPORATION (CODE:3234) Results of 2nd Fiscal Period (Ended July 31, 2007) MORI HILLS REIT INVESTMENT CORPORATION Mori Building Investment Management Co.,Ltd. http://mori-hills-reit.co.jp/ 0 http://www.morifund.co.jp/ Contents 1. Introduction of New President 2. Overview of Financial Results for the Second Period 3. External Growth Strategies 4. Internal Growth Strategies 5. Portfolio Overview 6. Safety & Security 7. Financial Policies & IR Strategies Appendix This document has been prepared by MORI HILLS REIT INVESTMENT CORPORATION (“MHR”) for informational purposes only and should not be construed as an offer of any transactions or the solicitation of an offer of any transactions. Please inquire with the various securities companies concerning the purchase of MHR investment units. This document’s content includes forward- looking statements about business performance; however, no guarantees are implied concerning future business performance. Although the data and opinions contained in this document are derived from what we believe are reliable and accurate sources, we do not guarantee their accuracy or completeness. The contents contained herein may change without prior notice. Regardless of the purpose, any reproduction and/or use of this document in any shape or form without the prior written consent from MHR is prohibited. We will send invitations to future financial results briefings to those who participated in the financial results briefing for the second period based on the personal information they have shared with us; we guarantee that we make every effort to adequately manage and/or use and protect the information in 1accordance with the private policy posted on the official website of Mori Building Investment Management Co., Ltd. -

00A.M. Number of Guest Rooms

TEL 03-5562-0077 Check-in 3:00 p.m. FAX We may cancel your reservation, if you do not arrive at the indicated 03-5562-0088 arrival time without any notice. URL www.presso-inn.com/akasaka/ Check-out 11:00 a.m. 6-2-13 Akasaka, Minato-ku, 157 Tokyo 107-0052 Number of Guest Rooms Number Room Type Capacity of Rooms Room Size Single 146 Rooms 12m2 1-2 Persons Double Twin 10 Rooms 16m2 1-2 Persons Universal- (Example pictured above) 1 Room 24m2 1-3Persons Complimentary Breakfast Designed Twin 6:30a.m. 10:00a.m. Akasaka Fudo-son● To Ikebukuro To Komagome To Nishi-nippori Itokuji Temple Exit 10 Nagatacho Sta. JR Yamanote Line Bic Camera● Ginza Line Akasaka-mitsuke Sta. Mitsubishi UFJ● Shinjuku ● Seven-Eleven ●Prudential Tower Marunouchi Line Hitotsugi Dori Mitsui Marunouchi Line Akasaka ACT Theater FamilyMart Sumitomo Akasaka BLITZ Akasaka Sacas Harajuku Otemachi ● Meiji-jingumae ● ● Akasaka Biz TULLY’S ●Hie Shrine Akasaka-mitsuke Namboku Line Chiyoda Line Hibiya Akasaka Tower ●COFFEE Ginza Line Omote-sando Sta. Tokyo Chiyoda ●FamilyMart Exit 5b Line Shibuya Kokkai-gijidomae Sanno-shita Sotobori Dori (Hie Shrine Entrance) Akasaka Post Office Tameike-sanno Ebisu Hikawa Park● ●Sanno Park Tower Hibiya Line Namboku Line Ginza Meguro ●Koban Toei Asakusa Line Akasaka 2-chome Koban-mae Kokkaigijido-mae Sta. Gotanda Higashi-ginza Shimbashi Shinagawa ORIX Akasaka Keikyu Line 2-chome Building● Tameike-sanno Sta. Haneda Airport Exit 11 Access from Major Stations and Airports 1-minute walk from Akasaka Station Exit 5b on the Tokyo Metro Chiyoda Line 19 minutes from Tokyo Station 10-minute walk from Akasaka-mitsuke Station Exit 10 minutes from Shinagawa Station on the Ginza Line/Marunouchi Line 24 Metro 19 minutes from Shinjuku Station 7-minute walk from Tameike-sanno Station Exit 11 on the Ginza Line/Namboku Line 40 minutes from Haneda Airport (Take the Keikyu Line which merges into the Toei Asakusa Line and change to the Tokyo Metro Hibiya Line *e estimated time indicated above may dier from the time actually required. -

Expert of Electric Water Heater Our Philosophy

Expert of Electric Water Heater Our philosophy Our corporate philosophy started by "Knowing". Knowing people. Knowing things. Knowing time. Nihon ITOMIC Co., Ltd. 2 President's Commitments We are committed to offer a safe, comfortable, and environmentally friendly hot water system, catering to individual needs. We contribute to the society through the company activities, keeping in mind with the idea of conservation. Nihon ITOMIC Co., Ltd. 3 What makes ITOMIC so special? For fifty years, we went on with these philosophy and have continuously supplied electric water heaters to make up the dominant 70% share of the market in Japan. Nihon ITOMIC Co., Ltd. 4 Our technical know-how accumulated through fifty years of experience has inculcated the customers with unwavering confidence in the brand “ITOMIC.” Nihon ITOMIC Co., Ltd. 5 Consequently, our brand name “ITOMIC ”is often used as a common noun for electric water heaters. Nihon ITOMIC Co., Ltd. 6 Further, we try our best to offer variety of products to meet every customer’s expectation. Nihon ITOMIC Co., Ltd. 7 Our products are used in places like: Government /Public facilities Office Buildings Factories/Power Facilities Hospitals/Welfare Institution Hotels Retail Stores/Restaurants Cultural Facilities Embassies/Overseas Theme Parks/Sports facilities/ Other facilities Nihon ITOMIC Co., Ltd. 8 Government /Public facilities Imperial Palace The Supreme Court Narita International Airport Kansai International Airport State Guest House in Akasaka, Tokyo Tokyo Fire Department Tokyo Metropolitan Police Department Tokyo Metropolitan Subway stations Japan Mint of Ministry of Finance Bank of Japan Japan Post Highway Parking Areas/Service Areas Water and sewage plants Japan Railway stations Tokyo New Transit YURIKAMOME TokyoTokyo New Metropolitan Transit YURIKAMOME Government Nihon ITOMIC Co., Ltd. -

Trade Marks Journal No. 013/2015

27 March 2015 Trade Marks Journal No. 013/2015 TRADE MARKS JOURNAL SINGAPORE TRADE PATENTS MARKS DESIGNS PLANT VARIETIES © 2015 Intellectual Property Office of Singapore. All rights reserved. Reproduction or modification of any portion of this Journal without the permission of IPOS is prohibited. Intellectual Property Office of Singapore 51 Bras Basah Road #01-01, Manulife Centre Singapore 189554 Tel: (65) 63398616 Fax: (65) 63390252 http://www.ipos.gov.sg Trade Marks Journal No. 013/2015 TRADE MARKS JOURNAL Contents Page General Information i Practice Directions ii Application Published for Opposition Purposes Under The Trade Marks Act (Cap.332, 2005 Ed.) 1 International Registration Filed Under The Madrid Protocol Published For Opposition Under The Trade Marks Act (Cap.332, 2005 Ed.) 235 Changes in Published Application Applications Amended After Publication 426 Corrigenda 427 Trade Marks Journal No. 013/2015 Information Contained in This Journal The Registry of Trade Marks does not guarantee the accuracy of its publications, data records or advice nor accept any responsibility for errors or omissions or their consequences. Permission to reproduce extracts from this Journal must be obtained from the Registrar of Trade Marks. Trade Marks Journal No. 013/2015 Page No. i GENERAL INFORMATION Trade Marks Journal This Journal is published by the Registry of Trade Marks pursuant to rule 86A of the Trade Marks Rules. Request for past issues of the journal published more than three months ago may be made in writing and is chargeable at $12 per issue. It will be reproduced in CD-ROM format and to be collected at the following address: Registry of Trade Marks Intellectual Property Office of Singapore 51 Bras Basah Road #01-01 Manulife Centre Singapore 189 554 This Journal is published weekly on Friday and on other days when necessary, upon giving notice by way of practice circulars found on our website.