Mccormick Foundation D Employer Identification Number Address Change Doing Business As Mccormick Foundation Number and Street (Or P.O

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

July 2019–June 2020 Annual Report 2019-2020 Year in Review Table of Contents

JULY 2019–JUNE 2020 ANNUAL REPORT 2019-2020 YEAR IN REVIEW TABLE OF CONTENTS 3 Chair’s Message 5 President’s Message 7 This is Chicago Campaign Our Mission 9 Institutional News To share Chicago stories, serving as a hub of scholarship and 12 Public Engagement learning, inspiration, and civic engagement. 16 Spring Quarantine 19 Educational Initiatives 21 Board of Trustees A New Look In July 2020, the Chicago History Museum (CHM) debuted a new 22 Honor Roll of Donors brand platform comprising strategic statements, a master narrative, 38 Donors to the Collection and visual elements. Our new logo, color palette, and typography 40 Treasurer’s Report will serve as an ongoing touchstone for brand communications 42 Volunteers and expression as we help people make meaningful and personal 43 Staff connections to history. 1601 North Clark Street The Chicago History Museum gratefully acknowledges the support of the Chicago, Illinois 60614-6038 Chicago Park District on behalf of the people of Chicago. 312.642.4600 CHICAGO HISTORY MUSEUM 2 2019–20 Annual Report 2020 ANNUAL REPORT CHAIR’S MESSAGE Your Chicago History Museum has never been more museum swung into full gear. On the very first day of the relevant or more essential than it is today. During quarantine, “Chicago History at Home” was born as a daily FY 2020, we marked many achievements, confronted the series making use of our digital content. As the quarantine unprecedented challenges of the COVID-19 pandemic, and went on, our education team designed daily activities for continued to address the deeply rooted legacy of racial children, families, and teens to supplement the Museum’s discrimination in our society. -

2019 Final Program

Welcome to the AAP’s Annual Meeting! 2019 Final Program Puerto Rico Convention Center Physiatry.org/2019 The AAP’s mission is to create the future of academic physiatry Welcome to Puerto Rico through mentorship, leadership and Physiatry ’19! and discovery. he sun is shining and the energy is palpable at Thank You to Our 2019 Physiatry ’19, the AAP’s Annual Meeting. It is my Program Committee TABLE OF CONTENTS Tpleasure to welcome you to the academic physiatry • Mooyeon Oh-Park, MD, MS conference of the year. We have broken records in more – Chair General Information ................................................................. 4 • Mohammad Agha, MD Schedule at a Glance .................................................................7 ways than one: over 1,300 attendees join us from 13 • Karen Barr, MD Plenary Speakers ........................................................................8 countries and 43 U.S. states, 882 abstracts were submitted • Allison Bean, MD Pre-Conference Workshops .................................................. 12 for poster presentations, and more than 200 proposals • Nikola Dragojlovic, MD were submitted for educational sessions. We’re sure that this lush landscape and • Daniel Fechtner, MD DAILY SCHEDULES • Stephen Hampton, MD Thursday .................................................................................19 preeminent program will inspire you personally and professionally for years to come. • Daniel Herman, MD, PhD Friday ......................................................................................24 -

Elebrate in CHICAGO

NORTHWESTERN UNIVERSITY FEINBERG SCHOOL OF MEDICINE Celebrate IN CHICAGO ALUMNI WEEKEND 2020 FRIDAY, APRIL 24 SATURDAY, APRIL 25 Greetings to All Northwestern University Feinberg School of Medicine Alumni: We invite you to join the Alumni Relations team, the Medical Alumni Association, and medical school leadership, along with your friends and classmates, on the medical campus this spring for Alumni Weekend 2020 (April 24–25). If you have attended Alumni Weekend before, but not for a few years, we have added some new events—networking opportunities, lectures, Chicago tours, and more. If you have never attended Alumni Weekend, make this your time to start—especially if it is your reunion year. Of course, for most alumni, the best part of returning to campus for Alumni Weekend is reconnecting with old friends and classmates. There is ample opportunity to do just that throughout the weekend, with many occasions to share laughs and memories and even network professionally with one another. The All Alumni Celebration and Dinner on Friday night and Reunion Class Dinners on Saturday night are two touchstone events designed for reconnecting and reminiscing in mind. In addition, there are plenty of opportunities to learn. Take full advantage of presentations by our renowned faculty and earn AMA PRA Category 1 Credit(s)™. The continuing medical education sessions kick off Friday morning. There will Welcoming ALL Medical School Alumni also be in-depth tours of the hospitals and several laboratories, along with mentoring sessions. back to campus! Registering online is easy at feinberg.northwestern.edu/alumni/alumni-weekend. You have the option to include your name on our registrant list that appears on Come back to learn, reminisce, and reconnect. -

Loyola University of Chicago

Loyola University of Chicago Consolidated Financial Statements as of and for the Years Ended June 30, 2019 and 2018, Supplemental Schedule of Expenditures of Federal Awards for the Year Ended June 30, 2019, and Independent Auditors’ Reports LOYOLA UNIVERSITY OF CHICAGO TABLE OF CONTENTS YEAR ENDED JUNE 30, 2019 Page PART I INDEPENDENT AUDITORS’ REPORT 1–2 CONSOLIDATED STATEMENTS OF FINANCIAL POSITION 3 CONSOLIDATED STATEMENTS OF ACTIVITIES AND CHANGES IN NET ASSETS 4 CONSOLIDATED STATEMENTS OF CASH FLOWS 5 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 6–36 PART II REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING AND ON COMPLIANCE AND OTHER MATTERS BASED ON AN AUDIT OF FINANCIAL STATEMENTS PERFORMED IN ACCORDANCE WITH GOVERNMENT AUDITING STANDARDS 38–39 PART III REPORT ON COMPLIANCE FOR EACH MAJOR FEDERAL PROGRAM; AND REPORT ON INTERNAL CONTROL OVER COMPLIANCE AS REQUIRED BY THE UNIFORM GUIDANCE FOR FEDERAL AWARDS 41–42 PART IV SCHEDULE OF EXPENDITURES OF FEDERAL AWARDS 44–50 NOTES TO SCHEDULE OF EXPENDITURES OF FEDERAL AWARDS 51–52 PART V SCHEDULE OF FINDINGS AND QUESTIONED COSTS: Section I—Summary of Auditors’ Results 54 Section II—Financial Statement Findings 55 Section III—Federal Award Findings and Questioned Costs 56 Section IV—Summary Schedule and Resolution of Prior-Year Audit Findings and Questioned Costs 57 PART I INDEPENDENT AUDITORS’ REPORT INDEPENDENT AUDITORS’ REPORT To the Board of Trustees of Loyola University of Chicago Chicago, Illinois We have audited the accompanying consolidated financial statements of Loyola University of Chicago (“LUC”), which comprise the consolidated statements of financial position as of June 30, 2019 and 2018, and the related consolidated statements of activities and changes in net assets and cash flows for the years then ended, and the related notes to the consolidated financial statements. -

Sports Medicine Fellowship

Shirley Ryan AbilityLab and Northwestern Feinberg School of Medicine Sports Medicine Fellowship Dear Fellowship Applicant, Thank you for your interest in our Sports Fellowship at the Shirley Ryan AbilityLab and Northwestern Feinberg School of Medicine. July 2020 will mark the start of the 28th year of this program. The fellowship is twelve months in duration and includes clinical, teaching, and research experiences. The fellowship is ACGME- accredited in sports medicine so physicians completing this fellowship will be eligible to take the subspecialty board exam for sports medicine. A prospective applicant does not need to complete an elective rotation at our institution to be considered for the fellowship. Requirements for the spine and sports fellowship at our institution include: 1. Completion of an ACGME-or RCPSC-accredited residency in emergency medicine, family medicine, internal medicine, pediatrics, or physical medicine and rehabilitation 2. Completion of an ERAS application Applications will be accepted after July 15th and the deadline is September 1st, 2020. Interviews will be granted only following receipt of all application materials. Interviews will take place at Shirley Ryan AbilityLab in Chicago. Selection of the fellow will occur via the National Resident Matching Program (NRMP). Submit your application at the website for the Electronic Residency Application Service (ERAS): https://students-residents.aamc.org/training-residency-fellowship/applying-fellowships-eras/ For further questions about the fellowship application process, contact Rita Bailey, Fellowship Coordinator, by email at [email protected]. You may contact Sam Chu at [email protected] if you have any questions about the fellowship. Once again, we thank you for your interest in our program. -

Large Commercial-Industrial & Tax-Exempt Users

Large Commercial-Industrial & Tax-Exempt Users as of 1/6/2020 Facility ID Facility Name Address City User Charge Classification 20600 208 South LaSalle 208 S LaSalle Street Chicago LCIU 27686 300 West Adams Management, LLC 300 W Adams Street Chicago LCIU 27533 5 Rabbit Brewery 6398 W 74th Street Bedford Park LCIU 27981 6901 Bedford LLC 6901 W 65th Street Bedford Park LCIU 27902 9W Halo OpCo L.P. 920 S Campbell Avenue Chicago LCIU 11375 A T A Finishing Corp 8225 Kimball Avenue Skokie LCIU 26440 A-Wire Corporation 4825 W Grand Avenue Chicago LCIU 27610 A. Finkl and Sons Company dba Finkl Steel 1355 E 93rd Street Chicago LCIU 10002 Aallied Die Casting Co. of Illinois 3021 Cullerton Drv Franklin Park LCIU 26752 Abba Father Christian Center 2056 N Tripp Avenue Chicago TXE 26197 Abbott Molecular, Inc. 1300 E Touhy Avenue Des Plaines LCIU 24781 Able Electropolishing Company 2001 S Kilbourn Avenue Chicago LCIU 26702 Abounding in Christ Love Ministries, Inc. 14620 Lincoln Avenue Dolton TXE 16259 Abounding Life COGIC 14615 Mozart Avenue Posen TXE 25290 Above & Beyond Black Oxide Inc 1027-29 N 27th Avenue Melrose Park LCIU 18063 Abundant Life MB Church 2306 W 69th Street Chicago TXE 16270 Acacia Park Evangelical Lutheran Church 4307 N Oriole Avenue Norridge TXE 13583 Accent Metal Finishing Co. 9331 W Byron Street Schiller Park LCIU 26289 Access Living 115 W Chicago Avenue Chicago TXE 11340 Accurate Anodizing 3130 S Austin Blvd Cicero LCIU 11166 Ace Anodizing & Impregnating Inc 4161 Butterfield Road Hillside LCIU 27678 Acme Finishing Company, LLC -

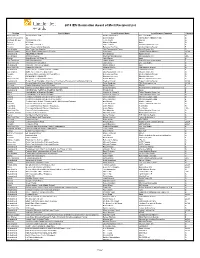

2018 IES Illumination Award of Merit Recipient List

2018 IES Illumination Award of Merit Recipient List Section Project Name Lead Designer Name Lead Deigner Company Category New York City 150 North Riverside Stephen Margulies One Lux Studio G District of Columbia 2U David Ghatan CM KLING + ASSOCIATES G Portland, Oregon 38 Davis Mixed Use Jesse Smith Glumac G Denver 609 Main Michael Shepard Illume G Houston A.D. Players Theater Lance Gandy Gandy2 Lighting Design G Toronto Ajax Library Lighting Upgrade Rebecca Ho-Dion ALULA Lighting Design E Los Angeles Akin Gump Los Angeles Lisa Passamonte Green Visual Terrain, Inc. G Orange County Amegy Bank Headquarters - Exterior Chip Israel Lighting Design Alliance OLDA International AQUAFIELD HANAM Ken Okamoto Ripple design G Los Angeles Arclight Cinemas Matthias Nikolakopulos Nikolakopulos, inc. LCA Boston Arup Boston - 60 State St Jake Wayne Arup G San Francisco ASID Headquarters James Benya Benya Burnett Consultancy E New York City Associated Press Offices Jack Bailey One Lux Studio G International Atlas Bar - Park View Square Martin Klaasen KLD G New York City Audain Art Museum Hayden McKay HLB Lighting Design G International Audrey House London | Façade Lighting Karen Ihlau Lichtvision Design E Los Angeles Battle For Texas: The Experience Lisa Passamonte Green Visual Terrain, Inc. G Toronto Bensimon Byrne and One Method Offices Rebecca Ho-Dion ALULA Lighting Design G Other BIGHORN CLUBHOUSE Blackbird Interiors Blackbird Interiors G New York City Bloomberg London Headquarters Suzan Tillotson Tillotson Design Associates G International Bulgari Hotel Shanghai - Chamber of Commerce Facade and Landscape Lighting Stephen Gough Project Lighting Design OLDA Vancouver Burrard Bridge Heritage & Modern Lighting Peter Boudreau PBX Engineering Ltd. -

Chicago Area Wellness Classes Northern Suburbs Chicago Dance

Chicago Area Wellness Classes Northern Suburbs Chicago Dance Therapy 1847 Oak St., Northfield, IL Multiple Classes: On the Move with PD – Dance Therapy Movement as Medicine Fee associated For more information visit: www.chicagodancetherapy.com or call Erica Hornthal at 847‐848‐0697 CJE Senior Life/Lieberman Center for Health and Rehabilitation 9700 Gross Point Road, Skokie, IL Multiple Classes: Basic Exercise Class Seated Tai Chi Seated Dance and Movement Telling Your Story Through The Arts Free to attend and open to the public For more information or to register call: Cindy Pedersen at 847‐929‐3022 or email [email protected] CJE SeniorLife/Weinberg Community for Senior Living 1551 Lake Cook Road, Deerfield, IL Parkinson’s on the Move Free to attend and open to the public For more information or to register call: Michelle Bernstein at 847‐236‐7852 Glenview Park District 2400 Chestnut Ave., Glenview, IL Multiple Classes: High Effort Cardio PWR! Circuit (Level 1‐2) PWR! Moves *Fee associated for all classes For more information visit: www.niceguytraining.com or call Drew at 847‐502‐0630 Movement Revolution/Neuro Intensive Training Center 158 S. Waukegan Rd. Deerfield, IL (inside the Joy of the Game Sports Complex) Multiple Classes: Connect, Calibrate, Center (C3) Adapted Yoga One on One Personal Training PWR! Moves Rock Steady Boxing Windy City Vim & Vigor *Fee associated for all classes For more information visit: www.movement-revolution.com, call 312-465-3921 or email [email protected] North Shore Nordic Walking Evanston, -

Inpatient Program

Inpatient Program STROKE | BRAIN | SPINAL CORD | PEDIATRIC | CANCER Contents 4 Welcome 5 Our Unique Care Model 6 Who We Treat 8 Inside Shirley Ryan AbilityLab 10 What to Expect 12 Meet Your Care Team 14 Your Room 16 Support Services 18 Continuum of Care Options 19 Meet Our Patient 2 3 Welcome to Shirley Ryan AbilityLab Our Unique Care Model The committed, passionate staff here will work with you to reach your goals and will be by With the largest portfolio of rehabilitation research in the world, we have a global reputation for your side every step of the way. developing treatments and technologies that translate to better outcomes for patients. Ranked #1 by U.S. News & World Report The hospital is home to the world’s largest The Shirley Ryan AbilityLab is the only since 1991, the Shirley Ryan AbilityLab is research center dedicated to physical rehabilitation hospital with a record of five the only hospital of any kind to ever medicine and rehabilitation, with more federal research designations funded by achieve this distinction. Known worldwide than 300 active research studies the National Institutes of Health and the for extraordinary science and care, adults underway and 800,000 square feet of National Institute of Disability and and children from 46 states and more than dedicated space. The dynamic Rehabilitation Research. We utilize the 57 countries travel to the hospital relationship between our clinicians and most advanced technologies (including following stroke, brain or spinal cord scientists fosters research developed in the Lokomat, Exsoskeleton and Armeo) injuries. We also have 30+ sites of care response to patients’ needs and, in turn, and the best-supported practices so you throughout Illinois. -

State of the Chicago Health Care Industry

STATE OF THE CHICAGO HEALTH CARE INDUSTRY UPDATED MARCH 2018 Introduction: Chicago’s Health Care Business Climate............................................................................................. 3 Political and Economic Climate 3 Overview of Sections 4 Section I: Chicago Health Care Sectors...................................................................................................................... 5 Providers 5 Commercial Health Insurance 7 Illinois Medicaid Managed Care 8 Digital Health 10 Medical Device and Technology 12 Life Sciences 13 Associations 14 Section II: Workforce Development......................................................................................................................... 15 Medical Education 15 Health Care Vocational Training 15 Section III: Mergers, Acquisitions, and Capital Formation..................................................................................... 16 Merger and Acquisition (M&A) Activity 16 Providers 17 Payers 17 Medical Device and Technology 17 Life Sciences 17 Nontraditional Entrants 18 Chicago Capital Stock 18 Private Equity 18 Venture Capital 18 Capital Allocation 18 Investor Expectations 18 Increasing Chicago Investment Potential 20 Section IV: Health Care Innovation and Incubation............................................................................................... 24 Corporate Innovation 24 Innovation Hubs 24 Incubators and Accelerators 24 Section V: Health Equity and Public Health............................................................................................................ -

Proposal for Center for Bioethics and Medical Humanities Research Pilot/Exploratory Grant 2021-2022

Proposal for Center for Bioethics and Medical Humanities Research Pilot/Exploratory Grant 2021-2022 About the Center for Bioethics and Medical Humanities: The vision of the Center for Bioethics and Medical Humanities is to lead local, national, and global efforts in bioethics and medical humanities that improve healthcare education, delivery, research, and scholarship. The mission of the Center for Bioethics and Medical Humanities is to advance bioethics and medical humanities at Northwestern and beyond through education, innovation, clinical application, and thought leadership Purpose: The Center for Bioethics and Medical Humanities will fund pilot/exploratory grants that support research in bioethics and medical humanities. This award will provide funding for pilot/exploratory projects that explore an important emerging or unanswered bioethics problem in clinical care, biomedical research, public health, or healthcare policy. The aim is to support preliminary work that will provide a foundation for obtaining funding to support larger research projects. Preference will be given to proposals with a clearly delineated plan for obtaining subsequent extramural or internal funding. Award Information: Projects can be up to one year in duration. Awards up to $2,500.00 (total costs) will be granted. Eligibility: To be eligible for a pilot/exploratory project grant, applicants must be one of the following: - A Northwestern University Feinberg School of Medicine medical student, resident, or fellow* - An employee of Northwestern Memorial Hospital, Shirley Ryan AbilityLab, or Ann & Robert H. Lurie Children’s Hospital* - A Northwestern University Feinberg School of Medicine faculty member *All medical students, residents, fellows, and employees should identify a Northwestern University faculty member mentor with whom to collaborate. -

Loyola University of Chicago

Loyola University of Chicago Consolidated Financial Statements as of and for the Years Ended June 30, 2020 and 2019, Supplemental Schedule of Expenditures of Federal Awards for the Year Ended June 30, 2020, and Independent Auditors’ Reports LOYOLA UNIVERSITY OF CHICAGO TABLE OF CONTENTS YEAR ENDED JUNE 30, 2020 Page PART I INDEPENDENT AUDITORS’ REPORT 1–2 CONSOLIDATED STATEMENTS OF FINANCIAL POSITION 3 CONSOLIDATED STATEMENTS OF ACTIVITIES AND CHANGES IN NET ASSETS 4 CONSOLIDATED STATEMENTS OF CASH FLOWS 5 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 6–39 PART II REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING AND ON COMPLIANCE AND OTHER MATTERS BASED ON AN AUDIT OF FINANCIAL STATEMENTS PERFORMED IN ACCORDANCE WITH GOVERNMENT AUDITING STANDARDS 41–42 PART III REPORT ON COMPLIANCE FOR EACH MAJOR FEDERAL PROGRAM; AND REPORT ON INTERNAL CONTROL OVER COMPLIANCE AS REQUIRED BY THE UNIFORM GUIDANCE FOR FEDERAL AWARDS 44–45 PART IV SCHEDULE OF EXPENDITURES OF FEDERAL AWARDS 47–52 NOTES TO SCHEDULE OF EXPENDITURES OF FEDERAL AWARDS 53–55 PART V SCHEDULE OF FINDINGS AND QUESTIONED COSTS: Section I—Summary of Auditors’ Results 57 Section II—Financial Statement Findings 58 Section III—Federal Award Findings and Questioned Costs 59 Section IV—Summary Schedule and Resolution of Prior-Year Audit Findings and Questioned Costs 60 PART VI FINANCIAL RESPONSIBILITY SCHEDULE 62-64 PART I INDEPENDENT AUDITORS’ REPORT INDEPENDENT AUDITORS’ REPORT To the Board of Trustees of Loyola University of Chicago Chicago, Illinois We have audited the accompanying consolidated financial statements of Loyola University of Chicago (“LUC”), which comprise the consolidated statements of financial position as of June 30, 2020 and 2019, and the related consolidated statements of activities, and changes in net assets and cash flows for the years then ended, and the related notes to the consolidated financial statements.