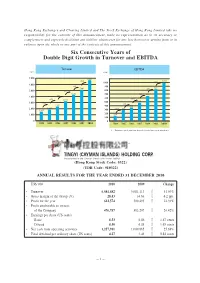

Five Consecutive Years of Double Digit Growth in Turnover and EBITDA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interim Results for the Six Months Ended 30Th June 2009

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibilities for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Stock Code: 0322) INTERIM RESULTS FOR THE SIX MONTHS ENDED 30TH JUNE 2009 SUMMARY For the six months ended 30 June US$ million 2009 2008 Change • Turnover 2,501.673 2,049.253 +22.08% • Gross margin of the Group 36.21% 32.94% +3.27ppt. • Gross profit of the Group 905.781 674.936 +34.20% • EBITDA 416.898 322.127 +29.42% • Profit for the period 249.105 190.982 +30.43% • Profit attributable to equity holders of the Company 179.383 127.607 +40.57% • Earnings per share (US cents) 3.21 2.28 +US0.93cents At 30 June 2009, Cash and cash equivalents was US$731.606 million and Gearing ratio was 0%. INTRODUCTION With the effective implementation of the economic stimulus package by the government of the PRC, the gross domestic product (GDP) of the second quarter in 2009 grew by 7.9%, representing an increase of 1.8 ppt. as compared to the growth rate of 6.1% in the first quarter. This is the first increase in the growth rate of the PRC economy after consecutive declines in year-on-year quarterly growth rates since the third quarter of 2007, indicating a trend of recovery in the PRC economy. -

康師傅控股有限公司 Tingyi (Cayman Islands) Holding Corp

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibilities for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 康 師 傅 控 股 有 限 公 司 * TINGYI (CAYMAN ISLANDS) HOLDING CORP. (Incorporated in the Cayman Islands with limited liability) (Stock Code: 0322) INTERIM RESULTS FOR THE SIX MONTHS ENDED 30TH JUNE 2017 SUMMARY For the three months For the six months ended 30 June ended 30 June RMB’000 2017 2016 Change 2017 2016 Change (Restated) (Restated) ‧ Revenue 14,370,083 13,727,975 ↑ 4.68% 28,567,722 27,415,339 ↑ 4.2% ‧ Gross margin 30.15% 31.85% ↓ 1.7 ppt. 29.10% 31.63% ↓ 2.53 ppt. ‧ Gross profit of the Group 4,332,709 4,373,020 ↓ 0.92% 8,313,493 8,672,353 ↓ 4.14% ‧ EBITDA 1,610,783 1,351,242 ↑ 19.21% 3,343,401 3,182,959 ↑ 5.04% ‧ Profit for the period 405,283 118,137 ↑ 243.06% 880,150 592,082 ↑ 48.65% ‧ Profit attributable to 266,700 77,042 ↑ 246.17% 700,204 452,952 ↑ 54.59% owners of the Company ‧ Earnings per share (RMB cents) Basic 4.76 1.38 ↑ 3.38 cents 12.49 8.08 ↑ 4.41 cents Diluted 4.76 1.38 ↑ 3.38 cents 12.49 8.08 ↑ 4.41 cents As at 30 June 2017, cash and cash equivalents was RMB10,393.040 million, representing an increase of RMB161.228 million when compared to 31 December 2016. -

Xianease MAY 2011 MAY 2011 Xianease 3

WWW.XIANEASE.COM MAY 2011 XIANEASE 1 19th 2 XIANEASE MAY 2011 WWW.XIANEASE.COM WWW.XIANEASE.COM MAY 2011 XIANEASE 3 m o Volume 13 Note From The Team ease.c Excitement! That’s pretty much our idea or miss something we used to have? XIANEASE n a www.xianease.com feeling right now, it seems that every note Send us a note at [email protected]. CONTENTS xi MAY 2011 is about the weather or something to do This month we have some great stuff General Manager with the weather and while it’s always a (of course we would say that) for you all, Yasuo Kitajima nice way to wax poetic about the passing from BBQ places to get fat and gyms to get In This Issue [email protected] of time it’s a rather strange obsession for skinny, another great restaurant review a team that has no window in their office by Amy, fashion tips from Kristen, more (yeah that’s right NO window). Anyway amazing recipes from Stephen, and a tea From the Team Marketing Manager let’s digress, it’s not the weather that has obsession from Christain. It’s a packed is- Patrick Antony us excited (though it is great), it’s not the 5 Note From the Xianease Team sue this month so don’t miss the Through [email protected] new issue (though maybe it should be), it’s Bar review from Sarah or the wedding that not even the fact that we are soon mov- Deborah attended. -

Interim Results for the Six Months Ended 30Th June 2008

(Stock Code: 322) INTERIM RESULTS FOR THE SIX MONTHS ENDED 30TH JUNE 2008 SUMMARY For the six months ended 30 June US$ million 2008 2007 Change • Turnover 2,049.253 1,502.834 +36.36% • Gross margin of the Group (%) 32.94% 32.71% +0.23ppt. • Gross profit of the Group 674.936 491.613 +37.29% • EBITDA 322.127 234.828 +37.18% • Profit for the period 190.982 145.935 +30.87% • Profit attributable to equity holders of the Company 127.607 95.819 +33.18% • Earnings per share (US cents) 2.28 1.71 +US0.57cents INTRODUCTION China’s gross domestic products (“GDP”) for the second quarter represented a growth of 10.1% as compared to the corresponding period last year, and a decrease of 0.5ppt. as compared to 10.6% of the first quarter. China’s GDP for the first half of the year increased by 10.4% over the corresponding period last year, and decreased by 1.8ppt. over the previous quarter, displaying a slowdown in growth rate of its economy. The Consumer Price Index (“CPI”) for the first half year increased by 7.9% as compared to the corresponding period last year, representing a year-on-year increase of 4.7ppt. China has been under negative real interest rates for the nineteenth consecutive months. However, the producer price index (“PPI”), being the leading indicator of CPI, recorded a year-on-year increase of 7.6%, representing a year-on-year increase in growth rate of 4.8ppt. The growth rate of PPI has been setting new record highs for the sixth consecutive months since three years ago, which indicates an increasingly high inflation pressure. -

Annual Results for the Year Ended 31 December 2013

(Hong Kong Stock Code: 0322) (TDR Code: 910322) ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2013 US$’000 2013 2012 Change (restated) • Turnover 10,940,996 9,211,852 ↑ 18.77% • Gross margin 30.25% 29.90% ↑ 0.35 ppt. • Gross profit 3,309,999 2,754,488 ↑ 20.17% • EBITDA 1,161,152 1,204,507 ↓ 3.60% • Profit for the year 494,311 604,719 ↓ 18.26% • Profit for the year – after excluding gain on bargain purchase 494,311 414,860 ↑ 19.15% • Profit attributable to owners of the Company 408,544 458,622 ↓ 10.92% • Profit attributable to owners of the Company-after excluding gain on bargain purchase 408,544 363,683 ↑ 12.34% • Earnings per share (US cents) Basic 7.30 8.20 ↓ 0.90 cents Diluted 7.28 8.17 ↓ 0.89 cents • Final dividend per ordinary share (US cents) 3.65 3.22 ↑ 0.43 cents At 31 December 2013, cash and cash equivalents was US$1,249.890 million and gearing ratio was 0.15 times. – 1 – CHAIRMAN STATEMENT In 2013, the Chinese economy continued to see a slowdown in growth and the economic environment was full of challenges! Under such slowing economic situation, competition remained intense. Coupled with a change in the behavior of consumers, the demand was getting higher for both price and value. In response to the change in the market, we enhanced our investment in brands and product innovation over the past year. With an extensive and dense sales network, premium brands and a deep understanding of the market, we established a strong and solid operating platform to improve our operating efficiency and continuously launched new products to offer more quality and affordable choices for consumers. -

Annie Pelletier Annie Pelletier

2015.082014.09 Page 9 Answer the QUIZ WIN 1 FREE TICKETth th - 18 TIANJIN OPEN 2015 October 12 16 Cheering the Start18 of theAnnie School Pelletier Year Perfection新学期开学啦! of Art 裴安妮 完美的艺术 InterMediaChinaInterMediaChina wwwwww.tianjinplus.tianjinplus.com.com IST offers your children a welcoming, inclusive international school experience, where skilled and committed teachers deliver an outstanding IB education in an environment of quality learning resources and world-class facilities. IST is... fully accredited by the Council of International Schools (CIS) IST is... fully authorized as an International Baccalaureate World School (IB) IST is... fully accredited by the Western Association of Schools and Colleges (WASC) IST is... a full member of the following China and Asia wide international school associations: ACAMIS, ISAC, ISCOT, EARCOS and ACMIBS Website: www.istianjin.org Email: [email protected] Tel: 86 22 2859 2003/5/6 NO.22 Weishan South Road, Shuanggang, Jinnan District, Tianjin 300350, P.R.China 2015 2015 CONTENTS 09 CONTENTS 09 Calendar 06 Beauty 38 37 The Beard Diaries 14 Quiz 09 Sport & Fitness 40 Partner Promotions 10 Tianjin Open 2015: Bigger and Better than Ever! Art & Culture 14 How to 42 Culinary Gymnastics: The Ancient Art of Noodle Making Feature Story 16 Beijing Beat 44 The Tianjin Blast. It is Time to Change. 40 Cover Story 18 Special Days 46 Annie Pelletier. Perfection of Art. Restaurant Past Events 48 Flo Brasserie 23 Special Dishes 26 16 Listings Chit Chat 27 46 Tianjin Listing Index 51 TEDA Listing Index 63 Fashion 28 Stepping out in style Entertainment 68 Education We are Family! 30 China Travel 70 IST - Accreditation Success! 31 Escape to China’s Wonderland. -

Six Consecutive Years of Double Digit Growth in Turnover and EBITDA

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Six Consecutive Years of Double Digit Growth in Turnover and EBITDA # Excluding capital gain from disposal of partial interests in subsidiaries (Hong Kong Stock Code: 0322) (TDR Code: 910322) ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2010 US$’000 2010 2009 Change • Turnover 6,681,482 5,081,113 ↑ 31.50% • Gross margin of the Group (%) 28.43 34.63 ↓ 6.2 ppt. • Profit for the year 612,574 500,495 ↑ 22.39% • Profit attributable to owners of the Company 476,787 383,207 ↑ 24.42% • Earnings per share (US cents) Basic 8.53 6.86 ↑ 1.67 cents Diluted 8.50 6.85 ↑ 1.65 cents • Net cash from operating activities 1,257,911 1,000,885 ↑ 25.68% • Final dividend per ordinary share (US cents) 4.27 3.43 ↑ 0.84 cents – 1 – CHAIRMAN’S STATEMENT In 2010, the situation of the Chinese economy was good in general, with gross domestic product (GDP) reaching RMB39.8 trillion, up 10.3% year-on-year. Consumption maintained stable and faster growth, the fixed assets investment structure continued to improve, and foreign trade recovered rapidly. Agricultural and industrial production grew faster, residential income increased steadily, but the pressure for price increase was higher. -

18119 Enter the Dragons Den UK Layout 1

ENTER THE DRAGONS’ DEN CHINA TOP 50 FMCG COMPANIES 2010 Est. Grocery Revenue Rank Company (RMBm) Category Key Brands 1 Wahaha 49,500 Non-alcoholic Beverages, Dairy, Packaged Food Future Cola, Shuang WaiWai, AD Calcium Milk, Wahaha Non-alcoholic Beverages, Packaged Food, 2 Tingyi 45,244 Kang Shi Fu (Master Kong) Bakery & Snacks 3 P&G 31,707 Beauty & Personal Care, Home Care Safeguard, Olay, Crest, Tide, Whisper, Pampers 4 Coca-Cola 31,380 Non-alcoholic Beverages Coca-Cola, Sprite, Minute Maid Pulpy 5 Mengniu 30,265 Dairy, Ice-cream Telunsu, Mengniu Suan Suan Ru, Mengniu Ice-cream 6 Yili Group 29,162 Dairy, Ice-cream Jindian, Yili Ice-cream, Yili Milk Powder 7 China Resources Enterprise 27,815 Beer, Non-alcoholic Beverages, Packaged Food Snow Beer, C’estbon Water, Ng Fung Hong 8 Amway 22,000 Consumer Health, Beauty & Personal Care, Home Care Amway, Artistry 9 Shuanghui Group 21,311 Packaged Food Shuanghui Meat Food 10 Tsingtao Brewery 19,614 Beer Tsingtao Beer 11 AB InBev 19,482 Beer Budweiser, Harbin Beer 12 SABMiller 18,029 Beer Snow Beer Non-alcoholic Beverages, Dairy, Bakery & Snacks, 13 Nestlé 17,822 Nescafe, Nestlé Packaged Food 14 Yihai Kerry Oils & Grains 16,617 Packaged Food Arawana (Jinlongyu) Edible Oils, Rice & Flour 15 Want Want 15,196 Dairy, Bakery & Snacks Hot-Kid Milk, Want Want Rice Cracker Dove Chocolate, Twix®, Mars®, M&M’s® Chocolate, 16 Mars 15,178 Bakery & Snacks Pedigree, Whiskas 17 Wuliangye Group 14,081 Spirits Wuliangye Heqizheng Herbal tea, Daliyuan, Copico Chips, 18 Dali Group 13,000 Non-alcoholic Beverages, Bakery -

嘉士利集團有限公司 JIASHILI GROUP LIMITED (Incorporated in the Cayman Islands with Limited Liability) Stock Code : 1285 JIASHILI GROUP LIMITED 嘉士利集團有限公司

嘉士利集團有限公司 JIASHILI GROUP LIMITED (Incorporated in the Cayman Islands with limited liability) Stock Code : 1285 JIASHILI GROUP LIMITED 嘉士利集團有限公司 GLOBAL OFFERING Sole Global Coordinator, Sole Sponsor and Sole Bookrunner Joint Lead Managers Project K Cover H13.indd 2 14年9月9日 上午12:24 IMPORTANT If you are in any doubt about any of the contents of this prospectus, you should obtain independent professional advice. Jiashili Group Limited (Incorporated in the Cayman Islands with limited liability) GLOBAL OFFERING Number of Offer Shares under : 100,000,000 Shares (subject to the Global Offering the Over-allotment Option) Number of Hong Kong Offer Shares : 10,000,000 Shares (subject to adjustment) Number of International Offer Shares : 90,000,000 Shares (subject to adjustment and the Over-allotment Option) Offer Price : HK$3.7 per Offer Share, plus brokerage fee of 1.0%, SFC transaction levy of 0.003% and Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong dollars and subject to refund) Nominal value : HK$0.01 per Share Stock code : 1285 Sole Global Coordinator, Sole Sponsor and Sole Bookrunner Joint Lead Managers Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. A copy of this prospectus, having attached thereto the documents specified in the section headed “Appendix VI — Documents delivered to the registrar of companies and available for inspection” in this prospectus, has been registered with the Registrar of Companies in Hong Kong as required by section 342C of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Chapter 32 of the Laws of Hong Kong). -

El Pairis Assured the Scenic Driveway Around the Him of the Mesa Ask the Jtotarians About It

El Pairis Assured the Scenic Driveway Around the Him of the Mesa Ask the Jtotarians About It SECCIÓN ESPAfiOU The Mornliu Tlnrsrn' PAGINA 16-1-7 Prtatod and rrattrtbntesd 18,345 'MM iMIft, M Day' Mar n.tti. Loan, par too lbs w.mbm.m. Am Avertura fdr takter, 34TH YEAR EL PASO. TEXAS, SUNDAY, JULY 12, 1914. THIRTY-EIGH- T PAGES PRICE FIVE CENTS comprehending that the causea or the included In the bill as It stands. These that afTllet our ronatry emlnate potáis win pa disposed or Monday. rrom the pretoiianltm. plutocracy and the WILL HERESIGN? The judiciary committee decided COMPROMISE clergy, the division or the north and BLAME COLLIER HUERTA NAY eliminate from the Clayton bill the section WILSON northeast solemnly agree to right until the) wmcn would make It unlawful ror dealer PLAN ex federal army shall disappear completaB in cert ató unutuodlUea to refuse to sell to he supplanted by the constitutionalist their nrodurt to responsible applicants. It army and to plant a democratic form or Was also decid sd to strike from the hill government to procura the enactment or in provision pranimtmg pingaiinr on the wise lawt ror the protection or laborers premises or enxplovars tn time or strikes AT TORREON to exconomlrally emancípale the farmers FOR ACCIDENT MAKEGEJAWAY or oiner laoor tronóles IN PHILIPPINES ny mating an evntiiaoie aiainnunon 01 urn lands as wen as an oiner meant or reaman KOI PBONS AW DRAD tinns which mav solve the agrarian oro idem, to punish and exact responsibilities Responsibility Sinking His vicUms or Ktresalra Real la its Conference Declines to Bar rrom the Roman Catholic clergy, who for of Reported Will Tender Louis -- other Denlas Reported More Autonomous Govern- materially or Intellectually have assisted Sw Ihe ateontsfetf rVwaa Carranza From Succeeding the uanmer. -

Morning Notes Market Wrap Market Highlight Nissin Foods (1475

Equity Market Hong Kong Equity Morning Notes Cyrus Tai (SFC CE:BKJ685) (852) 3519 1292 May 29, 2020 Friday Market Wrap HSI▼0.72% HSCEI▼0.17% Turnover HK$132.7 bn ▲24% (30-day average) SSE Composite▲0.33% SZSE Component ▼0.27% Sector tracking Stock tracking 1D ▲% 1Y ▲% 1D ▲% 1Q ▲% Textiles 2.7 Equip 204.7 NOBLE ENGINEERIN(8445) 88.0 SUNSHINE OILSAND(2012) 158.4 Retail 2.6 Household Prod 62.1 LAI GROUP HOLDIN(8455) 61.4 BOSSINI INTL(592) 137.7 Printing 2.0 Semicon 43.5 MAJOR HOLDINGS(1389) 52.5 CROSSTEC GROUP H(3893) 104.2 Gold 1.6 Softw & Serv 29.8 ISDN HOLDINGS LT(1656) 41.5 MICROPORT SCIENT(853) 99.2 Coal 1.5 Apparel 29.7 BCI GROUP HOLDIN(8412) 26.3 MY HEART BODIBRA(8297) 88.0 Market Highlight Nissin Foods (1475 HK) Sees Strong Growth in Mainland China Business The parent company Nissin Japan (JPY:2897) was established in 1948 by Mr. Momofuku Ando. It is currently a leading company in the instant noodle industry in Japan with the market share surpassing 70%. Nissin Foods Company Limited, a renowned food company in Hong Kong and China, best known for popular household brands like Demae Iccho, Cup Noodles and Doll Instant Noodles, got spun-off and listed on HKEx in 2017. With years of accumulated recognition and precipitation and the acquisition of local brands, the Company has become a monopoly in Hong Kong, gaining a leading market share over 60%. However, it has a relatively smaller market share in Mainland China, compared with that of Master Kong and Uni-President, due to the fierce competition there. -

Tingyi (Cayman Islands) Holding Corp. 康師傅控股有限

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibilities for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. TINGYI (CAYMANISLANDS)HOLDING CORP. 康師傅控股有限公司* (Incorporated in the Cayman Islands with limited liability) (Stock Code: 0322) INTERIM RESULTS FOR THE SIX MONTHS ENDED 30TH JUNE 2020 SUMMARY For the six months ended 30 June RMB’000 2020 2019 Change ‧ Revenue 32,934,421 30,495,309 ↑8.00% ‧ Gross margin 33.43% 31.93% ↑1.50 ppt. ‧ Gross profit of the Group 11,009,724 9,736,448 ↑13.08% ‧ EBITDA 5,166,659 4,154,177 ↑24.37% ‧ Profit for the period 2,653,381 1,801,832 ↑47.26% ‧ Profit attributable to owners of the Company 2,380,431 1,503,085 ↑58.37% ‧ Earnings per share (RMB cents) Basic 42.33 26.74 ↑15.59 cents Diluted 42.28 26.72 ↑15.56 cents As at 30 June 2020, cash and cash equivalents was RMB23,307.312 million, representing an increase of RMB5,876.925 million when compared to 31 December 2019. Gearing ratio was -45.62%. 2020 INTERIM RESULTS The Board (the “Board”) of Directors (the “Directors”) of Tingyi (Cayman Islands) Holding Corp. (the “Company”) is pleased to announce the unaudited condensed consolidated results of the Company and its subsidiaries (the “Group”) for the six months ended 30 June 2020 together with the comparative figures for the corresponding period in 2019.