Isaac Tourism Strategy – 28.02.2019 02

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ACARP C22029 Managing Cumulative Impacts in Mixed-Industry Regions

APPENDIX 4 ACARP C22029 Managing Cumulative Impacts in Mixed-Industry Regions Isaac Region (Bowen Basin) Case Study Queensland Centre for Social Responsibility in Mining Authors: Sustainable Minerals Institute Bernadetta Devi Dr Jo-Anne Everingham The University of Queensland, Australia [email protected] www.csrm.uq.edu.au Table of Contents Table of Contents ..................................................................................................................... ii 1. Context ............................................................................................................................... 1 1.1 A brief overview of Bowen Basin, IRC and Moranbah Town....................................... 1 2. Methodology ....................................................................................................................... 3 3. Main impacts with cumulative dimensions and related measures, policies or legislation ... 4 3.1 Environment ................................................................................................................ 5 3.1.1 Air quality/dust ................................................................................................... 5 3.1.2 Water and waterways ........................................................................................ 6 3.2 Community and social ................................................................................................. 8 3.2.1 Housing ............................................................................................................ -

Region Region

THE MACKAY REGION Visitor Guide 2020 mackayregion.com VISITOR INFORMATION CENTRES Mackay Region Visitor Information Centre CONTENTS Sarina Field of Dreams, Bruce Highway, Sarina P: 07 4837 1228 EXPERIENCES E: [email protected] Open: 9am – 5pm, 7 days (May to October) Wildlife Encounters ...........................................................................................4–5 9am – 5pm Monday to Friday (November to April) Nature Reserved ..................................................................................................6–7 9am – 3pm Saturday Hooked on Mackay ...........................................................................................8–9 9am – 1pm Sunday Family Fun ..............................................................................................................10–11 Melba House Visitor Information Centre Local Flavours & Culture ............................................................................12–13 Melba House, Eungella Road, Marian P: 07 4954 4299 LOCATIONS E: [email protected] Cape Hillsborough & Hibiscus Coast ...............................................14–15 Open: 9am – 3pm, 7 days Eungella & Pioneer Valley .........................................................................16–17 Mackay Visitor Information Centre Mackay City & Marina .................................................................................. 18–19 320 Nebo Road, Mackay (pre-Feb 2020) Northern Beaches .........................................................................................20–21 -

4.0 Overview of the Regional Surface and Subsurface Geology of the Duaringa Basin

Duaringa Basin Report on Hydrological Investigations 4.0 Overview of the Regional Surface and Subsurface Geology of the Duaringa Basin 4.1 Introduction The surface geology of the Duaringa Basin project site and surrounding environment is characterised by the surface exposures of the Tertiary age Duaringa Formation sediments and surrounding exposures of the Permian age sediments (Figure 4.1). The Duaringa Formation is composed of interbedded mudstones, shale, oil shale siltstone and lignite beds and rare sandstone, conglomerate and basalt beds (Day et al., 1983). The Permian age sediments are part of the Bowen Basin stratigraphic sequence. The overlying Tertiary age Duaringa Formation does not form part of the formal Bowen Basin stratigraphic sequence. The surface exposures of the Duaringa Formation can be differentiated into recent exposures and older lateritic tablelands. There are also some small outcrops of Tertiary age volcanics exposed through the Tertiary age and Permian age sediments present in and near the Duaringa Basin. The significant rivers, such as the Mackenzie River and Dawson River, which traverse the Duaringa Basin, have deposited large volumes of alluvial sediment in broad braided plains on both the Duaringa Formation and Permian age sediments. The Duaringa Basin along with the Biloela Basin and Hillsborough Basin formed during the opening of the Coral Sea during the Eocene between 52 and 34 million years ago (SRK, 2008). These basins are bounded by NE to SW trending bounding faults along their western margins. Movement along these faults is largely sinistal (left lateral). However, there has been significant downward movement on the eastern side of the fault blocks, which has opened deep asymmetrical grabens (Veevers and Powell, 1994). -

SUBURB PHARMACY ADDRESS PC PHONE Shop 9-11 the Village Shopping Centre

SUBURB PHARMACY ADDRESS PC PHONE Shop 9-11 The Village Shopping Centre. 78 ANDERGROVE United Chemists Andergrove Celeber Drive ANDERGROVE 4740 +61749424652 AFS Dispensaries - Elphinstone BERSERKER** Street 117 Elphinstone Street. BERSERKER 4701 +61749285031 BILOELA** Biloela Discount Chemist Shop 2. 38-44 Kariboe Street BILOELA 4715 +61749926551 Pharmacy Essentials BLACKWATER Blackwater Shop 8 Town Centre. Blain Street BLACKWATER 4717 +61749825204 Shop 4 Hibiscus Shopping Centre. 44 Downie BUCASIA United Chemists Bucasia Avenue BUCASIA 4750 +61749546655 Alive Pharmacy Warehouse Shop 17, Calliope Central Shopping Centre. 2041 CALLIOPE Calliope Dawson Highway CALLIOPE 4680 +61749757946 Chemist Warehouse Home Shop 3, Home Gladstone. 220 Dawson Highway CLINTON Gladstone CLINTON 4680 +61749780810 COLLINSVILLE Collinsville Pharmacy 40 Stanley Street. COLLINSVILLE 4804 +61747855450 EAST MACKAY Denis Higgins Pharmacy 101 Shakespeare Street. EAST MACKAY 4740 61749576090 T17 Central Highlands Market Place. 2-10 EMERALD** Direct Chemist Outlet Emerald Codenwarra Road EMERALD 4720 +61749820666 Shop 13 Emerald Plaza Shopping Centre. 144 EMERALD Emerald Plaza Pharmacy Egerton Street EMERALD 4720 +61749821164 Direct Chemist Outlet Central Shop 2 Emerald Village Shopping Centre. 51-57 EMERALD Highlands Hospital Road EMERALD 4720 +61749821641 Star Discount Chemist Emu EMU PARK Park 16 Emu Street. EMU PARK 4710 +61749396364 FRENCHVILLE AFS Dispensaries - Dean Street 378 Dean Street. FRENCHVILLE 4701 +61749281230 GP Discount Pharmacy Shop T1A Gladstone Central Shopping Centre. GLADSTONE Gladstone 45 -69 Dawson Highway GLADSTONE 4680 +61749723822 Chemist Discount Centre Shop 2 Centro Gladstone, 184 Goondoon Street. GLADSTONE Gladstone GLADSTONE 4680 +61749728244 Blooms The Chemist GLADSTONE Gladstone 119 Toolooa Street. GLADSTONE 4680 +61749721992 Chemist Warehouse GLADSTONE Gladstone 157 Goondoon Street. GLADSTONE 4680 +61749721277 Optimal Pharmacy Plus Kin Shop 4 Windmill Centre. -

Moranbah Public Hearing—Inquiry Into the Mineral Resources (Galilee Basin) Amendment Bill 2018

STATE DEVELOPMENT, NATURAL RESOURCES AND AGRICULTURAL INDUSTRY DEVELOPMENT COMMITTEE Members present: Mr CG Whiting MP (Chair) Mr JE Madden MP Mr BA Mickelberg MP Mr PT Weir MP Member in attendance: Mr MC Berkman MP Staff present: Dr J Dewar (Committee Secretary) PUBLIC HEARING—INQUIRY INTO THE MINERAL RESOURCES (GALILEE BASIN) AMENDMENT BILL 2018 TRANSCRIPT OF PROCEEDINGS TUESDAY, 5 MARCH 2019 Moranbah Public Hearing—Inquiry into the Mineral Resources (Galilee Basin) Amendment Bill 2018 TUESDAY, 5 MARCH 2019 ____________ The committee met at 6.05 pm. CHAIR: Good evening. I declare open this public hearing for the committee’s inquiry into the Mineral Resources (Galilee Basin) Amendment Bill 2018. I would like to acknowledge the traditional owners of the land on which we gather today. I would also like to take a moment to acknowledge the recent tragedy that has occurred at the Moranbah North mine and the impact this has had on the community. We extend our sympathy and our thoughts to the Hardwick family and colleagues. On 31 October 2018 Mr Michael Berkman MP, the member for Maiwar, introduced the Mineral Resources (Galilee Basin) Amendment Bill 2018 to the parliament. This bill has been referred to the State Development, Natural Resources and Agricultural Industry Development Committee for examination with a report date of 30 April 2019. Thank you for your interest and your attendance here today. My name is Chris Whiting. I am the member for Bancroft and the chair of the committee. The other committee members here with me today are Mr Pat Weir, deputy chair and member for Condamine; Mr Jim Madden, member for Ipswich West; and Mr Brent Mickelberg, member for Buderim. -

Kit 5 Welcome to Isaac!

Welcome to Isaac Information for our new residents Isaac... helping to energise the world Contents Who We Are ...................................................................... 4 Our Elected Members .................................................... 5 Welcome to Isaac ............................................................ 6 Our Communities ............................................................. 7 Recreation ......................................................................... 8 Exploring Isaac ................................................................ 10 Travelling Isaac ................................................................ 11 Events ................................................................................ 12 Art and Culture ................................................................ 14 Essential Services ........................................................... 16 Council Services ............................................................. 20 Community Facilities ...................................................... 22 Business in Isaac ............................................................ 24 Disaster Management .................................................... 25 Useful Information ........................................................... 26 Connect with Council ..................................................... 27 Disclaimer All information presented in this document is provided in good faith with every effort made to ensure its accuracy. However as Isaac’s communities -

BMA Community Partnerships 2004 REVIEW of ACTIVITIES Partnerships Between BMA, Our Employees and the Local Communities of Central Queensland CONTENTS

BMA Community Partnerships 2004 REVIEW OF ACTIVITIES Partnerships between BMA, our employees and the local communities of Central Queensland CONTENTS Introduction 3 About BMA 4 About the Program 5 The Community Partnerships Program 1: Youth Support 6 2: Business & Skills Training 8 3: Community Welfare 10 4: Sport & Recreation 12 5: Arts & Entertainment 14 6: Environment 15 Other Local Initiatives 16 Our Communities 18 Map of the Region 19 Front cover: With BMA’s assistance, youth development workers play a pivotal role in improving services and options for teenagers in the Central Highlands communities. It is just over two years since BMA launched its We thank you for your comments and feedback Community Partnerships Program (CPP) as part which have resulted in improved community of our vision for the long term future for the engagement and have helped us to better business and, consequently, for the address areas of greatest need. communities in which we operate. By targeting those areas which residents This report provides CPP stakeholders with a themselves have identified, we are concise update of the various activities endeavouring to make a difference through the supported by BMA since the program’s Community Partnerships Program with a range inception in 2002, including activities funded of activities to enhance the ability of under Stage 2 of the CPP which was launched communities to shape their own futures. earlier this year. I also acknowledge the volunteering efforts of The projects highlighted within this brochure BMA employees and family members, whose cover the key activities we are conducting with special contributions have added significantly our partners in government, welfare more value to the CPP. -

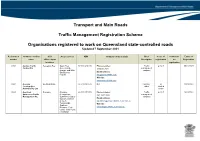

Traffic Management Scheme

Transport and Main Roads Traffic Management Registration Scheme Organisations registered to work on Queensland state-controlled roads Updated 7 September 2021 Registration Company / trading QLD Areas services ABN Company contact details Brief Scope of Conditions Expiry of number name office / depot Description registration on Registration locations registration 0202 Aaction Traffic Deception Bay South East 37 128 649 445 Phone number: Traffic O, S, D 30/11/2023 Control P/L Queensland, 1300 055 619 management Gympie and Wide company Bay Burnett Email address: regions [email protected] Website: www.aactiontraffic.com 0341 Acciona South Brisbane 66 618 030 872 N/A Industry - D 31/01/2023 Construction other Limited Australia Pty Ltd scope 0043 Acquired Brendale Brisbane 45 831 570 559 Phone number: Traffic O, S, D 15/12/2022 Awareness Traffic Metropolitan, (07) 3881 3008 management Management P/L Sunshine Coast to company Gympie, western Email address: areas to [email protected] Toowoomba, Website: Southern Brisbane, Gold www.acquiredawareness.com.au Coast, Gold Coast Hinterland Registration Company / trading QLD Areas services ABN Company contact details Brief Scope of Conditions Expiry of number name office / depot Description registration on Registration locations registration 0278 Action Control Labrador South East 92 098 736 899 Phone Number: Traffic O, S 31/10/2021 (Aust) P/L Queensland 0403 320 558 management Limited company scope Email address: [email protected] Website: www.actioncontrol.com.au 0271 -

Bowen Gas Project SREIS Issue No

N SOCIAL IMPACT MANAGEMENT PLAN 1 ENTER HERE BACK TO CONTENTS SUPPLEMENTARY REPORT TO THE EIS a Social Impact Management Plan May 2014 Bowen Gas 42627140/01/01 Project SREIS Prepared for: Arrow Energy Pty Ltd Prepared by URS Australia Pty Ltd AUSTRALIA DOCUMENT PRODUCTION / APPROVAL RECORD Issue No. Name Signature Date Position Title Prepared by Pat Vidler 21/02/2014 Senior Associate Social Scientist Checked by Dan Simmons 21/02/2014 Senior Associate Environmental Scientist Approved by Chris Pigott 21/02/2014 Senior Principal Report Name: DOCUMENT REVISION RECORD Bowen Gas Project SREIS Issue No. Date Details of Revisions Sub Title: Social Impact Management Plan FINAL 21/02/2014 Final revision Report No. 42627140/01/01 Status: FINAL Client Contact Details: Arrow Energy Pty Ltd Level 39, 111 Eagle Street, Brisbane QLD 4000 Issued by: URS Australia Pty Ltd Level 17, 240 Queen Street Brisbane, QLD 4000 GPO Box 302, QLD 4001 Australia T: +61 7 3243 2111 F: +61 7 3243 2199 © Document copyright Except as required by law, no third party, other than a government or regulatory authority under applicable government or regulatory controls, may use or rely on the contents, concepts, designs, drawings, specifications, plans etc. included in this document. URS Australia accepts no liability of any kind for any unauthorised use of the contents of this document and reserve the right to seek compensation for any such unauthorised use. Document Delivery. URS Australia provides this document in either printed format, electronic format or both. URS Australia considers the printed version to be binding. The electronic format is provided for the client’s convenience and URS Australia requests that the client ensures the integrity of this electronic information is maintained. -

How Mining Tragedies Like Moranbah Can Impact Entire Communities, and Haunt Families

Queensland Legislative Assembly How mining’tragedies like Moranbah can impact entire communities, and haunt families - ABC News --r-HTLo 19/i/20, 10:03 am Number:_^W2l3j2------ lODieiiTabled UrQ 19 MAY 2020 ByiMven K»NEWS ©MP; Mg. /lyuriA’ _ ; Clerk'sSignatureL^^^^=£: How mining tragedies like Moranbah can impact entire communities, and haunt families ABC Tropical North / By Melissa Maddison and Ollie Wykeham Posted 5d ago, updated 3d ago Since the Moranbah mine accident, the community has called for greater support in crisis recovery. (SuppLied: Isaac Regional Council) https://www.abc.net.au/news/2020-05-14/mining-tragedies-take-toll-on-whole-famiiy-and-community/12241496 Page 1 of 15 How mining" tragedies like Moranbah can impact entire communities, and haunt families - ABC News 19/5/20, 10:03 am As word spread of a major incident in the coal mining industry in Queensland, dozens of families waited anxiously to hear if their loved ones were safe. Last Wednesday, five men received significant burns when gas ignited at the Grosvenor Mine, near Moranbah in the Bowen Basin. They remain in a Brisbane hospital, with four in a critical condition. The ABC interviewed two women^bothjyive^jifjwfters..a^ mothers of tvvo children, who requeste^’anonymity foTfear their husbands'jobs might be jeopardised by speaking out. One woman found the news of the blast upsetting — her husband worked at the same mine, but was not on shift that day. "Sending him to work underground is pretty nerve-racking on a normal day," she said. __ 'li-L ta__ "When you hear there's been an incident at the mine they work at, it makes it 10 times worse. -

Central Queensland Coal Project Chapter 24 – References Supplementary Environmental Impact Statement

Central Queensland Coal Project Chapter 24 – References Supplementary Environmental Impact Statement Central Queensland Coal Project Chapter 24 - References 20 December 2018 CDM Smith Australia Pty Ltd ABN 88 152 082 936 Level 4, 51 Alfred Street Fortitude Valley QLD 4006 Tel: +61 7 3828 6900 Fax: +61 7 3828 6999 Table of Contents 24 References ........................................................................................................................................ 24-2 24.1 Introduction .......................................................................................................................................... 24-2 24.2 Project Need and Alternatives ...................................................................................................... 24-3 24.3 Description of the Project ............................................................................................................... 24-3 24.4 Climate ..................................................................................................................................................... 24-4 24.5 Land .......................................................................................................................................................... 24-5 24.6 Traffic and Transport ........................................................................................................................ 24-9 24.7 Waste Management .......................................................................................................................... -

Grosvenor Project

AUSTRALIA/CANADA – NO.07 DECEmBER 2011 2011 ScholarShipS announced OUR Met Coal welcomes students. GraSStree’S lonGwall 100 improvementS Excellent progress by workforce. aquila mine recoGniSed NEWS for Safety performance Team awarded for outstanding commitment metallurGical coal to working safety. BOARD APPROVAL FOR GROSVENOR PROJECT on 6 december 2011 anglo american announced the Board approval of its 4.7 million tonne per annum (mtpa) Grosvenor metallurgical coal project in the queensland Bowen Basin. “Our longwall design model will enable us to The greenfield Grosvenor project is situated Middle coal seam as Moranbah North, and will replicate our approach across our expansion immediately to the south of Anglo American’s process its coal through the existing Moranbah footprint, ensuring the transfer of best practice Moranbah North metallurgical coal mine and is North CHPP and train loading facilities. project efficiency, cost control and risk mitigation.” expected to produce an average of 4.7 Mtpa of saleable premium hard coking coal (HCC) “We are excited to be developing the next phase First development coal from Grosvenor is from its underground longwall operation over a of our planned Moranbah hub which will drive expected in 2013 and the commissioning of projected life of 26 years. our target of 12% compound annual production the longwall in 2016. Such project timings are growth by 2020,” Seamus said. contingent upon the receipt of the appropriate Anglo American’s Metallurgical Coal business licences and permits. Grosvenor has received Chief Executive, Seamus French, said in its first “Grosvenor and the wider hub will produce approval of its Environmental Impact Statement, phase of development, Grosvenor will consist some of the highest quality hard coking coal in the project’s Environmental Authority is of a single new underground longwall mine, the world and represents a major investment underway and the key Mining Lease is targeting the same well understood Goonyella commitment for the town of Moranbah.