Turning Inaction Into Action! Helping You to Mitigate Rising Energy Prices

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Geotechnical and Geo-Environmental Desk Study Report

Index:- Page no: Contents: 1 ................. Guidance notes. 2 …………... The area covered by this guide. 3 1:500 view Network Records …………… Scenery. 4 …………… Scenery (UK Power Networks use only). 7 …………… Primary distribution cables (EHV). NetMAP Symbols 8 …………… Secondary distribution cables (HV/LV). 9 …………… Service cables/terminations. 10 …………… Cable ducts. 11 …………… EHV/HV/LV sites. Booklet - 13 …………… Mains joints. 14 …………… Service joints. 15 …………… Cross sections. East of England 17 …………… Common abbreviations/terminology (all views). 19 1:2500 (LV) & 1:10000 (HV) network views (UK Power Networks use only). …………… General. 20 …………… 1:2500 scale LV network. 22 …………… 1:10000 scale HV network. This symbol booklet is intended as a general 23 LV network diagram view (UK Power Networks use only). guide only - some local variations of these …………… Overhead lines. symbols may be found. 24 …………… Underground cables. 25 …………… Joints. 26 …………… Substations/pole transformers. Version 1.2 Released October 2010 Always check with your local Network Records office or the UK Power Networks server to ensure that you are using the most up to date copy of this booklet - Tel: 08000 565866. (i) (ii) Guidance notes. The area covered by this guide: Important notice: If you do not understand the NetMAP record that you are using, please UK Power Networks contact the UK Power Networks Network Records team for guidance East of England. Tel: 08000 565866. This is the only area where this document applies The position of apparatus shown on NetMAP is believed to be correct, but the original landmarks may have altered since the apparatus was installed. It must be assumed that there is at least one service to each property, lamp column, street sign etc. -

RS Green Patent Data

https://uk.rs-online.com/web/ Methodology: We scraped over 6000 patent applications containing the word 'renewable energy' and organised the number of applications per comapny as well as the year the application was made, in order to find out which companies are leading the way in green energy advancements. Data correct as of February 2020. Application Application Publication Full Link Link Number Title Applicant Inventor Office Date Grant Date Data "PANNELLO IBRIDO TERMO-FOTOVOLTAICO, RELATIVO CONSORZIO detail.jsf?docId=IT231041101&_cid=P10-K5XQXG-91547-18https://patentscope.wipo.int/search/en/detail.jsf?docId=IT231041101&_cid=P10-K5XQXG-91547-18FI20120108 IMPIANTO E METODO DI PRODUZIONE DI ENERGIA" TERRANUOVA NERI ALESSANDRO Italy 2012-06-05 2013-12-06 2kw to 20kw Hybrid Power Systems for Recreational and Special Vehicles. This innovation relates to electrical power systems in recreational and special vehicles that don't use electrical power exclusively for locomotion. It introduces in-vehicle power generation greater than 2kw used in conjunction with renewable power sources to charge Lithium Batteries on an independent subsidiary electrical system at 48VDC with conversion to 12VDC network of appliances and energy consumers on an independent network with a battery and with conversion to 110-240V A/C network of appliances and energy detail.jsf?docId=AU239173241&_cid=P10-K5XQX8-91326-15https://patentscope.wipo.int/search/en/detail.jsf?docId=AU239173241&_cid=P10-K5XQX8-91326-152019100177 consumers Hou, Changyi MS Australia 2019-02-17 2019-03-07 -

Customer Engagement Proposal

RIIO ED2 Stakeholder Engagement Triangulation Consultancy Report Prepared for Electricity North West Prepared by Michael Viveash-Brainch Presented 08 July 2019 Re-issued 14th August 2019 Project No. 0976 0 Table of contents 1 INTRODUCTION 2 1.1 What is triangulation? ................................................................................................................ 2 1.2 Triangulation objectives ............................................................................................................. 2 1.3 Triangulation methodology ........................................................................................................ 3 2 OFGEM EXPECTATIONS 3 2.1 RIIO-2 Business Plan Guidance ................................................................................................... 3 2.2 RIIO-2 Sector Specific Methodology .......................................................................................... 4 2.2.1 Responses to RIIO-2 Sector Specific Methodology 5 2.3 Draft Consumer Vulnerability Strategy 2025 ............................................................................. 6 3 WHAT DOES GOOD LOOK LIKE? 7 3.1 Ofwat’s Seven Principles ............................................................................................................ 7 3.2 Citizens Advice: Strengthening the voice of consumers ............................................................ 7 3.3 AA1000 Stakeholder Engagement Standard (AA1000SES) 2015 ............................................... 8 3.4 Raising the bar for -

A Holistic Framework for the Study of Interdependence Between Electricity and Gas Sectors

November 2015 A holistic framework for the study of interdependence between electricity and gas sectors OIES PAPER: EL 16 Donna Peng Rahmatallah Poudineh The contents of this paper are the authors’ sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its members. Copyright © 2015 Oxford Institute for Energy Studies (Registered Charity, No. 286084) This publication may be reproduced in part for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgment of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the Oxford Institute for Energy Studies. ISBN 978-1-78467-042-9 A holistic framework for the study of interdependence between electricity and gas sectors i Acknowledgements The authors are thankful to Malcolm Keay, Howard Rogers and Pablo Dueñas for their invaluable comments on the earlier version of this paper. The authors would also like to extend their sincere gratitude to Bassam Fattouh, director of OIES, for his support during this project. A holistic framework for the study of interdependence between electricity and gas sectors ii Contents Acknowledgements .............................................................................................................................. ii Contents ............................................................................................................................................... -

Environmental and Safety Solutions Industry Update September 2013

Environmental and Safety Solutions Industry Update │ September 2013 Harris Williams & Co. Environmental and Safety Solutions │September 2013 MONTHLY SPOTLIGHT CONTENTS MONTHLY SPOTLIGHT Trends in Single-Stream Recycling and Mixed-Waste Processing WHAT WE’RE READING Waste management has entailed recycling for some 40 years, with recycling technology RELEVANT HW&CO. TRANSACTIONS PUBLIC MARKETS inching along over this period toward an increasingly holistic view of the waste stream. PUBLIC COMPARABLES Today’s technologies offer the potential for successful implementation of single-stream NOTABLE M&A ACTIVITY recycling (all recyclable materials collected together), as well as truly “all-in-one” M&A TRANSACTION DETAIL mixed-waste processing that manages all waste through one collection. The popularity of single-stream recycling has expanded considerably in recent years (see charts below), OUR PRACTICE and the advent of more sophisticated mixed-waste processing facilities is just beginning. The theoretical advantages of moving to mixed-waste processing through a “single-bin” Harris Williams & Co. is a leading advisor solution have tremendous potential. A single truck collection route can substantially to the environmental and safety solutions reduce the energy use and pollution associated with waste collection, while customers M&A market. Our Environmental and effectively lose the ability to opt-out of recycling programs, instantly boosting Safety Solutions (E&S) Practice includes experience across a broad range of sectors, participation rates to 100%. Despite lingering concerns regarding the purity of including products and services that meet recovered recycling content from these “all-in-one” collection programs and facilities, environmental and safety demands for a advanced material processing technology today offers compelling opportunities to variety of end markets. -

Contact Details for Distribution Network Operators (Dnos)

Contact details for Distribution Network Operators (DNOs) cec.uk.com | 01737 556631 Control Energy Costs Ltd, Kingsgate, 62 High Street, Redhill RH1 1SH Finding your Distribution Network Operators (DNOs) To identify your electricity distributor you’ll need the relevant first two digits shown as part of your MPAN (Meter Point Administration Number). Your MPAN is the unique identifying number for the electricity meter at your property, often referred to as a ‘Supply Number’ or ‘S’ number. This number is made up of 13 digits highlighted in the bottom row of the illustration on the right. user-headset General enquiries MPAN map-marked-altArea buildingCompany name desktopWebsite Prefix envelope Email address phone Telephone 10 East England UK Power Networks ukpowernetworks.co.uk [email protected] 0800 029 4285 11 East Midlands Western Power Distribution westernpower.co.uk [email protected] 0800 096 3080 12 London UK Power Networks ukpowernetworks.co.uk [email protected] 0800 029 4285 North Wales, Merseyside 13 Scottish Power Energy Networks scottishpower.com [email protected] 0330 101 0444 and Cheshire 14 West Midlands Western Power Distribution westernpower.co.uk [email protected] 0800 096 3080 15 North East England Northern Powergrid northernpowergrid.com [email protected] 0800 011 3332 16 North West England Electricity North West enwl.co.uk [email protected] 0800 048 1820 17 North Scotland Scottish -

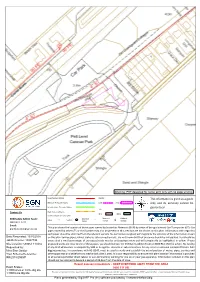

Metres Warning: PDF Designed for Colour Print Only with No Page Scaling

0 10 20 metres Warning: PDF designed for colour print only with no page scaling. Low Pressure Mains Digsite: This information is given as a guide Medium Pressure Mains Line: Area: only and its accuracy cannot be Intermediate Pressure Mains guaranteed. LAs Contact Us High Pressure Mains GTs SSSIs Some Examples Of Plant Items SGN Safety Admin Team : 5 Depth of $ Diameter Material " Valve Syphon Change = Change 0800 912 1722 Cover Email : [email protected] This plan shows the location of those pipes owned by Scotia Gas Networks (SGN) by virtue of being a licensed Gas Transporter (GT). Gas pipes owned by other GTs or third parties may also be present in this area but are not shown on this plan. Information with regard to such pipes should be obtained from the relevant owners. No warranties are given with regard to the accuracy of the information shown Date Requested: 10/10/2018 on this plan. Service pipes, valves, siphons, sub-connections etc. are not shown but their presence should be anticipated. You should be Job Reference: 13927735 aware that a small percentage of our pipes/assets may be undergoing review and will temporarily be highlighted in yellow. If your Site Location: 589051 113432 proposed works are close to one of these pipes, you should contact the SGN Safety Admin Team on 0800 912 1722 for advice. No liability Requested by: of any kind whatsoever is accepted by SGN or its agents, servants or sub-contractors for any error or omission contained herein. Safe Miss Sian Oastler digging practices, in accordance with HS (G)47, must be used to verify and establish the actual position of mains, pipes, services and Your Scheme/Reference: other apparatus on site before any mechanical plant is used. -

Chapter 3: Addressing Affordability and Vulnerability Unitedutilities.Com

3 Addressing affordability and vulnerability 3.1 Key messages • Our stretching plan delivers our largest ever bill reduction - average bills fall by £45 in real terms: Bill reductions will help lift 250,000 customers out of water poverty, with another 66,500 helped through targeted financial support • A 34% increase in the value of financial support United Utilities provides: Worth £71m in AMP7, financially supporting up to 152,000 customers each year • Industry leading Priority Services scheme, instigated in AMP6 and extended in AMP7: Pioneering cross sectoral data sharing for the utilities sector and support for people resident in business properties • Implementing new ‘Payment Breaks’ and ‘Lowest Bill Guarantee’ schemes to help customers avoid debt: New co-designed innovations, building on externally benchmarked best in class collection practices • Stretching performance commitments on delivering affordability and serving customers in vulnerable circumstances: Moving the industry frontier with fivefold increase in the number of customers supported through Priority Services between 2015 and 2025 • Delivering regional partnership working to co-create new support for customers struggling to pay: Demonstrable track record, co-creation with others through initiatives such as the North West Affordability Summit • Creation of Independent Affordability & Vulnerability Panel with annual reporting on our progress: Being transparent about the work we do and holding ourselves to account 3.2 Overview United Utilities provides a substantial level of support for assisting customers in vulnerable circumstances, including those with affordability challenges. This section describes our track record and how we aim to improve further through AMP7. As a provider of a vital public service, United Utilities has a responsibility to assist customers in vulnerable situations and we are striving to deliver continuous improvements to these services. -

Employment Equity Act, 1998 (Act No

STAATSKOERANT, 15 APRIL 2013 No. 36362 3 GOVERNMENT NOTICE DEPARTMENT OF LABOUR No. R. 281 15 April 2013 PUBLIC REGISTER NOTICE EMPLOYMENT EQUITY ACT, 1998 (ACT NO. 55 OF 1998) I, Mildred Nelisiwe Oliphant, Minister of Labour, publish in the attached Schedule hereto the register maintained in terms of Section 41 of the Employment Equity Act, 1998 (Act No. 55 of 1998) of designated employers that have submitted employment equity reports in terms of Section 21, of the Employment Equity Act, Act No. 55 of 1998. MN OLIPHANT MINISTER OF LABOUR t No. R. 281 15 April 2013 ISAZISO SASEREJISTRI SOLUNTU /-7/ov2.z2/3 UMTHETHO WOKULUNGELELANISA INGQESHO, (UMTHETHO YINOMBOLO YAMA-55 KA-1998) Mna, Mildred Nelisiwe Oliphant, uMphathiswa wezabasebenzi, ndipapasha kule Shedyuli iqhakamshelwe apha irejista egcina ngokwemiqathango yeCandelo 41 lomThetho wokuLungelelanisa iNgqesho, ka-1998 (umThetho oyiNombolo yama- 55 ka-1998)izikhundla zabaqeshi abangeniseiingxelozokuLungelelanisa iNgqeshongokwemigaqoyeCandelo 21, IomThethowokuLungelelanisa iNgqesho, umThetho oyiNombolo yama-55 ka-1998. elsv# MN OLIPHANT UMPHATHISWA WEZEMISEBENZI fly 0 3/ 2043 4 No. 36362 GOVERNMENT GAZETTE, 15 APRIL 2013 List of designated employers who reported for the 01 September 2012 reporting cycle Description of terms: No: This represents sequential numbering of designated employers and bears no relation to an employer. (The list consists of 4831 large employers and 17181 small employers). Business name: This is the name of the designated employer who reported. Status code: 0 means -

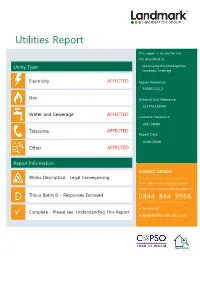

Utilities Report

Utilities Report This report is issued for the site described as: Utility Type Site at Camp Hill, Chiddingstone Causeway, Tonbridge Electricity AFFECTED Report Reference: 150851113_1 Gas National Grid Reference: 551770,146740 Water and Sewerage AFFECTED Customer Reference: LM / 61066 Telecoms AFFECTED Report Date: 11/01/2018 Other AFFECTED Report Information CONTACT DETAILS Works Description: Legal Conveyancing ------------------------------ If you require any assistance please contact our customer services team on: This is Batch D - Responses Enclosed 0844 844 9966 D ------------------------------ or by email at: Comple te - Please see 'Understanding This Report' [email protected] Utilities Report Understanding This Report We have asked a comprehensive list of Utility companies whether they have any apparatus or underground services in the vicinity of the site. Location Map This shows the plan that was dispatched to the Utility companies. The companies have been asked to return informa- tion on the area outlined, which will encompass your chosen site. Request Status Report This will confirm the current status of the information requests. We list which responses we have received and whether the company is affected. The Status Report will be divided into the following sections. Affected Utilities - We have received plans/information No response received - We are still awaiting a full response Not affected utilities - We have received a not affected/no plant present response Responses Affected responses are listed by company. Any responses from companies confirming they are not affected are provided at the back of the report for your records. ! ‘Awaiting Further Responses’ or ‘Pack Complete’ ? We do not include Local Authority requests when indicating if the pack is ‘Complete’ or ‘Awaiting Further Responses’ as Local Authorities are not obliged to reply to these enquiries. -

Global Design and Manufacture

A Summary of Group Capabilities Ulverston – UK Acrastyle – Global Design and Manufacture • Centre of Excellence for Protection and Control Design, Engineering and Since the company’s inception in 1962, Acrastyle has continued to supply Manufacture, Interface and Integration. some of the most comprehensive and intricate control and protection • Acrastyle Limited Head Office. Global systems to all sectors of the UK and overseas, both directly and as sales and support for all products and subcontract partners to major electrical equipment manufacturers. services. With expanding manufacturing units in Ulverston, UK, and facilities in Chennai and Pondicherry – India Chennai, India, we are amongst the leading independent suppliers of • Centre of Excellence for S&S protection, control and substation equipment to utility, industrial and Switchgear and Disconnector products infrastructure clients worldwide. (manufactured in Pondicherry). Protection Panel Design, Engineering In the UK, Acrastyle occupies a large factory and office complex in and Manufacture for regional markets. Ulverston. The company offers complete design, build and project management of electrical and mechanical protection systems, plus control • Group and Regional Head Office. Global sales and support for all products and systems and equipment for a wide range of applications and customers. services (Chennai). We offer a comprehensive in-house engineering function with full drawing office support and the preparation of schematic diagrams, according to specification and to international standards. “ The UK electricity Distribution Network Operators (DNO) and Transmission System Operators (TSO) represent Acrastyle Limited’s major client base. Acrastyle recognise the importance of providing them with competitively priced, high quality solutions to meet their precise specifications and project timescales. -

Newsletter Power & Utilities in Europe

Newsletter Power & Utilities Newsletter Power & Utilities in Europe July, 2017 1 Power & Utilities July 2017 Newsletter Power & Utilities NEWSLETTER Newsletter June 2017 Power & Utilities in Europe COMMODITIES Commodities Crude oil Crude oil ($/bbl) Source: Capital IQ Crude oil ($/bbl) 120 OPEC and 11 non-OPEC countries, including Russia, agreed to extend Spot Brent 110 production cuts of 1.8m barrels per day until 2018. Compliance with the 100 Spot WTI 90 agreement has been high at around 96%. However, Libyan and Nigerian oil 80 productionFuture (both of whom are exempt from production cuts) increased over Brent 70 the second quarter. 60 50 Global supply rose to 96.7mb/d and OECD commercial oil stocks are now 40 30 higher than their levels when OPEC first agreed to cut production. As a result of the continuing oversupply in the oil market, oil prices have been in phased decline from $55/bbl in March to reach a low of $45/bbl by the end of June. The period from April to June 2017 saw prices heading for the biggest Spot Brent Spot WTI Future Brent Future WTI quarterly decline since 2015, during which time Brent Crude has fallen about Source Capital IQ 10 percent. OPEC and 11 non-OPEC countries, including Russia, agreed to extend production cuts of 1.8m barrels per day until 2018. Compliance with the agreement has been high at around 96%. However, Libyan and Nigerian oil production (both of whom are exempt from production cuts) increasedGas over the second quarter. Global supplyGas rose (€/MWh)to 96.7mb/d and OECD commercial oil stocks are now higher than Source: Capital IQ their levels when OPEC first agreed to cut production.