Delivering Long-Term Growth in Asia First P Acific Company L Imited a Nnual R Eport 2011

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corporate Profile First Pacific Is a Hong Kong-Based Investment Management and Holding Company with Operations Located in Asia

於亞洲創建 長期價值 第一太平有限公司 二零一零年年報 年報 二零一零年 Corporate Profile First Pacific is a Hong Kong-based investment management and holding company with operations located in Asia. Its principal business interests relate to Telecommunications, Infrastructure, Consumer Food Products and Natural Resources. Listed in Hong Kong, First Pacific’s shares are also available for trading in the United States through American Depositary Receipts. As at 21 March 2011, First Pacific’s economic interest in PLDT is 26.5%, in MPIC 55.6%, in Indofood 50.1% and in Philex* 31.3%. First Pacific’s principal investments are summarized on page 164. * Two Rivers Pacific Holdings Corporation, a Philippine affiliate of First Pacific, holds an additional 15.0% interest in Philex. Vision Strategy • Create long-term value in Asia • Identify undervalued or underperforming assets with strong growth potential and possible synergies Mission which bring strong cash flows • Manage investments by setting strategic direction, • Active management developing business plans and defining targets • Enhance potential • Raise governance levels to world-class standards at • Enrich lives the investee companies Contents Inside Corporate Profile, Vision, Mission 43 Chairman’s Letter 71 Financial Review Front and Strategy 71 Liquidity and Financial Cover 44 Managing Director and Chief Executive Officer’s Letter Resources 1 Financial Performance and 74 Financial Risk Management 46 Board of Directors and Recurring Profit 78 Adjusted NAV Per Share Senior Executives 2 Ten-year Statistical Summary 79 Statutory -

JAFCO Investment (Hong Kong) Ltd

Venture Capital: Funding Alternative for New Enterprises Presentation By Vincent Chan Director & Executive Vice President JAFCO Investment (Hong Kong) Ltd. Rom 201B, Level, 2, Hong Kong Convention & Exhibition Centre 11:15am-12:30pm November 29, 2001 11 ContentContent 1. Definition 2. Nature of Venture Capital 3. Source of Funding 4. Revenue Model 5. Stages of Investment 6. Geographical Preference 7. Industry Preference 8. Investment Process 9. Past Development 10. Competition 11. VC looking for in return 12. Classic Cases 13. Points to Take Home 14. General Information 15. About JAFCO 12 1.1. Definition:Definition: WhatWhat isis VentureVenture CapitalCapital ¾ U.S. – >30 years in existence ¾ Fairly new term in Asia (until the last 2-3 years) ¾ Earliest venture capital firm in Asia began in 1963 in Japan ¾ Refers to investments in young, rapidly growing companies (particularly high-tech related) in the U.S. ¾ Wider meaning in Asia ------- generally refers to equity investments in growing, unlisted companies. ¾ Private Equity ¾ Direct Investments ¾ Serves as an intermediary between investors looking for high returns and entrepreneurs in need of capital 13 2.2. NatureNature ofof VentureVenture CapitalCapital ¾ VS Debt Financing ¾ VS Public Market ¾ Objective: generation of long term capital gains ¾ Horizon: 2-7 years ¾ Liquidity: low ¾ Risk: High ¾ Instruments: shares, convertible bonds, options, warrants ¾ Critical factor(s): Management team and market potential, rather than collateral ¾ Impact on Profit, Balance Sheet 14 3.3. WhereWhere doesdoes thethe moneymoney comescomes from?from? ¾ Fund investors: ¾ Insurance companies ¾ Pension funds ¾ University endowment funds ¾ Family trusts ¾ Government Treasury / Agencies ¾ Listed corporations / Private companies ¾ Wealthy high net worth individuals (>US$1 million) 15 4.4. -

Board of Directors and Senior Executives

Board of Directors and Senior Executives Board of Directors ANTHONI SALIM MANUEL V. PANGILINAN Chairman Managing Director and Chief Executive Officer Age 58, born in Indonesia. Mr. Salim is the son of Soedono Salim. Age 60, born in the Philippines. Mr. Pangilinan received a BA from He graduated from Ewell County Technical College in London. Ateneo de Manila University and an MBA from University of Mr. Salim is the President and CEO of the Salim Group, President Pennsylvania’s Wharton School before working in the Philippines Director and CEO of PT Indofood Sukses Makmur Tbk, and holds and Hong Kong for the PHINMA Group, Bancom International positions as Commissioner and Director in various companies, Limited and American Express Bank. He served as First Pacific’s including Futuris Corporation Limited, Australia. Managing Director after founding the Company in 1981, was appointed Executive Chairman in February 1999 and resumed the Mr. Salim serves on the Boards of Advisors of several multi- role of Managing Director and CEO in June 2003. national companies. He was a member of the GE International Advisory Board from September 1994, and is currently a member Mr. Pangilinan also served as President and CEO of PLDT since of the Advisory Board of ALLIANZ Group, an insurance company November 1998 and was appointed Chairman of PLDT in February based in Germany, and Rabo Bank of the Netherlands. He joined 2004. He is the Chairman of Metro Pacific Investments the Asia Business Council in September 2004. Corporation, Metro Pacific Corporation, Smart Communications, Inc., Pilipino Telephone Corporation, and Landco Pacific Mr. -

Corporate Social Responsibility Report GRI Table of Contents

2016 Corporate Social Responsibility Report GRI Table of Contents INTRODUCTION ..................................................3 ENVIRONMENTAL STEWARDSHIP ...................35 A message from Alain Monié ........................................... 4 Recognizing Risks and Opportunities .......................... 36 2016 at a Glance .............................................................. 5 Managing Energy Use and Emissions .......................... 38 About Ingram Micro ......................................................... 6 Reducing Waste ............................................................ 42 Our Strategic Priorities ............................................... 7 Understanding Water and Biodiversity Impacts ........... 43 Our Values .................................................................. 8 Our Customers ........................................................... 9 Our Operations ........................................................... 9 SUPPLY CHAIN RESPONSIBILITY ....................45 About Our Approach ...................................................... 10 Working Toward a Responsible Supply Chain .............. 46 Corporate Governance .............................................. 10 Protecting Human Rights ............................................. 47 External Frameworks ................................................. 10 Stakeholder Engagement .......................................... 11 OUR 2017 GOALS ...............................................49 Reporting Scope and Boundaries............................. -

Hong Kong's Venture Capital System and the Commercialization of New

HONG KONG’S VENTURE CAPITAL SYSTEM 1 AND THE COMMERCIALIZATION OF NEW TECHNOLOGY (Final, March 2009) KEVIN AU The Chinese University of Hong Kong STEVEN WHITE China Europe International Business School The objective of this chapter is to describe the features of Hong Kong’s venture capital system and make policy recommendations to improve its effectiveness as an institutional support for the establishment of new firms and the commercialization of new technologies as part of a larger objective of diversifying Hong Kong’s industrial base and creating a base for future economic growth. To do this effectively, we must address venture capital (VC) as a “system” rather than the more limited sense of a category of investment capital or a segment of the finance industry. With this broader scope, we will show how the characteristics of specific types of actors and the formal and informal rules and norms by which they make decisions. As our analysis reveals, the current system has emerged from Hong Kong’s particular historical, social, political and economic environment. While logical in this sense, it has not proven to be very supportive of new technology-based ventures. Hong Kong has the largest pool of venture capital and has been home to one of the largest number of funds in Asia since the mid-1990’s (Figure 1). In spite of this apparent huge pool of investment funds, however, its performance in terms of financing new technology-based firms in Hong Kong has been low. In their World Bank study, Martin, Han, and Tanaka (2007) described the VC industries in Taiwan and Israel as successful, but not Hong Kong. -

Through the Eyes of 25 Years... REGIONAL MANAGEMENT 714.382.8282 Michael T

06479_Cvrs_15 4/21/05 12:49 PM Page 1 BOARD OF DIRECTORS CORPORATE MANAGEMENT* CORPORATE OFFICES Kent B. Foster Kent B. Foster Ingram Micro Inc. Chairman and Chief Executive Officer Chairman and Chief Executive Officer 1600 E. St. Andrew Place Ingram Micro Inc. Santa Ana, CA 92705 Kevin M. Murai Phone: 714.566.1000 Howard I. Atkins President Executive Vice President and Annual Meeting Chief Financial Officer Gregory M.E. Spierkel The 2005 Annual Meeting of Shareowners Wells Fargo & Company President will be held at 10:00 a.m. (Pacific Daylight Time), Wednesday, June 1, 2005, John R. Ingram William D. Humes at Ingram Micro Inc., Chairman Executive Vice President 1600 E. St. Andrew Place Ingram Distribution Holdings and Chief Financial Officer Santa Ana, California 92705. Shareowners are cordially invited to attend. Martha R. Ingram Larry C. Boyd Chairman of the Board Senior Vice President, Independent Auditors Ingram Industries Inc. Secretary and General Counsel PricewaterhouseCoopers LLP 300 South Grand Avenue Orrin H. Ingram II Karen E. Salem Los Angeles, CA 90071 President and Chief Executive Officer Senior Vice President and Phone: 213.356.6000 Ingram Industries Inc. Chief Information Officer Transfer Agent and Registrar Dale R. Laurance Matthew A. Sauer EquiServe Trust Company, N.A. Owner, Laurance Enterprises and Senior Vice President, P.O. Box 43069 Former President Human Resources Providence, RI 02940-3069 Occidental Petroleum Corporation Web: www.equiserve.com Ria M. Carlson Phone: 816.843.4299 Linda Fayne Levinson Corporate Vice President, TDD: 800.952.9245 Independent Investor and Advisor Strategy and Communications and Former Partner Shareowners Inquiries GRP Partners James F. -

Corporate Social Responsibility Report | 2017 Table of Contents

Corporate Social Responsibility Report | 2017 Table of contents INTRODUCTION 3 GLOBAL COMMUNITY A message from Alain Monié 4 DEVELOPMENT HIGHLIGHTS 38 About Ingram Micro 5 How we deliver value 6 ENVIRONMENTAL AND SUPPLY CHAIN Our operations at a glance 7 RESPONSIBILITY 43 About our approach 9 Risks and opportunities 44 Corporate governance 9 Materials 45 External frameworks 9 Waste and recycling 46 Memberships 10 Water 50 Precautionary principle 10 Energy and emissions 51 Stakeholder engagement 11 Supply chain 56 Operational changes 16 Reporting scope and boundaries 16 OUR GOALS 58 Materiality 16 About this report 18 2017 MARTHA INGRAM LEADERSHIP AWARD 59 FAIR BUSINESS PRACTICES 19 Compliance risk management 20 APPENDICES 60 Fair business training and communication 21 Appendix A: Global subsidiaries 61 ISO 37001:2016 verification 22 Appendix B: Country-level data 65 At a glance 23 Appendix C: Data summary 67 Appendix D: GRI index 70 OUR ASSOCIATES 24 Our workforce by the numbers 25 Diversity and inclusion 27 Learning and development 31 Workplace safety management 33 Program expansion 33 Safety management approach 34 Occupational injuries and illnesses 34 Injury prevention and engagement 35 Community support and development 36 Introduction | Introduction Fair business practices Our associates Environmental and supply chain responsibility Our goals Appendices 3 A message from Alain Monié A message from Alain Monié Ingram Micro had much to celebrate in 2017. We grew our business to more than $46 billion in gross annual revenues, expanded our Advanced Solutions offerings, broadened our global logistics infrastructure and surpassed two million active seats on our cloud marketplace. In addition, we successfully completed ISO 37001:2016 verification of our anti-bribery management system, received TCO certification for our private label V7 displays and trained nearly 500 associates on our sustainability data management platform. -

Ingram Micro Annual Report 2005 COMPANY INFORMATION

ENTER A WORLD OF DIFFERENCE ENTER A WORLD · INGRAM MICRO 2005 ANNUAL REPORT © 2006 Ingram Micro Inc. All rights reserved. Ingram Micro and the Ingram Micro logo are trademarks used under license by Ingram Micro Inc. All other trademarks are the property of their respective companies. Ingram Micro Annual Report 2005 COMPANY INFORMATION Board of Directors Corporate Management Corporate Offices Kent B. Foster Gregory M.E. Spierkel Ingram Micro Inc. Chairman of the Board Chief Executive Officer 1600 E. St. Andrew Place Former Chief Executive Officer Santa Ana, CA 92705 Ingram Micro Inc. Kevin M. Murai Phone: 714.566.1000 President and Chief Operating Officer Howard I. Atkins Annual Meeting Senior Executive Vice President William D. Humes The 2006 Annual Meeting of Shareowners and Chief Financial Officer Executive Vice President will be held at 10:00 a.m. (Pacific Daylight Wells Fargo & Company and Chief Financial Officer Time), Wednesday, May 31, 2006, at Ingram Micro Inc., 1600 E. St. Andrew Place, Santa John R. Ingram Larry C. Boyd Ana, Calif. 92705. Shareowners are cordially Chairman of the Board Senior Vice President, invited to attend. Ingram Distribution Holdings Secretary and General Counsel Independent Auditors Martha R. Ingram Karen E. Salem Chairman of the Board Senior Vice President and PricewaterhouseCoopers LLP Ingram Industries Inc. Chief Information Officer 350 South Grand Avenue Los Angeles, CA 90071 Orrin H. Ingram II Matthew A. Sauer Phone: 213.356.6000 President and Chief Executive Officer Senior Vice President, Ingram Industries Inc. Human Resources Transfer Agent and Registrar Computershare Trust Company, N.A. Dale R. Laurance Ria M. -

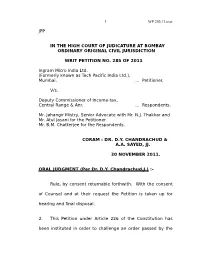

Jpp in the High Court of Judicature at Bombay

1 WP 285.11.sxw JPP IN THE HIGH COURT OF JUDICATURE AT BOMBAY ORDINARY ORIGINAL CIVIL JURISDICTION WRIT PETITION NO. 285 OF 2011 Ingram Micro India Ltd. (Formerly known as Tech Pacific India Ltd.), Mumbai. ... Petitioner. V/s. Deputy Commissioner of Income-tax, Central Range & Anr. ... Respondents. Mr. Jahangir Mistry, Senior Advocate with Mr. N.J. Thakkar and Mr. Atul Jasani for the Petitioner. Mr. B.M. Chatterjee for the Respondents. CORAM : DR. D.Y. CHANDRACHUD & A.A. SAYED, JJ. 30 NOVEMBER 2011. ORAL JUDGMENT (Per Dr. D.Y. Chandrachud,J.) :- Rule, by consent returnable forthwith. With the consent of Counsel and at their request the Petition is taken up for hearing and final disposal. 2. This Petition under Article 226 of the Constitution has been instituted in order to challenge an order passed by the 2 WP 285.11.sxw Deputy Commissioner of Income Tax (OSD-II), Mumbai under Section 163 (2) of the Income Tax Act, 1961. By the impugned order, the assessee has been treated as an agent of a Company based in Bermuda by the name of Techpac Holdings Ltd. Consequently, capital gains in the hands of the Foreign Company in the amount of Rs.575.39 crores are proposed to be assessed in the hands of the Petitioner as an agent under Section 163 of the Income Tax Act, 1961 for Assessment Year 2005-06. 3. The shares of Techpac Holdings Ltd. - a Bermudian Company, were held by non-resident shareholders being private equity funds and by a few resident shareholders. The Bermudian Company held under its fold several operating companies in Australia, New Zealand and Thailand and a holding company named Tech Pacific Asia Ltd. -

DPS Payment Express Gateway

Introduction to DPS and Internet / Web Processing Solutions Payment Express is a Visa and MasterCard certified solution, developed by DPS, which facilitates electronic payments seamlessly from multiple access points i.e. EFTPOS, Billing, IVR, CRM, Vending, MOTO (Mail Order / Telephone Order), Web and Wireless. DPS are certified with banks in Australia, New Zealand, Pacific Islands, Singapore, South Africa and Malaysia. DPS evolved from CSD; the software development company which produced and certified several leading processing solutions, including the OCV Server, which was subsequently, licensed to Ingenico, ANZ and St George banks in Australia and PC EFTPOS – the first integrated Windows POS / EFT-POS solution. In 2000 the PC EFTPOS technology was spun off in a multimillion-dollar deal to the ANZ bank and DPS replaced the legacy OCV Server with a next generation, zero hardware solution - Payment Express™. Our area of expertise is with complex high value, high volume merchants: Ticketing, Utilities, Telecommunications, Insurance, Government, Online Trading, Travel, Vending etc. Complex merchants use DPS technology for the ease of integration with billing and fulfillment systems and our global reconciliation facility, which provides organizations with business intelligence and reporting tools across multiple business units and countries. DPS’ clients include: AMI Insurance, American Express, APN Holdings, Ascent Technology, Automobile Association, Auckland City Council, AXA, Aussie Stadium, Air Rarotonga, Bank of New Zealand, Bond and -

Supplement DISTRIBUTORS SUPPLEMENT the Road Ahead

ARARNN The road ahead March Distributors 2004 Supplement DISTRIBUTORS SUPPLEMENT The road ahead The landscape of IT distribution in Australia and around the world has been undergoing some major changes during recent years. But as margins have been whittled away, and the demands of vendors and resellers have increased, the men in the middle have been looking at smarter ways of operating that builds new value into the vital role they play in the delivery of technology. BRIAN CORRIGAN discussed fresh ways of thinking, market opportunities and shifting dynamics with the managing directors of some local distribution operations. Lan System’s Nick Verykios — “Niche opportunities reduce as a market matures but there will always be room in emerging he IT distribution industry has undoubt- positive picture and insisted it was time for peo- technologies and complex things like security” edly gone through some tough times in ple to clear their heads if they were going to rise recent years with the success of Dell’s di- to the challenge ahead. rect model forcing companies at all points “There has been a tendency in recent times Ton the supply chain to reassess the way they have for both commentators and industry players to been doing business. misread the opportunity presented by this new Synnex managing director, Frank Sheu, said the environment,” he said. “They have committed the major industry change in recent times had come age-old error of hoping that what was done yester- from vendors demanding that distributors become day must be fought for today. more efficient and add value to the service they “The market today is huge. -

Cwoutstandingassets30sep2018.Pdf

Corporate Insolvency - Outstanding Assets (Defunct Companies) as at 30 September 2018 Case Name Year Reference No. (DF) ALFA-PACIFIC NOMINEES PTE LTD 2013 A13001157 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2014 A14002198 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2015 A15001105 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2016 A16002481 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2018 A18002680 (DF) ALFA-PACIFIC NOMINEES PTE LTD 2017 A17002340 (DF) ALFA-PACIFIC NOMINNES PTE LTD 2013 A13000946 (DF) ALFA-PACIFIC NOMINNES PTE LTD 2012 A12000598 (DF) BT BROKERAGE & ASSOCIATES PTE LTD 2017 A17003225 (DF) BT BROKERAGE & ASSOCIATES PTE LTD 2013 A13000893 (DF) BT BROKERAGE & ASSOCIATES PTE LTD 2012 A12000481 (DF) BT BROKERAGE & ASSOCIATES PTE LTD 2018 A18003875 (DF) CAK SEAFOOD PTE LTD 2018 A18002228 (DF) CAK SEAFOOD PTE LTD 2018 A18002253 (DF) CHAI SOON HENG PTE LTD (CW/60146/01) 2013 A13000836 (DF) CHARLES WAREHOUSING CO PTE LTD (CW/99/1987) 2012 A12000489 (DF) CITY SECURITIES PTE (CW/450/1986) 2016 A16001604 (DF) CORTEN FURNITURE PTE LTD (CW/33/04) 2013 A13001331 (DF) CORTEN FURNITURE PTE LTD (CW/33/04) 2013 A13001666 (DF) CROWM CORPORATION (S) PTE LTD OR/11 88/1998 2016 A16003502 (DF) CROWM CORPORATION (S) PTE LTD OR/11 88/1998 2015 A15002420 (DF) DAIMARU SINGAPORE PTE LTD (OR993/03) 2016 A16003125 (DF) DAIMARU SINGAPORE PTE LTD (OR993/03) 2016 A16004673 (DF) EE REALTY PTE LTD (OR/537/1993) 2012 A12001231 (DF) EE REALTY PTE LTD (OR/537/1993) 2014 A14002840 (DF) FOUR SEAS CONSTRUCTION CO PTE LTD ( 314/1998 ) 2012 A12002421 (DF) FOUR SEAS CONSTRUCTION CO PTE LTD ( 314/1998