Case Synopsis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Neon Caves - Coming Soon to Nintendo Switch

Neon Caves - Coming Soon to Nintendo Switch. FOR IMMEDIATE RELEASE Bristol, United Kingdom, Wednesday 13th March, 2019 – Force Of Habit have announced today their endless arcade-retro shooter game Neon Caves will be coming exclusively to Nintendo Switch with a brand new trailer. View it on YouTube: https://www.youtube.com/watch?v=zm7VSlFmiJE Release Date: 27th March 2019 Pre-purchase Date (EU/AU): 15th March 2019 Pre-purchase Date (NA): 20th March 2019 Price: £3.99 / $3.99 / €3.99 Pre-purchase Price: 25% off! Neon Caves is an experimental offshoot of our debut Nintendo Switch title, Toast Time: Smash Up!, with graphics by Terra Lauterbach (@rotten_tater) and music by Joe Williamson (@joecreates). To Fnd out more information about the game, including screenshots, promo codes, development videos, visit the Press Kit or alternatively Fre an email to: [email protected] Game Description: Explore the Neon Caves, a fragile ecosystem lost to the world for centuries. Recently rediscovered by your research team, use your ship's anchor ability and elite implements to stabilise the cave while keeping the hostile inhabitants at bay. Features: * Endless arcade-action gameplay. How long can you survive? * 9 unique enemy types: including historically accurate giant crustaceans! * 4 awesome power-ups: rapid Fre, bombs, invincibility and ghost ship! * 28 Achievements * Nintendo Switch exclusive Online Leaderboards Quotes: • “An eclectic mix of retro shooter and modern twin-stick shooters. The game has an achievement called 'Nic Cage'. Just remember that.” - TwinFnite • “If you’re looking for an awesome new shooter with a killer art style and a bit of depth, you’ll deFnitely want to check out Neon Caves." - Super Game Droid • “Tricky to get the hang of, but it’s fun. -

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

Blast Off Broken Sword

ALL FORMATS LIFTING THE LID ON VIDEO GAMES Broken Sword blast off Revolution’s fight Create a jetpack in for survival Unreal Engine 4 Issue 15 £3 wfmag.cc TEARAWAYS joyful nostalgia and comic adventure in knights and bikes UPGRADE TO LEGENDARY AG273QCX 2560x1440 A Call For Unionisation hat’s the first thing that comes to mind we’re going to get industry-wide change is collectively, when you think of the games industry by working together to make all companies improve. and its working conditions? So what does collective action look like? It’s workers W Is it something that benefits workers, getting together within their companies to figure out or is it something that benefits the companies? what they want their workplace to be like. It’s workers When I first started working in the games industry, AUSTIN within a region deciding what their slice of the games the way I was treated wasn’t often something I thought KELMORE industry should be like. And it’s game workers uniting about. I was making games and living the dream! Austin Kelmore is across the world to push for the games industry to But after twelve years in the industry and a lot of a programmer and become what we know it can be: an industry that horrible experiences, it’s now hard for me to stop the Chair of Game welcomes everyone, treats its workers well, and thinking about our industry’s working conditions. Workers Unite UK, allows us to make the games we all love. That’s what a a branch of the It’s not a surprise anymore when news comes out Independent Workers unionised games industry would look like. -

Notes Du Mont Royal ←

Notes du mont Royal www.notesdumontroyal.com 쐰 Cette œuvre est hébergée sur « No- tes du mont Royal » dans le cadre d’un exposé gratuit sur la littérature. SOURCE DES IMAGES Google Livres OMHPOY HOIHMATA. do...- HOMERI CARMINA. UNIE"!!! Hum DIDOT PRAIRIES, "A JACOB, 56. OMHPOY HOIHMATA KAI TA TOY KYKAOY AEIWANA. HOMERI CARMINA ET CYCLI EPICI RELIQUIÆ. ---n---- GRÆCE ET LATINE CUM INDICE NOMINUM ET BERUM. PARISIIS, EDITORE AMBROS. FIRMIN DIDOT, INST llllllllllllllllll M DCCC XXXVHL 604562 PRÆFATIO. [nounou nostrum, quo primi in Gallia Græcos scriptores in unius corporis æquabilitatem redigere aggressi sumus, commendatione et nolis præfationum artibus egere non videtur; sed paucis dicendum est. unde en quam elegimus edendi ratio pendent. Dudum ægre tuleramus quod tot scriptorum editiones veteribus inquinatæ vitiis vulgo circum- ferpentur atque adeo sæpius repeterentur, dum exstarent commdem scriptorum emendatæ et a summis criticis autiquo nitori restitutæ: armon oportuit illorum ingeniorum, qua: optimi quique nostratium laudibuset imitatione celebrarunt, opera popularibus nostris exliiberi pure, emendata, quantum fieri potest libera a depravatione barbaria- quam transierant? Hoc igitur primum et præcipue curamus, ut non solum ex optimis quœ exstant editionibus scriptorum quisque expri- matur, au] harum etiam multas criticis celeberrimis tradidimus denuo examinandas et emendandas; præterea, ubicumque res videtur postu- lare, Regiæ Bihliothecæ manuscriptos imus consultum. Altera cura est, ut ad intelligentiam quoque scriptorum in Collectione nostra præste- mus quod prosit unicuique: quum enim adnotatio vel præstantissimn ex arbitrio denique pendeat commentatoris, cui plana nonnunquam videbuntur quæ aliis ohscura, lhterlnefationes lutinas e regione grac- corum panera decrevimus, utpote quæ prorsus omuia reddaut, non locos selectos illustrent. H33 vero, antequam tradantur typothetis, doctissimi viri severo examini subjectas accurate corrigunt; nonuullo- mm scriptorum plane novæ parantur. -

The Merciad Has Message, with a True Emphasis Modest Republic

Readers respond to Teri Rhodes coverage>> PAGE 14 SEPT. 26, 2007 Vol. 81 No. 5 >>PAGE 2 HOW THE WEST WAS WON RAs respond to editorial 4-1 >> page 15 >>PAGE 19 Halo 3 Hailed >>PAGE 10 PAGE 2 NEWS Sept. 26, 2007 Mercyhurst campus accepts tailgating shame that we would have to put By Ashley Pastor Scoot Williams photo an end to it,” said Barnett. Staff writer The Mercyhurst West campus is located at 824 Main St. in Girard, Pa. Barnett, as well as others in the athletic department, Student The Mercyhurst College foot- Life and Police and Safety came West part of strategic plan ball team has kicked off its together to come up with an season with a record of 4-1, with alternative to the hill area. Dr. Gary Brown said the college rently under an annually renew- big defeats over rival Gannon The goal was to fi nd a place By Joshua Wilwohl is currently working on plans able lease agreement with farmer University and Wayne State. So where fans could have the same Editor-in-chief and trying to decide on academic Mike Picardo. what are you doing to support energy and still be responsible. offerings for the campus. Mercyhurst College Director our football players? Tailgating became the unani- Mercyhurst West offers more Mercyhurst College Director of Financial Services Jane Kelsey Look no further than the mous solution to the problem. than corn as far as the eye can of Mercyhurst West Melissa said Picardo leases approximately parking lot by Baldwin Hall an Offi cial tailgating began during see. -

Podcast Transcript Download The

Paul Raines, GameStop CEO, on getting ahead of disruption Transcript Mike Kearney: I have two boys—Tyler, who is 16, almost 17, and Cayden, who is 8. And I have been to GameStop over 100 times in my life. You know, listen, it’s probably actually more like 200 times. It seems like we would go there once or twice a week, especially about a year or two ago. And I'll tell you, they love looking at all of the new games. They especially love looking at all of the used games. And it’s amazing how much time they can spend given the fact that the footprint of the store isn't actually that big. If you look at the GameStop story, just the GameStop piece of their business, you can say, "Well that's an organization or a company that is on the brink of disruption." But that is not the story of GameStop. And what I think you're going to find out, what’s fascinating about them, is how they really have diversified their business over the last five years. And an interesting stat that I heard is that in the next few years, only 50 percent of GameStop's revenue is going to come from traditional gaming. Think about that. Most of you probably think of GameStop as going and buying a console, going and buying a physical game. But in only a few years, only 50 percent of their revenue is going to come from that. They have done an incredible job diversifying their business. -

Video Games Review DRAFT5-16

Video Games: History, Technology, Industry, and Research Agendas Table of Contents I. Overview ....................................................................................................................... 1 II. Video Game History .................................................................................................. 7 III. Academic Approaches to Video Games ................................................................. 9 1) Game Studies ....................................................................................................................... 9 2) Video Game Taxonomy .................................................................................................... 11 IV. Current Status ........................................................................................................ 12 1) Arcade Games ................................................................................................................... 12 2) Console Games .................................................................................................................. 13 3) PC Standalone Games ...................................................................................................... 14 4) Online Games .................................................................................................................... 15 5) Mobile Games .................................................................................................................... 16 V. Recent Trends .......................................................................................................... -

Fighting Games, Performativity, and Social Game Play a Dissertation

The Art of War: Fighting Games, Performativity, and Social Game Play A dissertation presented to the faculty of the Scripps College of Communication of Ohio University In partial fulfillment of the requirements for the degree Doctor of Philosophy Todd L. Harper November 2010 © 2010 Todd L. Harper. All Rights Reserved. This dissertation titled The Art of War: Fighting Games, Performativity, and Social Game Play by TODD L. HARPER has been approved for the School of Media Arts and Studies and the Scripps College of Communication by Mia L. Consalvo Associate Professor of Media Arts and Studies Gregory J. Shepherd Dean, Scripps College of Communication ii ABSTRACT HARPER, TODD L., Ph.D., November 2010, Mass Communications The Art of War: Fighting Games, Performativity, and Social Game Play (244 pp.) Director of Dissertation: Mia L. Consalvo This dissertation draws on feminist theory – specifically, performance and performativity – to explore how digital game players construct the game experience and social play. Scholarship in game studies has established the formal aspects of a game as being a combination of its rules and the fiction or narrative that contextualizes those rules. The question remains, how do the ways people play games influence what makes up a game, and how those players understand themselves as players and as social actors through the gaming experience? Taking a qualitative approach, this study explored players of fighting games: competitive games of one-on-one combat. Specifically, it combined observations at the Evolution fighting game tournament in July, 2009 and in-depth interviews with fighting game enthusiasts. In addition, three groups of college students with varying histories and experiences with games were observed playing both competitive and cooperative games together. -

What Does It Take to Lead a Nation

2 FORECASTS, Volume 2 │ Issue 8 │ February 2021 2 THEMES & 2 REACTIONS What does it take to Lead a Nation As we continue on, we have been in confinement due to the COVID-19 pandemic almost ten months, the year end is a good moment to reflect and evaluate everything that has been happening and how our lives have changed. For one, I, being the optimist that I am, have been trying to identify the “silver lining” within all these events. I must confess it has not been easy, but must admit that, probably, all this has forced us to do things differently. And has also forced us to leap bound and adopt new technologies and ways of doing business that probably, in our comfort zone, we had not even considered. So, for whatever it’s worth, let’s look at the positive aspect and embrace all the good things that this unfortunate event has brought us. Happy New Year and please keep safe and enjoy this issue of our Zenith Investor. Miguel L. Vargas-Jiménez Executive Director & CEO Birling Capitals' goal is to provide you with expert opinions and commentaries from all over the world to our readers with a detailed view of the economy, markets, and geopolitics. We also offer you our outlook for Puerto Rico's economic progress and the United States to allow you to plan with a 3 to 5-year window. We invite you to examine this month's insights to help you stay ahead of the curve. We thank you for your continued support. -

United States Securities and Exchange Commission Washington, Dc 20549

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 5(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of report (Date of earliest event reported) April 26, 2007 (April 25, 2007) GAMESTOP CORP. (Exact Name of Registrant as Specified in Charter) Delaware (State or Other Jurisdiction of Incorporation) 1-32637 20-2733559 (Commission File Number) (IRS Employer Identification No.) 625 Westport Parkway, Grapevine, Texas 76051 (Address of Principal Executive Offices) (Zip Code) (817) 424-2000 (Registrant’s Telephone Number, Including Area Code) (Former Name or Former Address, if Changed Since Last Report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 1.01 Entry into a Material Definitive Agreement. On April 25, 2007, GameStop Corp. (the “Company”) entered into the First Amendment (the “Amendment”) to the Credit Agreement, dated as of October 11, 2005, by and among the Company, certain subsidiaries of the Company, Bank of America, N.A. and the other lending institutions listed therein, Bank of America, N.A. -

Using the ZMET Method to Understand Individual Meanings Created by Video Game Players Through the Player-Super Mario Avatar Relationship

Brigham Young University BYU ScholarsArchive Theses and Dissertations 2008-03-28 Using the ZMET Method to Understand Individual Meanings Created by Video Game Players Through the Player-Super Mario Avatar Relationship Bradley R. Clark Brigham Young University - Provo Follow this and additional works at: https://scholarsarchive.byu.edu/etd Part of the Communication Commons BYU ScholarsArchive Citation Clark, Bradley R., "Using the ZMET Method to Understand Individual Meanings Created by Video Game Players Through the Player-Super Mario Avatar Relationship" (2008). Theses and Dissertations. 1350. https://scholarsarchive.byu.edu/etd/1350 This Thesis is brought to you for free and open access by BYU ScholarsArchive. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of BYU ScholarsArchive. For more information, please contact [email protected], [email protected]. Using the ZMET Method 1 Running head: USING THE ZMET METHOD TO UNDERSTAND MEANINGS Using the ZMET Method to Understand Individual Meanings Created by Video Game Players Through the Player-Super Mario Avatar Relationship Bradley R Clark A project submitted to the faculty of Brigham Young University in partial fulfillment of the requirements for the degree of Master of Arts Department of Communications Brigham Young University April 2008 Using the ZMET Method 2 Copyright © 2008 Bradley R Clark All Rights Reserved Using the ZMET Method 3 Using the ZMET Method 4 BRIGHAM YOUNG UNIVERSITY GRADUATE COMMITTEE APPROVAL of a project submitted by Bradley R Clark This project has been read by each member of the following graduate committee and by majority vote has been found to be satisfactory. -

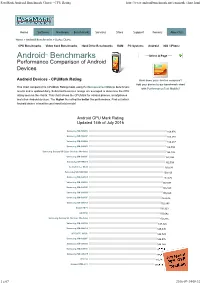

Passmark Android Benchmark Charts - CPU Rating

PassMark Android Benchmark Charts - CPU Rating http://www.androidbenchmark.net/cpumark_chart.html Home Software Hardware Benchmarks Services Store Support Forums About Us Home » Android Benchmarks » Device Charts CPU Benchmarks Video Card Benchmarks Hard Drive Benchmarks RAM PC Systems Android iOS / iPhone Android TM Benchmarks ----Select A Page ---- Performance Comparison of Android Devices Android Devices - CPUMark Rating How does your device compare? Add your device to our benchmark chart This chart compares the CPUMark Rating made using PerformanceTest Mobile benchmark with PerformanceTest Mobile ! results and is updated daily. Submitted baselines ratings are averaged to determine the CPU rating seen on the charts. This chart shows the CPUMark for various phones, smartphones and other Android devices. The higher the rating the better the performance. Find out which Android device is best for your hand held needs! Android CPU Mark Rating Updated 14th of July 2016 Samsung SM-N920V 166,976 Samsung SM-N920P 166,588 Samsung SM-G890A 166,237 Samsung SM-G928V 164,894 Samsung Galaxy S6 Edge (Various Models) 164,146 Samsung SM-G930F 162,994 Samsung SM-N920T 162,504 Lemobile Le X620 159,530 Samsung SM-N920W8 159,160 Samsung SM-G930T 157,472 Samsung SM-G930V 157,097 Samsung SM-G935P 156,823 Samsung SM-G930A 155,820 Samsung SM-G935F 153,636 Samsung SM-G935T 152,845 Xiaomi MI 5 150,923 LG H850 150,642 Samsung Galaxy S6 (Various Models) 150,316 Samsung SM-G935A 147,826 Samsung SM-G891A 145,095 HTC HTC_M10h 144,729 Samsung SM-G928F 144,576 Samsung