Fidelity® Mid Cap Enhanced Index Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

Usef-I Q2 2021

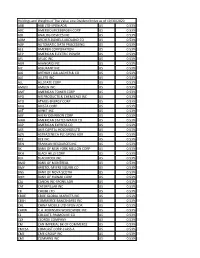

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Wilmington Funds Holdings Template DRAFT

Wilmington Large-Cap Strategy Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS APPLE INC 4.97% MICROSOFT CORP 4.69% AMAZON.COM INC 3.45% FACEBOOK INC 1.99% ALPHABET INC 1.80% ALPHABET INC 1.77% BERKSHIRE HATHAWAY INC 1.48% JPMORGAN CHASE & CO 1.35% TESLA INC 1.20% JOHNSON & JOHNSON 1.12% UNITEDHEALTH GROUP INC 0.98% VISA INC 0.96% NVIDIA CORP 0.96% BANK OF AMERICA CORP 0.89% HOME DEPOT INC/THE 0.87% WALT DISNEY CO/THE 0.82% MASTERCARD INC 0.80% PAYPAL HOLDINGS INC 0.77% EXXON MOBIL CORP 0.68% PROCTER & GAMBLE CO/THE 0.67% COMCAST CORP 0.66% ADOBE INC 0.62% INTEL CORP 0.59% VERIZON COMMUNICATIONS INC 0.59% CISCO SYSTEMS INC 0.57% CHEVRON CORP 0.55% PFIZER INC 0.54% NETFLIX INC 0.54% AT&T INC 0.53% SALESFORCE.COM INC 0.53% ABBOTT LABORATORIES 0.51% ABBVIE INC 0.50% MERCK & CO INC 0.48% WELLS FARGO & CO 0.48% BROADCOM INC 0.47% THERMO FISHER SCIENTIFIC INC 0.47% ACCENTURE PLC 0.46% CITIGROUP INC 0.45% MCDONALD'S CORP 0.44% TEXAS INSTRUMENTS INC 0.44% COCA-COLA CO/THE 0.44% HONEYWELL INTERNATIONAL INC 0.44% LINDE PLC 0.43% MEDTRONIC PLC 0.43% NIKE INC 0.43% ELI LILLY & CO 0.42% PEPSICO INC 0.42% UNITED PARCEL SERVICE INC 0.41% WALMART INC 0.40% DANAHER CORP 0.40% UNION PACIFIC CORP 0.40% QUALCOMM INC 0.38% BRISTOL-MYERS SQUIBB CO 0.37% ORACLE CORP 0.37% LOWE'S COS INC 0.36% BLACKROCK INC 0.35% CATERPILLAR INC 0.35% AMGEN INC 0.35% BOEING CO/THE 0.35% MORGAN STANLEY 0.35% COSTCO WHOLESALE CORP 0.35% RAYTHEON TECHNOLOGIES CORP 0.34% STARBUCKS CORP 0.34% GOLDMAN SACHS GROUP INC/THE 0.34% GENERAL ELECTRIC -

GROW with US Essential Utilities, Inc

GROW WITH US Essential Utilities, Inc. 2021 Annual Meeting of Shareholders NYSE: WTRG 47998_EU_Proxy-21_Covers_4c_v6.indd 1 3/19/21 4:26 PM OUR KEY PILLARS Infrastructure We are committed to thoughtful and continuous investment in the infrastructure that delivers water and wastewater service and natural gas to our customers safely and reliably. Operations We are committed to responsibly leveraging our industry expertise, purchasing power, economies of scale and efficiencies and to operational excellence benefiting our customers and shareholders. Environment We take our role as a provider of water and natural gas very seriously, and we return wastewater safely back to the environment. We are committed to sustainable business practices that protect these valuable natural resources and work to ensure the environment is safeguarded for future generations. Safety We are committed to creating a culture that empowers employees to prioritize their safety and well-being and the safety of others above all else. We strive for safe treatment and delivery of water and gas to each customer we serve. 47998_EU_Proxy-21_Covers_4c_v6.indd 2 3/19/21 4:26 PM March 22, 2021 To Our Shareholders On behalf of your Board of Directors, I am pleased to invite you to attend the 2021 Annual Meeting of the Shareholders of Essential Utilities, Inc. to be held virtually on Wednesday, May 5, 2021. I’m sure you will agree that 2020 was a transformative year for the company, as well as the country. Just as the COVID-19 pandemic began to sweep the U.S. and the country started to shut down and begin social distancing, Essential completed our momentous acquisition of Peoples Natural Gas. -

U.S. Investor-Owned Electric Companies International Members Associate Members EEI the Edison Electric Institute, Is the Association That Represents All U.S

Members List U.S. Investor-Owned Electric Companies International Members Associate Members EEI The Edison Electric Institute, is the association that represents all U.S. investor-owned electric companies. Our members provide electricity for about 220 million Americans, and operate in all 50 states and the District of Columbia. As a whole, the electric power industry supports more than 7 million jobs in communities across the United States. In addition to our U.S. members, EEI has more than 65 international electric companies with operations in more than 90 countries, as International Members, and hundreds of industry suppliers and related organizations as Associate Members. Organized in 1933, EEI provides public policy leadership, strategic business intelligence, and essential conferences and forums. U.S. Energy Companies AES Corporation Entergy Corporation Otter Tail Corporation Dayton Power & Light Company Entergy Arkansas Otter Tail Power Company Indianapolis Power & Light Company Entergy Louisiana PG&E Corporation Alaska Power & Telephone Company Entergy Mississippi Pacific Gas & Electric Company ALLETE Entergy New Orleans Pinnacle West Capital Corporation Minnesota Power Entergy Texas Arizona Public Service Company Superior Water, Light and Power Company Evergy PNM Resources Alliant Energy Eversource Energy PNM Ameren Corporation Exelon Corporation TNMP Ameren Illinois Atlantic City Electric Portland General Electric Ameren Missouri BGE PPL Corporation American Electric Power ComEd PPL Electric Utilities AEP Ohio Delmarva Power LG&E -

2020 Annual Report

2020 Annual Report 1 THE GIRL SCOUT MISSION THE GIRL SCOUT LAW Girl Scouting builds girls of courage, I will do my best to be confidence, and character, honest and fair, who make the world a better place. friendly and helpful, considerate and caring, courageous and strong, and THE GIRL SCOUT PROMISE responsible for what I say and do, and to On my honor, I will try: respect myself and others, To serve God and my country, respect authority, To help people at all times, use resources wisely, And to live by the Girl Scout Law. make the world a better place, and be a sister to every Girl Scout. Annual Report Cover – The cover of the Annual Report this year represents the tale of two half years that we experienced in 2020 with color and a girl journey. The two half years are represented by the two Pantone colors of the year, Ultimate Gray and Illuminating Yellow. The gradient and movement of the two colors interacting with one another share how the year started out yellow, exciting and normal and moved into the gray with uncertainty and overwhelming change of the world around us. The girl’s journey ultimately reverts back to yellow as we take our new normal in stride and look into our future with resilience. 2 TABLE OF CONTENTS Executive Message 4 Take the Lead 22 Transformation Strategy 6 Thank you to our Donors 24 Program Accomplishments FY20 10 Board of Directors 30 Financial Report 20 Our Footprint 31 3 GIRL SCOUT LEADERSHIP EXPERIENCE (GSLE) IN ACTION: GIRL SCOUTS GIVING BACK DURING THE PANDEMIC Making masks for frontline healthcare workers Writing letters to isolated elderly people in retirement communities Organizing food and supply drives for increased at-risk population Staying connected while physically apart EXECUTIVE MESSAGE 4 Working Together to help create the next generation of female leaders. -

Holdings and Weights of the Value Line Dividend

Holdings and Weights of The Value Line Dividend Index as of 10/30/2020 ABB ABB LTD-SPON ADR US 0.53% ABC AMERISOURCEBERGEN CORP US 0.53% ADI ANALOG DEVICES INC US 0.53% ADM ARCHER-DANIELS-MIDLAND CO US 0.53% ADP AUTOMATIC DATA PROCESSING US 0.53% AEE AMEREN CORPORATION US 0.53% AEP AMERICAN ELECTRIC POWER US 0.53% AFL AFLAC INC US 0.53% AGR AVANGRID INC US 0.53% AIZ ASSURANT INC US 0.53% AJG ARTHUR J GALLAGHER & CO US 0.53% ALE ALLETE INC US 0.53% ALL ALLSTATE CORP US 0.53% AMGN AMGEN INC US 0.53% AMT AMERICAN TOWER CORP US 0.53% APD AIR PRODUCTS & CHEMICALS INC US 0.53% ATO ATMOS ENERGY CORP US 0.53% AVA AVISTA CORP US 0.53% AVT AVNET INC US 0.53% AVY AVERY DENNISON CORP US 0.53% AWR AMERICAN STATES WATER CO US 0.53% AXP AMERICAN EXPRESS CO US 0.53% AXS AXIS CAPITAL HOLDINGS LTD US 0.53% AZN ASTRAZENECA PLC-SPONS ADR US 0.53% BCE BCE INC US 0.53% BEN FRANKLIN RESOURCES INC US 0.53% BK BANK OF NEW YORK MELLON CORP US 0.53% BKH BLACK HILLS CORP US 0.53% BLK BLACKROCK INC US 0.53% BMO BANK OF MONTREAL US 0.53% BMY BRISTOL-MYERS SQUIBB CO US 0.53% BNS BANK OF NOVA SCOTIA US 0.53% BOH BANK OF HAWAII CORP US 0.53% CAJ CANON INC-SPONS ADR US 0.53% CAT CATERPILLAR INC US 0.53% CB CHUBB LTD US 0.53% CBOE CBOE GLOBAL MARKETS INC US 0.53% CBSH COMMERCE BANCSHARES INC US 0.53% CHL CHINA MOBILE LTD-SPON ADR US 0.53% CHRW C.H. -

Fidelity ZEROSM Large Cap Index Fund

Quarterly Holdings Report for Fidelity ZEROSM Large Cap Index Fund January 31, 2021 LCX-QTLY-0321 1.9891462.102 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.4% Shares Value COMMUNICATION SERVICES – 11.0% Diversified Telecommunication Services – 1.4% AT&T, Inc. 678,175 $ 19,416,150 Liberty Global PLC: Class A (a) 13,191 318,431 Class C (a) 34,749 839,536 Lumen Technologies, Inc. 94,068 1,164,562 Verizon Communications, Inc. 393,785 21,559,729 43,298,408 Entertainment – 2.3% Activision Blizzard, Inc. 73,574 6,695,234 Electronic Arts, Inc. 27,623 3,955,614 Live Nation Entertainment, Inc. (a) 13,635 906,046 Netflix, Inc. (a) 42,045 22,384,338 Roku, Inc. Class A (a) 10,373 4,035,408 Take‑Two Interactive Software, Inc. (a) 10,958 2,196,531 The Walt Disney Co. 172,301 28,975,859 69,149,030 Interactive Media & Services – 5.7% Alphabet, Inc.: Class A (a) 28,643 52,341,072 Class C (a) 27,594 50,655,410 Facebook, Inc. Class A (a) 228,778 59,100,221 InterActiveCorp (a) 7,546 1,584,283 Match Group, Inc. (a) 18,165 2,540,557 Snap, Inc. Class A (a) 86,961 4,603,715 Twitter, Inc. (a) 75,715 3,825,879 174,651,137 Media – 1.4% Charter Communications, Inc. Class A (a) 13,887 8,437,186 Comcast Corp. Class A 434,551 21,540,693 Discovery Communications, Inc.: Class A (a) (b) 15,124 626,436 Class C (non‑vtg.) (a) 28,193 987,601 DISH Network Corp. -

New Covenant Growth Fund

SCHEDULE OF INVESTMENTS (Unaudited) September 30, 2020 New Covenant Growth Fund Market Value Market Value Description Shares ($ Thousands) Description Shares ($ Thousands) COMMON STOCK — 98.7% COMMON STOCK (continued) Bosnia and Herzegovina — 0.0% Live Nation Entertainment Inc * 181 $ 10 RenaissanceRe Holdings Ltd 248 $ 42 Madison Square Garden Entertainment – Corp * 39 3 Canada — 0.1% Match Group Inc * 1,537 170 Lululemon Athletica Inc * 1,171 386 – Meredith Corp * 1,401 18 Cayman Islands — 0.0% MSG Networks Inc * 2,988 29 Herbalife Nutrition Ltd * 1,088 51 New York Times Co/The, Cl A 439 19 – Ireland — 1.0% Nexstar Media Group Inc, Cl A 455 41 Accenture PLC, Cl A 11,297 2,553 Omnicom Group Inc 10,137 502 Jazz Pharmaceuticals PLC * 616 88 Scholastic Corp 1,266 27 Medtronic PLC 19,976 2,076 Shenandoah Telecommunications Co 222 10 NortonLifeLock Inc 13,065 272 Sirius XM Holdings Inc 7,153 38 Perrigo Co PLC 211 10 Spotify Technology SA * 1,265 307 Take-Two Interactive Software Inc * 830 137 4,999 – TechTarget Inc * 1,986 87 Puerto Rico — 0.0% TEGNA Inc 3,052 36 Popular Inc 1,507 55 – T-Mobile US Inc * 6,009 687 Switzerland — 0.0% Twitter Inc * 7,369 328 Garmin Ltd 1,092 103 Verizon Communications Inc 57,853 3,442 – ViacomCBS Inc, Cl B 1,000 28 United Kingdom — 0.1% Walt Disney Co/The * 26,709 3,314 Healthpeak Properties Inc ‡ 9,384 255 – World Wrestling Entertainment Inc, Cl A 780 32 United States — 97.5% Zillow Group Inc, Cl C * 752 76 Communication Services — 8.3% Zynga Inc, Cl A * 14,448 132 Activision Blizzard Inc 8,807 713 39,734 Alphabet -

Istoxx® Mutb Global Momentum 600 Index

ISTOXX® MUTB GLOBAL MOMENTUM 600 INDEX Components1 Company Supersector Country Weight (%) TESLA Automobiles & Parts United States 0.44 ZOOM VIDEO COMMUNICATIONS A Technology United States 0.38 BEIGENE Health Care Hong Kong 0.29 Z HOLDINGS Technology Japan 0.29 AFTERPAY Financial Services Australia 0.29 ROKU Media United States 0.29 M3 Health Care Japan 0.28 SARTORIUS STEDIM BIOTECH Health Care France 0.28 WAYFAIR CL.A Retail United States 0.27 GAMES WORKSHOP Personal & Household Goods Great Britain 0.27 WUXI BIO Health Care Hong Kong 0.27 SAMHALLSBYGGNADSBOL AGET NORD Real Estate Sweden 0.27 ADVANCED MICRO DEVICES Technology United States 0.27 KESKO Retail Finland 0.27 MicroPort Scien. Health Care Hong Kong 0.26 NETCOMPANY GROUP AS Technology Denmark 0.26 CAPCOM Technology Japan 0.26 NVIDIA Corp. Technology United States 0.26 WHEATON PRECIOUS METALS CORP. Basic Resources Canada 0.25 ROYAL MAIL Industrial Goods & Services Great Britain 0.25 Agnico-Eagle Mines Ltd. Basic Resources Canada 0.25 CENTAMIN Basic Resources Great Britain 0.25 KIRKLAND LAKE GOLD Basic Resources Canada 0.25 WEST PHARM.SVS. Health Care United States 0.25 DOCUSIGN Technology United States 0.25 SINCH Technology Sweden 0.25 SWECO 'B' Construction & Materials Sweden 0.24 TECAN Health Care Switzerland 0.24 NEXTDC Technology Australia 0.24 NIPPON PAINT HOLDINGS Chemicals Japan 0.24 NEXI SPA Industrial Goods & Services Italy 0.24 SHOPIFY A NYS Technology United States 0.24 INSULET Health Care United States 0.24 Bank of Kyoto Ltd. Banks Japan 0.24 Ibiden Co. Ltd. -

MDU RESOURCES GROUP INC (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _____________ to ______________ Commission file number 1-03480 MDU RESOURCES GROUP INC (Exact name of registrant as specified in its charter) Delaware 30-1133956 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 1200 West Century Avenue P.O. Box 5650 Bismarck, North Dakota 58506-5650 (Address of principal executive offices) (Zip Code) (701) 530-1000 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol(s) Name of each exchange on which registered Common Stock, par value $1.00 per share MDU New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒. Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

CSO List Below Is Our List of Publicly Traded U.S

CSO List Below is our list of publicly traded U.S. companies with heads of sustainability based in the U.S. with “Chief Sustainability Officer” included in their title as of March 2021. Company CSO Year Appointed 3M Gayle Schueller 2018 AIG Jennifer Waldner Grant 2019 Allstate Susan L. Lees 2020 Amyris Beth Baker Bannerman 2020 AppHarvest Jackie Roberts 2020 Aramark Ash Hanson 2020 Archer Daniel Midlands Alison Taylor 2017 AT&T Charlene Lake 2009 Ball Corporation Kathleen Pitre 2019 Berkshire Hathaway Amanda Smith 2012 BlackRock Alexis Rosenblum 2019 Blackstone Don Anderson 2011 Boeing Christopher Raymond 2020 Brighthouse Financial David Ward 2020 Bunge Robert Coviello 2019 Capri Holdings Limited Krista Ann McDonough 2016 Citigroup Val Smith 2019 Cognizant Sophia Mendelsohn 2020 Colgate Palmolive Ann Tracy 2020 Comcast Corporation Susan Jin Davis 2016 Corteva Agriscience Anne Alonzo 2020 Covanta Energy Paul Gilman 2008 CVS Health Eileen Howard Boone 2013 Dana Incorporated Douglas Liedberg 2017 DaniMer Scientific Scott Tuten 2020 DICK'S Sporting Goods Peter Land 2020 Dow Mary Draves 2019 Duke Energy Katherine Neebe 2020 DuPont Alexa Dembek 2019 eBay Renee Morin 2020 Ecolab Emilio Tenuta 2019 Emerson Michael Train 2021 Enviva Jennifer Jenkins 2016 Essential Utilities Chris Crockett 2020 Exelon Chris Gould 2010 Extreme Networks Katy Motiey 2020 FedEx Mitch Jackson 2017 CSO List Page 2 Company CSO Year Appointed FMC Corporation Karen Totland 2020 Ford Motor Company Bob Holycross 2019 Fresh Del Monte Produce Hans Sauter 2020 Gap Inc. Julie Gruber 2020 General Mills Mary Jane Melendez 2019 General Motors Dane Parker 2020 Hewlett Packard Enterprise Brian Tippens 2021 Home Depot Ron Jarvis 2020 Honeywell D.