Reporting Instructions for the Electronic Transmission Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introduction of the Euro at the Bratislava Stock Exchange: the Most Frequently Asked Questions

Introduction of the Euro at the Bratislava Stock Exchange: The Most Frequently Asked Questions Starting from the day of the euro introduction, asset values denominated in the Slovak currency are regarded as asset values denominated in the euro currency. How is this stipulation reflected in the conversion of nominal value of shares that form registered capital as well as other securities? Similar to asset values in general, the nominal values of shares that form registered capital and other securities denominated in the Slovak currency are, starting from 1 January 2009, regarded as the nominal values and securities denominated in the euro, based on a conversion and rounding of their nominal values according to a conversion rate and other rules applying to the euro changeover. This condition, however, does not affect the obligation of legal entities to ensure and perform a change, conversion and rounding of the nominal value of shares that form registered capital as well as other securities from the Slovak currency to the euro, in a manner according to the Act on the Euro Currency Introduction in the Slovak Republic and separate legislation. What method is used to convert the nominal value of securities from the Slovak currency to the euro currency? Every issuer of securities denominated in the Slovak currency is obligated to perform the change, conversion and rounding of the nominal value of securities from the Slovak koruna to the euro currency. In the case of equity securities, the conversion of their asset value must be performed simultaneously with the conversion of registered capital. The statutory body of a relevant legal entity is entitled to adopt and carry out the decision on such conversion. -

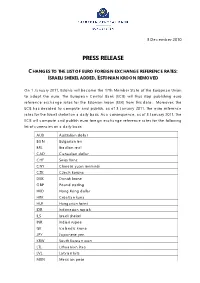

Press Release Changes to the List of Euro Foreign Exchange Reference

3 December 2010 PRESS RELEASE CHANGES TO THE LIST OF EURO FOREIGN EXCHANGE REFERENCE RATES: ISRAELI SHEKEL ADDED, ESTONIAN KROON REMOVED On 1 January 2011, Estonia will become the 17th Member State of the European Union to adopt the euro. The European Central Bank (ECB) will thus stop publishing euro reference exchange rates for the Estonian kroon (EEK) from this date. Moreover, the ECB has decided to compute and publish, as of 3 January 2011, the euro reference rates for the Israeli shekel on a daily basis. As a consequence, as of 3 January 2011, the ECB will compute and publish euro foreign exchange reference rates for the following list of currencies on a daily basis: AUD Australian dollar BGN Bulgarian lev BRL Brazilian real CAD Canadian dollar CHF Swiss franc CNY Chinese yuan renminbi CZK Czech koruna DKK Danish krone GBP Pound sterling HKD Hong Kong dollar HRK Croatian kuna HUF Hungarian forint IDR Indonesian rupiah ILS Israeli shekel INR Indian rupee ISK Icelandic krona JPY Japanese yen KRW South Korean won LTL Lithuanian litas LVL Latvian lats MXN Mexican peso 2 MYR Malaysian ringgit NOK Norwegian krone NZD New Zealand dollar PHP Philippine peso PLN Polish zloty RON New Romanian leu RUB Russian rouble SEK Swedish krona SGD Singapore dollar THB Thai baht TRY New Turkish lira USD US dollar ZAR South African rand The current procedure for the computation and publication of the foreign exchange reference rates will also apply to the currency that is to be added to the list: The reference rates are based on the daily concertation procedure between central banks within and outside the European System of Central Banks, which normally takes place at 2.15 p.m. -

The Lira: Back in the Zone Panel Was Frequently Below the Lower Edge of the Band

February 1997 I,Trends MA~Y It: were frequently realigned. The forward rate in the top The Lira: Back in the Zone panel was frequently below the lower edge of the band. Thus, these narrow target zones were not seen After more than four years, the Italian lira returned as credible by the market. Since reentry, however, the to the Exchange Rate Mechanism (ERM) of the forward rate, as shown in the lower panel, is well European Union (EU) on November 25, 1996. A within the target zone, indicating that market partici- speculative attack had forced the withdrawal of the pants expect the lira to remain within the target lira from the ERM on September 17, 1992. The zones. Thus, the current wide bands appear to be ERM commits member countries to maintain their more credible than the narrower bands of the earlier exchange rates within bilateral bands or target zones period. against all the other currencies. The lira is allowed to Christopher J. Neely fluctuate within margins of 15 percent on both sides of the mid-point of the target zone, known as the central parity, which is 1.0101 DM per 1000 lire for Target Zone, Spot and 1-year Forward Rate the bilateral band with Germany. Although target zones are said to offer the advantages of more stable DM per 1000 Lira exchange rates and greater inflation credibility, the 2.4 primary motivation of the Italian government for rejoining the ERM is the requirement that the lira Target Zone 2.0 remain within the target zone for at least two years before Italy can join the European Monetary Union Spot Rate (EMU). -

THE IMPACT of the EURO ADOPTION on SLOVAKIA Thesis

THE IMPACT OF THE EURO ADOPTION ON SLOVAKIA Thesis by Anna Gajdošová Submitted in Partial Fulfillment of the Requirements for the Degree of Bachelor of Science in Business Administration State University of New York Empire State College 2019 Reader: Tanweer Ali Statutory Declaration / Čestné prohlášení I, Anna Gajdošová, declare that the paper entitled: The Impact of the Euro Adoption on Slovakia was written by myself independently, using the sources and information listed in the list of references. I am aware that my work will be published in accordance with § 47b of Act No. 111/1998 Coll., On Higher Education Institutions, as amended, and in accordance with the valid publication guidelines for university graduate theses. Prohlašuji, že jsem tuto práci vypracovala samostatně s použitím uvedené literatury a zdrojů informací. Jsem vědoma, že moje práce bude zveřejněna v souladu s § 47b zákona č. 111/1998 Sb., o vysokých školách ve znění pozdějších předpisů, a v souladu s platnou Směrnicí o zveřejňování vysokoškolských závěrečných prací. In Prague, 06.08.2019 Anna Gajdošová Acknowledgement I would like to express my special thanks to my mentor, Prof. Tanweer Ali, for his useful advice, constructive feedback, and patience through the whole process of writing my senior project. I would also like to thank my family for supporting me during this whole journey of my studies. Table of Contents Methodology .......................................................................................................................... 8 1. Historical Overview -

The Euro: Internationalised at Birth

The euro: internationalised at birth Frank Moss1 I. Introduction The birth of an international currency can be defined as the point in time at which a currency starts meaningfully assuming one of the traditional functions of money outside its country of issue.2 In the case of most currencies, this is not straightforwardly attributable to a specific date. In the case of the euro, matters are different for at least two reasons. First, internationalisation takes on a special meaning to the extent that the euro, being the currency of a group of countries participating in a monetary union is, by definition, being used outside the borders of a single country. Hence, internationalisation of the euro should be understood as non-residents of this entire group of countries becoming more or less regular users of the euro. Second, contrary to other currencies, the launch point of the domestic currency use of the euro (1 January 1999) was also the start date of its international use, taking into account the fact that it had inherited such a role from a number of legacy currencies that were issued by countries participating in Europe’s economic and monetary union (EMU). Taking a somewhat broader perspective concerning the birth period of the euro, this paper looks at evidence of the euro’s international use at around the time of its launch date as well as covering subsequent developments during the first decade of the euro’s existence. It first describes the birth of the euro as an international currency, building on the international role of its predecessor currencies (Section II). -

Task Force on Economic and Monetary Union Briefing 22 First

Task Force on Economic and Monetary Union Briefing 22 First revision Prepared by the Directorate General for Research Economic Affairs Division The opinions expressed are those of the author, and do not necessarily reflect the position of the European Parliament Although Greece is making remarkable progress towards economic convergence, it remains the only EU country that does not satisfy any of the Maastricht criteria. Luxembourg 28th. April 1998 PE 166.453/rev.1 EMU and Greece Contents Introduction 3 Fulfilment of the Criteria 4 a) Inflation 4 b) Long-term interest rates 5 c) Budget deficit as a percentage of GDP 6 d) Public debt as a percentage of GDP 7 e) Exchange rate stability 9 f) Independence of the Greek Central Bank 9 g) Growth and Unemployment 10 h) Balance of Payments 12 The Political background 13 a) Government policy 13 b) The Opposition 13 c) Industry 13 d) Trade Unions 14 e) Privatization 15 f) The Press 15 g) Public opinion 15 Tables and Charts Table 1: Convergence criteria for Greece 4 Table 2: Gross public debt - structural characteristics 8 Table 3: Sustainability of debt trends 9 Chart 1: Inflation (1990-1999) 5 Chart 2: Long-term interest rates 6 Chart 3: Budget deficits as a percentage of GDP (1990-1999) 7 Chart 4: Public debt as a percentage of GDP (1990-1999) 8 Chart 5: Growth of GDP (1990-1999) 10 Chart 6: Unemployment (1990-1999) 11 Chart 7: Occupation of the labour force in 3 sectors of the economy 11 Chart 8: Balance of payments 12 Authors: Alexandros Kantas and Jérome Durand Editor: Ben Patterson 2 PE 166.453/rev.1 EMU and Greece Introduction On the 25th March the Commission and the European Monetary Institute published their separate reports on progress towards meeting the convergence criteria for Economic and Monetary Union. -

Interview with Director of the Italian State Mint November 14, 2011 by Michael Alexander 2 Comments

Interview with Director of the Italian State Mint November 14, 2011 By Michael Alexander 2 Comments Classic numismatic design has its roots in the ancient states of Athens and Rome. Today, this unparalleled tradition continues in the modern city of Rome at the Instituto Poligrafico Zecca dello Stato (IZPS), the Italian State Mint. As Italy celebrates 150 years of Unification in 2011, Michael Alexander of the London Banknote and Monetary Research Centre speaks to Angelo Rossi, Director of the IPZS about its past present and what’s in store for this prime producer of classical European coinage. For many world coin collectors, the coinage of the many Italian states before unification and those of Italy are considered among some of the most beautifully designed with classic renditions of historic persons, legendary and allegorical figures. Italy’s longest serving head of state, king, Victor Emanuel III (reigned 1900 – 1946) took a particular interest in the coinage of a unified Italy as he was a keen life-long coin collector. The former king’s collection was world renowned for including some of the most extraordinary rarities, (including some of the coins issued under his reign with his portrait) and much of it is on display in the Roman Museum to delight dedicated numismatists. Italian coinage has continued to carry on the long established tradition of classically designed small works of art which can be seen throughout their designs. Should you find yourself in Europe’s Eternal City, I can heartily recommend a visit to the Roman Museum as well as the Temple where the first Mint is said to have existed, a veritable plethora of homage to our beloved activity. -

European and International Constraints on Irish Fiscal Policy, By

2. EUROPEAN AND INTERNATIONAL CONSTRAINTS ON IRISH FISCAL POLICY Patrick Honohan* 2.1 In a world of increasing interdependence, fiscal autonomy of individual Introduction nations has increasingly been constrained. Ireland is no exception. Yet it is possible to exaggerate the degree to which fiscal autonomy has been lost. The purpose of my talk today is to explore some of the dimensions of external constraints on fiscal policy, focusing on the role of the European Union, other international governmental pressures, and international market pressures. It is convenient to distinguish between two rather different types of constraint: those that limit a government's flexibility in setting tax rates, and those that limit a government's ability to run a temporary deficit.1 I will argue that, despite the considerable recent focus on our European Union commitments as a constraint on aggregate fiscal policy, these have so far been of much less importance than the EU's influence on tax rates and tax design. International governmental pressures on tax rates are also growing in importance. Market forces can provide the most decisive of constraints but, so far as policy on the overall budgetary stance is concerned, these may have reached their full extent – indeed may have actually declined – though they will continue to grow so far as tax rates are concerned. The most spectacular European Union initiative in the area of fiscal 2.2 policy has undoubtedly been the Maastricht criteria for Economic and Deficits Monetary Union (EMU) membership. Suddenly, and more or less out of * The views expressed are strictly personal and do not reflect those of the World Bank. -

Development of a Knowledge Based Decision Support System for Private Sector Participation in Water and Sanitation Utilities

FORSCHUNGS- UND ENTWICKLUNGSINSTITUT FÜR INDUSTRIE- UND SIEDLUNGSWASSERWIRTSCHAFT SOWIE ABFALLWIRTSCHAFT E.V. STUTTGART Carla Gonçalves Pinheiro Böhl Development of a Knowledge Based Decision Support System for Private Sector Participation in Water and Sanitation Utilities KOMISSIONSVERLAG OLDENBOURG INDUSTRIEVERLAG GMBH, MÜNCHEN 2007 D93 Bibliographische Information Der Deutschen Bibliothek Die Deutsche Bibliothek verzeichnet die Publikation in der Deutschen Nationalbibliographie; detaillierte bibliographische Daten sind im Internet über http://dnb.ddb.de abrufbar Carla Gonçalves Pinheiro Böhl Development of a Knowledge Based Decision Support System for Private Sector Participation in Water and Sanitation Utilities Forschungs- und Entwicklungsinstitut für Industrie- und Siedlungswasserwirtschaft sowie Abfallwirtschaft e.V. Stuttgart (FEI). München: Oldenbourg Industrieverlag GmbH, 2007. (Stuttgarter Berichte zur Siedlungswasserwirtschaft; Bd. 189) Zugl.: Stuttgart, Univ., Diss., 2007 ISBN 978-3-8356-3137-3 ISBN 978-3-8356-3137-3 © 2007 Alle Rechte vorbehalten Satz: Institut für Siedlungswasserbau, Wassergüte- und Abfallwirtschaft der Universität Stuttgart Bandtäle 2, 70569 Stuttgart (Büsnau) Druck: medien-fischer.de GmbH, Benzstr. 3, 70736 Fellbach Printed in Germany ACKNOWLEDGEMENTS As a Doctoral Candidate of the Faculty of Engineering of the University of Stuttgart (Germany) enrolled in the International Doctoral Program Environment Water (ENWAT) and the person authoring this dissertation, I wish to express my grateful thanks to Prof. Rott (University of Stuttgart) for his guidance and assistance during the research. Prof. Vermeer (University of Stuttgart) helped the research get started. Very special thanks are due to Prof. Marx (University of Stuttgart) and Prof. Bárdossy (University of Stuttgart): their explanations on how to model using composite programming have been most useful. Prof. David Stephenson (University of Botswana) for his invaluable inputs. -

Regional and Global Financial Safety Nets: the Recent European Experience and Its Implications for Regional Cooperation in Asia

ADBI Working Paper Series REGIONAL AND GLOBAL FINANCIAL SAFETY NETS: THE RECENT EUROPEAN EXPERIENCE AND ITS IMPLICATIONS FOR REGIONAL COOPERATION IN ASIA Zsolt Darvas No. 712 April 2017 Asian Development Bank Institute Zsolt Darvas is senior fellow at Bruegel and senior research Fellow at the Corvinus University of Budapest. The views expressed in this paper are the views of the author and do not necessarily reflect the views or policies of ADBI, ADB, its Board of Directors, or the governments they represent. ADBI does not guarantee the accuracy of the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with ADB official terms. Working papers are subject to formal revision and correction before they are finalized and considered published. The Working Paper series is a continuation of the formerly named Discussion Paper series; the numbering of the papers continued without interruption or change. ADBI’s working papers reflect initial ideas on a topic and are posted online for discussion. ADBI encourages readers to post their comments on the main page for each working paper (given in the citation below). Some working papers may develop into other forms of publication. Suggested citation: Darvas, Z. 2017. Regional and Global Financial Safety Nets: The Recent European Experience and Its Implications for Regional Cooperation in Asia. ADBI Working Paper 712. Tokyo: Asian Development Bank Institute. Available: https://www.adb.org/publications/regional-and-global-financial-safety-nets Please contact the authors for information about this paper. Email: [email protected] Paper prepared for the Conference on Global Shocks and the New Global/Regional Financial Architecture, organized by the Asian Development Bank Institute and S. -

The Greek Anomaly: Three Bailouts and a Continuing Crisis

THE GREEK ANOMALY: THREE BAILOUTS AND A CONTINUING CRISIS by MARKOS BEYS PAPACHRISTOU Submitted in partial fulfillment of the requirements for the degree of Master of Arts Thesis Adviser: Professor Elliot Posner Department of Political Science CASE WESTERN RESERVE UNIVERSITY January, 2017 CASE WESTERN RESERVE UNIVERSITY SCHOOL OF GRADUATE STUDIES We hereby approve the thesis/dissertation of Markos Beys Papachristou candidate for the degree of Master of Arts * Committee Chair: Elliot Posner Committee Member: Peter Moore Committee Member: Joseph White Date of Defense: December 9, 2016 * We also certify that written approval has been obtained for any proprietary material contained therein. To my Parents Christos and Patricia Papachristou Table of Contents 1. Introduction.......................................................................................................................1 2. Origins and Causes of the Greek Crisis.............................................................................7 2.1 Issues with the Greek Politics and Economics...........................................................7 2.2 Economics of the Greek Debt...................................................................................14 3. EU – ECB – IMF Bailouts of Greece..............................................................................20 3.1 Bailouts and Austerity Measures..............................................................................20 3.2 Cost of Austerity.......................................................................................................28 -

The Future of the Euro: the Options for Finland

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Kanniainen, Vesa Article The Future of the Euro: The Options for Finland CESifo Forum Provided in Cooperation with: Ifo Institute – Leibniz Institute for Economic Research at the University of Munich Suggested Citation: Kanniainen, Vesa (2014) : The Future of the Euro: The Options for Finland, CESifo Forum, ISSN 2190-717X, ifo Institut - Leibniz-Institut für Wirtschaftsforschung an der Universität München, München, Vol. 15, Iss. 3, pp. 56-64 This Version is available at: http://hdl.handle.net/10419/166578 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Special The think tank held that the foreseen political union THE FUTURE OF THE EURO: including the banking union and fiscal union will push THE OPTIONS FOR FINLAND the eurozone towards a sort of practical federal state, referred to as the ‘weak federation’.