Transfer Pricing Considerations in Light of COVID-19 – a Dialogue with Regulator 14 July 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Welcome Address by President Tony Tan Keng Yam at The

WELCOME ADDRESS BY PRESIDENT TONY TAN KENG YAM AT THE TEA RECEPTION FOR TEAM SINGAPORE ATHLETES AND OFFICIALS OF THE RIO 2016 OLYMPIC AND PARALYMPIC GAMES ON SATURDAY 19 NOVEMBER 2016, 3.30PM AT ISTANA Ms Grace Fu Minister for Culture, Community and Youth Mr Tan Chuan-Jin Minister for Social and Family Development Members of the Singapore National Olympic Council and Singapore National Paralympic Council Team Singapore athletes, Care-givers, Coaches and Officials Ladies and Gentlemen Good afternoon I am happy to host today’s reception for our Team Singapore contingent. Congratulations to all of you for the outstanding performance at the Rio 2016 Olympic and Paralympic Games! In Rio, we witnessed several monumental achievements – a first ever Gold medal from Joseph Schooling at the Olympics; two Gold medals from Yip Pin Xiu and a Bronze medal from Theresa Goh at the Paralympics. This was the most successful Olympic and Paralympic Games in the history of Team Singapore. You have certainly done Singapore proud on the world’s biggest sporting stage. Beyond these achievements, I also want to commend everyone for your strong effort. Qualifying for the Olympics or Paralympics is itself an extraordinary achievement. It takes years of hard work, commitment and perseverance to train, and ultimately, compete against the best athletes in the world. I had the opportunity to meet and interact with some of you during your training sessions earlier this year. What I sensed then was your tremendous determination to do your best, and do Singapore proud in Rio. It is this strength of character in each and every one of you which embodies the spirit of the Games, and continues to inspire all of us. -

Transformation

MCI (P) 114/11/2018 1 DIRECTORS BULLETIN Quarter 3, 2019 GETTING ON BOARD TRANSFORMATION Board Realising Should Tax Transformation: Digital Ambition Keep Pace with BOD 2.0 Changing to Through Talent Transformation Stay Ahead and Culture – or Shape it? Page 38 Page 46 Page 52 SID DIRECTORS BULLETIN 2019 Q3 2 SID DIRECTORS CONFERENCE 2019 Today, we live in an era of transformation, in an age of astonishing possibilities, sudden breakthroughs and social and political upheavals. Businesses have to respond to unexpected change on many fronts – including climate change, consumer behaviour, demographics, culture, and trade. In this conference, we seek to examine how businesses can reimagine and adapt organisational strategies, policies and processes to produce a mindset change beyond technological developments. Participants will have opportunities to network, interact and engage with industry leaders in carefully curated topics at the three dedicated breakout tracks. Wednesday, 11 September 2019 Suntec Singapore Convention & Exhibition Centre GUEST OF HONOUR PLENARY SPEAKERS W. Chan Kim Chris Wei Charles Ormiston Mr Ong Ye Kung The BCG Chair Professor of INSEAD Business School Executive Chairman, Aviva Asia & Digital Partner, Bain & Company Minister for Education - Co-author of Blue Ocean Strategy - Global leader and digital trailblazer - Transformational change adviser BREAKOUT TRACKS • Technology - presented by NCS • Strategy - co-presented by Google & SAI Global • Connectivity - presented by Huawei CONFERENCE FEES EARLY BIRD REGULAR all fees are inclusive of GST ends 31 July 2019 SID MEMBER S$513.60 S$727.60 NON-SID MEMBER S$834.60 S$1,048.60 Register Today at www.sid.org.sg/conference2019 Organised By: Supported By: SID DIRECTORS BULLETIN 2019 Q3 SID DIRECTORS BULLETIN 2019 Q3 DIRECTIONS 3 On Board with Transformation By PAULINE GOH DIRECTIONS Chair, SID Bulletin Committee It’s a truism that change is all around us. -

Table of Content Table Des Matières

1 www.natation.ca TABLE OF CONTENT TABLE DES MATIÈRES THE SPORT OF SWIMMING / LE SPORT DE LA NATATION Origins of the Paralympic Games/ p.5 Origines des Jeux Paralympiques The Sport / Le Sport p.7 SWIMMING CANADA / NATATION CANADA About Swimming Canada / p.13 À propos de Natation Canada The Sport of Swimming Vision / Mission Laymans Guide to Classification / Guide d’interprétation des classifications à l’intention du profane p.17 Le sport de la natation BIOGRAPHY / BIOGRAPHIE Women’s Bios / Biographie des femmes p.23 Men’s Bios / Biographie des hommes p.57 Coaches / Entraîneurs p.71 Staff / Personnel Media Contact / Contact pour les médias p.77 STATISTICS / STATISTIQUES Canadian Records / Records canadiens World Records / Records du monde p.81 Medals won at the Paralympic Games / p.130 Médailles remportées aux Jeux Paralympiques SCHEDULE / HORAIRE Competition Schedule & Who to watch / Horaire des épreuves p.133 www.swimming.ca 2 3 Paralympics Profile History of the Paralympics The Paralympic movement began back in 1948 when Sir Ludwig Guttman organized a sports competition involving World War II veterans with a spinal cord injury in Stoke, Mandeville, England. In 1952, the Netherlands joined the competition and an international movement was born. The very first Olympic style Games for athletes with a disability were organized in Rome in 1960. In Toronto in 1976, other disability groups, other than spinal cord injuries, were added and the idea of merging various disability groups for international sport competitions began. In the same year, the first Paralympic Winter Games took place in Sweden. Today, the Paralympics are elite sport events for athletes from six different disability groups. -

Yip Pin Xiu (Para Swimming)

146 GAMEGAMAAMME FORF ORO LIFLILIFE: 25 JOURNEYS IN HER ELEMENT 147 19 IN HER ELEMENT Para-swimmer YIP PIN XIU made sports history when she clinched gold for Singapore at the 2008 Beijing Paralympics. But this remarkable victory belies a debilitating and deteriorating condition that threatens her future in sports. Still, the optimistic 21-year-old believes in doing her best to overcome all odds. hen Yip Pin Xiu slips from her wheelchair into the water, she W does it like it is the most natural thing in the world. In the pool, she propels effortlessly through the water with each forceful backstroke. “It may sound clichéd, but I truly belong in the water. I can walk, do handstands and perform somersaults. It is only in the water that I can move freely and do whatever anyone else can do,” says Pin Xiu, who was diagnosed with hereditary sensorimotor neuropathy when she was just two, after an aunt noticed that she could not seem to fl ex her ankles. A form of muscular dystrophy, the condition causes nerve functions and muscles to progressively deteriorate over time. Since Pin Xiu was 13, she has 148 GAME FOR LIFE: 25 JOURNEYS IN HER ELEMENT 149 been wheelchair-bound. Now 21, she is gradually losing control of motor able-bodied kid”. So, she was allowed to join the class. “The fi rst time I swam, skills in her wrist and grip. The vision in her left eye is blurring. I didn’t even have a swimming costume! I just went into the water in a dress,” It is no wonder she finds reprieve in the water. -

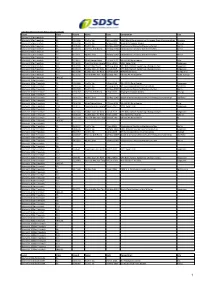

Para Swimming National Record (Long Course) Event Class Record

Para Swimming National Record (Long Course) Event Class Record Name Date Competition City Women's 50m Freestyle S1 Women's 50m Freestyle S2 01:01.00 Yip Pin Xiu 30-Apr-2016 2020 World Para Swimming European Open Championships Madeira Women's 50m Freestyle S3 00:57.04 Yip Pin Xiu 6-Sep-2008 Beijing Paralympic Games Beijing Women's 50m Freestyle S4 01:05.06 Yip Pin Xiu 24-May-2007 International Deutsche Meisterschaften Berlin Women's 50m Freestyle S5 00:43.20 Theresa Goh Rui Si 22-May-2008 International Deutsche Meisterschaften Berlin Women's 50m Freestyle S6 Women's 50m Freestyle S7 00:53.71 Ng Xiu Zhen 24-May-2007 International Deutsche Meisterschaften Berlin Women's 50m Freestyle S8 Women's 50m Freestyle S9 00:38.27 Shick Emma Dione 17-Dec-2011 6th ASEAN Para Games Solo Women's 50m Freestyle S10 00:46.03 Tong Jing Xuan Janelle 19-Jan-2021 SDSC Swim Trial Singapore Women's 50m Freestyle S11 01:37.65 Chiam Shermaine 27-Aug-2016 SPH National Incl Swimming Championships Singapore Women's 50m Freestyle S12 00:38.10 Sophie Soon Jin Wen 14-Jul-2015 SPH National Incl Swimming Championships Singapore Women's 50m Freestyle S13 00.34.78 Sophie Soon Jin Wen 15-Feb-2019 WPS World Series Melbourne Women's 50m Freestyle S14 00:30.58 Danielle Moi Yan Ting 18 Sept 2017 9th ASEAN Para Games Kuala Lumpur Women's 50m Freestyle INAS II3 Women's 100m Freestyle S1 Women's 100m Freestyle S2 02:11.86 Yip Pin Xiu 4-Dec-2015 8th ASEAN Para Games Singapore Women's 100m Freestyle S3 02:07.56 Yip Pin Xiu 12-Aug-2013 IPC Swimming World Championships Montreal Women's -

Theresa and the Four Trials

Theresa and the four trials by Claire Delahunty Athens, Greece. 2004 Theresa had never flown on an airplane for so long in her life! She was nervous to travel so far from Singapore, her little home country. Athens was a long way from her mum and dad and her little brother and sister, too. She was seventeen years old. At school, she was one of the big kids. She felt confident with her friends around her, and she knew the swimming pool she trained in like the back of her hand. This was different. She was relieved to be with her team-mates—other athletes going to compete, like her, at the Paralympic Games in Greece! Theresa’s wheelchair was stowed away, and by the time she wheeled off the plane, she would be in another country! She shifted around in her seat to get comfortable, rolling the powerful swimming muscles of her shoulders. Theresa was born with damage to her spine, and her legs had never worked like other kids’ legs. But that had never slowed her down. She had tried all sorts of sports, and discovered swimming was the best one of all. She was weightless and speedy in the water. And now she was going to test that strength and speed at a big competition. The Paralympic Village, where all the athletes stayed, was bustling. She couldn’t believe she was under the same roof as so many talented people. Some of them held world records! All of them had some sort of disability, but they achieved amazing things with their bodies. -

2009 IWAS World Games, Bangalore, India

Results book 2009 IWAS World Games, Bangalore, India IWAS WORLD GAMES 2009 Bangalore, India FINAL MEDAL TABLE R COUNTRY CODE GOLD SILVER BRONZE TOTAL 1 China CHN 47 18 6 71 2 India IND 32 38 40 110 3 Thailand THA 26 18 17 61 4 Germany GER 21 11 5 37 5 Russia RUS 9 15 14 38 6 Algeria ALG 8 2 5 15 7 Iraq IRQ 6 8 7 21 8 Saudi Arabia KSA 6 7 4 17 9 Czech Republic CZE 6 6 0 12 10 South Africa RSA 5 3 4 12 11 Croatia CRO 5 1 1 7 12 Malaysia MAS 4 7 10 21 13 Slovakia SVK 4 7 3 14 14 Brazil BRA 4 5 6 15 15 Philippines PHI 4 4 2 10 16 Bulgaria BUL 4 4 0 8 17 Kenya KEN 3 4 5 12 18 Chinese Taipei TPE 3 2 4 9 19 Austria AUT 3 1 3 7 20 Singapore SGP 3 1 3 7 21 Korea KOR 2 4 5 11 22 Poland POL 2 2 5 9 23 Macau MCH 2 2 1 5 24 Azerbaijan AZE 2 1 0 3 25 Finland FIN 2 1 0 3 26 France FRA 2 0 0 2 27 Latvia LAT 2 0 0 2 28 UAE UAE 1 6 10 17 29 Nepal NPL 1 3 2 6 30 Kuwait KUW 1 2 5 8 31 Japan JPN 1 2 2 5 32 Serbia SRB 1 2 1 4 33 Cyprus CYP 1 2 0 3 34 Great Britain GBR 1 2 0 3 35 Lithuania LTU 0 2 1 3 36 Greece GRC 0 2 0 2 37 New Zealand NZL 0 2 0 2 38 Qatar QAT 0 1 3 4 39 Portugal POR 0 1 0 1 40 Sweden SWE 0 0 4 4 41 Norway NOR 0 0 1 1 42 Belarus BLR 0 0 0 0 Archery IWAS WORLD GAMES ARCHERY RESULTS 70 METRE ROUND W2 Recurve 1 Tseng Lung-Hui TPE 597 2 Chen Wu-Ying TPE 534 3 Tang Wen-Chieh TPE 520 4 Amol Boriwale IND 374 5 Sadhana Malik IND 80 Standing Recurve 1 Francisco Dantas BRA 575 2 Ranbir Singh IND 560 3 Salam Lukwanlakp IND 524 4 Dinesh Balgopal IND 381 5 Rajkumar IND 355 6 Asif Mohamad IND 348 Open Compound 1 Lee Ouk-Soo KOR 685 2 Andrey Muniz BRA 668 3 Go Sung-Kil KOR 665 4 Kweon Hyun-Ju KOR 663 5 Mangesh Kuttikar IND 497 30 metre round Development event Somshekara 1 Puttannnaiah IND 256 Najundrao 2 Lakshmanrao IND 252 Majunath 3 Gangadarppa IND 162 4 Kumar Prashant IND 42 Athletics IWAS World Games 2009 Bangalore - Kanteerava Stadium Result list Men 100 m men +1,3 26.11.2009 Final T42 1. -

IPC Swimmer Ranking From02.01.01-To03.12.28

IPC Swimmer Ranking From02.01.01-To03.12.28 IPC sex 種目 距離 クラス ランク Time Name Country Date Place IPC0402 Wo Fr 50m S1 1 01:19.65 Danielle Watts Great Britain 03/11/28 Swansea IPC0402 Wo Fr 50m S1 2 2:07.97* Jennifer Johnson USA 02/12/10 Mar del Plata IPC0402 Wo Fr 50m S1 3 02:13.47 Efi Gaitanidou Greece 02/12/10 Mar del Plata IPC0402 Wo Fr 50m S2 1 01:27.27 Sara Carracelas Spain 02/12/10 Mar del Plata IPC0402 Wo Fr 50m S2 2 01:29.84 Maria Kalpakidou Greece 02/06/29 Athens IPC0402 Wo Fr 50m S2 3 01:31.25 Virginia Hernandez Mexico 02/07/26 Almendralejo IPC0402 Wo Fr 50m S2 4 01:35.79 Betiana Basualdo Argentina 02/12/10 Mar del Plata IPC0402 Wo Fr 50m S2 5 01:42.35 Alejandra Perezlindo Argentina 03/12/06 Mar del Plata IPC0402 Wo Fr 50m S2 6 01:58.99 Katarzyna Mielczarek Poland 03/08/28 Brno IPC0402 Wo Fr 50m S3 1 00:57.48 Penny Clapcott Great Britain 03/11/28 Swansea IPC0402 Wo Fr 50m S3 2 01:04.43 Patricia Valle Mexico 02/12/10 Mar del Plata IPC0402 Wo Fr 50m S3 3 01:04.61 Annke Conradi Germany 02/06/23 Berlin IPC0402 Wo Fr 50m S3 4 01:06.71 Fran Williamson Great Britain 02/12/10 Mar del Plata IPC0402 Wo Fr 50m S3 5 01:10.75 Susana Barroso Portugal 02/12/10 Mar del Plata IPC0402 Wo Fr 50m S3 6 01:11.47 Jana Hoffmanova Czech Republic 02/06/23 Berlin IPC0402 Wo Fr 50m S3 7 01:13.64 Amaia Zuazua Spain 02/12/10 Mar del Plata IPC0402 Wo Fr 50m S3 8 01:16.25 Perpetua Vaza Portugal 03/08/28 Brno IPC0402 Wo Fr 50m S3 9 01:18.00 Sonia Guirado Spain 02/07/26 Almendralejo IPC0402 Wo Fr 50m S3 10 01:18.45 Beth Kolbe USA 03/11/29 Indianapolis IPC0402 Wo -

May 2019. Let’S Show Them They Are NOT Alone on Home Ground

September 2016. Theresa Goh won her first Paralympic medal, landing Singapore 46th out of 83 nations. We celebrated her never-give-up spirit, as told by her fellow team mate and Paralympic Gold medalist, Yip Pin Xiu. Singapore 2019 World Para Swimming World Series. May 2019. Let’s show them they are NOT alone on home ground. A World-Class Event on this Little Red Dot From 10 to 12 May 2019, Singapore would lock its global reputation as we stage the 1st Asian edition of the World Para Swimming World Series. Singapore is the fifth leg of this Series and the only Asian host of this prestigious event, which has travelled to countries like the United Kingdom, Australia, United States of America and Germany. More than 100 top swimmers from all over the world would be descending on our shores for this event. Their results will put them on the qualification path for Tokyo 2020 Paralympic Games, equal to the Olympics for athletes with disability. Amongst them would be our homeboys and girls who have blazed the trail for sports in Singapore: YIP PIN XIU 2-time Paralympic Medalist (Beijing 2008, Rio 2016) Youngest Nominated Member of Parliament THERESA GOH Paralympic Medalist (Rio 2016) Most internationally bemedaled athlete in Singapore’s disability sports history TOH WEI SOONG Commonwealth Games Medalist (Gold Coast 2018) Singapore’s 1st Commonwealth swimming gold Let’s welcome the world to Singapore. The Singapore brand, for you and us. Be our Presenter Sponsor / Diamond Sponsor / Official Partner More than 200 ground staff and volunteers are involved in the planning and delivery of this milestone event. -

China MICE Workshop

TNZ’s Asia Strategy • “Get China Right” by growing – FIT leisure – Mono NZ group leisure – Incentives • Build sustainable demand from South & South East Asia • Recover Japan & Korea There’s a long way to go, but we’re getting… ‘China Right’ Chinese visitors for the six months July-Dec 2012 (cross-referencing several information sources) compared to the same six month period in 2011: July-Dec July-Dec 11 12 Proportion of group visitors 63.9% 61.5% Proportion of ADS dual visitors 48.3% 45.5% Proportion of ADS mono and ADS premium dual (long stay or 5.9% 7.2% South Island) Proportion of independent holiday 14.9% 18.1% % of “quality” Chinese holiday visitors (i.e. ADS mono + ADS premium dual + general group + independent holiday) 21.8% 27.2% International Visitor Survey Regions Stayed Overnight (Current Year End) Arrivals, Year Ended Jan 2013 Thailand Taiwan Singapore Philippines Malaysia Korea, Republic of Japan Indonesia India Hong Kong (SAR) China, People's Republic of -30.0 -20.0 -10.0 0.0 10.0 20.0 30.0 % change Asian MICE Outlook “Despite a challenging worldwide economic environment, the meetings, incentive, conference and events industry in China and Asia is rapidly expanding” China & Asia Meetings Industry Research Report TNZ Incentive Plan China Market and position New Zealand as an attractive and compelling business events destination internationally Destination marketing campaign Keyword testing in SEM currently driving to translated MICE page on Business Events website Advertising in key MICE publications utilising dedicated Business -

Asean Para Games (APG) Bow, Is Inching Slowly but Surely Towards Her Ultimate Goal

Sophie’s motto in life is that if you want something, you need to work hard for it. When Singapore swimmer Sophie Soon was 12, she was asked in a school oral examination what she could do if she could swim. "Save lives," she replied at first, before wishfully adding: "Represent Singapore at the Paralympics." Six years on, the visually impaired swimmer who will be making her Asean Para Games (APG) bow, is inching slowly but surely towards her ultimate goal . And it was all possible because, despite her rapidly deteriorating vision, Sophie dared to dream - Big. Sophie will be making her Asean Para Games debut in swimming this week. She aims to The Nanyang Polytechnic student was continue training hard to go for as many competitions as she can and, hopefully, qualify for the diagnosed with cone rod dystrophy at the age Paralympics. ST PHOTO: ALPHONSUS CHERN of five, when her parents realised she was always holding objects close to her eyes. when I was nine," said Sophie, who performed train hard and go for as many competitions as I The condition leads to the loss of cone cells in alongside local band The Sam Willows at last can, and try to qualify for the Paralympics." the retina responsible for central and colour year's President's Star Charity. Because by now Sophie knows well enough vision. Part of it was down to a lack of personal there is only one way if she wants to get Now, when she looks straight, she sees coaching. At eight, she joined a swimming something. -

ANNUAL REPORT Lifecoursecentre 2014

ANNUAL REPORT lifecoursecentre 2014 ARC Centre of Excellence for Children and Families over the Life Course lifecoursecentre.org.au The Life Course Centre The ARC Centre of Excellence for Children and Families over the Life Course acknowledges the support of the Australian Research Council We acknowledge the financial and in-kind support provided by our collaborating organisations and our Partner Organisations (see back cover) contents Introduction 3 Director’s report 4 Highlights 6 Governance and structure 11 Staff and students 14 Research programs 29 Activity plan 45 Appendices 54 “the changing dynamics of households and families, particularly in the last 30 years or so, have important ramifications for understanding changing patterns of inequality and planning effective social policy responses. the Life course centre will deepen our understanding of disadvantage and provide a launch pad for new approaches in policy and practice that will make a genuine difference in people’s lives” Preventing deep disadvantage: Realising life’s potential Prof Janeen Baxter Centre Director IntRoductIon The ARC Centre of Excellence for Children and Families over the Life Course (Life Course Centre) is investigating the critical factors underlying disadvantage to provide life-changing solutions for policy and service delivery. We aim to identify the drivers of disadvantage, characterised by the spread of social and economic poverty within families and across generations, and to develop innovative solutions to reduce disadvantage. The Life Course Centre will Vision and Mission »» Identify the drivers of deep and persistent disadvantage Vision »» Develop and trial new solutions in policy and practice Preventing deep disadvantage, realising life’s potential »» Train the next generation of research leaders »» Build capacity across government, researchers and non- Mission government organisations To identify the mechanisms underlying the transmission of disadvantage across generations and within families over the life course.