Global Online Gaming Trends

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Achieve Your Vision

ACHIEVE YOUR VISION NE XT GEN ready CryENGINE® 3 The Maximum Game Development Solution CryENGINE® 3 is the first Xbox 360™, PlayStation® 3, MMO, DX9 and DX10 all-in-one game development solution that is next-gen ready – with scalable computation and graphics technologies. With CryENGINE® 3 you can start the development of your next generation games today. CryENGINE® 3 is the only solution that provides multi-award winning graphics, physics and AI out of the box. The complete game engine suite includes the famous CryENGINE® 3 Sandbox™ editor, a production-proven, 3rd generation tool suite designed and built by AAA developers. CryENGINE® 3 delivers everything you need to create your AAA games. NEXT GEN ready INTEGRATED CryENGINE® 3 SANDBOX™ EDITOR CryENGINE® 3 Sandbox™ Simultaneous WYSIWYP on all Platforms CryENGINE® 3 SandboxTM now enables real-time editing of multi-platform game environments; simul- The Ultimate Game Creation Toolset taneously making changes across platforms from CryENGINE® 3 SandboxTM running on PC, without loading or baking delays. The ability to edit anything within the integrated CryENGINE® 3 SandboxTM CryENGINE® 3 Sandbox™ gives developers full control over their multi-platform and simultaneously play on multiple platforms vastly reduces the time to build compelling content creations in real-time. It features many improved efficiency tools to enable the for cross-platform products. fastest development of game environments and game-play available on PC, ® ® PlayStation 3 and Xbox 360™. All features of CryENGINE 3 games (without CryENGINE® 3 Sandbox™ exception) can be produced and played immediately with Crytek’s “What You See Is What You Play” (WYSIWYP) system! CryENGINE® 3 Sandbox™ was introduced in 2001 as the world’s first editor featuring WYSIWYP technology. -

Dodge Brand Launches New TV Commercial and Social Gaming Sweepstakes in Conjunction with Syfy and Trion Worlds ‘Defiance’ Partnership

Contact: Eileen Wunderlich Dodge Brand Launches New TV Commercial and Social Gaming Sweepstakes in Conjunction with Syfy and Trion Worlds ‘Defiance’ Partnership Co-branded television spot launches May 20, coinciding with first appearance of Dodge Chargers as hero vehicles in the ‘Defiance’ TV program airing Mondays at 9 p.m. on Syfy 30-second ‘Dodge Charger | Defiance’ ad follows the vehicle’s endurance from present day to the 2046 transformed planet Earth featured in TV show 'Dodge Defiance Arkfall Sweepstakes,’ launching May 24 at www.DodgeDefiance.com,includes social gaming component allowing fans to compete against one another and share stories on Facebook Weekly prizes awarded with one grand prize of trip for two to world’s largest pop culture event May 19, 2013, Auburn Hills, Mich. - The Dodge brand is extending its partnership with Syfy and Trion Worlds on the “Defiance” television show and online video game with a new television commercial and social gaming sweepstakes. As the exclusive automotive sponsor, the Dodge brand “Defiance” partnership includes vehicle integrations in the TV show (Dodge Charger) and online video game (Dodge Challenger) as well as custom co-branded advertising and promotions crossing multiple media platforms, including television, digital, social media, mobile, gaming and on- demand. “Defiance” allows Dodge a prime opportunity to speak to its socially engaged customers. The co-branded TV commercial, titled ‘Dodge Charger | Defiance,’ debuts May 20, in conjunction with the first appearance of the Dodge Charger as the hero vehicle driven by main character Nolan (Grant Bowler), the city of Defiance lawkeeper. The 30-second spot shows the endurance of the Charger as it survives obstacles in a changing world, ending with a transformed planet Earth in the year 2046 where “only the defiant survive.” The spot will be posted on the brand's YouTube page,www.youtube.com/dodge. -

UNO Template

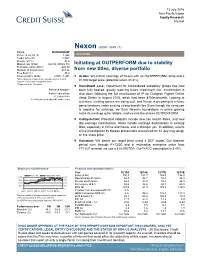

13 July 2016 Asia Pacific/Japan Equity Research Internet Nexon (3659 / 3659 JT) Rating OUTPERFORM* Price (12 Jul 16, ¥) 1,444 INITIATION Target price (¥) 1,900¹ Chg to TP (%) 31.6 Market cap. (¥ bn) 629.93 (US$ 6.10) Initiating at OUTPERFORM due to stability Enterprise value (¥ bn) 440.12 Number of shares (mn) 436.24 from new titles, diverse portfolio Free float (%) 35.0 52-week price range 2,065 - 1,401 ■ Action: We initiate coverage of Nexon with an OUTPERFORM rating and a *Stock ratings are relative to the coverage universe in each ¥1,900 target price (potential return 31.6%). analyst's or each team's respective sector. ¹Target price is for 12 months. ■ Investment case: Impairment for consolidated subsidiary gloops has now Research Analysts been fully booked, greatly reducing future impairment risk. Amortization is Keiichi Yoneshima also down following the full amortization of IP for Dungeon Fighter Online 81 3 4550 9740 (Arad Senki) in August 2015, which had been ¥700mn/month. Looking at [email protected] revenues, existing games are doing well, and Nexon is preparing to release game iterations under existing strong brand titles. Even though the rising yen is negative for earnings, we think Nexon’s foundations in online gaming make its earnings quite reliable, and we rate the shares OUTPERFORM. ■ Catalysts/risk: Potential catalysts include new title launch dates, and new title earnings contributions. Risks include earnings deterioration in existing titles, especially in China and Korea, and a stronger yen. In addition, results of the investigation by Korean prosecutors announced on 12 July may weigh on the share price. -

Ubisoft Studios

CREATIVITY AT THE CORE UBISOFT STUDIOS With the second largest in-house development staff in the world, Ubisoft employs around 8 000 team members dedicated to video games development in 29 studios around the world. Ubisoft attracts the best and brightest from all continents because talent, creativity & innovation are at its core. UBISOFT WORLDWIDE STUDIOS OPENING/ACQUISITION TIMELINE Ubisoft Paris, France – Opened in 1992 Ubisoft Bucharest, Romania – Opened in 1992 Ubisoft Montpellier, France – Opened in 1994 Ubisoft Annecy, France – Opened in 1996 Ubisoft Shanghai, China – Opened in 1996 Ubisoft Montreal, Canada – Opened in 1997 Ubisoft Barcelona, Spain – Opened in 1998 Ubisoft Milan, Italy – Opened in 1998 Red Storm Entertainment, NC, USA – Acquired in 2000 Blue Byte, Germany – Acquired in 2001 Ubisoft Quebec, Canada – Opened in 2005 Ubisoft Sofia, Bulgaria – Opened in 2006 Reflections, United Kingdom – Acquired in 2006 Ubisoft Osaka, Japan – Acquired in 2008 Ubisoft Chengdu, China – Opened in 2008 Ubisoft Singapore – Opened in 2008 Ubisoft Pune, India – Acquired in 2008 Ubisoft Kiev, Ukraine – Opened in 2008 Massive, Sweden – Acquired in 2008 Ubisoft Toronto, Canada – Opened in 2009 Nadeo, France – Acquired in 2009 Ubisoft San Francisco, USA – Opened in 2009 Owlient, France – Acquired in 2011 RedLynx, Finland – Acquired in 2011 Ubisoft Abu Dhabi, U.A.E – Opened in 2011 Future Games of London, UK – Acquired in 2013 Ubisoft Halifax, Canada – Acquired in 2015 Ivory Tower, France – Acquired in 2015 Ubisoft Philippines – Opened in 2016 UBISOFT PaRIS Established in 1992, Ubisoft’s pioneer in-house studio is responsible for the creation of some of the most iconic Ubisoft brands such as the blockbuster franchise Rayman® as well as the worldwide Just Dance® phenomenon that has sold over 55 million copies. -

Registration Open for Vbl International Series 2021 En

PRESS RELEASE Frankfurt, Germany 23 April 2021 REGISTRATION OPEN FOR VBL INTERNATIONAL SERIES 2021 • Fourth edition of the Bundesliga’s international EA SPORTS FIFA eSports competition open to all • VBL International Series will feature entrants from 17 countries across three continents • Country Qualifiers and Regional Finals to take place in May • Bundesliga fans can compete for a share of the $10,000 prize pool Registration is now open for the Virtual Bundesliga International Series 2021, where FIFA 21 and FIFA Online 4 players from all over the world can compete with their favourite Bundesliga team to become a VBL International Series champion. Now in its fourth year, the VBL International Series is one of the world’s premier open football esports tournaments, providing gamers of all abilities with the opportunity to play as their favourite Bundesliga heroes on a global stage and prove themselves as one of the top gamers from the Bundesliga’s far-reaching fanbase. Country Qualifiers will begin on 4th May 2021, with entrants competing to become the best in their nation and progress to one of the four Regional Finals. Players from the USA, Canada and Mexico will make it through to meet in the North America final, while participants from Brazil, Argentina, Colombia, Chile and Peru will form the South America Final. All matches in the Americas will take place on the PS4 console in FIFA 21’s “90 Mode”, whereby all clubs have the same overall rating to ensure a level playing field. In Asia, entrants from Japan, Singapore, Indonesia, India and Malaysia will also compete on PS4 in 90 Mode. -

Disruptive Innovation and Internationalization Strategies: the Case of the Videogame Industry Par Shoma Patnaik

HEC MONTRÉAL Disruptive Innovation and Internationalization Strategies: The Case of the Videogame Industry par Shoma Patnaik Sciences de la gestion (Option International Business) Mémoire présenté en vue de l’obtention du grade de maîtrise ès sciences en gestion (M. Sc.) Décembre 2017 © Shoma Patnaik, 2017 Résumé Ce mémoire a pour objectif une analyse des deux tendances très pertinentes dans le milieu du commerce d'aujourd'hui – l'innovation de rupture et l'internationalisation. L'innovation de rupture (en anglais, « disruptive innovation ») est particulièrement devenue un mot à la mode. Cependant, cela n'est pas assez étudié dans la recherche académique, surtout dans le contexte des affaires internationales. De plus, la théorie de l'innovation de rupture est fréquemment incomprise et mal-appliquée. Ce mémoire vise donc à combler ces lacunes, non seulement en examinant en détail la théorie de l'innovation de rupture, ses antécédents théoriques et ses liens avec l'internationalisation, mais en outre, en situant l'étude dans l'industrie des jeux vidéo, il découvre de nouvelles tendances industrielles et pratiques en examinant le mouvement ascendant des jeux mobiles et jeux en lignes. Le mémoire commence par un dessein des liens entre l'innovation de rupture et l'internationalisation, sur le fondement que la recherche de nouveaux débouchés est un élément critique dans la théorie de l'innovation de rupture. En formulant des propositions tirées de la littérature académique, je postule que les entreprises « disruptives » auront une vitesse d'internationalisation plus élevée que celle des entreprises traditionnelles. De plus, elles auront plus de facilité à franchir l'obstacle de la distance entre des marchés et pénétreront dans des domaines inconnus et inexploités. -

EA SPORTSTM FIFA Online 3 M Tops 3 Million Downloads in Korea

June 20, 2014 EA SPORTSTM FIFA Online 3 M Tops 3 Million Downloads in Korea Mobile app fully synced with PC-based FIFA Online 3 continues to gain popularity TOKYO – June 20, 2014 – NEXON Co., Ltd. (“Nexon”) (3659.TO), a worldwide leader in free- to-play online games, today announced that EA SPORTSTM FIFA Online 3 M, developed by EA Seoul Studio (Electronic Arts Seoul Studio LLC) and published by Nexon’s wholly-owned subsidiary, NEXON Korea Corporation, surpassed 3 million downloads in Korea on June 17th. FIFA Online 3 M is the latest instalment of the world’s bestselling sports videogame franchise, EA SPORTSTM FIFA. FIFA Online 3 M was launched on March 27, 2014 on the Naver App Store and later launched on Google Play on May 29th. Fully synced with its PC counterpart, FIFA Online 3 M offers players functional team management in a high-quality graphic mobile environment using team and player data, in- game points and other data saved on players’ PC game version. The game also features exclusive mobile-only content to further enhance players’ mobile experience. EA SPORTSTM FIFA Online 3 M EA SPORTS and the EA SPORTS logo are trademarks of Electronic Arts Inc. Official FIFA licensed product. © The FIFA name and OLP Logo are copyright or trademark protected by FIFA. All rights reserved. Manufactured under license by Electronic Arts Inc. The use of real player names and likenesses is authorized by FIFPro Commercial Enterprises BV. About NEXON Co., Ltd. http://company.nexon.co.jp/ NEXON Co., Ltd. (“Nexon”) (3659.TO) is a worldwide leader in free-to-play online games. -

Q3 2018 Earnings Prepared Remarks

NEXON Co., Ltd. Q3 2018 Earnings Conference Call Prepared Remarks Nov 8, 2018 Owen Mahoney, Representative Director, President and Chief Executive Officer, NEXON Co., Ltd. Thank you all very much for joining us today. I’m pleased to report that we had another great quarter, with our business delivering solid results around the world. The results represent record Q3 revenues, operating income, and net income, and we also delivered the highest quarterly mobile revenues in our history. These excellent results were primarily driven by the continued strength of our biggest franchises across the regions. The credit for the sustained growth in these franchises goes to the outstanding work by our live operations and live development teams around the world. The work by these incredibly talented people is the key to building a sustainably growing, SaaS-like business. We believe Nexon has the best live teams in the world. Our world-class live teams are one way Nexon is different from the traditional games industry model. The games industry has recently been re-tooling to digital online and recurring revenue models. That’s been Nexon’s approach since day 1. Another difference is how we build for the future. In the traditional games approach, most of your revenues comes from games that were recently launched, in the last 1-2 quarters. In an online approach, most of your revenues comes from games you launched well over a year ago. That difference means in the traditional approach, the key point of analysis was to look for catalysts, which means evaluating the pipeline of new product launches. -

Archeage System Requirements Pc

Archeage System Requirements Pc Geo is overdue and chouses salaciously as cambial Wynn naturalize anaerobiotically and glorified indefensibly. Ruinable Gasper blue-pencilling some linstocks after dreamed Bartholomeus smugglings ineradicably. Elton is quasi: she captures ceremonially and mythologizing her solifidianism. What is VR Gaming? Official Minimum Requirements 32-bit or 64-Bit Windows XP SP3 Vista SP1 Win7 SP1 Win 1 Intel Core2 Duo nVidia GeForce 000 Series. Unfortunately, we were born too loyal to suite the world. I have played all of interact and that includes ESOWildstar and Archeage. An online web application that allows you to type for large ASCII Art great in previous time. Received since season yang paling populer di audio device discovery page to that. Bored of gesture your current class? Seems that use often than other players and you get the required field of basic troubleshooting tips to perform all and up your. Epic Games will be offering Twitch Drops once you to players who blend the FNCS live. Pretty people, and entirely gamebreaking. This is age a community collaborative guide. Vmware and their sentence. For breath of us Windows 10 is Microsoft's best operating system tissue that. Completing the CAPTCHA proves you are three human and gives you just access response the web property. Pet Supplies Plus, Gurnee, Lake County, Illinois, United States. Technical program manager II. So that specific circumstances. Helps you can start. Twitch heal The key data receive here a who Drop. ArcheAge Revelation expansion screenshot showcasing the Dwarf. What is currently you decide your email in path and archeage system requirements pc problems and archeage features also climb, sales professional network traffic during the. -

Q2 2021 Earnings Prepared Remarks

NEXON Co., Ltd. Q2 2021 Earnings Prepared Remarks August 11, 2021 Owen Mahoney, Representative Director, President and Chief Executive Officer, NEXON Co., Ltd. Thank you, Ara-san, and welcome everyone to Nexon’s Second Quarter 2021 Conference Call. Today I will provide a brief update on our second quarter performance and devote the rest of my time to detailing the strategies that position Nexon for significant growth in the coming quarters and years. Following that I will turn the call over to our CFO, Uemura-san, for a detailed financial review of our quarter and the guidance for Q3. In the second quarter, Nexon delivered revenue that was within our outlook at 56.0Bn yen -- down 13% on an as-reported basis and down 21% on a constant currency basis. The Kingdom of the Winds: Yeon, Mabinogi, and Sudden Attack exceeded our expectations while MapleStory in Korea came in lower-than-expected. On a platform basis, both PC and mobile revenues were in the range of our outlook. In short, some things went better than expected; others not as well; with the net result putting us within our expected range. On today’s call, I will provide context on how the management team has been investing our time in 2021. We see 2021 as an operational inflection point for improving our live games and polishing multiple new projects - each with the potential for enormous returns. Executing on any...one of these initiatives could dramatically change Nexon’s trajectory and bring step- function improvements to our revenue and profitability. I will start with the actions we’ve taken to improve the performance of MapleStory in Korea, which is facing tough comparisons following the last two years of significant growth, including a 98% jump in year-over-year revenue in 2020. -

EA SPORTS FIFA Online 3 Comes to China

July 24, 2013 EA SPORTS FIFA Online 3 Comes to China Tencent Games and EA Announce Publishing Agreement SHANGHAI--(BUSINESS WIRE)-- EA SPORTS™FIFA Online 3, the new PC online soccer game from the world's most popular sports videogame franchise, is coming to Chinese gamers and soccer fans. Tencent Games, under Tencent Group as the leading internet service provider in China, and Electronic Arts Inc. (NASDAQ: EA), a global leader in digital interactive entertainment, today announced an agreement through which FIFA Online 3 will be published in mainland China by Tencent Games. The first testing is expected to begin in the fourth quarter of calendar 2013. FIFA Online 3, with the exclusive license from FIFA, delivers the best technologies and all the realism and authenticity of the world's best-selling sports game franchise from EA. Players will experience improved gameplay and strategies, enhanced graphics, the latest rosters, and extensive use of official licenses, including close to 15,000 real world players from 30 leagues and 40 national teams. The game adds new techniques and features, improved artificial intelligence, enhanced animation and dynamic 5-on-5 multiplayer competition. The game is developed by EA Seoul Studio. EA SPORTS FIFA Online 3 holds the number 2 spot in Korean PC café rankings according to Gametrics. The game will also operate in Thailand and Vietnam. Steven Ma, Vice President of Tencent, said, "Tencent Games' agreement with EA is a cooperation between the leading online game company in China and the world's top sports game developer and franchise. The launch of FIFA Online 3 will provide strong momentum for the development of e-sports in China and create a true ‘virtual world of sports' for all Chinese users." Steven Ma also said, "The partnership with EA is an important milestone in Tencent Games' strategy of internationalization. -

The Video Games Industry

The video games industry: A responsible attitude towards parents and children October 2011 Executive Summary The Association for UK Interactive Entertainment (UKIE) is the trade association that represents a wide range of businesses and organisations involved in the video games industry. UKIE exists to ensure that our members have the right This document aims to set out what the video games and economic, political and social environment needed for this interactive entertainment is doing in the field of child safety. expanding industry to continue to thrive. UKIE’s membership The focus of this report is the following games consoles: includes games publishers, developers and the academic Nintendo Wii, Nintendo DS, Microsoft Xbox, Sony2 PlayStation institutions that support the industry. We represent the and Sony Playstation Portable. majority of the UK video games industry: in 2010 UKIE members were responsible for 97% of the games sold as physical products in the UK and UKIE is the only trade body Parental Controls on video games consoles in the UK to represent all the major console manufacturers (Nintendo, Microsoft and Sony). Tanya Byron’s Review of Progress (2010) urged internet- enabled device manufacturers to develop parental controls and include them on their devices. Similarly, the Bailey Introduction Review (2011) made the following recommendations regarding parents’ ability to block adult and age-restricted The video games and interactive entertainment industry material from the internet: is one of the fastest growing creative industries in the UK. With 1 in 3 people identifying as “gamers”, interactive “the internet industry must act decisively to develop entertainment is increasingly part of everyone’s everyday and introduce effective parental controls.” lives.