Global Reinsurance Highlights 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trade Credit Insurance

Trade Credit Insurance Peter M. Jones PRIMER SERIES ON INSURANCE ISSUE 15, FEBRUARY 2010 NON-BANK FINANCIAL INSTITUTIONS GROUP GLOBAL CAPITAL MARKETS DEVELOPMENT DEPARTMENT FINANCIAL AND PRIVATE SECTOR DEVELOPMENT VICE PRESIDENCY www.worldbank.org/nbfi Trade Credit Insurance Peter M. Jones primer series on insurance issue 15, february 2010 non-bank financial institutions group global capital markets development department financial and private sector development vice presidency www.worldbank.org/nbfi ii Risk Based Supervision THIS ISSUE Author Peter M. Jones was the Chief Executive Officer of the African Trade Insurance Agency (ATI) from 1 February, 2006 up until 31 July, 2009 when he retired. During his time as CEO of ATI, Peter successfully implemented a legal and capital restructuring, including the expansion of the Agency’s product offering to ensure that it meets the full needs of the private and public sector in Africa. Prior to joining ATI, Peter held various positions at the Multilateral Investment Guarantee Agency (MIGA). He was also a Vice-President at Export Development Canada (EDC), where he was responsible for all of EDC’s business operations in the Transportation sector, as well as for the establishment, development and management of its equity investment program. This experience, together with his senior positions at the Canadian Imperial Bank of Commerce (CIBC) and ANZ/Grindlays Bank, has provided him with wide ranging skills and experience in identification of viable equity opportunities, including successful exits. Peter is a Fellow of the Institute of Chartered Secretaries and Administrators. Series editor Rodolfo Wehrhahn is a senior insurance specialist at the World Bank. -

Pyatnits SC) EIJSC 39362474 Moscow

2008 ANNUAL REPORT Table of contents Address by the General Director ............................................4 Reinsurance ..........................................................................49 Position of Ingosstrakh in the Insurance Market .....................6 Investments ..........................................................................52 Quantitative and qualitative insurance Marketing .............................................................................54 market parameters ..............................................................9 Personnel .................................................................................56 Key Events and Trends in the Russian Insurance Market in 2008 ..............................13 Risk management ....................................................................62 Current Positioning of Ingosstrakh in the Market ...............16 Communications ......................................................................70 Deliverables in major areas of business ..................................20 Government relations ..........................................................73 Motor insurance ...................................................................23 Public relations .....................................................................74 Corporate property and liability insurance .........................27 Charity and sponsorship ......................................................76 Voluntary Medical insurance ................................................29 -

Report International Conference on Inclusive Insurance 2020 Digital Edition

Report International Conference on Inclusive Insurance 2020 Digital Edition Edited by Zahid Qureshi and Dirk Reinhard Report International Conference on Inclusive Insurance 2020 — Digital Edition Conference documents and This report is the summary of the Inter- presentations are available online: national Conference on Inclusive Insur- ance — Digital Edition, which took place from 2 to 6 November 2020. Individual summaries, in various styles, were contributed by a team of international www.inclusiveinsurance.org rapporteurs. Readers, authors and organisers might not share all opinions expressed or agree with the recommen- dations given. These, however, reflect the rich diversity of the discussions. Over 70 speakers participated in the conference. Report International Conference on Inclusive Insurance 2020 — Digital Edition 1 Contents 1 Contents 31 Agenda 61 Agenda 2 Foreword Day 3—4 November 2020 Day 5—6 November 2020 3 Acknowledgements How to reach scale and develop Lessons learnt and next steps 4 Participant overview inclusive insurance markets 62 Session 16 5 Agenda 32 Session 8 Technology driving Day 1—2 November 2020 Integrated risk inclusive insurance Inclusive insurance management solutions amidst a pandemic 65 Session 17 36 Session 9 The ups and downs of 6 Session 1 How digitisation can inclusive insurance: Opening of the conference — spur market growth Learning from experience The landscape of inclusive insurance 2020 39 Session 10 68 Session 18 Lessons learnt from Outlook: What will be the next 9 Keynote national strategies milestones -

Investor Presentation

Investor Presentation www.lancashiregroup.com Safe harbour statements NOTE REGARDING FORWARD-LOOKING STATEMENTS: CERTAIN STATEMENTS AND INDICATIVE PROJECTIONS (WHICH MAY INCLUDE MODELLED LOSS SCENARIOS) MADE IN THIS RELEASE OR OTHERWISE THAT ARE NOT BASED ON CURRENT OR HISTORICAL FACTS ARE FORWARD-LOOKING IN NATURE INCLUDING, WITHOUT LIMITATION, STATEMENTS CONTAINING THE WORDS “BELIEVES”, “ANTICIPATES”, “PLANS”, “PROJECTS”, “FORECASTS”, “GUIDANCE”, “INTENDS”, “EXPECTS”, “ESTIMATES”, “PREDICTS”, “MAY”, “CAN”, “LIKELY”, “WILL”, “SEEKS”, “SHOULD”, OR, IN EACH CASE, THEIR NEGATIVE OR COMPARABLE TERMINOLOGY. ALL SUCH STATEMENTS OTHER THAN STATEMENTS OF HISTORICAL FACTS INCLUDING, WITHOUT LIMITATION, THE FINANCIAL POSITION OF THE COMPANY AND ITS SUBSIDIARIES (THE “GROUP”), THE GROUP’S TAX RESIDENCY, LIQUIDITY, RESULTS OF OPERATIONS, PROSPECTS, GROWTH, CAPITAL MANAGEMENT PLANS AND EFFICIENCIES, ABILITY TO CREATE VALUE, DIVIDEND POLICY, OPERATIONAL FLEXIBILITY, COMPOSITION OF MANAGEMENT, BUSINESS STRATEGY, PLANS AND OBJECTIVES OF MANAGEMENT FOR FUTURE OPERATIONS (INCLUDING DEVELOPMENT PLANS AND OBJECTIVES RELATING TO THE GROUP’S INSURANCE BUSINESS) ARE FORWARD-LOOKING STATEMENTS. SUCH FORWARD-LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER IMPORTANT FACTORS THAT COULD CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE GROUP TO BE MATERIALLY DIFFERENT FROM FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO: THE ACTUAL -

Close Brothers Group Plc (Incorporated with Limited Liability in England and Wales with Registered Number 00520241)

PROSPECTUS DATED 8 JUNE 2021 Close Brothers Group plc (incorporated with limited liability in England and Wales with registered number 00520241) £200,000,000 2.00% Subordinated Tier 2 Notes Issue price: 99.531 per cent. The £200,000,000 2.00% Subordinated Tier 2 Notes (the “Notes”) will be issued by Close Brothers Group plc (the “Issuer”) on or about 11 June 2021 (the “Issue Date”). The terms and conditions of the Notes are set out herein in “Terms and Conditions of the Notes” below (the “Conditions”, and references to a numbered “Condition” shall be construed accordingly). The Notes will bear interest on their outstanding principal amount from (and including) the Issue Date to (but excluding) 11 September 2026 (the “Reset Date”), at a rate of 2.00 per cent. per annum and thereafter at the Reset Interest Rate as provided in Condition 5. Interest will be payable on the Notes semi-annually in arrear on each Interest Payment Date, commencing on 11 September 2021 (with a short first Interest Period from (and including) the Issue Date to (but excluding) 11 September 2021). Unless previously redeemed or purchased and cancelled, or (pursuant to Condition 7(f)) substituted, the Notes will mature on 11 September 2031 and shall be redeemed at their principal amount, together with any accrued and unpaid interest on such date. The Noteholders will have no right to require the Issuer to redeem or purchase the Notes at any time. The Issuer may, in its discretion but subject to Regulatory Approval, elect to (a) redeem all (but not some only) of the -

Reinsurance Market in Russia: 2015 Future Outlook

Reinsurance Market in Russia: Future Outlook Joint analytical report of ARIA and RNRC 1 Summary The reinsurance market in Russia needs a fresh start. The scope of internal reinsurance in Russia is declining progressively. The amount of reinsurance premiums on the internal market in 2015 was RUB 35.2 billion, which is RUB 8.9 billion (20%) less than in 2012. Over the 9 months of 2016, the amount of premiums for accepted risks was 28.8 billion. In 2012-2014, the reinsurance market in Russia was expanding: premiums during this period increased by RUB 23.6 billion (20.5%); but affected by the negative political and economic factors in 2015, the reinsurance market stopped growing and entered a recession phase. During 2011-2015, reinsurance premiums increased just by 2% in 2015, while the growth of prices for insurance services reached 58% according to the Federal State Statistics Service. The Russian reinsurance market is characterized by a low penetration rate. Refusal to cede risks is associated with a few factors: inability to cede risks, conscious refusal to cede risks by insurers and lack of insurers' trust in Russian companies operating on the incoming reinsurance market. Despite the sanctions, the share of reinsurance premiums flowing abroad is increasing. In 2012 to 2015, premiums ceded to foreign reinsurers grew from RUB 79.4 billion to 98.4 billion. The size of the reinsurance market in Russia for the 9 months of 2016 was RUB 28.8 billion, which is equivalent to 3.25% of premiums on the insurance market. According to 2015 data, this figure on the international reinsurance market was estimated at 5%. -

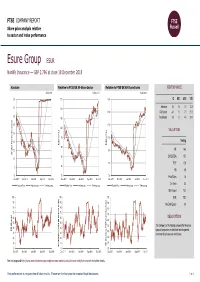

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 18 December 2018 Esure Group ESUR Nonlife Insurance — GBP 2.796 at close 18 December 2018 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 18-Dec-2018 18-Dec-2018 18-Dec-2018 2.8 115 130 1D WTD MTD YTD Absolute 0.0 0.0 0.1 12.5 2.7 110 120 Rel.Sector -0.1 1.0 7.1 21.2 2.6 105 Rel.Market 0.8 1.9 4.5 29.7 2.5 110 100 VALUATION 2.4 (local currency) (local 95 100 2.3 Trailing Relative Price Relative Price 90 2.2 90 PE 14.6 Absolute Price Price Absolute 85 EV/EBITDA 10.7 2.1 80 PCF 12.8 2 80 PB 3.9 1.9 75 70 Price/Sales 1.5 Dec-2017 Mar-2018 Jun-2018 Sep-2018 Dec-2018 Dec-2017 Mar-2018 Jun-2018 Sep-2018 Dec-2018 Dec-2017 Mar-2018 Jun-2018 Sep-2018 Dec-2018 Div Yield 3.4 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 70.1 100 100 100 ROE 28.2 90 90 90 Net Debt/Equity 0.4 80 80 80 70 70 70 60 60 DESCRIPTION 60 50 50 50 The Company is the holding company for the esure 40 40 RSI (Absolute) RSI 40 group of companies, established to write general 30 30 insurance for private cars and homes. -

Investor Presentation H1 2021 Update Safe Harbor Statements

Investor Presentation H1 2021 Update www.lancashiregroup.com Safe harbor statements NOTE REGARDING FORWARD-LOOKING STATEMENTS: CERTAIN STATEMENTS AND INDICATIVE PROJECTIONS (WHICH MAY INCLUDE MODELLED LOSS SCENARIOS) MADE IN THIS PRESENTATION OR OTHERWISE THAT ARE NOT BASED ON CURRENT OR HISTORICAL FACTS ARE FORWARD-LOOKING IN NATURE INCLUDING, WITHOUT LIMITATION, STATEMENTS CONTAINING THE WORDS “BELIEVES”, “AIMS”, “ANTICIPATES”, “PLANS”, “PROJECTS”, “FORECASTS”, “GUIDANCE”, “INTENDS”, “EXPECTS”, “ESTIMATES”, “PREDICTS”, “MAY”, “CAN”, “LIKELY”, “WILL”, “SEEKS”, “SHOULD”, OR, IN EACH CASE, THEIR NEGATIVE OR COMPARABLE TERMINOLOGY. SUCH FORWARD-LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER IMPORTANT FACTORS THAT COULD CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE GROUP TO BE MATERIALLY DIFFERENT FROM FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. FOR A DESCRIPTION OF SOME OF THESE FACTORS, SEE THE GROUP’S ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2020. ALL FORWARD-LOOKING STATEMENTS IN THIS PRESENTATION OR OTHERWISE SPEAK ONLY AS AT THE DATE OF PUBLICATION. LANCASHIRE EXPRESSLY DISCLAIMS ANY OBLIGATION OR UNDERTAKING (SAVE AS REQUIRED TO COMPLY WITH ANY LEGAL OR REGULATORY OBLIGATIONS INCLUDING THE RULES OF THE LONDON STOCK EXCHANGE) TO DISSEMINATE ANY UPDATES OR REVISIONS TO ANY FORWARD-LOOKING STATEMENT TO REFLECT ANY CHANGES IN THE GROUP’S EXPECTATIONS OR CIRCUMSTANCES ON WHICH ANY SUCH STATEMENT IS BASED. ALL SUBSEQUENT WRITTEN AND ORAL FORWARD-LOOKING STATEMENTS ATTRIBUTABLE TO THE GROUP OR INDIVIDUALS ACTING ON BEHALF OF THE GROUP ARE EXPRESSLY QUALIFIED IN THEIR ENTIRETY BY THIS NOTE. PROSPECTIVE INVESTORS SHOULD SPECIFICALLY CONSIDER THE FACTORS IDENTIFIED IN THIS PRESENTATION WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER BEFORE MAKING AN INVESTMENT DECISION. -

WT/TPR/S/345/Rev.1 6 December 2016 (16

WT/TPR/S/345/Rev.1 6 December 2016 (16-6657) Page: 1/173 Trade Policy Review Body TRADE POLICY REVIEW REPORT BY THE SECRETARIAT RUSSIAN FEDERATION Revision This report, prepared for the first Trade Policy Review of the Russian Federation, has been drawn up by the WTO Secretariat on its own responsibility. The Secretariat has, as required by the Agreement establishing the Trade Policy Review Mechanism (Annex 3 of the Marrakesh Agreement Establishing the World Trade Organization), sought clarification from the Russian Federation on its trade policies and practices. Any technical questions arising from this report may be addressed to Mr. John Finn (Tel: 022 739 5081), Mr. Ricardo Barba (Tel: 022 739 5088), Mr. Peter Milthorp (Tel: 022 739 5016) and Mr. Rosen Marinov (Tel: 022 739 6391). Document WT/TPR/G/345 contains the policy statement submitted by the Russian Federation. Note: This report was drafted in English. WT/TPR/S/345/Rev.1 • Russian Federation - 2 - CONTENTS SUMMARY ........................................................................................................................ 8 1 ECONOMIC ENVIRONMENT ........................................................................................ 13 1.1 Main Features of the Economy .....................................................................................13 1.2 Recent Economic Developments ...................................................................................14 1.3 Trade and Investment Performance ................................................................................18 -

US Sanctions on Russia

U.S. Sanctions on Russia Updated January 17, 2020 Congressional Research Service https://crsreports.congress.gov R45415 SUMMARY R45415 U.S. Sanctions on Russia January 17, 2020 Sanctions are a central element of U.S. policy to counter and deter malign Russian behavior. The United States has imposed sanctions on Russia mainly in response to Russia’s 2014 invasion of Cory Welt, Coordinator Ukraine, to reverse and deter further Russian aggression in Ukraine, and to deter Russian Specialist in European aggression against other countries. The United States also has imposed sanctions on Russia in Affairs response to (and to deter) election interference and other malicious cyber-enabled activities, human rights abuses, the use of a chemical weapon, weapons proliferation, illicit trade with North Korea, and support to Syria and Venezuela. Most Members of Congress support a robust Kristin Archick Specialist in European use of sanctions amid concerns about Russia’s international behavior and geostrategic intentions. Affairs Sanctions related to Russia’s invasion of Ukraine are based mainly on four executive orders (EOs) that President Obama issued in 2014. That year, Congress also passed and President Rebecca M. Nelson Obama signed into law two acts establishing sanctions in response to Russia’s invasion of Specialist in International Ukraine: the Support for the Sovereignty, Integrity, Democracy, and Economic Stability of Trade and Finance Ukraine Act of 2014 (SSIDES; P.L. 113-95/H.R. 4152) and the Ukraine Freedom Support Act of 2014 (UFSA; P.L. 113-272/H.R. 5859). Dianne E. Rennack Specialist in Foreign Policy In 2017, Congress passed and President Trump signed into law the Countering Russian Influence Legislation in Europe and Eurasia Act of 2017 (CRIEEA; P.L. -

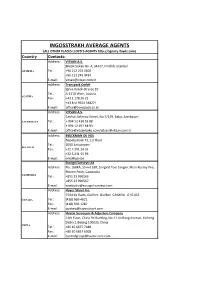

INGOSSTRAKH AVERAGE AGENTS (ALL OTHER PLACES LLOYD’S AGENTS Country Contacts: Address: VITSAN A.S

INGOSSTRAKH AVERAGE AGENTS (ALL OTHER PLACES LLOYD’S AGENTS http://agency.lloyds.com) Country Contacts: Address: VITSAN A.S. Bilezik Sokak No. 4, 34427, Findikli, Istanbul ARMENIA Tel.: +90 212 252 0600 +90 212 249 4434 E‐mail: [email protected] Address: Transpack GmbH Ignaz‐Koeck‐Strasse 10 Tel.: A‐1210 Wien, Austria AUSTRIA Fax: +43 1 278 26 22 +43 810 9554 338271 E‐mail: [email protected] Address: VITSAN A.S. Ceyhun Selimov Street, No:7/129, Baku, Azerbaijan AZERBAIJAN Tel.: + 994 12 430 53 88 + 994 12 497 68 93 E‐mail: [email protected]/[email protected] Address: BEECKMAN DE VOS Napelsstraat 73, 1st Floor Tel.: 2000 Antwerpen BELGIUM Fax: +32 3 201 24 33 +32 3 231 55 99 E‐mail: [email protected] Eurogal Surveys Ltd Address: No. 168KA, Street 598, Sangkat Toul Sangke, Khan Russey Keo, Phnom Penh, Cambodia CAMBODIA Tel.: +855 23 996566 +855 23 996567 E‐mail: cambodia@eurogal‐surveys.com Address: Hayes Stuart Inc. 7504 du Daim, Québec, Québec CANADA G1G 6S2 CANADA Tel.: (418) 660‐4621 Fax: (418) 660‐1287 E‐mail: [email protected] Address: Huatai Surveyors & Adjusters Company 14th Floor, China Re Building, No.11 Jin Rong Avenue, Xicheng District, Beijing 100033, China CHINA Tel.: +86 10 6657 7488 Fax: +86 10 6657 6508 E‐mail: controlgroup@huatai‐serv.com Address: Marinter SA Edificio "Playa", Calle 12, Nº 105, e/ 1ra y 3ra, 2do Piso, Miramar, Playa Ciudad de la Habana, Cuba CUBA Tel.: +53 7 2049742 Fax: +53 7 2049743 E‐mail: [email protected] Address: CRS Czech Republic Junacka 22, 169 00 Praha 6, Czech Republic CZECH -

The Insurance Market in Russia

The insurance market in Russia Vladimir Kalinin MAPFRE RE’s Commercial Adviser for Russia and the countries of the CIS Moscow – Russia 16 / 61 / 2012 661_trebol_ing.indd1_trebol_ing.indd 1616 117/07/127/07/12 112:182:18 Among the markets of the emerging countries, the Russian Federation’s insurance market is turning out to be the most important and to have the greatest potential in Central and Eastern Europe. In 2010, Russia, with a population of some 140 million and abundant natural resources, ranked ninth in the world in terms of gross domestic product (GDP), with USD 1,803 billion, placing it between Italy and Canada. [1] Russian insurance in the world market1 Russia’s share of the world insurance market is 0.96% of total premiums, put at USD 4.3 billion in 2010. In 2010, Russia ranked 19th in the world in terms of total premium income (USD 41,644 million), behind Ireland and ahead of Belgium. As regards Non-Life premium income, Russia ranks 12th in the world (USD 40,742 million), after Spain and ahead of Australia and Brazil. Its share of the world market is 2.24%. On the other hand, with per capita premium of USD 296.8, Russia comes behind Brazil, occupying 48th place in the world ranking. As regards insurance penetration, Russia drops to 55th place, with an insurance market accounting for 2.3% of its GDP in 2010. In 2010, total Russian premium accounted 1 Data from Swiss Re, for 47.4% of the total premium in Central Sigma No. 2/2011.