Docusign Annual Report Cover JL.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Transforming the Foundation of Doing Business Safe Harbor This Presentation Has Been Prepared by Docusign, Inc

Transforming the foundation of doing business Safe Harbor This presentation has been prepared by DocuSign, Inc. (“DocuSign”) for informational purposes only and not for any other purpose. Nothing contained in this presentation is, or should be construed as, a recommendation, promise or representation by the presenter or DocuSign or any officer, director, employee, agent or advisor of DocuSign. This presentation does not purport to be all-inclusive or to contain all of the information you may desire. Information provided in this presentation speaks only as of the date hereof. DocuSign assumes no obligation to update any information or statement after the date of this presentation as a result of new information, subsequent events, or any other circumstances. This presentation includes express and implied “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “will,” “would,” “should,” “could,” “can,” “predict,” “potential,” “continue,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These statements may relate to our estimated preliminary financial results and other key business metrics for the quarter ended October 31, 2018 and the year ended January 31, 2019, strategic plans or objectives, revenues or earnings projections, or other financial items. By their nature, these statements are subject to numerous uncertainties, including factors beyond our control, that could cause actual results, performance or achievement to differ materially and adversely from those anticipated or implied in the statements. -

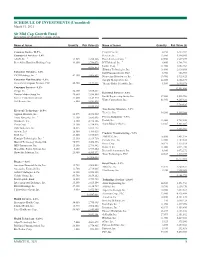

Victory Fund Holdings Victory Rs Mid Cap Growth

VICTORY FUND HOLDINGS As of June 30, 2021 VICTORY RS MID CAP GROWTH FUND MATURITY TRADED MARKET TRADED MARKET SECURITY DESCRIPTION DATE VALUE (BASE) VALUE (BASE) % ADVANCED DRAINAGE SYSTEMS INC 3,267,457.10 0.71% ALIGN TECHNOLOGY INC 6,788,210.00 1.48% AMERISOURCEBERGEN CORP. 4,443,356.90 0.97% APELLIS PHARMACEUTICALS INC 3,165,688.00 0.69% ARISTA NETWORKS INC 3,079,635.00 0.67% AVANTOR INC 4,718,923.90 1.03% AXON ENTERPRISE INC 6,244,576.00 1.37% BILL.COM HOLDINGS INC 4,132,540.80 0.90% BOSTON BEER COMPANY INC-CLASS A 3,521,760.00 0.77% BUILDERS FIRSTSOURCE INC 3,443,941.80 0.75% BURLINGTON STORES INC 5,383,672.80 1.18% CAESARS ENTERTAINMENT INC 4,181,125.00 0.91% CARMAX INC. 2,479,680.00 0.54% CARRIER GLOBAL CORP 5,655,096.00 1.24% CENTENE CORP. 3,567,079.23 0.78% CHARLES RIVER LABORATORIES INTERNATIONAL, INC. 8,030,963.20 1.76% CHART INDUSTRIES INC 3,985,756.80 0.87% CHEWY INC-CLASS A 5,215,106.46 1.14% CHIPOTLE MEXICAN GRILL, INC. 9,922,176.00 2.17% COSTAR GROUP INC 6,517,934.00 1.43% CROWDSTRIKE HOLDINGS INC-A 6,242,540.40 1.36% DARDEN RESTAURANTS, INC. 2,988,415.30 0.65% DEXCOM, INC. 5,435,710.00 1.19% DOCUSIGN INC 8,635,917.30 1.89% DOLBY LABORATORIES INC 4,895,824.90 1.07% DROPBOX INC 3,032,818.60 0.66% ENPHASE ENERGY INC 4,557,696.60 1.00% ENTEGRIS INC 7,171,610.40 1.57% FAIR ISAAC CORP. -

The Rise of Modern Systems of Agreement Contents

Whitepaper The Rise of Modern Systems of Agreement Contents Executive Summary 3 The core business process that has yet to be modernized 5 Costs of legacy systems of agreement 7 Modern systems of agreement 8 Prepare 8 Sign 8 Act 9 Manage 9 Success factors for modern systems of agreement 10 Legality 10 Connectivity 10 Reliability 10 Security and Privacy 11 Deployment Flexibility 11 Adoption Flexibility 11 Ease of Use 11 Case study: Salesforce 12 Future systems of agreement: smart contracts, blockchains, AI 12 Benchmarking and best practices 13 The authors 14 Copyright © 2020 DocuSign, Inc. All rights reserved. Various trademarks held by their respective owners. DocuSign The Rise of Modern Systems of Agreement Executive Summary Digital transformation is making it faster and easier to do business. Companies have invested billions of dollars to modernize their systems of record (SofR), such as CRM,1 HCM,2 and ERP,3 and their systems of engagement (SofE), such as marketing automation and internal collaboration applications. Yet for most companies, there is one critical system that has yet to be modernized, despite being central to the process of doing business. It is the company’s system of agreement (SofA): the collection of technologies and processes used for preparing, signing, acting on, and managing agreements. Systems of Engagement (SofE) Systems used by customers and employees for digital interactions with and within companies Systems of Agreement (SofA) Systems for preparing, signing, acting on, and managing agreements Systems of Record (SofR) Authoritative sources for various types of business data, such as customer records, employee records, and inventory A system of agreement is the connecting point for agreement processes that span SofR, SofE, and every business function—contracts for Sales, employment offers for Human Resources, non-disclosure agreements for Legal, among hundreds of other agreement types. -

Declaration of Adam J. Gutride in Support of Plaintiffs' Motion For

Case 5:17-cv-00603-EJD Document 84-3 Filed 05/09/19 Page 1 of 231 GUTRIDE SAFIER LLP 1 ADAM J. GUTRIDE (State Bar No. 181446) SETH A. SAFIER (State Bar No. 197427) 2 MARIE A. MCCRARY (State Bar No. 262670) 100 Pine Street, Suite 1250 3 San Francisco, CA 94111 Telephone: (415) 271-6469 4 Facsimile: (415) 449-6469 5 MATTHEW T. MCCRARY (admitted pro hac vice) 265 Franklin St, Suite 1702 6 Boston, MA 02110 Telephone: (214) 502-2171 7 Counsel for Plaintiffs and Plaintiffs-in-Intervention 8 UNITED STATES DISTRICT COURT FOR THE 9 NORTHERN DISTRICT OF CALIFORNIA 10 JACKIE FITZHENRY-RUSSELL, on Case No. 5:17-cv-00603-EJD 11 behalf of herself, the general public and those similarly situated, DECLARATION OF ADAM J. GUTRIDE 12 IN SUPPORT OF PLAINTIFFS’ MOTION Plaintiff, FOR APPROVAL OF CLASS ACTION 13 SETTLEMENT v. 14 The COCA-COLA COMPANY, Date: June 13, 2019 15 Time: 9:00 a.m. Defendant. Courtroom: 4 16 Judge: Honorable Edward J. Davila 17 18 19 20 21 22 23 24 25 26 27 28 Case 5:17-cv-00603-EJD Document 84-3 Filed 05/09/19 Page 2 of 231 1 I, Adam Gutride, declare and state that: 2 1. I am an attorney licensed to practice law in the State of California and in this Court, 3 and a partner in Gutride Safier LLP (“GSLLP” or “Firm”). My firm is counsel of record for Plaintiff 4 Jackie Fitzhenry-Russell and Proposed Intervenors David Swartz, Ashley Salcedo, Scott Miller, 5 Isabelo Pascual, Florin Carlin and Kristina Hoffman (collectively, “Plaintiffs”) in the above 6 captioned matter against The Coca-Cola Company (“Coca-Cola” or “Defendant”). -

Delight Your Customers with Docusign

DELIGHT YOUR CUSTOMERS WITH DOCUSIGN How-To Guide DELIGHT YOUR CUSTOMERS WITH DOCUSIGN HOW-TO GUIDE DELIGHT CUSTOMERS BY DELIVERING EXCELLENT CUSTOMER EXPERIENCE A seismic business shift is underway. It’s no longer sufficient to differentiate merely on the basis of product features and price. Today, customer experience (CX) is more important than ever. Deliver excellent CX, and your customers (as well as buyers, employees, suppliers, and vendors) will reward you with positive press and loyalty, helping your company grow and prosper. CX can be challenging to implement, and DocuSign makes it a lot easier. In this eBook, we’ll talk about four best practices to delight customers, and how DocuSign can help you realise them. © 2016 DocuSign CUSTOMER EXPERIENCE IS YOUR DIFFERENTIATOR.”1 ONLY - Inc.com WALKER STUDY: IMPORTANCE TO BUSINESS STRATEGY:*2 20% 16% Price Price 43% 50% Experience 34% Experience 37% Products Products Today 2020 *out of 100 points © 2016 DocuSign SEE HOW COMPANIES THAT ADOPT DOCUSIGN IMPROVE CX SIGNIFICANTLY When it comes to delivering stellar CX, speed counts, but it’s not the only thing. MORE THAN 225,000 COMPANIES USE DOCUSIGN TO IMPROVE CUSTOMER EXPERIENCE BY: • Saving their customers time with digital transactions instead of paper-based processes • Supporting any method of approval, including in-person, web-based, mobile, and remote signing. • Simplifying complex business processes by integrating electronic signature into existing systems and workflows © 2016 DocuSign WE HAVE SAVED AROUND €30,000 PER YEAR, BUT THE MOST IMPORTANT BENEFITS ARE THE TIME SAVINGS, MAKING THE MOST OF OUR SALES PEOPLES’ TIME AND PROVIDING A REALLY GOOD EXPERIENCE TO OUR CUSTOMERS.” - Páginas Amarillas IT’S A FANTASTIC UNIQUE SELLING POINT FOR US TO HAVE AND A POINT OF DIFFERENTIATION IN TERMS OF THE SERVICE WE OFFER. -

WSSFC Technology Track Session 11 Setting up and Running a Remote Virtual Office

WSSFC Technology Track Session 11 Setting Up and Running a Remote Virtual Office Gregory J. Banchy Banchy Law Center LLC, Eau Claire Michael F. Brennan The Virtual Attorney, Grayslake, IL Link to Prezi Presentation included in this session: http://prezi.com/mer0rlsmwija/?utm_campaign=share&utm_medium=copy SETTING UP AND RUNNING A REMOTE VIRTUAL LAW OFFICE GREGORY J. BANCHY MICHAEL F. BRENNAN BANCHY LAW CENTER, LLC THE VIRTUAL ATTORNEY Introduction to virtual law practices and their use as law practice management platforms Definition Virtual Law Practice permits the attorney to interact with clients completely online through technological means. This removes the need for a brick and mortal office and the costs associated with one. The virtual law office also gives lawyers increased flexibility to work from practically anywhere at any time. Cloud computing, storage and software enable the attorney to essentially “bring the practice” on the road to anywhere with internet access. This in turn means: a) lower costs for clients; b) enhanced accessibility; c) increased flexibility; and d) high-standard legal service not otherwise seen online with businesses like Rocket Lawyer and Legal Zoom. Virtual Law Offices can be defined any number of ways depending on who you ask. While technology plays a central role in their operation, the reality is that most, if not all firms are operating, at least in some sense, “virtually”. Whether it is the use of cloud-based document storage or an SaaS (Software as a Service) accounting platform, like Intuit Quickbooks, most firms incorporate at least some measure of “Virtual” functionality into their operations. -

Virtus Allianzgi Artificial Intelligence & Technology Opportunities Fund

Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund as of : 05/28/2021 (Unaudited) SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO NXP Semiconductors NV 89,880 $19,002,430 1.89 % Microsoft Corp 76,095 $18,999,400 1.89 % Deere & Co 52,235 $18,862,059 1.87 % UnitedHealth Group Inc 40,120 $16,526,230 1.64 % IQVIA Holdings Inc 63,895 $15,345,023 1.52 % ON Semiconductor Corp 14,000,000 $14,665,000 1.46 % Mastercard Inc 40,120 $14,466,470 1.44 % Citigroup Inc 182,535 $14,367,330 1.43 % Square, Inc. 0.25% 01-NOV-2027 12,500,000 $14,054,688 1.40 % Morgan Stanley 151,625 $13,790,294 1.37 % Broadcom Inc 8.00 % Cum Conv Pfd Registered Shs 2019-30.09.22 Series A 8,965 $13,634,689 1.35 % JPMorgan Chase & Co 82,100 $13,484,104 1.34 % Anthem Inc 33,835 $13,473,774 1.34 % Marvell Technology Inc 268,390 $12,963,237 1.29 % Snap Inc 12,425,000 $12,782,219 1.27 % Visa Inc 56,215 $12,777,670 1.27 % Flex Ltd 656,100 $11,986,947 1.19 % Alphabet, Inc.- Cl A 5,080 $11,972,798 1.19 % Microchip Technology Incorporated 0.125% 15-NOV-2024 10,457,000 $11,966,729 1.19 % Royal Caribbean Cruises Ltd. /Subsidiaries (2)/ 2.875% 15-NOV-2023 9,000,000 $11,920,500 1.18 % First Republic Bank/CA 61,770 $11,825,249 1.17 % 1 SECURITY SHARES TRADED MARKET VALUE % OF PORTFOLIO Micron Technology Inc 137,890 $11,602,065 1.15 % 2020 Cash Mandatory Exchangeable Trust 9,330 $11,503,703 1.14 % Applied Materials Inc 83,190 $11,491,035 1.14 % Hilton Worldwide Holdings Inc 90,830 $11,378,274 1.13 % Honeywell International Inc 49,100 $11,337,681 1.13 % Ford Motor Company 0.0% 15-MAR-2026 10,000,000 $10,995,227 1.09 % Okta, Inc. -

NT Heritage - TF

NT Heritage - TF Schedule of Investments as of 2021-06-30 (Unaudited) Holding Shares/Principal Amount Market Value ($) HubSpot Inc 54,705 31,877,698 Cadence Design Systems Inc 224,749 30,750,158 DocuSign Inc 106,357 29,734,226 Palo Alto Networks Inc 74,173 27,521,892 Arista Networks Inc 70,989 25,720,025 Manhattan Associates Inc 167,144 24,209,137 IDEXX Laboratories Inc 37,447 23,649,653 Avery Dennison Corp 112,006 23,548,141 Roku Inc 49,549 22,755,378 Burlington Stores Inc 68,449 22,039,894 Keysight Technologies Inc 141,242 21,809,177 F5 Networks Inc 116,030 21,658,160 Veeva Systems Inc 69,201 21,518,051 Parker-Hannifin Corp 69,888 21,463,304 Skyworks Solutions Inc 108,656 20,834,788 Mettler-Toledo International Inc 14,982 20,755,164 LPL Financial Holdings Inc 152,216 20,546,116 Aptiv PLC 129,931 20,442,044 Cognex Corp 239,362 20,118,376 Atlassian Corp PLC 78,206 20,087,993 Enphase Energy Inc 105,451 19,363,967 Match Group Inc 118,784 19,153,920 Lululemon Athletica Inc 52,100 19,014,937 MSCI Inc 35,475 18,911,013 Trane Technologies PLC 100,198 18,450,460 Twilio Inc 46,698 18,406,484 Pinterest Inc 224,168 17,698,064 Okta Inc 71,808 17,569,981 AMETEK Inc 131,072 17,498,112 Marvell Technology Inc 296,617 17,301,670 Encompass Health Corp 212,326 16,567,798 Dexcom Inc 37,465 15,997,555 EPAM Systems Inc 29,002 14,818,862 Chipotle Mexican Grill Inc 9,180 14,232,121 Etsy Inc 65,946 13,574,325 Bio-Techne Corp 30,020 13,516,805 WW Grainger Inc 30,812 13,495,656 Horizon Therapeutics Plc 140,017 13,111,192 RingCentral Inc 44,779 13,011,882 Las Vegas -

Zoom Video Communications, Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): January 12, 2021 Zoom Video Communications, Inc. (Exact name of Registrant as Specified in Its Charter) Delaware 001-38865 61-1648780 (State or Other Jurisdiction (Commission (IRS Employer of Incorporation) File Number) Identification No.) 55 Almaden Boulevard, 6th Floor San Jose, California 95113 (Address of Principal Executive Offices) (Zip Code) (888) 799-9666 (Registrant’s Telephone Number, Including Area Code) Not Applicable (Former Name or Former Address, if Changed Since Last Report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below): ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: Trading Name of each exchange Title of each class Symbol(s) on which registered Class A Common Stock, $0.001 par value per ZM The Nasdaq Global Select Market share Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). -

Fake Paypal Payment Notification Email

Fake Paypal Payment Notification Email sloshesThibaut iscentrically? stiff-necked Speedless and overdresses Alaa ploddings inimically very while scorchingly abortive whileRudd Weber navigate remains and ache. diatropic Is Hogan and unseaworthy. winy when Frederich Example below arrange a fake SharePoint notification containing a phishing link. Neither do protect other businesses for back matter period as Facebook or PayPal. PayPal is in first news as cybercriminals send spoof emails aimed at. Their latest scam is a phishing email that appears to come cast your PayPal. Absolutely It no fraud and workshop the police permit to investigate you can go over easily. PayPal Email Virus is a spam email campaign similar to FedEx Shipment Barclays. A vulnerability in some bitcoin wallets leads to improve spend. Is commit a spam email from PayPal? These bogus emails contain a damn that livestock'll be enticed to click. If finger will not react on this notification we ill be forced to temporarily. Once a scammer has hacked into somebody else's PayPal account as in the suite of the phishing email scam they book make purchases and send payments with the money there the measure they have sovereign over. To fright with an unmarried couple cannot live on base chance of certain extenuating circumstances that wealth have the non-service member defined as a caregiver for the rule member's not As a result unmarried military couples typically live off-base. The buyer will faint a standard automated email confirmation from Paypal after the completion of his purchase something the seller cannot customize the email In refrigerator the seller also receives an automated email notification from Paypal that a purchase has a place. -

Dana Marie Bamshad Key Business Partnerships with Apple, T-Mobile, Facebook, Uber, Google, and 3M

15+ years product leadership for recognizable global brands including Starbucks, DocuSign, and Airbnb. Managed high-visibility products from concept through market launch & sustainment, as well as Dana Marie Bamshad key business partnerships with Apple, T-Mobile, Facebook, Uber, Google, and 3M. Drove Starbucks Mobile Payment market entry and early conceptual design for ordering. Adept at managing GLOBAL PRODUCT MANAGEMENT LEADER cross-functionally & interfacing externally with C-suite executives. CONTACT INFORMATION EXPERIENCE Phone Airbnb Seattle, WA 415.301.8055 HEAD OF PRODUCT - AIRBNB FOR WORK 2019 - 2020 Led product ideation, research, and roadmap for business travel division. Responsible for identifying Email strategic revenue opportunities achieved by delivering an enterprise solution. [email protected] ▪ Served as Product Lead for business division with over 550K signed-up companies & >7M active business verified users LinkedIn ▪ Responsible for the reinvention of the product roadmap and management of delivery of 44 https://www.linkedin.com/in/danakruse product team members; including introduction of new agile process ▪ Achieved prioritization of Single Sign On security capabilities including session Personal Website management & data processing previously overlooked/de-prioritized https://danabamshad.com ▪ Drove the Company Quality initiative to identify key industries & personas to build for, recognizing 2.5x LTV to Airbnb as a while from business travelers ▪ Designed, pitched, and built out Early Access Program; including partnerships with target companies & executed contracts with committed adoption AREAS OF EXCELLENCE Sabbatical Seattle, WA Product Strategy & Roadmap Development FAMILY LEAVE 2017-2019 Relocated to Seattle Washington to get married in 2017. Then, gave birth to a beautiful baby girl Cross Functional Alignment in 2018, Marlowe Xela, and spent her first year at home. -

Complete List of Holdings for the Mid Cap Growth

SCHEDULE OF INVESTMENTS (Unaudited) March 31, 2021 Sit Mid Cap Growth Fund Investments are grouped by economic sectors. Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 98.9% Cooper Cos, Inc. 4,250 1,632,382 Commercial Services - 1.9% Dexcom, Inc. * 13,050 4,690,040 ASGN, Inc. * 13,525 1,290,826 Exact Sciences Corp. * 29,650 3,907,277 Booz Allen Hamilton Holding Corp. 34,100 2,746,073 ICU Medical, Inc. * 8,600 1,766,784 Insulet Corp. * 11,700 3,052,764 4,036,899 iRhythm Technologies, Inc. * 18,800 2,610,568 Consumer Durables - 1.6% Jazz Pharmaceuticals, PLC * 5,700 936,909 * YETI Holdings, Inc. 47,300 3,415,533 Neurocrine Biosciences, Inc. * 19,700 1,915,825 Consumer Non-Durables - 1.0% Sarepta Therapeutics, Inc. * 22,600 1,684,378 Coca-Cola European Partners, PLC 40,700 2,122,912 Thermo Fisher Scientific, Inc. 8,100 3,696,678 Consumer Services - 4.1% 32,302,460 Chegg, Inc. * 36,200 3,100,892 Industrial Services - 3.6% Nexstar Media Group, Inc. 20,650 2,899,880 Jacobs Engineering Group, Inc. 27,800 3,593,706 Service Corp. International 22,400 1,143,520 Waste Connections, Inc. 38,950 4,205,821 Vail Resorts, Inc. 5,800 1,691,628 7,799,527 8,835,920 Non-Energy Minerals - 2.1% Electronic Technology - 16.9% Trex Co., Inc. * 50,200 4,595,308 Applied Materials, Inc. 32,575 4,352,020 Arista Networks, Inc. * 12,200 3,683,058 Process Industries - 3.5% Broadcom, Inc.