Management Accounting Concepts and Techniques

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Impact of Relevant Costing for Decision-Making in Ready- Made Garments (Rmgs) Industry of Bangladesh

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 16, Issue 3. Ver. I (Mar. 2014), PP 01-07 www.iosrjournals.org The Impact of Relevant Costing for decision-making in Ready- Made Garments (RMGs) industry of Bangladesh. , 1(Department of Accounting, Hajee Mohammad Danesh Science and Technology University, Bangladesh. 2(Lecturer, Department of Accounting, Hajee Mohammad Danesh Science and Technology University, Bangladesh. Abstract: Relevant costing is a management accounting term that relates to focus on only the cost relevant to a specific decision being made. Irrelevant costs are excluded from any incremental decision-making problem because they are supposed to have equal effects on all the available alternatives ( Dillon, R. D. and, J. F. Nash, 1978). This study adopts an observation of quantitative method with primary and secondary data in view of the nature of the analysis. Relevant costing is often used in short-term decision-making and a number of specific practical examples are illustrated in this study. This study has designed to make the aim of assessing the level of perceptions of four areas such as (i) making and buying; (ii) dropping or retaining a segment; (iii) constrained resources; and (iv) special orders; in using relevant costing in Ready-Made Garments (RMGs) industry of Bangladesh. To meet this aim total 100 companies as a sample from Ready-Made Garments (RMGs) industry have been randomly selected. By using variance analysis, authors have found that all four factors have significant influence in using relevant costing. Last, the result of this study suggested that the strengthening the decision-making mechanism required a strong relevant costing benefits and its proper application. -

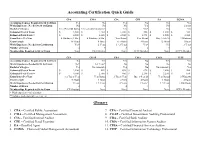

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

How IFRS and the Convergence of Corporate Governance Standards Can Help Foreign Issuers Raise Capital in the United States and Abroad Kyle W

Northwestern Journal of International Law & Business Volume 30 Issue 2 Spring Spring 2010 Lowering the Cost of Rent: How IFRS and the Convergence of Corporate Governance Standards Can Help Foreign Issuers Raise Capital in the United States and Abroad Kyle W. Pine Follow this and additional works at: http://scholarlycommons.law.northwestern.edu/njilb Part of the Corporation and Enterprise Law Commons, International Law Commons, and the Securities Law Commons Recommended Citation Kyle W. Pine, Lowering the Cost of Rent: How IFRS and the Convergence of Corporate Governance Standards Can Help Foreign Issuers Raise Capital in the United States and Abroad, 30 Nw. J. Int'l L. & Bus. 483 (2010) This Comment is brought to you for free and open access by Northwestern University School of Law Scholarly Commons. It has been accepted for inclusion in Northwestern Journal of International Law & Business by an authorized administrator of Northwestern University School of Law Scholarly Commons. Lowering the Cost of Rent: How IFRS and the Convergence of Corporate Governance Standards Can Help Foreign Issuers Raise Capital in the United States and Abroad Kyle W. Pine* I. INTRODUCTION Since the early 1990s the United States has experienced a dramatic growth in the number of foreign firms choosing to trade their shares in U.S. markets.' Meanwhile, Europe and other markets have not experienced this effect to the same extent. In part, this growth is attributable to the popularity of American Depository Receipts ("ADRs")3 that increased throughout the 1990s, with the number of depository programs increasing from 352 in 1990 to 1800 by 1999.4 More generally, though, there has been J.D. -

9.1 Financial Cost Compared with Economic Cost 9.2 How

9.0 MEASUREMENT OF COSTS IN CONSERVATION 9.1 Financial Cost Compared with Economic Cost{l} Since financial analysis relates primarily to enterprises operating in the market place, the data of costs and retums are derived from the market prices ( current or expected) of the transactions as they are experienced. Thus the cost of land, capital, construction, etc. is the ~ recorded price of the accountant. By contrast, in economic analysis ( such as cost bene fit analysis) the costs and benefits of a project are analysed from the point of view of society and not from the point of view of a single agent's utility of the landowner or developer. They are termed economic. Some effects of the project, though conceming the single agent, do not affect society. Interest on borrowing, taxes, direct or indirect subsidies are transfers that do not deploy real resources and do not therefore constitute an economic cost. The costs and the retums are, in part at least, based on shadow prices, which reflect their "social value". Economic rate of retum could therefore differ from the financial costs which are based on the concept of "opportunity cost"; they are measured not in relation to the transaction itself but to the value of the resources which that financial cost could command, just as benefits are valued by the resource costs required to achieve them. This differentiation leads to the following significant rules in conside ring costs in cost benefit analysis, as for example: (a) Interest on money invested This is a transfer cost between borrower and lender so that the economyas a whole is no different as a result. -

The Current Expected Credit Loss Accounting Standard and Financial Institution Regulatory Capital

U.S. DEPARTMENT OF THE TREASURY The Current Expected Credit Loss Accounting Standard and Financial Institution Regulatory Capital September 15, 2020 Table of Contents Executive Summary .................................................................................................................. 3 I. Background ....................................................................................................................... 6 II. CECL’s Implications for Financial Institution Regulatory Capital .......................... 14 III. Key Areas of Debate ....................................................................................................... 21 IV. Recommendations ........................................................................................................... 25 Executive Summary 3 Executive Summary The current expected credit loss (CECL) methodology is a new accounting standard for estimating allowances for credit losses. CECL currently applies—or will apply—to all entities whose financial statements conform to Generally Accepted Accounting Principles in the United States (GAAP), including all banks, credit unions, savings associations, and their holding companies (collectively, “financial institutions”) that file regulatory reports that conform to GAAP. CECL requires financial institutions and other covered entities to recognize lifetime expected credit losses for a wide range of financial assets based not only on past events and current conditions, but also on reasonable and supportable forecasts. Over the -

Account Guidelines for Managers and Delegates

ACCOUNT/BUDGET GENERAL OPERATING PRINCIPLES for IU SOUTHEAST ACCOUNT MANAGERS / ACCOUNT DELEGATES The Fiscal Year runs from July 1 – June 30. Operating budgets are distributed in June/July. Accounts may not exceed their budgeted amounts within the fiscal year. Account managers will be required to develop a plan to bring the account in balance before the closing of the fiscal year or to carry forward the over- expenditures to the next fiscal year. Allocated funds do not carry forward to the next fiscal year. Unused funds are forfeited. Allocated funds should be spent to or close to zero. Every department has an organization code (contact Melissa Hill in Accounting Services, #2359). Examples: Student Affairs (SSER), Athletics (ATHL). A budget binder or file should be established for each account. All budget documents should be kept for the current fiscal year within the budget binder or file. Receipts/documentation must be kept for all expenditures. All budget documentation must be kept on file for seven years. Use of funds must conform to IU Financial Policies found on web site: http://www.indiana.edu/%7Epolicies/ The Financial Information System (FIS) is used for account transactions and account monitoring. Passwords and access are needed (contact IT or Accounting Services). If FIS training is needed, contact Melissa Hill in Accounting Services (#2359). Monthly operating statements should be printed from FIS (available first of month—notification comes by email) and account transactions should be reconciled by the account manager or delegate on a monthly basis at minimum. Each expenditure must be accounted for with receipts or other appropriate documentation. -

Cop 416 Cooperative Accounting

NATIONAL OPEN UNIVERSITY OF NIGERIA SCHOOL OF MANAGEMENT SCIENCES COURSE CODE: COP 416 COURSE TITLE: COOPERATIVE ACCOUNTING COURSE MAIN TEXT Course Developer/ Mr. S. O. Israel-Cookey Unit Writer School of Management Sciences, National Open University of Nigeria, Lagos. Course Editor: Dr. O. J. Onwe NOUN, Lagos Programme Leader: Dr. C. I. Okeke School of Management Sciences, National Open University of Nigeria, Lagos. Course Coordinator:Pastor Timothy O. Ishola School of Management Sciences, National Open University of Nigeria, Lagos NATIONAL OPEN UNIVERSITY OF NIGERIA 14/16 AMADU BELLO WAY, VICTORIA ISLAND, LAGOS SCHOOL OF MANAGEMENT SCIENCES COP415 ASSESSMENT SHEET PROGRAMME: B.Sc. COOPERATIVE MANAGEMENT COURSE CODE: COP 415 COURSE TITLE: SEMINAR IN COOPERATIVE 1 CREDIT: 02 PART A: SEMINAR PRESENTATION NAME OF CENTER: ……………………………………. NAME OF STUDENT: ………………………………...... MATRIC NO: ……………………………………………. S/N Seminar presentation Max Facilitator Head/Coordinator, Remark Score Score (%) Hq. Score(%) (%) i. Content mastery: 10 • Relevance and Comprehensiveness • Correctness ii. Comportment of the presenter 5 iii. • Confidence 10 • Demonstration of boldness to address the audience iv. • Response to questions 10 • Ease attending to audience’s questions and observation v. Communication- Correction of grammer 10 • Fluency and Simplicity vi. Dressing-Simplicity and neatness 5 Grand total 50% 50% Facilitator name and signature PART B: ASSESSMENT OF TERM PAPER S/N Term Paper Report Feature Max Score /Coordinator, Hq. Remark (%) Score(%) i. Literature review 15 • Relevancy of cited works • Comprehensiveness of the review • Extensive of the sources – textual, interact, journals, government report etc. ii. Summary, conclusion and recommendation: 10 iii. Referencing: 10 • Materials – correctly cited using the APA format, Comprehensive cited iv. -

Historical Evolution of Management Accounting

1990's: Value Based Management Focus shifted to include the creation of customer value, strategy, balanced scorecards, EVA, and other related concepts. 1980's: Lcan Enterprise CA M-I Cost Management Focus shifted to the reduction of waste, JTT, teamwork, ABC, target costing, quality, investment & product life cycle management. 1951 - 1980's: Managerial Accounting Focus shifted to providinginformation for management planning & control. 1920 - 1950: Cost Accounting Matching concept developed. Focus on cost determination and financial control. 1812 - 1920: Accountingfor Processes Prior to the matching concept. Focus on operating cost and efficiency of processes. Shah Kamal Historical Evolution of Assistant Relationship Manager Management Accounting Bank Alfalah [email protected] Abstract The obsolescence of most companies' cost accounting and management control systems is particularly unfortunate for the global competition of the 1980s (Johnson & Kaplan, 1987). During the past two decades, conventional cost and management accounting practices have been under extensive criticism for their malfunction to instigate change and their inability to support management accounting innovations in coping with the requirements of a changing environment. The academic literature has been crucial of conventional management accounting systems particularly for their lack of efficiency and capability to present comprehensive and the latest information and to assure decision makers and potential users of such information. Focusing on this debate, current study reviews the evolution of cost and management accounting innovations over the past century around the world and to examine whether there has been a significant impact of management accounting in the organization. The analyses suggest that management accounting is changing. However, these changes do not have much bearing upon the type of management accounting techniques. -

Cost of Goods Sold

Cost of Goods Sold Inventory •Items purchased for the purpose of being sold to customers. The cost of the items purchased but not yet sold is reported in the resale inventory account or central storeroom inventory account. Inventory is reported as a current asset on the balance sheet. Inventory is a significant asset that needs to be monitored closely. Too much inventory can result in cash flow problems, additional expenses and losses if the items become obsolete. Too little inventory can result in lost sales and lost customers. Inventory is reported on the balance sheet at the amount paid to obtain (purchase) the items, not at its selling price. Cost of Goods Sold • Inventory management Involves regulation of the size of the investment in goods on hand, the types of goods carried in stock, and turnover rates. The investment in inventory should be kept at a minimum consistent with maintenance of adequate stocks of proper quality to meet sales demand. Increases or decreases in the inventory investment must be tested against the effect on profits and working capital. Standard levels of inventory should be established as adequate for a given volume of business, and stock control procedures applied so as to limit purchase as required. Such controls should not preclude volume purchase of nonperishable items when price advantages may be obtained under unusual circumstances. The rate of inventory turnover is a valuable test of merchandising efficiency and should be computed monthly Cost of Goods Sold • Inventory management All inventories are valued at cost which is defined as invoice price plus freight charges less discounts. -

Trade Management Guidelines

Trade Management Guidelines TRADE MANAGEMENT TASK FORCE Theodore R. Aronson, CFA, Chairman Aronson + Partners Gregory H. Bokach, CFA Damian Maroun American Century Investment Management G.E. Asset Management Corporation Eugene K. Bolton Jean Margo Reid G.E. Asset Management Corporation Paul Richards* Michael H. Buek, CFA Financial Services Authority The Vanguard Group H. Paul Reynolds Richard A. Carriuolo Frank Russell Securities, Inc. R.M. Davis, Inc. George U. Sauter Gene A. Gohlke, Ph.D., CPA* The Vanguard Group U.S. Securities and Exchange Commission Erik R. Sirri Paul S. Gottlieb Babson College Merrill Lynch Wayne H. Wagner Joanne M. Hill Plexus Group Goldman, Sachs & Co. Jessica L. Mann, CFA Donald B. Keim CFA Institute The Wharton School Maria J. A. Clark, CFA Anthony J. Leitner CFA Institute Goldman, Sachs & Co. Ananth Madhavan ITG, Inc. * Observer. 1 CFA INSTITUTE TRADE MANAGEMENT GUIDELINES Recognizing the ambiguities and complexities surrounding the concept of Best Execution,1 CFA Institute Trade Management Task Force has developed the CFA Institute Trade Management Guidelines (Guidelines) for investment management firms (Firms). The recommendations contained herein stem from the obligations Firms have to clients regarding the execution of their trades and provide Firms with a demonstrable framework from which to make consistently good trade-execution decisions over time. The Guidelines formalize processes, disclosures, and record-keeping suggestions that, together, form a systematic, repeatable, and demonstrable approach to seeking Best Execution. It is important to note that the Guidelines are a compilation of recommended practices and not standards. CFA Institute encourages Firms worldwide to adopt as many of the recommendations as are appropriate to their particular circumstances. -

Total Cost and Profit

4/22/2016 Total Cost and Profit Gina Rablau Gina Rablau - Total Cost and Profit A Mini Project for Module 1 Project Description This project demonstrates the following concepts in integral calculus: Indefinite integrals. Project Description Use integration to find total cost functions from information involving marginal cost (that is, the rate of change of cost) for a commodity. Use integration to derive profit functions from the marginal revenue functions. Optimize profit, given information regarding marginal cost and marginal revenue functions. The marginal cost for a commodity is MC = C′(x), where C(x) is the total cost function. Thus if we have the marginal cost function, we can integrate to find the total cost. That is, C(x) = Ȅ ͇̽ ͬ͘ . The marginal revenue for a commodity is MR = R′(x), where R(x) is the total revenue function. If, for example, the marginal cost is MC = 1.01(x + 190) 0.01 and MR = ( /1 2x +1)+ 2 , where x is the number of thousands of units and both revenue and cost are in thousands of dollars. Suppose further that fixed costs are $100,236 and that production is limited to at most 180 thousand units. C(x) = ∫ MC dx = ∫1.01(x + 190) 0.01 dx = (x + 190 ) 01.1 + K 1 Gina Rablau Now, we know that the total revenue is 0 if no items are produced, but the total cost may not be 0 if nothing is produced. The fixed costs accrue whether goods are produced or not. Thus the value for the constant of integration depends on the fixed costs FC of production. -

What Board Members Need to Know About Not-For-Profit Finance and Accounting

What Board Members Need to Know About Not-for-Profit Finance and Accounting www.jjco.com 1-2014 Table of Contents Introduction 2 Role of Board Member in Financial Oversight 3 Understanding Financial Statements 4 Financial Statements: Review Checklist 12 Reviewing the IRS Form 990 13 Key Financial & Governance Policies 17 Evaluating Funding Sources 18 Roles and Responsibilities 20 Glossary of Terms 26 (words and terms found in glossary are italicized throughout) Other Resources 30 Our Services/Contact Us 34 © 2014 Jacobson Jarvis & Co PLLC. All rights reserved. 1 Introduction Thank you for agreeing to serve on the board of a not-for-profit organization. Without your dedication and commitment, we would not enjoy the thriving not-for-profit community we do. As a board member, you are probably very familiar with some aspects of not-for-profit management. You understand the basic need to raise money to support the activities of the organization for which you volunteer, and you probably have seen the fundamental challenge every not-for-profit management team faces – to make the dollars raised go as far as possible. However, in addition to addressing funding challenges, as a board member you now have a legal responsibility to protect the organization’s assets by overseeing its financial activities and implementing “best practices” to protect the organization. For board members without experience in not- for-profit accounting,and especially for those without any formal accounting training, it is easy to neglect this important responsibility and bear some liability for the outcome. This booklet is designed to help you perform your financial responsibilities more effectively.