Minutes Have Been Seen by the Administration)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Yours Truly 2021

Region Name Country Information Mailing Address Gender Africa Yahaya Sharif Aminu Nigeria 22-year old singer at risk of execution after being sentenced Yahaya Sharif-Aminu Male to death by hanging for circulating a song via WhatsApp Nigerian Correctional Service considered blasphemous. Kano State Command c/of Nigeria Correctional Service National Headquarters Bill Clinton Drive, Airport Road. P.M.B 16 Garki Abuja. Nigeria MENA Ruba Asi Palestine Ruba Asi a Palestinian student who has been in military Ruba Asi Female detention since 9 July 2020, she is currently charged with Damon Prison participation and affiliation with a democratic student P.O. Box 98 political group at Birzeit University. Daliyat al-Karmel Israel Europe & EECA Julian Assange Austrialia Julian Assange is an Australian journalist who founded Julian Assange Male WikiLeaks in 2006. He is being sought by the current US DOB 3 July 1971 administration for publishing US government documents #A9379AY which exposed war crimes and human rights abuses. The HMP Belmarsh politically motivated charges represent an unprecedented Western Way attack on press freedom and the public’s right to know – London SE28 0EB seeking to criminalise basic journalistic activity. United Kingdom If convicted Julian Assange faces a sentence of 175 years, likely to be spent in extreme isolation. MENA Marwan Barghouti Palestine Marwan Barghouti is the Secretary-General of Fatah in the Marwan Barghouti Male West Bank. He was arrested in 2002 and sentenced to five Hadarim Prison life sentences and 40 years. P.O. Box 165 Even Yehuda 405000 Israel Asia "Slow beat" Hong Kong Currently charged under conspiracy to commit subversion. -

The Brookings Institution Center for Northeast Asian Policy Studies

THE BROOKINGS INSTITUTION CENTER FOR NORTHEAST ASIAN POLICY STUDIES The 2004 Legislative Council Elections and Implications for U.S. Policy toward Hong Kong Wednesday, September 15, 2004 Introduction: RICHARD BUSH Director, Center for Northeast Asian Policy Studies The Brookings Institution Presenter: SONNY LO SHIU-HING Associate Professor of Political Science University of Waterloo Discussant: ELLEN BORK Deputy Director Project for the New American Century [TRANSCRIPT PREPARED FROM A TAPE RECORDING.] THE BROOKINGS INSTITUTION CENTER FOR NORTHEAST ASIAN POLICY STUDIES 1775 MASSACHUSETTS AVENUE, NW WASHINGTON, D.C. 20036 202-797-6307 P R O C E E D I N G S MR. BUSH: [In progress] I've long thought that politically Hong Kong plays a very important role in the Chinese political system because it can be, I think, a test bed, or a place to experiment on different political forums on how to run large Chinese cities in an open, competitive, and accountable way. So how Hong Kong's political development proceeds is very important for some larger and very significant issues for the Chinese political system as a whole, and therefore the debate over democratization in Hong Kong is one that has significance that reaches much beyond the rights and political participation of the people there. The election that occurred last Sunday is a kind of punctuation mark in that larger debate over democratization, and we're very pleased to have two very qualified people to talk to us today. The first is Professor Sonny Lo Shiu-hing, who has just joined the faculty of the University of Waterloo in Canada. -

Minutes Have Been Seen by the Administration)

立法會 Legislative Council Ref : CB2/PL/CA LC Paper No. CB(2)133/12-13 (These minutes have been seen by the Administration) Panel on Constitutional Affairs Minutes of special meeting held on Saturday, 19 May 2012, at 9:00 am in Conference Room 1 of the Legislative Council Complex Members : Hon TAM Yiu-chung, GBS, JP (Chairman) present Hon Mrs Sophie LEUNG LAU Yau-fun, GBS, JP (Deputy Chairman) Hon Albert HO Chun-yan Ir Dr Hon Raymond HO Chung-tai, SBS, S.B.St.J., JP Dr Hon Margaret NG Hon CHEUNG Man-kwong Dr Hon Philip WONG Yu-hong, GBS Hon WONG Yung-kan, SBS, JP Hon LAU Kong-wah, JP Hon LAU Wong-fat, GBM, GBS, JP Hon Miriam LAU Kin-yee, GBS, JP Hon Emily LAU Wai-hing, JP Hon Abraham SHEK Lai-him, SBS, JP Hon Audrey EU Yuet-mee, SC, JP Hon LEE Wing-tat Hon Jeffrey LAM Kin-fung, GBS, JP Hon CHEUNG Hok-ming, GBS, JP Hon WONG Ting-kwong, BBS, JP Dr Hon LAM Tai-fai, BBS, JP Hon CHAN Kin-por, JP Hon IP Kwok-him, GBS, JP Hon Mrs Regina IP LAU Suk-yee, GBS, JP Hon Paul TSE Wai-chun, JP Dr Hon Samson TAM Wai-ho, JP Hon Alan LEONG Kah-kit, SC Hon LEUNG Kwok-hung Members : Hon WONG Kwok-hing, MH absent Hon Timothy FOK Tsun-ting, GBS, JP Hon Ronny TONG Ka-wah, SC - 2 - Hon CHIM Pui-chung Hon Cyd HO Sau-lan Dr Hon Priscilla LEUNG Mei-fun, JP Hon WONG Kwok-kin, BBS Hon WONG Yuk-man Public Officers : Sessions One to Three attending Office of the Chief Executive-elect Mrs Fanny LAW FAN Chiu-fun Head of the Chief Executive-elect's Office Ms Alice LAU Yim Secretary-General of the Chief Executive-elect's Office Constitutional and Mainland Affairs Bureau Mr -

Hong Kong: in the Name of National Security Human Rights Violations Related to the Implementation of the Hong Kong National Security Law

HONG KONG: IN THE NAME OF NATIONAL SECURITY HUMAN RIGHTS VIOLATIONS RELATED TO THE IMPLEMENTATION OF THE HONG KONG NATIONAL SECURITY LAW Amnesty International is a global movement of more than 10 million people who campaign for a world where human rights are enjoyed by all. Our vision is for every person to enjoy all the rights enshrined in the Universal Declaration of Human Rights and other international human rights standards. We are independent of any government, political ideology, economic interest or religion and are funded mainly by our membership and public donations. © Amnesty International 2021 Except where otherwise noted, content in this document is licensed under a Creative Commons (attribution, non-commercial, no derivatives, international 4.0) licence. https://creativecommons.org/licenses/by-nc-nd/4.0/legalcode For more information please visit the permissions page on our website: www.amnesty.org Where material is attributed to a copyright owner other than Amnesty International this material is not subject to the Creative Commons licence. First published in 2021 by Amnesty International Ltd Peter Benenson House, 1 Easton Street London WC1X 0DW, UK Index: ASA 17/4197/2021 June 2021 Original language: English amnesty.org CONTENTS INTRODUCTION 2 1. BACKGROUND 3 2. ACTS AUTHORITIES CLAIM TO BE ‘ENDANGERING NATIONAL SECURITY’ 5 EXERCISING THE RIGHT OF PEACEFUL ASSEMBLY 5 EXERCISING THE RIGHT TO FREEDOM OF EXPRESSION 7 EXERCISING THE RIGHT TO FREEDOM OF ASSOCIATION 9 ENGAGING IN INTERNATIONAL POLITICAL ADVOCACY 10 3. HUMAN RIGHTS VIOLATIONS ENABLED BY THE NSL 12 STRINGENT THRESHOLD FOR BAIL AND PROLONGED PERIOD OF PRETRIAL DETENTION 13 FREEDOM OF MOVEMENT 15 RETROACTIVITY 16 SPECIALLY APPOINTED JUDGES 16 RIGHT TO LEGAL COUNSEL 17 ADEQUATE TIME AND FACILITIES TO PREPARE A DEFENCE 17 4. -

OFFICIAL RECORD of PROCEEDINGS Wednesday, 18

LEGISLATIVE COUNCIL ― 18 October 2017 161 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 18 October 2017 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE LEUNG YIU-CHUNG THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, G.B.S., J.P. PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, G.B.S., J.P. THE HONOURABLE STARRY LEE WAI-KING, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, B.B.S., J.P. THE HONOURABLE CHAN KIN-POR, G.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. THE HONOURABLE WONG KWOK-KIN, S.B.S., J.P. 162 LEGISLATIVE COUNCIL ― 18 October 2017 THE HONOURABLE MRS REGINA IP LAU SUK-YEE, G.B.S., J.P. THE HONOURABLE PAUL TSE WAI-CHUN, J.P. THE HONOURABLE CLAUDIA MO THE HONOURABLE MICHAEL TIEN PUK-SUN, B.B.S., J.P. THE HONOURABLE STEVEN HO CHUN-YIN, B.B.S. THE HONOURABLE FRANKIE YICK CHI-MING, S.B.S., J.P. THE HONOURABLE WU CHI-WAI, M.H. THE HONOURABLE YIU SI-WING, B.B.S. THE HONOURABLE MA FUNG-KWOK, S.B.S., J.P. THE HONOURABLE CHARLES PETER MOK, J.P. THE HONOURABLE CHAN CHI-CHUEN THE HONOURABLE CHAN HAN-PAN, J.P. -

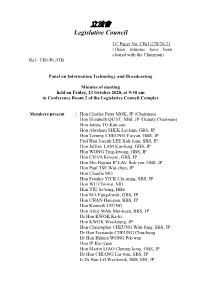

Minutes Have Been Cleared with the Chairman) Ref : CB1/PL/ITB

立法會 Legislative Council LC Paper No. CB(1)278/20-21 (These minutes have been cleared with the Chairman) Ref : CB1/PL/ITB Panel on Information Technology and Broadcasting Minutes of meeting held on Friday, 23 October 2020, at 9:30 am in Conference Room 2 of the Legislative Council Complex Members present : Hon Charles Peter MOK, JP (Chairman) Hon Elizabeth QUAT, BBS, JP (Deputy Chairman) Hon James TO Kun-sun Hon Abraham SHEK Lai-him, GBS, JP Hon Tommy CHEUNG Yu-yan, GBS, JP Prof Hon Joseph LEE Kok-long, SBS, JP Hon Jeffrey LAM Kin-fung, GBS, JP Hon WONG Ting-kwong, GBS, JP Hon CHAN Kin-por, GBS, JP Hon Mrs Regina IP LAU Suk-yee, GBS, JP Hon Paul TSE Wai-chun, JP Hon Claudia MO Hon Frankie YICK Chi-ming, SBS, JP Hon WU Chi-wai, MH Hon YIU Si-wing, BBS Hon MA Fung-kwok, GBS, JP Hon CHAN Han-pan, BBS, JP Hon Kenneth LEUNG Hon Alice MAK Mei-kuen, BBS, JP Dr Hon KWOK Ka-ki Hon KWOK Wai-keung, JP Hon Christopher CHEUNG Wah-fung, SBS, JP Dr Hon Fernando CHEUNG Chiu-hung Dr Hon Helena WONG Pik-wan Hon IP Kin-yuen Hon Martin LIAO Cheung-kong, GBS, JP Dr Hon CHIANG Lai-wan, SBS, JP Ir Dr Hon LO Wai-kwok, SBS, MH, JP - 2 - Hon Alvin YEUNG Hon Andrew WAN Siu-kin Dr Hon Junius HO Kwan-yiu, JP Hon LAM Cheuk-ting Hon SHIU Ka-fai, JP Hon SHIU Ka-chun Hon YUNG Hoi-yan, JP Hon CHAN Chun-ying, JP Hon HUI Chi-fung Hon LUK Chung-hung, JP Hon KWONG Chun-yu Hon Jeremy TAM Man-ho Hon Vincent CHENG Wing-shun, MH, JP Members absent : Hon Michael TIEN Puk-sun, BBS, JP Hon Dennis KWOK Wing-hang Hon CHUNG Kwok-pan [According to the announcement made by the Hong Kong -

Hong Kong's National Security

FEBRUARY 2021 HONG KONG’S NATIONAL SECURITY LAW: A Human Rights and Rule of Law Analysis by Lydia Wong and Thomas E. Kellogg THE NATIONAL SECURITY LAW constitutes one of the greatest threats to human rights and the rule of law in Hong Kong since the 1997 handover. This report was researched and written by Lydia Wong (alias, [email protected]), research fellow, Georgetown Center for Asian Law; and Thomas E. Kellogg ([email protected]), executive director, Georgetown Center for Asian Law, and adjunct professor of law, Georgetown University Law Center. (Ms. Wong, a scholar from the PRC, decided to use an alias due to political security concerns.) The authors would like to thank three anonymous reviewers for their comments on the draft report. We also thank Prof. James V. Feinerman for both his substantive inputs on the report, and for his longstanding leadership and guidance of the Center for Asian Law. We would also like to thank the Hong Kongers we interviewed for this report, for sharing their insights on the situation in Hong Kong. All photographs by CLOUD, a Hong Kong-based photographer. Thanks to Kelsey Harrison for administrative and publishing support. Contents EXECUTIVE SUMMARY i The National Security Law: Undermining the Basic Law, Threatening Human Rights iii Implementation of the NSL iv I INTRODUCTION 1 THE HONG KONG NATIONAL SECURITY LAW: II A HUMAN RIGHTS AND RULE OF LAW ANALYSIS 6 The NSL: Infringing LegCo Authority 9 New NSL Structures: A Threat to Hong Kong’s Autonomy 12 The NSL and the Courts: Judicial -

Human Rights Defenders in Hong Kong Face New Charges for Tiananmen Vigil

10 August 2020 Statement: Human rights defenders in Hong Kong face new charges for Tiananmen vigil On 6 August 2020, the Hong Kong police brought new charges against 24 pro-democracy activists1 and human rights defenders for organising or participating in an annual vigil on 4 June 2020 to commemorate the 1989 massacre in Beijing’s Tiananmen Square. On 3 and 4 June 1989, Chinese troops opened fire on p eaceful protesters who had assembled in great numbers in the capital to call for political and economic reforms, killing hundreds and possibly thousands. After 31 years, no one has been held accountable for these killings despite repeated demands from families and civil society. Front Line Defenders considers all those who peacefully advocate for truth, accountability, and reparations for the massacre, including through commemorative acts, to be human rights defenders. Among the 24 activists facing new charges, 11 are affiliated with the pro-democracy advocacy group Hong Kong Alliance in Support of Patriotic Democratic Movements in China, which has been organising the vigil since 1990. The other 13 activists include civil society group leaders, current and former Legislative Council or District Council members, and student and youth activists. Of the 24 human rights defenders, 13 were already charged in June for “inciting others to participate in unauthorised assemblies” in relation to the Tiananmen vigil. On 6 August, all 24 were charged with “knowingly participating in an unauthorised assembly”, while one also faces an additional new charge of “holding an unauthorised assembly”. Six of the 24 defenders were also among the 15 pro-democracy activists and human rights defenders charged in April 2020 with “organising and participating in unlawful assemblies” for protests that took place in August and October 2019. -

Minutes Have Been Seen by the Administration)

立法會 Legislative Council Ref : CB2/BC/3/18 LC Paper No. CB(2)1457/18-19 (These minutes have been seen by the Administration) Bills Committee on National Anthem Bill Minutes of the fourth meeting held on Monday, 18 March 2019, from 8:45 am to 10:45 am in Conference Room 1 of the Legislative Council Complex Members : Hon Martin LIAO Cheung-kong, SBS, JP (Chairman) present Hon CHEUNG Kwok-kwan, JP (Deputy Chairman) Hon LEUNG Yiu-chung Hon Tommy CHEUNG Yu-yan, GBS, JP Prof Hon Joseph LEE Kok-long, SBS, JP Hon Jeffrey LAM Kin-fung, GBS, JP Hon WONG Ting-kwong, GBS, JP Hon Starry LEE Wai-king, SBS, JP Hon CHAN Hak-kan, BBS, JP Hon CHAN Kin-por, GBS, JP Dr Hon Priscilla LEUNG Mei-fun, SBS, JP Hon WONG Kwok-kin, SBS, JP Hon Paul TSE Wai-chun, JP Hon Claudia MO Hon Michael TIEN Puk-sun, BBS, JP Hon Frankie YICK Chi-ming, SBS, JP Hon WU Chi-wai, MH Hon YIU Si-wing, BBS Hon MA Fung-kwok, SBS, JP Hon Charles Peter MOK, JP Hon CHAN Chi-chuen Hon CHAN Han-pan, BBS, JP Hon LEUNG Che-cheung, SBS, MH, JP Hon Kenneth LEUNG Hon Alice MAK Mei-kuen, BBS, JP Dr Hon KWOK Ka-ki Hon KWOK Wai-keung, JP Hon Dennis KWOK Wing-hang Hon Christopher CHEUNG Wah-fung, SBS, JP Dr Hon Helena WONG Pik-wan Hon IP Kin-yuen - 2 - Dr Hon Elizabeth QUAT, BBS, JP Dr Hon CHIANG Lai-wan, SBS, JP Ir Dr Hon LO Wai-kwok, SBS, MH, JP Hon Alvin YEUNG Hon Andrew WAN Siu-kin Hon CHU Hoi-dick Hon Jimmy NG Wing-ka, JP Dr Hon Junius HO Kwan-yiu, JP Hon HO Kai-ming Hon LAM Cheuk-ting Hon Holden CHOW Ho-ding Hon SHIU Ka-fai Hon SHIU Ka-chun Hon Wilson OR Chong-shing, MH Hon YUNG Hoi-yan Hon -

Minutes Have Been Seen by the Administration)

立法會 Legislative Council LC Paper No. CB(2)2360/08-09 (These minutes have been seen by the Administration) Ref : CB2/PL/WS Panel on Welfare Services Minutes of special meeting held on Saturday, 11 July 2009, at 9:00 am in Conference Room A of the Legislative Council Building Members : Hon Albert CHAN Wai-yip (Chairman) present Hon CHEUNG Kwok-che (Deputy Chairman) Hon Albert HO Chun-yan Hon LEE Cheuk-yan Hon LEUNG Yiu-chung Hon TAM Yiu-chung, GBS, JP Hon LI Fung-ying, BBS, JP Hon Frederick FUNG Kin-kee, SBS, JP Hon WONG Kwok-hing, MH Hon Alan LEONG Kah-kit, SC Hon LEUNG Kwok-hung Hon Paul CHAN Mo-po, MH, JP Hon WONG Sing-chi Hon WONG Kwok-kin, BBS Member : Hon Ronny TONG Ka-wah, SC absent Member : Dr Hon PAN Pey-chyou attending Public Officers : Item I attending Mrs Polly CHAN Principal Assistant Secretary for Labour and Welfare (Welfare)4 - 2 - Mr Stephen Fisher, JP Director of Social Welfare Mr FUNG Pak-yan Deputy Director of Social Welfare (Administration) Mr NG Wai-kuen Chief Social Security Officer 1 Social Welfare Department Item II Mrs Cecilia YUEN Assistant Director of Social Welfare (Rehabilitation and Medical Social Services) Mr FONG Kai-leung Chief Social Work Officer (Rehabilitation and Medical Social Services)2 Social Welfare Department Dr HUNG Se-fong Hospital Chief Executive, Kwai Chung Hospital Hospital Authority Ms Margaret TAY Chief Manager (Integrated Care Programs) Hospital Authority Deputations : Item I by invitation Oxfam Hong Kong Ms WONG Shek-hung Advocacy Officer for Hong Kong Programme Mr Joseph WOO Man-lung Manager -

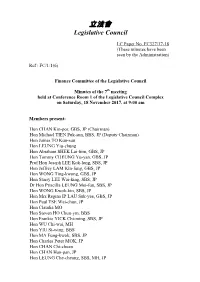

Minutes Have Been Seen by the Administration)

立法會 Legislative Council LC Paper No. FC327/17-18 (These minutes have been seen by the Administration) Ref : FC/1/1(6) Finance Committee of the Legislative Council Minutes of the 7th meeting held at Conference Room 1 of the Legislative Council Complex on Saturday, 18 November 2017, at 9:00 am Members present: Hon CHAN Kin-por, GBS, JP (Chairman) Hon Michael TIEN Puk-sun, BBS, JP (Deputy Chairman) Hon James TO Kun-sun Hon LEUNG Yiu-chung Hon Abraham SHEK Lai-him, GBS, JP Hon Tommy CHEUNG Yu-yan, GBS, JP Prof Hon Joseph LEE Kok-long, SBS, JP Hon Jeffrey LAM Kin-fung, GBS, JP Hon WONG Ting-kwong, GBS, JP Hon Starry LEE Wai-king, SBS, JP Dr Hon Priscilla LEUNG Mei-fun, SBS, JP Hon WONG Kwok-kin, SBS, JP Hon Mrs Regina IP LAU Suk-yee, GBS, JP Hon Paul TSE Wai-chun, JP Hon Claudia MO Hon Steven HO Chun-yin, BBS Hon Frankie YICK Chi-ming, SBS, JP Hon WU Chi-wai, MH Hon YIU Si-wing, BBS Hon MA Fung-kwok, SBS, JP Hon Charles Peter MOK, JP Hon CHAN Chi-chuen Hon CHAN Han-pan, JP Hon LEUNG Che-cheung, SBS, MH, JP - 2 - Hon Kenneth LEUNG Hon Alice MAK Mei-kuen, BBS, JP Dr Hon KWOK Ka-ki Hon KWOK Wai-keung, JP Hon Dennis KWOK Wing-hang Hon Christopher CHEUNG Wah-fung, SBS, JP Dr Hon Fernando CHEUNG Chiu-hung Dr Hon Helena WONG Pik-wan Dr Hon Elizabeth QUAT, BBS, JP Hon Martin LIAO Cheung-kong, SBS, JP Hon POON Siu-ping, BBS, MH Dr Hon CHIANG Lai-wan, JP Ir Dr Hon LO Wai-kwok, SBS, MH, JP Hon CHUNG Kwok-pan Hon Alvin YEUNG Hon Andrew WAN Siu-kin Hon CHU Hoi-dick Hon HO Kai-ming Hon Holden CHOW Ho-ding Hon SHIU Ka-fai Hon Wilson OR Chong-shing, MH Hon -

Hong Kong Island Tat Cheng Arrested Fergus Leung Arrested Tiffany

Hong Kong Island Tat Cheng Arrested Fergus Leung Arrested Tiffany Yuen Arrested Clarisse Yeung Arrested Andy Chui Arrested Michael Pang Arrested Nathan Law In self-exile Ted Hui In self-exile Kowloon West Jimmy Sham Arrested Claudia Mo Arrested Lawrence Lau Arrested Helena Wong Arrested Nathan Lau Arrested Kalvin Ho Arrested Jeffrey Andrews Arrested Frankie Fung Arrested Sunny Cheung In self-exile Kowloon East Jeremy Tam Arrested Wu Chi-wai Arrested Sze Tak-loy Arrested Kinda Li Arrested Joshua Wong Imprisoned Tam Tak-chi Imprisoned New Territories West Carol Ng Arrested Prince Wong Arrested Sam Cheung Arrested Eddie Chu Arrested Kwok Ka-ki Arrested Andrew Wan Arrested Ng Kin-wai Arrested Roy Tam Arrested New Territories East Alvin Yeung Arrested Leung Kwok-hung Arrested Ray Chan Arrested Lam Cheuk-ting Arrested Gwyneth Ho Arrested Owen Chow Arrested Ricky Or Arrested Hendrick Lui Arrested Gary Fan Arrested Lee Chi-yung Arrested Ventus Lau Arrested Mike Lam Arrested Functional Constituency – District Council II James To Arrested Shun Lee Arrested Henry Wong Arrested Lester Shum Arrested Roy Kwong Arrested Functional Constituency – Health Services Lau Hoi-man Arrested Joseph Lee Kok-long Arrested Ricky Yuen Arrested Winnie Yu Arrested Other primary election organisers Benny Tai Primaries organiser Arrested Robert Chung Primaries co-organiser, executive director of PORI Assistance requested for investigation Andrew Chiu Power for Democracy convenor Arrested John Clancey Power for Democracy treasurer Arrested Ben Chung Power for Democracy deputy convenor Arrested Au Nok-hin Primaries coordinator Arrested Gordon Ng Ching-hang Activist advocating for the primaries Arrested .