Deric Wyatt District 2 Engineer Sheridan Rotary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Arkansas Embarks on Its Largest Highway Construction Program

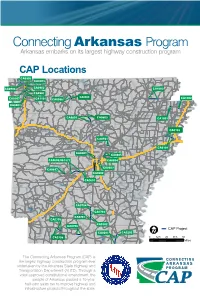

Connecting Arkansas Program Arkansas embarks on its largest highway construction program CAP Locations CA0905 CA0903 CA0904 CA0902 CA1003 CA0901 CA0909 CA1002 CA0907 CA1101 CA0906 CA0401 CA0801 CA0803 CA1001 CA0103 CA0501 CA0101 CA0603 CA0605 CA0606/061377 CA0604 CA0602 CA0607 CA0608 CA0601 CA0704 CA0703 CA0701 CA0705 CA0702 CA0706 CAP Project CA0201 CA0202 CA0708 0 12.5 25 37.5 50 Miles The Connecting Arkansas Program (CAP) is the largest highway construction program ever undertaken by the Arkansas State Highway and Transportation Department (AHTD). Through a voter-approved constitutional amendment, the people of Arkansas passed a 10-year, half-cent sales tax to improve highway and infrastructure projects throughout the state. Job Job Name Route County Improvements CA0101 County Road 375 – Highway 147 Highway 64 Crittenden Widening CA0103 Cross County Line - County Road 375 Highway 64 Crittenden Widening CA0201 Louisiana State Line – Highway 82 Highway 425 Ashley Widening CA0202 Highway 425 – Hamburg Highway 82 Ashley Widening CA0401 Highway 71B – Highway 412 Interstate 49 Washington Widening CA0501 Turner Road – County Road 5 Highway 64 White Widening CA0601 Highway 70 – Sevier Street Interstate 30 Saline Widening CA0602 Interstate 530 – Highway 67 Interstates 30/40 Pulaski Widening and Reconstruction CA0603 Highway 365 – Interstate 430 Interstate 40 Pulaski Widening CA0604 Main Street – Vandenberg Boulevard Highway 67 Pulaski Widening CA0605 Vandenberg Boulevard – Highway 5 Highway 67 Pulaski/Lonoke Widening CA0606 Hot Springs – Highway -

Comprehensive Annual Financial Report Fiscal Year Ended June 30, 2020

ARKANSAS The Natural State Comprehensive Annual Financial Report Fiscal Year Ended June 30, 2020 ARKANSAS Comprehensive Annual Financial Report Fiscal Year Ended June 30, 2020 Asa Hutchinson Governor Larry W. Walther Secretary Department of Finance and Administration Prepared By The Department of Finance and Administration Office of Accounting The requirements of State agencies to print annual reports, such as the State of Arkansas’s Comprehensive Annual Financial Report, were reduced by Ark. Code Ann. § 25-1-203. The report is available in electronic format at https://www.dfa.arkansas.gov/accounting-office/CAFR. The photograph of Governor Asa Hutchinson is courtesy of the Governor’s Office. Governor Asa Hutchinson STATE OF ARKANSAS ASA HUTCHINSON GOVERNOR January 15, 2021 To the People of Arkansas and the Honorable Members of the Arkansas General Assembly: I am pleased to submit the Fiscal Year 2020 Arkansas Comprehensive Annual Financial Report (CAFR). This annual publication demonstrates my commitment to accurate and timely financial reporting. The financial statements and accompanying disclosures provide detailed information of the State of Arkansas’s financial status, accounting methods and economic data to the public. The Fiscal Year 2020 CAFR goes beyond generally accepted accounting principles to highlight important statistical information of the State. For these efforts, I am pleased to report that the 2019 CAFR received the Government Finance Officers Association Certificate of Achievement for Excellence in Financial Reporting. Arkansas has received this prestigious award twenty-two times for its transparency in reporting. I appreciate the work performed by all State employees who have maintained financial records. Using this information, the Department of Finance and Administration team has worked over the last several months to complete this fiscal year 2020 report for your review. -

Final Report

FINAL REPORT December 1, 2010 Presented to: The Honorable Mike Beebe, Governor House Interim Committee on Public Transportation Senate Interim Committee on Transportation, Technology and Legislative Affairs House Interim Committee on Revenue and Taxation Senate Interim Committee on Revenue and Taxation Arkansas Legislative Council Arkansas State Highway Commission Association of Arkansas Counties Arkansas Municipal League TABLE OF CONTENTS Chairman’s Comments and Summary of Recommendations .............................. i Introduction.............................................................................................................. 1 Highway Needs – Historic Information .................................................................. 3 Highway Revenue – A Structural Problem ............................................................ 6 The Link Between Transportation Investments and the Economy.................... 15 Revenue Proposals ............................................................................................... 17 Other Recommended Legislation......................................................................... 28 Recommended Studies......................................................................................... 31 Other Recommendations...................................................................................... 34 Appendix................................................................................................................ 35 CHAIRMAN’S COMMENTS AND SUMMARY OF RECOMMENDATIONS -

2016 ANNUAL Report

2016 ANNUAL Report ARKANSAS STATE HIGHWAY AND TRANSPORTATION DEPARTMENT AHTD Mission Statement To provide a safe, efficient, aesthetically pleasing and environmentally sound intermodal transportation TABLE OF system for the user. CONTENTS 4 DIRECTOR’S MESSAGE 6 ARKANSAS STATE HIGHWAY COMMISSION 8 TOP TEN CONTRACTS OF 2016 10 CONSTRUCTION HIGHLIGHTS 14 IMPROVING OUR HIGHWAY SYSTEM 16 GROUNDBREAKINGS & RIBBON CUTTINGS 18 PUBLIC INVOLVEMENT 19 IDRIVEARKANSAS AND TWITTER STATISTICS 20 RECOGNITIONS & ACCOMPLISHMENTS 22 DISTRICT INFORMATION PHOTO THIS PAGE / Highway 70 Railroad Overpass (Roosevelt Rd., Little Rock) photo by Rusty Hubbard 24 ORGANIZATION & WORKFORCE FRONT & BACK COVER PHOTOS / Highway 70 Bridge (Broadway St.) over the Arkansas River photo by Rusty Hubbard 2 3 WORK CONTINUED ON REPLACING the Broadway Bridge (U.S. HIGHWAY 70) CONNECTING Little Rock and DIRECTOR’S message North Little Rock HE ARKANSAS STATE HIGHWAY AND TRANSPORTATION DEPARTMENT (AHTD) is proud to present our annual report and share the highlights and successes that the Department experienced over calendar year 2016. For the year, the Department let to contract 263 projects totaling just overT $1.2 billion. The largest of those projects was on Interstate 40 in Prairie County. In addition, work continued on replacing the Broadway Bridge (U.S. Highway 70) connecting Little Rock and North Little Rock and on improvements to Interstates 49 and 440. This report provides information on projects in all 10 of our Districts across the State. Each reflects our commitment to making our highway system one of the best in the nation as well as one of the safest. Our two major road improvement programs progressed well in 2016. -

In the United States District Court for the Eastern District of Arkansas the Little Rock Downtown Neighborhood Association

IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF ARKANSAS THE LITTLE ROCK DOWNTOWN NEIGHBORHOOD ASSOCIATION, INC., THE PETTAWAY NEIGHBORHOOD ASSOCIATION, THE HANGER HILL NEIGHBORHOOD ASSOCIATION, THE FOREST HILLS NEIGHBORHOOD ASSOCIATION, INC., THE COALITION OF LITTLE ROCK NEIGHBORHOODS, INC., ARKANSAS COMMUNITIES ORGANIZATION, INC., JOSHUA SILVERSTEIN, DALE PEKAR, JOHN HEDRICK, DENISE ENNETT, ROHN MUSE, BARBARA BARROWS and KATHY WELLS PLAINTIFFS Vs. Case No. ______________________ FEDERAL HIGHWAY ADMINISTRATION, UNITED STATES DEPARTMENT OF TRANSPORTATION; ANGEL L. CORREA, DIVISION ADMINISTRATOR, ARKANSAS DIVISION, FEDERAL HIGHWAY ADMINISTRATION; and ARKANSAS DEPARTMENT OF TRANSPORTATION and SCOTT BENNETT DIRECTOR, ARKANSAS DEPARTMENT OF TRANSPORTATION DEFENDANTS COMPLAINT FOR DECLARATORY JUDGMENT, AND FOR PRELIMINARY AND PERMANENT INJUNCTIVE RELIEF Come the Plaintiffs, The Downtown Little Rock Neighborhood Association, Inc., Pettaway Neighborhood Association, The Hanger Hill Neighborhood Association, Inc., The Forest Hills Neighborhood Association, Inc., the Coalition of Little Rock, Neighborhoods, The Arkansas Communities Organization, Inc. (“the Organizational Plaintiffs”), and Joshua Silverstein, Dale Pekar, John Hedrick, Denise Ennett, Rohn Muse, Barbara Barrows and Kathy 1 Wells (“the Individual Plaintiffs”), (collectively herein “the Plaintiffs”), and for their cause of action against the Defendants, Federal Highway Administration, United States Department Of Transportation (“FHWA); Angel L. Correa, Division Administrator, -

NOTICE of LOCATION & DESIGN PUBLIC HEARING Job No. CA0602

NOTICE OF LOCATION & DESIGN PUBLIC HEARING Job No. CA0602 “30 Crossing” I-530 – Hwy. 67 (Widening & Reconst.) (I-30 & I-40) Pulaski County The Arkansas Department of Transportation (ARDOT), in cooperation with the Federal Highway Administration (FHWA) and U.S. Army Corps of Engineers (USACE), will conduct an open forum Location and Design Public Hearing to present and discuss the Environmental Assessment and proposed design plans. This project proposes to improve Interstate 30 from Interstate 530 and Interstate 440 to Interstate 40; including the Arkansas River Bridge, and a portion of I-40 from Highway 365 (MacArthur Drive) to Highway 67/167 including associated interchanges. The Location and Design Public Hearing will be held on Thursday, July 12, 2018, from 4:00 p.m. to 7:00 p.m., at the Wyndham Riverfront (Silver City Rooms), located at 2 Riverfront Place in North Little Rock. The public hearing will present the proposed preferred alternative, the 6-Lane with Collector/Distributor (C/D) Lanes with Split Diamond Interchange (SDI) at the Highway 10 interchange. The open forum format allows citizens the opportunity to view the Environmental Assessment and proposed location and design plans, and discuss the project with representatives of ARDOT, FHWA, and the USACE. Information on the right of way appraisal and acquisition procedures will be available. Appendix H of the Environmental Assessment will include De Minimus Section 4(f) Evaluations of potential impacts to the recreational values of the Clinton Center and Park, Riverfront Park, and North Shore Riverwalk Park. Potential impacts, as well as protective actions that will be used to minimize impacts at these parks, are also included. -

Implementation Plan Executive Summary

Implementation Plan Executive Summary action is recommended for inclusion in a CUS Implementation Plan Executive Implementation grant request proposal. n Documents / Memoranda of Agreement. Summary These actions will enhance partnerships and processes to address compatible planning The Pine Bluff Arsenal Compatible Use Study and development. These actions are (CUS) serves as a planning tool for managing recommended for inclusion in a CUS growth and maintaining the balance between Implementation grant request proposal. community needs and interests and military needs and interests. The goal of compatibility n Plan / Regulation Updates. These actions planning is to promote an environment where will update local planning documents / both community and military entities policies and regulations to address communicate, coordinate, and implement compatible growth. These actions are mutually supportive actions that allow both to recommended for inclusion in a CUS achieve their respective objectives. The CUS Implementation grant request proposal. Study identified 35 high priority implementation n Educational Materials / Information. These actions as outlined in the eight categories actions will develop educational materials and described below and shown in Table 1. These information for the public and other high priority actions are required to mutually stakeholders to assist in making informed support Pine Bluff Arsenal and the surrounding decisions or to be aware of local, state, or community. The high priority actions will also federal requirements. These actions are require additional funding or resources. recommended for inclusion in a CUS Implementation grant request proposal. Compatible Use Study – High n Defense Community Infrastructure Program Priority Action Categories (DCIP). These actions will require developing projects and application packages for n Studies. -

Request for Proposal

Military Affairs Advisory Committee City of White Hall, Arkansas FINAL Rev. 3, 5-25-21 REQUEST FOR PROPOSAL Pine Bluff Arsenal Compatible Use Implementation To Include the Jurisdictions of: City of White Hall City of Pine Bluff County of Jefferson State of Arkansas and U.S. Army Pine Bluff Arsenal Proposal Requested By: Office of the Mayor City of White Hall, Arkansas 101 Parkway Drive White Hall, Arkansas 71602 Date of the Request for Proposal - May 25, 2021 Date Proposals are due to White Hall Mayor’s Office - June 25, 2021 PBA Compatible Use Implementation FINAL RFP Rev 3, 5-25-21 SCOPE OF WORK – PINE BLUFF ARSENAL COMPATIBLE USE IMPLEMENTATION The City of White Hall, Arkansas, is seeking proposals from qualified firms to implement and address the specific, high-priority recommendations from the initial Compatible Use Study in support of the U.S. Army Pine Bluff Arsenal. The Compatible Use Implementation will address 35 high-priority recommendations that cover a range of issues to promote compatible economic development in support of the Arsenal’s mission, to include: • Developing detailed plans and preliminary designs to address transportation capacity, access road safety, utility resilience, and other issues. • Developing additional GIS overlays for incorporation into existing web-based portals to assist with compatible siting process. • Establishing documents / Memoranda of Agreement to formalize communication and coordination and facilitate decision-making for economic development compatibility. • Creating / updating and adopting local planning policies / documents / regulations to manage and limit future incompatible uses. • Developing educational materials to provide communities, organizations, and the public information on Pine Bluff Arsenal’s missions, to assist in making informed decisions, and to be aware of local, state, and federal requirements. -

Tours of Little Rock

60090 Cover_46702 Cover 8/5/13 12:27 PM Page 1 Pro Produced in conjunction with TOURS The Little Rock Convention & Visitors Bureau of Base maps courtesy of Arkansas State Highway and Transportation Department LITTLE ROCK 60090 Text_46702 Text 8/5/13 12:29 PM Page A1 TOURS OF LITTLE ROCK PREFACE I grew up on the car line in the Pulaski Heights area of Little Rock. From our house at 3415 Kavanaugh, my brother and I watched the streetcar turn around on “I” Street, if it was not scheduled to continue northwest on the gravel roadbed which began a few blocks from our house. I have seen a lot of changes in 70 years and it is difficult to see all of Little Rock without a guide. This guidebook is my offer to show you around Little Rock. The old street car line climbed 200 feet from downtown Little Rock to the Heights and in doing so, left the Delta and started up the mountains. Spring comes several days earlier in downtown Little Rock than it does in the Heights, and fall comes earlier in the Heights than it does in downtown. The Arkansas River carves a gateway between the Ouachita and Ozark Mountains to the Delta at Little Rock. The terrain drops only 200 feet from Little Rock to the Gulf of Mexico in the south and rises over 2,000 feet in the Ouachitas and Ozarks to the north and west. This varied ter- rain has a lot of sights and action. Little Rock is a paradise for sightseers, hikers, antiquers, histori- ans, sports, food lovers, and all the rest. -

Plaintiffs' Motion for Preliminary and Permanent

Case 4:19-cv-00362-JM Document 48 Filed 07/10/20 Page 1 of 7 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF ARKANSAS CENTRAL DIVISION THE LITTLE ROCK DOWNTOWN NEIGHBORHOOD ASSOCIATION, INC., THE PETTAWAY NEIGHBORHOOD ASSOCIATION, THE HANGER HILL NEIGHBORHOOD ASSOCIATION, THE FOREST HILLS NEIGHBORHOOD ASSOCIATION, INC., THE COALITION OF LITTLE ROCK NEIGHBORHOODS, INC., ARKANSAS COMMUNITIES ORGANIZATION, INC., JOSHUA SILVERSTEIN, DALE PEKAR, JOHN HEDRICK, DENISE ENNETT, ROHN MUSE, BARBARA BARROWS and KATHY WELLS PLAINTIFFS Vs. Case No. 4:19CV 362-JM FEDERAL HIGHWAY ADMINISTRATION, UNITED STATES DEPARTMENT OF TRANSPORTATION; ANGEL L. CORREA, DIVISION ADMINISTRATOR, ARKANSAS DIVISION, FEDERAL HIGHWAY ADMINISTRATION; and ARKANSAS DEPARTMENT OF TRANSPORTATION and LORIE TUDOR, DIRECTOR, ARKANSAS DEPARTMENT OF TRANSPORTATION DEFENDANTS PLAINTIFFS’ MOTION FOR PRELIMINARY AND PERMANENT INJUNCTION RICHARD MAYS LAW FIRM PLLC Richard H. Mays (AR Bar # 61043) 2226 Cottondale Lane – Suite 100 Little Rock, AR 72202 [email protected] 1 Case 4:19-cv-00362-JM Document 48 Filed 07/10/20 Page 2 of 7 PLAINTIFFS’ MOTION FOR PRELIMINARY AND PERMANENT INJUNCTION Come the Plaintiffs, by and through their attorneys, Richard H. Mays of Richard Mays Law Firm PLLC, Little Rock, Arkansas, and for their Motion for a Preliminary Injunction prohibiting the Defendants from commencing any construction on any portion of the proposed reconstruction of a 7.3 mile section of Interstate 30 in Little Rock and North Little Rock, Arkansas, more particularly described herein, pending a final hearing for a permanent injunction based on the merits of the First Amended Complaint or any subsequent amended Complaint filed herein, state: 1. -

City & Town, November 2020 Vol. 76, No. 11

NOVEMBER 2020 VOL. 76, NO. 11 THE OFFICIAL PUBLICATION OF THE ARKANSAS MUNICIPAL LEAGUE How do you think new money becomes old money? Lile Choate Richard Clark Rena Escue Chuck Tlapek Alexandra Bowen VP, Trust Officer SVP, Trust Officer Trust Officer SVP, Chief Investment Officer VP, Trust Officer Little Rock, AR Conway, AR Jonesboro, AR Little Rock, AR Jonesboro, AR At Simmons, our Investment Management services help you get the most out of your money. Our wealth management professionals have on average more than 20 years of experience and are responsible for over $6 billion in assets. We will manage your portfolio with a diligent approach and in-depth knowledge of the marketplace. We’ll devise clear strategies to help protect and grow your assets. That way, you can continue to work towards the future you’ve always envisioned. Put our experience to work for your legacy. Speak with one of our wealth management experts and start planning your tomorrow. Trust | Inves tments | Insur ance | Privat e Banking Simmons Wealth Management is a marketing name used by the trust division of Simmons Bank. Investments and Insurance Products Are: Not a Deposit | Not FDIC Insured Not Insured by Any Federal Government Agency | Not Bank Guaranteed | May Lose Value. simmonsbank.com MUNICIP S AL A L S E N A A G K U R E A G E R ARK ANSAS MUNICIPAL LEAGUE T GREAT CITIES MAKE A GREAT STATE E A A T T S C T I A TI E ES GR MAKE A ON THE COVER—The new Pine Bluff Main Library is just one part of a resurgent downtown. -

INFORMATION RELEASE Office of the Director a RKANSAS STATE HIGHWAY and TRANSPORTATION DEPARTMENT P

INFORMATION RELEASE Office of the Director A RKANSAS STATE HIGHWAY AND TRANSPORTATION DEPARTMENT P. O. Box 2261 – Little Rock, Arkansas ArkansasHighways.com Telephone (501) 569- 2227 Twitter: @ A HTD Contact: NR 15-360 Danny Straessle October 16, 2015 AHTD TO HOLD “30 CROSSING” PUBLIC INVOLVEMENT MEETING IN NORTH LITTLE ROCK LITTLE ROCK (10-16) – The Arkansas State Highway and Transportation Department (AHTD) will hold a public involvement meeting in North Little Rock to present and discuss plans to widen Interstate 30 in Little Rock and North Little Rock between Interstate 40 and Interstate 530, including the Arkansas River Bridge, as well as improvements to I-40 from JFK Boulevard to Highway 67. The 30 Crossing project is part of the department’s Connecting Arkansas Program (CAP). The public meeting will provide an update since the Planning and Environmental Linkages (PEL) study was completed and approved in July. During this time, the study team has further evaluated roadway, bridge and interchange concepts to widen I-30 to 10 lanes with a downtown collector/distributor system, as well as evaluated an additional alternative to widen I-30 to 8 lanes. Additional work has included initiating environmental evaluations required under the National Environmental Policy Act and identifying and analyzing ways to minimize impacts. The meeting will be held Thursday, October 22, 2015, from 4:00 p.m. to 7:00 p.m., at Friendly Chapel Church of the Nazarene (Gym), 116 South Pine Street in North Little Rock. The meeting will be held in an open house format, and the public is invited to visit anytime during the scheduled hours to view displays, ask questions, and offer comments about the proposed project.