Capitaland Group Presentation Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Clinics in Downtown Core Open on Friday 24 Jan 2020

LIST OF CLINICS IN DOWNTOWN CORE OPEN ON FRIDAY 24 JAN 2020 POSTAL S/N NAME OF CLINIC BLOCK STREET NAME LEVEL UNIT BUILDING TEL OPENING HOURS CODE 1 ACUMED MEDICAL GROUP 16 COLLYER QUAY 02 03 INCOME AT RAFFLES 049318 65327766 8.30AM-12.30PM 2 AQUILA MEDICAL 160 ROBINSON ROAD 05 01 SINGAPORE BUSINESS FEDERATION CENTER 068914 69572826 11.00AM- 8.00PM 3 AYE METTA CLINIC PTE. LTD. 111 NORTH BRIDGE ROAD 04 36A PENINSULA PLAZA 179098 63370504 2.30PM-7.00PM 4 CAPITAL MEDICAL CENTRE 111 NORTH BRIDGE ROAD 05 18 PENINSULA PLAZA 179098 63335144 4.00PM-6.30PM 5 CITYHEALTH CLINIC & SURGERY 152 BEACH ROAD 03 08 GATEWAY EAST 189721 62995398 8.30AM-12.00PM 6 CITYMED HEALTH ASSOCIATES PTE LTD 19 KEPPEL RD 01 01 JIT POH BUILDING 089058 62262636 9.00AM-12.30PM 7 CLIFFORD DISPENSARY PTE LTD 77 ROBINSON ROAD 06 02 ROBINSON 77 068896 65350371 9.00AM-1.00PM 8 DA CLINIC @ ANSON 10 ANSON ROAD 01 12 INTERNATIONAL PLAZA 079903 65918668 9.00AM-12.00PM 9 DRS SINGH & PARTNERS, RAFFLES CITY MEDICAL CENTRE 252 NORTH BRIDGE RD 02 16 RAFFLES CITY SHOPPING CENTRE 179103 63388883 9.00AM-12.30PM 10 DRS THOMPSON & THOMSON RADLINK MEDICARE 24 RAFFLES PLACE 02 08 CLIFFORD CENTRE 048621 65325376 8.30AM-12.30PM 11 DRS. BAIN + PARTNERS 1 RAFFLES QUAY 09 03 ONE RAFFLES QUAY - NORTH TOWER 048583 65325522 9.00AM-11.00AM 12 DTAP @ DUO MEDICAL CLINIC 7 FRASER STREET B3 17/18 DUO GALLERIA 189356 69261678 9.00AM-3.00PM 13 DTAP @ RAFFLES PLACE 20 CECIL STREET 02 01 PLUS 049705 69261678 8.00AM-3.00PM 14 FULLERTON HEALTH @ OFC 10 COLLYER QUAY 03 08/09 OCEAN FINANCIAL CENTRE 049315 63333636 -

Office Listing & Rental Price

Office Listing & Rental Price Subject to availability, survey, approval and contract Asking rents are subject to revision without any notice Francis Goh (65) 97305200 [email protected] CEA Reg. No: R041398H TYPE DISTRICT LOCATIONS ADDRESS SIZE (SQFT) PSF (S$) PRICE (S$) AVAILABLE REMARKS Retail (F&B) 1 Crown at Robinson 140 Robinson Road 068907 2,508 13.00 32,604 Immediate Fitted Office 1 Crown at Robinson 140 Robinson Road 068907 592 9.00 5,328 Immediate Bare Office 1 Crown at Robinson 140 Robinson Road 068907 592 9.00 5,328 Immediate Bare Office 1 Crown at Robinson 140 Robinson Road 068907 592 9.00 5,328 Immediate Partially fitted Office 1 Crown at Robinson 140 Robinson Road 068907 926 9.00 8,334 Immediate Partially fitted Office 1 Crown at Robinson 140 Robinson Road 068907 6,792 9.00 61,128 Immediate Fitted Office 1 Crown at Robinson 140 Robinson Road 068907 1,485 9.00 13,365 Immediate Penthouse office (Furnished and fitted) Office 1 UOB Plaza 1 No. 80 Raffles Place 1,862 11.00 20,482 Immediate Bare Office 1 UOB Plaza 1 No. 80 Raffles Place 5,253 11.00 1,500 Immediate Fitted Office 1 UOB Plaza 1 No. 80 Raffles Place 5,963 11.00 1,500 Immediate Bare Office 1 UOB Plaza 1 No. 80 Raffles Place 12,206 11.00 134,266 Immediate Bare Office 1 UOB Plaza 1 No. 80 Raffles Place 2,099 11.00 23,089 Immediate Fitted Office 1 UOB Plaza 1 No. 80 Raffles Place 2,454 11.00 26,994 1-May-21 Fitted Office 1 UOB Plaza 1 No. -

Office Rental Guide Official Asking Rates

Office Rental Guide Keck Seng Tower $6.00-$6.50 Singapore Pools Building Full Manulife Tower $9.00-$10.00 Sunshine Plaza $6.00 Official Asking Rates MYP Plaza $6.50 Tanglin Shopping Centre $5.60-$6.20 OUE Downtown 1 & 2 $9.00 The Bencoolen $5.50 S$ per sq ft per month – PIL Building $6.50 The Heeren $10.50 inclusive of service charge Robinson 77 $9.00 Thong Teck Building $7.00-$8.00 Robinson 112 $6.80 Tong Building $9.00 1 February 2021 Robinson Point $8.00-$8.80 TripleOne Somerset $8.50-$8.80 SBF Centre $6.45-$8.00 Visioncrest Commercial $9.00 Raffles Place/New Downtown SGX Centre 1 & 2 $8.50-$9.50 Wheelock Place $11.50 6 Battery Road $13.00 Shenton House $5.00-$5.80 Wilkie Edge $9.00 6 Raffles Quay $6.50-$8.00 SIF Building $7.20 Winsland House I & II $9.50 18 Robinson $12.00 The Globe $6.50 Wisma Atria $9.50-$11.00 20 Collyer Quay $9.00-$12.30 The Octagon $5.80 30 Raffles Place $11.00 Tokio Marine Centre $8.00-$8.50 Chinatown/River Valley Road 55 Market Street $10.50 Tong Eng Building $5.20-$7.00 Central Mall Full AIA Tower Full UIC Building Full CES Centre $5.80 Asia Square Tower 1 $14.00 Chinatown Point $8.00 Asia Square Tower 2 $12.00-$13.50 Tanjong Pagar Great World City $7.50 ASO Building $6.20 78 Shenton Way Tower 1 $7.00-$8.00 Havelock II $7.50 Bank of China Building Full 78 Shenton Way Tower 2 $9.20 King’s Centre $6.50 Bank of Singapore Centre $9.50 79 Anson Road $8.50 The Central $8.00-$9.50 Bharat Building $6.30 100AM $7.30 UE Square $8.50 CapitaGreen $13.50 ABI Plaza $6.00 Valley Point $6.50 CapitaSpring $14.00 Anson Centre -

List-Of-Bin-Locations-1-1.Pdf

List of publicly accessible locations where E-Bins are deployed* *This is a working list, more locations will be added every week* Name Location Type of Bin Placed Ace The Place CC • 120 Woodlands Ave 1 3-in-1 Bin (ICT, Bulb, Battery) Apple • 2 Bayfront Avenue, B2-06, MBS • 270 Orchard Rd Battery and Bulb Bin • 78 Airport Blvd, Jewel Airport Ang Mo Kio CC • Ang Mo Kio Avenue 1 3-in-1 Bin (ICT, Bulb, Battery) Best Denki • 1 Harbourfront Walk, Vivocity, #2-07 • 3155 Commonwealth Avenue West, The Clementi Mall, #04- 46/47/48/49 • 68 Orchard Road, Plaza Singapura, #3-39 • 2 Jurong East Street 21, IMM, #3-33 • 63 Jurong West Central 3, Jurong Point, #B1-92 • 109 North Bridge Road, Funan, #3-16 3-in-1 Bin • 1 Kim Seng Promenade, Great World City, #07-01 (ICT, Bulb, Battery) • 391A Orchard Road, Ngee Ann City Tower A • 9 Bishan Place, Junction 8 Shopping Centre, #03-02 • 17 Petir Road, Hillion Mall, #B1-65 • 83 Punggol Central, Waterway Point • 311 New Upper Changi Road, Bedok Mall • 80 Marine Parade Road #03 - 29 / 30 Parkway Parade Complex Bugis Junction • 230 Victoria Street 3-in-1 Bin Towers (ICT, Bulb, Battery) Bukit Merah CC • 4000 Jalan Bukit Merah 3-in-1 Bin (ICT, Bulb, Battery) Bukit Panjang CC • 8 Pending Rd 3-in-1 Bin (ICT, Bulb, Battery) Bukit Timah Plaza • 1 Jalan Anak Bukit 3-in-1 Bin (ICT, Bulb, Battery) Cash Converters • 135 Jurong Gateway Road • 510 Tampines Central 1 3-in-1 Bin • Lor 4 Toa Payoh, Blk 192, #01-674 (ICT, Bulb, Battery) • Ang Mo Kio Ave 8, Blk 710A, #01-2625 Causeway Point • 1 Woodlands Square 3-in-1 Bin (ICT, -

Independent Market Overview Mapletree Commercial Trust by CBRE Pte Ltd

Independent Market Overview Mapletree Commercial Trust by CBRE Pte Ltd 1 THE SINGAPORE ECONOMY Rising private road transport costs are also expected to contribute to higher inflation in 2017. The Singapore economy expanded 2.0% in 2016, improving from the 1.9% growth achieved in 2015. Economic growth The ongoing economic restructuring efforts will increase in 2016 was largely driven by the education, health and Singapore’s dependence on the services producing industries. social services segment, as well as the information and High-value hi-tech firms will increasingly replace the communication segment. traditional manufacturing sector. Service producing industries grew 1.0% in 2016, contracting However, prospects for global economic growth remain from 3.2% in 2015 due to the challenging global economic muted as political risks and anti-globalisation sentiments environment. Growth in the services sector was led mainly by pose headwinds in 2017, particularly for open economies the Other Services sector comprising education, health, and such as Singapore. social services segment. The Other Services sector recorded growth rates of 3.1% in 2016 while the information and The Ministry of Trade & Industry (MTI) has forecast a communication segment grew 2.3% over the same period. relatively modest GDP growth of between 1.0% and 3.0% in 2017, supported largely by the domestic-orientated Headline inflation in 2016 was -0.5%, unchanged from sectors as well as potential upside to exports demand. 2015 due to lower transport cost and housing rents. The Oxford Economics, a leading global economics advisory firm, Monetary Authority of Singapore (MAS) forecast inflation to forecast Singapore’s GDP to grow by 2.7% in 2017 on the range between 0.5% and 1.5% for the whole of 2017, with back of additional fiscal support from the government and positive contribution from energy-related components and modest easing by MAS. -

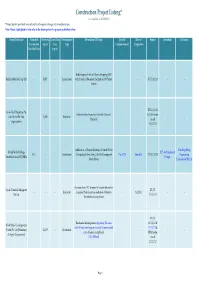

Construction Project Listing* (Last Updated on 20/12/2013) *Project Details Provided May Subject to Subsequent Changes by Owner/Developer

Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer. Note: Words highlighted in blue refer to the latest updates for projects published before. Owner/Developer Estimated Site Area Gross Floor Development Description Of Project Date Of Date of Source Consultant Contractor Construction (sq m) Area Type Commencement Completion Cost ($million) (sq m) Redevelopment into a 6 Storey Shopping Mall Raffles Medical Group Ltd - 5,827 - Institutional with 2 levels of Basement Carpark at 100 Taman - - ST 17/12/13 - - Warna BT 11/12/13 Grow-Tech Properties Pte Industrial development at Gambas Crescent & URA tender Ltd (Part of Far East - 14,302 - Industrial -- -- (Parcel 3) result Organization) 13/12/13 Addition of a 5 Storey Building to United World Kim Seng Heng United World College BLT Architecture & 42.5 - - Institutional College South East Asia (UWCSEA) campus at Dec-2013 Aug-2015 BT 13/12/13 Engineering South East Asia (UWCSEA) Design Dover Road Construction Pte Ltd Erection of an LPG Terminal to import alternative Vopak Terminals Singapore BT/ST - - - Industrial Liquefied Petroleum Gas feedstock at Banyan - 1Q 2016 -- Pte Ltd 11/12/13 Terminal in Jurong Island BT/ST Residential development comprising 281 units 16/11/12 & World Class Developments with 24 hour concierge service and 18 commercial 11/12/13 & (North) Pte Ltd [Subsidiary - 10,170 - Residential -- -- units at Jalan Jurong Kechil URA tender of Aspial Corporation] (The Hillford) result 22/11/12 Page 1 Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer. -

Beach Road's Changing Skyline

PROPERTY PERSONALISED MCI (P) 047/08/2018 PPS 1519/09/2012 (022805) Visit EdgeProp.sg to find properties, research market trends and read the latest news The week of May 6, 2019 | ISSUE 880-102 Highlight Market Trends Under the Hammer Oxley sells Chevron House Private residential prices Unit at Skies Miltonia for $1.03 bil fall by 0.7% in 1Q2019 going for $1.14 mil EP2 EP4 EP11 Beach Road’s changing skyline From Guoco Midtown and Shaw Towers to the new residential developments at Tan Quee Lan Street and Middle Road, the Beach Road-Rochor Road area is set for a massive renewal. Turn to our Cover Story on Pages 6 & 7. The new Shaw Towers and Guoco Midtown will be linked to each other CapitaLand’sand to their neighbouring M&A will give developments it access to Ascendas-Singbridge’s as well as MRT stations Changi Business Park SAMUEL ISAAC CHUA/EDGEPROP SINGAPORE CHUA/EDGEPROP ISAAC SAMUEL EP2 • EDGEPROP | MAY 6, 2019 PROPERTY BRIEFS SAMUEL ISAAC CHUA/EDGEPROP SINGAPORE Oxley sells Chevron House for cluding tenant representation, corporate $1.03 bil solutions and capital markets and in- EDITORIAL EDITOR | Oxley Holdings has signed a deal to sell vestment, across key gateway cities in Cecilia Chow Chevron House for $1.03 billion, after the Asia-Pacific. DEPUTY EDITOR | acquiring the prime office space for $660 “This strategic appointment under- Amy Tan million in December 2017. scores our intent to continue to grow SENIOR WRITER | Timothy Tay Located at 30 Raffles Place, Chevron our share of business and influence in WRITERS | Bong Xin Ying, House is a 32-storey commercial devel- the market, both in Singapore and inter- Charlene Chin opment with 27 levels of office space nationally,” says Tang Wei Leng, man- HEAD, COPY EDITING | Pek Tiong Gee and a five-storey retail podium with a aging director at Colliers International. -

AEW Asia Research Perspective Q215 in Progress .Indd

GENERAL ECONOMIC OVERVIEW Globally the economy is expanding at a moderate pace and key commodity prices AEW Asia Research Perspective Q2 2015 are much lower than they were at the beginning of the year. Growth expectations for 2016 and 2017 were broadly unchanged over the quarter while near-term global growth is expected to be slightly lower than initially anticipated. The Asian Development Bank is projecting growth of 2.8% in 2015 increasing to about 3.2% per annum over the following two years. Looking forward, global activity should be supported by continued low commodity prices and generally still-benign fi nancing conditions, notwithstanding the expected modest tightening in U.S. monetary policy. In the second half of 2015, it is likely that we will see a divergence in central bank policy in the major economies. In the U.S. it is widely expected the Federal Reserve will raise the Federal Funds Rate before the end of the year, perhaps as early as their September meeting. This is an important event for global capital markets as it will mark the Federal Reserve’s fi rst rate increase since 2006, and the fi rst increase since the policy rate hit zero at the end of 2008. Meanwhile, we anticipate that other central banks, such as the Bank of Japan and European Central Bank, will continue their highly accommodative monetary policies until at least the end of the year. In line with this central banks in the Fund’s target markets are also easing. Most notably the Bank of Korea reduced its policy rate to 1.5%, a record low, while the Peoples Bank of China (PBOC) is loosening its policy stance with lower benchmark interest rates and lower reserve requirement ratios. -

Own a Distinctive Address at Guoco Midtown

OWN A DISTINCTIVE ADDRESS AT GUOCO MIDTOWN OWN A DISTINCTIVE ADDRESS AT GUOCO MIDTOWN MIDTOWN In world cities like New York and Tokyo, Midtown is the area where once older neighbourhoods have been transformed with great success to form a vibrant part of the city centre, with a high concentration of trendy residences, prime corporate offices, shops as well as fashionable dining and entertainment venues. Chen Si Yuan. (2013). Times Square, Manhattan, New York City (2013), One Of The World's Busiest Pedestrian Intersections. Retrieved from https://en.wikipedia.org/wiki/Midtown_Manhattan GUOCO MIDTOWN Guoco Midtown is a game changer. It is a landmark mixed-use development that will rejuvenate the Beach Road district. The iconic development will redefine public spaces, enhance street life, redefine the experience of working in Grade A offices and introduce an exciting new concept of urban living. Following the success of Guoco Tower, which injected new life to the Tanjong Pagar district, GuocoLand has put tremendous thought into Guoco Midtown, from assembling an internationally renowned team, understanding the needs of the community, to creating a new-to-market product that will redefine the way we live, work and entertain. Guoco Midtown is the future brought forward to the present. A modern, progressive, and innovative development that anticipates the future lifestyle of the people. ARTIST’S IMPRESSION MIDTOWN SQUARE Welcome to Guoco Midtown. Life and energy permeate the entire development, including public spaces such as Midtown Square, bringing together nature, community and exciting new ways of urban living. From Midtown Square, there is also direct access to the office lobby and underground pedestrian network. -

2020 MICE Directory

2020 MICE Directory EMPOWERING COMMERCE, CAPABILTIES, COMMUNITY CONTENTS MESSAGES 5 Message from SACEOS President 6 Message from Singapore Tourism Board EVENT CALENDARS 28 Calendar of Conferences 2020 31 Calendar of Exhibitions 2020 36 Calendar of Conferences 2021 38 Calendar of Exhibitions 2021 VENUE 44 Auditorium, Conventions & Exhibitions Centres 57 Hotels 69 Unique Venues DIRECTORY LISTING 81 SACEOS Members Listings 116 General Listings 209 Singapore Statutory Boards & Government Agencies 217 Advertiser’s Index SACEOS DIRECTORY 2020 Message from SACEOS President I Message from Singapore Tourism Board MR ALOYSIUS ARLANDO MS MELISSA OW President Singapore Association of Deputy Chief Executive Convention & Exhibition Singapore Tourism Board Organisers & Suppliers (SACEOS) Welcome to the 2020 edition of MICE e-directory – the industry’s go-to guide. SACEOS is a community-based association of the MICE industry whose members contribute to a rich history of successful corporate events, business meetings and conventions and exhibitions in Singapore. 2019 was another exciting year for Singapore’s business events landscape. The city maintains its momentum as a leading global business events hub, This year in 2020, SACEOS rang in the new decade with a big bang - by unveiling our brand playing host to a vibrant array of business events across various industry PRESIDENT new visual identity, a symbol of transformation, and a timely reflection that represents a hallmark clusters, and keeping its position as Asia Pacific’s leading city in the 2018 for the next phase of our growth, our hope, our unified future. global ranking by the International Congress and Convention Association MESSAGE (ICCA), and top international meeting country since 2013 in the Union of Singapore is a key player in the ASEAN region and the rest of the world. -

Duo Towerduo

The Building DUO TOWERDUO A WORKING ENVIRONMENT SCULPTED FOR MODERN BUSINESS. Situated in central Singapore and forming a landmark location in a key growth area, DUO Tower benefits from being part of an integrated masterplan that includes; a boutique retail plaza in DUO Galleria, a 5-star hotel and exclusive DUO Residences. Designed by Ole Scheeren, the architect behind the world famous CCTV building in Beijing, this prime Grade A office development will provide a 24/7 work, live, play solution for all business requirements. 2 3 DUO TOWER OVERVIEW 568,000 sq ft of Prime Grade A Offices The dynamic architecture and scale of the development provides a striking corporate marque and with class leading floor plate sizes combined with innovative design features, DUO Tower delivers an environment that is flexible and engaging. Space for tenants to develop and grow their business where features include: • One of the largest net lettable floor plates in the Bugis micro-market with up to approximately 31,000 sq ft • 3m clear floor to ceiling height • 150mm raised flooring • Knock-out panels for inter-floor connectivity • Exclusive Sky Terrace Garden on Level 8 as alternative recreational point • Outdoor event space and water features set within lush landscaped gardens • Boutique food and beverage and lifestyle retail offerings • 5-star hotel with 352 rooms • Panoramic City Skyline view from observation deck • Bicycle parking lots and shower facilities • BCA Green Mark Platinum Certified One of the largest floor plates in the micro-market Artist’s Impression DUO TOWER 4 5 DUO TOWER 15 MINS Located in Bugis, DUO Tower is positioned LOCATION in the Ophir-Rochor corridor that forms a natural extension to the financial districts of Raffles Place and Marina Bay. -

Singapore Office Market Review

Q2 2021 Published 8 April 2021 Singapore Office Market Review DEMAND Pg 3 SUPPLY Pg 4 Special Feature: Guoco Midtown Pg 6 New Developments: B1/2 Category Pg 7 Rentals Forecasts Top prime rates for premium Grade A buildings have softened from a • Market still dominated by tech firms and the financial services high of $14.00 per sq ft a year ago, to around $11.50 - $12.00 per sq ft. / investment sector, as well as displaced tenants looking for new Average prime rates in the Raffles Place area are in the region of office premises. $9.50 per sq ft. Office rates in theRobinson Road / Shenton Way area are in the $7.00 - $8.50 per sq ft bracket. • Demand for co-working space to continue with hybrid solutions proving popular. There is not much difference in the rental costs for Tanjong Pagar, which averages around $7.50 per sq ft. City Hall ranges from $7.00 to • Ample choice of supply at the moment and the amount of shadow $9.00 per sq ft and Beach Road averages around $7.25 per sq ft. space is increasing, due to companies rightsizing. There has been little movement on Orchard Road, and as such this • Supply will begin to tighten later in the year. location still enjoys a relatively high occupancy rate. Rents range from $7.50 to $9.50 per sq ft in this district. • Only two sizeable office developments due for completion this year in the CBD (CapitaSpring and Afro-Asia iMark). Edge of CBD like Novena, River Valley Road and decentralized locations like Harbourfront Centre and Paya Lebar Square range from • Rates to soften by 7% across the board, but rate of decline will $6.00 to $7.00 per sq ft.