Beach Road's Changing Skyline

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Where Everything Meets in the Middle

WHERE EVERYTHING MEETS IN THE MIDDLE Development Information Located in Middle Road, this is a 99-year leasehold mixed-use development with 522 residential apartments and one level of retail component. The site has a land area of 7,462.7 sq m and a permissible gross floor area of 31,344 sq m. The M consists of three 20-storey towers and one 6-storey tower. CONFIDENTIAL STRICTLY FOR INTERNAL USE ONLY & NOT FOR CIRCULATION SUBJECT TO CHANGE 10 Jan 2020 The development is in Bugis, right in the heart of the Arts and Cultural District and next to the Civic District. It has excellent connectivity with well-established transportation network and will eventually transform into one of the car-lite district of the nation, in accordance to the plans of the authority. It is walking distance to 3 MRT stations (4 min walk to Bugis MRT station, 6 min walk to City Hall MRT station and 8 min walk to Esplanade MRT station). The Central Business District and The Marina Bay Financial District is 2 and 3 MRT stations away respectively. The Orchard Road shopping belt is also just minutes’ away. The residents of the M will also benefit from the wide range of amenities and F&B options round the clock at Bugis and City Hall. Information at a Glance Project Name: The M Address: 30, 32, 34, 36, 38 Middle Road Postal Code: 188940, 188941, 188943, 188945, 188947 District: 7 Developer: Wingcharm Investment Pte Ltd, a subsidiary of Wing Tai Asia Tenure: 99-year leasehold Land Area: Approx. -

Office Listing & Rental Price

Office Listing & Rental Price Subject to availability, survey, approval and contract Asking rents are subject to revision without any notice Francis Goh (65) 97305200 [email protected] CEA Reg. No: R041398H TYPE DISTRICT LOCATIONS ADDRESS SIZE (SQFT) PSF (S$) PRICE (S$) AVAILABLE REMARKS Retail (F&B) 1 Crown at Robinson 140 Robinson Road 068907 2,508 13.00 32,604 Immediate Fitted Office 1 Crown at Robinson 140 Robinson Road 068907 592 9.00 5,328 Immediate Bare Office 1 Crown at Robinson 140 Robinson Road 068907 592 9.00 5,328 Immediate Bare Office 1 Crown at Robinson 140 Robinson Road 068907 592 9.00 5,328 Immediate Partially fitted Office 1 Crown at Robinson 140 Robinson Road 068907 926 9.00 8,334 Immediate Partially fitted Office 1 Crown at Robinson 140 Robinson Road 068907 6,792 9.00 61,128 Immediate Fitted Office 1 Crown at Robinson 140 Robinson Road 068907 1,485 9.00 13,365 Immediate Penthouse office (Furnished and fitted) Office 1 UOB Plaza 1 No. 80 Raffles Place 1,862 11.00 20,482 Immediate Bare Office 1 UOB Plaza 1 No. 80 Raffles Place 5,253 11.00 1,500 Immediate Fitted Office 1 UOB Plaza 1 No. 80 Raffles Place 5,963 11.00 1,500 Immediate Bare Office 1 UOB Plaza 1 No. 80 Raffles Place 12,206 11.00 134,266 Immediate Bare Office 1 UOB Plaza 1 No. 80 Raffles Place 2,099 11.00 23,089 Immediate Fitted Office 1 UOB Plaza 1 No. 80 Raffles Place 2,454 11.00 26,994 1-May-21 Fitted Office 1 UOB Plaza 1 No. -

Office Rental Guide Official Asking Rates

Office Rental Guide Keck Seng Tower $6.00-$6.50 Singapore Pools Building Full Manulife Tower $9.00-$10.00 Sunshine Plaza $6.00 Official Asking Rates MYP Plaza $6.50 Tanglin Shopping Centre $5.60-$6.20 OUE Downtown 1 & 2 $9.00 The Bencoolen $5.50 S$ per sq ft per month – PIL Building $6.50 The Heeren $10.50 inclusive of service charge Robinson 77 $9.00 Thong Teck Building $7.00-$8.00 Robinson 112 $6.80 Tong Building $9.00 1 February 2021 Robinson Point $8.00-$8.80 TripleOne Somerset $8.50-$8.80 SBF Centre $6.45-$8.00 Visioncrest Commercial $9.00 Raffles Place/New Downtown SGX Centre 1 & 2 $8.50-$9.50 Wheelock Place $11.50 6 Battery Road $13.00 Shenton House $5.00-$5.80 Wilkie Edge $9.00 6 Raffles Quay $6.50-$8.00 SIF Building $7.20 Winsland House I & II $9.50 18 Robinson $12.00 The Globe $6.50 Wisma Atria $9.50-$11.00 20 Collyer Quay $9.00-$12.30 The Octagon $5.80 30 Raffles Place $11.00 Tokio Marine Centre $8.00-$8.50 Chinatown/River Valley Road 55 Market Street $10.50 Tong Eng Building $5.20-$7.00 Central Mall Full AIA Tower Full UIC Building Full CES Centre $5.80 Asia Square Tower 1 $14.00 Chinatown Point $8.00 Asia Square Tower 2 $12.00-$13.50 Tanjong Pagar Great World City $7.50 ASO Building $6.20 78 Shenton Way Tower 1 $7.00-$8.00 Havelock II $7.50 Bank of China Building Full 78 Shenton Way Tower 2 $9.20 King’s Centre $6.50 Bank of Singapore Centre $9.50 79 Anson Road $8.50 The Central $8.00-$9.50 Bharat Building $6.30 100AM $7.30 UE Square $8.50 CapitaGreen $13.50 ABI Plaza $6.00 Valley Point $6.50 CapitaSpring $14.00 Anson Centre -

Participating Merchants

PARTICIPATING MERCHANTS PARTICIPATING POSTAL ADDRESS MERCHANTS CODE 460 ALEXANDRA ROAD, #01-17 AND #01-20 119963 53 ANG MO KIO AVENUE 3, #01-40 AMK HUB 569933 241/243 VICTORIA STREET, BUGIS VILLAGE 188030 BUKIT PANJANG PLAZA, #01-28 1 JELEBU ROAD 677743 175 BENCOOLEN STREET, #01-01 BURLINGTON SQUARE 189649 THE CENTRAL 6 EU TONG SEN STREET, #01-23 TO 26 059817 2 CHANGI BUSINESS PARK AVENUE 1, #01-05 486015 1 SENG KANG SQUARE, #B1-14/14A COMPASS ONE 545078 FAIRPRICE HUB 1 JOO KOON CIRCLE, #01-51 629117 FUCHUN COMMUNITY CLUB, #01-01 NO 1 WOODLANDS STREET 31 738581 11 BEDOK NORTH STREET 1, #01-33 469662 4 HILLVIEW RISE, #01-06 #01-07 HILLV2 667979 INCOME AT RAFFLES 16 COLLYER QUAY, #01-01/02 049318 2 JURONG EAST STREET 21, #01-51 609601 50 JURONG GATEWAY ROAD JEM, #B1-02 608549 78 AIRPORT BOULEVARD, #B2-235-236 JEWEL CHANGI AIRPORT 819666 63 JURONG WEST CENTRAL 3, #B1-54/55 JURONG POINT SHOPPING CENTRE 648331 KALLANG LEISURE PARK 5 STADIUM WALK, #01-43 397693 216 ANG MO KIO AVE 4, #01-01 569897 1 LOWER KENT RIDGE ROAD, #03-11 ONE KENT RIDGE 119082 BLK 809 FRENCH ROAD, #01-31 KITCHENER COMPLEX 200809 Burger King BLK 258 PASIR RIS STREET 21, #01-23 510258 8A MARINA BOULEVARD, #B2-03 MARINA BAY LINK MALL 018984 BLK 4 WOODLANDS STREET 12, #02-01 738623 23 SERANGOON CENTRAL NEX, #B1-30/31 556083 80 MARINE PARADE ROAD, #01-11 PARKWAY PARADE 449269 120 PASIR RIS CENTRAL, #01-11 PASIR RIS SPORTS CENTRE 519640 60 PAYA LEBAR ROAD, #01-40/41/42/43 409051 PLAZA SINGAPURA 68 ORCHARD ROAD, #B1-11 238839 33 SENGKANG WEST AVENUE, #01-09/10/11/12/13/14 THE -

CDL FY 2016 Results Presentation

FULL YEAR 2016 RESULTS PRESENTATION 23 February 2017 (1 Jan – 31 Dec 2016) AGENDA • EXECUTIVE SUMMARY • FINANCIAL HIGHLIGHTS • SINGAPORE OVERVIEW • INTERNATIONAL OVERVIEW • HOTEL OPERATIONS EXECUTIVE SUMMARY Key Highlights . Creditable PATMI achieved despite headwinds and challenges: – $244 million for Q4 2016 (Q4 2015: $410 million) – $653 million for FY 2016 (FY 2015: $773 million) – Supported by divestures in City e-Solutions Limited in Q3 2016 and Exchange Tower in Q4 2016; exiting of equity interest in Nouvel 18 – Maiden profit contribution of Phase 1 of Suzhou Hong Leong City Center in Q4 2016 . Record revenue achieved for FY 2016: - 18.2% increase to $3.9 billion - 36.5% increase in revenue for Q4 2016: $1.2 billion . Stellar performance of property development business segment: – 73% of Q4 and 57% of FY 2016 pre-tax profits respectively – 1,017 units with sales value of approx. $1.2 billion for FY 2016 in Singapore . South Beach integrated project fully completed; JW Marriott Hotel Singapore South Beach soft opened in Dec 2016 . Robust financial position maintained: ^ - $3.9 billion, with net gearing ratio of 16% as at 31 Dec 2016 . Special final dividend of 4.0 cents per share, in addition to the ordinary dividend of 8.0 cents per share. Total dividends for 2016: 16.0 cents* (2015: 16.0 cents) ^ Without factoring in fair value gains on investment properties * Includes special interim dividend of 4.0 cents paid in Sep 2016 4 Resilient Performance amidst Macroeconomic Challenges Summary of Financial Results Q4 Q4 % FY FY % 2016 2015 Change 2016 2015 Change Revenue ($m) 1,167 855 36.5 3,905 3,304 18.2 PATMI ($m) 244 410 (40.6) 653 773 (15.5) Basic Earnings Per Share 26.1 44.4 (41.2) 70.4 83.6 (15.8) (cents) NAV Per Share ($) 10.22 9.89 3.3 Return on Equity (%) 7.03 8.59 (1.6) pts No fair values adopted on investment properties. -

Stay Fit & Feel Good Memorable Events at The

INTEGRATED DINING DESTINATION SINGAPORE ISLAND MAP STAY FIT & FEEL GOOD Food warms the soul and we promise that it is always a lavish gastronomic experience Relax after a day of conference meeting or sightseeing. Stay in shape at our 24-hour gymnasium, at the Grand Copthorne Waterfront Hotel. have a leisurely swim in the pool, challenge your travel buddies to a game of tennis or soothe your muscles in the outdoor jacuzzi. MALAYSIA SEMBAWANG SHIPYARD NORTHERN NS11 Pulau MALAYSIA SEMBAWANG SEMBAWANG Seletar WOODLANDS WOODLANDS SUNGEI BULOH WETLAND CHECKPOINT TRAIN CHECKPOINT RESERVE NS10 ADMIRALTY NS8 NS9 MARSILING WOODLANDS YISHUN SINGAPORE NS13 TURF CLUB WOODLANDS YISHUN Pulau SARIMBUN SELETAR RESERVOIR EXPRESSWAY Punggol KRANJI NS7 Barat KRANJI Pulau BUKIT TIMAH JALAN Punggol NS14 KHATIB KAYU Timor KRANJI Pulau Pulau LIM CHU KANG RESERVOIR SELETAR PUNGGOL Serangoon Tekong KRANJI SINGAPORE RESERVOIR PUNGGOL (Coney Island) WAR ZOO AIRPORT Pulau Ubin MEMORIAL NEE LOWER SELETAR NE17 SOON RESERVOIR PUNGGOL Punggol EXPRESSWAY UPPER NIGHT TAMPINES EXPRESSWAY (TPE) LRT (PG) NS5 SAFARI SELETAR YEW TEE RESERVOIR MEMORABLE EVENTS AT THE WATERFRONT (SLE) SERANGOON NE16 RESERVOIR Bukit Panjang SENGKANG RIVER Sengkang LRT (BP) SAFARI With 33 versatile meeting rooms covering an impressive 850 square metres, SENGKANG LRT (SK) CAFHI JETTY NS4 CHOA CHU YIO CHU CHOA CHU KANG KANG CHANGI the Waterfront Conference Centre truly offers an unparalleled choice of meeting KANG NE15 PASIR NS15 BUANGKOK VILLAGE EASTERN DT1 BUKIT YIO CHU KANG TAMPINES EXPRESSWAY (TPE) BUKIT PANJANG (BKE) RIS Boasting a multi-sensory dining experience, interactive Grissini is a contemporary Italian grill restaurant spaces with natural daylight within one of the best designed conference venues PANJANG HOUGANG (KPE) EW1 CHANGI PASIR RIS VILLAGE buffet restaurant, Food Capital showcases the best specialising in premium meats and seafood prepared in DT2 LOWER NS16 NE14 in the region. -

List-Of-Bin-Locations-1-1.Pdf

List of publicly accessible locations where E-Bins are deployed* *This is a working list, more locations will be added every week* Name Location Type of Bin Placed Ace The Place CC • 120 Woodlands Ave 1 3-in-1 Bin (ICT, Bulb, Battery) Apple • 2 Bayfront Avenue, B2-06, MBS • 270 Orchard Rd Battery and Bulb Bin • 78 Airport Blvd, Jewel Airport Ang Mo Kio CC • Ang Mo Kio Avenue 1 3-in-1 Bin (ICT, Bulb, Battery) Best Denki • 1 Harbourfront Walk, Vivocity, #2-07 • 3155 Commonwealth Avenue West, The Clementi Mall, #04- 46/47/48/49 • 68 Orchard Road, Plaza Singapura, #3-39 • 2 Jurong East Street 21, IMM, #3-33 • 63 Jurong West Central 3, Jurong Point, #B1-92 • 109 North Bridge Road, Funan, #3-16 3-in-1 Bin • 1 Kim Seng Promenade, Great World City, #07-01 (ICT, Bulb, Battery) • 391A Orchard Road, Ngee Ann City Tower A • 9 Bishan Place, Junction 8 Shopping Centre, #03-02 • 17 Petir Road, Hillion Mall, #B1-65 • 83 Punggol Central, Waterway Point • 311 New Upper Changi Road, Bedok Mall • 80 Marine Parade Road #03 - 29 / 30 Parkway Parade Complex Bugis Junction • 230 Victoria Street 3-in-1 Bin Towers (ICT, Bulb, Battery) Bukit Merah CC • 4000 Jalan Bukit Merah 3-in-1 Bin (ICT, Bulb, Battery) Bukit Panjang CC • 8 Pending Rd 3-in-1 Bin (ICT, Bulb, Battery) Bukit Timah Plaza • 1 Jalan Anak Bukit 3-in-1 Bin (ICT, Bulb, Battery) Cash Converters • 135 Jurong Gateway Road • 510 Tampines Central 1 3-in-1 Bin • Lor 4 Toa Payoh, Blk 192, #01-674 (ICT, Bulb, Battery) • Ang Mo Kio Ave 8, Blk 710A, #01-2625 Causeway Point • 1 Woodlands Square 3-in-1 Bin (ICT, -

Independent Market Overview Mapletree Commercial Trust by CBRE Pte Ltd

Independent Market Overview Mapletree Commercial Trust by CBRE Pte Ltd 1 THE SINGAPORE ECONOMY Rising private road transport costs are also expected to contribute to higher inflation in 2017. The Singapore economy expanded 2.0% in 2016, improving from the 1.9% growth achieved in 2015. Economic growth The ongoing economic restructuring efforts will increase in 2016 was largely driven by the education, health and Singapore’s dependence on the services producing industries. social services segment, as well as the information and High-value hi-tech firms will increasingly replace the communication segment. traditional manufacturing sector. Service producing industries grew 1.0% in 2016, contracting However, prospects for global economic growth remain from 3.2% in 2015 due to the challenging global economic muted as political risks and anti-globalisation sentiments environment. Growth in the services sector was led mainly by pose headwinds in 2017, particularly for open economies the Other Services sector comprising education, health, and such as Singapore. social services segment. The Other Services sector recorded growth rates of 3.1% in 2016 while the information and The Ministry of Trade & Industry (MTI) has forecast a communication segment grew 2.3% over the same period. relatively modest GDP growth of between 1.0% and 3.0% in 2017, supported largely by the domestic-orientated Headline inflation in 2016 was -0.5%, unchanged from sectors as well as potential upside to exports demand. 2015 due to lower transport cost and housing rents. The Oxford Economics, a leading global economics advisory firm, Monetary Authority of Singapore (MAS) forecast inflation to forecast Singapore’s GDP to grow by 2.7% in 2017 on the range between 0.5% and 1.5% for the whole of 2017, with back of additional fiscal support from the government and positive contribution from energy-related components and modest easing by MAS. -

CAPITALAND COMMERCIAL TRUST Capitaland Group Corporate Day, Bangkok 14 August 2019 Important Notice

CAPITALAND COMMERCIAL TRUST CapitaLand Group Corporate Day, Bangkok 14 August 2019 Important Notice This presentation shall be read in conjunction with CCT’s 2Q 2019 Unaudited Financial Statement Announcement. The past performance of CCT is not indicative of the future performance of CCT. Similarly, the past performance of CapitaLand Commercial Trust Management Limited, the manager of CCT is not indicative of the future performance of the Manager. The value of units in CCT (CCT Units) and the income derived from them may fall as well as rise. The CCT Units are not obligations of, deposits in, or guaranteed by, the CCT Manager. An investment in the CCT Units is subject to investment risks, including the possible loss of the principal amount invested. Investors have no right to request that the CCT Manager redeem or purchase their CCT Units while the CCT Units are listed. It is intended that holders of the CCT Units may only deal in their CCT Units through trading on Singapore Exchange Securities Trading Limited (SGX-ST). Listing of the CCT Units on the SGX-ST does not guarantee a liquid market for the CCT Units. This presentation may contain forward-looking statements that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other developments or companies, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training costs), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. -

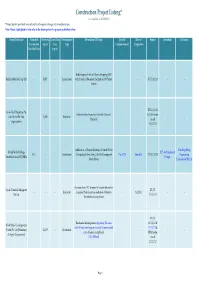

Construction Project Listing* (Last Updated on 20/12/2013) *Project Details Provided May Subject to Subsequent Changes by Owner/Developer

Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer. Note: Words highlighted in blue refer to the latest updates for projects published before. Owner/Developer Estimated Site Area Gross Floor Development Description Of Project Date Of Date of Source Consultant Contractor Construction (sq m) Area Type Commencement Completion Cost ($million) (sq m) Redevelopment into a 6 Storey Shopping Mall Raffles Medical Group Ltd - 5,827 - Institutional with 2 levels of Basement Carpark at 100 Taman - - ST 17/12/13 - - Warna BT 11/12/13 Grow-Tech Properties Pte Industrial development at Gambas Crescent & URA tender Ltd (Part of Far East - 14,302 - Industrial -- -- (Parcel 3) result Organization) 13/12/13 Addition of a 5 Storey Building to United World Kim Seng Heng United World College BLT Architecture & 42.5 - - Institutional College South East Asia (UWCSEA) campus at Dec-2013 Aug-2015 BT 13/12/13 Engineering South East Asia (UWCSEA) Design Dover Road Construction Pte Ltd Erection of an LPG Terminal to import alternative Vopak Terminals Singapore BT/ST - - - Industrial Liquefied Petroleum Gas feedstock at Banyan - 1Q 2016 -- Pte Ltd 11/12/13 Terminal in Jurong Island BT/ST Residential development comprising 281 units 16/11/12 & World Class Developments with 24 hour concierge service and 18 commercial 11/12/13 & (North) Pte Ltd [Subsidiary - 10,170 - Residential -- -- units at Jalan Jurong Kechil URA tender of Aspial Corporation] (The Hillford) result 22/11/12 Page 1 Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer. -

AEW Asia Research Perspective Q215 in Progress .Indd

GENERAL ECONOMIC OVERVIEW Globally the economy is expanding at a moderate pace and key commodity prices AEW Asia Research Perspective Q2 2015 are much lower than they were at the beginning of the year. Growth expectations for 2016 and 2017 were broadly unchanged over the quarter while near-term global growth is expected to be slightly lower than initially anticipated. The Asian Development Bank is projecting growth of 2.8% in 2015 increasing to about 3.2% per annum over the following two years. Looking forward, global activity should be supported by continued low commodity prices and generally still-benign fi nancing conditions, notwithstanding the expected modest tightening in U.S. monetary policy. In the second half of 2015, it is likely that we will see a divergence in central bank policy in the major economies. In the U.S. it is widely expected the Federal Reserve will raise the Federal Funds Rate before the end of the year, perhaps as early as their September meeting. This is an important event for global capital markets as it will mark the Federal Reserve’s fi rst rate increase since 2006, and the fi rst increase since the policy rate hit zero at the end of 2008. Meanwhile, we anticipate that other central banks, such as the Bank of Japan and European Central Bank, will continue their highly accommodative monetary policies until at least the end of the year. In line with this central banks in the Fund’s target markets are also easing. Most notably the Bank of Korea reduced its policy rate to 1.5%, a record low, while the Peoples Bank of China (PBOC) is loosening its policy stance with lower benchmark interest rates and lower reserve requirement ratios. -

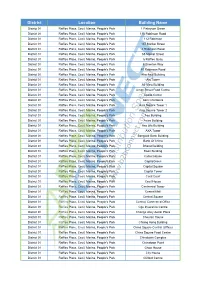

District Location Building Name

District Location Building Name District 01 Raffles Place, Cecil, Marina, People's Park 1 Finlayson Green District 01 Raffles Place, Cecil, Marina, People's Park 110 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 112 Robinson District 01 Raffles Place, Cecil, Marina, People's Park 137 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 4 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 55 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 6 Raffles Quay District 01 Raffles Place, Cecil, Marina, People's Park 6 Shenton Way District 01 Raffles Place, Cecil, Marina, People's Park 80 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park Afro-Asia Building District 01 Raffles Place, Cecil, Marina, People's Park Aia Tower District 01 Raffles Place, Cecil, Marina, People's Park Air View Building District 01 Raffles Place, Cecil, Marina, People's Park Amoy Street Food Centre District 01 Raffles Place, Cecil, Marina, People's Park Apollo Center District 01 Raffles Place, Cecil, Marina, People's Park Asia Chambers District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 1 District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 2 District 01 Raffles Place, Cecil, Marina, People's Park Aso Building District 01 Raffles Place, Cecil, Marina, People's Park Aviva Building District 01 Raffles Place, Cecil, Marina, People's Park Axa Life Building District 01 Raffles Place, Cecil, Marina, People's Park AXA Tower District 01