Office Sector Briefing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Clinics in Downtown Core Open on Friday 24 Jan 2020

LIST OF CLINICS IN DOWNTOWN CORE OPEN ON FRIDAY 24 JAN 2020 POSTAL S/N NAME OF CLINIC BLOCK STREET NAME LEVEL UNIT BUILDING TEL OPENING HOURS CODE 1 ACUMED MEDICAL GROUP 16 COLLYER QUAY 02 03 INCOME AT RAFFLES 049318 65327766 8.30AM-12.30PM 2 AQUILA MEDICAL 160 ROBINSON ROAD 05 01 SINGAPORE BUSINESS FEDERATION CENTER 068914 69572826 11.00AM- 8.00PM 3 AYE METTA CLINIC PTE. LTD. 111 NORTH BRIDGE ROAD 04 36A PENINSULA PLAZA 179098 63370504 2.30PM-7.00PM 4 CAPITAL MEDICAL CENTRE 111 NORTH BRIDGE ROAD 05 18 PENINSULA PLAZA 179098 63335144 4.00PM-6.30PM 5 CITYHEALTH CLINIC & SURGERY 152 BEACH ROAD 03 08 GATEWAY EAST 189721 62995398 8.30AM-12.00PM 6 CITYMED HEALTH ASSOCIATES PTE LTD 19 KEPPEL RD 01 01 JIT POH BUILDING 089058 62262636 9.00AM-12.30PM 7 CLIFFORD DISPENSARY PTE LTD 77 ROBINSON ROAD 06 02 ROBINSON 77 068896 65350371 9.00AM-1.00PM 8 DA CLINIC @ ANSON 10 ANSON ROAD 01 12 INTERNATIONAL PLAZA 079903 65918668 9.00AM-12.00PM 9 DRS SINGH & PARTNERS, RAFFLES CITY MEDICAL CENTRE 252 NORTH BRIDGE RD 02 16 RAFFLES CITY SHOPPING CENTRE 179103 63388883 9.00AM-12.30PM 10 DRS THOMPSON & THOMSON RADLINK MEDICARE 24 RAFFLES PLACE 02 08 CLIFFORD CENTRE 048621 65325376 8.30AM-12.30PM 11 DRS. BAIN + PARTNERS 1 RAFFLES QUAY 09 03 ONE RAFFLES QUAY - NORTH TOWER 048583 65325522 9.00AM-11.00AM 12 DTAP @ DUO MEDICAL CLINIC 7 FRASER STREET B3 17/18 DUO GALLERIA 189356 69261678 9.00AM-3.00PM 13 DTAP @ RAFFLES PLACE 20 CECIL STREET 02 01 PLUS 049705 69261678 8.00AM-3.00PM 14 FULLERTON HEALTH @ OFC 10 COLLYER QUAY 03 08/09 OCEAN FINANCIAL CENTRE 049315 63333636 -

01 K-Reit 6Pp Gatefold.Indd 2 11/2/2010 6:27:21 PM Constituted in the Republic of Singapore Pursuant to a Trust Deed Dated 28 November 2005 (As Amended)

Constituted in the Republic of Singapore pursuant to a trust deed dated 28 November 2005 (as amended) Artist impression of the promenade and drop-off point at the Marina Bay Financial Centre The overview section is qualifi ed in its entirety by, and should be read in conjunction with the full text of this Circular. Meanings of the capitalised terms may be found in the Glossary of this Circular. Any discrepancies in the tables included herein between the listed amounts and the totals thereof are due to rounding. Unitholders should note that the proposed Acquisition and Divestment is dependent on the satisfaction of certain conditions precedent, including the approval of the shareholders of Keppel Land Limited for the sale of the one-third interest in the MBFC Property and the purchase of KTGE. Actual views may differ from the artist impressions contained herein. THE ACQUISITION AND DIVESTMENT The net proceeds from the KTGE Divestment is approximately S$569.9 million (the “Net Sale K-REIT is proposing to acquire a one-third interest Proceeds”), comprising the sale proceeds less in Marina Bay Financial Centre Towers 1 & 2 and the estimated fees and expenses (excluding the Marina Bay Link Mall (the “MBFC Acquisition”) divestment fee payable to the Manager) relating to and divest Keppel Towers and GE Tower (the “KTGE the KTGE Divestment. Divestment”), (together, the “Transactions”). The Transactions will renew, optimise and enhance K-REIT’s METHOD OF FINANCING Artist impression of the Marina Bay Financial Centre property portfolio. The DPU accretive Transactions are in line with K-REIT’s objective of delivering stable and The Manager intends to part fi nance the MBFC sustainable returns to Unitholders. -

Suntec Real Estate Investment Trust Annual Report 2014

Suntec Real Estate Investment Trust Annual Report 2014 CELEBRATING TEN YEARS OF SUCCESS OUR MISSION Forging ahead to create, provide and deliver premium value to all stakeholders of Suntec REIT. The world’s preeminent sparkling wine, Champagne is the result of a unique process of cultivation perfected over centuries. The essence of its value and exclusivity lies in the premium grapes grown only amid the terroirs of the Champagne region of France, a secondary fermentation process that gives rise to its distinctive bubbles, and a combination of grape varieties that is unique to each Champagne house. Suntec REIT is equally meticulous in cultivating its portfolio, from selecting quality and well located assets to solid fundamentals with growth potential. The result is a legacy of stable and sustainable return to our stakeholders. CONTENTS About Suntec REIT 1 Manager’s Report 21 Year In Review 8 Property Portfolio 26 Chairman’s Report 10 Independent Market Report 45 Financial Highlights 12 Investor Communications 48 Unit Performance 13 Corporate Governance 50 Board Of Directors 14 Financial Contents 63 Management Team 18 ABOUT SUNTEC REIT Listed on 9 December 2004 on the Main Board of the Singapore Exchange Securities Trading Limited (“SGX-ST”), Suntec Real Estate Investment Trust (“Suntec REIT”) is the first composite REIT in Singapore, owning income-producing real estate that is primarily used for retail and/or office purposes. As at 31 December 2014, Suntec REIT’s portfolio comprises office and retail properties in Suntec City, Park Mall, a one-third interest in One Raffles Quay and a one-third interest in Marina Bay Financial Centre Towers 1 and 2 and the Marina Bay Link Mall, all strategically located in the growth corridors of Marina Bay and the Civic and Cultural District within Singapore’s Central Business District. -

POISED for a GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected]

COLLIERS QUARTERLY OFFICE | SINGAPORE | RESEARCH | Q4 2020 | 14 JANUARY 2021 Shirley Wong POISED FOR A GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected] Tricia Song 2021–25 Director and Head | Research | Insights & Q4 2020 Full Year 2021 Annual Average Singapore > CBD Grade A office showed resilience with +65 6531 8536 Recommendations [email protected] 336,900 sq ft net absorption in 2020 despite CBD Grade A rents declined 2.1% GDP contraction of 5.8%, driven by previous QOQ in Q4 2020 and 5.4%* for Demand flexible workspace commitments. In 2021, -59,600 sq ft 787,900 sq ft 894,000 sq ft the full year to SGD9.57 (USD7.24) we expect technology to drive demand. per sq foot, on weak global > We expect relatively muted CBD Grade A economic conditions. We forecast supply in 2021-2022, with annual expansion rents to grow 5.5% by the end of averaging 2.6% of stock versus 4.7% for the 0 sq ft 783,900 sq ft 883,000 sq ft 2021, on an eventual economic Supply last five years. 2023 should see higher supply rebound and benign supply. at 4.5% of stock. We forecast new demand in 2021 Annual Average to be driven by the technology QOQ / YOY / Growth 2021–25 / End Q4 End 2021 End 2025 sector. Meanwhile, Q4 2020 CBD > CBD Grade A rents declined 2.1% in Q4 2020 Grade A vacancy of 5.2% (+1.8pp 1.0pp-2.1%* +3.7% and 5.4%* for the full year to SGD9.57 5.5% YOY) could tighten over the next (USD7.24) per sq foot. -

Stay Fit & Feel Good Memorable Events at The

INTEGRATED DINING DESTINATION SINGAPORE ISLAND MAP STAY FIT & FEEL GOOD Food warms the soul and we promise that it is always a lavish gastronomic experience Relax after a day of conference meeting or sightseeing. Stay in shape at our 24-hour gymnasium, at the Grand Copthorne Waterfront Hotel. have a leisurely swim in the pool, challenge your travel buddies to a game of tennis or soothe your muscles in the outdoor jacuzzi. MALAYSIA SEMBAWANG SHIPYARD NORTHERN NS11 Pulau MALAYSIA SEMBAWANG SEMBAWANG Seletar WOODLANDS WOODLANDS SUNGEI BULOH WETLAND CHECKPOINT TRAIN CHECKPOINT RESERVE NS10 ADMIRALTY NS8 NS9 MARSILING WOODLANDS YISHUN SINGAPORE NS13 TURF CLUB WOODLANDS YISHUN Pulau SARIMBUN SELETAR RESERVOIR EXPRESSWAY Punggol KRANJI NS7 Barat KRANJI Pulau BUKIT TIMAH JALAN Punggol NS14 KHATIB KAYU Timor KRANJI Pulau Pulau LIM CHU KANG RESERVOIR SELETAR PUNGGOL Serangoon Tekong KRANJI SINGAPORE RESERVOIR PUNGGOL (Coney Island) WAR ZOO AIRPORT Pulau Ubin MEMORIAL NEE LOWER SELETAR NE17 SOON RESERVOIR PUNGGOL Punggol EXPRESSWAY UPPER NIGHT TAMPINES EXPRESSWAY (TPE) LRT (PG) NS5 SAFARI SELETAR YEW TEE RESERVOIR MEMORABLE EVENTS AT THE WATERFRONT (SLE) SERANGOON NE16 RESERVOIR Bukit Panjang SENGKANG RIVER Sengkang LRT (BP) SAFARI With 33 versatile meeting rooms covering an impressive 850 square metres, SENGKANG LRT (SK) CAFHI JETTY NS4 CHOA CHU YIO CHU CHOA CHU KANG KANG CHANGI the Waterfront Conference Centre truly offers an unparalleled choice of meeting KANG NE15 PASIR NS15 BUANGKOK VILLAGE EASTERN DT1 BUKIT YIO CHU KANG TAMPINES EXPRESSWAY (TPE) BUKIT PANJANG (BKE) RIS Boasting a multi-sensory dining experience, interactive Grissini is a contemporary Italian grill restaurant spaces with natural daylight within one of the best designed conference venues PANJANG HOUGANG (KPE) EW1 CHANGI PASIR RIS VILLAGE buffet restaurant, Food Capital showcases the best specialising in premium meats and seafood prepared in DT2 LOWER NS16 NE14 in the region. -

CAPITALAND COMMERCIAL TRUST 2Q 2020 Financial Results 23 July 2020 Important Notice

CAPITALAND COMMERCIAL TRUST 2Q 2020 Financial Results 23 July 2020 Important Notice This presentation shall be read in conjunction with CCT’s 2Q 2020 Unaudited Financial Statement Announcement. This presentation may contain forward-looking statements. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, availability of real estate properties, competition from other developments or companies, shifts in customer demands, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training, property operating expenses), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. You are cautioned not to place undue reliance on these forward-looking statements, which are based on the current view of management regarding future events. No representation or warranty express or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this presentation. Neither CapitaLand Commercial Trust Management Limited (“Manager”) nor any of its affiliates, advisers or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising, whether directly or indirectly, from any use of, reliance on or distribution of this presentation or its contents or otherwise arising in connection with this presentation. -

Capitacommercial Trust CIRCULAR DATED 9 JUNE 2008 Overview

CAPITACOMMERCIAL TRUST CAPITACOMMERCIAL CIRCULAR DATED 9 JUNE 2008 OVERVIEW THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. (Constituted in the Republic of Singapore pursuant to a trust deed dated 6 February 2004 (as amended)) Singapore Exchange Securities Trading Limited takes no responsibility for the accuracy of any statements or opinions made, or reports contained, in this Circular. If you are in any doubt as to the action you should take, you should consult your stockbroker, bank manager, solicitor, accountant or other professional adviser immediately. If you have sold or transferred all your units in CapitaCommercial Trust, you should immediately forward this Circular, together with the Notice of Extraordinary General Meeting and the accompanying Proxy Form in this Circular, to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for onward transmission to the purchaser or transferee. Meanings of capitalised terms may be found in the Glossary of this Circular. CIRCULAR DATED CIRCULAR DATED CIRCULAR TO UNITHOLDERS IN RELATION TO: 9 JUNE 2008 (1 GEORGE STREET) (1) the proposed acquisition of 1 George Street, Singapore; and (2) The proposed general mandate for the issue of new Units and/or Prime Landmark Office Building Convertible Securities. 1 George Street is one of the newest premier commercial properties prominently located in the core of Singapore’s CBD with large column-free floor plates and state-of-the-art building specifications IMPORTANT DATES AND TIMES FOR UNITHOLDERS MANAGED BY CAPITACOMMERCIAL TRUST designed to suit tenants in the financial services industry and Last date and time for lodgment of Proxy Forms : Wed, 25 June 2008 at 10.30 a.m. -

1 CAPITALAND COMMERCIAL TRUST ANNOUNCEMENT ASSET VALUATION Pursuant to Rule 703 of the Singapore Exchange Securities Trading

CAPITALAND COMMERCIAL TRUST (Constituted in the Republic of Singapore pursuant to a Trust Deed dated 6 February 2004 (as amended)) ANNOUNCEMENT ASSET VALUATION Pursuant to Rule 703 of the Singapore Exchange Securities Trading Limited (“SGX-ST”) Listing Manual, CapitaLand Commercial Trust Management Limited (the “Manager”), as manager of CapitaLand Commercial Trust (“CCT”), wishes to announce that independent valuations as at 30 June 2019, have been obtained for the properties owned/ jointly owned by CCT. The value of CCT’s Singapore properties comprising Asia Square Tower 2, CapitaGreen, Capital Tower, Six Battery Road and 21 Collyer Quay (HSBC Building) was S$7,112.2 million in aggregate as at 30 June 2019. This figure of S$7,112.2 million excludes CCT’s 60.0% interest in Raffles City Singapore held through RCS Trust, 50.0% interest in One George Street held through One George Street LLP and 45.0% interest in CapitaSpring held through Glory Office Trust and Glory SR Trust. The value of Raffles City Singapore as at 30 June 2019 was S$3,340.0 million. CCT’s 60.0% interest in Raffles City Singapore held through RCS Trust was S$2,004.0 million. The value of One George Street was S$1,141.0 million as at 30 June 2019. CCT’s 50.0% interest in One George Street held through One George Street LLP was S$570.5 million. The value of CapitaSpring, based on the residual land value approach, was S$1,062.0 million. CCT’s 45.0% interest in CapitaSpring held through Glory Office Trust and Glory SR Trust amounts to S$477.9 million. -

CAPITALAND COMMERCIAL TRUST Capitaland Group Corporate Day, Bangkok 14 August 2019 Important Notice

CAPITALAND COMMERCIAL TRUST CapitaLand Group Corporate Day, Bangkok 14 August 2019 Important Notice This presentation shall be read in conjunction with CCT’s 2Q 2019 Unaudited Financial Statement Announcement. The past performance of CCT is not indicative of the future performance of CCT. Similarly, the past performance of CapitaLand Commercial Trust Management Limited, the manager of CCT is not indicative of the future performance of the Manager. The value of units in CCT (CCT Units) and the income derived from them may fall as well as rise. The CCT Units are not obligations of, deposits in, or guaranteed by, the CCT Manager. An investment in the CCT Units is subject to investment risks, including the possible loss of the principal amount invested. Investors have no right to request that the CCT Manager redeem or purchase their CCT Units while the CCT Units are listed. It is intended that holders of the CCT Units may only deal in their CCT Units through trading on Singapore Exchange Securities Trading Limited (SGX-ST). Listing of the CCT Units on the SGX-ST does not guarantee a liquid market for the CCT Units. This presentation may contain forward-looking statements that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other developments or companies, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training costs), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. -

Beach Road's Changing Skyline

PROPERTY PERSONALISED MCI (P) 047/08/2018 PPS 1519/09/2012 (022805) Visit EdgeProp.sg to find properties, research market trends and read the latest news The week of May 6, 2019 | ISSUE 880-102 Highlight Market Trends Under the Hammer Oxley sells Chevron House Private residential prices Unit at Skies Miltonia for $1.03 bil fall by 0.7% in 1Q2019 going for $1.14 mil EP2 EP4 EP11 Beach Road’s changing skyline From Guoco Midtown and Shaw Towers to the new residential developments at Tan Quee Lan Street and Middle Road, the Beach Road-Rochor Road area is set for a massive renewal. Turn to our Cover Story on Pages 6 & 7. The new Shaw Towers and Guoco Midtown will be linked to each other CapitaLand’sand to their neighbouring M&A will give developments it access to Ascendas-Singbridge’s as well as MRT stations Changi Business Park SAMUEL ISAAC CHUA/EDGEPROP SINGAPORE CHUA/EDGEPROP ISAAC SAMUEL EP2 • EDGEPROP | MAY 6, 2019 PROPERTY BRIEFS SAMUEL ISAAC CHUA/EDGEPROP SINGAPORE Oxley sells Chevron House for cluding tenant representation, corporate $1.03 bil solutions and capital markets and in- EDITORIAL EDITOR | Oxley Holdings has signed a deal to sell vestment, across key gateway cities in Cecilia Chow Chevron House for $1.03 billion, after the Asia-Pacific. DEPUTY EDITOR | acquiring the prime office space for $660 “This strategic appointment under- Amy Tan million in December 2017. scores our intent to continue to grow SENIOR WRITER | Timothy Tay Located at 30 Raffles Place, Chevron our share of business and influence in WRITERS | Bong Xin Ying, House is a 32-storey commercial devel- the market, both in Singapore and inter- Charlene Chin opment with 27 levels of office space nationally,” says Tang Wei Leng, man- HEAD, COPY EDITING | Pek Tiong Gee and a five-storey retail podium with a aging director at Colliers International. -

Capitaland Commercial Trust

CAPITALAND COMMERCIAL TRUST FY 2019 Financial Results – Additional Information 22 January 2020 FY 2019 Gross Revenue higher by 4.7% YoY Higher gross revenue mainly from Gallileo, Main Airport Center, Asia Square Tower 2 and 21 Collyer Quay S$ million FY 2018 FY 2019 110.3 105.0 91.1 91.4 71.4 73.1 68.9 67.2 Divested on 29 Aug 2018 25.3 27.2 20.4 12.8 12.5 11.8 10.1 7.7 - - (1) (2) Asia Square CapitaGreen Capital Tower Six Battery Road 21 Collyer Quay Gallileo Main Airport Bugis Village Twenty Anson Tower 2 Center (MAC) (1) Notes: (1) CCT owns 94.9% of Gallileo and MAC which contributed revenue and income from 19 June 2018 and 18 September 2019 respectively. The reported figure is on 100.0% basis. (2) Bugis Village returned to the State on 1 April 2019. 2 CapitaLand Commercial Trust Presentation Jan 2020 FY 2019 Net Property Income higher by 2.1% YoY Net property income lifted mainly by Asia Square Tower 2, Gallileo, 21 Collyer Quay S$ million FY 2018 FY 2019 83.4 80.0 73.3 72.0 54.8 56.3 55.1 52.8 Divested on 29 Aug 2018 24.7 22.5 20.3 12.3 9.3 9.4 5.0 4.5 - - Asia Square CapitaGreen Capital Tower Six Battery Road 21 Collyer Quay Gallileo (1) Main Airport Bugis Village(2) Twenty Anson Tower 2 Center (MAC)(1) Notes: (1) CCT owns 94.9% of Gallileo and MAC which contributed revenue and income from 19 June 2018 and 18 September 2019 respectively. -

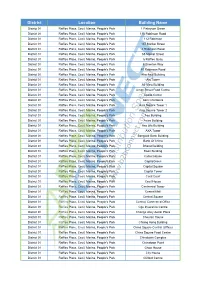

District Location Building Name

District Location Building Name District 01 Raffles Place, Cecil, Marina, People's Park 1 Finlayson Green District 01 Raffles Place, Cecil, Marina, People's Park 110 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 112 Robinson District 01 Raffles Place, Cecil, Marina, People's Park 137 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 4 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 55 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 6 Raffles Quay District 01 Raffles Place, Cecil, Marina, People's Park 6 Shenton Way District 01 Raffles Place, Cecil, Marina, People's Park 80 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park Afro-Asia Building District 01 Raffles Place, Cecil, Marina, People's Park Aia Tower District 01 Raffles Place, Cecil, Marina, People's Park Air View Building District 01 Raffles Place, Cecil, Marina, People's Park Amoy Street Food Centre District 01 Raffles Place, Cecil, Marina, People's Park Apollo Center District 01 Raffles Place, Cecil, Marina, People's Park Asia Chambers District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 1 District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 2 District 01 Raffles Place, Cecil, Marina, People's Park Aso Building District 01 Raffles Place, Cecil, Marina, People's Park Aviva Building District 01 Raffles Place, Cecil, Marina, People's Park Axa Life Building District 01 Raffles Place, Cecil, Marina, People's Park AXA Tower District 01