Defence Accounts Department Office Manual Part – Xvi

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

India Country Name India

TOPONYMIC FACT FILE India Country name India State title in English Republic of India State title in official languages (Bhārat Gaṇarājya) (romanized in brackets) भारत गणरा煍य Name of citizen Indian Official languages Hindi, written in Devanagari script, and English1 Country name in official languages (Bhārat) (romanized in brackets) भारत Script Devanagari ISO-3166 code (alpha-2/alpha-3) IN/IND Capital New Delhi Population 1,210 million2 Introduction India occupies the greater part of South Asia. It was part of the British Empire from 1858 until 1947 when India was split along religious lines into two nations at independence: the Hindu-majority India and the Muslim-majority Pakistan. Its highly diverse population consists of thousands of ethnic groups and hundreds of languages. Northeast India comprises the states of Arunāchal Pradesh, Assam, Manipur, Meghālaya, Mizoram, Nāgāland, Sikkim and Tripura. It is connected to the rest of India through a narrow corridor of the state of West Bengal. It shares borders with the countries of Nepal, China, Bhutan, Myanmar (Burma) and Bangladesh. The mostly hilly and mountainous region is home to many hill tribes, with their own distinct languages and culture. Geographical names policy PCGN policy for India is to use the Roman-script geographical names found on official India-produced sources. Official maps are produced by the Survey of India primarily in Hindi and English (versions are also made in Odiya for Odisha state, Tamil for Tamil Nādu state and there is a Sanskrit version of the political map of the whole of India). The Survey of India is also responsible for the standardization of geographical names in India. -

Dibrugarh 4000 5000 15000

Vistara Award Flights One Way Awards Award Flight Chart (for travel outside India) CV Points Required OOriginrigin Destination EconomyEconomy PremiumPremium EconomyEconomy BBuussiinneessss Bangkok Delhi 16000 27000 52000 Colombo Mumbai 10000 17000 33000 Colombo Delhi 10000 17000 33000 Delhi Bangkok 16000 27000 52000 Delhi Colombo 10000 17000 33000 Delhi Singapore 22000 40000 75000 Delhi Kathmandu 6500 10500 20000 Dubai Mumbai 16000 27000 52000 Kathmandu Delhi 6500 10500 20000 Mumbai Colombo 10000 17000 33000 Mumbai Dubai 16000 27000 52000 Mumbai Singapore 22000 40000 75000 Singapore Delhi 22000 40000 75000 Singapore Mumbai 22000 40000 75000 DibrugarhAward Flight Chart400 (f0or travel within India)5000 15000 Origin Destination Economy Premium Economy Business Ahmedabad Bengaluru 5000 8500 18000 Ahmedabad Delhi 4000 6500 12000 Ahmedabad Mumbai 4000 6500 12000 Amritsar Delhi 4000 6500 12000 Amritsar Mumbai 5000 8500 18000 Bagdogra Delhi 4500 7000 15000 Bagdogra Dibrugarh 4000 6500 12000 Bengaluru Ahmedabad 5000 8500 18000 Bengaluru Delhi 7500 13500 28000 Bengaluru Mumbai 4500 7000 15000 Bengaluru Pune 4000 6500 12000 Bhubaneswar Delhi 5000 8500 18000 Chandigarh Delhi 2000 2500 6000 Chandigarh Mumbai 5000 8500 18000 Chennai Delhi 7500 13500 28000 Chennai Kolkata 5000 8500 18000 Chennai Mumbai 4500 7000 15000 Chennai Port Blair 5000 8500 18000 Dehradun Delhi 2000 2500 6000 Delhi Ahmedabad 4000 6500 12000 Delhi Amritsar 4000 6500 12000 Delhi Bagdogra 4500 7000 15000 Delhi Bengaluru 7500 13500 28000 Delhi Bhubaneswar 5000 8500 18000 Delhi Chandigarh -

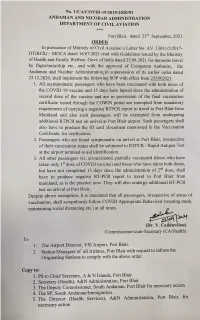

Andaman & Nicobar Administration Directorate of Civil Aviation

ANDAMAN & NICOBAR ADMINISTRATION DIRECTORATE OF CIVIL AVIATION *** RESERVATION REQUEST FORM FOR CHARTER FLIGHT 1. Date of journey : 2. Sector : From........................................ To.............................. 3. Purpose of journey : .................................................................................... 4. Nationality : .................................................................................... 5. Applicant Status : Single/Family Name(s) of Passenger Relation Sex Age Whether Islander/ S.No (surname first) Non-Islander (*See Note Below) 1. 2. 3. 4. 5. Contact Address : .................................................................................... 6. Contact No : (a) Telephone ............................................…………. : (b) Mobile .............................................................. 7. Email ID : ..................................................................................... Signature of the Applicant Name: _____________________________________________________________________________ *Note:- For Islander a copy of Islander Card/ Local Certificate and for employee of Central Govt./PSUs/Defence personnel posted in A & N Islands a copy of certificate issued by HoD/Head of Office to be submitted alongwith this form. Original Islander Card/Proof is required to be presented at time of submission of application for verification. _________________________________________________________________________________ FOR OFFICE USE ONLY Application received at_______________ (hrs) on ___________________ -

Government of India Ministry of Information and Broadcasting

GOVERNMENT OF INDIA MINISTRY OF INFORMATION AND BROADCASTING LOK SABHA UNSTARRED QUESTION No.2259 (TO BE ANSWERED ON 11.12.2015) AIR/ DD COVERAGE 2259. SHRI ASHOK MAHADEORAO NETE: SHRI P. NAGARAJAN: SHRI JAGDAMBIKA PAL: SHRI BODHSINGH BHAGAT: SHRIMATI MAUSAM NOOR: SHRIMATI KAMLA DEVI PAATLE: DR. RAMESH POKHRIYAL "NISHANK": Will the Minister of INFORMATION AND BROADCASTING be pleased to state: (a) the total number of All India Radio (AIR) and Doordarshan (DD) stations in the country, location and State/UT-wise; (b) whether the Government proposes to expand the AIR/DD network by establishing more number of stations in various States in the country, where Doordarshan/Radio broadcast is not available, if so, the details thereof, State/ UT-wise including Madhya Pradesh, Maharashtra and Chhattisgarh along with the time frame fixed for operationalising the same; (c) whether the broadcast of All India Radio has improved in terms of reach/ coverage throughout the country in the past ten years, if so, the details thereof; (d) whether the popularity of AIR has been affected due to poor quality or low coverage, if so, the corrective measures taken by the Government in this regard; and (e) the concrete steps taken/proposed to be taken by the Government to increase radio density and DD coverage in the country particularly in rural/ remote/ backward/ tribal regions of the country? ANSWER THE MINISTER OF STATE IN THE MINISTRY OF INFORMATION AND BROADCASTING {COL RAJYAVARDHAN RATHORE (Retd.) } (a) Prasar Bharati has informed that as far as All India Radio (AIR) is concerned, total 414 nos. of AIR Broadcasting Stations are functioning in the country. -

Policy Andaman and Nicobar

II. SOP REGARDING COVID-19 TESTING FOR TOURISTS COMING TO ANDAMAN ISLANDS On arrival at Port Blatr 1. The tourists need to carry COVID-19 negative test report from mainland based 1CMR approved lab using Reverse Transcriptase-Polymerase Chain Reaction (RTPCR). However, the sample for RTPCR test should have been taken within 48 hours prior to starting the journey from the origin station. (For e.g. if the tourist takes a flight from Delhi at 0600 hrs. on 1st September, 2021, the sample for RTPCR test should have beern taken not before 0600 hrs. on 30th August, 2021). 2. The tourists/visitors on arrival at Port Blair airport have to undergo mandatorily Covid-19 screening with RTPCR test free of cost. Thereafter the tourists/visitors are allowed to move to their respective hotels. However, they will have to be under quarantine at Port Blair in their hotels rooms until the result of RTPCR tests are received. In case of RTPCR positive test results, the tourists/visitors shall be remain in institutional quarantine in hotels notilied by the Hoteliers Association in consent with the A&N Administration, on rates as specified or to the designated hospital/ Covid-19 care centre on case to case basis. Other guidelines prescribed by the Ministry of Civil Aviation for airport (available at https://www.mohfw.gov.in and SOP) issued by Airport Manager, VSI also need to followed. 3. Tourists may also have to urndergo random Rapid Antigen Test conducted from time to time on payment basis as prescribed by A8N Administration. Incase tourist tests Positive for COVID-19 during stay 4. -

Revised Allocation of Foodgrains to Andaman & Nicobar Islands Under

F. No. 1-8/2013-BP-1I1(VoLlI) Government of India Ministry of Consumer Affairs and Food and Public Distribution Department of Food and Public Distribution Krishi B~awan, New Delhi Dated:-<"I February, 2017. To The Secretary cum Director, Department of Civil Supplies & ConsumerAffairs, Andaman& NicobarAdministration, Port Blair. Sub: Revised allocation of foodgrains to Andaman & Nicobar Islands under tide over category from April, 2017- reg. Sir, I am directed to refer to this Department's letters of even number dated 29th November,2016 and so" November, 2016 revisingthe allocation of foodgrains under tide over categoryfor the period from December,2016 to March, 2017. As already conveyedto the State Governmentthat the allocationwould be revisedfrom April, 2017 onwards, it has now been decided to revise the wheat-rice ratio of tide over allocationto the previouslevel. Accordingly,in partial modificationof this Department'sallocation letter of even number 1- 8/201~-BP.II.1(Vo!.-II) dated.29/30, November, 2016 and 6t~December, 2016, the revised monthlyallocationof foodgrains to Andaman & Nicobar Islandsfrom April, 2017 onwards is as under: Allocation Monthlyquantity (in tons) Issue price per kg (in Rsl category Rice Wheat Total Rice Wheat MY 128.433 16.572 145.005 Rs.3.00 Rs.2.00 Priority 150.152 37.538 187.690 Total 278.585 54.110 332.695 Tide Over 1369.520 760.950 2130.470 RS.8.30 RS.6.10 2. The validity period for deposit of cost and lifting of the above revised allocation for the month of April, 2016 will be 31stMarch,2017. The validity period for rest of the months will be as per the existing instructionsconveyedvide this Department'sletter No.1-2/2007- BP.III dated 11.07.2014. -

Government of Union Territory of Andaman And

MR. CHAIRMAN ; The question is: Legislative Assembly A demand was also made by the Members of this House, a number of times, that Andaman ‘That leave be granted to withdraw the Bill to & Nicobar also be given the Statehood provide for free and compulsory education upto higher secondary level to all children The demand was made when this House throughout the country and for matters unanimously passed the Delhi State Bill An assurance connected therewith.*' was given when the matter was raised by us. particularly by the Member representing Andaman & The motion was adopted Nicobar Islands for the last six terms. Shri Manoranjan DR. T. SUBBARAMI REDDY : I withdraw the Bill. Bhakta. At that time, we were assured that Andaman & Nicobar .Islands would also be given the Statehood. That was in the year 1991. when elections were held [Translation] in Delhi, the Assembly was constituted and a State Government was formed in Delhi. It is functioning for MR. CHAIRMAN Now the Minister for the last three years. But the people of Andaman & parliamentary affairs and the Minister for Home are Nicobar Islands are yet to get a Statehood or an present here in the House A few moments back when Assembly the hon ble Deputy Speaker was in the Chair. Shri Ganga Charan Rajput had made a special mention and he had Why are we asking Statehood tor Andaman & raised this issue. Now. if you have to say anything else, Nicobar Islands? It is not only for a Legislative Assembly you may say. but it is the experience of the people after the Predesh Council started functioning since 1 981 Their experience THE MINISTER OF PARLIAMENTARY AFFAIRS is that there is no proper representation of the people; AND MINISTER OF TOURISM (SHRI SRIKANTA JENA) : the voice of the people, the demand of the peopjfe/the At that time I was not present in the House. -

Domestic : Base Fares & Airline Fuel Charge

Air india Domestic Fares (Apex & Instant Purchase Fares) Domestic : Base Fares & Airline Fuel Charge -TABLE I Link Fares : Base Fares & Airline Fuel Charge -TABLE II Return Fares: Base Fares & Airline Fuel Charge -TABLE III LTC Scheme:Base Fares & Airline Fuel Charge -TABLE IV Islanders Fares -TABLE V Remarks & Notings -TABLE VI TABLE I Advance Purchase Instant Purchase Instant Instant Instant Instant Instant First Purchase Purchase Purchase Purchase Purchase 3 Days ROUTE 90days 60days 30 Days 14 Days 7 Days Advance Business Class Class S.NO. SECTOR & V.V Direct/Via SAP90 SAP60 EIPFS SIPFS TIPFS UEIPFS LEIPFS SAP 30 TAP 14 TAP 7 UEIP LEIP GEIP WEIP VEIP QEIP KEIP HEIP MEIP B Y P ZAP J D C F Airline Fuel Charge Remarks Base Base Base Base Base Base Base Base Base Base Base Base Base Base Base Base Base Base Base Base Base Fare Fare Fare Fare Fare Fare Fare Fare Fare Fare Fare Fare Fare Fare Fare Fare Fare Base Fare Fare Fare Fare Fare 1 Agartala Guwahati D 194 500 1000 1710 2360 2870 3070 3320 3570 3820 4070 4370 4831 5804 6476 7649 8250 10433 12050 13890 1850 2 Agartala Kolkata D 194 500 1000 1710 2360 2870 2970 3120 3270 3420 3570 3720 3891 5225 6259 7804 9250 10606 10790 11651 1850 3 Agartala Silchar D 194 500 1000 1710 2360 2870 3070 3280 3500 3720 3940 4160 4401 5321 5940 7019 1850 4 Agatti Bengaluru V 194 500 1000 1710 2360 2870 3070 3570 4300 5300 6300 7300 10691 12010 13028 15030 1850 5Agatti Chennai D 194 600 1100 2020 3620 4620 4900 5300 5750 6750 7750 8750 10646 13145 15344 18771 2150 6 Agatti Kochi D 194 500 1000 1710 2360 -

Andaman & Nicobar Administration Directorate of Civil Aviation

Pre-Feasibility Report For Development of Water Aerodrome at Swaraj Island, A&N Project Proponent “Andaman & Nicobar Administration Directorate of Civil Aviation” Pre-Feasibility Report for Development of Water Aerodrome at Swaraj Island, A&N TABLE OF CONTENTS 1. EXECUTIVE SUMMARY ...................................................................................................... 1 2. INTRODUCTION OF THE PROJECT/BACKGROUND INFORMATION .................... 2 2.1 Identification of Project and Project Proponent ............................................................... 2 2.1.1 Project Proponent ...................................................................................................... 2 2.1.2 Identification of Project ............................................................................................ 2 2.2 Brief Description of Nature of the Project ....................................................................... 2 2.3 Need for the Project and its Importance to the Country and or Region ........................... 3 2.4 Employment Generation (Direct and Indirect) due to the Project ................................... 3 3. PROJECT DISCRIPTION ...................................................................................................... 4 3.1 Type of Project ................................................................................................................. 4 3.2 Location of the Project Site .............................................................................................. 4 -

New Normal Dates of Onset/Progress and Withdrawal of Southwest Monsoon Over India

2020 RR No. 3/2020 CRS RESEARCH REPORT New Normal Dates of D.S.Pai1 Arti Bandgar 1 Onset/Progress and Withdrawal of Sunitha Devi2 Madhuri Musale 1 Southwest Monsoon over India M. R. Badwaik 1 A. P. Kundale 1 Sulochana Gadgil3 M. Mohapatra2 M. Rajeevan4 1 India Meteorological Department, Pune 2 India Meteorological Department, New Delhi 3 Indian Institute of Science, Bengaluru 4Ministry of Earth Sciences, New Delhi New Normal Dates of Onset/Progress and Withdrawal of Southwest Monsoon over India By D. S. Pai1, Arti Bandgar1, Sunitha Devi2, Madhuri Musale1, M. R. Badwaik1, A. P. Kundale1, Sulochana Gadgil3, M. Mohapatra2 and M. Rajeevan4 1India Meteorological Department, Pune 2India Meteorological Department, New Delhi 3Indian Institute of Science, Bengaluru 4Ministry of Earth Sciences, New Delhi OFFICE OF THE HEAD, CLIMATE RESEARCH & SERVICES IMD, PUNE- 411005 Table of Contents Page Number Executive Summary 1 Abstract 2 1 Introduction 4 2 Existing Normal Dates of Monsoon Onset/progress and 7 Withdrawal 3 Data Used and Methodology 9 3.1 Data Used 10 3.2 New Rainfall Criteria Used for declaring Onset, 11 Advance/progress Dates of Southwest Monsoon 4 Results and Discussions 13 4.1 Normal Dates of Monsoon Onset/progress based on 13 Operational Data 4.2 Normal Dates of Monsoon Onset/progress based on 16 New Rainfall Criteria 4.3 Monsoon Onset/progress: Operational vs. New Rainfall 20 Criteria 4.4 Normal Dates of Monsoon Withdrawal based on 23 Operational Data 4.5 Normal Dates of Onset/progress and Withdrawal of 26 Southwest Monsoon over Major Cities of the Country 5 Summary and Conclusions 30 Acknowledgements 32 References 32 Executive Summary New Normal Dates of Onset/Progress and Withdrawal of 1 Document title Southwest Monsoon over India 2 Document type Research Report 3 Issue No. -

No. 31011/3/2018-Estt.(A-IV) Government of India Ministry of Personnel, Public Grievances and Pensions Department of Personnel and Training Establishment A-IV Desk

No. 31011/3/2018-Estt.(A-IV) Government of India Ministry of Personnel, Public Grievances and Pensions Department of Personnel and Training Establishment A-IV Desk North Block, New Delhi.-110 001 Dated: October 8, 2020 OFFICE MEMORANDUM Subject:- Central Civil Services (Leave Travel Concession) Rules, 1988 — Relaxation to travel by air to visit North East Region, Union Territory of Jammu & Kashmir, Union Territory of Ladakh and Andaman & Nicobar Islands— extension beyond 25.09.2020. The undersigned is directed to refer to this Department's O.M. No. 31011/3/2018- Estt.A-IV dated 20.09.2018 regarding relaxation to travel by air to visit North East Region, Jammu & Kashmir and Andaman & Nicobar and to say that in relaxation to CCS (LTC) Rules, 1988, the scheme allowing Government servants to travel by air to North East Region (NER), Union Territory of Jammu and Kashmir (J&K), Union Territory of Ladakh and Union Territory of Andaman & Nicobar Islands (A&N) is extended for a further period of 26th 25th two years, w.e.f. September, 2020 till September, 2022 as under: (i) LTC for visiting NER, J&K, Ladakh and A&N in lieu of a Home Town LTC. (ii) Facility of air journey to non-entitled Government servants for visiting NER, J&K, Ladakh and A&N. (iii) Permission to undertake journey to J&K, Ladakh, NER and A&N by private airlines. 2. The above special dispensation is subject to the following terms & conditions: (i) All eligible Government servants may avail LTC to visit any place in NER! A&N/ J&K/ Ladakh against the conversion of their one Home Town LTC in a four year block. -

Directory Establishment

DIRECTORY ESTABLISHMENT SECTOR :URBAN STATE : ANDAMAN & NICOBAR ISLAN DISTRICT : Andamans Year of start of Employment Sl No Name of Establishment Address / Telephone / Fax / E-mail Operation Class (1) (2) (3) (4) (5) NIC 2004 : 1531-Manufacture of grain mill products 1 L V R MILLS ABERDEEN BAZAR PORT BLAIR SOUTH ANDAMAN PIN CODE: NA , STD CODE: NA , TEL NO: NA NA 10 - 50 , FAX NO: NA, E-MAIL : N.A. NIC 2004 : 1810-Manufacture of wearing apparel, except fur apparel 2 STYLO TAILORS DAIRY FARM JUNGLIGHAT POST OFFICE PORT BLAIR , PIN CODE: 744103, STD CODE: 03192, TEL NO: NA 1984 10 - 50 , FAX NO: NA, E-MAIL : N.A. NIC 2004 : 2021-Manufacture of veneer sheets; manufacture of plywood, laminboard, particle board and other panels and boards 3 THE MILL MANAGER CHATTAM OFFICE OF DCF MILL DIVISION CHATTAM HADDO PORT BLAIR PIN CODE: 744102, STD 1983 > 500 CODE: NA , TEL NO: NA , FAX NO: NA, E-MAIL : N.A. NIC 2004 : 2221-Printing 4 DAILY TELEGRAM NEWS WING PORT BLAIR SOUTH ANDAMAN PIN CODE: 744101, STD CODE: NA , TEL NO: NA , NA 10 - 50 FAX NO: NA, E-MAIL : N.A. 5 GOVT PRESS PORT BLAIR , , PIN CODE: 744101, STD CODE: NA , TEL NO: NA , FAX NO: NA, E-MAIL : N.A. NA 10 - 50 NIC 2004 : 2811-Manufacture of structural metal products 6 MA GHANI ANDAMAN MOTOR PRIVATE LTD TATA SEASHORE ROAD PORT BLAIR PIN CODE: NA , STD CODE: 1976 10 - 50 NA , TEL NO: NA , FAX NO: NA, E-MAIL : N.A. 7 DEEP ENGINEERING HADDO PO SOUTH ANDAMAN PIN CODE: 744102, STD CODE: NA , TEL NO: NA , FAX NO: NA, 1990 10 - 50 E-MAIL : N.A.