Trustees' Annual Report 2016-17

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May-2019-Magazine.Pdf

Magheralin Parish MAGHERALIN PARISH DIRECTORY STAFF Rector Rev Simon Genoe Tel: 9261 1273 07955 356 055 Please note the Rector’s day off is Wednesday – if you would like to leave a message please call the Parish Office and we will make sure it is passed on. Curate Rev Carlton Baxter Tel: 028 9261 9569 e-mail: [email protected] (Please note Carlton’s day off is Monday) Youth Pastor Paul Martin Tel: 07963 014 335 Young Families Worker Rebecca Cromie Tel: 07553 051 261 Youth Worker Richard Lyttle Tel: 07576 556 951 Parish Office Secretary Ann King Tel: 9261 9569 07761 029 604 e-mail: [email protected] Office Opening Hours Monday – Thursday 9.00am - 2.00pm Friday 9.00am - 12 noon Caretaker David Kerr Tel: 9261 2327 – 07510 223 932 Organist Gareth Murray Tel: 07743 652 661 Safeguarding Trust Panel Raymond White - Phyllis Rusk - Doreen Waddell Church Wardens Rector’s – Jamie Haughton People’s – Jackie Irvine Magheralin Church Wardens Rector’s – Ross McCartney People’s – Barry Taylor Dollingstown Glebe Wardens Rector’s – Terry Nicholson People’s – Nicola Waddington Select Vestry Mark Bailey, Bertie Campbell, Mervyn Cordner, Linda Dawson, Mildred Dawson, Judith Kinnen, Harry Lockhart, Tom Maginnis, Raymond Neill, Basil O’Malley, Stephen Trew, Alan Waddell, Mission Co-ordinator Aileen Smyth Tel: 3832 9956 Gift Aid Secretary Godfrey Ellis Tel: 3882 0296 Honorary Treasurer Raymond Neill Tel: 3888 1017 Honorary Secretary Mildred Dawson Tel: 3832 6962 Graveyard Secretary Oswald Ellis Tel: 9261 1320 If anyone is admitted to hospital please let the Rector or the Parish Office know as soon as possible so a visit can be organised. -

The Belfast Gazette 17 May 1991 Notices Under the Bankruptcy Acts

526 THE BELFAST GAZETTE 17 MAY 1991 In the Matter of Frederick McCullough, fisherman, residing at NOTICES UNDER THE "Balteagh", 43 Manse Road, Kilkeel, Newry, County Down, BANKRUPTCY ACTS BT34 4BN, Bankrupt. The public examination of the above-named will be held at the IN THE HIGH COURT OF JUSTICE IN Royal Courts of Justice, Chichester Street, Belfast, on Tuesday, 4th NORTHERN IRELAND June, 1991 at 10.00am. Chancery Division Dated 17th May, 1991. BANKRUPTCY Official Assignee for Bankruptcy In the Matter of Kevin Harkin, subcontractor, residing at and carrying on business at 2 Laurel Drive, Strabane, County In the Matter of George Winston Rainey, Asphalt and tar-spraying Tyrone, BT82 9PL, Bankrupt. contractor, residing at and carrying on business at 90 The public examination of the above-named will be held at the Thornleigh Park, Lisburn, County Antrim, BT28 2DD, and Royal Courts of Justice, Chichester Street, Belfast, on Thursday, 6th formerly residing at and formerly carrying on business at Flat 4, June, 1991 at 10.00am. Dalboyne House, Belsize Road, Lisburn, County Antrim, Dated 17th May, 1991. BT28 9XX, Bankrupt. Official Assignee for Bankruptcy The public examination of the above-named will be held at the Royal Courts of Justice, Chichester Street, Belfast, on Tuesday, 4th June, 1991 at 10.00am. Dated 17th May, 1991. In the Matter of Chan Ying Ming, Restaurateur, residing at 31 Official Assignee for Bankruptcy Bloomfield Parade, Belfast BTS 5 AS, and carrying on business at 434 Woodstock Road, Belfast BT6 9DR, under the trade name of Loon Yie Chinese Restaurant and formerly residing at 129 East Bread Street, Belfast BTS SAQ, Bankrupt. -

Register of Employers

REGISTER OF EMPLOYERS A Register of Concerns in which people are employed in accordance with Article 47 of the Fair Employment and Treatment (Northern Ireland) Order 1998 The Equality Commission for Northern Ireland Equality House 7-9 Shaftesbury Square Belfast BT2 7DP Tel: (02890) 500 600 Fax: (02890) 328 970 Textphone: (02890) 500 589 E-mail [email protected] SEPTEMBER 2003 ________________________________________________REGISTRATION The Register Under Article 47 of the Fair Employment and Treatment (Northern Ireland) Order 1998 the Commission has a duty to keep a Register of those concerns employing more than 10 people in Northern Ireland and to make the information contained in the Register available for inspection by members of the public. The Register is available for use by the public in the Commission’s office. Under the legislation, public authorities as specified by the Office of the First Minister and the Deputy First Minister are automatically treated as registered with the Commission. All other employers have a duty to register if they have more than 10 employees working 16 hours or more per week. Employers who meet the conditions for registration are given one month in which to apply for registration. This month begins from the end of the week in which the concern employed more than 10 employees in Northern Ireland. It is a criminal offence for such an employer not to apply for registration within this period. Persons who become employers in relation to a registered concern are also under a legal duty to apply to have their name and address entered on the Register within one month of becoming such an employer. -

Armagh City, Banbridge and Craigavon

2 Contents Foreword ............................................................................................................ 4 Introduction ............................................................................................................ 5 Strategic Context .................................................................................................................... 6 Local Context ................................................................................................................... 13 Outcome 1 – Help people find housing support and solutions ......................................... 28 Outcome 2 – Deliver better homes ................................................................................. 30 Outcome 3 – Fostering vibrant sustainable communities ................................................ 34 Outcome 4 – Deliver quality public services .................................................................... 39 Appendix 1 Community Plan themes and outcomes ............................................. 42 Appendix 2 Social Housing Need by Settlement 2018-2023 ................................... 43 Appendix 3 Social Housing Development Programme ........................................... 44 Appendix 4 Maintenance Programme, Grants and Adaptations information ......... 45 Appendix 5 Supporting People Information .......................................................... 49 Appendix 6 NIHE Stock at March 2019 .................................................................. 50 Appendix 7 Applicants -

Planning Applications Validated

Planning Applications Validated Period: 25 April 2016 to 29 April 2016 Reference Number Application Proposal Location Applicant Name & Address Agent Name & Address Type LA05/2016/0403/O Local Site for 2 Infill Dwellings 80m South of 6 Brookmount Brian Dawson & Joan Fleming 6 Park Design Associates Road Lisburn Brookmount Road Parkmore House Parkmore Lisburn BT28 2TD Heights Ballymena BT43 5DB LA05/2016/0405/O Local Dwelling on a farm Adjacent to (& nw of) 1 Julie Anderson McCready Architects Whitemountain Road 1 White Mountain Road 8 Market Place Lisburn Lisburn Lisburn BT28 3QU BT28 1AN LA05/2016/0406/A Local Double sided free standing La Bella Vita and Black Wolf Lyn Frame shared sign Tattoo Studio 767-769 769 Upper Newtownards Road Upper Newtownards Road Dundonald Belfast BT16 Dundonald Belfast BT16 2QY 2QY LA05/2016/0407/F Local Proposed single storey 1 Lime Kiln Lane Aghalee Stuart Reid Architectural Services extension to dwelling along with BT67 0EZ 1 Lime Kiln Lane 28 Old Forge Road internal renovations Aghalee BT67 0EZ New Forge Road Magheralin BT67 0RS LA05/2016/0408/F Local Extension to side of dwelling to 56 Mornington Avenue Jennifer Devlin Matthew Johnson provide additional bedroom and Lisburn 56 Mornington Avenue Lisburn 2A Bridge Street Lisburn BT28 ensuite 1XY LA05/2016/0410/F Local Application to amend planning Approx. 510m North East of Mr & Mrs Wiggins Wind NI Ltd approval S/2011/0589/F to 46 Stoneyford Road 46 Stoneyford Road Lisburn 20 Upper Main Street reduce turbine height by 10m Lisburn BT28 3RG BT28 3RG Larne BT40 1SX and reduce rotor diameter by 3m *See explanatory note at end of document Planning Applications Validated Period: 25 April 2016 to 29 April 2016 Reference Number Application Proposal Location Applicant Name & Address Agent Name & Address Type LA05/2016/0411/F Local Erection of 11 no. -

Register of Employers 2021

REGISTER OF EMPLOYERS A Register of Concerns in which people are employed In accordance with Article 47 of the Fair Employment and Treatment (Northern Ireland) Order 1998 The Equality Commission for Northern Ireland Equality House 7-9 Shaftesbury Square Belfast BT2 7DP Tel: (02890) 500 600 E-mail: [email protected] August 2021 _______________________________________REGISTRATION The Register Under Article 47 of the Fair Employment and Treatment (Northern Ireland) Order 1998 the Commission has a duty to keep a Register of those concerns employing more than 10 people in Northern Ireland and to make the information contained in the Register available for inspection by members of the public. The Register is available for use by the public in the Commission’s office. Under the legislation, public authorities as specified by the Office of the First Minister and the Deputy First Minister are automatically treated as registered with the Commission. All other employers have a duty to register if they have more than 10 employees working 16 hours or more per week. Employers who meet the conditions for registration are given one month in which to apply for registration. This month begins from the end of the week in which the concern employed more than 10 employees in Northern Ireland. It is a criminal offence for such an employer not to apply for registration within this period. Persons who become employers in relation to a registered concern are also under a legal duty to apply to have their name and address entered on the Register within one month of becoming such an employer. -

THE BELFAST GAZETTE, 18Th DECEMBER, 1959

480 THE BELFAST GAZETTE, 18th DECEMBER, 1959. Messrs. Win. Finlay & Sons Ltd., Finprint House, 16 WHEREAS an Order for the administration of this Corporation Street, Belfast, 1. estate was made on the 15th day of December, 1959, Fox's Glacier Mints, Ltd., Alanbrooke Road, Castle- a Public Sitting will be held before the Court at reagh, Belfast, 6. the Royal Courts of Justice (Ulster) Belfast, on Messrs. J. & T. M. Greeves, Ltd., Conway Street, Tuesday, the 12th day of January, 1960, at the hour Belfast, 13. of eleven o'clock in the forenoon. Messrs. J. & T. M. Greeves, Ltd., Cupar Street, Creditors may prove their debts at such sitting and Belfast, 13. thereat choose a Creditor's Assignee. Messrs. Herdmans Ltd., Sion Mills, Co. Tyrone. Messrs. Johnston Barbour, Ltd., Whitehouse, Belfast. All persons having in their possession any property Messrs. Philip Johnston & Sons Ltd., Jennymount to which the Personal Representative of the deceased Mills, North Derby Street, Belfast, 15. is entitled as such should deliver it to, and all debts Messrs. G. Kinnaird & Co. Ltd., Owen O'Cork Mill, due to the Personal Representative of the deceased Beersbridge Road, Belfast, 5. as such should be paid to, the Official Assignee, Lurgan Boxmaking Co. Ltd., Dollingstown, Lurgan, Royal Courts of Justice (Ulster) Belfast, to whom Co. Armagh. Creditors may forward their affidavits of debt. Messrs. Munster, Simms & Co. Ltd., 114/116 Gt. JOHN M. HUNTER, Registrar. George's Street, Belfast, 15. Messrs. McCaw, Stevenson & Orr, Ltd., Castlereagh JOHN McKEE & SON, Solicitors for Road, Belfast, 5. Petitioner, 109 Victoria Street, Belfast, 1. -

EONI-REP-223 - Streets - Streets Allocated to a Polling Station by Area Local Council Elections: 02/05/2019

EONI-REP-223 - Streets - Streets allocated to a Polling Station by Area Local Council Elections: 02/05/2019 LOCAL COUNCIL: ARMAGH, BANBRIDGE AND CRAIGAVON DEA: ARMAGH ST PETER'S PRIMARY SCHOOL, COLLEGELANDS, 90 COLLEGELANDS ROAD, CHARLEMONT, DUNGANNON, BT71 6SW BALLOT BOX 1/AR TOTAL ELECTORATE 810 WARD STREET POSTCODE N08000207 AGHINLIG COTTAGES, AGHINLIG, DUNGANNON BT71 6TD N08000207 AGHINLIG PARK, AGHINLIG, DUNGANNON BT71 6TE N08000207 AGHINLIG ROAD, AGHINLIG, DUNGANNON BT71 6SR N08000207 AGHINLIG ROAD, AGHINLIG, DUNGANNON BT71 6SP N08000207 ANNAHAGH ROAD, KILMORE, DUNGANNON BT71 7JE N08000207 ARMAGH ROAD, CORR AND DUNAVALLY, DUNGANNON BT71 7HY N08000207 ARMAGH ROAD, KEENAGHAN, DUNGANNON BT71 7HZ N08000207 ARMAGH ROAD, DRUMARN, DUNGANNON BT71 7HZ N08000207 ARMAGH ROAD, KILMORE, DUNGANNON BT71 7JA N08000207 CANARY ROAD, DERRYSCOLLOP, DUNGANNON BT71 6SU N08000207 CANARY ROAD, CANARY, DUNGANNON BT71 6SU N08000207 PORTADOWN ROAD, CHARLEMONT BORO, DUNGANNON BT71 7SE N08000207 COLLEGE LANDS ROAD, KISHABOY, DUNGANNON BT71 6SN N08000207 CHURCHVIEW, CHARLEMONT, DUNGANNON BT71 7SZ N08000207 DERRYGALLY ROAD, DERRYCAW, DUNGANNON BT71 6LZ N08000207 GARRISON PLACE, CHARLEMONT, DUNGANNON BT71 7SA N08000207 MAIN STREET, CHARLEMONT, MOY BT71 7SF N08000207 COLLEGE LANDS ROAD, CHARLEMONT BORO, MOY BT71 7SE N08000207 COLLEGE LANDS ROAD, KEENAGHAN, MOY BT71 6SN N08000207 COLLEGE LANDS ROAD, AGHINLIG, MOY BT71 6SW N08000207 CORRIGAN HILL ROAD, KEENAGHAN, DUNGANNON BT71 6SL N08000207 DERRYCAW ROAD, CANARY, DUNGANNON BT71 6SX N08000207 DERRYCAW ROAD, CANARY, -

Information of Service Men and Women Death While on Operations

Army Secretariat Army Headquarters IDL 24 Blenheim Building Marlborough Lines Andover Hampshire, SP11 8HJ United Kingdom Ref: Army Sec/06/06/09633/75948 E-mail: [email protected] Website: www.army.mod.uk xxxxxxxxxxxx xxxxxxxxxxxxxxxxxxxxx 23 November 2015 Dear xxxxxxxxxx,, Thank you for your email of 1 November requesting the following information: - A list of deaths of servicemen/women of the British Army while on 'Op Banner' (Northern Ireland), where the death was due to terrorism or otherwise. I would, ideally, like the information in a spreadsheet. With the following information, ‘Service Number, Rank, First Names, Last Name, Unit, Age, Date of Death, Place of Death, and how died. - A list of deaths of servicemen/women of the British Army while on recent operations in Iraq. I would, ideally, like the information in a spreadsheet. With the following information, ‘Service Number, Rank, First Names, Last Name, Unit, Age, Date of Death, Place of Death, and how died. - A list of deaths of servicemen/women of the British Army while on recent operations in Afghanistan. I would, ideally, like the information in a spreadsheet. With the following information, ‘Service Number, Rank, First Names, Last Name, Unit, Age, Date of Death, Place of Death, and how died. I am treating your correspondence as a request for information under the Freedom of Information Act 2000. A search for the information has now been completed within the Ministry of Defence, and I can confirm that all information in scope of your request is held. The information you have requested for a list of deaths of servicemen and women in Northern Ireland on Op Banner is available in the attached spreadsheet. -

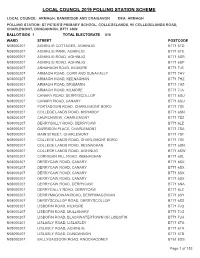

Local Council 2019 Polling Station Scheme

LOCAL COUNCIL 2019 POLLING STATION SCHEME LOCAL COUNCIL: ARMAGH, BANBRIDGE AND CRAIGAVON DEA: ARMAGH POLLING STATION: ST PETER'S PRIMARY SCHOOL, COLLEGELANDS, 90 COLLEGELANDS ROAD, CHARLEMONT, DUNGANNON, BT71 6SW BALLOT BOX 1 TOTAL ELECTORATE 816 WARD STREET POSTCODE N08000207AGHINLIG COTTAGES, AGHINLIG BT71 6TD N08000207AGHINLIG PARK, AGHINLIG BT71 6TE N08000207AGHINLIG ROAD, AGHINLIG BT71 6SR N08000207AGHINLIG ROAD, AGHINLIG BT71 6SP N08000207ANNAHAGH ROAD, KILMORE BT71 7JE N08000207ARMAGH ROAD, CORR AND DUNAVALLY BT71 7HY N08000207ARMAGH ROAD, KEENAGHAN BT71 7HZ N08000207ARMAGH ROAD, DRUMARN BT71 7HZ N08000207ARMAGH ROAD, KILMORE BT71 7JA N08000207CANARY ROAD, DERRYSCOLLOP BT71 6SU N08000207CANARY ROAD, CANARY BT71 6SU N08000207PORTADOWN ROAD, CHARLEMONT BORO BT71 7SE N08000207COLLEGE LANDS ROAD, KISHABOY BT71 6SN N08000207CHURCHVIEW, CHARLEMONT BT71 7SZ N08000207DERRYGALLY ROAD, DERRYCAW BT71 6LZ N08000207GARRISON PLACE, CHARLEMONT BT71 7SA N08000207MAIN STREET, CHARLEMONT BT71 7SF N08000207COLLEGE LANDS ROAD, CHARLEMONT BORO BT71 7SE N08000207COLLEGE LANDS ROAD, KEENAGHAN BT71 6SN N08000207COLLEGE LANDS ROAD, AGHINLIG BT71 6SW N08000207CORRIGAN HILL ROAD, KEENAGHAN BT71 6SL N08000207DERRYCAW ROAD, CANARY BT71 6SX N08000207DERRYCAW ROAD, CANARY BT71 6SX N08000207DERRYCAW ROAD, CANARY BT71 6SX N08000207DERRYCAW ROAD, CANARY BT71 6SX N08000207DERRYCAW ROAD, DERRYCAW BT71 6NA N08000207DERRYGALLY ROAD, DERRYCAW BT71 6LZ N08000207DERRYMAGOWAN ROAD, DERRYMAGOWAN BT71 6SY N08000207DERRYSCOLLOP ROAD, DERRYSCOLLOP BT71 6SS N08000207LISBOFIN -

27 November 2009 No WA 1

Friday Volume 46 27 November 2009 No WA 1 OFFICIAL REPORT (HANSARD) CONTENTS Written Answers to Questions Office of the First Minister and deputy First Minister [p1] Department of Agriculture and Rural Development [p4] Department of Culture, Arts and Leisure [p8] Department of Education [p25] Department for Employment and Learning [p40] Department of Enterprise, Trade and Investment [p44] Department of the Environment [p50] Department of Finance and Personnel [p53] Department of Health, Social Services and Public Safety [p56] Department for Regional Development [p66] Department for Social Development [p83] Northern Ireland Assembly Commission [p92] Written Answers [p103] £5.00 This publication contains the written answers to questions tabled by Members. The content of the responses is as received at the time from the relevant Minister or representative of the Assembly Commission and has not been subject to the official reporting process or changed in any way. This document is available in a range of alternative formats. For more information please contact the Northern Ireland Assembly, Printed Paper Office, Parliament Buildings, Stormont, Belfast, BT4 3XX Tel: 028 9052 1078 ASSEMBLY MeMBerS Adams, Gerry (West Belfast) McCarthy, Kieran (Strangford) Anderson, Ms Martina (Foyle) McCartney, Raymond (Foyle) Armstrong, Billy (Mid Ulster) McCausland, Nelson (North Belfast) Attwood, Alex (West Belfast) McClarty, David (East Londonderry) Beggs, Roy (East Antrim) McCrea, Basil (Lagan Valley) Boylan, Cathal (Newry and Armagh) McCrea, Ian (Mid Ulster) -

Primary Inspection St Patrick's Primary School, Magheralin, Co Down

PRIMARY INSPECTION St Patrick’s Primary School, Magheralin, Co Down Education and Training Inspectorate Report of an Inspection in December 2013 Quantitative terms In this report, proportions may be described as percentages, common fractions and in more general quantitative terms. Where more general terms are used, they should be interpreted as follows: Almost/nearly all - more than 90% Most - 75%-90% A majority - 50%-74% A significant minority - 30%-49% A minority - 10%-29% Very few/a small number - less than 10% Performance levels The Education and Training Inspectorate (ETI) use the following performance levels in reports: DESCRIPTOR Outstanding Very Good Good Satisfactory Inadequate Unsatisfactory Contents Section Page 1. Inspection method and evidence base 1 2. Context 1 3. Focus of inspection 2 4. Overall finding 2 5. Achievements and standards 2 6. Provision 3 7. Leadership and management 4 8. Conclusion 4 1. Inspection method and evidence base The key questions and quality indicators which guide inspection and self-evaluation of primary schools, which were applied to this inspection, are available in the Education and Training Inspectorate’s (ETI) publication Together Towards Improvement: a process for self-evaluation at: http://www.etini.gov.uk/index/together-towards-improvement/together- towards-improvement-primary.htm. Inspectors observed teaching and learning, scrutinised documentation and the children’s written work and held formal and informal discussions with children, teachers, parent and staff with specific responsibilities. The arrangements for this inspection included: • meeting with representatives from the governors; • meetings with groups of children; and • the opportunity for the parents, teaching and support staff to complete a confidential questionnaire.