Global Survey 2008

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Dictionary T

Leach’s Tax Dictionary. Version 9 as at 5 June 2016. Page 1 T T Tax code Suffix for a tax code. This suffix does not indicate the allowances to which a person is entitled, as do other suffixes. A T code may only be changed by direct instruction from HMRC. National insurance National insurance contribution letter for ocean-going mariners who pay the reduced rate. Other meanings (1) Old Roman numeral for 160. (2) In relation to tapered reduction in annual allowance for pension contributions, the individual’s adjusted income for a tax year (Finance Act 2004 s228ZA(1) as amended by Finance (No 2) Act 2015 Sch 4 para 10). (3) Tesla, the unit of measure. (4) Sum of transferred amounts, used to calculate cluster area allowance in Corporation Tax Act 2010 s356JHB. (5) For the taxation of trading income provided through third parties, a person carrying on a trade (Income Tax (Trading and Other Income) Act 2005 s23A(2) as inserted by Finance (No 2) Act 2017 s25(2)). (6) For apprenticeship levy, the total amount of levy allowance for a company unit (Finance Act 2016 s101(7)). T+ Abbreviation sometimes used to indicate the number of days taken to settle a transaction. T$ (1) Abbreviation: pa’anga, currency of Tonga. (2) Abbreviation: Trinidad and Tobago dollar. T1 status HMRC term for goods not in free circulation. TA (1) Territorial Army. (2) Training Agency. (3) Temporary admission, of goods for Customs purposes. (4) Telegraphic Address. (5) In relation to residence nil rate band for inheritance tax, means the amount on which tax is chargeable under Inheritance Tax Act 1984 s32 or s32A. -

Taxation of Crypto Assets

Taxation of Crypto Assets Edited by Niklas Schmidt Jack Bernstein Stefan Richter Lisa Zarlenga Published by: Kluwer Law International B.V. PO Box 316 2400 AH Alphen aan den Rijn The Netherlands E-mail: [email protected] Website: lrus.wolterskluwer.com Sold and distributed by: Wolters Kluwer Legal & Regulatory U.S. 7201 McKinney Circle Frederick, MD 21704 United States of America Email: [email protected] Printed on acid-free paper. ISBN 978-94-035-2350-7 e-Book: ISBN 978-94-035-2351-4 web-PDF: ISBN 978-94-035-2352-1 © 2021 Niklas Schmidt, Jack Bernstein, Stefan Richter & Lisa Zarlenga All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without written permission from the publisher. Permission to use this content must be obtained from the copyright owner. More information can be found at: lrus.wolterskluwer.com/policies/permissions-reprints-and-licensing Printed in the United Kingdom. Editors Jack Bernstein is the Senior Tax Partner at Aird & Berlis LLP in Toronto and Chair of the firm’s International Tax practice. Jack is well known in international tax planning, mergers and acquisitions, corporate restructuring, reorganizations and financing. He is experienced in dealing with public and private corporations and has advised hedge funds, venture capital funds and real estate funds. He also has extensive experience in advising high-net-worth private clients on international, cross-border and domestic estate and tax planning. An authority on multijurisdictional matters and a prolific writer and speaker, Jack regularly contributes to leading tax publications globally, including Tax Notes International. -

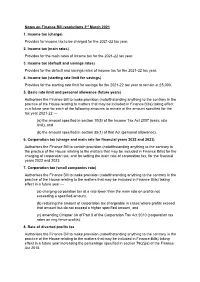

Notes on Finance Bill Resolutions 3Rd March 2021 1

Notes on Finance Bill resolutions 3rd March 2021 1. Income tax (charge) Provides for income tax to be charged for the 2021-22 tax year. 2. Income tax (main rates) Provides for the main rates of income tax for the 2021-22 tax year. 3. Income tax (default and savings rates) Provides for the default and savings rates of income tax for the 2021-22 tax year. 4. Income tax (starting rate limit for savings) Provides for the starting rate limit for savings for the 2021-22 tax year to remain at £5,000. 5. Basic rate limit and personal allowance (future years) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to matters that may be included in Finance Bills) taking effect in a future year for each of the following amounts to remain at the amount specified for the tax year 2021-22 — (a) the amount specified in section 10(5) of the Income Tax Act 2007 (basic rate limit), and (b) the amount specified in section 35(1) of that Act (personal allowance). 6. Corporation tax (charge and main rate for financial years 2022 and 2023) Authorises the Finance Bill to contain provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) for the charging of corporation tax, and for setting the main rate of corporation tax, for the financial years 2022 and 2023. 7. Corporation tax (small companies rate) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) taking effect in a future year — (a) charging corporation tax at a rate lower than the main rate on profits not exceeding a specified amount, (b) reducing the amount of corporation tax chargeable in cases where profits exceed that amount but do not exceed a higher specified amount, and (c) amending Chapter 3A of Part 8 of the Corporation Tax Act 2010 (corporation tax rates on ring fence profits). -

Customs and Excise Acts (Application) (Amendment) Order 2019 Index

Customs and Excise Acts (Application) (Amendment) Order 2019 Index c CUSTOMS AND EXCISE ACTS (APPLICATION) (AMENDMENT) ORDER 2019 Index Article Page 1 Title ................................................................................................................................... 3 2 Commencement .............................................................................................................. 3 3 Interpretation ................................................................................................................... 3 4 Application ...................................................................................................................... 3 5 Amendment of the principal Order ............................................................................. 4 6 Amendment of Customs and Excise Acts (Application) Order 2011 .................... 13 SCHEDULE 15 EXCEPTIONS, ADAPTATIONS AND MODIFICATIONS SUBJECT TO WHICH PART 3 OF SCHEDULE 7, PART 2 OF SCHEDULE 8 AND PARAGRAPH 9 OF SCHEDULE 9 TO THE TAXATION (CROSS-BORDER TRADE) ACT 2018 (C.22 OF PARLIAMENT) SHALL HAVE EFFECT IN THE ISLAND 15 GENERAL MODIFICATION 15 SCHEDULE 7 – IMPORT DUTY: CONSEQUENTIAL AMENDMENTS 15 PART 3 – AMENDMENTS OF OTHER ENACTMENTS 15 SCHEDULE 8 – VAT AMENDMENTS CONNECTED WITH WITHDRAWAL FROM THE EU 17 PART 2 – AMENDMENTS TO OTHER ENACTMENTS 17 SCHEDLE 9 – EXCISE DUTY AMENDMENTS CONNECTED WITH WITHDRAWAL FROM EU 18 PARAGRAPH 9 18 ANNEX 19 ENDNOTES 24 TABLE OF ENDNOTE REFERENCES 24 c SD No.2019/0083 Page 1 Customs and Excise Acts (Application) -

Legislative Drafting and the Rule of Law Ronan Cormacain Institute Of

Legislative Drafting and the Rule of Law Ronan Cormacain Institute of Advanced Legal Studies, School of Advanced Study, University of London PhD Thesis 2017 1 Declaration The work presented in this thesis is my own. Dedication I dedicate this thesis to my long-suffering family who have endured many years of a father and husband too busy with work to spend time with his family. 2 Abstract The rule of law is a cornerstone of the UK legal order, it states that we are all subject to, and ruled in accordance with, the law. Under Bingham’s analysis, the rule of law is made up of eight separate elements. Element one has four aspects, these are that legislation ought to be accessible, intelligible, clear and predictable. Legislative drafting means turning policy ideas into legislation fit for the statute book – it is literally writing the law. It is best described as phronesis, the subjective application of wisdom. The hypothesis of this thesis is that legislative drafting principles can be derived from element one of Bingham’s definition of the rule of law, and that these drafting principles facilitate the drafting of legislation in accordance with the rule of law. The methodology is deductive reasoning, meaning that each aspect of element one is examined, and from each aspect, drafting principles are derived. The principles therefore flow directly from the rule of law. In Chapter 2 the rule of law requirement of accessibility is dissected. Accessibility means that citizens have access to the law. This leads to the conclusions that legislation ought to be drafted so as to be available (citizens can physically read it), navigable (citizens can find their way around it, particularly to the portion which directly affects them) and inclusive (containing all the relevant legal information). -

Civil Service Quarterly Issue 03 January 2014

7 Issue 3 » January 2014 Civil Service Quarterly Legislation.gov.uk and Good Law » Clear laws are essential to the economy and society, but people often find them difficult to understand. Recent research has been exploring how to make legislation better and present it in more effective ways, says John Sheridan, Head of Legislation at The National Archives. It’s not news that people want legislation that is simple, Good Law ...We want... accessible and easy to comply The Good Law initiative to create with. It isn’t always possible: is an appeal to everyone legislation needs to be confidence among users interested in the making precise to have the intended that the law is for them… and publishing of law legal effect, and precision – www.gov.uk/ to come together with can be complicated. But a good-law a shared objective of lot can be done to improve making legislation work the accessibility of the law. well for the users of today That’s the aim of the Good and tomorrow. Law initiative, being led by the any UK statute. Around two Office of the Parliamentary million people do so every Good law is law that is: Counsel (OPC), a partnership month. They are the users • necessary involving everyone with a of Legislation.gov.uk. The • clear role in making, shaping and challenge now is to ensure the • coherent presenting legislation. needs of this new audience • effective The National Archives are properly understood and • accessible manages Legislation.gov. addressed, so they have a fair uk, the official home of UK chance of comprehending the legislation. -

Taxation of Charitable Trusts and Institutions - a Study

TAXATION OF CHARITABLE TRUSTS AND INSTITUTIONS - A STUDY [Based on the law as amended by the Finance Act, 2008] Direct Taxes Committee The Institute of Chartered Accountants of India (Set up by an Act of Parliament) New Delhi THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior permission in writing, from the publisher. Website : www.icai.org E-mail : [email protected] First Edition : January, 1978 Reprinted : July, 1978 Second Revised Edition : October, 1980 Third Revised Edition : March, 1984 Fourth Revised Edition : May, 1999 Fifth Revised Edition : January, 2002 Sixth Edition : February, 2009 Price : Rs. 300/- ISBN No : 978-81-8441-213-0 Published by : The Publication Department on behalf of CA. Mukta K. Verma, Secretary, Direct Taxes Committee, The Institute of Chartered Accountants of India, A-94/4, Sector-58 Noida -201 301. Printed by : Sahitya Bhawan Publications, Hospital Road, Agra 282 003. February/2009/1000 Copies ii FOREWORD TO THE SIXTH EDITION Taxation of “Charitable trusts and Institutions” is an important area in the Income-tax Act. Since the medium of charitable trusts is widely perceived as a toll of tax planning, the government has progressively made the law relating to taxation of charitable trust very strict. In the recent past there have been many amendments in the law through which the Government has tried to bring the anonymous donations made to these trusts under the tax net. -

The Taxes (Base Erosion and Profit Shifting) (Country-By-Country

STATUTORY INSTRUMENTS 2016 No. 237 TAXES The Taxes (Base Erosion and Profit Shifting) (Country-by- Country Reporting) Regulations 2016 Made - - - - 26th February 2016 Laid before the House of Commons 26th February 2016 Coming into force - - 18th March 2016 CONTENTS 1. Citation and commencement 2 2. Interpretation 2 3. Filing of CBC reports 2 4. Threshold requirement 3 5. United Kingdom country-by-country report and United Kingdom Entity 4 6. Conditions that apply for the purposes of regulation 3(4)(b) and 3(8)(c) 4 7. Commissioners’ directions 5 8. Form and method of filing of CBC reports 5 9. CBC report filing presumptions 5 10. Reporting entities 5 11. Provision of information 5 12. Penalties for failure to comply with Regulations 6 13. Daily default penalty 6 14. Penalties for inaccurate information 6 15. Matters to be disregarded in relation to liability to penalties 6 16. Assessment of penalties 7 17. Right to appeal against penalty 7 18. Procedure on appeal against penalty 7 19. Application for increased daily default penalty 7 20. Payment and enforcement of penalties 8 21. Anti-avoidance 8 The Treasury make these Regulations in exercise of the powers conferred by section 136 of the Finance Act 2002( a) and section 122 of the Finance Act 2015( b): (a) 2002 c. 23. (b) 2015 c.11. Citation and commencement 1. These Regulations may be cited as the Taxes (Base Erosion and Profit Shifting) (Country-by- Country) Reporting Regulations 2016 and come into force on 18th March 2016. Interpretation 2. —(1) In these Regulations— “CBC report” -

Daily Report Wednesday, 25 March 2015 CONTENTS

Daily Report Wednesday, 25 March 2015 This report shows written answers and statements provided on 25 March 2015 and the information is correct at the time of publication (06:29 P.M., 25 March 2015). For the latest information on written questions and answers, ministerial corrections, and written statements, please visit: http://www.parliament.uk/writtenanswers/ CONTENTS ANSWERS 6 Low Pay 17 ATTORNEY GENERAL 6 Minimum Wage 18 Domestic Violence: North West 6 Public Sector: Mutual Societies 18 EU Countries 6 Shoplifting: North West 18 Staff 6 Youth Services 18 BUSINESS, INNOVATION AND COMMUNITIES AND LOCAL SKILLS 7 GOVERNMENT 19 Adult Education 7 Affordable Housing 19 Adult Education: Hackney 8 Affordable Housing: South East 20 Adult Education: Lancashire 8 Council Housing: Greater Economic Growth: South West 9 London 21 Local Enterprise Partnerships 9 Forced Labour 22 Regional Growth Fund 10 Local Government Finance: Derbyshire 22 CABINET OFFICE 15 Local Plans 24 Brain: Tumours 15 Parking 25 Chronic Obstructive Pulmonary Disease 15 Private Sector: Thames Gateway 26 Civil Servants 16 Right to Buy Scheme 27 Efficiency and Reform Group 16 Social Services 28 Electronic Government 16 York 28 Government Departments: CULTURE, MEDIA AND SPORT 29 Advertising 17 Broadband: North West 29 Government Departments: Broadband: Rural Areas 29 Disclosure of Information 17 Broadband: Urban Areas 30 Government Departments: Internet: EU Action 32 Trade Unions 17 Local Press 32 2 Wednesday, 25 March 2015 Daily Report Mobile Phones 32 Passports: British Nationals -

Explanatory Notes to Finance Bill 2020

Finance Bill Explanatory Notes 19 March 2020 Introduction ............................................................................................................................................ 5 Part 1: Income Tax, Corporation Tax and Capital Gains Tax .......................................................... 6 Clause 1: Income tax charge for tax year 2020 - 21 ............................................................................ 7 Clause 2: Main rates of income tax for tax year 2020- 21 ................................................................. 8 Clause 3: Default and savings rates of income tax for tax year 2020- 21 ........................................ 9 Clause 4: Starting rate limit for savings for tax year 2020-21 ........................................................ 10 Clause 5: Main rate of corporation tax for financial year 2020 ...................................................... 11 Clause 6: Corporation tax: charge and main rate for financial year 2021 .................................... 12 Clause 7: Determining the appropriate percentage for a car: tax year 2020-21 onwards .......... 13 Clause 8: Determining the appropriate percentage for a car: tax year 2020-21 only .................. 15 Clause 9: Determining the appropriate percentage for a car: tax year 2021-22 only .................. 17 Clause 10: Apprenticeship bursaries paid to persons leaving local authority care .................... 19 Clause 11: Tax treatment of certain Scottish social security benefits ........................................... -

Corporation Tax Act 2009

Domestic Abuse (Scotland) Act 2011 The Damages (Scotland) Act 2011 (Commencement, Transitional Provisions and Savings) Order 2011 The Companies Act 2006 (Commencement No. 5, Transitional Provisions and Savings) Order 2007 The Companies (Reporting Requirements in Mergers and Divisions) RegulationsThe Yarmouth2011 (Isle of Wight) Harbour Revision Order 2011 The Limited Liability Partnerships (Accounts and Audit) (Application of Companies Act 2006) Regulations 2008 The Building Societies (Insolvency and Special Administration) (Amendment) Order 2010 The Companies Act 2006 (Amendment of Schedule 2) Order 2009 The European Public Limited-Liability Company (Amendment) Regulations 2009 The Banking Act 2009 (Exclusion of Insurers) Order 2010 Damages (Scotland) Act 2011 The Companies Act 2006 (Transfer of Audit Working Papers to Third Countries) Regulations 2010 The Companies Act 2006 (Part 35) (Consequential Amendments, Transitional Provisions and Savings) Order 2009 The Statutory Auditors and Third Country Auditors (Amendment) Regulations 2008 The Banking Act 2009 (Bank Administration) (Modification for Application to Banks in Temporary Public Ownership) Regulations 2009 The Insurance Accounts Directive (Miscellaneous Insurance Undertakings) Regulations 2008 The Statutory Auditors and ThirdThe Country Companies Auditors Act 2006 Regulations(Commencement 2007 No. 8, Transitional Provisions and Savings) Order 2008The Companies (Share Capital and Acquisition by Company of its Own Shares) Regulations 2009 The Insolvency (Company Arrangement or Administration -

Finance Act 2008

Finance Act 2008 CHAPTER 9 CONTENTS PART 1 CHARGES, RATES, ALLOWANCES, RELIEFS ETC Income tax 1 Charge and main rates for 2008-09 2 Personal allowance for those aged under 65 3 Personal allowances for those aged 65 and over 4 Basic rate limit 5 Abolition of starting and savings rates and creation of starting rate for savings Corporation tax 6 Charge and main rates for financial year 2009 7 Small companies’ rates and fractions for financial year 2008 etc Capital gains tax 8Rate etc 9 Entrepreneurs’ relief Inheritance tax 10 Transfer of unused nil-rate band etc Alcohol and tobacco 11 Rates of alcoholic liquor duty 12 Rates of tobacco products duty ii Finance Act 2008 (c. 9) Fuel duties 13 Rates and rebates: simplification 14 Biodiesel and bioblend 15 Rates and rebates: increase from 1 October 2008 16 Fuel for aircraft and boats, heating oil and fuel for certain engines Environmental taxes and duties 17 Rates of vehicle excise duty 18 Standard rate of landfill tax 19 Rates of climate change levy 20 Rate of aggregates levy 21 Carbon reduction trading scheme: charges for allocations Gambling duties 22 Rates of gaming duty 23 Amusement machine licence duty PART 2 INCOME TAX, CORPORATION TAX AND CAPITAL GAINS TAX - GENERAL Residence and domicile 24 Periods of residence 25 Remittance basis Research and development 26 Rates of R&D relief and vaccine research relief 27 Qualifying expenditure: R&D relief and vaccine research relief 28 Companies in difficulty: SME R&D relief and vaccine research relief 29 Cap on R&D aid 30 Vaccine research relief: