2002 NWT Mineral Exploration Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Environment and Natural Nt and Natural Resources

ENVIRONMENT AND NATURAL RESOURCES Implementation Plan for the Action Plan for Boreal Woodland Caribou in the Northwest Territories: 2010-2015 The Action Plan for Boreal Woodland Caribou Conservation in the Northwest Territories was released after consulting with Management Authorities, Aboriginal organizations, communities, and interested stakeholders. This Implementation Plan is the next step of the Action Plan and will be used by Environment and Natural Resources to implement the actions in cooperation with the Tᰯch Government, Wildlife Management Boards and other stakeholders. In the future, annual status reports will be provided detailing the progress of the actions undertaken and implemented by Environment and Natural Resources. Implementation of these 21 actions will contribute to the national recovery effort for boreal woodland caribou under the federal Species at Risk Act . Implementation of certain actions will be coordinated with Alberta as part of our mutual obligations outlined in the signed Memorandum of Understanding for Cooperation on Managing Shared Boreal Populations of Woodland Caribou. This MOU acknowledges boreal caribou are a species at risk that are shared across jurisdictional lines and require co-operative management. J. Michael Miltenberger Minister Environment and Natural Resources IMPLEMENTATION PLAN Environment and Natural Resources Boreal Woodland Caribou Conservation in the Northwest Territories 2010–2015 July 2010 1 Headquarters Inuvik Sahtu North Slave Dehcho South Slave Action Initiative Involvement Region Region Region Region Region 1 Prepare and implement Co-lead the Dehcho Not currently Currently not Not currently To be developed To be developed comprehensive boreal caribou Boreal Caribou Working needed. needed. needed. by the Dehcho by the Dehcho range management plans in Group. -

The Archaeology of Brabant Lake

THE ARCHAEOLOGY OF BRABANT LAKE A Thesis Submitted to the College of Graduate Studies and Research in Partial Fulfilment of the Requirements for the Degree of Master of Arts in the Department of Anthropology and Archaeology University of Saskatchewan Saskatoon By Sandra Pearl Pentney Fall 2002 © Copyright Sandra Pearl Pentney All rights reserved. PERMISSION TO USE PERMISSION TO USE In presenting this thesis in partial fulfilment of the requirements for a Postgraduate degree from the University of Saskatchewan, I agree that the Libraries of this University may make it freely available for inspection. I further agree that permission for copying of this thesis in any manner, in whole or in part, for scholarly purposes may be granted by the professor or professors who supervised my thesis work or, In their absence, by the Head of the Department or the Dean of the College in which my thesis work was done. It is understood that any copying or publication or use of this thesis or parts thereof for financial gain shall not be allowed without my written permission. It is also understood that due recognition shall be given to me and to the University of Saskatchewan in any scholarly use which may be made of any material in my thesis. Requests for permission to copy or to make other use of material in this thesis in whole or part should be addressed to: Head of the Department of Anthropology and Archaeology University of Saskatchewan Saskatoon, Saskatchewan (S7N 5B 1) ABSTRACT Boreal forest archaeology is costly and difficult because of rugged terrain, the remote nature of much of the boreal areas, and the large expanses of muskeg. -

Compendium of Research in the Northwest Territories 2014

Compendium of Research in the Northwest Territories 2014 www.nwtresearch.com This publication is a collaboration between the Aurora Research Institute, the Department of Environment and Natural Resources, Fisheries and Oceans Canada and the Prince of Wales Northern Heritage Centre. Thank you to all who submitted a summary of research or photographs, and helped make this publication possible. Editor: Ashley Mercer Copyright © 2015 ISSN: 1205-3910 Printed by Aurora Research Institute Foreword Welcome to the 2014 Compendium of Research in the Northwest Territories. This year marked a special anniversary for the Aurora Research Institute and northern research. Fifty years ago, the Inuvik Research Laboratory was built and has served as a hub for research in the western arctic ever since. The Lab, as it was known, was first built as an initiative of the Canadian federal government in the newly established community of Inuvik. It remains on the same site today, but in 2011, a new modern multi-purpose facility opened to continue to support research in the north. We have included a brief history of the Lab and its impact in this edition of the Compendium to mark its long lasting importance to many researchers and community members. As part of the 50th anniversary celebration, the Aurora Research Institute team undertook a full set of NWT-wide celebrations. We celebrated the history, capacity and growth of research in the NWT that touched all corners of the territory and beyond. We honoured the significant scientific contributions that have taken place in the NWT over the past 50 years, and the role of NWT researchers, technicians and citizens in these accomplishments. -

Print PDF and Play!

Match each image with the right Guess where? province or territory on the map. 7 1 8 10 Yukon 9 2 11 Nunavut Northwest Territories Newfoundland and Labrador 3 Alberta 12 British Columbia Manitoba Prince Edward Island Quebec Saskatchewan Nova Scotia Ontario 5 New Brunswick 4 13 6 Did you know that Library and Archives Canada has over 30 million photographs in its collection? Check out the website at bac-lac.gc.ca. You can use images from our collection in your own projects (subject to copyright). Answer key: 1. Quebec; 2. New Brunswick; 3. Ontario; 4. Manitoba; 5. Northwest Territories; 6. British Columbia; 7. Prince Edward Island; 8. Nova Scotia; 9. Alberta; 10. Saskatchewan; 11. Newfoundland and Labrador; 12. Nunavut; 13. Yukon; All of the images are from the Library and Archives Canada collection. Here are the titles and reference numbers of the original photographs: 1. Quebec. “Percé Rock from South Beach.” Percé Rock, Quebec, 1916. Reference no. a011350. 2. New Brunswick. “Rocks at Hopewell, N.B.” Hopewell, New Brunswick, no date. Reference no. a021073. 3. Ontario. “Canadian Falls, Niagara Falls.” Niagara Falls, Ontario, ca. 1870-1873. Reference no. a031559. 4. Manitoba. “Canadian National Railways station and yards, Winnipeg, Manitoba.” Winnipeg, Manitoba, no date. Reference no. a047871-v8. 5. Northwest Territories. “Dog teams carrying mail.” Mackenzie River, Northwest Territories, 1923. Reference no. a059980-v8. 6. British Columbia. “First through train between Montreal and coast, [B.C.].” British Columbia, 1886. Reference no. a066579. 7. Prince Edward Island. “On the shore near Cavendish, Prince Edward Island National Park, P.E.I.” Near Cavendish, Prince Edward Island, 1953. -

Mapping Known and Potential Karst Areas in the Northwest Territories, Canada

Mapping Known and Potential Karst Areas in the Northwest Territories, Canada Derek Ford, PGeo., PhD, FRSC. Emeritus Professor of Geography and Earth Sciences, McMaster University [email protected] For: Environment and Natural Resources, Government of the Northwest Territories August 2009 (i) Executive Summary The Goal of this Report is to Produce Maps of the Known and Potential Karst Landform Sites in the Northwest Territories (NWT) Karst landforms are those created by the dissolution of comparatively soluble rocks and the routing of the water (from rain or snowmelt) underground via caves rather than at the surface in river channels. The principal karst rocks are salt (so soluble that it is scarcely seen at the surface in the NWT), gypsum and anhydrite (solubility around 2500 mg/l of water), and limestone and dolomite (solubility around 250 -350 mg/l). All of these rock types are common and widespread amongst the sedimentary strata in the NWT. Surface karst landforms include: a) karren, which are spreads of individually small solution pits, shafts, and runnels that, collectively, may cover many hectares (limestone pavements); b) sinkholes of solutional, collapse, or other origin that can be tens to hundreds of metres in diameter and proportionally as deep. Sinkholes are considered the diagnostic karst landform worldwide; c) larger topographically closed depressions that may flood or drain seasonally, poljes if flat-floored, otherwise turloughs; d) extensive dry valleys and gorges, dry because their formative waters have been captured underground. All water sinking underground via karst landforms of all sizes drain quickly in comparison with all other types of groundwater because they are able to flow through solutionally enlarged conduits, termed caves where they are of enterable size. -

Technical Report on the Cantung Mine, Northwest Territories, Canada

NORTH AMERICAN TUNGSTEN CORPORATION LTD. TECHNICAL REPORT ON THE CANTUNG MINE, NORTHWEST TERRITORIES, CANADA PREPARED BY NORTH AMERICAN TUNGSTEN LTD. Report for NI 43-101 September 19, 2014 NORTH AMERICAN TUNGSTEN CORPORATION LTD. DOCUMENT TITLE ; TECHNICAL REPORT ON THE CANTUNG MINE, NORTHWEST TERRITORIES, CANADA Authors: Brian Delaney, P.Eng (Newfoundland and Labrador) Finley J. Bakker, P.Geo (BC and NWT) Date: September 19th, 2014 1-2 NORTH AMERICAN TUNGSTEN CORPORATION LTD. Table of Contents PAGE 1 SUMMARY ............................................................................................................... 1-1 2 INTRODUCTION ..................................................................................................... 2-1 3 RELIANCE ON OTHER EXPERTS ........................................................................ 3-1 4 PROPERTY DESCRIPTION AND LOCATION ..................................................... 4-1 4.1 Property Size ................................................................................................. 4-1 4.2 Location ........................................................................................................ 4-1 4.3 Mineral Tenure .............................................................................................. 4-2 4.4 Property Title ................................................................................................ 4-5 4.5 Royalties Payable .......................................................................................... 4-6 4.6 Environmental -

A Guide to Mineral Deposits NORTHWEST TERRITORIES 2007 a Guide to Mineral Deposits

A GUIDE TO MINERAL DEPOSITS NORTHWEST TERRITORIES 2007 A Guide to Mineral Deposits of the Northwest Territories Minerals, Oil and Gas Division Department of Industry, Tourism and Investment Government of the Northwest Territories November 2007 Edited by: Christy Campbell Published by: Minerals, Oil and Gas Division Department of Industry, Tourism and Investment Government of the Northwest Territories November 2007 Available from: Minerals, Oil and Gas Division Department of Industry, Tourism and Investment Government of the Northwest Territories 9th Floor, Scotia Centre 600, 5102-50th AVE YELLOWKNIFE NT X1A 3S8 www.iti.gov.nt.ca/mog/index.htm Cover Description: Photos courtesy of Diavik Diamond Mines Inc. and John Veevaert of Trinity Mineral Company. Note: This publication supersedes earlier editions of A Guide to Mineral Deposits of the Northwest Territories, published by Minerals, Oil and Gas Division, Department of Industry, Tourism and Investment, Government of the Northwest Territories. Table of Contents Introduction .................................................................................................................................................. 1 GOLD PROPERTIES .................................................................................................................................. 4 Miramar Con Mine ....................................................................................................................................... 6 Miramar Giant Mine .................................................................................................................................... -

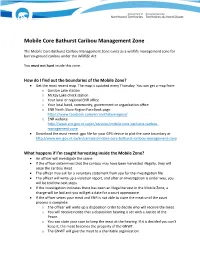

Mobile Core Bathurst Caribou Management Zone

Mobile Core Bathurst Caribou Management Zone The Mobile Core Bathurst Caribou Management Zone exists as a wildlife management zone for barren-ground caribou under the Wildlife Act. You must not hunt inside this zone. How do I find out the boundaries of the Mobile Zone? • Get the most recent map. The map is updated every Thursday. You can get a map from: o Gordon Lake station o McKay Lake check station o Your local or regional ENR office o Your local band, community, government or organization office o ENR North Slave Region FaceBook page https://www.facebook.com/enrnorthslaveregion/ o ENR website http://www.enr.gov.nt.ca/en/services/mobile-core-bathurst-caribou- management-zone • Download the most recent .gpx file for your GPS device to plot the zone boundary at http://www.enr.gov.nt.ca/en/services/mobile-core-bathurst-caribou-management-zone What happens if I’m caught harvesting inside the Mobile Zone? • An officer will investigate the scene. • If the officer determines that the caribou may have been harvested illegally, they will seize the caribou meat. • The officer may ask for a voluntary statement from you for the investigation file. • The officer will write up a violation report, and after an investigation is under way, you will be told the next steps. • If the investigation indicates there has been an illegal harvest in the Mobile Zone, a charge will be laid and you will get a date for a court appearance. • If the officer seizes your meat and ENR is not able to store the meat until the court process is complete: o The officer will write up a disposition order to decide who will receive the meat. -

NWT/NU Spills Working Agreement

NORTHWEST TERRITORIES–NUNAVUT SPILLS WORKING AGREEMENT Updated October 2014 This page intentionally left blank. TABLE OF CONTENTS Section Content Page Cover Front Cover 1 Cover Inside Front Cover 2 Introductory Table of Contents 3 Introductory Record of Amendments 3 1. Introduction/Purpose/Goals 4 2. Parties to the Agreement 5 3. Letter of Agreement 6 - Background 6 - Lead Agency Designation and Contact 6 - Lead Agency Responsibilities 6 - General 7 4. Signatures of Parties to the Agreement 8 5. Glossary of Terms 9 Table 1A Lead Agency Designation for Spills in the NT and NU 10 Table 1B Lead Agency Designation for NT Airport Spills 14 Table 1C Lead Agency Designation for NU Airport Spills 14 Table 1D Territorial Roads and Highways in the NT 15 Table 1E Territorial Roads in NU 15 Table 2 General Guidelines for Assessing Spill Significance and Spill File Closure 16 Table 3 Spill Line Contract and Operation 17 Appendix A Schedule 1 - Reportable Quantities for NT-NU Spills 18 Appendix B Spill Line Report Form 20 Appendix C Instructions for Completing the NT/NU Spill Report Form 21 Appendix D Environmental Emergencies Science Table (Science Table) 22 RECORD OF AMENDMENTS * No. Amendment Description Entered By / Date Approved By / Date 1 GNWT spills response structure changed on April 1. 2014 to reflect the changes of devolution. Departments of Industry Tourism and Investment and Lands were added to the NT/NU SWA 2 Environment Canada nationally restructured their spill response structure in 2012. 3 4 5 6 7 8 9 10 * Starting in 2015, the NT/NU SWA will be reviewed and updated annually during the Fall NT/NU Spills Working Group meeting. -

Arctic Environmental Strategy Summary of Recent Aquatic Ecosystem Studies Northern Water Resources Studies

Arctic Environmental Strategy Summary of Recent Aquatic Ecosystem Studies Northern Water Resources Studies Arctic Environmental Strategy Summary ofRecent Aquatic Ecosystem Studies August 1995 Northern Affairs Program Edited by J. Chouinard D. Milburn Published under the authority of the Honourable Ronald A. Irwin, P.C., M.P., Minister of Indian Affairs and Northern Development Ottawa, 1995 QS-8507-030-EF-Al Catalogue No. R72-244/1-1995E ISBN 0-662-23939-3 © Minister of Public Works and Government Services Canada FOREWORD The Arctic Environmental Strategy (AES), announced in April 1991, is a six-year $100 million Green Plan initiative. The overall goal ofthe AES is to preserve and enhance the integrity, health, biodiversity and productivity ofour Arctic ecosystems for the benefit ofpresent and future generations. Four specific programs address some ofthe key environmental challenges: they are waste cleanup, contaminants, water management, and environment and economy integration. The programs are managed by the Northern Affairs Program ofthe Department of Indian Affairs and Northern Development (DIAND); however, there is a strong emphasis on partnerships with northern stakeholders including Native organizations, other federal departments and the territorial governments. The AES Action on Water Program specifically strives to enhance the protection ofnorthern freshwaters through improved knowledge and decision-making. Water Resources managers in the Yukon and the Northwest Territories administer this Program which focuses on freshwater aquatic ecosystems. This report is the first detailed compilation ofstudies.conducted under the AES Action on Water Program. It covers work done from 1991 to 1994. Many studies have been concluded, while others are ongoing. Although data may not be available for all studies, or results are preliminary at this time, this report presents detailed background, objectives and methodology. -

SAFETY ACT CONSOLIDATION of GENERAL SAFETY REGULATIONS R.R.N.W.T. 1990,C.S-1 (Current To: April 1, 2010)

SAFETY ACT CONSOLIDATION OF GENERAL SAFETY REGULATIONS R.R.N.W.T. 1990,c.S-1 (Current to: April 1, 2010) AS AMENDED BY NORTHWEST TERRITORIES REGULATIONS: R.R.N.W.T. 1990,c.S-1(Supp.) In force September 15, 1992: SI-013-92 R-028-93 R-096-93 R-072-95 R-135-98 AS AMENDED BY NUNAVUT REGULATIONS: R-021-2000 In force December 1, 2000 This consolidation is not an official statement of the law. It is an office consolidation prepared for convenience only. The authoritative text of regulations can be ascertained from the Revised Regulations of the Northwest Territories, 1990 and the monthly publication of Part II of the Northwest Territories Gazette (for regulations made before April 1, 1999) and Part II of the Nunavut Gazette (for regulations made on or after April 1, 1999). A copy of a regulation of Nunavut can be obtained from the Territorial Printer at the address below. The Nunavut Gazette and this consolidation are also available online at http://www.justice.gov.nu.ca/english/legislation.html but are not official statements of the law. Any registered regulations not yet published in the Nunavut Gazette can be obtained through the Registrar of Regulations at the address below. Territorial Printer Legislation Division Department of Justice Government of Nunavut Tel.: (867) 975-6305 P.O. Box 1000, Station 550 Fax: (867) 975-6189 Iqaluit, NU X0A 0H0 Email: [email protected] R.R.N.W.T. 1990,c.S-1 GLOSSARY OF TERMS USED IN CONSOLIDATIONS Miscellaneous c. -

28Th Annual General Assembly 2021 Press Release

DEHCHO FIRST NATIONS BOX 89, FORT SIMPSON, N.W.T. X0E 0N0 TEL: (867) 695-2355/2610 FAX: (867) 695-2038 Communications: [email protected] PRESS RELEASE Annual General Assembly 2021 DFNAGA 06-25 For Immediate Release 28th Dehcho Annual General Assembly Acclaims New Grand Chief The 28th Dehcho First Nations Annual General Assembly was held in Fort Providence from June 23rd to June 25th, 2021. On Thursday, June 24th, 2021 West Point Chief Kenneth Cayen was elected as the new Grand Chief of Dehcho First Nations. Following the Dehcho election process, an ad calling for nominations was sent out forty days before the due date to submit nomination packages. 3 applicants submitted nomination packages, and the election committee reported that 2 of the nomination packages were not finalized by the due date of June 4th, 2021. As a result, Dehcho Leadership decided to open the discussion on whether to elect Chief Kenneth Cayen through acclamation to the delegates and members of the communities. After several hours of discussion, the Assembly came to a consensus to acclaim West Point First Nation Chief Kenneth Cayen to the position of Grand Chief. The Assembly also reviewed and accepted the new Grand Chief Terms of Reference. The changes include a change from a 3 - year term to a 4 - year term, as well as a transition period from the outgoing to the newly elected Grand Chief. Under the new transition period, the Grand Chief will be officially sworn in within one 1 month of being newly elected. Dehcho First Nations represents First Nation and Métis communities in the Dehcho Region of the Northwest Territories.