GSK Investor Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

!Hcl^S Office Filed Under Seal

IN THE UNITED STATES DISTRICT COURT P FOR THE DISTRICT OF MASSACHUSETTS !^D !HCL^S OFFICE Civil Action No. 03-10641-NG-RWZ Civil Action No. 11-10398-NG-RWZ UNITED STATES OF AMERICA, et at, ex rel GREGORY W. THORPE and BLAIR HAMRICK, Plaintiffs, v. SMITH KLINE BEECHAM, INC., and GLAXOSMITHKLINE PLC d/b/a GLAXOSMITHKLINE, Defendants. SEVENTH AMENDED COMPLAINT FILED UNDER SEAL PURSUANT TO 31 U.S.C. §§ 3729 etseq. Matthew J. Fogelman, Esquire FOGELMAN & FOGELMAN LLC 100 Wells Avenue William J. Leonard, pro hac vice Newton, MA 02459 Richard P. Limburg, pro hac vice Kimberly D. Sutton, pro hac vice Brian P. Kenney Alex P. Basilevsky,/>/"6> hac vice M. Tavy Deming OBERMAYER REBMANN MAXWELL & Emily C. Lambert HIPPEL LLP KENNEY & McCAFFERTY, PC One Perm Center, 19th floor 3031 Walton Road, Suite C202 1617 John F. Kennedy Boulevard Plymouth Meeting, PA 19462 Philadelphia, PA 19103 A Homeys for Plaintiffs-Relators Gregory W. Thorpe and Blair Hamrick 4612364 TABLE OF CONTENTS I. BACKGROUND.....................................................................................................2 II. PARTIES ................................................................................................................4 III. JURISDICTION AND VENUE............................................................................6 IV. GENERAL ALLEGATIONS...............................................................................7 A. Drugs Marketed By GSK For Off-Label Use...............................................12 1. Advair ...................................................................................................13 -

Sleepless No More SUB.1000.0001.1077

SUB.1000.0001.1077 2019 Submission - Royal Commission into Victoria's Mental Health System Organisation Name: Sleepless No More SUB.1000.0001.1077 1. What are your suggestions to improve the Victorian community’s understanding of mental illness and reduce stigma and discrimination? Australia is unfortunately a country with pervasive Incorrect Information, Lack of Information, Unsubstantiated Information and Out of Date Information about mental health, emotional health and the underlying reasons for emotional challenges. The reason people do not understand emotional challenges, being promoted as “mental illness”, is that they are not being given full and correct, up to date and relevant information. The Australian public is being given information which is coming from the ‘mental health industry’ not information that reduces mental health problems. The information is industry driven. “Follow the money” is a phrase very relevant in this field. People need to be given correct information that empowers them and ensures that they continue to be emotionally resilient. The information being promoted, marketed as ‘de-stigmatising mental health’ has resulted in people incorrectly self-diagnosing and presenting to their medical professionals asking for help with their anxiety (mental health problem), depression (mental health problem), bipolar (mental health problem), etc. Examples of information and mental health developments I do not see mentioned or promoted in Australia as part of making Australians emotionally resilient, and therefore not diagnosed and medicated as mentally ill: The flaws in the clinical trial process, and how to check the strategies being promoted by health care professionals, the government, doctors and psychiatrists. Making Medicines Safer for All of Us. -

What Influences Healthcare Providers' Prescribing Decisions?

Research in Social and Administrative Pharmacy xxx (xxxx) xxx Contents lists available at ScienceDirect Research in Social and Administrative Pharmacy journal homepage: www.elsevier.com/locate/rsap What influenceshealthcare providers’ prescribing decisions? Results from a national survey Simani M. Price a,*, Amie C. O’Donoghue b, Lou Rizzo a, Saloni Sapru a, Kathryn J. Aikin b a Westat, Inc., Rockville, MD, USA b U.S. Food and Drug Administration, Silver Spring, MD, USA ARTICLE INFO ABSTRACT Keywords: Background: Prior U.S. Food and Drug Administration (FDA) surveys with healthcare providers (HCPs) have Healthcare providers focused on attitudes toward direct-to-consumer advertising and have not specifically examined professionally- Prescription drug promotion targeted prescription drug promotion. Similarly, there are no recent national surveys of HCPs examining their Detailing interactions with the pharmaceutical industry. Pharmaceutical opinion leaders Objectives: The goal of this study was to use a national sample of HCPs to examine exposure to professionally- Off-label prescribing Prescribers targeted prescription drug promotions and interactions with industry, and knowledge, attitudes and practices related to FDA approval of prescription drugs. Methods: An online national survey was conducted with 2000 HCPs representing primary care physicians (PCPs), specialists (SPs), physician assistants (PAs), and nurse practitioners (NPs). The sample was randomly drawn from WebMD’s Medscape subscriber network, stratified by HCP group, and designed to yield target numbers of completed surveys in each group. Weights were computed to correct for unequal selection probabilities, dif ferential response rates, and differential coverage and used to generalize completed surveys to a national pop ulation of PCPs, SPs, NPs, and PAs. -

Index 499 Abacavir Case Study, 359 Drug Labeling And, 448 Infectious Diseases And, 317 Pharmacist And, 465 Pharmacodynamics Of

Index 499 A Allele, 3, 8 detection of, 59, 70-71, 74, 92, 94 Abacavir discrimination, 59, 68, 70-72, 74-75, 88, 90-92, case study, 359 94 drug labeling and, 448 frequency calculations for, 34 infectious diseases and, 317 genetics and, 19, 20, 22, 28-30, 32, 34-47, 49, 52-53 pharmacist and, 465 methodologies, 59, 60, 70-75, 85-94, 96-97 pharmacodynamics of, 198 respiratory diseases and, 327, 336-338, 343, toxicogenomics of, 367 346 ABC transporters, 153-154 -specific amplifications, 92-93 ABCB1, 154-158, 160-161, 258, 263, 314 Allele-specific oligonucleotide (ASO) hybridiza- ABCC transporter family, 161-168 tion, 59, 74, 90-91 Allelic drift, 38 ABCC1, 161-162 All-trans retinoic acid (ATRA), 271 ABCC2, 162-163 Alpha-glucosidase inhibitors, 406, 421-422 ABCC3, 163 gene polymorphisms and, 425 ABCC4, 163 Alzheimer’s disease, 201, 296 ABCC5, 163 American Academy for Study of Liver Diseases, ABCC6, 166 322 American College of Cardiology, 228 ABCC8, 407-409, 410-411, 414, 446 American College of Medical Genetics working ABCC11, 166-167 group, 475 ABCG2, 167-168 American Heart Association Foundation, 228 Acamprosate, 394 American Hospital Formulary Service Drug Infor- Acarbose, 421-422 mation, 461 Americans with Disabilities Act, 479 Access issues, 474 Amino acid, 25 Accreditation Counsel for Pharmacy Education, 461 Amiodarone, 243-244 Accuracy, 72 Amitriptyline, 285 ACE inhibitors, 194-195, 200, 230, 232-233, 296 Analytical specificity, 71-72 Acenocoumarol, 222 Ancillary information, 467-468, 470, 473, 475-477, Acetaminophen, 112 480-481 Anderson, -

Comments to Draft

March 8, 2021 Institute for Clinical and Economic Review Two Liberty Square, Ninth Floor Boston, MA 02109 Re: Comments to Draft Evidence Report on Anti B-Cell Maturation Antigen CAR T-cell and Antibody Conjugate Therapy for Heavily Pre-Treated Relapsed and Refractory Multiple Myeloma Introduction The Alliance for Regenerative Medicine (ARM) appreciates the opportunity to submit the following comments to the Institute for Clinical and Economic Review (ICER) February 11, 2021 draft report on Anti B-Cell Maturation Antigen CAR T-cell and Antibody Conjugate Therapy for Heavily Pre-Treated Relapsed and Refractory Multiple Myeloma (“Draft Evidence Report”).1 ARM is the leading international advocacy organization dedicated to realizing the promise of regenerative medicines and advanced therapies. ARM promotes legislative, regulatory and reimbursement initiatives to advance this innovative and transformative sector, which includes cell therapies, gene therapies and tissue-based therapies. In its 11-year history, ARM has become the global voice of the sector, representing the interests of 380+ members worldwide, including small and large companies, academic research institutions, major medical centers and patient groups. Although focused on one type of rare cancer, the Draft Evidence Report raises important issues for ARM members because of its potential negative impact on the development of the therapies under review and future therapies. ARM is concerned that the timing of the review prevents ICER from taking into account the FDA’s perspective on the appropriate patient population (i.e., through the label), that of expert providers’ perspectives (i.e., through recognized compendia), and the technology’s durability. Consequently, ARM is concerned that the Draft Evidence Report may harm market and patient access. -

Study 329: Trials Why Is It So Important?

© July - August 2016 RIAT ; Restoring Invisible and Abandoned Study 329: Trials Why is it so important? tudy 329 is a GlaxoSmithKline (GSK) sponsored trial with S22 academic authors that compared paroxetine, imipra- mine, and placebo for adolescent depression. In this trial 275 safetysaafee adolescents with major depression were randomized in a dou- y ble-blind fashion to paroxetine (93), imipramine (95) or pla- cebo (87) for 8 weeks. Those who completed 8 weeks were efficacy studied in a 6-month continuation phase. Published 8-week results (2001)1: Compared with placebo, paroxetine demonstrated significantly greater improvement in The publications report in detail the methods used 3 selected depression rating scales and a Clinical Global Im- to re-analyze Study 329. Notably, they followed the provement score of 1 or 2. The response to imipramine was protocol (and amendments) established by GSK7 not significantly different from placebo for any measure. and used all appropriate procedural steps to avoid Authors’ conclusions: “Paroxetine is generally well tol- bias. They have also made the original anonymous erated and effective for major depression in adolescents.”1 patient data available for others to analyze. This trial has been cited over 600 times and was very influ- RIAT analysis of Study 329 ential in increasing prescribing of paroxetine in this clinical (acute phase) setting.2 The trial protocol7 specified two primary effica- Did these published conclusions reflect cy variables: change in total score on a Hamilton “reality”? depression rating scale (HAM-D) from baseline Critical appraisal of the 2001 publication would have led to endpoint, and the proportion of responders at to questions about the authors’ conclusions. -

List of Medicinal Products Under Additional Monitoring

26 October 2018 EMA/245297/2013 Rev.60 Inspections & Human Medicines Pharmacovigilance List of medicinal products under additional monitoring Related Information: Additional monitoring explained: http://www.ema.europa.eu/ema/index.jsp?curl=pages/special_topics/document_listing/document_listing_000365.jsp Good Pharmacovigilance Practice Module on additional monitoring: http://www.ema.europa.eu/ema/index.jsp?curl=pages/regulation/document_listing/document_listing_000345.jsp To note: All products added to the list in September 2018 are shown in red font. All products removed from the list are shown with a strikethrough for the period of one month after which they are excluded. Date of Product name Active Substance (s) Reason (s) on list Marketing Authorisation Holder (s) Link to Product Information Inclusion http://www.ema.europa.eu/ema/index.jsp?curl=pages/medicines/human/medicines/ Abasaglar (previously Abasria) Insulin glargine New biological Eli Lilly Nederland B.V. 002835/human_med_001790.jsp&mid=WC0b01ac058001d124 October 2014 Acarizax (also known in some EU countries as MITIZAX) Standardised allergen extract from house dust mites New Biological ALK-Abelló A/S https://portal.dimdi.de/amispb/doc/pei/Web/2613318-spcde-20170401.pdf May 2016 http://www.ema.europa.eu/ema/index.jsp?curl=pages/medicines/human/medicines/ Accofil Filgrastim New biological Accord Healthcare Limited 003956/human_med_001798.jsp&mid=WC0b01ac058001d124 October 2014 http://www.ema.europa.eu/ema/index.jsp?curl=pages/medicines/human/medicines/ Adcetris Brentuximab vedotin -

Eortc-1307-Bcg) (Big5-13) (Tesaro Pr-30-5010-C)

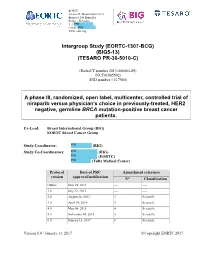

EORTC Avenue E. Mounierlaan 83/11 Brussel 1200 Bruxelles België – Belgique Tel: PPD e-mail: PPD www.eortc.org Intergroup Study (EORTC-1307-BCG) (BIG5-13) (TESARO PR-30-5010-C) (EudraCT number 2013-000684-85) (NCT01905592) (IND number # 117580) A phase III, randomized, open label, multicenter, controlled trial of niraparib versus physician’s choice in previously-treated, HER2 negative, germline BRCA mutation-positive breast cancer patients. Co-Lead: Breast International Group (BIG) EORTC Breast Cancer Group Study Coordinator: PPD (BIG) Study Co-Coordinators: PPD (BIG) PPD (EORTC) PPD (Tufts Medical Center) Protocol Date of PRC Amendment reference version approval/notification N° Classification Outline June 28, 2013 ---- ---- 1.0 July 22, 2013 ---- ---- 2.0 August 28, 2013 1 Scientific 3.0 April 24, 2014 3 Scientific 4.0 May 04, 2015 4 Scientific 5.0 November 04, 2015 5 Scientific 6.0 January 13, 2017 8 Scientific Version 6.0 / January 13, 2017 Copyright EORTC 2017 EORTC-1307-BCG / BIG5-13 / TESARO PR-30-5010-C Niraparib in BRCA germline mutated MBC Contact addresses Executive Committee: Defined in the related study charter Writing Committee: PPD (EORTC, Statistician) PPD (EORTC, Study Co-coordinator) PPD (Tufts Medical Center) PPD (BIG, Scientific Director) PPD (BIG, Ass. Scientific Director) PPD (EORTC, Statistician) PPD (EORTC, Clinical Research Physician) PPD (BIG, Study Coordinator) Steering Committee: Defined in the related study charter Version 6.0 2 / 102 January 13, 2017 EORTC-1307-BCG / BIG5-13 / TESARO PR-30-5010-C Niraparib -

In Re: Glaxosmithkline Plc Securities Litigation 05-CV-3751

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK __________________________________________ ) In re: GlaxoSmithKline plc Securities ) Civil Action No. 05 CIV. 3751 (LAP) Litigation ) ) DEMAND FOR JURY TRIAL __________________________________________) CONSOLIDATED SECOND AMENDED COMPLAINT JURISDICTION AND VENUE 1. The claims asserted herein arise under §§ 10(b) and 20(a) of the Securities Exchange Act of 1934 (“1934 Act”) and Rule 10b-5. Jurisdiction is conferred by § 27 of the 1934 Act, and 28 U.S.C. §1331. Venue is proper here pursuant to § 27 of the 1934 Act. GlaxoSmithKline plc and SmithKline Beecham Corporation doing business as GlaxoSmithKline plc (collectively “GSK”) is headquartered in London, England, but conducts business in this District. GSK’s ADRs trade on the New York Stock Exchange headquartered in this District. THE PARTIES 2. Lead Plaintiff Joseph J. Masters (“Plaintiff”) acquired publicly traded securities of GSK during the Class Period and was damaged thereby. 3. Defendant GlaxoSmithKline plc is a public company. GlaxoSmithKline plc’s ADRs trade in an efficient market on the NYSE under the symbol “GSK.” GlaxoSmithKline plc’s ordinary shares trade in an efficient market on the London Stock Exchange. Defendant SmithKline Beecham Corporation is a Delaware corporation, which is a wholly-owned subsidiary of GlaxoSmithKline plc. GlaxoSmithKline plc was created in December 2000 when Glaxo Wellcome merged with SmithKline Beecham. Both GlaxoSmithKline plc and SmithKline Beecham, as well as all of their predecessors, subsidiaries and successors, are referred to herein collectively as “GSK.” 4. Defendant Jean-Pierre Garnier (“Garnier”) was CEO and Chairman of GSK throughout the Class Period. By reason of his position, Garnier had access to material inside information about GSK and was able to control directly or indirectly the acts of GSK and the contents of the representations disseminated during the Class Period by or in the name of GSK. -

January 2020: Additions and Deletions to the Drug Product List

Prescription and Over-the-Counter Drug Product List 40TH EDITION Cumulative Supplement Number 01 : January 2020 ADDITIONS/DELETIONS FOR PRESCRIPTION DRUG PRODUCT LIST ACETAMINOPHEN; HYDROCODONE BITARTRATE TABLET;ORAL HYDROCODONE BITARTRATE AND ACETAMINOPHEN >A> AA XIROMED 325MG;5MG A 211690 001 Feb 07, 2020 Jan NEWA >A> AA 325MG;7.5MG A 211690 002 Feb 07, 2020 Jan NEWA >A> AA 325MG;10MG A 211690 003 Feb 07, 2020 Jan NEWA ACYCLOVIR CREAM;TOPICAL ACYCLOVIR >D> AB PERRIGO UK FINCO 5% A 208702 001 Feb 04, 2019 Jan CHRS >A> AB ! 5% A 208702 001 Feb 04, 2019 Jan CHRS ZOVIRAX >D> AB +! BAUSCH 5% N 021478 001 Dec 30, 2002 Jan CHRS >A> AB + 5% N 021478 001 Dec 30, 2002 Jan CHRS OINTMENT;TOPICAL ACYCLOVIR >A> AB XIROMED 5% A 201501 001 Jan 29, 2020 Jan NEWA TABLET;ORAL ACYCLOVIR >D> AB HETERO LABS LTD V 800MG A 203834 002 Oct 29, 2013 Jan CHRS >A> AB ! 800MG A 203834 002 Oct 29, 2013 Jan CHRS >D> ZOVIRAX >D> AB + MYLAN 400MG N 020089 001 Apr 30, 1991 Jan DISC >A> + @ 400MG N 020089 001 Apr 30, 1991 Jan DISC >D> AB +! 800MG N 020089 002 Apr 30, 1991 Jan DISC >A> + @ 800MG N 020089 002 Apr 30, 1991 Jan DISC AMINO ACIDS; CALCIUM CHLORIDE; DEXTROSE; MAGNESIUM SULFATE; POTASSIUM CHLORIDE; SODIUM ACETATE; SODIUM GLYCEROPHOSPHATE; SOYBEAN OIL EMULSION;INTRAVENOUS PERIKABIVEN IN PLASTIC CONTAINER >D> + FRESENIUS KABI USA 2.4%;20MG/100ML;6.8GM/100ML;68M N 200656 003 Aug 25, 2014 Jan CHRS G/100ML;124MG/100ML;170MG/100ML ;105MG/100ML;3.5GM/100ML (2400ML) >A> +! 2.4%;20MG/100ML;6.8GM/100ML;68M N 200656 003 Aug 25, 2014 Jan CHRS G/100ML;124MG/100ML;170MG/100ML -

Annotated Bibliography of Published Studies Addressing Searching for Unpublished Studies and Obtaining Access to Unpublished Data

Providing consultancy and research in health economics for the NHS, pharmaceutical and health care industries since 1986 Annotated bibliography of published studies addressing searching for unpublished studies and obtaining access to unpublished data MICK ARBER, Information Specialist MARIA CIKALO, Associate JULIE GLANVILLE, Associate Director CAROL LEFEBVRE, Associate DANIELLE VARLEY, Research Assistant HANNAH WOOD, Information Specialist JUNE 2013 Contents Page No. Acknowledgements Section 1: Introduction 1 1.1 Introduction 1 1.2 Objectives 1 Section 2: Methods 2 2.1 Criteria for considering studies for this Annotated Bibliography 2 2.2 Search methods for identification of studies 3 Section 3: Results 5 3.1 Search results 5 3.2 Structured abstracts 6 Appendices: Appendix A: Search Strategies Appendix B: Papers which we have not been able to obtain and / or assess for relevance All reasonable precautions have been taken by YHEC to verify the information contained in this publication. However, the published material is being distributed without warranty of any kind, either expressed or implied. The responsibility for the interpretation and use of the material lies with the reader. In no event shall YHEC be liable for damages arising from its use. Acknowledgements We are grateful to the following individuals and their colleagues, who supplied copies of their publications or information about their publications: Iain Chalmers Kay Dickersin Jini Hetherington Sally Hopewell Chris Hyde Tom Jefferson John Kirwan Steve McDonald David Moher Lorenzo Moja Helen Worthington How to cite this document: Arber M, Cikalo M, Glanville J, Lefebvre C, Varley D, Wood H. Annotated bibliography of published studies addressing searching for unpublished studies and obtaining access to unpublished data. -

Final Belgian List

Final Belgian list: (Last update 07/02/2019) Marketing name Active substance MAH Reason on list ABASAGLAR (ABASRIA previously)INSULINE GLARGINE ELI LILLY REGIONAL OPERATIONS GMBH New Biological ACARIZAX STANDARDIZED ALLERGEN EXTRACT FROM HOUSE DUSTALK-ABELLO MITES A/S New Biological ACCOFIL FILGASTRIM ACCORD HEALTHCARE LIMITED New Biological ADCETRIS BRENTUXIMAB VEDOTINE TAKEDA GLOBAL R&D CENTRE (EUROPE) LTD New AS, Cond Auth, PASS ADEMPAS RIOCIGUAT BAYER PHARMA New AS ADYNOVI RURIOCTOCOG ALFA PEGOL BAXALTA INNOVATIONS GMBH New AS, PASS AIMOVIG ERENUMAB NOVARTIS EUROPHARM LIMITED New AS, New Biological AFSTYLA LONOCTOCOG ALFA CSL BEHRING GmbH New AS STANDARDIZED ALLERGEN EXTRACT FROM HOUSE AITARO ALK-ABELLO A/S New Biological DUST MITES AKYNZEO NETUPITANT, PALONOSETRON HELSINN BIREX PHARMACEUTICALS LTD New AS ALECENSA ALECTINIB ROCHE REGISTRATION LIMITED New AS, Cond Auth ALOFISEL DAVASTROCEL TiGenix SAU New AS ALPHA-RIX TETRA INFLUENZA VACCINE INACTIVATED GLAXOSMITHKLINE BIOLOGICALS S.A. New Biological ALPIVAB PERAMIVIR BIOCRYST UK LTD New AS ALPROLIX EFTRENOCOG ALFA BIOGEN IDEC LTD New AS ALUNBRIG BRIGATINIB TAKEDA PHARMA A/S New AS AMGEVITA ADALIMUMAB AMGEN EUROPE BV New biological STANDARDIZED ALLERGEN EXTRACT FROM HOUSE AMITEND ALK-ABELLO A/S New Biological DUST MITES AMITIZA LUBIPROSTON Sucampo Pharma Europe Ltd New AS ANORO GLAXO GROUP LTD New AS, PASS UMECLIDINIUM BROMIDE, VILANTEROL TRIFENATATE APLEEK ETHINYL ESTRADIOL/GESTODENE BAYER PHARMA AG PASS ATRIANCE NELARABINE 5.00 MG/ML GLAXO GROUP LTD Auth under excep circumstances