LIC Housing Finance Limited: Rating Reaffirmed Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

August 10, 2021 the Secretary National Stock Exchange of India

August 10, 2021 The Secretary The Secretary National Stock Exchange of India Ltd BSE Limited Exchange Plaza, C/1, Block G, P J Towers, Dalal Street, Bandra Kurla Complex, Bandra (East) Fort, Mumbai – 400 001 Mumbai – 400 051 BSE Scrip Code: 540595 NSE Symbol: TEJASNET Dear Sir/Madam, Re: ICRA Rating - Tejas Networks Limited - Ratings placed on watch with positive implications Please find enclosed the ICRA Credit Rating action dated August 9, 2021 following the announcement of Material event stating that the Ratings have been placed on watch with positive implications. The same is also made available on the Company’s website at www.tejasnetworks.com Kindly take the above on record. Yours sincerely For Tejas Networks Limited N R Ravikrishnan General Counsel, Chief Compliance Officer & Company Secretary Encl; as above August 9, 2021 Tejas Networks Limited- Ratings placed on watch with positive implications Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Long Term / Short Term - Fund [ICRA]A-%/[ICRA]A2+%; Placed on 90.00 90.00 Based watch with positive implications Long Term / Short Term - Non [ICRA]A-%/[ICRA]A2+%, Placed on 193.50 193.50 Fund Based watch with positive implications Long Term / Short Term - [ICRA]A-%/[ICRA]A2+%, Placed on 276.36 276.36 Unallocated watch with positive implications Total 559.86 559.86 *Instrument details are provided in Annexure-1; % - Rating placed on watch with positive implications Rationale Material Event On July 29, 2021, Tejas Networks Limited (TNL) announced that it has executed definitive agreements with Panatone Finvest Limited (PFL), a subsidiary of Tata Sons Private Limited (TSPL) which will entail preferential allotment of 1.94 crore equity share aggregating to Rs. -

Sharekhan Top Picks

Visit us at www.sharekhan.com June 02, 2014 Sharekhan Top Picks The Indian equity market shed all inhibitions and celebrated the an attractive opportunity for investors to accumulate these stocks thumping majority mandate for the Narendra Modi led National with a little longer time horizon. Democratic Alliance government in the last month. The benchmark To make space, we exit ITC (keeping in mind a possible hike in indices, Sensex and Nifty, appreciated by 10.2% and 10% the excise duty on cigarettes in the forthcoming budget) and respectively. Our Top Pick basket appreciated by 10.4%, which is take home some profits in Apollo Tyres (making space for the largely in line with the movement in the benchmark indices. The other stocks in the auto sector) and HCL Technologies. One action was more pronounced in the mid-cap space with the CNX addition more than the deletions this time is to make up for one Midcap Index appreciating by close to 17% in the same period. extra deletion made in the last month. In line with the key identified investment themes (policy push- To re-iterate our bullish stance, we believe that the equity market driven re-rating of construction, power and public sector is on the cusp of a multi-year rally with the potential to give undertakings, and early beneficiaries of an economic revival, like exponential returns to investors. Do not get bogged down by the auto and financial services), we are adding LIC Housing Finance, recent 20-25% run-up and take a longer-term view on the stock TVS Motor Company, Gabriel India and Gateway Distriparks to market (and play the multi-year rally for handsome gains). -

Sharekhan BNP Paribas Financial Services Limited: Rating Reaffirmed

July 31, 2020 Sharekhan BNP Paribas Financial Services Limited: Rating reaffirmed Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Commercial paper programme 1,000.00 1,000.00 [ICRA]A1+; reaffirmed Commercial paper programme 2,300.00 2,300.00 [ICRA]A1+; reaffirmed (IPO financing) Total 3,300.00 3,300.00 *Instrument details are provided in Annexure-1 Rationale To arrive at the rating, ICRA has taken a consolidated view of Sharekhan Limited (SKL) and its subsidiaries (including Sharekhan BNP Paribas Financial Services Limited; SBPFSL). The reaffirmation of the rating for SBPFSL’s commercial paper (CP) programme factors in its strong parentage by virtue of being a part of the BNP Paribas Group. The company is a wholly-owned subsidiary of SKL (rated [ICRA]A1+), which is a subsidiary of BNP Paribas S.A. (BNPP; rated Aa3/Stable/P-1 by Moody’s). The rating also takes into account SKL’s considerable track record in the equity broking business and its well-established position in the retail broking space with a widespread clientele. The rating also factors in SKL’s healthy capital structure (gearing of 0.06 times as on March 31, 2020) and comfortable liquidity profile, on a consolidated basis, with sizeable cash and liquid investments and unutilised bank lines as on March 31, 2020. The rating continues to factor in SKL’s high dependence on broking income, which remains susceptible to the extent of competition in the industry and the inherent volatility associated with capital markets. While reaffirming the rating, ICRA has taken note of SKL’s decision to foray into the discount broking business under a new subsidiary with a new brand name. -

PARALYZED ECONOMY? Restructure Your Investments Amid Gloomy Economy with Reduced Interest Rates

Outlook Money - Conclave pg 54 Interview: Prashant Kumar, Yes Bank pg 44 APRIL 2020, ` 50 OUTLOOKMONEY.COM C VID-19 PARALYZED ECONOMY? Restructure your investments amid gloomy economy with reduced interest rates 8 904150 800027 0 4 Contents April 2020 ■ Volume 19 ■ issue 4 pg 10 pg 10 pgpg 54 43 Cultivating OutlookOLM Conclave Money ConclaveReports and insights from the third Stalwartsedition of share the Outlook insights Moneyon India’s valour goalConclave to achieve a $5-trillion economy Investors can look out for stock Pick a definite recovery point 36 Management34 stock strategies Pick of Jubilant in the market scenario, FoodWorksHighlighting and the Crompton management Greaves strategies of considering India’s already ConsumerJUBL and ElectricalsCGCE slow economic growth 4038 Morningstar Morningstar InIn focus: focus: HDFC HDFC short short term term debt, debt, HDFC HDFC smallsmall cap cap fund fund and and Axis Axis long long term term equity equity Gold Markets 4658 Yes Yes Bank Bank c irisisnterview Real EstateInsuracne AT1Unfair bonds treatment write-off meted leaves out investors to the AT1 in a Mutual FundsCommodities shock,bondholders exposes in gaps the inresolution our rating scheme system 5266 My My Plan Plan COVID-19: DedicatedHow dedicated SIPs can SIPs help can bring bring financial financial Volatile Markets disciplinediscipline in in your your life lives Investors need to diversify and 6 Talk Back Regulars : 6 Talk Back restructure portfolios to stay invested Regulars : and sail through these choppy waters AjayColumnsAjayColumns Bagga, Bagga, SS Naren,Naren, :: Farzana Farzana SuriSuri CoverCover Design: Vinay VINAY D DOMINICOMinic HeadHead Office Office AB-10, AB-10, S.J. -

Revision in Credit Rating

August 9, 2021 National Stock Exchange of India Limited BSE Limited Exchange Plaza, Corporate Relations Department, Plot No. C/1, G Block, 1st Floor, New Trading Ring, Bandra - Kurla Complex, Bandra (East), P. J. Towers, Dalal Street, Mumbai - 400 051. Mumbai - 400 001. Symbol: L&TFH Security Code No.: 533519 Kind Attn: Head - Listing Department / Department of Corporate Communications Dear Sir / Madam, Sub: Intimation under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Pursuant to Regulation 30 read with Schedule Ill of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“SEBI Regulations”), we hereby inform you that ICRA Limited (ICRA), the credit rating agency, has reaffirmed the credit rating of following instrument(s) of the Company and the outlook on the long-term rating has been revised to ‘Stable’ from ‘Negative’. The summary of rating action is given below: Instrument type Current Rated Rating action Amount (Rs. in Crore) Non-convertible 1,000 [ICRA]AAA (Stable); reaffirmed; outlook debentures revised to ‘Stable’ from ‘Negative’ Commercial papers 2,500 [ICRA]A1+; reaffirmed Please refer the report issued by ICRA attached as enclosure A for complete details on the rating rationale. We request you to take the aforesaid on records. Thanking you, Yours faithfully, For L&T Finance Holdings Limited Apurva Rathod Company Secretary and Compliance Officer Encl: As above Enclosure A August 09, 2021 L&T Finance Holdings Limited: Ratings reaffirmed; Outlook on long-term ratings revised to Stable from Negative Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. -

LIC Housing Finance (LICHF)

LIC Housing Finance (LICHF) CMP: | 408 Target: | 400 (-2%) Target Period: 12 months HOLD months August 6, 2021 Uncertainty on stress accretion, low NPA buffer… About the stock: LIC Housing Finance (LICHF) is among the largest HFCs in India with an extensive distribution network of 282 marketing office and 2421 employees. Particulars Ess Total 91% of LICHF’s customers are salaried and 9% are self employed Particulars Amount Retail home loans form 78.3% of the overall book Market Capitalisation | 20605 crore Networth (FY21) | 20521 crore 52 week H/L 542 / 255 Face value | 2 Q1FY22 Results: Subdued overall performance; asset quality concern looming. Update Company Shareholding pattern NII up 4.5% YoY, down 15.3% QoQ, NIMs down 46 bps QoQ to 2.2% (in %) Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Promoter 40.3 40.3 40.3 40.3 40.3 Higher provisions at | 830 crore, C/I ratio rise impacted PAT at | 153 crore FII 34.3 34.4 29.3 28.2 28.8 Stage 3 assets rose 181 bps from 4.12% to 5.93% & 2.3% was restructured DII 10.6 10.4 15.4 16.8 15.6 Others 14.8 21.9 21.9 14.7 15.3 Price Chart What should investors do? LICHF has given ~57% return over the past year. 600 20000 500 However, we believe a healthy recovery on stressed asset is necessary for better 15000 valuations. 400 300 10000 200 We retain our HOLD rating on the stock 5000 100 Target Price and Valuation: We value LIC Housing at ~0.9 FY23E BV and revise 0 0 our target price for the stock at | 400 per share from | 475 earlier. -

32 Nd AGM Notice

NOTICE NOTICE IS HEREBY GIVEN THAT THE THIRTY SECOND M/s Gokhale & Sathe (Firm Registration Number 103264W) ANNUAL GENERAL MEETING OF THE MEMBERS OF LIC who have offered themselves for appointment and have HOUSING FINANCE LIMITED WILL BE HELD THROUGH VIDEO confirmed their eligibility to be appointed as Statutory CONFERENCE (‘VC’) / OTHER AUDIO VISUAL MEANS (‘OAVM’) Central Auditors in terms of Section 141 of the Companies ON MONDAY, 27TH SEPTEMBER, 2021 AT 3.00 P.M. (IST) TO Act, 2013 and applicable rules and the RBI guidelines dated TRANSACT THE ITEMS OF BUSINESS MENTIONED BELOW: April 27, 2021, be and are hereby appointed as the joint Statutory Central Auditors of the Company for a period of ORDINARY BUSINESS: 3 (three) years to hold office from the conclusion of the 1. To receive, consider and adopt: 32nd Annual General Meeting until the conclusion of the 33rd Annual General Meeting to be held in 2022 at such (a) the audited (standalone) financial statements of increased remuneration payable to the Joint Statutory the Company for the F.Y. ended 31st March, 2021 Auditors namely, M/s. M P Chitale & Co., Chartered and the Reports of the Board of Directors and Accountants (Firm Registration Number 101851W) and M/s Auditors thereon. Gokhale & Sathe (Firm Registration Number 103264W) of ` 65,72,700/- per annum plus applicable taxes / cess and (b) the audited (consolidated) financial statements of out of pocket expenses on actual basis (being ` 32,86,350/- the Company for the F.Y. ended 31st March, 2021 and per annum per firm plus applicable taxes/ cess and out of the Report of the Auditors thereon. -

Stock Holding Corporation of India Limited - Update on the Details of Lender Facilities

August 09, 2021 Stock Holding Corporation of India Limited - Update on the details of lender facilities Instrument Type Lender Name* Rated Amount (Rs. crore) Intra Day Facility IDBI Bank 2,000.00 Overdraft Facility IDBI Bank 100.00 Bank Guarantee IDBI Bank 125.00 Overdraft Facility HDFC Bank 100.00 Overdraft against Fixed Deposit HDFC Bank 50.00 Bank Guarantee HDFC Bank 50.00 Total 2,425.00 * as on August 5, 2021 The details presented in this document provide an update on the names of lenders, in reference to the total credit facilities of Stock Holding Corporation of India Limited rated by ICRA. To access the previous rating rationale: Click Here. This update is being published as per the directions of the Reserve Bank of India (RBI) to the Credit Rating Agencies (CRAs) vide the communication [CO.DOR.ISG.No.S150/21-06-008/2021-2022] dated June 4, 2021. About ICRA Limited: ICRA Limited was set up in 1991 by leading financial/investment institutions, commercial banks and financial services companies as an independent and professional investment Information and Credit Rating Agency. Today, ICRA and its subsidiaries together form the ICRA Group of Companies (Group ICRA). ICRA is a Public Limited Company, with its shares listed on the Bombay Stock Exchange and the National Stock Exchange. The international Credit Rating Agency Moody’s Investors Service is ICRA’s largest shareholder. For more information, visit www.icra.in www.icra .in Page | 1 ICRA Limited Registered Office B-710, Statesman House 148, Barakhamba Road, New Delhi-110001 Tel: +91 11 23357940-45 Branches © Copyright, 2021 ICRA Limited. -

Sharekhan Top Picks

EQUITY FUNDAMENTALS SHAREKHAN TOP PICKS SHAREKHAN TOP PICKS The Sharekhan Top Picks is celebrating its 100th month ended up registering positive gains for the month, with since inception with a record of delivering a strong four stocks giving close to double-digit returns. This month outperformance consistently. While the benchmark again, we are booking handsome gains in two companies - indices, the Nifty and Sensex, appreciated in the range of Bharat Electronics (BEL) and Indian Oil Corporation (IOCL). 1-1.5% in April, the Sharekhan Top Picks portfolio gave a Both the companies were introduced into the Sharekhan handsome return of 7.2% in the same period. Despite the Top Picks in December 2016. In the last five months, IOCL Large Cap bias of the Sharekhan Top Picks folio (65-70% in and BEL have appreciated by 44% and 27%, respectively. Large Cap index stocks), it comprehensively outperformed To replace them, we are introducing Petronet LNG (PLNG) even the CNX Midcap index in April as well as over the and Power Grid Corporation (Power Grid). PLNG is more longer timeframe of three years and five years. That’s of a churn within the Oil & Gas sector. Valuation of PLNG not all, the performance of the Sharekhan Top Picks appears relatively favourable to us post the sharp run-up has been consistent with its track record of continued in IOCL. On the other hand, Power Grid is our preferred outperformance for eight consecutive years. pick in the Power sector, where the policy changes are It was an all-round performance by the Sharekhan Top expected to benefit the power transmission companies. -

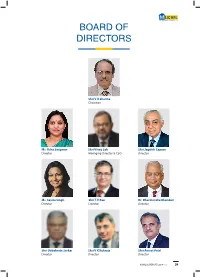

Board of Directors

BOARD OF DIRECTORS Shri V K Sharma Chairman Ms. Usha Sangwan Shri Vinay Sah Shri Jagdish Capoor Director Managing Director & CEO Director Ms. Savita Singh Shri T.V Rao Dr. Dharmendra Bhandari Director Director Director Shri Debabrata Sarkar Shri V K Kukreja Shri Ameet Patel Director Director Director 23 LIC HOUSING FINANCE LIMITED ANNUAL REPORT 2016-17 24 BOARD OF DIRECTORS SHRI V K SHARMA MS. USHA SANGWAN Chairman Director Shri Vijay Kumar Sharma took charge as Chairman, Life Mrs. Usha Sangwan, is the first ever woman Managing Insurance Corporation of India on 16th December, 2016. Prior Director of Life Insurance Corporation of India. She is Post to his taking over as Managing Director, LIC of India, on 1st Graduate in Economics and Post Graduate Diploma holder in November, 2013, he was Managing Director & Chief Executive Human Resource Management and Licentiate from Insurance Officer, LIC Housing Finance Limited (LICHFL), a premiere Institute of India. She joined LIC as Direct Recruit Officer in 1981. housing finance provider in the country with loan portfolio exceeding `83,000 crore. Mrs. Sangwan is the whole time Director of LIC of India, Board Member of General Insurance Corporation of India, Shri Vijay Kumar Sharma, born on 19th December, 1958 is LIC Housing Finance Ltd., Axis Bank, Ambuja Cements Ltd. a post-graduate (M.Sc.) in Botany from Patna University. and Bombay Stock Exchange Ltd., Board Member of LIC Shri Sharma joined LIC as Direct Recruit Officer in 1981 (International) BSC © Bahrain, Kenindia Assurance Co. Ltd., LIC and has grown with the Company since then. During his Card Services Ltd., Member of Governing Council of National stint as Senior Divisional Manager, Karnal, a rural division, Insurance Academy, Member on the Board of Education of had catapulated to Number One position in the country Insurance Institute of India, a Trustee of LIC Golden Jubilee in premium income ahead of all other metro centres. -

Aftermarket Research Source Book

Aftermarket Research Source Book November 2020 Refinitiv Aftermarket research collections provide the most comprehensive offering in the marketplace, with over 30 million research reports from over 1,900 sources. This document provides an index of the available research sources across the following collections: Subscription / Investext® Collection Pay-Per-View (PPV) / Research Select and Market Research Collections Aftermarket Research Source Book - November 2020 2 New Contributors Added Year to Date 81 contributors from 34 countries have been added to the collection since the beginning of 2020 Australia 3 Ireland 1 South Africa 1 Brazil 1 Japan 4 South Korea 1 Canada 5 Kenya 2 Spain 2 Chile 1 Lebanon 1 Switzerland 1 China 4 Liechtenstein 1 Turkey 2 Colombia 1 Nigeria 4 United Arab Emirates 6 France 2 Peru 1 United Kingdom 5 Germany 1 Philippines 1 United States 11 Ghana 1 Russia 1 Uzbekistan 2 Hong Kong 6 Saudi Arabia 1 Vietnam 1 India 3 Singapore 2 Indonesia 1 Slovenia 1 Contributor Highlights Refinitiv is pleased to announce that BofA Global Research has joined the list of exclusive BofA Global Research contributors only accessible, by qualifying users, through our Aftermarket Research collection. • A team of 285 analysts covering approximately 3,100 companies in 24 global industries – one of the largest research providers worldwide and with more sector coverage than anyone else. • More coverage (2,832) in large- and mid-caps than bulge-bracket peers. • One of the largest producers of equity research with approximately 47,000 documents published in 2019. GraniteShares is an entrepreneurial ETF provider focused on providing innovative, cutting-edge alternative investment solutions. -

Annual Report 2012 - 2013

Annual Report 2012 - 2013 Encouraging sustainability Empowering lives Accolades 2012-2013 Asia Money Best Bank Awards Financial Express Best Bank Awards ••Best Domestic Bank in India Best Bank – Private Sector • Best in Strength and Soundness Businessworld Awards for Banking Excellence • Best Banker – Aditya Puri • Most tech-friendly Bank • Deal of the year (Rupee bonds) IBA Banking Technology Awards • Best Online Bank CNBC TV18 India Best Banks and Financial Institutions • Best use of Business Intelligence Awards • Best Customer Relationship Initiative • Best Private Sector Bank • Best Risk Management & Security Initiative • Best use of Mobile Technology in Banking CSO Forum Information Technology Award • Best Information Security Practice IDRBT Banking Technology Excellence Awards • Best Bank in IT for Operational Effectiveness DSCI Information Technology Awards • Security Leader of the year Mint-Aon Hewitt’s India’s Best Managed Boards • Security in Bank • HDFC Bank among India’s six best managed Boards Dun & Bradstreet Banking Awards Nasscom CNBC-TV18 Innovation Award • Overall Best Bank • Best IT driven innovation in Banking (Commercial) • Best Private Sector Bank • Best Asset Quality – Private Sector National Quality Excellence Awards ••Best Retail Banking – Private Sector Best Customer Service Result Dun & Bradstreet Corporate Awards – India’s Top 500 NDTV Profit Business Leadership Awards Companies • Best Bank in India • Best Bank in India Skoch Foundation Financial Inclusion Awards Economic Times Awards for Corporate Excellence