Raising Angel & Venture Capital Finance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Handbook of Financing Growth

ffirs.qxd 2/15/05 12:30 PM Page iii The Handbook of Financing Growth Strategies and Capital Structure KENNETH H. MARKS LARRY E. ROBBINS GONZALO FERNÁNDEZ JOHN P. FUNKHOUSER John Wiley & Sons, Inc. ffirs.qxd 2/15/05 12:30 PM Page b ffirs.qxd 2/15/05 12:30 PM Page a Additional Praise For The Handbook of Financing Growth “The authors have compiled a practical guide addressing capital formation of emerging growth and middle-market companies. This handbook is a valuable resource for bankers, accountants, lawyers, and other advisers serving entrepreneurs.” Alfred R. Berkeley Former President, Nasdaq Stock Market “Not sleeping nights worrying about where the capital needed to finance your ambitious growth opportunities is going to come from? Well, here is your answer. This is an outstanding guide to the essential planning, analy- sis, and execution to get the job done successfully. Marks et al. have cre- ated a valuable addition to the literature by laying out the process and providing practical real-world examples. This book is destined to find its way onto the shelves of many businesspeople and should be a valuable ad- dition for students and faculty within the curricula of MBA programs. Read it! It just might save your company’s life.” Dr. William K. Harper President, Arthur D. Little School of Management (Retired) Director, Harper Brush Works and TxF Products “Full of good, realistic, practical advice on the art of raising money and on the unusual people who inhabit the American financial landscape. It is also full of information, gives appropriate warnings, and arises from a strong ethical sense. -

The Los Angeles Business Journal Digital Edition

2-Page Spread Single Page View Thumbnails | LABJ User Guide | Front Page | Table of Contents Previous Page Zoom In Zoom Out Next Page labusinessjournal.com LOS ANGELES BUSINESS JOURNALL TM DIGITAL EDITION THE COMMUNITY OF BUSINESS www.labusinessjournal.com/digital WELCOME TO THE LOS ANGELES BUSINESS JOURNAL DIGITAL EDITION To read your copy of the Digital Edition INSTRUCTION Please select a reading preference FOR PC/MAC How to read LABJ Digital Edition on iPad in iBooks: 1 TAP CENTER 2 TAP ‘OPEN WITH’ 3 TAP ‘iBOOKS’ Wait for gray bar with Wait for scroll down menu menu buttons to appear on and tap the iBooks icon. top of the PDF. Wait for PDF to load in iBOOKS. 2-Page Spread Single Page View Thumbnails | LABJ User Guide | Front Page | Table of Contents Previous Page Zoom In Zoom Out Next Page labusinessjournal.com LOS ANGELES BUSINESS JOURNAL Volume 33, Number 26 THE COMMUNITY OF BUSINESSTM June 27 - July 3, 2011 • $3.00 Up Angel Investors Talk Up Video Tech Front INTERNET: lion by Tech Coast Angels, the largest network of Vokle’s ‘virtual individual investors in the United States. auditorium’ a funding favorite. Vokle’s technology couples two hot Internet trends: social media and video advertising. By JOEL RUSSELL Staff Reporter Chief Executive Robert Kiraz explained that while Skype is the dominant Internet video service for one-to- When Republican presidential candidate Ron Paul one communications – what he called a video telephone decided to organize a virtual town hall meeting last – and services such as GoToMeeting provide a virtual week, his campaign did it with video streaming tech- boardroom, his company handles large gatherings nology from a Santa Monica startup called Vokle Inc. -

1 Summary of General Term Sheet Definitions

Summary of General Term Sheet Definitions The following is a brief summary of terms and concepts commonly used in Angel and Venture Capital transactions. • Anti-Dilution Protection. The conversion price of the preferred stock will be subject to adjustment for diluting events, such as stock splits or stock dividends, and will probably also be subject to "price protection," which is adjustment upon future sales of stock at prices below the conversion price. Price protection can take many forms, from an extreme "full- ratchet" protection which lowers the conversion price to the price at which any new stock is sold, no matter the number of shares, to a broad-based "weighted average" protection which adjusts the conversion price based on a formula incorporating both the number of new shares being issued and their price. The issuance of a certain number of shares is generally excluded from this protection to cover anticipated issuances to key employees, consultants and directors. Price protection is sometimes subject to a "pay-to-play" provision, which makes the continuation of such protection for a given investor contingent on that investor purchasing at least its pro-rata share of any future issuances priced below the conversion price. • Bridge Financing. A loan is used to provide the company with operating capital while the investors conduct due diligence and negotiate the terms of the investment. The bridge loan is usually converted into equity at the next equity financing of the company. • Broad-Based Weighted Average Antidilution. A type of anti-dilution mechanism. Weighted average anti-dilution protection adjusts downward the price per share of the preferred stock of investor A due to the issuance of new preferred shares to new investor B at a price lower than the price investor A originally received. -

The Board As a Collective Body

Arizona Legal Studies Discussion Paper No. 07-16 The (Not So) Puzzling Behavior of Angel Investors Darian M. Ibrahim The University of Arizona James E. Rogers College of Law February 2008 THE (NOT SO) PUZZLING BEHAVIOR OF ANGEL INVESTORS Darian M. Ibrahim† __ VAND. L. REV. __ (forthcoming 2008) Draft of February 2008 Angel investors fund start-ups in their earliest stages, which creates a contracting environment rife with uncertainty, information asymmetry, and agency costs in the form of potential opportunism by entrepreneurs. Venture capitalists also encounter these problems in slightly later-stage funding, and use a combination of staged financing, preferred stock, board seats, negative covenants, and specific exit rights to respond to them. Curiously, however, traditional angel investment contracts employ none of these measures, which appears inconsistent with what financial contracting theory would predict. This Article explains this (not so) puzzling behavior on the part of angel investors, and also explains the recent move toward venture capital-like contracts as angel investing becomes more of a professional endeavor. I. INTRODUCTION .........................................................................................2 II. THE VENTURE CAPITAL INVESTMENT MODEL ........................................6 III. THE ANGEL INVESTMENT MODEL: A DEPARTURE FROM FINANCIAL CONTRACTING THEORY? ............................................................................11 A. The Need for Angels............................................................................11 -

(Not So) Puzzling Behavior of Angel Investors!!!!!!!!!!!!!!!!!!!....2-50

Table of Contents The (Not So) Puzzling Behavior of Angel Investors!!!!!!!!!!!!!!!!!!!....2-50 Best Practice Guidance for Angel Groups " Deal Structure and Negotiation!!!!!!!!..!..51-63 TechStars Model Seed Funding Documents!!!!!!!!!!!!!!!!!!!!!!...64-65 Convertible Debt!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!.66-72 Raising Angel Money!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!.73-77 The Importance of Angel Investing in Financing the Growth of Entrepreneurial Ventures!!!!78-127 Reading 1 !"#$%!&'($)*+ ,-./,./--0+123425,+(&+ + !"#$%&'($)'*$+,--./01$2#"34/'5$'6$ 701#.$804#9('59$ !"#$"%&'(&)*#"+$,!& + !6++ + !78#9:;<8!97 6666666666666666666666666666666666666666666666666666666666666666666,5-= !!6+++ 8%*+>*78;#*+<$(!8$?+!7>*@8&*78+&9:*? 66666666666666666666,5,- !!!6++8%*+$7)*?+!7>*@8&*78+&9:*?2+$+:*($#8;#*++ A#9&+A!7$7<!$?+<978#$<8!7)+8%*9#BC 6666666666666666666666666,5,= -(&& .+/&0//1&23#&-%4/56((((((((((((((((((((((((((((((((((((((((((((((((,5,= 7(&& .#"1$8$3%"5&-%4/5&)%9/68,/%8&:3%8#";86((((((((((((((((,5/- :(&& <=>5"$%$%4&.#"1$8$3%"5&-%4/5&& )%9/68,/%8&7/+"9$3# (((((((((((((((((((((((((((((((((((((((((((((((,5/1 ,6++ 8DEFGHGIJEK+$JLMK+<IJHDENH+:MOGLJ+EO+ AGJEJNGEKKP+#EHGIJEK666666666666666666666666666666666666,5/0 "(&& .+/&0//1&23#&?3553@AB%&C/%8D#/&& :">$8"5&?D%1$%4 (((((((((((((((((((((((((((((((,5/0 *(&& )%23#,"5&ED*68$8D8/6&23#&:3%8#";8((((,53, ;(&& :3685F&:3%8#";8$%4&.+/3#F((((((((((((((((,533 1(&& G/>D8"8$3%"5&"%1&& :3D#8&E"%;8$3%6H ((((((((((((((((((((((((((((((,531 /6++ 7IJQGJEJNGEK+&IHGREHGIJO6666666666666666666666666666,53S "(&& 03%2$%"%;$"5&G/"63%6&23#&-%4/5& -

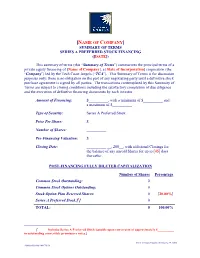

TCA Sample Term Sheet Series a Preferred

[NAME OF COMPANY] SUMMARY OF TERMS SERIES A PREFERRED STOCK FINANCING ([DATE]) This summary of terms (this “Summary of Terms”) summarizes the principal terms of a private equity financing of [Name of Company], a [State of Incorporation] corporation (the “Company”) led by the Tech Coast Angels (“TCA”). This Summary of Terms is for discussion purposes only; there is no obligation on the part of any negotiating party until a definitive stock purchase agreement is signed by all parties. The transactions contemplated by this Summary of Terms are subject to closing conditions including the satisfactory completion of due diligence and the execution of definitive financing documents by each investor. Amount of Financing: $__________, with a minimum of $__________ and a maximum of $__________. Type of Security: Series A Preferred Stock Price Per Share: $____ Number of Shares: __________ Pre-Financing Valuation: $______________ Closing Date: __________ __, 200__, with additional Closings for the balance of any unsold Shares for up to [45] days thereafter. POST-FINANCING FULLY DILUTED CAPITALIZATION Number of Shares Percentage Common Stock Outstanding: 0 Common Stock Options Outstanding: 0 Stock Option Plan Reserved Shares: 0 [20.00%] Series A Preferred Stock:[1] 0 TOTAL: 0 100.00% [1 Includes Series A Preferred Stock issuable upon conversion of approximately $__________ in outstanding convertible promissory notes.] TCA Version Updated February 25, 2008 888888/888888/1483790.01 TERMS OF SERIES A PREFERRED STOCK Dividend Preference: The holders of Series A Preferred Stock will be entitled to receive noncumulative dividends at the rate of 8.0% per annum, when and if declared by the Board of Directors (the “Board”), from funds legally available therefor. -

ACA) Conferences

The Australian Association of Angel Investors (AAAI) & US Angel Capital Association (ACA) Conferences New Zealand Delegate Trip Reports April 2013 Contents 1. AAAI Conference Report – Suse Reynolds & Ray Thomson 2. ACA Trip Report – Bill Murphy 3. ACA Trip Report – Brent Ogilvie 4. ACA Trip Report – Dave Allison 5. ACA Trip Report – Dean Tilyard 6. ACA Trip Report – Debra Hall 7. ACA Trip Report – Greg Sitters 8. ACA Trip Report – Karen Aitkens 9. ACA Trip Report – Ray Thomson 10. ACA Trip Report – Trevor Dickinson TRIP REPORT Australian Association of Angel Investors Conference 20-22 February 2013 Brisbane Suse Reynolds – Angel Association Ray Thomson – Angel Association KEY TAKE OUTS Look for disruptive markets • 3D printing • voice apps • UAVs • synthetic biology • medical personal devices • software • energy storage and solar power • new business models Angel networks need sidecar funds – more efficient, allow wider engagement Crowd funding is coming but is a challenge for legislators Preference shares increasingly popular in angel deals Successful entrepreneurs are: • risk managers not risk averse • have done it before • have made mistakes and learned from them • can build great teams • good with money and don't buy BMWs! • able to align capability, interests and strategy • communicate, communicate, communicate • are ready for the counter punch from the market • dogged and persistent but listen • are not psychopaths – psychopath test: looks you in the eye and is nice to the waiter! IMPRESSIVE PEOPLE David Roberts Singularity University http://singularityu.org/ Vice President and Director of Graduate Studies Serial entrepreneur in education, communication, health care, security and poverty Chairman of HaloDrop robotic incident response company Mike Volker Simon Fraser University www.mikevolker.com Runs two angel networks and manages three angel funds Has invested in over 30 ventures 1 John Morris Tech Coast Angels http://www.linkedin.com/in/johnmmorrisvistagechair Helped to found Tech Coast angels. -

Insurance Technology Four Trillion Dollar Industry Finally Goes Digital

Insurance Technology Four Trillion Dollar Industry Finally Goes Digital Greg Roth, Partner Ben Howe, CEO Matei Sanders, Principal Catch the Wave . Insurance Technology is riding a wave of innovation and investment that is attempting to do in a few short years what the insurance industry itself has failed to do over the last decade: a complete digital migration across all business processes . With $4.6 Trillion in global annual premiums, or 5.6% of global GDP, the insurance industry is a highly attractive market where incumbents have been slow to embrace innovation . There are three competitive threats at work in the insurance market and they all point to Technology Disruption: (1) an explosion of well funded, InsureTech startups; (2) the feared entry of the B2C tech “titans” (i.e. Google, Amazon, Facebook, etc.); and (3) incumbents racing to adopt modern enabling technologies . Investors can sense the opportunity: InsureTech investments are up six-fold over the last five years across at all stages of funding . Whereas this first wave has primarily focused on distribution, a second wave is taking aim at how insurance products are designed, priced, and operated . Incumbents’ initial reaction has been to partner and invest mostly in enabling technology . These market forces point to increased M&A activity as customer demand will make InsureTech solutions key to an insurer’s customer acquisition and retention strategy (# of Private Insurance Tech Investments Ramping Placements) 200 173 150 122 100 91 63 46 50 28 0 2011 2012 2013 2014 2015 2016 Source: Capital IQ, CB Insights 2 Investment in Technology Pays Dividends Investment in Technology Translates to . -

Template As Of: November 15, 2007

2008, Volume 11, Issue 1 Venture Capital Audio interview with Luis Villalobos, Founder of the Tech Coast Angels Nancy Dodd, MPW, MFA About the GBR: Since 1998, the Graziadio Business Report has provided practical information on dealing with business situations and problems. GBR authors translate the latest academic research and analysis into practical applications for business. From accounting and finance to ethics and work/life balance, the Graziadio Business Report extends current business debates in new directions that you can use to advance your business and professional career. Read us online at gbr.pepperdine.edu. About the GBR Blog: The GBR blog expands on ideas published in the Graziadio Business Report and provides timely updates and critical analysis of what is happening in the fast-paced world of business today. Read us online and watch video interviews with GBR authors on at gbr.pepperdine.edu/blog. #### Start #### Nancy Ellen Dodd: I’m Nancy Ellen Dodd, editor of the Graziadio Business Report. Today we are interviewing Luis Villalobos. In 2007, Mr. Villalobos received Hans Severance Memorial Award for outstanding contribution to Angel Investing. He sits on the Board of the Paul Mirage School of Business at the University of California Irvine and is Executive in Residence at he Graziadio School of Business and management at the Pepperdine University. Conducting our interview is David Sumethasorn, an MBA student at the Graziadio School of Business at Pepperdine and President of the Entrepreneurship Club. Welcome to Pepperdine University gentleman. David Sumethasorn: Mr. Villalobos, thank you for coming out. My name is David Sumethasorn from Pepperdine University and we’ll be conducting an interview about Tech Coast Angels. -

Eguide: How to Invest in a Startup

HOW TO INVEST IN A STARTUP eGuide www.tencapital.group [email protected] Contents PART I: Know the Startup Before You Invest ........................................... 4 The Definition of a Startup ....................................................................................................................... 5 Building a Board for your Startup – Noses In, Fingers Out ......................................................... 7 Board Planning - Finding the Company’s Competency ............................................................. 10 Capitalizing on the One-on-One Conference ................................................................................ 11 What's the Risk in a Consumer Product Deal? ............................................................................... 13 PART II: Learning Where and How to Invest .......................................... 14 Are You Ready for Marriage? ................................................................................................................ 15 How to Identify Quality Companies ................................................................................................... 16 Startup Investor Types ............................................................................................................................. 17 Venture Capital ........................................................................................................................................................................ 17 MicroVCs ................................................................................................................................................................................... -

2013 ACA Summit – Navigating Change for Angel Success Agenda

2013 ACA Summit – Navigating Change for Angel Success Agenda Tuesday, April 16 10:00 – 2:00 pm Bike Tour Frank Peters Our guided route takes us over the Golden Gate Bridge to Sausalito, where we'll have lunch and enjoy the views before hopping on the ferry to return to San Francisco. Wednesday, April 17 7:00 – 10:00 am Registration and Breakfast Grand Ballroom & Market Street Foyers 8:00 – 4:15 pm Angel Investing Overview Seminar Seacliff C-D Susan Preston, CALCEF Clean Energy Angel Fund Are you new to angel investing or looking to "tune-up" your investment skills? Or are you interested in finding an education program that will help recruit business angels to your angel organization or economic development initiative? This program is for both of you. This full-day seminar provides an overview of the angel investing process, including the details of finding, evaluating, and structuring deals and developing angel-entrepreneur relationships that lead to success. The highly interactive program provides attendees with practical information on best practices in angel investing through a balance of expert presentations, panel discussions, and small group case studies. A faculty of experienced angel investors, serial entrepreneurs, and expert service providers delivers the seminar. 8:00 – 12:00 pm Valuation of Early-Stage Companies Workshop Ballroom C Bill Payne, Frontier Angels Understanding how to properly value an early stage company is one of the most important skills an investor and entrepreneur can possess. The process of determining a value can seem difficult and intimidating. It should not be and with the right knowledge the process can be efficient and ultimately lead to greater returns. -

Angel Investing

Praise for Angel Investing “As an angel investor and a longtime fan of David S. Rose, I was delighted to hear that he finally captured his wit and wisdom in the pages of a book. David isaborn teacher—clear-minded, witty, and provocative, with amazing stories to illustrate every key idea and insight. Those gifts—as well as his unsurpassed knowledge of his field—are teaching me so much more about investing than I’ve learned over the years doing it! Read every page of Angel Investing.” —Barbara Corcoran Real estate mogul, Shark Tank star, angel investor “From the secret economics of angel investing and the best methods for finding and picking tomorrow’s big winners to proven techniques for adding value to any business you invest in, Angel Investing provides readers with everything they need to know to get started in this fascinating, fun, and lucrative business arena.” —David Bach #1 New York Times best-selling author of The Automatic Millionaire and Start Late, Finish Rich; angel investor “This is the most comprehensive and readable guide to angel investing ever writ- ten. The chapter on valuation and expectations lays out a clear framework for understanding one of the least-known pitfalls in the angel world. And its empha- sis on creating a win-win relationship with the entrepreneur is at the heart of being a long-term successful angel—and continuing to see the best deal flow. I recommend this book to anyone even thinking about making or receiving angel investments.” —Howard L. Morgan Founding Partner, First Round Capital “The world of entrepreneurial start-ups is where the most exciting and creative action is happening in today’s business world, which is why I was a strong sup- porter of the JOBS Act of 2012.