Topics Geo 2012 1 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pyatnits SC) EIJSC 39362474 Moscow

2008 ANNUAL REPORT Table of contents Address by the General Director ............................................4 Reinsurance ..........................................................................49 Position of Ingosstrakh in the Insurance Market .....................6 Investments ..........................................................................52 Quantitative and qualitative insurance Marketing .............................................................................54 market parameters ..............................................................9 Personnel .................................................................................56 Key Events and Trends in the Russian Insurance Market in 2008 ..............................13 Risk management ....................................................................62 Current Positioning of Ingosstrakh in the Market ...............16 Communications ......................................................................70 Deliverables in major areas of business ..................................20 Government relations ..........................................................73 Motor insurance ...................................................................23 Public relations .....................................................................74 Corporate property and liability insurance .........................27 Charity and sponsorship ......................................................76 Voluntary Medical insurance ................................................29 -

Reinsurance Market in Russia: 2015 Future Outlook

Reinsurance Market in Russia: Future Outlook Joint analytical report of ARIA and RNRC 1 Summary The reinsurance market in Russia needs a fresh start. The scope of internal reinsurance in Russia is declining progressively. The amount of reinsurance premiums on the internal market in 2015 was RUB 35.2 billion, which is RUB 8.9 billion (20%) less than in 2012. Over the 9 months of 2016, the amount of premiums for accepted risks was 28.8 billion. In 2012-2014, the reinsurance market in Russia was expanding: premiums during this period increased by RUB 23.6 billion (20.5%); but affected by the negative political and economic factors in 2015, the reinsurance market stopped growing and entered a recession phase. During 2011-2015, reinsurance premiums increased just by 2% in 2015, while the growth of prices for insurance services reached 58% according to the Federal State Statistics Service. The Russian reinsurance market is characterized by a low penetration rate. Refusal to cede risks is associated with a few factors: inability to cede risks, conscious refusal to cede risks by insurers and lack of insurers' trust in Russian companies operating on the incoming reinsurance market. Despite the sanctions, the share of reinsurance premiums flowing abroad is increasing. In 2012 to 2015, premiums ceded to foreign reinsurers grew from RUB 79.4 billion to 98.4 billion. The size of the reinsurance market in Russia for the 9 months of 2016 was RUB 28.8 billion, which is equivalent to 3.25% of premiums on the insurance market. According to 2015 data, this figure on the international reinsurance market was estimated at 5%. -

WT/TPR/S/345/Rev.1 6 December 2016 (16

WT/TPR/S/345/Rev.1 6 December 2016 (16-6657) Page: 1/173 Trade Policy Review Body TRADE POLICY REVIEW REPORT BY THE SECRETARIAT RUSSIAN FEDERATION Revision This report, prepared for the first Trade Policy Review of the Russian Federation, has been drawn up by the WTO Secretariat on its own responsibility. The Secretariat has, as required by the Agreement establishing the Trade Policy Review Mechanism (Annex 3 of the Marrakesh Agreement Establishing the World Trade Organization), sought clarification from the Russian Federation on its trade policies and practices. Any technical questions arising from this report may be addressed to Mr. John Finn (Tel: 022 739 5081), Mr. Ricardo Barba (Tel: 022 739 5088), Mr. Peter Milthorp (Tel: 022 739 5016) and Mr. Rosen Marinov (Tel: 022 739 6391). Document WT/TPR/G/345 contains the policy statement submitted by the Russian Federation. Note: This report was drafted in English. WT/TPR/S/345/Rev.1 • Russian Federation - 2 - CONTENTS SUMMARY ........................................................................................................................ 8 1 ECONOMIC ENVIRONMENT ........................................................................................ 13 1.1 Main Features of the Economy .....................................................................................13 1.2 Recent Economic Developments ...................................................................................14 1.3 Trade and Investment Performance ................................................................................18 -

US Sanctions on Russia

U.S. Sanctions on Russia Updated January 17, 2020 Congressional Research Service https://crsreports.congress.gov R45415 SUMMARY R45415 U.S. Sanctions on Russia January 17, 2020 Sanctions are a central element of U.S. policy to counter and deter malign Russian behavior. The United States has imposed sanctions on Russia mainly in response to Russia’s 2014 invasion of Cory Welt, Coordinator Ukraine, to reverse and deter further Russian aggression in Ukraine, and to deter Russian Specialist in European aggression against other countries. The United States also has imposed sanctions on Russia in Affairs response to (and to deter) election interference and other malicious cyber-enabled activities, human rights abuses, the use of a chemical weapon, weapons proliferation, illicit trade with North Korea, and support to Syria and Venezuela. Most Members of Congress support a robust Kristin Archick Specialist in European use of sanctions amid concerns about Russia’s international behavior and geostrategic intentions. Affairs Sanctions related to Russia’s invasion of Ukraine are based mainly on four executive orders (EOs) that President Obama issued in 2014. That year, Congress also passed and President Rebecca M. Nelson Obama signed into law two acts establishing sanctions in response to Russia’s invasion of Specialist in International Ukraine: the Support for the Sovereignty, Integrity, Democracy, and Economic Stability of Trade and Finance Ukraine Act of 2014 (SSIDES; P.L. 113-95/H.R. 4152) and the Ukraine Freedom Support Act of 2014 (UFSA; P.L. 113-272/H.R. 5859). Dianne E. Rennack Specialist in Foreign Policy In 2017, Congress passed and President Trump signed into law the Countering Russian Influence Legislation in Europe and Eurasia Act of 2017 (CRIEEA; P.L. -

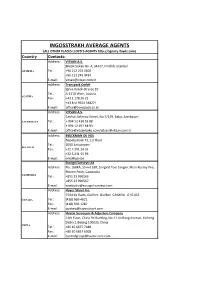

INGOSSTRAKH AVERAGE AGENTS (ALL OTHER PLACES LLOYD’S AGENTS Country Contacts: Address: VITSAN A.S

INGOSSTRAKH AVERAGE AGENTS (ALL OTHER PLACES LLOYD’S AGENTS http://agency.lloyds.com) Country Contacts: Address: VITSAN A.S. Bilezik Sokak No. 4, 34427, Findikli, Istanbul ARMENIA Tel.: +90 212 252 0600 +90 212 249 4434 E‐mail: [email protected] Address: Transpack GmbH Ignaz‐Koeck‐Strasse 10 Tel.: A‐1210 Wien, Austria AUSTRIA Fax: +43 1 278 26 22 +43 810 9554 338271 E‐mail: [email protected] Address: VITSAN A.S. Ceyhun Selimov Street, No:7/129, Baku, Azerbaijan AZERBAIJAN Tel.: + 994 12 430 53 88 + 994 12 497 68 93 E‐mail: [email protected]/[email protected] Address: BEECKMAN DE VOS Napelsstraat 73, 1st Floor Tel.: 2000 Antwerpen BELGIUM Fax: +32 3 201 24 33 +32 3 231 55 99 E‐mail: [email protected] Eurogal Surveys Ltd Address: No. 168KA, Street 598, Sangkat Toul Sangke, Khan Russey Keo, Phnom Penh, Cambodia CAMBODIA Tel.: +855 23 996566 +855 23 996567 E‐mail: cambodia@eurogal‐surveys.com Address: Hayes Stuart Inc. 7504 du Daim, Québec, Québec CANADA G1G 6S2 CANADA Tel.: (418) 660‐4621 Fax: (418) 660‐1287 E‐mail: [email protected] Address: Huatai Surveyors & Adjusters Company 14th Floor, China Re Building, No.11 Jin Rong Avenue, Xicheng District, Beijing 100033, China CHINA Tel.: +86 10 6657 7488 Fax: +86 10 6657 6508 E‐mail: controlgroup@huatai‐serv.com Address: Marinter SA Edificio "Playa", Calle 12, Nº 105, e/ 1ra y 3ra, 2do Piso, Miramar, Playa Ciudad de la Habana, Cuba CUBA Tel.: +53 7 2049742 Fax: +53 7 2049743 E‐mail: [email protected] Address: CRS Czech Republic Junacka 22, 169 00 Praha 6, Czech Republic CZECH -

The Insurance Market in Russia

The insurance market in Russia Vladimir Kalinin MAPFRE RE’s Commercial Adviser for Russia and the countries of the CIS Moscow – Russia 16 / 61 / 2012 661_trebol_ing.indd1_trebol_ing.indd 1616 117/07/127/07/12 112:182:18 Among the markets of the emerging countries, the Russian Federation’s insurance market is turning out to be the most important and to have the greatest potential in Central and Eastern Europe. In 2010, Russia, with a population of some 140 million and abundant natural resources, ranked ninth in the world in terms of gross domestic product (GDP), with USD 1,803 billion, placing it between Italy and Canada. [1] Russian insurance in the world market1 Russia’s share of the world insurance market is 0.96% of total premiums, put at USD 4.3 billion in 2010. In 2010, Russia ranked 19th in the world in terms of total premium income (USD 41,644 million), behind Ireland and ahead of Belgium. As regards Non-Life premium income, Russia ranks 12th in the world (USD 40,742 million), after Spain and ahead of Australia and Brazil. Its share of the world market is 2.24%. On the other hand, with per capita premium of USD 296.8, Russia comes behind Brazil, occupying 48th place in the world ranking. As regards insurance penetration, Russia drops to 55th place, with an insurance market accounting for 2.3% of its GDP in 2010. In 2010, total Russian premium accounted 1 Data from Swiss Re, for 47.4% of the total premium in Central Sigma No. 2/2011. -

(Minutes Dated 23.04.2018 # 15) REPORT On

Approved by the resolution of Rosneft Board of Directors (minutes dated 23.04.2018 # 15) REPORT On Rosneft related-party transactions made in 2017 This report provides the information on the related party transactions, signed by Rosneft in 2017. № Transaction subject and material conditions Transaction Body which value agreed (endorsed) the transaction, decision date / Information on the transaction procedure compliance as per clause 1.1 article 81 of the Federal Law on Joint Stock Companies. 1 Transactions where AZP is a party. Related parties: ROSNEFTEGAZ - controlling entity of Rosneft (The entity is indirectly controlled by Rosneftegaz and is a party to the transactions). 1 Provision by Rosneft (lender) of an interest-free loan for AZP Transaction Notification (borrower) for the investment activities financing to the amount RUB value is procedure is 2,624,694.4 K by the extension of the loan repayment period till RUB observed2 30.12.2020. The total transaction amount shall not exceed RUB 2 2,624,694.4 2,624,694.4 k. k. 2 AZP (provider) services for Rosneft (Customer) from 01.01.18 to Transaction Notification 31.12.18 related to acceptance, storage and processing of value – procedure is hydrocarbons; storage and loading of processed products; filling RUB observed and/or packing of commercial products. The throughput is up to 15,478,650.0 825.000 kt of feedstock totaling up to RUB 15,478,650.0 k (with k (with VAT). VAT). Transactions where ANPZ VNK is a party. Related parties: ROSNEFTEGAZ - controlling entity of Rosneft (The entity is indirectly controlled by Rosneftegaz and is a party to the transactions). -

Russia–US Economic Cooperation in Turbulent Times

Russia–us ECONOMIC COOPERATION IN TURBULENT TIMES Moscow, March 2019. Russia–US Economic Cooperation in Turbulent Times Moscow, March 2019. INTRODUCTORY REMARKS BY ALEXANDER SHOKHIN, PRESIDENT OF THE RUSSIAN UNION OF INDUSTRIALISTS AND ENTREPRENEURS and ChaiRman of the BoaRd of tRustees of the Russian-ameRiCan BUSINESS COUNCIL (RABC) Dear friends, U.S.–Russia relations have been very tense in recent years, and this directly affects cooperation in trade, economy and investment. During these difficult times, we believe it a task of utmost importance to find a stable foundation to maintain and develop relations in the future. In order to assess the current status quo and to look for solutions that will put U.S.–Russia relations on an upward trajectory, the Russian Union of Industrialists and Entrepreneurs (RSPP) and the Russian-American Business Council (RABC) have spearheaded a dialog on lost profits and on opportunities that still remain open for our countries’ businesses. The RSPP and the RABC commissioned a report “Russia-US Economic Cooperation in the Conditions of Uncertainty” prepared by experts from the National Research University Higher School of Economics, the Valdai International Discussion Club and Russia’s leading research centres; this report is intended to serve as grounds for the discussion. On behalf of the RSPP and the RABC, I would like to express my gratitude to everyone who made this report possible: the report’s contributors: Sergei Karaganov, Dean of the Faculty of World Economy and International Affairs at the National -

Strong Growth

country profile | Russia Strong growth Insurance market Figures presented by the supervisory au- The most important change in insurance portfolio thority of the insurance market in Moscow law is the requirement regarding the in- 1H 2011 indicate for the first half of the current crease of the underwritten share capital. year an increasing evolution of the profile In the first half of the year, some insurers industry of over 13% in EUR, the market - medium and small - have taken steps to reaching more than EUR15.4bn. eliminate or postpone the deadline of this For the development of the market, the gre- law. However, it seems that, starting next atest influences were the significant increase Life insurance (V) 2.36% year, the insurance companies that do not in car sales, the revival of the construction meet minimum capitalization require- Personal insurance (V) 13.82% market, increasing trade and goods trans- ment will face the withdrawal of license Property insurance (V) 26.50% portation. As a result, the market grew, and and termination of activity, said Andrey Liabilities (V) 2.14% grew significantly in almost all segments, VESELKOV. Mandatory health ins. 46.82% explained the market evolution Andrey Other important changes carried out in MTPL 7.20% VESELKOV, General Manager, Media-Infor- 2011 were due to the increased MTPL tar- mation Group, "Insurance Today ". Other mandatory ins. 1.15% rifs, as well as due to the launching of the Analyzing each market segment separate- draft law regarding mandatory insurance ly, traditionally, travel insurance, followed by liability insurance were the most profi- of highly dangerous objects. -

Global Reinsurance Highlights 2020 Edition

Global ReinsuranceGlobal HighlightsReinsurance 2019 Highlights 2020 PUBLISHEDPUBLISHED BY: BY: Global Reinsurance Highlights 2019 PUBLISHED BY: Global Reinsurance Highlights 2020 Edition For further information, please visit our reinsurance page on our website www.spratings.com Global Reinsurance Highlights | 2020 3 4 Global Reinsurance Peer Review Contributors For S&P Global Ratings For Intelligent Insurer Project Leaders Data Team Publisher Johannes Bender Patrice Mizeski, New York Nicholas Lipinski Taoufik Gharib Antun Zvonar, New York Tel: +44 (0) 203 301 8201 [email protected] Contributors Editorial Team Aishwarya Agarwal, Pune Heather Bayly, London Johannes Bender, Frankfurt Jennie Brookman, Frankfurt Managing editor Craig Bennett, Melbourne Jo Parker, Toronto Wyn Jenkins Rachit Chauhan, Mumbai Richard Smart, Tokyo Tel: +44 (0)203 301 8214 WenWen Chen, Hong Kong [email protected] Hoyt Crance, New York Charles-Marie Delpuech, London Sub editor Koshiro Emura, Tokyo Giulia Filocca, London Ros Bromwich Taoufik Gharib, New York Robert Greensted, London Design & Production Jean Paul Huby Klein, Frankfurt Garrett Fallon Maren Josefs, London Russell Cox Kalyani Joshi, Mumbai Marc-Philippe Juilliard, Paris Milan Kakkad, Mumbai Cover image: Ali Karakuyu, London Shutterstock / Ellerslie Olivier Karusisi, Paris Saurabh Khasnis, Centennial Eiji Kubo, Tokyo Volker Kudszus, Frankfurt Hardeep Manku, Toronto Mark Nicholson, London Dennis Sugrue, London Eunice Tan, Hong Kong Michael Zimmerman, Centennial The views expressed in this -

2017 Annual Report About This Report

2017 Annual Report About this Report Approach to the Report Disclaimer This Annual Report of Sberbank of Russia1 for 2017 (the “Report”) In addition, the Report reflects the contribution that Sberbank has This annual report is prepared by Sberbank and does not represent — in full or in includes the results of Sberbank and its subsidiaries2 for the reporting made to achieving the Sustainable Development Goals adopted by part — an offer for sale or issue, an invitation to submit offers for sale or issue, or a period from January 1, 2017 to December 31, 2017. the United Nations in 2015 in the document “Transforming Our World: recommendation regarding the purchase, subscription, guarantee of placement, or The 2030 Agenda for Sustainable Development”. other acquisition of any shares of Sberbank or any member of Sberbank Group, or • Federal Law “On the Securities Market” No. 39—FZ dated April 22, 1996; any securities representing such shares, or any other securities of said entities and • Federal Law “On Joint Stock Companies” No. 208—FZ dated shall not be interpreted as such; neither this report, any part thereof, nor the fact of December 26, 1995; This Report is prepared in accordance with the Core option its presentation or distribution shall give the grounds for any contract, obligation, or • Bank of Russia Directive “On the Deadlines and Procedure for of the Global Reporting Initiative Standards (GRI Standards). investment decision and shall not be relied upon in connection with any contract, the Preparation and Submission of the Financial Statements of Previous Sberbank reports were prepared “taking into obligation, or investment decision. -

Rosneft Annual Report 2012

ROSNEFT ANNUAL REPORT RESPONSIBILITY 2012 TO BE A LEADER ROSNEFT IS THE LEADER OF THE RUSSIAN OIL INDUSTRY AND ONE OF THE WORLD’S LARGEST PUBLICLY TRADED OIL AND GAS CORPORATIONS BUSINESS GEOGRAPHY: Nearly all regions of Russia and a number of foreign countries. MAIN BUSINESSES: Exploration and producton of oil and gas, production of petroleum products and petrochemicals, sale of outputs in Russia and abroad. MAIN ASSETS: • PRMS proved reserves: 18.3 billion barrels of crude oil and 992 bcm of gas; • 424 producing fields with annual output above 890 million barrels of oil and 16 bcm of gas; • 7 oil refineries in Russia with aggregate refining capacity of 54 mln t of oil per annum; • Stakes in 4 refineries in Germany with net capacity of 11.5 mln t of oil per annum; • 1,691 operating filling stations under the Rosneft brand in 46 regions of Russia and 3 filling stations in Abkhazia. COMPETITIVE ADVANTAGES: • Resource base of unique scale and quality; • Russia’s largest greenfield projects; • Lowest unit lifting costs; • Status of a Company of strategic importance for the Russian Federation. FUTURE: A global energy Company, providing consistently high returns to shareholders through sustainable growth, efficiency gains and innovation, including the design and application of new technologies. DEVELOPMENT PRIORITIES: • Maintaining production levels at existing fields and devel- opment of new fields, both onshore and offshore; • Bringing hard-to-recover reserves into production; • Efficient monetization of associated and natural gas reserves; • Completing modernization of refining capacities; • Increasing marketing efficiency in Russia and internationally; • Achieving technology leadership thanks to in-house re- search and development work and strategic partnerships; • Implementing best practice in protection of the environ- ment and industrial safety.