FTSE 250 Index V's FTSE 100 Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Midwest Financial Brian Johnson, RFC 706 Montana Street Glidden, IA 51443 [email protected] 712-659-2156

Midwest Financial Brian Johnson, RFC 706 Montana Street Glidden, IA 51443 www.midwestfinancial.us [email protected] 712-659-2156 The SITREP for the week ending 08/06/2021 ***************************************************** SIT REP: n. a report on the current situation; a military abbreviation; from "situation report". In the markets: U.S. Markets: U.S. stocks recorded solid gains for the week and several indices hit record highs. The Dow Jones Industrial Average rose 273 points finishing the week at 35,209, a gain of 0.8%. The NASDAQ retraced all of last week’s decline by rising 1.1% to close at 14,836. By market cap, the large cap S&P 500 rose 0.9%, while the mid cap S&P 400 and small cap Russell 2000 gained 0.5% and 1.0%, respectively. International Markets: Major international markets also finished the week solidly in the green. Canada’s TSX added 0.9%, while the United Kingdom’s FTSE 100 gained 1.3%. France’s CAC 40 and Germany’s DAX rose 3.1% and 1.4%, respectively. China’s Shanghai Composite added 1.8%, while Japan’s Nikkei rallied 2%. As grouped by Morgan Stanley Capital International, developed markets finished up 1.0% and emerging markets gained 0.7%. Commodities: Precious metals had a difficult week. Gold retreated -3.0% to $1763.10 per ounce, while Silver fell a steeper -4.8% to $24.33. West Texas Intermediate crude oil gave up all of the last two week’s gains, declining -7.7% to $68.28 per barrel. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, finished the week down -3%. -

Scanned Image

3130 W 57th St, Suite 105 Sioux Falls, SD 57108 Voice: 605-373-0201 Fax: 605-271-5721 [email protected] www.greatplainsfa.com Securities offered through First Heartland Capital, Inc. Member FINRA & SIPC. Advisory Services offered through First Heartland Consultants, Inc. Great Plains Financial Advisors, LLC is not affiliated with First Heartland Capital, Inc. In this month’s recap: the Federal Reserve eases, stocks reach historic peaks, and face-to-face U.S.-China trade talks formally resume. Monthly Economic Update Presented by Craig Heien with Great Plains Financial Advisors, August 2019 THE MONTH IN BRIEF July was a positive month for stocks and a notable month for news impacting the financial markets. The S&P 500 topped the 3,000 level for the first time. The Federal Reserve cut the country’s benchmark interest rate. Consumer confidence remained strong. Trade representatives from China and the U.S. once again sat down at the negotiating table, as new data showed China’s economy lagging. In Europe, Brexit advocate Boris Johnson was elected as the new Prime Minister of the United Kingdom, and the European Central Bank indicated that it was open to using various options to stimulate economic activity.1 DOMESTIC ECONOMIC HEALTH On July 31, the Federal Reserve cut interest rates for the first time in more than a decade. The Federal Open Market Committee approved a quarter-point reduction to the federal funds rate by a vote of 8-2. Typically, the central bank eases borrowing costs when it senses the business cycle is slowing. As the country has gone ten years without a recession, some analysts viewed this rate cut as a preventative measure. -

FRC Board Diversity and Effectiveness in FTSE 350

Leadership Institute Board Diversity and Effectiveness in FTSE 350 Companies July 2021 Acknowledgements Report written by: Mary Akimoto, Osman Anwar, Molly Broome, Dragos Diac, Dr Randall S Peterson, Dr Sergei Plekhanov, Simon Osborne and Vyla Rollins We thank the following individuals on the joint LBSLI/SQW research team for their contributions to this research: • Ruth Cluness, LBSLI • Tom Gosling, LBSLI • Brent Hamerla, LBSLI • Letitia Joseph, LBSLI • Barbara Moorer, LBSLI • Andrei Visiteu, LBSLI • Desi Zlatanova, LBSLI We also give a special thank you to our team of research interviewers: • Eva Beazley • Helen Beedham • Christine de Largy • Kathryn Gordon • Dr JoEllyn Prouty McLaren The London Business School Leadership Institute expresses its thanks to all of our stakeholder and collaborators, who supported our research efforts. We would like to express our specific gratitude to the following individuals, for their invaluable guidance, comments, suggestions and support throughout this project: Kit Bingham, Charlie Brown, Gerry Brown, Sue Clark, Louis Cooper, John Dore, Lisa Duke, Roshy Dwyer, Farrer & Co (Anisha Birk, Natalie Rimmer, Peter Wienand), Louise Fowler, Dr Julian Franks, Dr Karl George MBE, Dr Tom Gosling, Dr Byron Grote, Fiona Hathorn, Jonathan Hayward, Susan Hooper, Dr Ioannis Ioannou, Bernhard Kerres, LBS Accounts department (Akposeba Mukoro, Janet Nippard), LBS Advancement department (Luke Ashby, Susie Balch, Nina Bohn, Ian Frith, Sarah Jeffs, Maria Menicou), LBS Executive Education, LBS Research & Faculty Office and -

Ishares FTSE 250 UCITS ETF GBP (Dist)

iShares FTSE 250 UCITS ETF GBP (Dist) MIDD August Factsheet Unless otherwise stated, Performance, Portfolio Breakdowns and Net Assets information as at: 31-Aug-2021 All other data as at 07-Sep-2021 This document is marketing material. For Investors in Switzerland. Investors should read the Key Capital at risk. All financial investments Investor Information Document and Prospectus prior to investing. involve an element of risk. Therefore, the value of your investment and the income from it will The Fund seeks to track the performance of an index composed of 250 mid cap UK companies that vary and your initial investment amount cannot rank below the FTSE 100 Index be guaranteed. KEY FACTS KEY BENEFITS Asset Class Equity Fund Base Currency GBP Exposure to broadly diversified UK companies 1 Share Class Currency GBP 2 Direct investment into 250 UK companies Fund Launch Date 26-Mar-2004 Share Class Launch Date 26-Mar-2004 3 Single country exposure Benchmark FTSE 250 Index Valor 1828018 Key Risks: Investment risk is concentrated in specific sectors, countries, currencies or companies. ISIN IE00B00FV128 Total Expense Ratio 0.40% This means the Fund is more sensitive to any localised economic, market, political or regulatory Distribution Frequency Quarterly events. The value of equities and equity-related securities can be affected by daily stock market Domicile Ireland movements. Other influential factors include political, economic news, company earnings and Methodology Optimised significant corporate events. Counterparty Risk: The insolvency of any institutions providing Product Structure Physical services such as safekeeping of assets or acting as counterparty to derivatives or other Rebalance Frequency Quarterly instruments, may expose the Fund to financial loss. -

Restoring Strength, Building Value

Restoring Strength, Building Value QinetiQ Group plc Annual Report and Accounts 2011 Group overview Revenue by business The Group operates three divisions: US Services, 29% UK Services and Global Products; to ensure efficient 35% leverage of expertise, technology, customer relationships and business development skills. Our services businesses which account for more 36% than 70% of total sales, are focused on providing 2011 2010 expertise and knowledge in national markets. Our £m £m products business provides the platform to bring US Services 588.2 628.0 valuable intellectual property into the commercial UK Services 611.6 693.9 markets on a global basis. Global Products 502.8 303.5 Total 1,702.6 1,625.4 Division Revenue Employees US Services £588.2m 4,500 (2010: £628.0m) (2010: 5,369) Underlying operating profit* £44.3m (2010: £52.6m) Division Revenue Employees UK Services £611.6m 5,045 (2010: £693.9m) (2010: 5,707) Underlying operating profit* £48.7m (2010: £59.1m) Division Revenue Employees Global £502.8m 1,663 Products (2010: £303.5m) (2010: 2,002) Underlying operating profit* £52.4m (2010: £8.6m) * Definitions of underlying measures of performance are in the glossary on page 107. Underlying operang profit* by business Revenue by major customer type Revenue by geography 7% 17% 36% 31% 52% 37% 56% 31% 33% 2011 2010 2011 2010 2011 2010 £m £m £m £m £m £m US Services 44.3 52.6 US Government 894.3 754.1 North America 949.2 825.3 UK Services 48.7 59.1 UK Government 526.5 614.5 United Kingdom 623.7 720.0 Global Products 52.4 8.6 Other 281.8 -

Schroder UK Mid Cap Fund

Schroder UK Mid Ca p Fund plc Half Year Report and Accounts For the six months ended 31 March 2020 Key messages – Portfolio of “high conviction” stocks aiming to provide a total return in excess of the FTSE 250 (ex-Investment Companies) Index and an attractive level of yield. – Dividend has tripled since 2007 as portfolio investments have captured the cash generative nature of investee companies, in a market where income has become an increasingly important part of our investors’ anticipated returns. – Provides exposure to dynamic mid cap companies that have the potential to grow to be included in the FTSE 100 index, which are at an interesting point in their life cycle, and/or which could ultimately prove to be attractive takeover targets. – Proven research driven investment approach based on the Manager’s investment process allied with a strong selling discipline. – Managed by Andy Brough and Jean Roche with a combined 50 years’ investment experience 1, the fund has a consistent, robust and repeatable investment proces s. 1Andy Brough became Lead Manager on 1 April 2016 . Investment objective Schroder UK Mid Cap Fund plc’s (the “Company”) investment objective is to invest in mid cap equities with the aim of providing a total return in excess of the FTSE 250 (ex -Investment Companies) Index. Investment policy The strategy is to invest principally in the investment universe associated with the benchmark index, but with an element of leeway in investment remit to allow for a conviction-driven approach and an emphasis on specific companies and targeted themes. The Company may also invest in other collective investment vehicles where desirable, for example to provide exposure to specialist areas within the universe. -

UK FTSE 100 PDF Factsheet

FACTSHEET 31 August 2021 Life Fund Halifax UK FTSE 100 Halifax UK FTSE 100 single priced. This document is provided for the purpose of information only. This factsheet is intended for Asset Allocation (as at 30/06/2021) individuals who are familiar with investment UK Equity 98.8% terminology. Please contact your financial adviser if you need an explanation of the terms Money Market 1.1% used. This material should not be relied upon Futures 0.1% as sufficient information to support an investment decision. The portfolio data on this factsheet is updated on a quarterly basis. Fund Aim To match as closely as possible, subject to the effect of charges and regulations in force from time to time, the capital performance and net income yield of the FTSE 100 index. The Halifax FTSE 100 Index Tracking Life and Pension funds invest directly into the Halifax FTSE 100 Index Tracking OEIC. Derivatives Sector Breakdown (as at 30/06/2021) may be used for efficient portfolio management purposes only. Consumer Staples 18.4% Financials 17.8% Basic Fund Information Industrials 11.8% Fund Launch Date 29/02/1996 Basic Materials 11.1% Fund Size £10.1m Consumer Discretionary 10.7% Benchmark FTSE 100 Health Care 10.5% ISIN GB0031020992 Energy 9.0% MEX ID H9FTSP Other 4.9% SEDOL 3102099 Utilities 3.2% Manager Name Quantitative Investment Team Telecommunications 2.7% Manager Since 01/04/2005 Top Ten Holdings (as at 30/06/2021) Regional Breakdown (as at 30/06/2021) ASTRAZENECA PLC GBP0.0025 5.9% UNILEVER PLC GBP0.0311 5.7% HSBC HOLDINGS PLC GBP0.005 4.4% DIAGEO -

A Proposal for Regulatory Oversight of Stock Market Index Providers

Benchmarking the World: A Proposal for Regulatory Oversight of Stock Market Index Providers ABSTRACT Wall Street has recently seen a shift from active management, which involves investors or portfolio managers buying and selling stocks, towards passive management, where investors invest in funds that seek to match the returns of an underlying index. As the popularity of index funds has grown, questions have arisen regarding the role of the index providers that produce the underlying indices. Unlike the funds themselves, these providers are largely unregulated, and have considerable discretion to determine the makeup of indices. This wide discretion allows index providers to exercise control over the global investment community since they have the ability to control investors’ exposure to different countries’ markets. The role of index providers also raises concerns about investor transparency and market manipulation in the wake of the 2012 LIBOR manipulation scandal. Recently, efforts have been made to create regulatory frameworks within Europe and on an international scale. This Note argues that the US investment industry should require index providers to register with the Securities and Exchange Commission and to solicit comments from the public through notice-and-comment periods when the providers add new rules or modify existing rules. TABLE OF CONTENTS I. INTRODUCTION ........................................................................ 1192 II. THE RISE OF PASSIVE INVESTING AND THE IMPORTANCE OF STOCK MARKET INDICES ........................................................ -

FTSE UK Index Series Family

Benchmark Statement FTSE UK Index Series Family September 2021 v1.6 FTSE Russell An LSEG Business | FTSE UK Index Series Family This benchmark statement is provided by FTSE International Limited as the administrator of the FTSE UK Index Series Family. It is intended to meet the requirements of EU Benchmark Regulation (EU2016/1011) and the supplementary regulatory technical standards and the retained EU law in the UK (The Benchmarks (Amendment and Transitional Provision) (EU Exit) Regulations 2019) that will take effect in the United Kingdom at the end of the EU Exit Transition Period on 31 December 2020. The benchmark statement should be read in conjunction with the FTSE UK Index Series Ground Rules and other associated policies and methodology documents. Those documents are italicised whenever referenced in this benchmark statement and are included as an appendix to this document. They are also available on the FTSE Russell website (www.ftserussell.com). References to “BMR” or “EU BMR” in this benchmark statement refer to Regulation (EU) 2016/1011 of the European Parliament and of the Council of 8 June 2016 on indices used as benchmarks in financial instruments and financial contracts or to measure the performance of investment funds. References to “DR” in this benchmark statement refer to Commission Delegated Regulation (EU) 2018/1643 of 13 July 2018 supplementing Reguorlation (EU) 2016/1011 of the European Parliament and of the Council with regard to regulatory technical standards specifying further the contents of, and cases where updates are required to, the benchmark statement to be published by the administrator of a benchmark. -

Your Guide Directors' Remuneration in FTSE 250 Companies

Your guide Directors’ remuneration in FTSE 250 companies The Deloitte Academy: Promoting excellence in the boardroom October 2018 Contents Overview from Mitul Shah 1 1. Introduction 4 2. Main findings 8 3. The current environment 12 4. Salary 32 5. Annual bonus plans 40 6. Long term incentive plans 52 7. Total compensation 66 8. Malus and clawback 70 9. Pensions 74 10. Exit and recruitment policy 78 11. Shareholding 82 12. Non-executive directors’ fees 88 Appendix 1 – Useful websites 96 Appendix 2 – Sample composition 97 Appendix 3 – Methodology 100 Your guide | Directors’ remuneration in FTSE 250 companies Overview from Mitul Shah It has been a year since the Government announced its intention to implement a package of corporate governance reforms designed to “maintain the UK’s reputation for being a ‘dependable and confident place in which to do business’1, and in recent months we have seen details of how these will be effected. The new UK Corporate Governance Code, to take effect for accounting periods beginning on or after 1 January 2019, includes some far reaching changes, and the year ahead will be a period of review and change for many companies. Remuneration committees must look at how best to adapt to an expanded remit around workforce remuneration, as well as a greater focus on how judgment is used to ensure that pay outcomes are justified and supported by performance. Against this backdrop, 2018 has been a mixed year in the FTSE 250 executive pay environment. In terms of pay outcomes, the picture is relatively stable. Overall pay levels have fallen for FTSE 250 chief executives and we have seen continued momentum in companies adopting executive alignment features such as holding periods, as well as strengthening shareholding guidelines for executives. -

Bank of England Quarterly Bulletin 2008 Q1

6 Quarterly Bulletin 2008 Q1 Markets and operations This article reviews developments in sterling financial markets since the 2007 Q4 Quarterly Bulletin up to the end of February 2008. The article also reviews the Bank’s official operations during this period. Sterling financial markets(1) Chart 1 Changes in UK equity indices since 2 January 2007 Overview FTSE 100 FTSE 250 There were some signs of improvement in sterling money FTSE All-Share FTSE Small Cap Indices: 2 Jan. 2007 = 100 markets in December and early January, including a more 110 Previous Bulletin orderly year-end period than many market participants had 105 feared. But during February, conditions deteriorated again. While banks were reportedly able to raise very short-term 100 funds — up to around one month — longer-maturity funding markets remained impaired. 95 90 Information from market prices and comments by market participants suggested that difficult conditions in bank term 85 funding markets would continue for some time, which would 80 be likely to lead to a reduction in the supply of credit to the 75 economy generally. This could act as a drag on economic Jan. Mar. May July Sep. Nov. Jan. activity, and in turn could prompt further deterioration in the 2007 08 quality of banks’ assets and limit their ability and willingness Sources: Bloomberg and Bank calculations. to lend. Perhaps consistent with perceptions of possible Chart 2 Selected sectoral UK equity indices(a) adverse feedback effects between banks’ balance sheets and the macroeconomy, UK equity markets fell quite sharply in Mining Banks Oil and gas Real estate January (and became more volatile). -

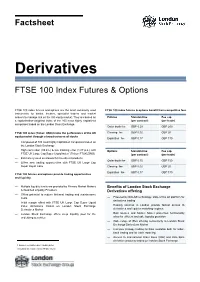

FTSE 100 Index Futures & Options

Factsheet Derivatives FTSE 100 Index Futures & Options FTSE 100 index futures and options are the most commonly used FTSE 100 index futures & options benefit from competitive fees instruments for banks, brokers, specialist traders and market makers to manage risk on the UK equity market. They are based on Futures Standard fee Fee cap a capitalization-weighted index of the 100 most highly capitalized (per contract) (per trade) companies traded on the London Stock Exchange. Order-book fee GBP 0.20 GBP 200 FTSE 100 index (Ticker: UKX) tracks the performance of the UK Clearing fee GBP 0.02 GBP 20 equity market through a broad universe of stocks Expiration fee GBP 0.17 GBP 170 — Composed of 100 most highly capitalized companies traded on the London Stock Exchange — High correlation (99.6%) & low tracking error (1.87 p.a.) with Options Standard fee Fee cap 1 FTSE UK Large Cap Super Liquid index (Ticker: FTUKLSNG) (per contract) (per trade) — Extensively used as a basis for investment products Order-book fee GBP 0.15 GBP 150 — Offers new trading opportunities with FTSE UK Large Cap Super Liquid index Clearing fee GBP 0.02 GBP 20 Expiration fee GBP 0.17 GBP 170 FTSE 100 futures and options provide trading opportunities and liquidity — Multiple liquidity levels are provided by Primary Market Makers Benefits of London Stock Exchange & Qualified Liquidity Providers Derivatives offering — Offers potential to reduce frictional trading and maintenance costs — Powered by SOLA® technology, state of the art platform for derivatives trading — Initial margin