FTSE Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Taylor Woodrow Plc Report and Accounts 2006 Our Aim Is to Be the Homebuilder of Choice

Taylor Woodrow plc Report and Accounts 2006 Our aim is to be the homebuilder of choice. Our primary business is the development of sustainable communities of high-quality homes in selected markets in the UK, North America, Spain and Gibraltar. We seek to add shareholder value through the achievement of profitable growth and effective capital management. Contents 01 Group Financial Highlights 54 Consolidated Cash Flow 02 Chairman’s Statement Statement 05 Chief Executive’s Review 55 Notes to the Consolidated 28 Board of Directors Financial Statements 30 Report of the Directors 79 Independent Auditors’ Report 33 Corporate Governance Statement 80 Accounting Policies 37 Directors’ Remuneration Report 81 Company Balance Sheet 46 Directors’ Responsibilities 82 Notes to the Company Financial Statement Statements 47 Independent Auditors’ Report 87 Particulars of Principal Subsidiary 48 Accounting Policies Undertakings 51 Consolidated Income Statement 88 Five Year Review 52 Consolidated Statement of 90 Shareholder Facilities Recognised Income and Expense 92 Principal Taylor Woodrow Offices 53 Consolidated Balance Sheet Group Financial Highlights • Group revenues £3.68bn (2005: £3.56bn) • Housing profit from operations* £469m (2005: £456m) • Profit before tax £406m (2005: £411m) • Basic earnings per share 50.5 pence (2005: 50.6 pence) • Full year dividend 14.75 pence (2005: 13.4 pence) • Net gearing 18.6 per cent (2005: 23.7 per cent) • Equity shareholders’ funds per share 364.7 pence (2005: 338.4 pence) Profit before tax £m 2006 405.6 2005 411.0 2004 403.9 Full year dividend pence (Represents interim dividends declared and paid and final dividend for the year as declared by the Board) 2006 14.75 2005 13.4 2004 11.1 Equity shareholders’ funds per share pence 2006 364.7 2005 338.4 2004 303.8 * Profit from operations is before joint ventures’ interest and tax (see Note 3, page 56). -

Disclaimer Strictly Not to Be Forwarded to Any

DISCLAIMER STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS IMPORTANT: You must read the following disclaimer before reading, accessing or making any other use of the attached document relating to SEGRO plc (the “Company”) dated 10 March 2017. In accessing the attached document, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached document is confidential and intended for you only and you agree you will not forward, reproduce, copy, download or publish this electronic transmission or the attached document (electronically or otherwise) to any other person. The attached document has been prepared solely in connection with the proposed rights issue and offering of nil paid rights, fully paid rights and new ordinary shares (the “Securities”) of the Company (the “Transaction”). The Prospectus has been published in connection with the admission of the Securities to the Official List of the UK Financial Conduct Authority (the ‘‘Financial Conduct Authority’’) and to trading on the London Stock Exchange plc’s main market for listed securities (together, ‘‘Admission’’). The Prospectus has been approved by the Financial Conduct Authority as a prospectus prepared in accordance with the Prospectus Rules made under section 73A of the Financial Services and Markets Act 2000, as amended. NOTHING IN THIS ELECTRONIC TRANSMISSION AND THE ATTACHED DOCUMENT CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. -

The Taylor Wimpey Difference

Annual Report and Accounts 2019 Difference The Taylor Wimpey Taylor Wimpey plc Annual Report and Accounts 2019 www.taylorwimpey.co.uk Taylor Wimpey plc is a customer-focused residential developer building and delivering homes and communities across the UK and in Spain. Our Company purpose is to deliver new homes within thriving communities, in a safe and environmentally responsible manner, with customers at the heart of our decision making and consideration of the potential impact on wider stakeholders. Contents Strategic report Financial statements Connect with us 1 The Taylor Wimpey difference 140 Independent auditor’s report There are several ways you can get in 12 Investment case 148 Consolidated income statement touch with us or follow our news. 14 Chair’s statement 149 Consolidated statement of www.taylorwimpey.co.uk/corporate 17 Group Management Team Q&A comprehensive income 18 UK market review 150 Consolidated balance sheet www.twitter.com/taylorwimpeyplc 22 Chief Executive’s letter 151 Consolidated statement of changes in equity 24 Our strategy and www.linkedin.com/company/taylor-wimpey key performance indicators 152 Consolidated cash flow statement 30 Our business model 153 Notes to the consolidated financial statements 32 Making a difference for our stakeholders Navigating this report 183 Company balance sheet 44 Non-financial information statement The icons below help to signpost where you 184 Company statement of changes 45 Our approach to identifying and can find more information. in equity managing risk 185 Notes to the -

Building Excellence

Barratt Developments PLC Building excellence Annual Report and Accounts 2017 Annual Report and Accounts 2017 Inside this report 1 45 113 175 Strategic Report Governance Financial Statements Other Information 1 Key highlights 46 The Board 114 Independent Auditor’s Report 175 KPI definitions and why we measure 2 A snapshot of our business 48 Corporate governance report 119 Consolidated Income Statement 176 Glossary 4 Our performance and financial highlights 60 Nomination Committee report 119 Statement of Comprehensive Income 177 Other Information 6 How we create and preserve value 65 Audit Committee report 120 Statement of Changes in 8 Chairman’s statement 74 Safety, Health and Environment Shareholders’ Equity – Group 10 Key aspects of our market Committee report 121 Statement of Changes in 76 Remuneration report Shareholders’ Equity – Company 12 Chief Executive’s statement Notice regarding limitations on Directors’ liability under 106 Other statutory disclosures 122 Balance Sheets English law 17 Our Strategic priorities Under the Companies Act 2006, a safe harbour limits the 112 Statement of Directors’ 123 Cash Flow Statements liability of Directors in respect of statements in, and omissions from, the Strategic Report contained on pages 1 to 44 and the Our principles Responsibilities 124 Notes to the Financial Statements Directors’ Report contained on pages 45 to 112. Under English Law the Directors would be liable to the Company (but not to 34 Keeping people safe any third party) if the Strategic Report and/or the Directors’ Report contains errors as a result of recklessness or knowing 35 Being a trusted partner misstatement or dishonest concealment of a material fact, 36 Building strong but would not otherwise be liable. -

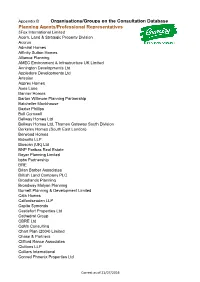

Organisations/Groups on the Consultation Database Planning

Appendix B Organisations/Groups on the Consultation Database Planning Agents/Professional Representatives 3Fox International Limited Acorn, Land & Strategic Property Division Acorus Admiral Homes Affinity Sutton Homes Alliance Planning AMEC Environment & Infrastructure UK Limited Annington Developments Ltd Appledore Developments Ltd Artesian Asprey Homes Axes Lane Banner Homes Barton Willmore Planning Partnership Batcheller Monkhouse Baxter Phillips Bell Cornwell Bellway Homes Ltd Bellway Homes Ltd, Thames Gateway South Division Berkeley Homes (South East London) Berwood Homes Bidwells LLP Bioscan (UK) Ltd BNP Paribas Real Estate Boyer Planning Limited bptw Partnership BRE Brian Barber Associates British Land Company PLC Broadlands Planning Broadway Malyan Planning Burnett Planning & Development Limited Cala Homes Calfordseaden LLP Capita Symonds Castlefort Properties Ltd Cathedral Group CBRE Ltd CgMs Consulting Chart Plan (2004) Limited Chase & Partners Clifford Rance Associates Cluttons LLP Colliers International Conrad Phoenix Properties Ltd Correct as of 21/07/2016 Conrad Ritblat Erdman Co-Operative Group Ltd., Countryside Strategic Projects plc Cranbrook Home Extensions Crest Nicholson Eastern Crest Strategic Projectsl Ltd Croudace D & M Planning Daniel Watney LLP Deloitte Real Estate DHA Planning Direct Build Services Limited DLA Town Planning Ltd dp9 DPDS Consulting Group Drivers Jonas Deloitte Dron & Wright DTZ Edwards Covell Architecture & Planning Fairclough Homes Fairview Estates (Housing) Ltd Firstplan FirstPlus Planning Limited -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

The Vale of Glamorgan Council Joint Housing Land

THE VALE OF GLAMORGAN COUNCIL JOINT HOUSING LAND AVAILABILITY STUDY 2014 BETWEEN THE VALE OF GLAMORGAN COUNCIL AND, THE HOME BUILDERS FEDERATION, BARRATT HOMES, HAFOD, NEWYDD HOUSING ASSOCIATION, PERSIMMON HOMES, REDROW HOMES & TAYLOR WIMPEY. July 2014 CONTENTS 1 Summary 2 Housing Land Supply 3 Commentary 4 Monitoring data Appendix 1 - Site Schedules Appendix 2 - Past Completions Data Appendix 3 - Previous Land Supply Data 1.0 SUMMARY 1.1 This is the Vale of Glamorgan Joint Housing Land Availability Study for 2014 which presents the housing land supply for the area at the base date of 1st April 2014. It replaces the report for the previous base date of 1st April 2013. 1.2 The JHLAS has been prepared in accordance with the requirements of Planning Policy Wales, Technical Advice Note 1 (TAN 1) and the Guidance Note on the JHLAS process (September 2012), and Welsh Government Clarification Letter (November 2013). Please refer to these documents for details of the requirements for the maintenance of a five year housing land supply in each Local Planning Authority area and the process for undertaking the JHLAS. This document can be accessed on the Welsh Government web site using the following link: http://wales.gov.uk/topics/planning/planningstats/housing-land- availability- in-wales/?lang=en 1.3 Section 2 sets out details of the housing land supply and how it has been calculated. It shows that based on the past building rates method set out in TAN 1; this indicates that the Vale of Glamorgan has a 7.3 year housing land supply. -

Berkeley Group Holdings Plc (BKG:LN)

Berkeley Group Holdings Plc (BKG:LN) Consumer Discretionary/Home Construction Price: 4,751.00 GBX Report Date: September 3, 2021 Business Description and Key Statistics Berkeley Group Holdings is a holding company. Through its Current YTY % Chg subsidiaries, Co. is engaged in residential-led mixed use development and ancillary activities. Co. builds homes and Revenue LFY (M) 2,202 14.7 communities across London, Birmingham and the EPS Diluted LFY 0.72 6.1 South-East of England. Market Value (M) 26,684 Shares Outstanding LFY (000) 561,659 Book Value Per Share 5.65 EBITDA Margin % 23.10 Net Margin % 19.6 Website: www.berkeleygroup.co.uk Long-Term Debt / Capital % 8.6 ICB Industry: Consumer Discretionary Dividends and Yield TTM 1.16 - 2.44% ICB Subsector: Home Construction Payout Ratio TTM % 100.0 Address: Berkeley House;19 Portsmouth Road Cobham 60-Day Average Volume (000) 455 GBR 52-Week High & Low 4,943.00 - 4,001.00 Employees: 2,627 Price / 52-Week High & Low 0.96 - 1.19 Price, Moving Averages & Volume 4,990.1 4,990.1 Berkeley Group Holdings Plc is currently trading at 4,751.00 which is 1.1% below its 50 day 4,860.6 4,860.6 moving average price of 4,804.42 and 3.2% above its 4,731.0 4,731.0 200 day moving average price of 4,603.30. 4,601.5 4,601.5 BKG:LN is currently 3.9% below its 52-week high price of 4,943.00 and is 18.7% above 4,472.0 4,472.0 its 52-week low price of 4,001.00. -

JUBILEE MILL APARTMENTS Nature Isn’T Just Beautiful, Even in Small Doses It Changes the Way We Feel

JUBILEE MILL APARTMENTS Nature isn’t just beautiful, even in small doses it changes the way we feel The River Thames on your doorstep Welcome to Jubilee Mill, a collection of impressive wharf-style apartments that form part ofthe exciting new Taplow Riverside development. The two and three bedroom apartments and penthouses are situated in an idyllic riverside setting only a short walk from thriving Maidenhead. Set amongst beautiful landscaped parkland, in a highly sought-after location between the Thames and Jubilee Rivers, this really is luxury living at its best. CONTENTS 06 __________________________________ SITE PLAN 30 ______________________________ SPECIFICATION 09 ______________________________ LANDSCAPING 32 ____________________ PENTHOUSE FLOORPLANS 11 ___________________________________ INTERIORS 33 _____________________________________ NO. 150 19 ________________________________ FLOORPLANS 34 ______________________________________NO. 151 20 _____________________________________ NO. 127 35 _____________________________________ NO. 152 21 ______________________________________ NO. 128 36 _______ PENTHOUSE SPECIFICATION FOR NO. 150 22 _______________________________ NOs. 129 & 130 38 __ PENTHOUSE SPECIFICATION FOR NOs. 151 & 152 23 ______________________________________NO. 131 43 ________________ SUSTAINABILITY AT ITS HEART 24 ______________________________________ NO.132 44 ______________________ BUY WITH CONFIDENCE 25 _____________________ NOs. 133, 134, 141, 142 & 149 46 __________________________ DESIGNED FOR LIFE 26 ________________________ -

Taylor Wimpey & Barratt Homes Henthorn Road, Clitheroe

Taylor Wimpey & Barratt Homes Henthorn Road, Clitheroe Sustainability & Energy Statement December 2012 Ref: 2012-103-009a Taylor Wimpey & Barratt Homes Henthorn Road, Clitheroe Sustainability & Energy Statement December 2012 Ref: 2012-103-009a Authorised for and on behalf NJL Consulting LLP Rob White Adamson House Partner Towers Business Park This report takes into account the particular instructions and Wilmslow Road requirements of our client. It is not intended for and should not be Manchester relied upon by any third party. Any such party relies on this report at M20 2YY Tel: 0845 362 8202 their own risk. Fax: 0870 130 5579 [email protected] © Report copyright of NJL Consulting LLP www.njlconsulting.co.uk Taylor Wimpey & Barratt Homes Sustainability & Energy Statement Contents 1.0 Introduction .................................................................................................................................. 2 2.0 Planning Policy Compliance ........................................................................................................ 5 3.0 CSH Sustainability Assessment .................................................................................................. 8 4.0 Energy Assessment .................................................................................................................. 18 5.0 Conclusion ................................................................................................................................. 25 Appendix A – Local Policies Appendix B - Code for -

Annual Report 2020

Berkeley Group 2020 Annual Report Building homes Strengthening communities Improving lives 2020 Annual Report Tony Pidgley CBE, 1947–2020 Since the issue of Berkeley’s results for the year ended 30 April 2020 we have with the greatest sadness announced the death of our founder and Chairman Tony Pidgley CBE. Tony’s values, vision and philosophy are deeply embedded within Berkeley and all it does and stands for. The 2020 Annual Report reflects Tony’s lifelong passion for creating quality homes, strengthening local communities and improving people’s lives. Berkeley at a Glance Berkeley builds homes and communities across London, Birmingham and the South-East of England. We focus on large-scale regeneration developments where our unique expertise and strong capital base can unlock long-term social and economic value for our stakeholders. We are a purpose driven company, with a clear long-term vision and deeply embedded culture and values that shape everything we do, underpinning our success, our brand and the positive contributions we make to society, the economy and the natural world. Our Purpose is to build quality homes, Our Values strengthen communities and improve Have Integrity – build trust by being people's lives. open, clear and credible Our Vision is to be a world-class Be Passionate – take pride in what business, defined by the quality of the we do and the impact we make places we create, generating long-term value and having a positive impact Think Creatively – find individual on society. solutions for every site and situation