Fintech Sector and M&A Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Debt Equity M&A

CAPITALIZE ON OUR CONNECTIONS. Cambridge Wilkinson is a leading global investment Debt bank with a focus on middle market companies. Equity SPEED – When you need additional capital, or an M&A opportunity arises, every day counts. An optimized capital structure can help reduce risk and create significant value. Otherwise opportunities could pass you by, your cost of capital may not be competitive, M&A or you may lack sufficient liquidity to weather periods of volatility. You need our nimble approach and speed to market to complete an acquisition, refinance, expand your product line, or capitalize for growth. CONNECTIONS – Completing transactions quickly requires a highly targeted cambridgewilkinson.com approach, knowing who to go to, and who is the best fit. We have a network build over 1-646-582-9423 decades of successful transactions which includes bank and alternative lenders, credit funds, large family offices, institutional investors, private equity, offshore relationships, and strategic and financial buyers and sellers. With deep transaction experience and deep All securities assignments are completed sector expertise, we have established relationships throughout many industries. through Avalon Securities, Ltd. a FINRA and SEC registered broker-dealer. CONFIDENCE – You get senior-level attention and the confidence that comes from a proven track record of optimizing transactions and capital structures, delivering on promises and looking out for our clients’ best interests. Our leadership team brings diverse perspectives gained from a wide range of experience in investment banking, corporate finance, and family office as well as building and owning specialty finance companies. Drawing from decades of relentless pursuit of total client satisfaction, we provide an unwavering commitment to our clients, assuring them they have the highest level of attention, focus and expert services available. -

Final Report

FINAL REPORT Road Map to Green Funding of LCBA Bankable Proposals for SMEs Non Key Expert Gustavo Pimentel, Managing Director [email protected] | +55 (21) 2247-1136 SITAWI Finance for Good 04 February 2017 Index 1. Introduction ........................................................................................................ 2 2. Overview of Financial Instruments Related to Green Funding ............................ 3 2.1 General Context ............................................................................................... 3 2.2 European Context ............................................................................................ 5 2.3 Brazilian Context .............................................................................................. 8 2.4 Types of Bankable Transactions ...................................................................... 8 2.5 Types of Funding ............................................................................................. 9 2.6 Matrix of Funding Possibilities per Type of Transaction ................................. 10 3. Green Funding Instruments and Conditions ..................................................... 24 3.1 Brazilian Institutions ....................................................................................... 24 3.2 International Institutions ................................................................................. 29 4. Road Map Template ......................................................................................... 12 5. Conclusions -

The Rise of Boutique Investment Banks in India Suveen K

Print Close The rise of boutique investment banks in India Suveen K. Sinha June 27, 2012 {table}It was amusing to see my host, a man of about 40, dressed in a white shirt with two front pockets, with flaps. Didn't those things go out with tail fins on cars? Useless paraphernalia. Not quite, it turned out. When the time came to pay the bill for our lunch, my host - MH for short; it would be tactless to name him - did not reach for his wallet in the back pocket. Instead, he undid a flap in front and took out a wad of currency notes. "We have not yet spent all of the fees we earned the last time," he said with a disarming smile. And thereby hangs a tale. A few months ago, a man in his fifties climbed up the steps to MH's office, caught his breath, put a satchel on the table and said: "Here." The satchel was packed with Rs 25 lakh in cash. MH had raised some working capital for this man's small business and he, brimming with gratitude, had come to pay the fees. {table}MH did not expect cash, but recovered quickly and told the client to come back after two days. When the client came back, MH simply kept the satchel. The client, unable to contain his curiosity, asked what had changed. Vipul Shah (L) and Mehul Savla | RippleWave Beginning: July 2008 | First meaningful deal: May 2010 | No. of significant deals: 3 | Value: Rs 650 crore | Size of the team: 4 Two things had. -

What's the Fastest Growing Investment Bank in Europe?

WHAT’S THE FASTEST GROWING INVESTMENT BANK IN EUROPE? The Answer Might Surprise You. Over the past four years, Houlihan Lokey has been growing all over the world. From Europe to the Middle East to Australia, we have steadily added offices, new business lines, and talented financial professionals to expand our comprehensive suite of services for clients around the globe—regularly topping league tables and winning coveted industry awards along the way. But we’re most excited about our expansion in Europe, particularly in corporate finance where the pace of our growth has been nothing less than remarkable. It’s all part of our mission to be the clear leader across all of our products and services—not just in the U.S., but everywhere we operate. 1 Unprecedented Growth in Europe 175 155 6X Bankers Mandates Increase in the number of dedicated More than 750% growth in 4 years More than 740% increase over 5 years financial sponsor coverage officers in Europe since 2016 Significant €7B 4 Acquisitions Committed debt financing arranged McQueen, Leonardo & Co., Quayle over the past 2 years Munro, and BearTooth since 2014 A simple goal: To be No. 1 in all businesses and markets. Our corporate finance growth strategy in Europe and around the world is simple: To replicate our decades-long leadership in financial restructuring, establishing Houlihan Lokey as the leading corporate finance advisor and the leading financial restructuring advisor in every single market. It is doubtless a tall order. With more than 200 professionals, our Financial Restructuring + business is the largest of its kind among any investment banking firm in the world, having advised 200 on more than 1,000 transactions over the past three decades with aggregate debt claims in Financial excess of $2.5 trillion. -

Global Finance Names the World's Best Investment Banks 2020

Global Finance Names The World’s Best Investment Banks 2020 NEW YORK, February 10, 2020 – Global Finance magazine has named the 21st annual World’s Best Investment Banks in an exclusive survey to be published in the April 2020 issue. Winning organizations will be honored at an awards ceremony on the evening of March 26 at Sea Containers London. J.P. Morgan was honored as the Best Investment Bank in the world for 2020. About Global Finance “Investment banking is a critical factor driving global growth. Global Finance’s Best Global Finance, founded in Investment Bank awards identify the financial institutions that deliver innovative and 1987, has a circulation of practical solutions for their clients in all kinds of markets,” said Joseph D. Giarraputo, 50,000 and readers in 188 publisher and editorial director of Global Finance. countries. Global Finance’s audience includes senior Global Finance editors, with input from industry experts, used a series of criteria— corporate and financial including entries from banks, market share, number and size of deals, service and officers responsible for making investment and strategic advice, structuring capabilities, distribution network, efforts to address market decisions at multinational conditions, innovation, pricing, after-market performance of underwritings and companies and financial market reputation—to score and select winners, based on a proprietary algorithm. institutions. Its website — Deals announced or completed in 2019 were considered. GFMag.com — offers analysis and articles that are the legacy For editorial information please contact Andrea Fiano, editor: [email protected] of 33 years of experience in international financial markets. Global Finance is headquartered in New York, with offices around the world. -

Global Finance Names the World's Best Investment Banks 2021

Global Finance Names The World’s Best Investment Banks 2021 NEW YORK, February 18, 2021– Global Finance magazine has named the 22nd annual World’s Best Investment Banks in an exclusive survey to be published in the April 2021 print and digital editions and online at GFMag.com. J.P. Morgan was honored as the Best Investment Bank in the World for 2021. “With widespread expectations of consolidation in multiple sectors and all around the About Global Finance world, investment banks will play a leading role in reshaping the world economy post- Global Finance, founded in pandemic,” said Joseph D. Giarraputo, publisher and editorial director of Global Finance. 1987, has a circulation of “Companies need more than ever to understand the specialties and skills that investment 50,000 and readers in 191 bank brings to the table. Global Finance awards are a valuable guide.” countries. Global Finance’s audience includes senior Global Finance editors, with input from industry experts, used a series of criteria— corporate and financial including entries from banks, market share, number and size of deals, service and officers responsible for making advice, structuring capabilities, distribution network, efforts to address market conditions, investment and strategic innovation, pricing, after-market performance of underwritings and market reputation— decisions at multinational companies and financial to score and select winners, based on a proprietary algorithm. Deals announced or institutions. Its website — completed in 2020 were considered. GFMag.com — offers analysis and articles that are the legacy For editorial information please contact Andrea Fiano, editor: [email protected] of 34 years of experience in international financial GLOBAL WINNERS markets. -

WST Overview

Wall Street Training & Advisory, Inc. (WST) Corporate Overview © 2021 Wall Street Training & Advisory, Inc. Agenda 1 What Makes WST Different 2 Our Philosophy: Training+ 3 Training Methodology & Platforms 4 Advisory & Capital Markets 5 Our Instructors wallst.training © 2021 Wall Street Training & Advisory, Inc. 2 What Makes WST Different wallst.training © 2021 Wall Street Training & Advisory, Inc. 3 WST: Founded to Standardize Best Practices Today’s Challenge • Professionals need to constantly refine and hone their skills, and validate that their approach is still relevant. • Top students exit the academic world without much practical knowledge, leaving a void during an era when finance needs some of the world’s brightest minds. Our mission is to bridge the gap between academic theory and on-the-job training via hands-on financial modeling training solutions, allowing market participants to make better informed decisions. wallst.training © 2021 Wall Street Training & Advisory, Inc. 4 Leveraging Technology and Our Competitive Advantage …to engage and sparkle delights during the journey. 10+ 20K 20+ 100 10+ 200 10+ years of More than 20,000 Live training in Over 100 in-house Designated Hours of online proven track participants 20+ cities corporate clients partner of 10+ self-study record trained worldwide globally professional content bodies Need CPE/CPT? Get Certified! Looking for Advice? Ready for Change? Rebranded Wall Street Public Seminar WST Certification WST Support Forum Career Advisory Training & Advisory Public, open-enrollment Earn our official seal of Ongoing online Custom tailored one-on-one WST officially rebranded seminars conducted approval indicating that support and career coaching to help to reflect greater internationally in key you have a solid grasp of discussions to develop a career path that is corporate identity and financial markets. -

The Annual General Meeting of Lucas Bols N.V. Thursday 9 July 2020 14.00 CET Paulus Potterstraat 14 1071 CZ Amsterdam the Nether

The annual general meeting of Lucas Bols N.V. Thursday 9 July 2020 14.00 CET Paulus Potterstraat 14 1071 CZ Amsterdam The Netherlands 1 CONVOCATION Dear Shareholder, We have the pleasure of inviting you to the annual general meeting of Lucas Bols N.V. (Lucas Bols or Company), to be held at 14.00 CET on Thursday 9 July 2020 at the head office of the Company at Paulus Potterstraat 14, 1071 CZ Amsterdam, the Netherlands. Due to the Dutch measures and recommendations relating to the coronavirus (COVID-19), shareholders cannot attend the annual general meeting in person. The Company facilitates its shareholders who wish to participate in the meeting by providing a live audio-webcast. The Company urges the shareholders to cast their votes by proxy or alternatively via the electronic voting system. This invitation has to be read in conjunction with the following documents: 1. Agenda 2. Explanatory notes to agenda 3. General information 4. Annual report 2019/20 Lucas Bols N.V. the Management Board Amsterdam, 28 May 2020 2 1. AGENDA 1. Opening 2. Annual report 2019/20 3. Financial statements 2019/20 (a) Implementation of the remuneration policy in financial year 2019/20 (for advice by vote) (b) Adoption of the annual accounts 2019/20 (voting item) (c) Dividend policy 4. Discharge (a) Discharge from liability of members of the Management Board for the performance of their duties in financial year 2019/20 (voting item) (b) Discharge from liability of members of the Supervisory Board for the performance of their duties in financial year 2019/20 (voting item) 5. -

Preparing for a Strategic Exit Your Guide to Unlocking a Lifetime of Work

Preparing for a strategic exit Your guide to unlocking a lifetime of work UBS Business Development Group Managing toward your future Today’s business environment is more complex than ever before, with advances in technology, globalization, changes to tax and regulatory frameworks and new competitors seemingly arising every day. Like all successful businesses, family-owned and entrepreneur-led businesses need to combine their passion, culture and long-term vision with a streamlined decision-making process and still drive profits to the bottom line. At the same time, family-owned and entrepreneur-led businesses face a range of additional challenges when it comes to planning the transition of ownership to the next generation or a management team, as well as the impact such a transition may have on their personal lives, the lives of their employees and their local community. For those thinking about potential The earlier you start to plan your about how to better prepare for your next steps with their business— transition strategy, the better the exit strategy. At UBS, we have a long whether it’s a transition from one outcome will be, even if it is history of helping businesses and generation to the next or an outright many years in the future. entrepreneurs through this process. sale to a third party—decisions are We routinely collaborate with often based on a variety of personal, In this report, we explore some business owners to design effective business-specific, industry and important considerations to think transition strategies. When it comes economic factors. Though many about when planning for the future to your complex needs, we can help business owners and entrepreneurs of your business. -

Wealth Management | Global After the Storm Covid 19 Has Permanently Changed the Way Wealth Managers Deliver Advice and Serve Their Clients

M BLUEPAPER Wealth Management | Global After the Storm Covid 19 has permanently changed the way Wealth Managers deliver advice and serve their clients. To drive outperformance over the next 5+ years, firms should double down on technology investments, strategically cut costs, build differentiated product offerings and consider inorganic opportunities. Oliver Wyman is a global leader in management consulting. For more information, visit www.oliverwyman.com. Oliver Wyman is not authorized or regulated by the PRA or the FCA and is not providing investment advice. Oliver Wyman authors are not research analysts and are neither FCA nor FINRA registered. Oliver Wyman authors have only contributed their expertise on business strategy within the report. Oliver Wyman’s views are clearly delineated. The securities and valuation sections of this report are the work of Morgan Stanley only and not Oliver Wyman. For disclosures specifically pertaining to Oliver Wyman, please see the Disclosure Section located at the end of this report. Morgan Stanley does and seeks to do business with companies covered in Morgan Stanley Research. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of Morgan Stanley Research. Investors should consider Morgan Stanley Research as only a single factor in making their investment decision. M BLUEPAPER Authors MORGAN STANLEY OLIVER WYMAN Betsy L. Graseck, CFA1 Kai Upadek EQUITY ANALYST PARTNER +1 212 761 8473 +44 20 7852 7657 [email protected] [email protected] Magdalena L Stoklosa, CFA2 Christian Edelmann EQUITY ANALYST PARTNER +44 20 7425 3933 +44 20 7852 7557 [email protected] [email protected] Nick Lord3 Bradley Kellum EQUITY ANALYST PARTNER +65 6834 6746 +1 646 364 8425 [email protected] [email protected] Michael J. -

2021The World's Leading Islamic Finance News Provider

COMPLIMENTARY COPY The World’s Leading Islamic Finance News Provider 2021 ANNUAL GUIDE London Dubai (DIFC) Kuala Lumpur Intermediary services & systems solutions to connect the global Islamic financial market responsibly Winner of Best Interbroker – Islamic Finance News Service Providers Awards 2019 DD&Co Limited DDGI Limited ETHOS AFP™ Sharia’a Compliant Markets Direct Investments & Strategic Award Winning Automated Trade Asset Commodity Facilitation Partnerships including and Post Trade Services Platform DDCAP Group’s award winning automated trade & post trade services platform. Risk Mitigation, Facilitator of Islamic Deal Full Straight Through Governance & Financial Connect powered Processing with Real Time Control Capability by Documentation Full member of: www.ddcap.com PREFACE The storm shall pass EDITORIAL Vineeta Tan – Managing Editor Volatility is built into the DNA of the financial markets and while we may embrace and [email protected] live by this truth, nothing could have prepared us for what 2020 unleashed. Lauren McAughtry – Contributing Editor To say that the COVID-19 pandemic ground the world to a halt is perhaps not an [email protected] overstatement. Economies paralyzed, borders shut, governments scrambling to find a Sasikala Thiagaraja – Senior Contributions Editor solution as the number of infectious cases and deaths continued to climb – such chaos at [email protected] such a scale, is unprecedented. Kenny Ng – Senior Copy Editor [email protected] One year on since the coronavirus bared its fangs, we are still navigating this “new” normal, with many still hoping to return to pre-pandemic normalcy – although that is unlikely, at Nessreen Tamano – News Editor least not for a few years as the damage caused has been so severe. -

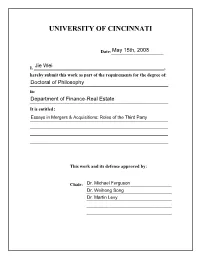

University of Cincinnati

UNIVERSITY OF CINCINNATI Date:___________________ I, _________________________________________________________, hereby submit this work as part of the requirements for the degree of: in: It is entitled: This work and its defense approved by: Chair: _______________________________ _______________________________ _______________________________ _______________________________ _______________________________ Essays in Mergers and Acquisitions: Roles of the Third Party A dissertation submitted to the Graduate School of the University of Cincinnati In partial fulfillment of the requirements for the degree of Doctoral of Philosophy In the Department of Finance-Real Estate College of Business By Jie Wei B.S., Wuhan University, 1997 M.S., University of California, Los Angeles, 2002 Committee Chair: Michael Ferguson, Ph.D. May 2008 Abstract Merger and Acquisition market is a very active section of the financial market, involving multi-trillion dollar businesses every year. Extensive research has been done on this field, mostly focusing on the two parties of the trade, namely the acquirer and the target. However, the third party like deal advisors and risk arbitrageurs play very important roles in these transactions too. They not only get directly involved by negotiating the price and the terms, but also indirectly influence deal outcomes and facilitate price discovery by trading both party’s equities. In the first part of this study, we focus on risk arbitrageurs. They participate the M&A games by providing the target shareholders a safe exit and make money from the P − P speculative spread ( offer +1 ). But if and why risk arbitrageurs earn risk adjusted P+1 excess returns is a big unanswered question in the M&A literature. Our empirical study shows that deal characteristics, as well as market conditions affect risk arbitrageur’s return.