Annual Report 2018 - 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Observational Study on Financial Jungle with Sharekhan As Your Guide

SUMMER TRAINING PROJECT REPORT SHAREKHAN LTD. Submitted in partial fulfillment of the requirement of Bachelor of Business Administration (BBA) Guru Jambeshwar University, Hissar AN OBSERVATIONAL STUDY ON FINANCIAL JUNGLE WITH SHAREKHAN AS YOUR GUIDE Training Supervisor Submitted By: MR. RAVI VERMA ANUJ DIWAKAR (AREA ASSISTANT MANAGER) (2007-2010) ROLL NO: 07511242131 Session (2007-2010) GURU JAMBESHWAR UNIVERSITY HISSAR-125001 PREFACE No professional curriculum is considered complete without work experience. It is well evident that work experience is an indispensable part of every professional course. In the same manner practical work in any organization is must for each an every individual, who is undergoing management course. Without the practical exposure one cannot consider himself as a qualified capable manager. Entering in the organization is like stepping into altogether a new world. At first, everything seems strange and unheard but as the time passes one can understand the concept and working of the organization thereby develop professional relationship. Initially I felt that as if classroom study was irrelevant and it is useless in any working concern. But gradually I realized that all fundamental basic concepts studied are linked in one or in another way to the organization. But how and what can be done with fundamentals, depend upon the intellectual and applicability skills of an individual. During my summer training, a specific customer survey was assigned to me which helped me to have a full market exposure. This project helped me to understand and cope up with different types of people and there diversified opinions or needs. ACKNOWLEDGEMENT The completion of my summer training and project would not have been possible without the constant and timely encouragement of MR. -

LSE SECURITIES LIMITED Registered Office : SCO 50-51, 1St Floor, Sector 34-A, Chandigarh-160022

1. Company Details 2 2. Notice 3 3. Directors' Report 5 4. Auditors' Report 10 5. Annexure to Auditors' Report 11 6. Balance Sheet 13 7. Profit & Loss Account 14 8. Notes Forming Part of Balance Sheet 15 9. Notes to Financial Statements 20 10. Proxy 31 Venue 13th Annual General Meeting At Hotel Park View, Sector 24, Near Indira Holiday Home, Chandigarh. 1 COMPANY DETAILS Mr. Vishal Goomber Chairman Mr. Pritpal Singh Chief General Manager Mr. Vijay Singhania Vice Chairman Ms. Ashima Arora Company Secretary Mr. Munish Sood Member Mr. Madhur Gupta HOD - IT Mr. Lalit Kishore Member Mr. Vinay Mahajan HOD - DP Mr. Sukhjiwan Rai Member Ms. Amanpreet Kaur HOD - Accounts - I Mr. Ajay Chaudhry Public Representative Director Mr. Vipen Goyal HOD - Clearing & Sett. Dr. Rakesh Kumar Gupta Public Representative Director Mr. Ravinder S. Saini HOD - Accounts - II Mr. Vinesh Kumar Public Representative Director Ms. Sonia Makkar HOD - KYC Mr. Ashish Aggarwal Public Representative Director Mr. Rajinder Pal Singh HOD - Margin Dr. Prem Kumar Public Representative Director Mr. Pawan Bhardwaj HOD - Membership Mrs. Pooja M. Kohli LSE Representative Director Ms. Paramjeet Kaur HOD - Surveillance & HR Registered Office : Corporate Office : SCO-50-51, 1st Floor, Sector 34-A, 1st Floor, Ludhiana Stock Exchange Bldg., Chandigarh-160 022 Feroze Gandhi Market, Ludhiana-141 001 Tele No. : 0172-3258091 Tele No. : 0161-3011158, 5021018 Statutory Auditors : Internal Auditors : M/s. Anoop K. Goel & Co. M/s. R.K. Deepak & Co. Add: 152H, Lane 3, Adj. Jassal Engg. 527-R, 2nd Floor, Citi Tower, GTB Nagar, Chandigarh Road, Model Town, Ludhiana-141 002 Ludhiana-141 010 Trading cum Clearing Member : Depository Participants : National Stock Exchange of India Limited National Securities Depository Ltd. -

Statement of Additional Information (Sai)

STATEMENT OF ADDITIONAL INFORMATION (SAI) 1903, B-Wing, Parinee Crescenzo, G-Block, Bandra Kurla Complex, Bandra East, Mumbai - 400 051 Tel: (022) 66578282 Fax: (022) 22042701 E-mail: [email protected] Website: www.tatamutualfund.com Corporate Identity Number: TAML - U65990-MH-1994-PLC-077090, TTCL - U65991-MH-1995-PLC-087722 STATEMENT OF ADDITIONAL INFORMATION (SAI) Sr. No. Table of Contents Page No. I. INFORMATION ABOUT SPONSORS, AMC AND TRUSTEE COMPANIES 1 A. Constitution of Mutual Fund 1 B. Sponsors 1 C. Trustee 2 D. Asset Management Company 4 E. Service Providers 12 II. CONDENSED FINANCIAL INFORMATION 13 III. HOW TO APPLY 28 IV. RIGHTS OF UNITHOLDERS OF THE SCHEME 47 V. INVESTMENT VALUATION NORMS FOR SECURITIES & OTHER ASSETS 47 VI. TAX & LEGAL & GENERAL INFORMATION 58 A. Tax on Investing in Mutual Fund 58 B. Legal Information 66 C. General Information 71 Version 17 TATA MUTUAL FUND VALUATION POLICY As per SEBI Regulation / Guidelines, Tata Asset Management Limited (TAML) has adopted the below mentioned Valuation Policy for valuation of investment securities. I EQUITY / EQUITY RELATED SECURITIES A Equity Shares 1. Traded Securities: For the purpose of valuation, TAML has adopted National Stock Exchange (NSE) as the Primary Stock Exchange and Bombay Stock Exchange (BSE) as the Secondary Stock Exchange, except for Tata Index Fund – Sensex for which BSE will be considered as the Primary Stock Exchange and NSE will be considered as the Secondary Stock Exchange. (a) The securities shall be valued at the closing price on the Primary Stock Exchange. (b) When on a particular valuation day, a security has not been traded on the Primary Stock Exchange; the value at which it is traded on the Secondary Stock Exchange will be considered. -

MUTUAL FUNDS: Comparison of Various Schemes Under Equity ”

A Project Report On “MUTUAL FUNDS: Comparison of various schemes under equity ” Submitted By: Yashika Sharma In partial fulfillment of the award of the degree of Master of Business Administration University School of Management Kuruksheta University Kurukhetra CERTIFICATE This is to certify that this project report “Mutual Funds: Comparison of various schemes under equity” is the bona fide work of Yashika Sharma who carried out the project under my supervision Date: (Signature) Anil Kumar Kapoor Manager- financial Planning Master Trust Ltd. ACKNOWLEDGEMENT It gives me immense pleasure to present the project report entitled “MUTUAL FUNDS: Comparison of various schemes under equity” Preservation, inspiration and motivation have always played a key role in the success of any venture. In the present world of competition and success, training is like a bridge between theoretical and practical working; willingly I prepared this particular Project. I am highly indebited to Mr. Chawla, Ms. Rinkoo Vashisht & Mr. Kapoor for their guidance and constant supervision as well as for providing necessary information regarding the project and also for their support in completing the project. I am also thankful to all the friends and family members. Yashika Sharma TABLE OF CONTENT S.NO. PARTICULERS PAGE NUMBER 1. Executive Summary 2. Objective 3. Introduction of the company – Master Trust LTD. 4. Mutual funds : Basics, History, Types & pros and cons 5. Equity funds explained 6. Fund houses: ICICI prudential Reliance SBI 7. Comparison of Various schemes under equity 8. Conclusion 9. Latest Amendments in Mutual Funds 10. References EXECUTIVE SUMMERY The Mutual Fund is an untapped area which is bound to be the next growth story. -

Ludhiana Stock Exchange Limited

WTM/RKA /MRD/166/2014 BEFORE THE SECURITIES AND EXCHANGE BOARD OF INDIA EXIT ORDER IN RESPECT OF: LUDHIANA STOCK EXCHANGE LIMITED. 1. Ludhiana Stock Exchange Ltd (hereinafter referred to as "LSE") was incorporated in the year 1981 as a limited company under the Companies Act, 1956. The Central Government had granted recognition to LSE, as a stock exchange under the provisions of section 4 of the Securities Contracts (Regulation) Act, 1956 (hereinafter referred to as the 'SCRA') on April 29, 1983, initially for a period of 5 years, which was subsequently renewed from time to time under rule 7 of the Securities Contracts (Regulation) Rules, 1957 (hereinafter referred to as the 'SCRR'). 2. The recognition of LSE was last renewed by Securities and Exchange Board of India (hereinafter referred to as 'SEBI') for a period of one year commencing on the April 28, 2013 and ending on April 27, 2014. The renewal was, however, subject to condition that the Exchange can commence trading only after complying with all the regulatory requirements imposed by SEBI. 3. SEBI, vide Circular No. MRD/DoP/SE/Cir - 36/2008 dated December 29, 2008, issued Guidelines and laid down the framework for exit by stock exchanges whose recognition is withdrawn and/or renewal of recognition is refused by SEBI and who may want to surrender their recognition. The said Guidelines were reviewed and modified vide Circular No. CIR/MRD/DSA/14/2012 dated May 30, 2012 (hereinafter referred to as "Exit Circular, 2012"). In terms of clause 2.2 of the Exit Circular, 2012, a stock exchange, where the annual trading turnover on its platform is less than `1,000 crore, can apply to SEBI for voluntary surrender of recognition and exit, at any time before the expiry of two years from the date of issuance of the said Circular. -

CHAPTER-2 STOCK MARKET the Financial Market Where the Existing Securities Are Traded Is Referred to As the STOCK MARKET

CHAPTER-2 STOCK MARKET The financial market where the existing securities are traded is referred to as the STOCK MARKET. It provides liquidity to financial instruments which are already issued in primary market. Stock exchange Stock exchanges are organized market place corporation or mutual organizations, where members of the organization gather to trade company stocks or other securities. The members may act either as agents for their customers, or as principals for their own accounts. History of Stock Exchange: The origin of stock exchange in India can be traced back to the letter half of 19th century. It started in the year 1875 where the brokers formed an informal association in Mumbai, In 1894 Ahmadabad stock exchange came in to existence and in the year 1956, Securities contract and regulation act gave power to the stock exchanges. In 1995 NSE and OTCEI was setup with screen based facility. Today we have 23 stock exchanges. Organisation and membership: Stock exchanges are an organised market place where members of the organisation gather to trade company stocks or other securities. The members may act either as agents for their own accounts. Stock exchange is an organised market for buying and selling corporate and other securities. It provides is a convenient and secured platform for transactions in different securities Governing body: Stock exchange is managed by a governing body which consists of 13 members, of which A] 6 members of the stock exchanges are elected by its member. B] Central Government nominates 3 members C] SEBI nominates 3 members D] One executive director is appointed by stock exchange. -

Information Memorandum of Regal Enterprises Limited

Information Memorandum Regal Enterprises Limited INFORMATION MEMORANDUM OF REGAL ENTERPRISES LIMITED FOR LISTING OF 3164800 EQUITY SHARES OF Rs.10/- EACH FULLY PAID UP NO EQUITY SHARES ARE PROPOSED TO BE OFFERED PURSUANT TO THIS INFORMATION MEMORANDUM CIN: L18101DL1989PLC269075 REGISTERED OFFICE: 308, BASEMENT, DEFENCE COLONY, DELHI-110024 Page 1 of 31 Information Memorandum Regal Enterprises Limited INFORMATION MEMORANDUM FOR LISTING OF 3164800 EQUITY SHARES OF RS. 10/- EACH FULLY PAID UP Regal Enterprises Limited was originally incorporated as a Private Limited Company on November 6, 1989 under the jurisdiction of the Registrar of Companies, Chandigarh. Further, w.e.f. March 28, 1995 the was converted into a Public Limited Company vide order dated June 16, 1995. Name of Company REGAL ENTERPRISES LIMITED Category Public Limited Company Registered Office Address 308, Basement, Defence Colony, Delhi-110024 Telephone & Fax No. TEL: +91 (0) 22 42270400 FAX: +91 (0)22 28503748 E- Mail ID [email protected] Website www.regalenterprise.in Date of Incorporation of Company November 6, 1989 CIN of the Company L18101DL1989PLC269075 ISIN of the Company INE384R01014 Name & Details of the Contact Person Sudha Sharma - Whole Time Director 306, Meghadut Imarat A, Raheja Township, Malad - East, Mumbai, 400097, Maharashtra, India Name of Regional Stock Exchanges where Delhi Stock Exchange Limited the Shares of Company are Listed Ahmadabad Stock Exchange Limited Ludhiana Stock Exchange Limited Name & Address of Auditors of the V.V. Ketkar, Chartered Accountants st Company 4, Adwait 1 Floor Saraswatibai Joshi Marg, Dadar – West, Mumbai – 400028 Registrar & Share Transfer Agents Adroit Corporate Services Pvt.Ltd. 17-20, Jafferbhoy Ind. -

Stock Exchanges – the More the Merrier?

Institutional EYE Stock exchanges – the more the merrier? It is hard to argue against SEBI’s intent to foster competition for stock exchanges and depositories. However, it is unclear if adding more stock exchanges will accomplish the desired outcome. While ownership regulations are being eased to lower entry barriers, SEBI needs to ensure this be done with stronger guardrails. Source: morguefile.com Competition is essential for continuous improvement to products and services, and to this extent, the intent of fostering greater competition for stock exchanges and depositories is in the right direction. Increasing use of technology, breakdown of trading platforms, co-location issues, have all laced the ‘equity’ exchanges. Commodity exchanges too have seen their fair share of scams. While the regulator can provide an enabling 05 February 2021 iiasadvisory.com 1 Institutional EYE environment, it cannot run the exchange. Therefore, the most enduring solution to customer delight is market-driven competition. Will having more stock exchanges and depositories achieve that objective? SEBI, in its January 2021 discussion paper on “Review of Ownership and Governance norms for facilitating new entrants to set up Stock Exchange / Depository” believes it will1. SEBI has argued that newer technologies of block chain and distributed ledgers will bring an innovative element to trading and price discovery, and perhaps that will. If nothing else, it will increase the technology intensity of trading from its current levels. Yet, India had over 20 stock exchanges in the past – most of them being local / territorial2. Although the Calcutta Stock Exchange continues (largely in name only), none of the other local / territorial exchanges survived against the size and liquidity of NSE and BSE (Exhibit 1). -

KOTAK STANDARD MULTICAP FUND.Cdr

KEY INFORMATION MEMORANDUM (KIM) 6th Floor, Kotak Infinity, KOTAK STANDARD MULTICAP FUND Building No. 21, Infinity Park, (Formerly known as Kotak Select Focus ) Off. Western Express Highway, Gen.A.K. Vaidya Marg, Malad (E) Riskometer (Multi Cap Fund- An open ended equity scheme Mumbai - 400 097. Moderate Moder ely investing across large cap, mid cap, small cap stocks) at at High ely 1800-222-626 ModerLow Continuous Offer: Unit of scheme is available at prices related to applicable NAV. [email protected] High assetmanagement.kotak.com Name This Scheme is suitable for investors who are seeking* Low Kotak Long term capital growth LOW HIGH Standard Investment in portfolio of predominantly equity & equity related securities Investors understand that their principal will be at generally focused on a few selected sectors across market capitalisation moderately high risk Multicap Fund *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. Scheme Re-opened on September 11, 2009 This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further details of the Scheme(s) / Mutual Fund, Due diligence certificate by the AMC, Key Personnel, Investors rights & services, Risk Factors, Penalties & Pending Litigations, Associate Transactions, etc. investors should, before investment, refer to the Schemes Information Document and Statement of Additional Information available free of cost at any of the Official Acceptance Points or distributors or from the website www.assetmanagement.kotak.com. The Scheme(s) particulars have been prepared in accordance with Securities and Exchange Board of India (Mutual Funds) Regulations, 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI). -

A Study on Risk and Return Analysis of Selected Stocks in BSE Sensex by ABHISHEK.V (1AZ16MBA04)

A Project report (16MBAPR407) A Study on Risk and Return analysis of Selected Stocks in BSE Sensex BY ABHISHEK.V (1AZ16MBA04) Submitted to VISVESVARAYA TECHNOLOGICAL UNIVERSITY, BELGAUM In partial fulfilment of the requirements for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under the guidance of INTERNAL GUIDE EXTERNAL GUIDE Dr.Prakash B Yargol Meghesh.M Professor Business Head Acharya Institute of Technology J WINGS Department of MBA Acharya Institute of Technology Soladevanahalli, Bangalore-560 107 May 2018 CERTIFICATE TO WHOl\l SO EVER IT MAY CONCERN I. This is to certify that Mr. Abhishek.\", a student of Acharya Institute of Technology - th Bangal01:e, Pursued 03 (Three) months of Internship with us from 15 January 2018 to 24'h March 2018 2. During the Summer Internship. he has successfully completed the project titled "A ~tudy on Risk and Re-turn analysis of selected stocks in BSE Sensex" under the guidance of Mr. Megesh. M. 3. The Students performance during the Internship and comments on his project work are as under:- Mr. Abhishek.V completes ass1gnmcnls in a timely manner. performs quality work that is accurate and thorough, and manages time effectively. Student is responsible, punctual. ha~ good attendance. Student expresses thoughts clearly and is professional in dealing with both co-workers and the clients. Initiative asks for work if not assigned and is able to work independently. We wish him all the very best in foturt' endeavors (Signature of the Autl10rized Company Official) Name Me~esh. M Designation: Business I lead Date 2-l-03 -2018 No. -

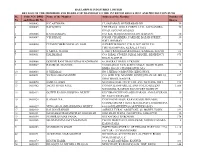

SL No. Folio NO./ DPID and Client ID No. Name of the Member Address of the Member Number of Shares 1 0000002 H C ASTHANA 17

BALLARPUR INDUSTRIES LIMITED DETAILS OF THE MEMBERS AND SHARE FOR TRANSFER TO THE INVESTOR EDUCATION AND PROTECTION FUND SL Folio NO./ DPID Name of the Member Address of the Member Number of No. and Client ID No. Shares 1 0000002 H C ASTHANA 17, SAIFABAD, HYDERABAD-DN. 30 2 0000003 RAFIQ BEG THE PRAGA TOOLS CORPN. LTD., ALEXANDRA 30 ROAD, SECUNDARABAD. 3 0000006 K M HAMEEDA C/O. K.B. MAQSOOD HUSSAIN, BADAUN, 30 4 0000007 V K DHAGE PODAR CHAMBERS, PARESEE BAZAR STREET, 30 FORT, BOMBAY 5 0000020 PUTHENCHERI GOPALAN NAIR SUPERINTENDENT, P.W.D. M.P. RETD P.O. 75 TIRUVEGAPPURA, KERALA STATE 6 0000029 S ABDUL WAHIB 5, OLD TRANQUEBAR STREET, KARIKAL, SOUTH 63 7 0000051 HALIMABAI C/O. IQBAL STORES, IQBAL MANZIL, RESIDENCY 975 ROAD, NAGPUR. 8 0000066 GOBIND RAM THAKURDAS WADHWANI 48, HAZRAT GANJ LUCKNOW. 3 9 0000067 RAMBHAU BANGDE C/O BHARATI SAW & RICE MILLS, EKORI WARD, 72 BINBA ROAD, CHANDRAPUR, M.S. 10 0000083 S J KHARAS NO.5,JEERA COMPOUND, KINGSWAY, 9 11 0000091 VATSALABAI MANDPE C/O. SHRI D.W. MANDPE, HINDUSTHAN OIL MILLS, 657 GHAT ROAD, NAGPUR. 12 0000098 SAMUEL JOHN NETURIA COAL CO./P/ LTD., P.O. NETURIA, DIST. 192 13 0000102 JAGJIT SINGH PAUL C/O.M/S. BANWARILAL AND CO LTD QUEENS 1,566 MANSIONS, BASTION ROAD FORT BOMBAY 14 0000122 GOTETI RADHA KRISHNA MURTY KUCHMANCHIVANI AGRAHARAM, AMALAPURAM, 30 DT. EAST GODAVARI. 15 0000124 K ANASUYA C/O P PATHU RAJU KEAVEKALKURGUMME 3 GUDDE,CIRCAR THOTA MACHLIPATTAM,KRISHNA 16 0000127 VENGARA RADHAKRISHNA MURTY 4-61/10 DILSHUKHNAGAR HYDERABAD 78 17 0000129 BALWANT SINGH AGRICULTURAL ASSISTANT, 85, MODEL TOWN, 192 18 0000131 GANGABAI MAHADEORAO JOGLEKAR JOGLEKAR WADA, GANJIPURA, JABALPUR. -

Summerintership Project

SUMMERINTERSHIP PROJECT “FUTURE OF METALS AS COMMODITY IN INDIA” Project Report Submitted Towards Partial Fulfillment of “Master of Business Administration Degree” (Affiliated to MTU and Approved by AICTE) 2013-2014 SUBMITTED TO: - SUBMITTED BY:- Mrs. Kavita Indrapurkar VARUN KUMAR RAVI 1271270097 PREFACE The successful completion of this project was a unique experience for me because by visiting many place and interacting various person, I achieved a better knowledge about commodity metal market. The experience which I gained by doing this project was essential at this turning point of my carrier. This project is being submitted which content detailed analysis of the research under taken by me. The research provides an opportunity to the students to devote his skills knowledge and competencies required during the technical session. The research on the topic “FUTURE OF METALS AS COMMODITY IN INDIA” ACKNOWLEDGEMENT “For any successful work, it owes its thanks to many” Hardwork, knowledge, dedication, and positive attitude all are necessary to do any task successfully but one ingredient which is also very important than others and at a time more important than others in co-operation and guidance of experts and experienced person. I I am very gratatefeful toto Prof. Kavita Indrapurkar who was my guidide duriring ththe develolopment of ththis projoject and it was her r guidance and assistance which help me in completing my project and I am thankful for her support and friendly guidance. I would also like to express my heartful regards to my parents, my frfriends and company mentor (Mr. Ashok kumar, Area Co-- ordinator, Reliance LEAP) & staff of Reliance Securities and others who directly or indirectly help me a lot for the successful completion of my project report.