China Telecom (0728) 4Q20 Results Performed Well, Together with A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Three Red Lines” Policy

Real Estate Developers with High Leverage to See Inventory Quality Tested Under Broader “Three Red Lines” Policy October 28, 2020 In our view, the widening of regulations aimed at controlling real estate developers’ interest- ANALYSTS bearing debt would further reduce the industry’s overall credit risk in the long term. However, the nearer term may see less headroom for highly leveraged developers to finance in the capital Xiaoliang Liu, CFA market, pushing them to sell off inventory to ease liquidity pressure. Beijing +86-10-6516-6040 The People’s Bank of China said in September that measures aimed at monitoring the funding [email protected] and financial management of key real estate developers will steadily be expanded. Media reports suggest that the new regulations would see a cap of 15% on annual growth of interest-bearing Jin Wang debt for all property developers. Developers will be assessed against three indicators, which are Beijing called “red lines”: whether asset liability ratios (excluding advance) exceeded 70%; whether net +86-10-6516-6034 gearing ratio exceeded 100%; whether cash to short-term debt ratios went below 1.0. Developers [email protected] which breached all three red lines won’t be allowed to increase their debt. If only one or two of the red lines are breached, such developers would have their interest-bearing debt growth capped at 5% and 10% respectively. The first half of the year saw debt grow rapidly among developers. In a sample of 87 real estate developers that we are monitoring, more than 40% saw their interest-bearing debt grow at a faster rate than 15% year over year as of the end of June (see the chart below). -

Vanke - a (000002 CH) BUY (Initiation) Steady Sales Growth Target Price RMB31.68 Up/Downside +16.8% Current Price RMB27.12 SUMMARY

10 Jun 2019 CMB International Securities | Equity Research | Company Update Vanke - A (000002 CH) BUY (Initiation) Steady sales growth Target Price RMB31.68 Up/downside +16.8% Current Price RMB27.12 SUMMARY. We initiate coverage with a BUY recommendation on Vanke – A share. Vanke is a pioneer in China property market, in terms of leasing apartment, prefabricated construction and etc. We set TP as RMB31.68, which is equivalent to China Property Sector past five years average forward P/E of 9.0x. Upside potential is 16.8%. Share placement strengthened balance sheet. Vanke underwent shares Samson Man, CFA placement and completed in Apr 2019. The Company issued and sold 263mn (852) 3900 0853 [email protected] new H shares at price of HK$29.68 per share. The newly issued H shares represented 16.67% and 2.33% of the enlarged total issued H shares and total Chengyu Huang issued share capital, respectively. Net proceeds of this H shares placement was (852) 3761 8773 HK$7.78bn and used for debt repayment. New capital can flourish the balance [email protected] sheet although net gearing of Vanke was low at 30.9% as at Dec 2018. Stock Data Bottom line surged 25% in 1Q19. In 1Q19, revenue and net profit surged by Mkt Cap (RMB mn) 302,695 59.4% to RMB48.4bn and 25.2% to RMB1.12bn, respectively. The slower growth Avg 3 mths t/o (RMB mn) 1,584 in bottom line was due to the scale effect. Delivered GFA climbed 88.2% to 52w High/Low (RMB) 33.60/20.40 3.11mn sq m in 1Q19 but only represented 10.5% of our forecast full year Total Issued Shares (mn) 9.742(A) 1,578(H) delivered GFA. -

Real Estate and Construction-210204-EN

Real Estate and Construction Beijing Guangzhou Hong Kong Shanghai Shenzhen 27/F, North Tower 17/F, International Finance 26/F, One Exchange Square 24/F, HKRI Centre Two, 17/F, Tower One, Kerry Plaza Beijing Kerry Centre Place, 8 Huaxia Road, 8 Connaught Place, Central HKRI Taikoo Hui 1 Zhong Xin Si Road 1 Guanghua Road Zhujiang New Town Hong Kong 288 Shi Men Yi Road Futian District Chaoyang District Guangzhou 510623, China Shanghai 200041, China Shenzhen 518048, China Beijing 100020, China Tel: +86 10 5769 5600 Tel: +86 20 3225 3888 Tel: +852 3976 8888 Tel: +86 21 2208 1166 Tel: +86 755 8159 3999 Fax:+86 10 5769 5788 Fax:+86 20 3225 3899 Fax:+852 2110 4285 Fax:+86 21 5298 5599 Fax:+86 755 8159 3900 www.fangdalaw.com Real Estate and Construction 01 Real Estate and Construction Practice Fangda’s Real Estate and Construction Practice Team excels at providing one-stop and full-scale services to leading real estate market players, including real estate developers, real estate private equity sponsors, institutional investors, financial institutions and other corporations and individuals in complicated domestic and cross-border real estate transactions. Our lawyers are frequently appointed as arbitrators in real estate and construction-related disputes. Our strength in this area includes a combination of understanding the traditions of the Chinese market and practice and our abundant experience in serving international clients, complemented by services for non-contentious and contentious cases. We are one of the few firms based in China that can provide integrated real estate and construction related legal services, and present practical advice based on our knowledge and experience in the local market. -

2020 Annual Report

AUGUST 31, 2020 2020 Annual Report iShares, Inc. • iShares ESG Aware MSCI EM ETF | ESGE | NASDAQ • iShares MSCI Emerging Markets ex China ETF | EMXC | NASDAQ • iShares MSCI Emerging Markets Min Vol Factor ETF | EEMV | Cboe BZX • iShares MSCI Emerging Markets Multifactor ETF | EMGF | Cboe BZX • iShares MSCI Global Min Vol Factor ETF | ACWV | Cboe BZX Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. Ifyou hold accounts throughafinancial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies ofyour shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held with your financial intermediary. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contactingyour financial intermediary. Please note that not all financial intermediaries may offer this service. -

Investment Savills Research

Shanghai – October 2020 MARKET IN MINUTES Investment Savills Research Savills team Please contact us for further information RESEARCH James Macdonald Senior Director Community retail garners attention China +8621 6391 6688 Smaller lump sums, lower price points and higher yields, as well as the james.macdonald@ potential for increased operational efficiencies, have attracted investors to the savills.com.cn community retail space. INVESTMENT • Only six deals were concluded in Q3/2020 for a total • Transaction volumes could pick up in Q4/2020 as buyers pull Nick Guan consideration of RMB4.5 billion, down 60% YoY. the trigger on deals and sellers seek to meet sales targets and Head of continue to feel financial pressure. Shanghai Investment • A fall in activity in the third quarter reflects the lack of deal +8621 6391 6688 origination in the first two quarters as a result of COVID-19 as nick.guan@ savills.com.cn well as continued market uncertainty and price disparities. • End-use buyers remain active in the office and business park “ Tighter control over Savills plc markets with three deals concluded in Q3/2020, accounting for Savills is a leading global real developer financing with the estate service provider listed on more than half of the office and business park transactions. the London Stock Exchange. The company established in 1855, has announcement of the 3-4-5 a rich heritage with unrivalled growth. It is a company that leads • The commercial land transaction volume in the first three rather than follows, and now has policy will mean that many over 600 offices and associates quarters of 2020 has already exceeded 2019 full-year volumes throughout the Americas, Europe, by 70%. -

Wanda: Strategic Transition to an Asset-Light Model

E-House Wanda: Strategic Transition to an Asset-light Model Sponsored by JUNE 2019 Wanda: Strategic Transition to an Asset-light Model The Chinese conglomerate Dalian Wanda Group is one of the world’s largest commercial property companies, with operations in real estate management, financial services, and the tourism and cultural businesses. The company is well known throughout China by way of its iconic Wanda Plazas — mixed-use centers that combine shopping, dining, and entertainment areas with residential and office spaces. It owns a vast array of businesses, ranging from its flagship commercial real estate holdings to theme parks, cinemas, hotels and asset management companies. Over the years, Wanda has grown to become a real estate industry leader with a well-respected brand in China. In 2015, Wanda’s founder and chairman Wang Jianlin Today, Wanda is helping property owners develop, build surprised the market by announcing that the company and operate commercial and cultural projects, as well would pivot to an asset-light strategy, during a speech at letting others license its brand name. The company plans the 8th entrepreneurship forum of the Shenzhen Stock to fully transition and operate under the asset-light Exchange. Since then, Wanda has offloaded more than US model by 2020, completely withdrawing from residential $10 billion of assets including hotels and theme parks.1 real estate development projects and thus significantly With this move, Wanda has embarked on what it calls its reducing its current financial liabilities. 2 The asset-light ‘fourth transformation’ toward an asset-light business strategy is gaining popularity among other real estate model. -

![Vanke [000002.SZ] Insights Fudan University, School of Management Part I: Company Overview](https://docslib.b-cdn.net/cover/5234/vanke-000002-sz-insights-fudan-university-school-of-management-part-i-company-overview-3155234.webp)

Vanke [000002.SZ] Insights Fudan University, School of Management Part I: Company Overview

Vanke [000002.SZ] Insights Fudan University, School of Management Part I: Company Overview China Vanke Co., Ltd. was established in 1984. After 30 years of development, it has become a leading urban and rural development and living services provider in China. Vanke was formerly known as Shenzhen Modern Science and Education Equipment Exhibition Center. In 1988, the company officially entered the real estate industry. On January 29, 1991, Vanke became a listed company, traded on the Shenzhen stock exchange, with a stock code of 000002.SZ. The company's sales exceeded 10 billion yuan in 2005 and exceeded 50 billion yuan in 2007. In 2010, it became the first Chinese real estate company with sales exceeding 100 billion yuan. In 2017, its sales exceeded 500 billion yuan. In July 2016, the Group was first listed on Fortune Global 500, ranking 356th. In 2017, the Group ranked 307th. In 2018, the Group further enhanced its positioning to “urban and rural development and living services provider”. The Group centers on the three most vibrant economic circles nationwide and hub cities in Midwest China. In 2014, Vanke had extended its position as a company offering “good houses, good services, good community” to an “integrated urban services provider” in its fourth ten-year development plan. In 2018, Vanke will further upgrade such position to “urban and rural development and living services provider” and refine it into four roles: a solution provider of better life, a contributor to real economy, an innovator for future development and a creator of harmonious ecosystem. The core business of the Group includes property development, property service and rental housing. -

SOE Megamergers Signal New Direction in China's Economic Policy

May 24, 2018 SOE Megamergers Signal New Direction in China’s Economic Policy Sean O’Connor, Policy Analyst, Economics and Trade Acknowledgments: The author thanks Rolando Cuevas, former Research Intern, Economics and Trade, for his research assistance. The author also thanks Wendy Leutert, Wentong Zheng, Paul Hubbard, and Roselyn Hsueh for their helpful review of early drafts. Their assistance does not imply any endorsement of this report’s contents and any errors should be attributed solely to the author. Disclaimer: This paper is the product of professional research performed by staff of the U.S.-China Economic and Security Review Commission, and was prepared at the request of the Commission to support its deliberations. Posting of the report to the Commission’s website is intended to promote greater public understanding of the issues addressed by the Commission in its ongoing assessment of U.S.- China economic relations and their implications for U.S. security, as mandated by Public Law 106-398 and Public Law 113-291. However, the public release of this document does not necessarily imply an endorsement by the Commission, any individual Commissioner, or the Commission’s other professional staff, of the views or conclusions expressed in this staff research report. Table of Contents Executive Summary....................................................................................................................................................3 History of SOE Reform in China ...............................................................................................................................4 -

China Evergrande Group ADD (No Change)

Company Note Property Development │ Hong Kong │ August 29, 2019 Insert Insert Hong Kong China Evergrande Group ADD (no change) Consensus ratings*: Buy 15 Hold 4 Sell 0 A-share restructuring is still very likely Current price: HK$17.36 ■ Evergrande’s 1H19 core net profit fell 50% yoy, dragged by lower revenue Target price: HK$28.000 booked, higher expenses from SG&A and finance cost. Previous target: HK$38.10 ■ Management is still confident that its A-share restructuring should be Up/downside: 61.3% completed in the next few months. CGS-CIMB / Consensus: -9.8% ■ We cut our SOP TP by 26% to HK$28 but keep our Add rating due to its Reuters: 3333.HK cheap valuations – 6x FY19 P/E and 9% yield. Bloomberg: 3333 HK Market cap: US$29,045m 1H19 results were well below due to fewer projects booked HK$227,906m Evergrande’s 1H19 came in well below our expectations, with core profit declining 50% Average daily turnover: US$37.74m yoy to Rmb16bn, 40% lower than our estimate, dragged by lower-than-expected revenue, HK$295.5m higher-than-expected expenses from SG&A and finance cost. Current shares o/s: 13,070m To see faster sales growth in the next few months Free float: 22.2% *Source: Bloomberg In 1H19, Evergrande achieved contracted sales of Rmb282bn (-7% yoy), 47% of its sales target of Rmb600bn for FY19. Given saleable resources of Rmb800bn in 2H19, Key changes in this note management said the company should be able to achieve its sales target. -

Holdings Ltd

SCHEDULE OF INVESTMENTS (000)* June 30, 2020 (Unaudited) Causeway Emerging Markets Fund Number of Shares Value COMMON STOCK Brazil — 4.3% B2W Cia Digital 1 273,300 $ 5,448 Banco do Brasil SA 1 2,162,294 12,823 JBS SA 6,761,300 26,570 Minerva SA 1 1,820,917 4,386 Petrobras Distribuidora SA 718,000 2,836 Petroleo Brasileiro SA, Class A ADR 1,262,900 10,066 Qualicorp Consultoria e Corretora de Seguros SA 1,547,500 8,295 Telefonica Brasil SA ADR 887,504 7,863 Vale SA, Class B ADR 1 3,027,759 31,216 YDUQS Participacoes S.A. 1 1,437,200 8,981 118,484 China — 36.5% Agile Group Holdings Ltd. 3,944,372 4,641 Alibaba Group Holding Ltd. ADR 1 893,771 192,786 Anhui Conch Cement Co. Ltd., Class H 5,541,113 37,320 Baidu Inc. ADR 1 340,600 40,835 China Communications Construction Co. Ltd., Class H 14,259,356 8,040 China Construction Bank Corp., Class H 109,347,000 88,460 China Lumena New Materials Corp. 1,2,3 264,100 — China Mobile Ltd. 3,484,500 23,513 China Mobile Ltd. ADR 333,460 11,218 China Petroleum & Chemical Corp., Class H 7,895,192 3,290 China Railway Construction Corp. Ltd., Class H 12,699,500 9,979 CNOOC Ltd. 25,610,000 28,483 Country Garden Holdings Co. Ltd. 11,400,000 14,003 Dongfeng Motor Group Co. Ltd., Class H 12,080,000 7,216 Fosun International Ltd. -

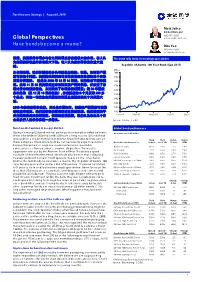

Global Perspectives [email protected]

Fixed Income Strategy | August 8, 2019 FIXED INCOME STRATEGY | July 31, 2019 Mark Jolley Global Strategist (852) 3911 8255 Global Perspectives [email protected] Have bonds become a mania? Diliu Yao (852) 3911 8269 [email protected] 目前,美国债券市场参与者之间的观点存在着很大的分歧。有人认 The bond rally looks increasingly speculative 为美国债券收益率将有很大下跌;有人认为债市即将发生重大逆 转。 Republic of Austria 100 Year Bond (Sep 2117) Price 从长期来看,我们怀疑债券多头可能是正确的。但是,如何资产配 200 置可能是个问题。美国国债期货的每日投资情绪指数保持五个交易 190 日百分百看涨。 这是自 2008 年 12 月 16 日后,该指数创下新的高 180 值。当年 11 月 25 日美联储宣布将购买资产抵押债券, 并改变了市 170 場对貨市政策的看法, 从而演示了市场的极端配置;使 30 年国債 160 息率急跌 (至 12 月 18 日的低位),并在随后的6个月反弹 200 多 150 个基点。而这一切发生在美国经济衰退且在随后的三个月美股大 140 泄。 130 2008 年的经验警告我们,无论基本面如何,极端资产配置都可能推 120 动收益率走高。我们相信我们正在接近这样的极端。我们更倾向于 110 Jan-19 Mar-19 May-19 Jul-19 Sep-1 关注短期的曲线陡峭程度。信用利差很脆弱,我们认为未来几个月 企业发行人的条件将进一步恶化。 Source: Gallup, CCBIS Bond market opinion is deeply divided Global bond performance Opinion among US bond market participants is deeply divided between All returns are in US dollar those who believe US bond yields still have a long way to fall and those who believe a major reversal is imminent. Most investors fall into one of Yield Yield Return Return these extremes. Interest rate bulls do not necessarily expect recession Bond Index Performance* (today) (end '18) (5 day) (YTD) but see the spread of negative interest rates as an inevitable Global Treasury 0.7% 1.3% 2.1% 6.8% consequence of broadening economic stagnation. This week’s US Treasury 1.7% 2.6% 1.4% 7.4% aggressive rate cut by the Reserve Bank of New Zealand is a good example of this relentless trend. -

Evergrande Real Estate Group Ltd SW 3 July 2014

Evergrande Real Estate Group Ltd SW 3 July 2014 Evergrande – House of cards Company Name: Evergrande Rating: SELL (-23%) Last close: HKD 3.08 Target Price: HKD 2.50 Real Estate Group Ltd Bbg Ticker: 3333 HK Evergrande is among China’s largest property developers – ranking first by saleable area as it has historically relied on volume and low prices to expand aggressively. We note that short-seller Citron Research alleged Evergrande of fraud in 2012, but the claims were vigorously refuted and Evergrande went to record over 40% bottomline growth in FY13. However, as the China residential property market starts to slow down alongside the Last close: HKD 3.08 economy, exacerbated by tight credit and home ownership restrictions, we think Target Price: HKD 2.50 (-23%) Evergrande, as the largest and most indebted, will be most at risk. Additionally, questionable management decisions raise more red flags than a Communist parade: Rating: Sell (1-year period) Stunning cash outflows on negative FCF guidance. An 18% HKD3bn dividend comprising 71% of earnings while guiding negative free cash flow for FY14; share repurchases totaling HKD3bn and purchase of a stake in Huaxia Bank for ~HKD1bn. Market Cap (USDm): 5,814 Veteran management selling shares and leaving the company. CEO Xie Haijun Avg 3M daily value traded sold 68m shares, his first sale since joining the Board in 2007; Li Gang, the vice- Chairman, resigned effective May 1 and sold 33m shares in April after a 8-year (USDm/day): 16.8 tenure; Lai Lixin resigned as Executive Director in February. In contrast, according to Evergrande’s annual reports, there were no management changes in 2010-2013 Shares outstanding (m): 14,630 during the previous property downcycle.