Electronic Arts Reports Q4 and FY21 Financial Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Take-Two Interactive Software, Inc. Equity Analyst Report

Merrimack College Merrimack ScholarWorks Honors Senior Capstone Projects Honors Program Spring 2016 Take-Two Interactive Software, Inc. Equity Analyst Report Brian Nelson Goncalves Merrimack College, [email protected] Follow this and additional works at: https://scholarworks.merrimack.edu/honors_capstones Part of the Finance and Financial Management Commons Recommended Citation Goncalves, Brian Nelson, "Take-Two Interactive Software, Inc. Equity Analyst Report" (2016). Honors Senior Capstone Projects. 7. https://scholarworks.merrimack.edu/honors_capstones/7 This Capstone - Open Access is brought to you for free and open access by the Honors Program at Merrimack ScholarWorks. It has been accepted for inclusion in Honors Senior Capstone Projects by an authorized administrator of Merrimack ScholarWorks. For more information, please contact [email protected]. Running Head: TAKE-TWO INTERACTIVE SOFTWARE, INC. EQUITY ANALYST REPORT 1 Take-Two Interactive Software, Inc. Equity Analyst Report Brian Nelson Goncalves Merrimack College Honors Department May 5, 2016 Author Notes Brian Nelson Goncalves, Finance Department and Honors Program, at Merrimack Collegei. Brian Nelson Goncalves is a Senior Honors student at Merrimack College. This report was created with the intent to educate investors while also serving as the students Senior Honors Capstone. Full disclosure, Brian is a long time share holder of Take-Two Interactive Software, Inc. 1 Running Head: TAKE-TWO INTERACTIVE SOFTWARE, INC. EQUITY ANALYST REPORT 2 Table of Contents -

Why John Madden Football Has Been Such a Success

Why John Madden Football Has Been Such A Success Kevin Dious STS 145: The History of Computer Game Design: Technology, Culture, Business Professor: Henry Lowood March 18, 2002 Kevin Dious STS 145: The History of Computer Game Design: Technology, Culture, Business Professor: Henry Lowood March 18, 2002 Why John Madden Football Has Been Such A Success Case History Athletic competition has been a part of the human culture since its inception. One of the most popular and successful sports of today’s culture is American football. This sport has grown into a worldwide phenomenon, and like the video game industry, has become a multi-billion entity. It was only a matter of time until game developers teamed up with the National Football League (NFL) to bring magnificent sport to video game players across the globe. There are few, if any, game genres that are as popular as sports games. With the ever-increasing popularity of the NFL, it was inevitable that football games would become one of the most lucrative of the sports game genre. With all of the companies making football games for consoles and PCs during the late 1980s and 1990s, there is one particular company that clearly stood and remains above the rest, Electronic Arts. EA Sports, the sports division of Electronic Arts, revolutionized not only the football sports games but also the entire sports game genre itself. Before Electronic Arts entered the sports realm, league licenses, celebrity endorsements, and re-release of games were all unheard of. EA was one of the first companies to release the same game annually, creating several series of games that are thriving even today. -

The Data Behind Netflix's Q3 Beat Earnings

The Data Behind Netflix’s Q3 Beat Earnings What Happened -- Earnings per share: $1.47 vs. $1.04 expected -- International paid subscriber additions: 6.26 million vs. 6.05 million expected -- Stock price surged more than 8% in extended trading Grow your mobile business 2 Apptopia’s data was a strong leading indicator of new growth -- Netflix increased new installs of its mobile app 8.4% YOY and 13.5% QOQ. -- New international installs of Netflix are up 11.3% YOY and 17.3% QOQ. -- New domestic installs of Netflix are down 3.6% YOY and 8.3% QOQ. Grow your mobile business 3 Other Indicators of Netflix’s Q3 2019 performance Netflix Domestic Growth YoY Netflix Global Growth YoY Q3 2018 - 19 Q3 2018 - 19 Netflix +6.4% Netflix +21.4% Reported: Paid Reported: Paid Subscribers Subscribers Apptopia +7.2% Apptopia +15.1% Estimate: Time Estimate: Time Spent In App Spent In App Apptopia +7.7% Apptopia +16% Estimate: Mobile Estimate: Mobile App Sessions App Sessions Grow your mobile business Other Indicators of Netflix’s Q3 2019 performance -- Netflix reported adding 517k domestic paid subscriber vs. 802k expected -- Its growth this quarter clearly came from international markets -- More specifically, according to Apptopia, it came from Vietnam, Indonesia, Saudi Arabia and Japan Grow your mobile business We’ve Got You Covered Coverage includes 10+ global stock exchanges and more than 3,000 tickers. Restaurants & Food Travel Internet & Media Retail CHIPOTLE MEXICAN CRACKER BARREL ALASKA AIR GROUP AMERICAN AIRLINES COMCAST DISH NETWORK ALIBABA GROUP AMBEST BUY -

Printmgr File

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K Í ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2019 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 000-17948 ELECTRONIC ARTS INC. (Exact name of registrant as specified in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 209 Redwood Shores Parkway 94065 Redwood City, California (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code: (650) 628-1500 Securities registered pursuant to Section 12(b) of the Act: Name of Each Exchange on Title of Each Class Trading Symbol Which Registered Annual Report Common Stock, $0.01 par value EA NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes Í No ‘ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ‘ No Í Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

EA SPORTS™ MADDEN NFL™ FOOTBALL Cabinet Settings

EA SPORTS™ MADDEN NFL SEASON 2 Cabinet Settings Worksheet Write your cabinet settings on this sheet for easy reference. Print more copies from the EA SPORTS™ MADDEN NFL™ FOOTBALL page of our Website at http://service.globalvr.com. Cabinet Serial Number: ______________________ Operator Menu Item Setting Screen Game Settings Credits / Free play Credit Free play Attract Credit Display Money Credits Coin Audit Credit Display OFF ON Credits per Money Credits per Exhibition Quarter Credits per Training Game Credits per Tournament Game Credits per Career Game Credits per Competition Player Credits per Smart Card 1 Player Quarter Length 2 Player Quarter Length 3 Player Quarter Length 4 Player Quarter Length Audio Settings Master Volume Attract Volume Game Volume Registration Cabinet ID Serial # Version Notes: 040-0128-01 Rev. A 9/28/2006 Page 1 of 1 © 2006 Electronic Arts Inc. Electronic Arts, EA, EA SPORTS and the EA SPORTS logo are trademarks or registered trademarks of Electronic Arts Inc. in the U.S. and/or other countries. All Rights Reserved. The mark “John Madden” and the name, likeness and other attributes of John Madden reproduced on this product are trademarks or other intellectual property of Red Bear, Inc. or John Madden, are subject to license to Electronic Arts Inc., and may not be otherwise used in whole or in part without the prior written consent of Red Bear or John Madden. © 2006 NFL Properties LLC. Team names/logos are trademarks of the teams indicated. All other NFL-related trademarks are trademarks of the National Football League. Officially licensed product of PLAYERS INC. -

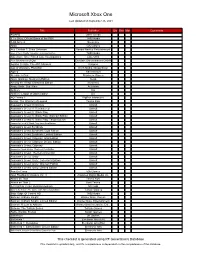

Microsoft Xbox One

Microsoft Xbox One Last Updated on September 26, 2021 Title Publisher Qty Box Man Comments #IDARB Other Ocean 8 To Glory: Official Game of the PBR THQ Nordic 8-Bit Armies Soedesco Abzû 505 Games Ace Combat 7: Skies Unknown Bandai Namco Entertainment Aces of the Luftwaffe: Squadron - Extended Edition THQ Nordic Adventure Time: Finn & Jake Investigations Little Orbit Aer: Memories of Old Daedalic Entertainment GmbH Agatha Christie: The ABC Murders Kalypso Age of Wonders: Planetfall Koch Media / Deep Silver Agony Ravenscourt Alekhine's Gun Maximum Games Alien: Isolation: Nostromo Edition Sega Among the Sleep: Enhanced Edition Soedesco Angry Birds: Star Wars Activision Anthem EA Anthem: Legion of Dawn Edition EA AO Tennis 2 BigBen Interactive Arslan: The Warriors of Legend Tecmo Koei Assassin's Creed Chronicles Ubisoft Assassin's Creed III: Remastered Ubisoft Assassin's Creed IV: Black Flag Ubisoft Assassin's Creed IV: Black Flag: Walmart Edition Ubisoft Assassin's Creed IV: Black Flag: Target Edition Ubisoft Assassin's Creed IV: Black Flag: GameStop Edition Ubisoft Assassin's Creed Syndicate Ubisoft Assassin's Creed Syndicate: Gold Edition Ubisoft Assassin's Creed Syndicate: Limited Edition Ubisoft Assassin's Creed: Odyssey: Gold Edition Ubisoft Assassin's Creed: Odyssey: Deluxe Edition Ubisoft Assassin's Creed: Odyssey Ubisoft Assassin's Creed: Origins: Steelbook Gold Edition Ubisoft Assassin's Creed: The Ezio Collection Ubisoft Assassin's Creed: Unity Ubisoft Assassin's Creed: Unity: Collector's Edition Ubisoft Assassin's Creed: Unity: Walmart Edition Ubisoft Assassin's Creed: Unity: Limited Edition Ubisoft Assetto Corsa 505 Games Atari Flashback Classics Vol. 3 AtGames Digital Media Inc. -

AI for Testing:The Development of Bots That Play 'Battlefield V' Jonas

AI for Testing:The Development of Bots that Play 'Battlefield V' Jonas Gillberg Senior AI Engineer, Electronic Arts Why? ▪ Fun & interesting challenges ▪ At capacity ▪ We need to scale Why? Battlefield V Multiplayer at launch Airborne Breakthrough Conquest Domination FinalStand Frontlines Team Deathmatch Aerodrome 64 64 32 64 32 32 Arras 64 64 32 64 32 32 Devastation 64 64 32 64 32 32 Fjell 652 64 64 32 64 32 32 Hamada 64 64 64 32 32 32 Narvik 64 64 64 32 32 32 Rotterdam 64 64 64 32 32 32 Twisted Steel 64 64 64 32 32 32 Test 1 hour per level / mode – 2304 hours Proof of Concept - MP Client Stability Testing Requirements ▪ All platforms ▪ Player similar ▪ Separate from game code ▪ No code required ▪ DICE QA Collaboration Stability Previously... Technical Lead AI Programmer Tom Clancy’s The Division Behavior Trees, server bots etc.. GDC 2016: Tom Clancy’s The Division AI Behavior Editing and Debugging Initial Investigation ▪ Reuse existing AI? ▪ Navmesh – Not used for MP ▪ Player scripting, input injection... ▪ Parallel implementation Machine Learning? Experimental Self-Learning AI in Battlefield 1 Implementation Functionality Fun Fidelity Single Client Control Inputs? Input (abstract) Movement Game • Yaw/Pitch Player Hardware Context • Fire Code • Actions • Jump • Etc • Etc UI Combat ▪ Weapon data=>Behavior ▪ Simple representation ▪ Closest target only ▪ Very cheap – good enough ▪ Blacklist invalid targets Navigation ▪ Server Pathfinding ▪ Not to be trusted ▪ Monitor progress ▪ No progress ▪ Button Spam (Jump, interact, open door) Navigation ▪ Server Pathfinding ▪ Not to be trusted ▪ Monitor progress ▪ No progress ▪ Button Spam (Jump, interact, open door) ▪ Still stuck - Teleport Visual Scripting – Frostbite Schematics AutoPlayer Objectives Objective Parameters ▪ MoveMode • Aggressive: Chase everything • Defensive: Keep moving – shoot if able • Passive: Stay on path – ignore all ▪ Other Parameters: • Unlimited Ammo • GodMode • Teleportation.. -

Electronic Arts Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of earliest event reported) June 8, 2021 ELECTRONIC ARTS INC. (Exact Name of Registrant as Specified in Its Charter) Delaware 0-17948 94-2838567 (State or Other Jurisdiction of Incorporation) (Commission File Number) (IRS Employer Identification No.) 209 Redwood Shores Parkway, Redwood City, California 94065-1175 (Address of Principal Executive Offices) (Zip Code) (650) 628-1500 (Registrant’s Telephone Number, Including Area Code) Former Name or Former Address, if Changed Since Last Report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or ☐ revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Titanfall 2 Xbox

WARNING Before playing this game, read the Xbox One™ system, and accessory manuals for important safety and health information. www.xbox.com/support. Important Health Warning: Photosensitive Seizures A very small percentage of people may experience a seizure when exposed to certain visual images, including flashing lights or patterns that may appear in video games. Even people with no history of seizures or epilepsy may have an undiagnosed condition that can cause “photosensitive epileptic seizures” while watching video games. Symptoms can include light-headedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confusion, momentary loss of awareness, and loss of consciousness or convulsions that can lead to injury from falling down or striking nearby objects. Immediately stop playing and consult a doctor if you experience any of these symptoms. Parents, watch for or ask children about these symptoms—children and teenagers are more likely to experience these seizures. The risk may be reduced by being farther from the screen; using a smaller screen; playing in a well-lit room, and not playing when drowsy or fatigued. If you or any relatives have a history of seizures or epilepsy, consult a doctor before playing. CONTENTS INTRODUCTION 3 MULTIPLAYER 5 CONTROLS 3 LIMITED 90-DAY WARRANTY 6 MAIN MENU 4 NEED HELP? 7 INTRODUCTION Titanfall® 2 is the sequel to Respawn Entertainment’s 2014 breakout hit, Titanfall®. In Titanfall 2 ’s Single Player campaign, you play as Jack Cooper—a Militia Rifleman who aspires to become a full-fledged Pilot. Explore the Frontier like never before, brave harsh environments, and forge a powerful bond with your Titan. -

V2.21 Patch Notes |

IMAGE: WALL STREET JOURNAL STREET WALL IMAGE: V2.21 PATCH NOTES | NOTES V2.21 PATCH FEBRUARY 2021 REPORT REDDIT, TIKTOK AND MORE BIG TAKEAWAYS PAGE 3 A quick summary of what stood out to us TABLE OF TRENDING PAGE 4 Trends we saw in the past month and the impact we expect them to have BRAND ACTIVATIONS PAGE 9 Interesting activations from some nonendemic brands OTHER IMPORTANTS PAGE 12 A hodgepodge of information from data to missteps PAGE 2 BIG TAKEAWAYS GameStop fans show up in unprecedented ways during Wall Street showdown. TikTok content creators are giving games tremendous exposure and, as a result, new users. Gaming brands are finding new ways to help gamers beyond the worlds of gaming. FEB 2021 Large companies continue to gobble up smaller game FEB 2021 creators in search of exclusive content. IMAGE: WALL STREET JOURNAL FEB 2021 FEB 2021 PAGE 3 TRENDING NO.001 SECTION WHAT’S INCLUDED A collection of new and interesting things that caught our attention last month. IMAGE: MAX-O-MATIC GAMESTOP GOES TO THE MOON IMAGE: CNBC WHAT HAPPENED The subreddit r/WallStreetBets started a rollercoaster of retail WHY IT MATTERS investing in GameStop stock. The initial excitement behind GameStop The rise of GameStop's stock dominated the conversation on social media started with a small group of investors who viewed the stock as for well over 48 hours. Reports are suggesting that 9% of Americans bought undervalued, citing many of the moves GameStop was making like shares of GameStop during the surge. In a matter of days we saw 001 the Tulsa test stores, a new focus on omnichannel offerings and new celebrities commenting on the situation, congresspeople discussing it on NO. -

Electronic Arts Inc. Fiscal Year 2009 Proxy Statement and Annual Report

Electronic Arts Inc. Fiscal Year 2009 Proxy Statement and Annual Report Proxy Statement Notice of 2009 Annual Meeting and Proxy Statement [THIS PAGE INTENTIONALLY LEFT BLANK] June 12, 2009 DEAR FELLOW STOCKHOLDERS: You are cordially invited to join us at our 2009 Annual Meeting of Stockholders on July 29, 2009 at 2:00 p.m. The meeting will be held at the headquarters campus of Electronic Arts in Building 250 (please note that the street address for Building 250 is 250 Shoreline Drive, Redwood City, California). For your convenience, we are also pleased to offer a live webcast of our Annual Meeting on the Investor Relations section of our web site at http://investor.ea.com. At this meeting, we are asking the stockholders to: Proxy Statement • Elect Leonard S. Coleman, Jeffrey T. Huber, Gary M. Kusin, Geraldine B. Laybourne, Gregory B. Maffei, Vivek Paul, Lawrence F. Probst III, John S. Riccitiello, Richard A. Simonson and Linda J. Srere to the Board of Directors to hold office for a one-year term; • Approve our Employee Stock Option Exchange Program; • Approve amendments to our 2000 Equity Incentive Plan and 2000 Employee Stock Purchase Plan; and • Ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal 2010. After the meeting, we will report on our recent performance and answer your questions. Details regarding admission to the meeting and the business to be conducted are described in the Notice of Internet Availability of Proxy Materials you received in the mail and in this proxy statement. We have also made available a copy of our Annual Report for the fiscal year ended March 31, 2009 with this proxy statement. -

ELECTRONIC ARTS INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarterly Period Ended September 30, 2018 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to Commission File No. 000-17948 ELECTRONIC ARTS INC. (Exact name of registrant as specified in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 209 Redwood Shores Parkway Redwood City, California 94065 (Address of principal executive offices) (Zip Code) (650) 628-1500 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES þ NO ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.