Draft Resolution on Setting the Council Tax 2021/22

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Y Wern 5 Ffordd Meillion Llangristiolus LL62 5DQ Freehold Detached Non Estate £489,950

Tel: 01248 714567 [email protected] www.lucasestateagents.com Y Wern 5 Ffordd Meillion Llangristiolus LL62 5DQ Freehold Detached Non Estate £489,950 • Stunning 5 Bedroom High Specification Detached Family Home • 3 Reception Rooms,3 Bathrooms,Utility,Cloaks/Wc,Galleried Landing • Spacious Attic Games Room/Studio • Ample Off Road Parking On Driveway Double Garage • Established Gardens Front & Rear,Patio • Oil Fired Central Heating • Lovely Views Of Snowdonia Mountains & Countryside • https://premium.giraffe360.com/lucas-estate-agents/73a6b71cac2a40cfa3b132111698c3e1/ Tel: 01248 714567 [email protected] www.lucasestateagents.com Property Summary A prestigious, five bedroom (two en-suite) detached house. Situated in a sought after location within a short waling distance of the local primary school and finished to a particularly high standard. Offering spacious accommodation complimented by a feature gallery landing. Viewing is highly recommended to appreciate the quality of this distinctive property. In our opinion an exceptional detached 5 bedroomed property, offering 3 bathrooms (two en-suite), ground floor W.C., lounge, sitting room, kitchen/diner, sun room, utility room, cloakroom and spacious attic room. Oak doors and carpeting throughout. Bespoke architraves and skirting boards. A large entrance hallway leads to an individually crafted, hardwood staircase onto a gallery landing. Integrated audio wiring. Wood effect uPVC double glazed doors and windows throughout. Built in safety deposit box. A remotely accessed integral double garage and driveway providing ample off road parking. The property is served by an oil central heating system with the added benefit of energy saving zonal control. Motion sensor alarm system. Smoke and heat detectors. Occupying a generous plot, pleasantly located in the rural village of Llangristiolus. -

Bangor Baseline Audit

Localities in North Wales: A Baseline Report Locality Baseline Report North Wales 1 Localities in North Wales: A Baseline Report Contents Preface Section 1 : Introduction: Defining the Locality Section 2 : Health, Wellbeing and Social Care Section 3 : Education and Young People Section 4 : Language, Citizenship and Identity Section 5 : Employment and Training Section 6 : Economic Development and Regeneration Section 7 : Crime, Public Space and Policing Section 8 : Housing and Transport Section 9 : Environment, Tourism and Leisure 2 Localities in North Wales: A Baseline Report Preface This is the first version of the localities baseline report. The intention is to up-date the report periodically when new data are released and as the Localities research progresses. 3 Localities in North Wales: A Baseline Report Section 1: Introduction: Defining Localities 1.1 The A55 Corridor –Heterogeneity and Connectivity WISERD@Bangor undertakes the localities work in North Wales. We provide an account of the A55 corridor. We provide an explanation and justification for our selection of three Unitary Authorities (UAs) - Gwynedd, Anglesey and Wrexham - and of the narrower localities sites within these. The A55 (North Wales Expressway) runs from Chester to Holyhead docks and is designated part of “Euroroute E22”. Figure 1.1 provides an overview of the locality in the context of Wales. Figure 1.1 The North Wales Locality Conwy Flintshire Anglesey Wrexham Gwynedd Denbighshire A55 4 Localities in North Wales: A Baseline Report The black line indicates the A55 expressway. The yellow shading represents the broader north Wales locality. This covers the six Unitary Authorities containing the A55 corridor (from east to west these are Wrexham 1, Flintshire, Denbighshire, Conwy, Gwynedd and Anglesey). -

Parc Menai Llangefni

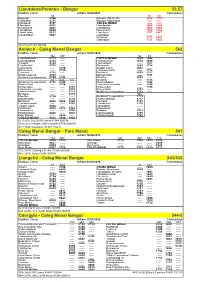

Llanddona/Penmon - Bangor 53,57 Dyddiau Coleg o/from 12/04/2021 Collegedays 58 58 58 Penmon 0744 Bangor Plaza (P) 1618 1728 Glanrafon 0755 Bangor Morrisons ----- ----- Llangoed 0757 COLEG MENAI ----- ----- Llan-faes 0802 Llandegfan 1638 1748 Beaumaris 0807 Llanddona 1652 1802 Llanddona 0819 Beaumaris 1702 1812 Llandegfan 0831 Llan-faes 1707 1817 Coed Mawr 0847 Llangoed ----- ----- Penmon 1712 1822 Glanrafon 1722 1832 58 Arriva 01248 360534 Amlwch - Coleg Menai Bangor 562 Dyddiau Coleg o/from 13/01/2020 Collegedays 562 477 62 63 Llanfachraeth 0710 ----- COLEG MENAI 1625 1646 Llanrhuddlad 0720 ----- Porthaethwy 1633 1659 Tregele 0724 ----- Llansadwrn ----- 1707 Llanfechell 0730 ----- Pentraeth 1643 1718 Carreglefn ----- 0725 Traeth Coch 1647 ----- Rhos-goch ----- 0735 Llanbedr-goch ----- 1722 Cemaes 0733 ----- Benllech 1651 1727 Porth Llechog 0740 ----- Marian-glas ----- 1731 Amlwch Co-operative 0745 0745 Moelfre 1657 ----- 62 62C 63 Brynteg ----- 1734 Amlwch Co-operative 0732 0749 ----- Maenaddwyn ----- 1742 Pen-y-Sarn ----- 0754 ----- Llannerch-y-medd ----- 1749 Rhos-y-bol ----- ----- 0710 Rhos-y-bol ----- 1753 Llannerch-y-medd ----- ----- 0718 Pen-y-Sarn 1707 ----- Maenaddwyn ----- ----- 0725 Amlwch Co-operative 1712 ----- Brynteg ----- ----- 0733 562 Moelfre 0754 ----- ----- Amlwch Co-operative 1713 Marian-glas ----- ----- 0736 Porth Llechog 1717 Benllech 0800 0806 0740 Cemaes 1725 Llanbedr-goch ----- ----- 0745 Llanfechell 1728 Traeth Coch 0804 ----- ----- Carreglefn ----- Pentraeth 0809 0812 0749 Rhos-goch ----- Llansadwrn ----- ----- -

John Leland's Itinerary in Wales Edited by Lucy Toulmin Smith 1906

Introduction and cutteth them out of libraries, returning home and putting them abroad as monuments of their own country’. He was unsuccessful, but nevertheless managed to John Leland save much material from St. Augustine’s Abbey at Canterbury. The English antiquary John Leland or Leyland, sometimes referred to as ‘Junior’ to In 1545, after the completion of his tour, he presented an account of his distinguish him from an elder brother also named John, was born in London about achievements and future plans to the King, in the form of an address entitled ‘A New 1506, probably into a Lancashire family.1 He was educated at St. Paul’s school under Year’s Gift’. These included a projected Topography of England, a fifty volume work the noted scholar William Lily, where he enjoyed the patronage of a certain Thomas on the Antiquities and Civil History of Britain, a six volume Survey of the islands Myles. From there he proceeded to Christ’s College, Cambridge where he graduated adjoining Britain (including the Isle of Wight, the Isle of Man and Anglesey) and an B.A. in 1522. Afterwards he studied at All Souls, Oxford, where he met Thomas Caius, engraved map of Britain. He also proposed to publish a full description of all Henry’s and at Paris under Francis Sylvius. Royal Palaces. After entering Holy Orders in 1525, he became tutor to the son of Thomas Howard, Sadly, little or none of this materialised and Leland appears to have dissipated Duke of Norfolk. While so employed, he wrote much elegant Latin poetry in praise of much effort in seeking church advancement and in literary disputes such as that with the Royal Court which may have gained him favour with Henry VIII, for he was Richard Croke, who he claimed had slandered him. -

3 Eurach Park, Llanddaniel, Gaerwen, Anglesey LL60 6EQ ● £155,000 Looking for a Great Holiday Home Or Investment? Then Look No Further!

3 Eurach Park, Llanddaniel, Gaerwen, Anglesey LL60 6EQ ● £155,000 Looking for a great holiday home or investment? Then look no further! . Delightful Detached Cottage Style Bungalow . Open Plan Lounge, Diner & Well Fitted Kitchen . Ideal Holiday Home Or Investment . Lawned Front & Rear Gardens & Patio . High Quality Construction & Fittings . LPG Central Heating & uPVC Double Glazing . Idyllic Rural Holiday Park Location . Vacant Possession . 2 Double Bedrooms Both With En-Suites . Close to All Amenities Cy merwy d pob gof al wrth baratoi’r many lion hy n, ond eu diben y w rhoi arweiniad Ev ery care has been taken with the preparation of these particulars but they are f or cyff redinol y n unig, ac ni ellir gwarantu eu bod y n f anwl gy wir. Cofiwch ofy n os bydd general guidance only and complete accuracy cannot be guaranteed. If there is any unrhy w bwy nt sy ’n neilltuol o bwy sig, neu dy lid ceisio gwiriad proff esiynol. point which is of particular importance please ask or prof essional v erification should Brasamcan y w’r holl ddimensiy nau. Nid y w cyf eiriad at ddarnau gosod a gosodiadau be sought. All dimensions are approximate. The mention of any f ixtures f ittings &/or a/neu gyf arpar y n goly gu eu bod mewn cyf lwr gweithredol eff eithlon. Darperir appliances does not imply they are in f ull eff icient working order. Photographs are ffotograff au er gwy bodaeth gyff redinol, ac ni ellir casglu bod unrhy w eitem a prov ided f or general inf ormation and it cannot be inf erred that any item shown is ddangosir y n gy nwysedig y n y pris gwerthu. -

Read Book Coastal Walks Around Anglesey

COASTAL WALKS AROUND ANGLESEY : TWENTY TWO CIRCULAR WALKS EXPLORING THE ISLE OF ANGLESEY AONB PDF, EPUB, EBOOK Carl Rogers | 128 pages | 01 Aug 2008 | Mara Books | 9781902512204 | English | Warrington, United Kingdom Coastal Walks Around Anglesey : Twenty Two Circular Walks Exploring the Isle of Anglesey AONB PDF Book Small, quiet certified site max 5 caravans or Motorhomes and 10 tents set in the owners 5 acres smallholiding. Search Are you on the phone to our call centre? Discover beautiful views of the Menai Strait across the castle and begin your walk up to Penmon Point. Anglesey is a popular region for holiday homes thanks to its breath-taking scenery and beautiful coast. The Path then heads slightly inland and through woodland. Buy it now. This looks like a land from fairy tales. Path Directions Section 3. Click here to receive exclusive offers, including free show tickets, and useful tips on how to make the most of your holiday home! The site is situated in a peaceful location on the East Coast of Anglesey. This gentle and scenic walk will take you through an enchanting wooded land of pretty blooms and wildlife. You also have the option to opt-out of these cookies. A warm and friendly welcome awaits you at Pen y Bont which is a small, family run touring and camping site which has been run by the same family for over 50 years. Post date Most Popular. Follow in the footsteps of King Edward I and embark on your walk like a true member of the royal family at Beaumaris Castle. -

4R Bus Time Schedule & Line Route

4R bus time schedule & line map 4R Bangor - Holyhead View In Website Mode The 4R bus line (Bangor - Holyhead) has 2 routes. For regular weekdays, their operation hours are: (1) Holyhead: 9:08 AM - 9:18 PM (2) Llangefni: 5:00 AM - 10:15 PM Use the Moovit App to ƒnd the closest 4R bus station near you and ƒnd out when is the next 4R bus arriving. Direction: Holyhead 4R bus Time Schedule 56 stops Holyhead Route Timetable: VIEW LINE SCHEDULE Sunday 9:00 AM - 4:45 PM Monday 9:08 AM - 9:18 PM Ysgol Y Bont, Llangefni Tuesday 9:08 AM - 9:18 PM Library, Llangefni Wednesday 9:08 AM - 9:18 PM Ysgol, Llangefni Thursday 9:08 AM - 9:18 PM Cildwrn Road, Llangefni Friday 9:08 AM - 9:18 PM Ffordd Corn Hir, Llangefni Saturday 9:08 AM - 9:18 PM Bodelis, Llangefni Cae Mawr, Rhostrehwfa Tan Rallt, Rhostrehwfa 4R bus Info Direction: Holyhead Penrhiw, Rhostrehwfa Stops: 56 Trip Duration: 46 min Gorwel Deg, Rhostrehwfa Line Summary: Ysgol Y Bont, Llangefni, Library, Llangefni, Ysgol, Llangefni, Ffordd Corn Hir, Gorwel Deg, Llangristiolus Community Llangefni, Bodelis, Llangefni, Cae Mawr, Rhostrehwfa, Tan Rallt, Rhostrehwfa, Penrhiw, Capel Cana, Rhostrehwfa Rhostrehwfa, Gorwel Deg, Rhostrehwfa, Capel Cana, Stad Tŷ Gwyn, Llangristiolus Community Rhostrehwfa, Cefn Cwmwd, Rhostrehwfa, Afhendre Fawr, Rhostrehwfa, Mona Isaf, Rhostrehwfa, Cefn Cwmwd, Rhostrehwfa Bodffordd Turn, Heneglwys, Anglesey Show Ground, Gwalchmai Uchaf, Old Toll House, Gwalchmai Uchaf, Afhendre Fawr, Rhostrehwfa Waverley, Gwalchmai Uchaf, Clock, Gwalchmai Uchaf, Rhosneigir Turn, Engedi, Ty-Hen -

Advisory Visit Bodorgan Estate, Anglesey April 2012

Advisory Visit Bodorgan Estate, Anglesey April 2012 1.0 Introduction This report is the output of a site visit undertaken by Tim Jacklin of the Wild Trout Trust to the Bodorgan Estate, Anglesey on, 12th April, 2012. Comments in this report are based on observations on the day of the site visit and discussions with Tim Bowie (General Manager of the Estate), Holly Parry (local graduate of Bangor University), Billy Tweddle (Gamekeeper) and Ian Ferrier (experienced local angler). Normal convention is applied throughout the report with respect to bank identification, i.e. the banks are designated left hand bank (LHB) or right hand bank (RHB) whilst looking downstream. 2.0 Catchment and Fishery Overview Bodorgan Estate is on the south-west of the Isle of Anglesey, North Wales, and covers an area of approximately 15,000 acres. Within the Estate is Llyn Coron, a lake of approximately 90 acres (cover picture), which is within the catchment of the Afon Ffraw. The lake contains wild brown trout and sea trout which run the Ffraw. The lake is fished by a small syndicate (and day ticket anglers) and is occasionally stocked with farmed brown trout. The main focus of this advisory visit was the Afon Fraw, Llyn Coron and their tributaries. Also on the Estate is the Afon Caradog, a tributary of the Afon Crigyll which joins the sea at Rhosneigr. Sections of the Caradog were also inspected during this visit at Y Werthyr (SH373783) and Bryn Glas (SH372781). Information from the River Basin Management Plan (Water Framework Directive) published by Environment Agency Wales (EAW) is shown in the table below for the Crigyll catchment (including Afon Caradog) and for the Ffraw. -

Topic Paper 11: North Anglesey

Topic Paper 11: North Anglesey Prepared in support of the Wylfa Newydd Project: Supplementary Planning Guidance Topic Paper 11: North Anglesey Page 2 Contents 1 Introduction 3 1.1 Purpose of this Topic Paper 3 1.2 Context 4 1.3 North Anglesey Overview 7 1.4 Structure of this Topic Paper 8 2 Policy Context 9 2.1 Introduction 9 2.2 International/European Plans and Programmes 9 2.3 UK Plans and Programmes 9 2.4 National (Wales), Legislation, Plans and Programmes 11 2.5 Regional and Sub-Regional Plans and Programmes 16 2.6 Local Plans and Programmes 17 2.7 Key Policy Messages for the Wylfa Newydd SPG 24 3 Baseline Information and Future Trends 26 3.1 Introduction 26 3.2 Baseline Information 26 3.3 Future Trends 47 3.4 Key Issues for the Wylfa Newydd SPG 48 4 Challenges and Opportunities 50 4.1 Introduction 50 4.2 SWOT Analysis 50 4.3 Summary of Key Matters to be addressed by the SPG 52 4.4 How Should the Wylfa Newydd SPG Respond? 52 Topic Paper 11: North Anglesey Page 3 1 Introduction 1.1 Purpose of this Topic Paper 1.1.1 The purpose of this topic paper is to bring together the evidence base and policy context in relation to the communities and environment of North Anglesey to inform the updating of the Wylfa Newydd Supplementary Planning Guidance (Wylfa Newydd SPG). It is one of 11 topic papers that have been prepared to support the: Identification of the key matters to be considered in drafting the revised SPG; Provision of guidance with respect to how the revised SPG could respond to the challenges and opportunities identified; and Offer further information to the public in support of consultation on a draft revised SPG. -

Adroddiad Sylwadau Rhan 2

Cynllun Adnau: Adroddiad Sylwadau Rhan 2—Mapiau Cynllun Datblygu Lleol ar y Cyd Gwynedd a Môn Hyd 2015 Contents 1.0 Cyflwyniad ......................................................................................................................................................4 2.0 Beth yw’r camau nesaf?.................................................................................................................................4 3.0 Gwybodaeth Bellach ......................................................................................................................................5 RHAN 2: Sylwadau ar y Ddogfen Mapiau1 CANOLFAN ISRANBARTHOL...................................................................................................................................6 1) Bangor ................................................................................................................................................................6 CANOLFANNAU GWASANAETH TREFOL ............................................................................................................11 2) Amlwch .............................................................................................................................................................11 3) Caergybi ...........................................................................................................................................................14 4) Llangefni...........................................................................................................................................................21 -

Cyndal, Llanddona, LL58 8UB Offers in the Region Of

Cyndal, Llanddona, LL58 8UB Offers In The Region Of £210,000 A quaint 2 bedroom semi detached cottage situated in an idyllic location being a stones throw away from Llanddona Beach set in an elevation position. Directions Adjoining outhouse. There is a garden area to the From Menai Bridge proceed along the A5025 rear of the property with a patio seating area to the towards Benllech, passing Pentraeth Automotive front enjoying sea views. garage, take the next right signposted Llansadwrn. Services Continue through the village at the T Junction turn Mains electricity, water and shared private drainage. left and in 0.5 miles, turn right signposted Wern Y No services, appliances or central heating (if any) Wylan/Llanddona. At the next junction in approx 1 have been tested by Morgan Evans and Company mile turn right and then left at the following junction. Limited. Continue up through the village and turn left before reaching the Owain Glyndwr Public House. Rights of Way, Easements Continue along this lane and bear right passing the The land is offered for sale subject to and with the police mast down the hill and continue over a grass benefit of all rights either public or private, track to the gate of Cyndal. wayleaves, easements or other rights whether specifically referred to or not. Description A quaint semi detached stone built cottage boasting Council Tax character. Situated in the popular village of We understand from our verbal enquiries to the Llanddona. local authority that the property is in Band "C" and the amount payable for 2020/2021 is approx Accommodation £1,434.32 Front Door to:- Tenure Kitchen We have been informed by the vendor (the seller), 10'8" x 6'1" (3.25m x 1.85m) this property is FREEHOLD with vacant possession upon completion of the sale. -

Member's Annual Report 2016/17

Member’s Annual Report 2016/17 This is the report by the Councillor below regarding his key activities over the year ending 31 March 2017. It is provided for the information of all constituents and for no other purpose. The views expressed in this report are those of the Councillor and they do not necessarily reflect the views of the Isle of Anglesey County Council. Councillor: Carwyn Elias Jones Group: Plaid Cymru Ward: Seiriol 1 - Role & Responsibilities Diversity Champion I am the Isle of Anglesey County Council Diversity Champion Full Council, Appointments Panel, Partnership and Regeneration Scrutiny Committee I have spoken out on many topics at Full Council including the budget. The Partnership and Regeneration Scrutiny Committee deals with external projects and the Appointments Panel conducts the recruitment and selection process for senior post holders. Between April 2016 and March 2017, I sat on the following main 1Attendance Figures committees / sub-committees: Council 6 (67%) Partnership and Regeneration Scrutiny Committee 8 (89%) Appointments Committee No meetings Indemnities sub-committee No meetings The statistics provided are relevant only to the committees listed in this table. The statistics do not include attendance at other meetings related to the work of the Council. Attendance levels may vary due to the nature of work and responsibilities of members - as portfolio holder, committee chair or representing the Council on outside bodies, for example. I am a member of the Isle of Anglesey Charitable Trust (not a Council Committee) and attended 2 meetings (50%). I also attended 2 meetings (100%) of the Regeneration Committee (subcommittee of the Trust which deals with grant applications) 2 - Constituency Activity Community Councils - The Seiriol Ward rota is used to attend the Community Council meetings at Llanddona, Cwm Cadnant and Llangoed, and also attend and report back to the Beaumaris Town Council.